Free Education and Medical Care : Fact or Myth?

-

To provide a fair comparison, you should add the total tax revenue of the Australian government and the Australian governments income from other sources, like utilities, transport and communication, because these services form part of the government's revenue too.Originally posted by Gazelle:

Then add up the total tax revenue from the Singaporean government and income from other sources, like SingTel, Singapore Power, Starhub, SMRT, Mediacorp, Singapore Food Industries, Singapore Pools, Capita Land, etc. Why do you ask that you add up the profits for all those companies? It's because it forms part of the government's total revenue, the government's revenue belongs to the people too (correct me if I am wrong, maybe it belongs to the pigs in Manor Farm). -

Please use the mater in between your ears, to come up with better response than a one liner, it hardly explain your points.Originally posted by Gazelle:a) There is a difference between public and private hospital in Australia? Who are the others?

b) What is the % of unfortunate soul like what you said in Australia?

c) The most important question you should ask yourself is, what is the chance of a singapore migrating to australia to be unemployed and be enjoying such healthcare funding?

a) Don't understand what you are trying to say.

b) It forms a minority, but in every system there are poor people. But the thing is, in an Australian context, he/she will get the required medical care. Whereas, in Singapore, you are left to your own devices.

c) Don't be thick, you think the Australian government is dumb like you when considering migration criteria. They have to look at your educational qualification, if not, then funds in millions which might qualify you for investor status before considering you. -

You have an understanding disability again? I said "It's like having bought a car, but it's kept in the showroom, you can't use it till you are about to die.", you can use "it's like buying a house, but you can't live in it till you are about to die". It's doesn't change the direction of the logic. You are missing the forest for the trees again!!!Originally posted by Gazelle:I am not interest in what you said above, and please to compare owning a car that you cant drive to CPF is pure stupid

a) Money dont get outdated like cars

b) Car is never an asset unless its a collectors item.

c) You cant use your CPF monies is probably you are still a student and the only money you have in there is government give out.

To cut the story short, I am still waiting for your to explain to me why the figures I provided doesnt favour my logic?

a) What point are you trying to put forward with your 1 liner? I don't understand you.

b) Like I said in the reply above, you are missing the forest for the trees.

c) You can't use your CPF money till your are at retirement age!!!

The figures provided by you are distorted with misinformation intended to mislead Singaporeans.

Like I said, if you really want to make a fair comparison, use all the revenues of the Australian government and the Singapore government.

All revenues includes, taxes, business income from state run businesses (afterall these money belongs to the government, the ultimate beneficiary should be the citizens).

It's not a fair comparison when Singapore charges lower taxes, but uses it's state owned monopolies to charge higher prices for goods and services, at the same time not providing free healthcare and education. Australia levies higher taxes, but it provides free healthcare and education. -

Ever wondered if CPF also stands for Cash Prior to Funeral?

-

It's not a gimmick - it's your ineptitude which precludes you from understanding what truly constitutes "free at the point of delivery".Originally posted by Gazelle:You are right, thats probably the no.1 marketing gimmick many australian bound forumers are trying to sell australia,

if you become an australian, you get free education and healthcare etc, however they didnt realise that before you even get to enjoy such benefits, you are already paying more than what you need through income taxes.

To qualify your point, just take the facts at face value. If you were an unemployed man paying no tax, you're pretty much entitled to the free healthcare in Britain as much as the billionaire who pays taxes through his nose. Would that not effectively be free?

Relate that example to this regime. If you were unemployed and paid no taxes, are you entitled to any form of free public healthcare here?

Can you see the difference? Or has the fascist here done such a good job at selling spin to muppets who can't seperate fact from fiction? -

More like this regime will tell you, in the usual high handed manner, that it is your fault that you don't qualify for healthcare.Originally posted by walesa:It's not a gimmick - it's your ineptitude which precludes you from understanding what truly constitutes "free at the point of delivery".

To qualify your point, just take the facts at face value. If you were an unemployed man paying no tax, you're pretty much entitled to the free healthcare in Britain as much as the billionaire who pays taxes through his nose. Would that not effectively be free?

Relate that example to this regime. If you were unemployed and paid no taxes, are you entitled to any form of free public healthcare here?

Can you see the difference? Or has the fascist here done such a good job at selling spin to muppets who can't seperate fact from fiction?

In explicitly, you deserve to die.....

