MAS's survey foresee sub-prime troubles?

-

u can say i am licking the boots of MIW.

Pl read first and talk later .SG has cooled down property market

in May 1996 ,well before 1997 crisis and shot few warning shots

recently before sub prime loan troubles.

In this internet era,no need to meet the Master in Chinese

temple to consult the important policy,just

use SMS lah!!

Sometimes,u has to believe Singapore old and new gurards

have crystals balls in their safes!!....14. This year, we have already had several reminders of the risks in the system. The Chinese stock market has experienced a few incidents of volatility following expectations of and actual government action. It remains vulnerable to further corrections. In the US, the sub-prime market has imploded. More recently, US treasuries have come under severe selling pressure, causing interest rates to rise and generating unease in stock markets.

----(A)Mr Lim Hng Kiang, Minister for Trade & Industry and Deputy Chairman, Monetary Authority of Singapore, at the ABS Annual Dinner

15. Nevertheless, the financial system has been resilient so far. Have we learnt our lessons from past crises and are now better prepared? Or are we just plain lucky? Whichever the answer, we should remain vigilant.

16. As bankers, you will be familiar with the saying that bad loans are made in good times. This saying is particularly worth repeating when the environment appears rosy and serves as a reminder that vigilance is our constant responsibility. With this in mind, MAS initiated a survey of risk managers and traders, many of whom are based in Singapore, about their key risk concerns. This poll was conducted between April and June this year. A roundtable discussion was also held with risk managers. Let me now share with you some of the findings from this survey.

17. The feedback received was open and honest and many views were shared. Most respondents believed that asset prices were frothy and that a big shock could happen. Some speculated that this could happen before the end of 2008.

In this age of increased connectivity and correlation of markets, respondents felt that a shock event such as a terrorist attack, pandemic or geopolitical instability could cause market disruptions.

18. Respondents also highlighted the current liquidity in the financial markets. They observed that speculative liquidity was circulating in the financial system. This has led to historically unprecedented pricing and terms. When referring to the new players in the financial markets, respondents spoke of hedge funds and private equity in the same breath as “highly leveraged”, “covenant-lite structures” and “large speculative positions”. In the current low interest rate environment, many yield-hungry investors have become hedge providers for institutions. Respondents expressed concern about the systemic risks such providers posed and their default risk in a severe market correction.

19. In summary, the responses to the survey indicated that there seems to be a heightened level of risk in the macroeconomic and financial environment. Nevertheless, these responses are encouraging from another perspective. They indicate that financial institutions are aware of this heightened level of risk. With acceptance comes preparedness for the risks that may materialize in future.

20. It is important for banks not to become complacent. As banks pursue the many opportunities that lie ahead, we must not let our guard down. Banks must not be lulled into a false sense of security by the external environmentÂ’s bullishness and resilience to shocks so far. We must not allow ourselves to get over-confident with our knowledge and analyses of the risks out there. Risks may deviate from expectations. Situations may take unexpected turns. In the face of such uncertainties, being prepared and ready is always a good proposition.....

on 29 June 2007,

(B)-- DIRECTORS

4. Mr Lim Hng Kiang---/www.gic.com.sg

2.Has SG taken any precautions against the troubles? -

The writings were already on the wall. Only those belonging to the mushroom club (kept in the dark and fed shit) didn't know.

-

Looks like the bubble is gonna pop....

-

For the life of me, I don't understand half a word of what you're spouting. Can someone rephrase the above in comprehensible English?Originally posted by lionnoisy:u can say i am licking the boots of MIW.

Pl read first and talk later .SG has cooled down property market

in May 1996 ,well before 1997 crisis and shot few warning shots

recently before sub prime loan troubles.

In this internet era,no need to meet the Master in Chinese

temple to consult the important policy,just

use SMS lah!!

Sometimes,u has to believe Singapore old and new gurards

have crystals balls in their safes!! -

x2Originally posted by walesa:For the life of me, I don't understand half a word of what you're spouting. Can someone rephrase the above in comprehensible English?

