Wooing the super-rich (from BT)

-

Originally posted by walesa:

a) I am glad that you are no longer mentioning about the US$4b figures. Glad that my extra effort has finally paid off.

Should your limited intellect not be sufficiently empowered to comprehend the fact a 50-50 joint venture does not necessarily (as in this particular case, it doesn't) mean a 50-50 cost-sharing in developing the project, you may wish to note that despite Morgans and Boyd engaging in a 50-50 joint venture, Morgans will only be chipping in with USD97.5 million for the additional USD700 million. With this in mind, that'd effectively take Boyd's venture to [b]USD3.5025 billion before factoring in the cost from its other joint ventures with Shangri-La and other smaller players.

Now, further taking today's exchange rate where USD1 = SGD1.519, USD3.5025 billion (which does not include Boyd's stake in its joint venture with Shangri-La) would translate to SGD5.32 billion. Clearly, it's not rocket science that SGD5.32 billion actually dwarfs the SGD5.05 billion LV Sands plan to invest on its Marina Bay IR, does it?

Keep your comical antics coming in to prove me wrong here - for starters, you could perhaps conjure up an argument to suggest USD1 is perhaps equal to SGD0.5 and therefore, there's actually a miscalculation in my figures? [/b]

[/b]

b) At USD3.5025b, it is actually lower than Marina Bay

Sands (http://www.msafdie.com/php/print_project.php?id=92) which is US$3.6b

And we are not even factoring the increase in cost of sands and granite in Singapore right now.

c) Shangri-la is not an equity investor, it only manages the hotel at at Echelon Place.

back to you my boy!! -

a) Stop digressing lah. Always bring up new topic non relevant to the discussion.Originally posted by Gazelle:a) That is the business model of Venetian in LV and MM Lee has quoted this clearly to the press after his visit to LV.

You want to know more about the Venetian business model?

http://www.usbusiness-review.com/content_archives/Jul05/index.html

b) Ball park figure is a good enough to determine your business risk and you income stream. Nah. I am not talkin about forex trading, I am more keen on talking aobut your trade in a particular currency. Business is dynamic and full of risk, but you need guildlines to manage risk and maximise profit.

c) A free market and a free market economy i know. but I dont know of a business that is call free market business.

b) "Just like a company will say what is our exposure to certain currency or certain markets." That's your original post. Now you say you not talking about FOREX, if you want to talk about other currency and markets, you are talking about FOREX. DUH!!! I suppose when you talk about trade, you are talking about sales in another market denominated in another currency like USD. Fine! You sell something to USA for USD 100,000 (USD 1 = 1.50), you proceed with the contract, tomorrow drops (USD 1 = 1.00). Your sales also affected. So how can you say the 70/30 rule will apply? Then you agree that business is dynamic. Don't tell us what everybody already knows, every business is in it to maximise profit.

c) A free market business is a business operating in a free market. You know what is stupid, you know what is idiot, so when I say stupid idiot!! You have no idea what it means?? Hehehe

Free Market business.

In case you are so thick to ask again, it means a business operating in a free market economy.

Treat health care like free-market business

Free market business reform

Think we should refrain from using complex terms, because I think your understandability is extremely challenged. Maybe I should speak to you like how I speak to primary school kids. -

Of course, if you take A and B as restaurant (which is similar to casino as there limited no, of seats), 1 have 100 seats, while the other have 200 seats, during peak hours lunch or dinner time, which restaurant can serve more food?Originally posted by walesa:Taking your stupidity at face value, let's compare two shops in the same shopping complex whereby A has an area twice the size of B.

So are you suggesting just because A has a land area twice that of B, it'd definitely have twice as many patrons and customers than B and consequently, rake in twice as much revenue? So I suppose the business activity and the products/services offered by A and B are irrelevant, eh?

If redefining stupidity were an Olympic sport, I'd have no qualms about your credentials as a gold medal-elect... -

I really dont quiet understand why someone is trying sugar coat what I am saying?(just to proof that he wiki the subject?) honestly, what is the point of comparing Adelson track record in MICE busines to his gaming business? Did I say Sheldon make more money from MICE than in gaming? I thought I say his track record in MICE business in 2nd to none?Originally posted by walesa:With the above statement of yours, the only thing I'm sure of is your stupidity being second to none.

