Public Sector Productivity?? Who's accountable?

-

In January 1998, it was revealed that a US diskdrive maker Micropolis, was taken over by ST technologies, and sank with losses of S$ 575 million. (1)

DBS, 37% percent owned by temasek holdings, lost heavily in acquiring Thai Danu bank, quoted to be an "expensive mistake". (2) The bank indicated the size of its mistake when it said it was raising its stake in the bank from 241mil to 763.4mil SGD

SIA acquired 25% of a troubled Airline, Air New Zealand in April 2001. The carrier's operational and and financial troubles caused its share price to nosedive. The NZ govt was force to bail out and diluting SIA's share to 5 percent. By Oct '04, SIA estimated to have lost over NZ$500 mil, according to investment director for Macquarie Equities. (3)

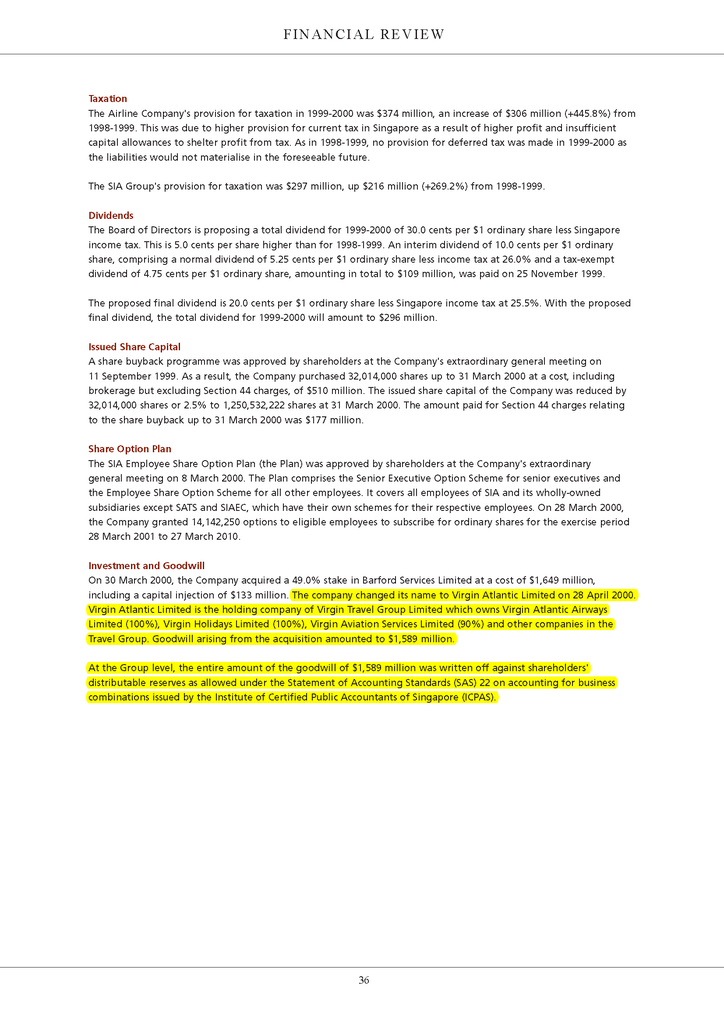

At the height of the tech boom in '01, SIA showed further ineptitude was revealed when it acquired 49 percent of Virgin Atlantic, for Aus$1.6 Billion. Boss of Virgin, Sir Branson must be laughing his way to the bank as he received top dollar and remain in charge. (4) Paying top dollar for 49% stake, and still leaving Branson in charge... good or bad business acumen?

(1)ST Jan 16 1998

(2)ST March 7, 2000

(3)ST October 6 2004

(4)The Australian, February 16-17 2002

Colleagues bugging to lunch, to be con't after I get back

Edit : apologies for the typo, 575 mil instead

-

Think for the Virgin Atlantic deal, SIA paid too much for it, think they wrote off quite afew hundred millions of purchased goodwill on either the year of purchase or the next year.

-

Originally posted by maurizio13:Think for the Virgin Atlantic deal, SIA paid too much for it, think they wrote off quite afew hundred millions of purchased goodwill on either the year of purchase or the next year.