I really dont understand what he is trying to say too

This is maddening -

u just need a sub prime IQ to understand me.

congra when u dunt understand me---u have a super prime IQ!! -

Actually, nobody of above average intelligence understands you. Like you said "u just need a sub prime IQ to understand me", means only an idiot will understand you.Originally posted by lionnoisy:u just need a sub prime IQ to understand me.

congra when u dunt understand me---u have a super prime IQ!! -

not everyone is as good in english as you, genius walesa.Originally posted by walesa:For the life of me, I don't understand half a word of what you're spouting. Can someone rephrase the above in comprehensible English? -

surely, someone as intelligent as you m13, wont understand.Originally posted by maurizio13:Actually, nobody of above average intelligence understands you. Like you said "u just need a sub prime IQ to understand me", means only an idiot will understand you. -

Hello? This is a routine survey, it seems. The opinions are that of private sector experts. How does this prove that our scholar MPs are smarter? Anyone following the subprime mortgage problem would know that analysts have been warning about it for months, if not years.

-

Originally posted by lionnoisy:

Thats a no brainer, thats why they can justify their million $ salary.

[b]u can say i am licking the boots of MIW.

Pl read first and talk later .SG has cooled down property market

in May 1996 ,well before 1997 crisis and shot few warning shots

recently before sub prime loan troubles.

In this internet era,no need to meet the Master in Chinese

temple to consult the important policy,just

use SMS lah!!

Sometimes,u has to believe Singapore old and new gurards

have crystals balls in their safes!! -

Huh?Originally posted by Gazelle:Thats a no brainer, thats why they can justify their million $ salary.

It's a no brainer and they can justify their million dollar salaries?

Meaning it's so easy that any tom dick and harry can do it, so their million dollar salaries is justified.

-

Sometimes it's not because they don't know, it's because they choose not to know. To them it's better to continue the lie, since it has been their support for so long, if you build your foundation on these lies, how can you not believe in them. For giving up on them will threaten their own existence.Originally posted by pearlie27:The writings were already on the wall. Only those belonging to the mushroom club (kept in the dark and fed shit) didn't know. -

Originally posted by Daddy!!:surely, someone as intelligent as you m13, wont understand.

u just need a sub prime IQ to understand me = you just need a below average IQ to understand meOriginally posted by lionnoisy:u just need a sub prime IQ to understand me.

congra when u dunt understand me---u have a super prime IQ!!

Which means anybody with below average IQ can understand him, instead of "anyone with average IQ can understand me".

If you understand him, maybe you can explain what he is trying to say? -

why you say it is easy? and why are you still a poor accountant?Originally posted by maurizio13:Huh?

It's a no brainer and they can justify their million dollar salaries?

Meaning it's so easy that any tom dick and harry can do it, so their million dollar salaries is justified.

-

the govt handled 97 monetary crisis fantastically. thats where i realised that they always think long term and thats good for the country. Govts that were greedy and played to please the greedy population got into serious trouble that made the country suffer.

-

1.u are damn right!!I say ''MAS's survey'',not MAS or MIT!!Originally posted by Panache1976:Hello? This is a routine survey, it seems. The opinions are that of private sector experts. How does this prove that our scholar MPs are smarter? Anyone following the subprime mortgage problem would know that analysts have been warning about it for months, if not years.

Did i say our high pay scholars find this warnings?

There is a company of foreign and local experts in GIC

and Temasek.I think some of them already shout out the warnings

internally..

The survey may just a windows dressing to shout of warnings. -

There is always a reason why MM Lee, at the age of 80 something, still accepted the job as an advisor for Citibank.

-

duny rely on western ratings so much.

What would u feel if u read in Dec 2006:The Aa3/P-1 debt and deposit ratings are based on IKB's 38% ownership by German

--

state-owned bank Kredinanstalt für Wiederaufbau (KfW; rated Aaa/P-1) and the

cooperation of both banks in government-sponsored loan programmes. In our opinion,

these close ties with KfW result in a moderate degree of implicit support for IKB....

Franchise And Strategy

STRONG FRANCHISE BASED ON SOLID POSITION AS LONG-TERM LENDER TO THE GERMAN MITTELSTAND...

LEADING POSITION IS SUPPORTED BY DEEP KNOWLEDGE OF THE MARKET AND EXTENSIVE PRODUCT

KNOW-HOW....