Adelson sold COMDEX for USD860 million in 1995 and as of 2003, his personal net worth stood at a mere USD1.4 billion. Following the public trading of LV Sands in 2004, his personal fortune snowballed 750%. Today, Adelson is worth USD23.4 billion based on his 65% stake in LV Sands.

Now, when you further consider the revenues raked in by LV Sands Corp from its gaming entities, compared with its non-gaming ones, is his record in the MICE industry second to none or is his record in the gaming industry second to none? Some talk about a 30-70 plan... -

I have no idea what you are comparing, as I have not read the previous post. But I gather you are trying to compare A as casino and B as restaurant. Casino and restaurant are two totally different business, a casino is not operated like a restaurant, where people can get stuffed eating 2-3 main courses, unlike gambling where there are no limits, unless you run out of funds.Originally posted by Gazelle:Of course, if you take A and B as restaurant (which is similar to casino as there limited no, of seats), 1 have 100 seats, while the other have 200 seats, during peak hours lunch or dinner time, which restaurant can serve more food? -

Let me ask you, Casino A has 100,000sqft, while Casino B has 200,000sqft.Originally posted by maurizio13:I have no idea what you are comparing, as I have not read the previous post. But I gather you are trying to compare A as casino and B as restaurant. Casino and restaurant are two totally different business, a casino is not operated like a restaurant, where people can get stuffed eating 2-3 main courses, unlike gambling where there are no limits, unless you run out of funds.

If Casino A can fit 400 tables, I am sure Casino B will be able to fit 800 table.

Suppose during the peak hours, is it right that Casino B will be able to accomodate more customers than A?

And so if our government limit the floor areas at the Casino at Singapore IR, arent they indirectly limiting the amount of business they can make from the Casino?

-

*

.

. -

Depends on the service quality, hygiene, appearance of the casino.Originally posted by Gazelle:Let me ask you, Casino A has 100,000sqft, while Casino B has 200,000sqft.

If Casino A can fit 400 tables, I am sure Casino B will be able to fit 800 table.

Suppose during the peak hours, is it right that Casino B will be able to accomodate more customers than A?

-

in this case, you can assume that they are all the same because we are talking about how floor area affect the same casino operator.Originally posted by maurizio13:Depends on the service quality, hygiene, appearance of the casino. -

Your comparison is wrong too, first of all we are comparing casino with entertainment, not between the size of two casinos. You are trying to justify your 70/30 allocation with the use of 2 casinos, when the 70/30 allocation applies to entertainment and casino. So much for a fair comparison and your challenged logic.Originally posted by Gazelle:Let me ask you, Casino A has 100,000sqft, while Casino B has 200,000sqft.

If Casino A can fit 400 tables, I am sure Casino B will be able to fit 800 table.

Suppose during the peak hours, is it right that Casino B will be able to accomodate more customers than A?

And so if our government limit the floor areas at the Casino at Singapore IR, arent they indirectly limiting the amount of business they can make from the Casino?

-

Originally posted by maurizio13:

a) This is an article I want to highlight to yuo.

a) Stop digressing lah. Always bring up new topic non relevant to the discussion.

b) "Just like a company will say what is our exposure to certain currency or certain markets." That's your original post. Now you say you not talking about FOREX, if you want to talk about other currency and markets, you are talking about FOREX. DUH!!! I suppose when you talk about trade, you are talking about sales in another market denominated in another currency like USD. Fine! You sell something to USA for USD 100,000 (USD 1 = 1.50), you proceed with the contract, tomorrow drops (USD 1 = 1.00). Your sales also affected. So how can you say the 70/30 rule will apply? Then you agree that business is dynamic. Don't tell us what everybody already knows, every business is in it to maximise profit.

c) A free market business is a business operating in a free market. You know what is [b]stupid, you know what is idiot, so when I say stupid idiot!! You have no idea what it means?? Hehehe

Free Market business.

In case you are so thick to ask again, it means a business operating in a free market economy.

Treat health care like free-market business

Free market business reform

Think we should refrain from using complex terms, because I think your understandability is extremely challenged. Maybe I should speak to you like how I speak to primary school kids.