-

still cannot figure out how you derived your figure of Income Tax Revenue : S$149.3 billion / yr (including superannuation tax and fringe benefit tax).Originally posted by Gazelle:RS, If you are sincere, why dont you just explain to us how we should calculate and use tax/benefit ratio, i think that is more important than discussing your post of 11.27pm isnt it?

Based on the the above information:

Total individuals and others withholding taxation + fringe benefits tax + Total superannuation taxation = A$116.14 b + A$3.73 b + A$6.97 b

The above = A$126.84 billion

Convert it to S$ based on your provided exchange rate of A$1=S$1.25, that means a sum of A$126.84 b x 1.25 = S$158.5 billion.

Kindly enlighten me.

This post at 11:27 pm is crucial. Enlighten me first on how you have derived the figure of S$149.3 billion. If it is accurate, I shall use this figure. If not, I shall use my own figure. Simple as that. Nothing to hide unless you have made a mistake in your calculations.

Just give me the breakdown and I promise that I will show you my benefit/tax computation right away. -

Hasn't come in yet, he works 9-6pm, 5 day week, weekends he brings his work home with him.

-

Originally posted by Gazelle:RS, since you are the ONLY one that has initiated us to use this benefit/tax ratio to measure the attractiveness of both countries, I am sure you must have had the experience and neccessary knowledge in using them cause you cant be so stupid to be asking something which you are incapable of explaining right?

As I am new to this ratio, hence i would like to ask you

a) What should be classified under benefits from the government expenditure?

e.g Is buying weapons to protect our country consider as benefits?

e.g Is running our country will little debt consider as benefit

e.g. Is building MRT and new highway consider as benefits.

b) Who is to decide what is and what is not consider as benefits?

Where's your brain? Are you sitting on it or what? Did you not read this post of mine on 17 June 8:57 pm?

Tax/Benefit ratio: take the total benefits allocated by the Australian and Singaporean governments in their budgets and divide by the total tax collected respectively. Compare the ratios and see which government offers more value as per tax collected.

If you want to teach us a new ball game, I think it is better that you first spell out the rule of the game or else you will always be the meaningless winner.

So Mr. Rock_Star, the ball is now in your hand, you got to tell us what to do with it because we can play!!

Have you missed out on this one too? 17 June 10:16 pm

We don't want to see an NKF where out of $1, only $0.10 went to charity, do we?

It's as simple as NKF and ABC unless you choose to be

"thick in the head" as Maurizio13 put it. -

What's this chap's profile? Civil servant, university grad, how old?Originally posted by maurizio13:Hasn't come in yet, he works 9-6pm, 5 day week, weekends he brings his work home with him. -

Originally posted by Rock^Star:

I am sure anybody how gone through their primary school education will be provide the same sentence as you do. We are not asking your about the shape of the ball, but the rule about this ball game that you are trying to teach us. Get It?

Tax/Benefit ratio: take the total benefits allocated by the Australian and Singaporean governments in their budgets and divide by the total tax collected respectively. Compare the ratios and see which government offers more value as per tax collected.

My question to you is simple, WHAT SHOULD BE CONSIDERED AS BENEFITS AND WHAT SHOUDLNT? AND WHY?

If you cant answer me the above question, then I suggest that you take your ratio somewhere and buried them. -

Originally posted by Rock^Star:

If your intention is to proof that australians are getting more benefits than the tax they are paying, I would suggest that you use a lower tax collection number. If your intention is to argue for the sake of arguing, then I suggest you use both, cause it might make you look smarter

still cannot figure out how you derived your figure of Income Tax Revenue : S$149.3 billion / yr (including superannuation tax and fringe benefit tax).

Based on the the above information:

Total individuals and others withholding taxation + fringe benefits tax + Total superannuation taxation = A$116.14 b + A$3.73 b + A$6.97 b

The above = A$126.84 billion

Convert it to S$ based on your provided exchange rate of A$1=S$1.25, that means a sum of A$126.84 b x 1.25 = S$158.5 billion.

Kindly enlighten me.

This post at 11:27 pm is crucial. Enlighten me first on how you have derived the figure of S$149.3 billion. If it is accurate, I shall use this figure. If not, I shall use my own figure. Simple as that. Nothing to hide unless you have made a mistake in your calculations.

Just give me the breakdown and [b]I promise that I will show you my benefit/tax computation right away.

