SDP is SINGAPORE DEMORALIZE PARTY.

-

I can confirm that SDP stands for SINGAPORE DEMORALIZE PARTY.

They just post all articles blacken SG baselessly.

if u just read this,''SIA's free lunch with Branson proved costly'',Alistair Osborne,The Telegraph

10 Jul 07,u think SIA is making a loss deal when SIA going

to sell Virgin.

But primary 3 can tell u 100 million pounds is greater than 60 m pounds!!

But our learned PhD CSJ choose to omit clicking the key board to

do some home work .He acts as mouth piece for anti--Singapore

western medias!!

2.CSJ is wrong.If SIA can sell at 100 m pounds,SIA earn

a compound interest rate at 6 % pa from 1999

to 2008.At least SIA is not losing $$$.

If the price increases 3 more years at 6 %,

SIA will double the value of the stack since its purchase.

3.What do opposition party need to do?Stay alive politically.

But CSJ just do the opposite---commit suicide politically

and frequently.

Does he think he can lead without holding ant party office?

4.How do u feel for SDP postings?

I feel very odd that SDP has issued very few Media Release.

But SDP post anti--Singapore articles almost every day!!

Do The Central Executive Committee authorize EVERY POSTING?

Or is it a ONE MAN SHOW?

How about if any posting get sued,who will be liable? -

SDP is dead politically while at least WP is trying to do something, hopefully it won't result in political suicide. I think the government needs stronger opposition parties which are more capable than those at present.

-

Originally posted by lionnoisy:I can confirm that SDP stands for SINGAPORE DEMORALIZE PARTY.

But primary 3 can tell u 100 million pounds is greater than 600 m pounds!!

which primary school you study?? 100million is greater than 600 million??

which primary school you study?? 100million is greater than 600 million?? -

Originally posted by anonymouscoward:

which primary school you study?? 100million is greater than 600 million??

which primary school you study?? 100million is greater than 600 million??

-

The same primary school where people are taught a pound of peanuts is approximately worth 100m $$$Originally posted by ndmmxiaomayi:

-

that's nothing compared to the SG$10.58 billion dollar spent on defence.

http://www.mof.gov.sg/budget_2007/expenditure_overview/mindef.html

http://youtube.com/watch?v=jldRWPJmdoM -

Mmmh PAP and their supporters are making me confused... first they tell us that a peanut is worth $600,000. Now they tell me that 100million Pound is worth more than 600million Pound.

I think I need to go back to school... either that or they need to start learning basic mathematics. -

Maybe right now, you can figure out why your thread attracts so many views.

I can't deny, it's entertaining to read your post. -

2.dunt zoom on this peanut thing.Originally posted by maurizio13:Maybe right now, you can figure out why your thread attracts so many views.

I can't deny, it's entertaining to read your post.

Pl look and read carefully if u want CSJ or their associates

rule u and your next generations. -

Originally posted by gigi5:

I prefer $10Billion SGD spend on Defence, than spent on some 'Mega Project' like Malaysia. My personal view of course....

that's nothing compared to the [b]SG$10.58 billion dollar spent on defence.

http://www.mof.gov.sg/budget_2007/expenditure_overview/mindef.html

http://youtube.com/watch?v=jldRWPJmdoM[/b]

-

I want CSJ to continue his activism. So?Originally posted by lionnoisy:2.dunt zoom on this peanut thing.

Pl look and read carefully if u want CSJ or their associates

rule u and your next generations.

-

1. dunt zoom out and deny ur mistake.Originally posted by lionnoisy:2.dunt zoom on this peanut thing.

Pl look and read carefully if u want CSJ or their associates

rule u and your next generations.

Just admit that you made a mistake with your claim that 100 million is greater than 600 million. Even Primary 3 boy can also admit his mistakes.

-

At least he can... count?Originally posted by lionnoisy:2.dunt zoom on this peanut thing.

Pl look and read carefully if u want CSJ or their associates

rule u and your next generations. -

The rise of the WP and the fall of the SDP

-

Originally posted by gigi5:

waste $$$, spore cant fight, why spend so much on defence

that's nothing compared to the [b]SG$10.58 billion dollar spent on defence.

http://www.mof.gov.sg/budget_2007/expenditure_overview/mindef.html

http://youtube.com/watch?v=jldRWPJmdoM[/b] -

Originally posted by lionnoisy:

Seems from TODAY that SIA is not making a loss from the sale. More like Virgin is not contributing as much profit as SIA would like.

I can confirm that SDP stands for SINGAPORE DEMORALIZE PARTY.

They just post all articles blacken SG baselessly.

[b]if u just read this,''SIA's free lunch with Branson proved costly'',Alistair Osborne,The Telegraph

10 Jul 07,u think SIA is making a loss deal when SIA going

to sell Virgin.

But primary 3 can tell u 100 million pounds is greater than 60 m pounds!!