[/b]

"Our business plan creates the most diversified sources of income of any of the major casino developments," Weidner says. "A large portion of our revenues relate to the conference and exhibition business. That in turn, drives rooms and catering revenues. As a result, our casino department contributes about 30 to 35 percent of the total. That's not because the casino doesn't do extraordinarily well – it does – but because we'll generate $320 million in rooms revenue alone this year"

Are you saying that this is a planned economy and not a free market economy?

b) 70/30 is not a theory, it is a business model use by LV Sands for the Venetian LV, and what I am saying is that Singapore government is using this model as an example for Singapore IR.

c) The example I am highlighting is just to counter someone's idea that in business you cannot forecast. -

We are not comparing casino with entertainment nor comparing casino to casino., we are trying to split the casino business away from ALL other business in the IR. 70/30 is a business model use by LV Sands for Venetian, and it has proven to be achievable and sustainable.Originally posted by maurizio13:Your comparison is wrong too, first of all we are comparing casino with entertainment, not between the size of two casinos. You are trying to justify your 70/30 allocation with the use of 2 casinos, when the 70/30 allocation applies to entertainment and casino. So much for a fair comparison and your challenged logic.

And there are 2 ways in which you can achieve the 70.30 target, that is to reduce the size of casino business or increase in the size of non-gaming business and our government is doing both. a) by limiting the floor are, b) choose a bidder with most promising non-gaming business. For LV Sands it will be MICE, Hotel, Retail and F&B. While Genting will be Theme Park, Animation Studio, Museum, Aquarium, Hotels, F&B, and Retail. -

Originally posted by Gazelle:

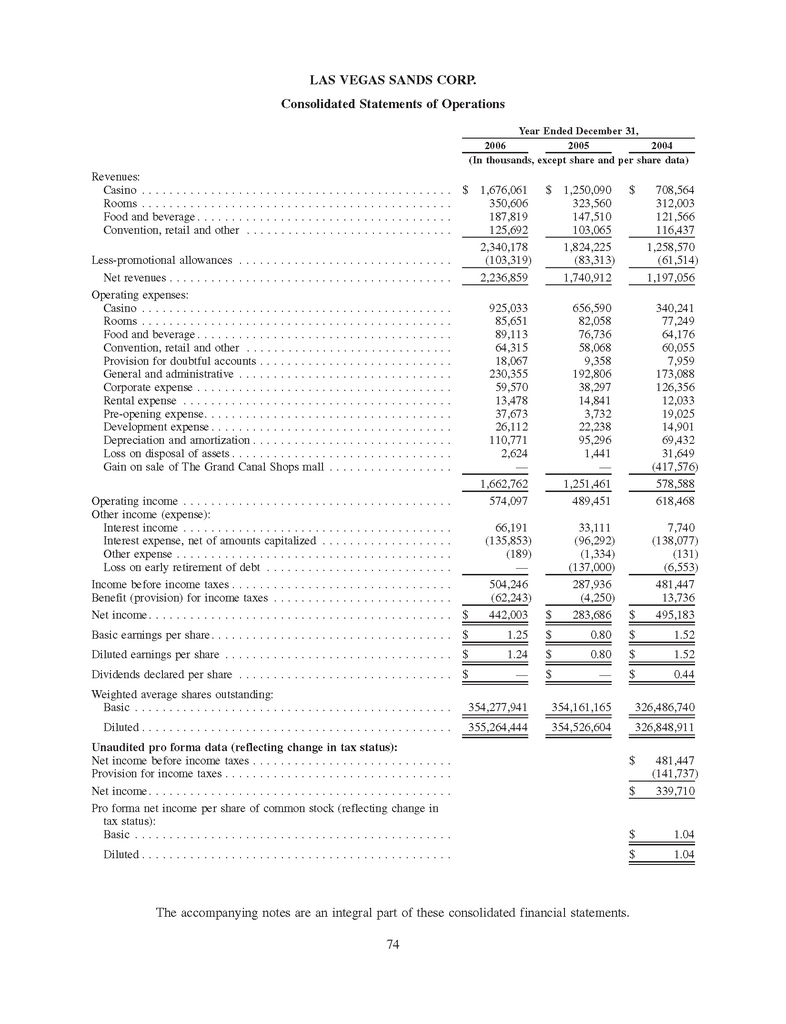

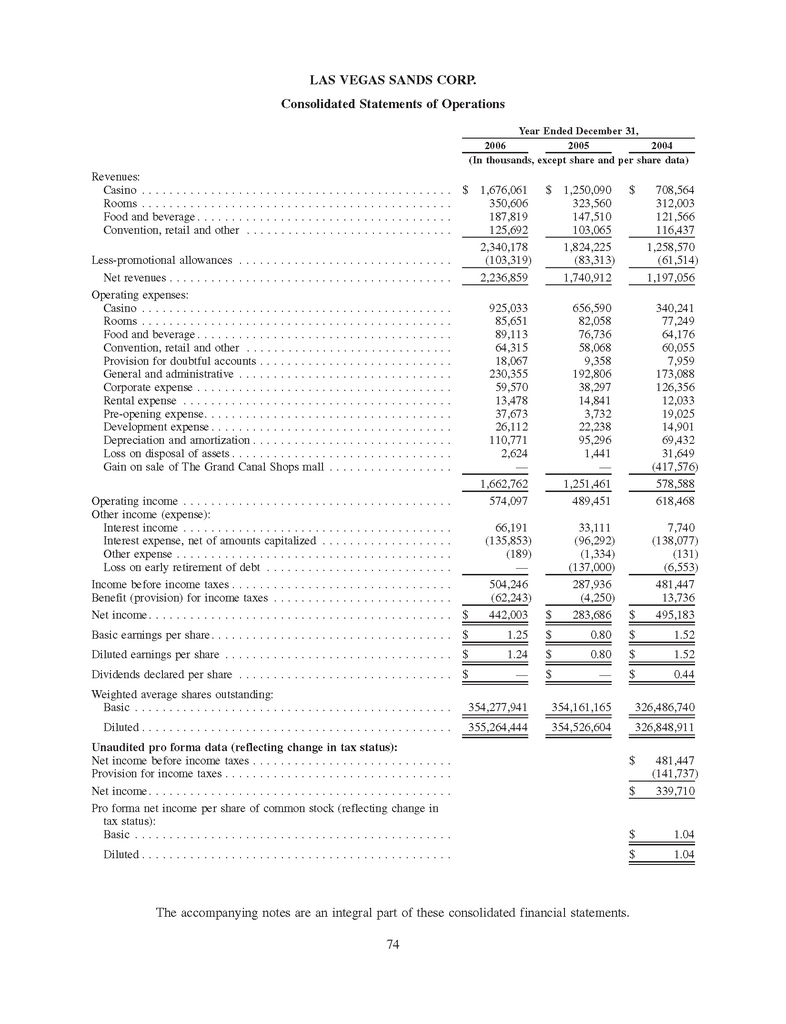

a) I also want to highlight to you. Can you tell me from their financial statements, which year of their casino operations say 30%? Don't tell me you are going to be like OM, "they reported it not me".

a) This is an article I want to highlight to yuo.

"Our business plan creates the most diversified sources of income of any of the major casino developments," Weidner says. "[b]A large portion of our revenues relate to the conference and exhibition business. That in turn, drives rooms and catering revenues. As a result, our casino department contributes about 30 to 35 percent of the total. That's not because the casino doesn't do extraordinarily well – it does – but because we'll generate $320 million in rooms revenue alone this year"

Are you saying that this is a planned economy and not a free market economy?

b) 70/30 is not a theory, it is a business model use by LV Sands for the Venetian LV, and what I am saying is that Singapore government is using this model as an example for Singapore IR.

c) The example I am highlighting is just to counter someone's idea that in business you cannot forecast.