-

They overpaid for Virgin Atlantic.Originally posted by de_middle:

Sometimes I wonder if the over payment is intentional. They overpaid for alot of acquisitions.

The standard requires purchased goodwill and certain intangible assets to be capitalised and, in most circumstances, to be amortised systematically through the profit and loss account (usually over 20 years or less). Impairment reviews must be undertaken, particularly if the goodwill or intangible asset is regarded as having an infinite life and is therefore not being amortised. Internally generated goodwill should not be capitalised and internally developed intangible assets should be capitalised only where they have a readily ascertainable market value.

FRS 11 sets out the principles and methodology for accounting for impairments of fixed assets and goodwill. It replaces the previous approach whereby diminutions in value were recognised only if they were regarded as permanent. Instead, the carrying amount of an asset is compared with its recoverable amount and, if the carrying amount is higher, the asset is written down.

-

Wah...lose S$575 billion.Originally posted by Jontst78:In January 1998, it was revealed that a US diskdrive maker Micropolis, was taken over by ST technologies, and sank with losses of S$ 575 billion. (1)

DBS, 37% percent owned by temasek holdings, lost heavily in acquiring Thai Danu bank, quoted to be an "expensive mistake". (2) The bank indicated the size of its mistake when it said it was raising its stake in the bank from 241mil to 763.4mil SGD

SIA acquired 25% of a troubled Airline, Air New Zealand in April 2001. The carrier's operational and and financial troubles caused its share price to nosedive. The NZ govt was force to bail out and diluting SIA's share to 5 percent. By Oct '04, SIA estimated to have lost over NZ$500 mil, according to investment director for Macquarie Equities. (3)

At the height of the tech boom in '01, SIA showed further ineptitude was revealed when it acquired 49 percent of Virgin Atlantic, for Aus$1.6 Billion. Boss of Virgin, Sir Branson must be laughing his way to the bank as he received top dollar and remain in charge. (4) Paying top dollar for 49% stake, and still leaving Branson in charge... good or bad business acumen?

(1)ST Dec 24 2003

(2)ST Sept 29 2004

(3)Economic Growth and Development in Singapore(Cheltenham, UK; Edward Elgar publishing, 2002) p203

(4)Today , Sept 24. 2004

Colleagues bugging to lunch, to be con't after I get back

that is like 3 times our reserves?

that is like 3 times our reserves?

-

So sad that Gazelle has to resort to attacking an honest typo, think any sane person should be able to know it. Reason being he can't find any other strong points to counter.Originally posted by Gazelle:Wah...lose S$575 billion. that is like 3 times our reserves?

that is like 3 times our reserves?

-

Wah lan eh! TS get your facts right leh........ SIA, ST Technologies = Public sector meh?

When you cannot even get this basic fact right, there's no necessity to even read whatever you write cos you've lost all credibility and you don't have any solid ground on which to found your comments.......

-

typo? maybe lah...or it could also be BIG TALK, fake infor, defaming, distorting fact and lying.Originally posted by maurizio13:So sad that Gazelle has to resort to attacking an honest typo, think any sane person should be able to know it. Reason being he can't find any other strong points to counter. -

it doesnt matter because they are just entertaining themselves. Of should I say mental masturbation.Originally posted by :Wah lan eh! TS get your facts right leh........ SIA, ST Technologies = Public sector meh?

When you cannot even get this basic fact right, there's no necessity to even read whatever you write cos you've lost all credibility and you don't have any solid ground on which to found your comments.......

-

They are investment arms of the government, used to supposedly grow public money. Companies that have access to public funds and companies where the government have a major stake in.Originally posted by :Wah lan eh! TS get your facts right leh........ SIA, ST Technologies = Public sector meh?

When you cannot even get this basic fact right, there's no necessity to even read whatever you write cos you've lost all credibility and you don't have any solid ground on which to found your comments.......

-

It was a typo, supposed to million, instead of billion. Sincere apologies.Originally posted by Gazelle:typo? maybe lah...or it could also be BIG TALK, fake infor, defaming, distorting fact and lying.

Sources are quoted, feel free to verify if you like. Maybe you wanna verify before attacking?

