Public Sector Productivity?? Who's accountable?

-

chill people. chill

Yap, the people behind the failed investments have to explain the reasons, like what private CEOs do. For SG, I dunno know much about it, and I dun care anyway, cos you can't do anything about it.

But I agreed with gazelle (is it?) that we have to look at the full portfolio returns to comment. News agencies have the habit to dramatise negative news.

It's like I say this school of 30 students bad, because 10 of their students got 5/100 for their exams. It's not fair. I have to also look at the performance of the 25 other students.

-

Straits Times has cited private sector estimates that the return on singapore's reserves, at 1.5 percent per year form 1965 to 1995, were among the lowest in asia.(Straits Times, March 2, 2001)

A report in Sept 2004 found that Singapore's investment strategy had yielded a simple annual return of 1.7 to 4 percent from 1999 to 2003, compared to hongkong's 6.1 percent.

(Business Times October 1st, 2004) -

Sad to say, our state owned monopolies can only suck higher percentages from Singaporeans, but when venture overseas they lose their monopoly power, then only losses and less than Singapore monopolised rates of return occur.Originally posted by Jontst78:Straits Times has cited private sector estimates that the return on singapore's reserves, at 1.5 percent per year form 1965 to 1995, were among the lowest in asia.(Straits Times, March 2, 2001)

A report in Sept 2004 found that Singapore's investment strategy had yielded a simple annual return of 1.7 to 4 percent from 1999 to 2003, compared to hongkong's 6.1 percent.

(Business Times October 1st, 2004)