[/b]

b) Aiyo, since when is any business wholly 70/30. You are really logically challenged. It depends on the market, like Microsoft can be having 70% of business in software, if it sees opportunities in hardware and invest in that area, it will affect their portfolio.

c) Business can be forecasted, BUT forecast is never accurate, it will never be accurate, it's like the weather forecast. If you can forecast the weather perfectly, you will be able to forecast a business with 100% accuracy. -

a) thank you for spending so much time to track down the financial report. However if you have read my post carefully you could have actually save yourself from doing it. The 70/30 business model is only applicable to Venetian LV and I have mentioned this many times before. So that is the reason why this will not be reflect in the their group financial statement because not every LV Sands operation operate that way.Originally posted by maurizio13:a) I also want to highlight to you. Can you tell me from their financial statements, which year of their casino operations say 30%? Don't tell me you are going to be like OM, "they reported it not me".

b) Aiyo, since when is any business wholly 70/30. You are really logically challenged. It depends on the market, like Microsoft can be having 70% of business in software, if it sees opportunities in hardware and invest in that area, it will affect their portfolio.

c) Business can be forecasted, BUT forecast is never accurate, it will never be accurate, it's like the weather forecast. If you can forecast the weather perfectly, you will be able to forecast a business with 100% accuracy.

b) 70/30 is not a theory, it is only use to describe Venetian LV business model, so what is your point of bringing Microsoft up as a comparison.

c) That all I want to know. "Business can be forecasted" because nobody here say that business outcome can be predicted. -

Well done on shooting yourself in the foot yet again. Firstly, the site you quoted estimates the cost to be USD3.6 billion after factoring in the land cost - which is effectively what was quoted all along with the figure in excess of SGD5 billion. So it's a classic case of shooting yourself in the foot by trying to twist around the numbers through a miscalculated attempt at converting the worth of the Marina Bay project to USD.Originally posted by Gazelle:a) I am glad that you are no longer mentioning about the US$4b figures. Glad that my extra effort has finally paid off.

b) At USD3.5025b, it is actually lower than Marina Bay

Sands (http://www.msafdie.com/php/print_project.php?id=92) which is US$3.6b

And we are not even factoring the increase in cost of sands and granite in Singapore right now.

c) Shangri-la is not an equity investor, it only manages the hotel at at Echelon Place.

back to you my boy!!

More importantly, perhaps you're daft enough to not be able to see the picture. There's nothing to suggest the Echelon Place costs anything less than USD4 billion. Even if other joint investors were to help defray the financial liability of Boyd Gaming Corp (which you have obviously failed to explain besides Morgan's USD97.5m - and even that was highlighted by me - where the other sources of funding for the project will come from), there's still no running away from the fact that Echelon Place is a project worth in excess of USD4 billion. In terms for illiterates, for Echelon Place to be able to operate on the scale depicted by its current blueprint, the combined total coughed up for the project would exceed the USD4 billion mark. So what's worth more now - USD3.6 billion or USD4 billion?

To qualify your silly comparison, you're suggesting Echelon Place isn't more expensive than Marina Bay (in your stoic defence of your misguided belief that the IR's in Singapore are the most expensive in the world) just because Boyd Gaming Corp isn't investing more than LV Sands (which is hardly true to begin with). So if you were to start a business with your father and this company, A, is worth more than another business venture, B, run by a lone proprietor, are you telling me venture B is more successful just because B is run by 1 person? More pertinently, if both A and B were PLC's subject to public trading, are you telling me the cost of taking over Company A will be lower than that for Company B just because Company A is a joint venture?

As if you needed any incentive to prove there's hardly a bigger idiot than yourself, try making sense of your final point to make a case for your own argument. So if Shangri-La "only manages" the hotel at Echelon Place, does that not make Boyd Gaming Corp the chief proprietors who will be coughing up the lion's share of the remaining USD400 million, taking Boyd's investment in the project to a tune of USD3.9 billion?

All that before you consider MGM's got a project in the pipeline which is projected to cost USD6 billion, which would easily dwarf your "world's most expensive Singapore IR's" at a canter anyway.

Have fun espousing more drivel - it certainly makes for some good entertainment, albeit logically incoherent and practically ridiculous. -

That's sheer stupidity at its finest and proves right what I've been saying all along : you have never set foot in a casino.Originally posted by Gazelle:Of course, if you take A and B as restaurant (which is similar to casino as there limited no, of seats), 1 have 100 seats, while the other have 200 seats, during peak hours lunch or dinner time, which restaurant can serve more food?