I have never made any personal attacks(flames?) against you Gazelle. Maybe you want to point out that I misquoted or distorted the facts with fact of your own instead of attacking another poster?

-

Actually if you are really insistent of the naming convention, I'll change the Thread title if you like. perhaps to something you might feel is more appropriate.Originally posted by :Wah lan eh! TS get your facts right leh........ SIA, ST Technologies = Public sector meh?

When you cannot even get this basic fact right, there's no necessity to even read whatever you write cos you've lost all credibility and you don't have any solid ground on which to found your comments.......

-

that is suppose to be an insult on M13, because he has failed to spot the big elephant in your post. Anyway, sheep are blind..Originally posted by Jontst78:It was a typo, supposed to million, instead of billion. Sincere apologies.

Sources are quoted, feel free to verify if you like. Maybe you wanna verify before attacking?

I have never made any personal attacks(flames?) against you Gazelle. Maybe you want to point out that I misquoted or distorted the facts with fact of your own instead of attacking another poster?

-

More Failed State Ventures with Public Funds (maybe should have used this title in the beginning)

In 2000, GIC purchased 15 million shares in Australia's Macquarie Corporate Telecom and ~$3 a share, making the GIC the largest shareholder in a company on a downward slide. A year later, the telco announced that it was losing money and share prices fell drastically. The GIC, left with depreciated shares, had to sell 14million shares at 18 cents a share. (1)

Charted Semiconductor Manufacturing, (temasek has 60% stake) bled money from 2001-4. (2) Having inferior technology to their Taiwanese rivals, didn't make any profit in 2000-4.(3)

(1) The Age (Melborne), April 11 2001

(2) The Economist, August 14 2004

(3) The Australian, October 28, 2004 -

TemasekÂ’s foray into Barclays-ABN deal is newsworthy. Another potential loss to watch out for.

-

Actually there is no point picking on the failed investment without comparing it to those that are successful.

For a fairer comparison, we have to look into their overall portfolio profitability. -

why you said that?Originally posted by googoomuck:TemasekÂ’s foray into Barclays-ABN deal is newsworthy. Another potential loss to watch out for. -

The US, France and Germany are drawing up rules to govern business transaction involving state controlled investment funds.Originally posted by Gazelle:why you said that?

France and Germany want to avoid a patchwork of regulations and are pushing for the 27-member European Union to introduce a united approach.

Temasek has a good track record of making giant losses, as can be seen from the list in the posts. -

I thought EU and Dutch regulator have already given the green light for Barclay's takeover bid.Originally posted by googoomuck:The US, France and Germany are drawing up rules to govern business transaction involving state controlled investment funds.

France and Germany want to avoid a patchwork of regulations and are pushing for the 27-member European Union to introduce a united approach.

Temasek has a good track record of making giant losses, as can be seen from the list in the posts. -

Hehehe.....Originally posted by Gazelle:that is suppose to be an insult on M13, because he has failed to spot the big elephant in your post. Anyway, sheep are blind..

As usual presumptious, just because you are blind and stupid doesn't mean everybody else is.

How did you know I did not spot the typo?

FYI, you should ask jonst78 the time of the email I sent him with particular reference to the typo. -

Overall portfolio profitability is due to monopolizing the Singapore market, charging us for basic services at an exhorbitant price.Originally posted by Gazelle:Actually there is no point picking on the failed investment without comparing it to those that are successful.

For a fairer comparison, we have to look into their overall portfolio profitability.

Whenever they make investments losses, they can just increase the prices of necessities and their overall profitability will increase.

-

M13, be careful of what you said or else you will have to defend what you said like mad sheep.Originally posted by maurizio13:Overall portfolio profitability is due to monopolizing the Singapore market, charging us for basic services at an exhorbitant price.

Whenever they make investments losses, they can just increase the prices of necessities and their overall profitability will increase.

-

This bit of information needs clarification. A 49% buyout remains a minority stake. Even when the buyout is 51%, sometimes it is a safer bet to stay with a promising management.Originally posted by Jontst78:(4) Paying top dollar for 49% stake, and still leaving Branson in charge... good or bad business acumen?