It is $1000 m and $600 m respectively.

But our learned PhD CSJ choose to omit clicking the key board to

do some home work .He acts as mouth piece for anti--Singapore

western medias!!

2.CSJ is wrong.If SIA can sell at 100 m pounds,SIA earn

a compound interest rate at 6 % pa from 1999

to 2008.At least SIA is not losing $$$.

Can you count properly? $1b is $1000 m.

If the price increases 3 more years at 6 %,

SIA will double the value of the stack since its purchase.

3.What do opposition party need to do?Stay alive politically.

But CSJ just do the opposite---commit suicide politically

and frequently.

Does he think he can lead without holding ant party office?

4.How do u feel for SDP postings?

I feel very odd that SDP has issued very few Media Release.

But SDP post anti--Singapore articles almost every day!!

Do The Central Executive Committee authorize EVERY POSTING?

Or is it a ONE MAN SHOW?

How about if any posting get sued,who will be liable?

[/b]

Chee's article has failed to mention the amount that SIA could sell for and made it sound like a really poor investment. Likewise, I wouldn't say it is a good one though.

Chee should stop doing so much of this "get PAP down at all costs" thing. It makes him lose credibility. -

Singapore Air may sell Virgin Atlantic stake-paper

LONDON/SINGAPORE, July 9 (Reuters) - Singapore Airlines is reviewing the future of its stake in Virgin Atlantic in a move that could lead to a 1 billion pound ($2 billion) sale or initial public offering, the Daily Telegraph said on Monday.

The newspaper, without citing sources, said the Singapore-based carrier, the world's biggest airline by stock market value, was in the early stages of examining options for its 49-percent stake in British entrepreneur Richard Branson's Virgin Atlantic (VA) [VA.UL].

A spokesman for Singapore Airlines (SIA) declined to comment, while Virgin Atlantic could not immediately be reached for comment.

Corinne Png, an analyst at Citigroup in Singapore said any disposal of the VA stake was to be welcomed but added that the stake in the British carrier may be worth less than reported.

"We view this potential exit strategy positively as VA has not contributed significantly to SIA's bottom-line nor network connectivity in the past 7 years, even though SIA paid a large sum for the stake," she said in a note to investors.

Singapore Airlines stock underperformed the broader Singapore stock market , up half a percent at S$19.10. The shares have risen just over 9 percent since the start of the year.

Singapore Airlines acquired 49 percent of Virgin Atlantic for 600.25 million pounds in December 1999.

Png said that the Singapore state-controlled carrier would be able to book a "bumper disposal gain" if it could sell the stake for around 950 million pounds.

"A substantial disposal gain is likely as we believe the carrying value of VA is relatively low; SIA had previously written off 1.59 billion pounds goodwill following the acquisition."

A sale could result in further capital management by Singapore Airlines, similar to the hefty S$2.16 billion ($1.4 billion) payout to investors announced in May, or could be used to fund aircraft or airline purchases, she added.

Source: Yahoo News Asia

More analysis has to be done on the financial statements, because SIA claims to have written off £1.59 billion for goodwill. I wonder how is it possible to pay £600.25 million and write off £1.59 billion. *shrugs*

Maybe you can do some indepth analysis before staking your claim.

Goodwill is the excess price paid over the fair value of the company.

If this is the case, we can't even be sure if the purchase of Virgin Atlantic was a good one. -

Chee is too focused on anti PAP. Thats his mistake.

I pity his family. -

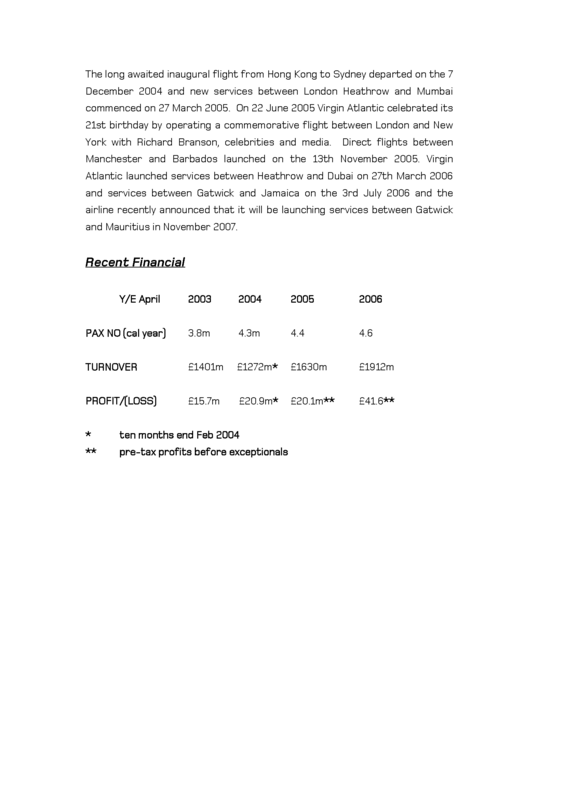

Was SIA's £600 million investment in Virgin Atlantic a good deal?