If you had set foot in a casino, it wouldn't be hard - even with your deceptively low IQ - to figure not all tables cater to gamblers of the same stakes and even then, the size of crowd (and wager) on each table is hardly the same.

Going by your silly logic, am I supposed to believe the combined takings by the casino for 20 tables (which would obviously cover a land area more than that of a VIP room) wagering between 50-500 per game would actually take in more than a VIP room with one individual losing a million at a game?

It's hardly rocket science for gazelles to work that out, methinks. -

I see you have trouble distinguishing MICE and gaming industries - why not try taking up some English classes for a start? That might help.Originally posted by Gazelle:I really dont quiet understand why someone is trying sugar coat what I am saying?(just to proof that he wiki the subject?) honestly, what is the point of comparing Adelson track record in MICE busines to his gaming business? Did I say Sheldon make more money from MICE than in gaming? I thought I say his track record in MICE business in 2nd to none?

For you to suggest MICE and gaming industries are exclusively one and the same is no different from saying all humans are boys just because all boys are humans? So nincompoop, are all humans necessarily boys? -

For your silly statement to hold true, cite me an example of a casino where it's so full it can't allow for anymore patrons to enter. To quantify it further, cite me an example (anywhere you can think of - from Las Vegas to Macau) where you've some tangible studies that backs up your bollocks whereby the number of patrons patronising a casino is directly proportional(and can be quantitatively qualified) to the area of a casino(ie.a casino with twice the area will necessarily have twice the number of gamblers)...Originally posted by Gazelle:Let me ask you, Casino A has 100,000sqft, while Casino B has 200,000sqft.

If Casino A can fit 400 tables, I am sure Casino B will be able to fit 800 table.

Suppose during the peak hours, is it right that Casino B will be able to accomodate more customers than A?

And so if our government limit the floor areas at the Casino at Singapore IR, arent they indirectly limiting the amount of business they can make from the Casino?

-

Well, if you look at your earlier post again, I will cut & paste for the benefit of others.Originally posted by Gazelle:a) thank you for spending so much time to track down the financial report. However if you have read my post carefully you could have actually save yourself from doing it. The 70/30 business model is only applicable to Venetian LV and I have mentioned this many times before. So that is the reason why this will not be reflect in the their group financial statement because not every LV Sands operation operate that way.

b) 70/30 is not a theory, it is only use to describe Venetian LV business model, so what is your point of bringing Microsoft up as a comparison.

c) That all I want to know. "Business can be forecasted" because nobody here say that business outcome can be predicted.

Your article talks about casino contribution of 30 to 35 percent (which the author cannot even confirm, so is it 70/30 or 65/35). You said that this article relates to the Venetian business model and the consolidated financial statements is different, but the next sentence it talks about rooms revenue of $320 million, which coincides with the 2005 consolidated financial statements $323 million. Don't tell me Venetian Resort is the only casino with rooms.Originally posted by Gazelle:"Our business plan creates the most diversified sources of income of any of the major casino developments," Weidner says. "A large portion of our revenues relate to the conference and exhibition business. That in turn, drives rooms and catering revenues. As a result, our casino department contributes about 30 to 35 percent of the total. That's not because the casino doesn't do extraordinarily well – it does – but because we'll generate $320 million in rooms revenue alone this year"

-

a) Please read earlier post.Originally posted by Gazelle:a) thank you for spending so much time to track down the financial report. However if you have read my post carefully you could have actually save yourself from doing it. The 70/30 business model is only applicable to Venetian LV and I have mentioned this many times before. So that is the reason why this will not be reflect in the their group financial statement because not every LV Sands operation operate that way.

b) 70/30 is not a theory, it is only use to describe Venetian LV business model, so what is your point of bringing Microsoft up as a comparison.

c) That all I want to know. "Business can be forecasted" because nobody here say that business outcome can be predicted.

b) I use Microsoft as a business like any other business, to show that your model of 70/30 is flawed, businesses exist to like you say "maximise profits", if more profits are to be generated from another area of the business, more investments will flow there. It's a matter of time before this 70/30 so called business model of yours is breached.