STRATEGIC PARTNERSHIP WITH KFW HAS LED TO STRONGER CO-OPERATION AND ALSO RESULTS IN

MODERATE DEGREE OF IMPLICIT SUPPORT..

Â…EXTENSIVE USE OF COLLATERALÂ…

Over recent years, IKB has increased its asset investments (mainly in the syndicated loan market) in the international

arena, primarily in the UK, France and the USA, and around a third of IKB's total loan book is now non-domestic.

We welcome this geographic diversification and the good returns of this portfolio (close to half of IKB's operating

profit comes from international business), since it makes IKB's revenues and risk profile less dependent on the performance

of the German economy. The quality of the non-domestic portfolio is sound as well. While a few years ago a

part of this international portfolio was in the non-investment grade rating range, the bulk of the international exposure

is now solidly of investment-grade quality. The bank's exposure to non-industrialised countries is predominately

secured by the extensive use of Hermes insurance.

rating_moodys.pdf

2.Conservative estimate IKB will lost Euro 3.6 billion in sub prime

troubles. -

among think tanks, conference board seems to be really accurate. but very few people have access to their reports.

-

I think our ministers always give signal when they make public annoucement. just got to learn to catch what they are trying to say.Originally posted by Mat Toro:among think tanks, conference board seems to be really accurate. but very few people have access to their reports. -

they do do their part and thats good advice.

but thats the most they can do cos its unfair for them to 'favour' the market one way or another in their position. -

I think our Andrew Yap in sgForums is smarter than the Ministers, he managed to predict accurately the date (afew days accuracy) of the crisis and sold off his stock before he got burnt.

I think anybody who has a knack for economics could have predicted that something is wrong with trade between China and US. I predicted the crisis would happen within this year or early next year, but I could not be certain of the date. There were quite afew prominent economist who predicted some kind of crisis this year too, my guess is, these Ministers must have read some article by these prominent economist and just plagiarize their works.

If our Minister's truly anticipated the risk, then they would have divested from the US$ holdings way before the crisis. The injection of money from the Feds would mean an increase in the money supply leading to inflation and depreciation of the US$ against other currencies.