There are several cases of General Electric acquiring potential companies but retaining their corporate staff because they have been producing results. Changing a CEO with a new direction can sometimes be a disruptive influence rather than a refresher. It all depends in the industry and target market.

Ultimately, if the company is making millions, no reason to change a winning formula. -

Hahaha......Originally posted by Gazelle:M13, be careful of what you said or else you will have to defend what you said like mad sheep.

You are really a moron to think that their other investments make more money than Singapore monopolies.

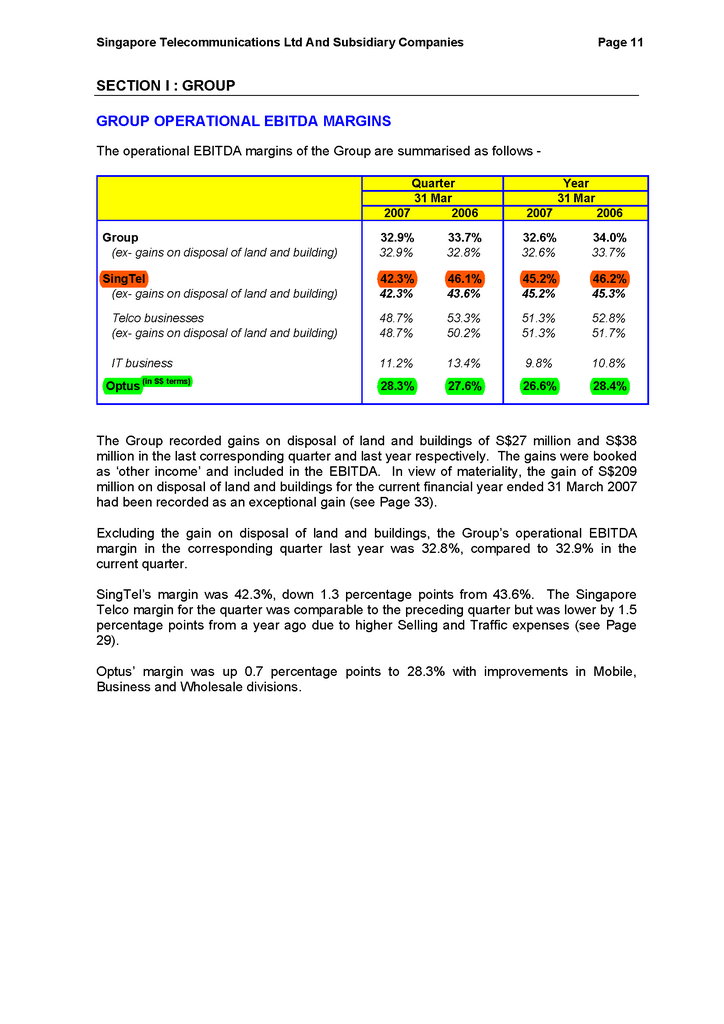

Take the Telecommunication companies for example (an industry which is both prevalent in Singapore and Australia), we compare both Singtel and Optus operational EBITDA (Earnings Before Interest Tax Depreciation and Amortisation). Operational EBITDA is almost equivalent to Gross Profit.

Singtel's Operational EBITDA is approximately 20% higher than Australia's Optus. Aren't the Singaporeans pure schmucks. Especially Gazelle who thinks that Temasek's overall profitability is due to it's investments overseas.

Gazelle, seriously....., try to provide more data to support your arguments instead of just claiming that all my data from official sources are bullsh|t.

I don't understand why you posisi your pantak for me to cho cho everytime, you enjoy my phallus so much?

Maybe other forumers can provide some comments on what they think of the operational EBITDA margins from Singtel and Optus?

Source: http://www.optus.com.au/dafiles/OCA/AboutOptus/MediaCentre/SharedStaticFiles/SharedDocuments/4thqtr07-MDA.pdf -

Hey Sheep,

This is what you wrote.

""Overall portfolio profitability is due to monopolizing the Singapore market, charging us for basic services at an exhorbitant price.

Whenever they make investments losses, they can just increase the prices of necessities and their overall profitability will increase.""

Overall portfolio is not equal to Singtel only. please open up your shi.t stained eyes and read what you wrote.

SHEEP!!