c) Everything can be forecasted, but it's a matter of accuracy. Did you forecast the bankruptcy of Enron? Or did anybody for that matter. If you agree that business outcome cannot be predicted, aren't you agreeing that the 70/30 allocation will not stand, afterall if you cannot predict the sales of a certain product, how can you claim that the 70/30 allocation stands. Based on the Efficient Market Hypothesis, the use of historical information to forecast the performance of a company is weak. Past performance is not indicative of future performance, just like our gov. -

Originally posted by Gazelle:

Did I assume the Singapore Government to be stupid, or are you simply jumping the gun to that conclusion by your own initiative ?

a) Sheldon Adelson has personally created the one of the world largest trade show, call COMDEX before he sold it to softbank and he got himself in to gaming business. So his track record in the MICE industry is 2nd to none.

b) The theme park at RWS will be MANAGED by Universal Studio themselves, and the aquarium and museum will be managed by world player who have years of experience in their own field. What Genting Int is providing is the resources to build the hardware.

The whole idea of the IRs for the government is not go after the gamblers number, but tourists.

Please stop assuming that singapore government are stupid and what they have chosen are proposal which have least execution risk.

If ''Sheldon Adelson has personally created one of the world largest trade show, call COMDEX before he sold it to softbank and he got himself in to gaming business.'' - then should you not ask yourself why would a reasonable man want to sell a successful business to get into the Gaming Industry ?

You seem to refuse the fact that his expertise at MICE will boost his ability to draw in the crowd to generate a faster return for his investments in the gaming industry.

Surely, you will admit that Sheldon Adelson is smarter than you to realise this by selling a successful MICE business and get into the Gaming Industry.

The Singapore Government is not stupid but was intelligent enough to work with a guy with a good sixth sense at business, by helping the government to close the credibility gap with his expertise at MICE - that will draw in the overseas crowd to Singapore, and helping the Government to substantiate the stated reason for building the Integrated Resorts.

Did you not mention in your earlier post that the government also take a hefty cut in gambling ? Do you think that the Government is not realising this end of the gaming business ?

You must be real brilliant to believe that the government and Sheldon Adelson are both only interested in bringing in the tourist to secure your future. -

Originally posted by Gazelle:

You seem to be burnt with the blind faith in the government statement that the Integrated Resorts is based on a 70/30 approach - in which 70% emphasis is on MICE and Family Entertainment, and 30% is on the Gaming Industry.

Since you are capable to talking about the political reasons on why Genting win the Sentosa IR bid, I would have reason to believe that you will hava a great understanding of STB RFQ and our government's objective for the IR. Unfortunately, I think I have over estimated your knowledge on this subject.

Instead of blaming me, why not blame yourself for the lack of understanding.

The 70/30 target which our government is expecting from IR bidder are very basic and fundamental requirement and you only need common sense to understand the objective behind it.

Instead you have choose to be a smart aleck and come up with a whole bunch of stupid theories accusing government of this and that, and when someone challenge your logic behind your accusation, you start to twist and turn without providing any sensible reply.

If the MICE business is so attractive and profitable business, will Sheldon Adelson have sold it and move into the Gaming Industry ?

You have refused to accept the fact that the Government has no other way to U-Turn on their 45 year resistance to having a Casino built in Singapore, except by spinning a tall story of having 70% of the Integrated Resorts being MICE and Family Entertainment, and that 30% will be from Gaming.

For all practical reasons, Sheldon Adelson is not a dumb person and is certainly more entrepreneurial than you - in seeing the bigger opportunity of acceding to the Singapore Government request to maintain your 70/30 gullibility - as for Sheldon Adelson, the 70% effort will anyway need to be implemented to draw in the Crowd to his Casino.

What can the Singapore Government do when the Year End Profit & Loss Statement reflect that the main portion of the Revenue is from the Casin ?

Even as the business in MICE and Family Entertainment expand year-on-year, its revenue growth cannot ever hope to exceed that from the Gaming Industry.

The rides and entertainment, and the MICE fixtures are all within a finite capacity and time - kid go to sleep; while the Gaming Industry continue operating 24 hours, with no limit in crowd entry, or bets placed over the various gaming stations.

The amount spent on a ride is fixed over any given period, while the turnover at every gaming station is far higher in the same period.