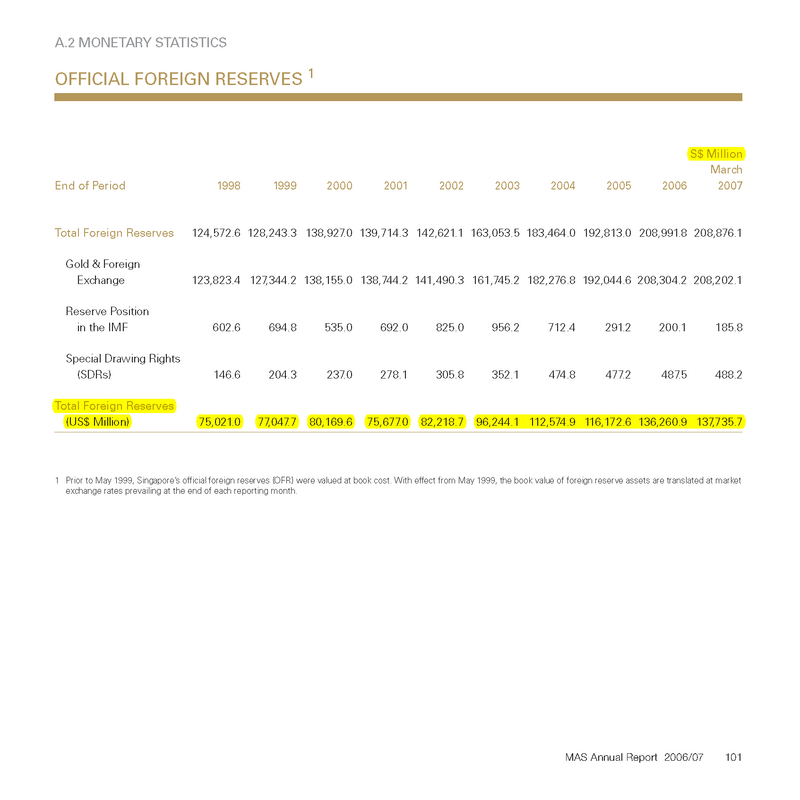

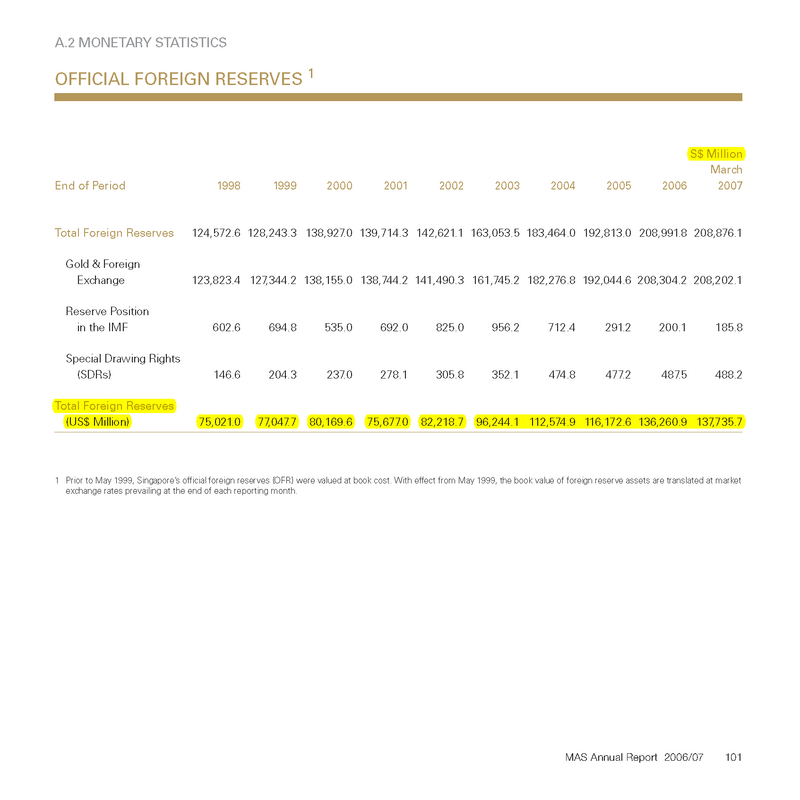

Our US$ reserves held by MAS stood at US$ 138 billion as on March 2007. FYI, US is one of Singapore's major trading partners, what better currency to hold than US$.

Sometimes, when it rains, there is lightning, a simpleton will awe at it's magnificence, "wow! lightning! so wonderful!". But a scientist will tell you it's the result of static charge forming in the clouds. Knowlege is powerful, without it you will look like the cronies in here.

I only give credit when credit is due, so....., no praises for our MIW this time. -

M13 must be one of the worst and stupid accountant in Singapore.

1) How can GIC and Temasek investment strategy be compared to a short term small time equity investor?

2) When Singapore says that our reserved is US$138b, that doesnt means that they are all in US$/GREENBACK, but rather the equivalent of US$ at that time.

Honestly if he is really good at what he claim he is good at, he wont be making such stupid assumption.

My advice to readers here is that, DONT and NEVER believe what he post in this forum. -

Also take note of the MAS annual report 2007, our "Gold and Foreign Exchange" is SG$208,202.1 millions and the "Total Foreign Reserves" US$137,735.7. If you multiply the US$137,735.7 by the exchange rate US$1 = SG$ 1.51, you get the SG$208,202.1 in "Gold and Foreign Exchange" which means that the majority of our reserves in "Gold and Foreign Exchange" is in US dollars (which might include US treasury bills, US bond, US equities, etc).Originally posted by Gazelle:M13 must be one of the worst and stupid accountant in Singapore.

1) How can GIC and Temasek investment strategy be compared to a short term small time equity investor?

2) When Singapore says that our reserved is US$138b, that doesnt means that they are all in US$/GREENBACK, but rather the equivalent of US$ at that time.

Honestly if he is really good at what he claim he is good at, he wont be making such stupid assumption.

My advice to readers here is that, DONT and NEVER believe what he post in this forum.

The annual report from MAS states "Gold and Foreign Exchange" at SG$208 billions, if it was held in other currencies, then you won't get a perfect exchange rate figure of US$1 = SG$1.51 when you divide SG$208,202.1 by US$137,735.7.

Do the maths and tell me the answer.