Let's say they really only paid £600 million for it.

The pre-tax profits:

2003 = £15.70

2004 = £20.90

2005 = £14.07 (UK has a 30% corporate tax rate [£20.1 X 70%])

2006 = £29.12 (UK has a 30% corporate tax rate [£41.6 X 70%])

SIA owns 49% of Virgin Atlantic, so therefore only approximately half of the profits belong to SIA.

2003 = £ 7.69

2004 = £10.24

2005 = £ 6.89

2006 = £14.27

Say the initial investment of £600 was a fixed deposit. The kind of interest returns you get on your fixed deposit would be:

2003 = 7.69 / 600 = 1.28%

2004 = 10.24 / 600 = 1.71%

2005 = 6.89 / 600 = 1.15%

2006 = 14.27 / 600 = 2.38%

Are these returns positive considering that Virgin Atlantic is a public listed company? Considering the risk that they are taking, I think SIA would have been better off investing in low risk bonds.

What the seller wants to sell for might not be the price transacted, as the seller wants to paid more for it, while the buyer wants to pay less for it.

I think our government is extremely naive.

Source: Virgin Atlantic -

do u seriously expect SIA, a company run by humans, to be perfect in every single damn thing that they do?

-

Any reply from lionnoisy?

Cat got your tongue? -

Originally posted by anonymouscoward:

which primary school you study?? 100million is greater than 600 million??

which primary school you study?? 100million is greater than 600 million??

-

You prefer war over liberty, death over rational thought. Your attitude will keep PAP spending billions on weapons and less on your health care and education. people like you will keep the radical cave-shittting bastards in the business of attacking us. Have you not learn anything from Iraq war?Originally posted by hloc:I prefer $10Billion SGD spend on Defence, than spent on some 'Mega Project' like Malaysia. My personal view of course....

http://youtube.com/watch?v=jldRWPJmdoM -

Quite frankly, investing in Virgin Atlantic was a bloody mistake, a strategic mistake. SIA got nothing out of it, and Virgin is actively competing against us.

-

An arrival, and a departure?

While it mulls CEA deal, SIA is considering selling its stake in Virgin Atlantic: Report

Johnson Choo

[email protected]

EVEN as Singapore Airlines (SIA) eyes a strategic stake in China Eastern Airlines (CEA), the Singapore-based carrier is looking to possibly sell off its stake in another airline: Sir Richard Branson's Virgin Atlantic.

.

The London-based Daily Telegraph reported yesterday, without quoting sources, that SIA is reviewing the future of its stake in Virgin Atlantic in a move that could lead to a £1-billion ($3.06-billion) sale or initial public offering. Media reports out of London suggest that SIA has spoken to a number of investment banks about the review, although it was not clear whether any had been given a formal mandate.

.

When contacted, SIA spokesman Stephen Forshaw said: "We do not comment on market speculation."

.

SIA paid £600 million for its stake in Virgin eight years ago, before the global aviation industry was hit by the terrorist attacks of Sept 11, the Sars outbreak in Asia and the Iraq war.

.

At the time, the deal was heralded as the start of a far-reaching code-sharing alliance between the two airlines. Although the code-sharing routes have been extended in recent months, analysts believe the partnership has failed to bear sufficient fruit, and have in fact reacted positively to the news.

.

Ms Corrine Png, an analyst with Citigroup Singapore, said in a note to investors: "We view this potential exit strategy positively as Virgin Atlantic has not contributed significantly to SIA's bottomline nor network connectivity in the past seven years, even though SIA paid a large sum for the stake."

.

In the first quarter of the year, SIA's earnings showed that profit contribution from associated companies shrank by about $176 million, with Virgin Atlantic singled out as the biggest contributor to the drop. Analysts predict that if the stake changed hands now, it would be worth between £900 million and £1 billion.

.

Ms Png added that if SIA could sell its stake for around £950 million, the airline would be able to book a "bumper disposal gain". A sale could also bring about better capital management for the airline.

.

Airline analysts also pointed out that if SIA's plan to buy into CEA takes off, the proceeds from the Virgin sale could come in handy to pay for the $900 million, or 15.8 per cent, stake of CEA that the Singapore carrier is believed to have been offered. About a month ago, the CEA board agreed to a plan to sell a combined 24 per cent to SIA and Temasek Holdings through a share offer.

.

Several airline observers, however, felt that the latest chapter in the SIA-Virgin Atlantic relationship is just another reminder of the Singapore carrier's less-than-rosy investment track record, from the lacklustre triumvirate formed with then Swissair and Delta Airlines, to the fiasco that came when it took up a stake in Air New Zealand.

As reported by our trustworthy government media.