How many rides and entertainment can you squeeze into the IR at Marina and Sentosa, with each ride having a fixed capacity ? How many MICE events can be conducted every month ? How long will the MICE event hall stay vacant in between each exhibition ? How many different exhibitors can be drawn in annually or bi-annually before MICE fatigue set in ?

Sheldon's move from MICE to the Gaming Industry speaks more than the words that you can ever think.

You should be grateful that I have shown you far greater latitude then others have given you, and I am surprised at my own generosity towards you.

It is sad to see you constantly being cornered due to your own pride in refusing to change your position, and chew onto the last torn piece of your hopeless fabric of false thinking that was cleverly woven for you only.

There must be something wrong with your position, if no one seems to agree to your views that are constantly being shredded.

This is getting pathetic, when you try to follow my lines but cannot deliver it with the same strength. -

Originally posted by Gazelle:

You repeat what I said so cleverly, but make no effort to read carefully and think about the sentences printed.

1) You have blamed the government of using Singaporeans tax money to fund the reclaimation of the land. (to support your argument that government is pampering the rich at the expense of the poor) And now you are saying that Singapore government sold the land to the IR bidder for very high price. Doesnt these statements contradict each other?

When the Singapore Government sell those reclaimed land at very high prices, have you ever wondered where will that sum of money go to ?

Does it help to increase the interest rates paid to your CPF account, or help to lower the cost of your HDB flats, or pay for the infrastructure costs for the roads, MRT, sewer and water distribution lines - so as to lower the costs of all these services that Singaporeans are being charged at a high price, even when the same is being built with our money ?

In all likelihood, the huge sum of money received - from the sale of the reclaimed land to these two IRs - will most likely end up into the accounts of the GIC and Temasek Holdings, and perhaps another Thaksin will sell another Shin Corp to Temasek, and walk away with $3 Billion of our money.

Can you Think for yourself, or have you been so dependent for all things to be clearly spelled out for you ?

I wonder if you will be able to read the ''writings on the wall'', or perhaps you will mistake it to be grafitti ?.

It seems that you are still a whole league behind in the business world. You want to know more, do some research about ''Stamp Duties''.

2) Could you please explain what sort of stamp duties the government impose on contractors and sub contractor? Kindly please explain.

20,000 out of 4,000,000 plus residents ? Keep the ball rolling and you may hit all 4,000,000 after some time, if you can provide sufficient impetus to start the ball rolling.

3) Suppose if the IR can create 20,000 [b]new jobs for singaporeans and their residents, doesnt the families of these 20,000 employed workers benefits from the IR?

[/b]

10m tourist ? In one year ? Are you for real - when the Government is hoping to have 4m arrivals ?

4) Suppose when when IR is up and running and Singapore is able to attract an addition 10m tourist to Singapore, doesnt that benefit Singaporeans as more tourist will be spending money in Singapore?

Even at the current rate of arrival, how much of the current numbers have benefitted the heartlanders ?

2006 saw an increase in tourist arrivals, yet during end-2006 unemployment rate was still hovering at 2.4%; and during the last report in early May 2007, the unemployment rate was at 2.8%. -

Originally posted by Gazelle:

If 10 gamblers get bankrupt per day, it will be 3,650 bankrupt gamblers (I hope you understand bankrupt + gamblers) per year, if each bankrupt gambler has a family of four (includes gambler), 14,600 lives are ruined a year.

3) Suppose if the IR can create 20,000 [b]new jobs for singaporeans and their residents, doesnt the families of these 20,000 employed workers benefits from the IR?

[/b]

If two gambler chooses the MRT tracks for his final journey, that will be 730 suicides due to casino.

What is the value of a human life?

20,000 jobs at the expense of 14,600 ruined lives or 730 casino related suicides? -

Sometimes I wonder what is the government's definition of tourist arrivals. Does transit en route to another destination qualify as arrivals.Originally posted by Atobe:10m tourist ? In one year ? Are you for real - when the Government is hoping to have 4m arrivals ?

Even at the current rate of arrival, how much of the current numbers have benefitted the heartlanders ?

2006 saw an increase in tourist arrivals, yet during end-2006 unemployment rate was still hovering at 2.4%; and during the last report in early May 2007, the unemployment rate was at 2.8%.