[/b] -

a) Could you explain to us why we should do that when we are comparing the amount of benefit an Australian get vs. the income tax they are paying?Originally posted by maurizio13:To provide a fair comparison, you should add the total tax revenue of the Australian government and the Australian governments income from other sources, like utilities, transport and communication, because these services form part of the government's revenue too.

Then add up the total tax revenue from the Singaporean government and income from other sources, like SingTel, Singapore Power, Starhub, SMRT, Mediacorp, Singapore Food Industries, Singapore Pools, Capita Land, etc. Why do you ask that you add up the profits for all those companies? It's because it forms part of the government's total revenue, the government's revenue belongs to the people too (correct me if I am wrong, maybe it belongs to the pigs in Manor Farm).

b) Do you have reason to believe that Australia government doesnt own aussie companies in Australia? clue : Telstra, Qantas, Australia post.

c) Suppose if you include all revenue of the government, are you also going to include all expenditure of the government? If not, why not? if yes, why yes? -

a) Why dont you just say that you choose to be a beach bum living in australia?Originally posted by walesa:It's not a gimmick - it's your ineptitude which precludes you from understanding what truly constitutes "free at the point of delivery".

To qualify your point, just take the facts at face value. If you were an unemployed man paying no tax, you're pretty much entitled to the free healthcare in Britain as much as the billionaire who pays taxes through his nose. Would that not effectively be free?

Relate that example to this regime. If you were unemployed and paid no taxes, are you entitled to any form of free public healthcare here?

Can you see the difference? Or has the fascist here done such a good job at selling spin to muppets who can't seperate fact from fiction?

b) Do you have reasons to belive that the australian government will allow asian immigrants to become a beach bum in Australia? And what is the chances of Singaporeans migrating to australia will gain from such healthcare and education policy?

c) Different culture require different approach. I am not critising their system because it has got nothing to do with me. However the point of this thread is to clear the myth that the so called "Free" healthcare and education is actually not free and it cost more than what you get. -

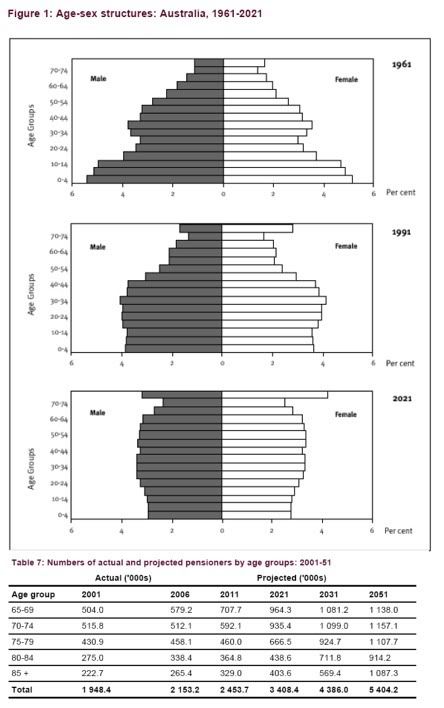

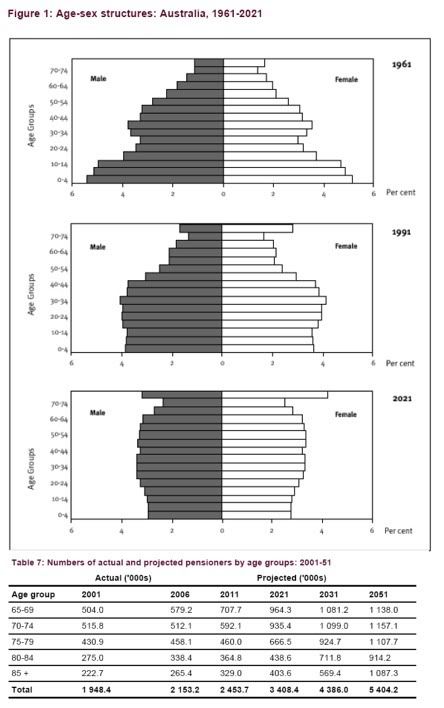

According to Department of Community and Services Australia, the number of pensioner is likely to double within the next 25 years, or about 4% per year, while the population growth rate is only growing at 1.4% per year.

Comparing the demography graphy between 1991 and 2021, it is very clear that the future generation of Australians working in Australia will have to carry a heavier burden of supporting the aging population in the country.