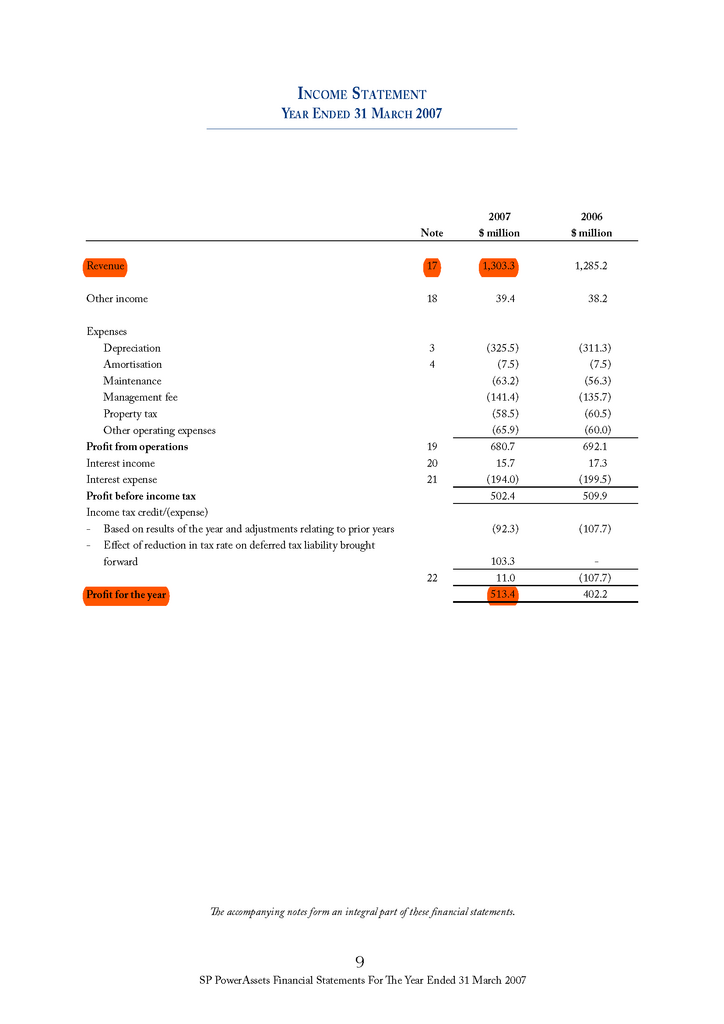

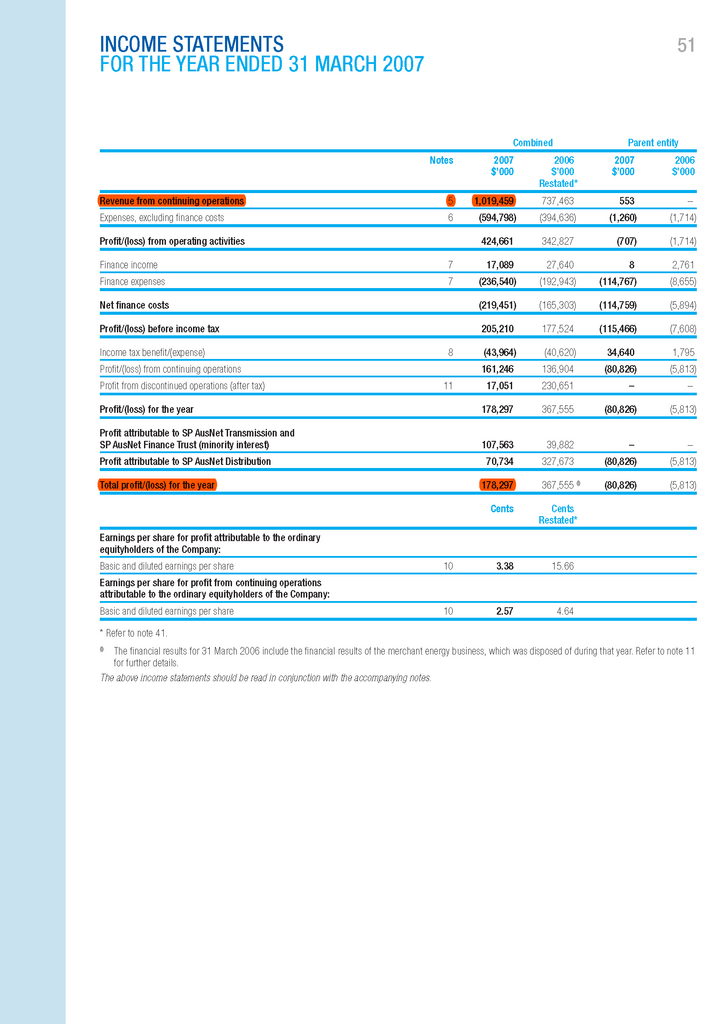

Below is the financial statements from Singapore Power (Singapore) and SP AustNet (Australia), the net profit margin for the Singapore company is 39.39%, whereas the Australian company is 17.49%. The difference between Singapore and AustNet is 21.9%. This probably accounts for why Temasek's shareholder returns are so high. Why the large difference in net profit margin? Is it because we are overcharged for our utilities? Do Singaporeans enjoy being constantly screwed over?

Singapore Power (Singapore): 513.4 / 1,303.3 = 39.39%

SP AustNet (Australia): 178,297 / 1,019,459 = 17.49%

Singapore Power Assets (Singapore)

Source: http://www.singaporepower.com.sg/pdf/pdf0607/SPPA_AR_2006_Financial.pdf

SP AustNet (Australia)

Source: http://www.sp-ausnet.com.au/CA256FE40021EF93/Lookup/20070612AnnRep2007/$file/SPA103_final%20low%20res.pdf -

I am waiting for dorky to reply, but seems he's busy with his other clothing pursuits.

-

obviously this SHEEP has no clue what what overal portfolio mean.Originally posted by maurizio13:I am waiting for dorky to reply, but seems he's busy with his other clothing pursuits.

Can some kindergarden kid please explain to him, because Gazelle has more interest and meaningful things that to read and reply his BS. -

From the data and analysis I have provided, it can be shown that when 2 similar industry exist in Singapore and Australia (higher GDP per capita than Singapore), the gross margins will be higher in Singapore than Australia. It calls to question if we are constantly being overcharged for our basic necessities so that we can attain a high total shareholder return for Temasek.Originally posted by Gazelle:obviously this SHEEP has no clue what what overal portfolio mean.

Can some kindergarden kid please explain to him, because Gazelle has more interest and meaningful things that to read and reply his BS.

For both the Telecommunication and Power industry, Singapore state owned monopolies earned 20% above their similar counterparts in Australia.

Gazelle, it would make better constructive argument if you could provide some data to support your claim that the high overall portolio returns is NOT due to Singapore.

I am waiting for your data and analysis. I have shown you two industries, maybe you can compare some industries common between Singapore and another country.

But I guess you won't be able to do so, because it's true that most of Temasek's return have been exploited from Singaporeans.

If what you say is indeed true, then it shouldn't be too difficult to find the data to prove me wrong. -

By showing only 2 of Temasek companies you want to convince us with what you said?Originally posted by maurizio13:From the data and analysis I have provided, it can be shown that when 2 similar industry exist in Singapore and Australia (higher GDP per capita than Singapore), the gross margins will be higher in Singapore than Australia. It calls to question if we are constantly being overcharged for our basic necessities so that we can attain a high total shareholder return for Temasek.

For both the Telecommunication and Power industry, Singapore state owned monopolies earned 20% above their similar counterparts in Australia.

Gazelle, it would make better constructive argument if you could provide some data to support your claim that the high overall portolio returns is NOT due to Singapore.

I am waiting for your data and analysis. I have shown you two industries, maybe you can compare some industries common between Singapore and another country.

But I guess you won't be able to do so, because it's true that most of Temasek's return have been exploited from Singaporeans.

If what you say is indeed true, then it shouldn't be too difficult to find the data to prove me wrong.

M13, why dont you do me a favour. I am tell you what your great great great great great grandfather was a gay SHEEP, with only 3 legs. -

Tsk tsk, cannot win arguments with logic, so you trying to derail the whole discussion with your antics.Originally posted by Gazelle:By show us 2 Temasek companies in of their portfolio you want to convince us with what you said?

M13, why dont you do me a favour. I am tell you what your great great great great great grandfather was a gay SHEEP, with only 3 legs.

Until you can provide some conclusive data to support your arguments, else I do not see any point in this.

Try eating more pig's brain, it might improve your intelligence.

-

M13, proofing you wrong is as easy as ABC, but I wont want to waste my effort of proofing a sheep dumb without getting something in return.Originally posted by maurizio13:Tsk tsk, cannot win arguments with logic, so you trying to derail the whole discussion with your antics.

Until you can provide some conclusive data to support your arguments, else I do not see any point in this.

Try eating more pig's brain, it might improve your intelligence.

""Overall portfolio profitability is due to monopolizing the Singapore market, charging us for basic services at an exhorbitant price.""

Before I prove to everybody that you are a big LIAR in this forum, are you willing to take the Gazelle challenge? Or are you going to start talking about BAR topic and then slid under the skirt again?