-

a) In your original post, you place Australia's tax revenue with Singapore's tax revenue. If you are not comparing both countries; what the fark are you doing? If you want to compare both countries, isn't it more equitable to compare the total revenues of both countries (at least hold 1 factor constant, so that you can see the overall effects). By doing what you are doing now, you are being lopsided, 1) the revenue collected by Singapore is not only tax revenue, they collect dividends from state owned monopolies which charge exorbitant prices (indirect form of tax) for essentials. Therefore you should bring in the earnings of Temasek and Singapore Pools, which are all Singapore government owned. Then bring in Australia's tax and dividends owned by the Australian government.Originally posted by Gazelle:a) Could you explain to us why we should do that when we are comparing the amount of benefit an Australian get vs. the income tax they are paying?

b) Do you have reason to believe that Australia government doesnt own aussie companies in Australia? clue : Telstra, Qantas, Australia post.

c) Suppose if you include all revenue of the government, are you also going to include all expenditure of the government? If not, why not? if yes, why yes?

Right now what you are doing is comparing 2 countries with 3 variable factors, 1) revenue (taxes & dividends), 2) free healthcare & 3) free education. Since Singapore doesn't provide free healthcare and free education, isn't it obvious that the picture is distorted, any simpleton (except you) will know that the country that provides free healthcare and free education will spend more.

Temasek's earnings last year was S$16.5 billions, it belongs to the government, which ultimately belongs to Singaporeans. Where has this $16.5 billions gone? Has this increase in revenue for the government benefited Singaporeans in anyway?

b) I didn't say that Australia doesn't have any state owned enterprise, but it would provide a better comparison.

c) When you want to compare revenue, you take all the government's revenue to compare. Can you explain your rationale for bringing in expenditure now? Or is this another tactic of yours to sidetrack the discussion. -

M13, I believe you have a different approach of comparing the numbers, hence instead of using F word and barking like a mad dog that has been hiding under the skirt and havent seen daylight for weeks, why dont you show us your methodology and give us your comments about your findings?Originally posted by maurizio13:a) In your original post, you place Australia's tax revenue with Singapore's tax revenue. If you are not comparing both countries; what the fark are you doing? If you want to compare both countries, isn't it more equitable to compare the total revenues of both countries (at least hold 1 factor constant, so that you can see the overall effects). By doing what you are doing now, you are being lopsided, 1) the revenue collected by Singapore is not only tax revenue, they collect dividends from state owned monopolies which charge exorbitant prices (indirect form of tax) for essentials. Therefore you should bring in the earnings of Temasek and Singapore Pools, which are all Singapore government owned. Then bring in Australia's tax and dividends owned by the Australian government.

Right now what you are doing is comparing 2 countries with 3 variable factors, 1) revenue (taxes & dividends), 2) free healthcare & 3) free education. Since Singapore doesn't provide free healthcare and free education, isn't it obvious that the picture is distorted, any simpleton (except you) will know that the country that provides free healthcare and free education will spend more.

Temasek's earnings last year was S$16.5 billions, it belongs to the government, which ultimately belongs to Singaporeans. Where has this $16.5 billions gone? Has this increase in revenue for the government benefited Singaporeans in anyway?

b) I didn't say that Australia doesn't have any state owned enterprise, but it would provide a better comparison.

c) When you want to compare revenue, you take all the government's revenue to compare. Can you explain your rationale for bringing in expenditure now? Or is this another tactic of yours to sidetrack the discussion.

Isnt that more effecting? -

I don't know how is this related to your topic. Is this relevant to your topic "Free Education and Medical Care: Fact or Myth?"?Originally posted by Gazelle:According to Department of Community and Services Australia, the number of pensioner is likely to double within the next 25 years, or about 4% per year, while the population growth rate is only growing at 1.4% per year.

Comparing the demography graphy between 1991 and 2021, it is very clear that the future generation of Australians working in Australia will have to carry a heavier burden of supporting the aging population in the country.

Out of context.

We might as well side track to educational reforms in Singapore or Australia. -

IMHO, income tax vs income tax comparison will show that the Aussies pay more tax and get less back for the government. But it is oversimplyfying I think.

SG govt uses the CPF to bolster the reserves, while the Aussie govt doesn't have that luxury ( I think..). A large portion of the CPF funds go back the govt via HDB, and property tax on top of that.

Well, I think I can safely say that its not a myth that free health care and education is available to the lower income group, which was what its meant for. -

Hehehe......Originally posted by Gazelle:M13, I believe you have a different approach of comparing the numbers, hence instead of using F word and barking like a mad dog that has been hiding under the skirt and havent seen daylight for weeks, why dont you show us your methodology and give us your comments about your findings?

Isnt that more effecting?

If you want to make comparisons, don't compare a goreng pisang with an un-skinned banana. It's not a fair comparison.

You are the fool who wanted to make such comparison, not me. I am telling others that it's not a fair comparison. If you want to be fair, you should show us the calculation. Don't be lame to ask me to do your calculation, after all, you are the person who started the comparison.

You are comparing a country with free medical care and free education (obviously the cost will be higher, therefore the tax revenue higher), with a country without free medical care and free education (obviously the tax revenue is lower).

Do you often make comparisons between lions with dogs? -

The final say with regards to the topic "Free Education and Medical Care: Fact or Myth?". It's a FACT, because low income Australians and unemployed Australians don't pay for medical care and education. It's available to all Australians. Unlike Singapore, if you don't have any CPF or money, think you are left to bide your time.Originally posted by Jontst78:IMHO, income tax vs income tax comparison will show that the Aussies pay more tax and get less back for the government. But it is oversimplyfying I think.

SG govt uses the CPF to bolster the reserves, while the Aussie govt doesn't have that luxury ( I think..). A large portion of the CPF funds go back the govt via HDB, and property tax on top of that.

Well, I think I can safely say that its not a myth that free health care and education is available to the lower income group, which was what its meant for. -

We are still waiting for your to show us your methodology of comparing those numbers? Waiting!!Originally posted by maurizio13:Hehehe......

If you want to make comparisons, don't compare a goreng pisang with an un-skinned banana. It's not a fair comparison.

You are the fool who wanted to make such comparison, not me. I am telling others that it's not a fair comparison. If you want to be fair, you should show us the calculation. Don't be lame to ask me to do your calculation, after all, you are the person who started the comparison.

You are comparing a country with free medical care and free education (obviously the cost will be higher, therefore the tax revenue higher), with a country without free medical care and free education (obviously the tax revenue is lower).

Do you often make comparisons between lions with dogs?

PS> Dont find excuses slip under the skirt again. -

To you the only thing that is within the context of discussion is you and your childish myopic thinking.Originally posted by maurizio13:I don't know how is this related to your topic. Is this relevant to your topic "Free Education and Medical Care: Fact or Myth?"?

Out of context.

We might as well side track to educational reforms in Singapore or Australia.

a) Does aging australian population requires more medical care than younger Australians?

b) If the demand of medical care increases, will the government spending on medical care increase or decrease?

c) With increase spending, does the government need increase revenue to balance the deficit?

d) With a strinking working class % in the population, will that reduces the tax income for the government? -

You are the buffoon that brought out the unfair numbers for comparison. Comparing Apples with Durians. I just told you since you want to compare it this way, you should at least make only 1 factor variable, makes better comparison. If you don't want to, so be it, but I am stating that the comparison is bias.Originally posted by Gazelle:We are still waiting for your to show us your methodology of comparing those numbers? Waiting!!

PS> Dont find excuses slip under the skirt again. -

a) So are you comparing future medical cost of Australia and Singapore? Can you please provide both countries future expenses to make the comparison? I reiterate, your topic is "Free Education and Medical Care: Fact or Myth?". As I do not have a crystal ball like you, to gaze into the future, I cannot tell you what the future will be. With your crystal ball, you can make a 100% assessment of the future, highly remarkable. Can your crystal ball tell us which counter on the SGX will go up tomorrow?Originally posted by Gazelle:To you the only thing that is within the context of discussion is you and your childish myopic thinking.

a) Does aging australian population requires more medical care than younger Australians?

b) If the demand of medical care increases, will the government spending on medical care increase or decrease?

c) With increase spending, does the government need increase revenue to balance the deficit?

d) With a strinking working class % in the population, will that reduces the tax income for the government?

b) Anything can pan out in the future, unless you are gods like P?P, then your predictions will be reality.

c) Not necessary, as cost can decrease over time too. Just like the cost of handphones in the 1990s as compared to now.

d) Do you have the figures to make this stake this claim? Please provide the relevant data, that states that the "working class population is shrinking". NPNT.