New HDB flat prices based on market prices of resale flats

-

It's confirmed: New HDB flat not subsidized

Source : Business Times, 12 Dec 2007

LETTER TO THE EDITOR

New HDB flat prices based on market prices of resale flats

Email this article

Print article

Feedback

I REFER to the letter, ‘Since when did resale prices decide cost of HDB flat?’ (BT, Nov 30) by Lu Keehong.

The prices of new HDB flats are based on the market prices of resale HDB flats, and not their costs of construction. In order to provide affordable housing to Singaporean families, new HDB flats are priced below their equivalent market values. In this way, new flat buyers can enjoy a substantial subsidy. This point has been explained in Parliament and reported in the media on many occasions.

As resale prices move up, so do new flat prices. Similarly, when resale prices move down, as happened during the property market downturn in recent years, the prices of new HDB flats were also reduced significantly.

By selling new flats with a market subsidy, HDB has been unable to recover the development cost of new flats. HDB has incurred an average deficit of $457 million a year in its home ownership programme in the last five years. These figures are reported in HDBÂ’s audited financial statements, which are available to the public.

HDB periodically reviews its building programme, and makes adjustments to respond to and anticipate changing market conditions. With the increased demand for new HDB flats, HDB is gradually stepping up its building programme to ensure a steady flow of public housing supply to meet the needs of present and future generations of Singaporean families.

Kee Lay Cheng (Ms)

Deputy Director (Marketing & Projects)

For Director (Estate Administration & Property)

Housing & Development Board -

Ho say! So many people in the queue but always not enough flats! Now the price is going up at the same time of a supply/demand mismatch! All the newlyweds can put off their plans already!

-

Why should newly weds get subsidized new flats when single professionals who pay far more taxes than most Singaporeans have to buy older flats at higher prices from the resale market?

Of course new HDB flat prices should be based on market prices of resale flats. Why should some folks get to earn so much by selling their government-subsidized flats to singles at the market rate? I say get rid of the subsidy completely. -

Think its to encourage Singaporeans to get marriedOriginally posted by oxford mushroom:Why should newly weds get subsidized new flats when single professionals who pay far more taxes than most Singaporeans have to buy older flats at higher prices from the resale market?

Of course new HDB flat prices should be based on market prices of resale flats. Why should some folks get to earn so much by selling their government-subsidized flats to singles at the market rate? I say get rid of the subsidy completely. which is fine by me

which is fine by me

And probably to make HDB more affordable to non professionals/low income earners

-

If the HDB does not sell its units below cost price but sell the units below resale price, Kee Lay Cheng should not use the term ‘substantial subsidy’ when there’s no subsidy.

-

So why should Singaporeans have babies then?Originally posted by oxford mushroom:Why should newly weds get subsidized new flats when single professionals who pay far more taxes than most Singaporeans have to buy older flats at higher prices from the resale market?

Of course new HDB flat prices should be based on market prices of resale flats. Why should some folks get to earn so much by selling their government-subsidized flats to singles at the market rate? I say get rid of the subsidy completely. -

You stupid fuck. It doesn't matter anymore if Singaporeans have babies or not.

-

Originally posted by oxford mushroom:Why should newly weds get subsidized new flats when single professionals who pay far more taxes than most Singaporeans have to buy older flats at higher prices from the resale market?

Of course new HDB flat prices should be based on market prices of resale flats. Why should some folks get to earn so much by selling their government-subsidized flats to singles at the market rate? I say get rid of the subsidy completely.

-

Oh it does , if you cannot afford a roof over your head - then why should you have a child ?Originally posted by frakfrakfrak:You stupid fuck. It doesn't matter anymore if Singaporeans have babies or not.

hahahah -

Subsidies.

-

if its cheaper than what you would pay for a resale flat..then its a subsidy. It's never based on cost of flat. The price of the flat would be somewhere 5-6 times salary. This is old news, came out in a paper more than a decade ago. If the demand for 5 room flats are high etc, naturally it'll be more expensive.

-

This is an old news. HDB officer in replying to people's previous query published in the Straits Times about 2 years ago challenging the claimed subsidy as only a lie and not an actual or cost subsidy, has simply been unable to give any satisfactory reply to the writers.

Ms Kee of HDB has simply in all her replies left unmentioned the S$100,000.00 profits already made by SLA on the lands on which the flats were built before the flats were built. If this hidden profit of $100,000.00 was included in the accounting of the development cost of a 3-rm HDB flats, then Minister Mah and HDB would be exposed as lying to parliament or the public for it would clearly show that HDB is making a huge profit. -

If HDB sells it's new units at a discount off the resale price, it still make a substantial profit.

HDB couldn't have incurred $457m deficit a year for five years unless it considers a discount off the resale price as less than the expected amount it earns, therefore it suffers a loss.

HDB should stop using the word "subsidy" and replace it with the word 'discount'. -

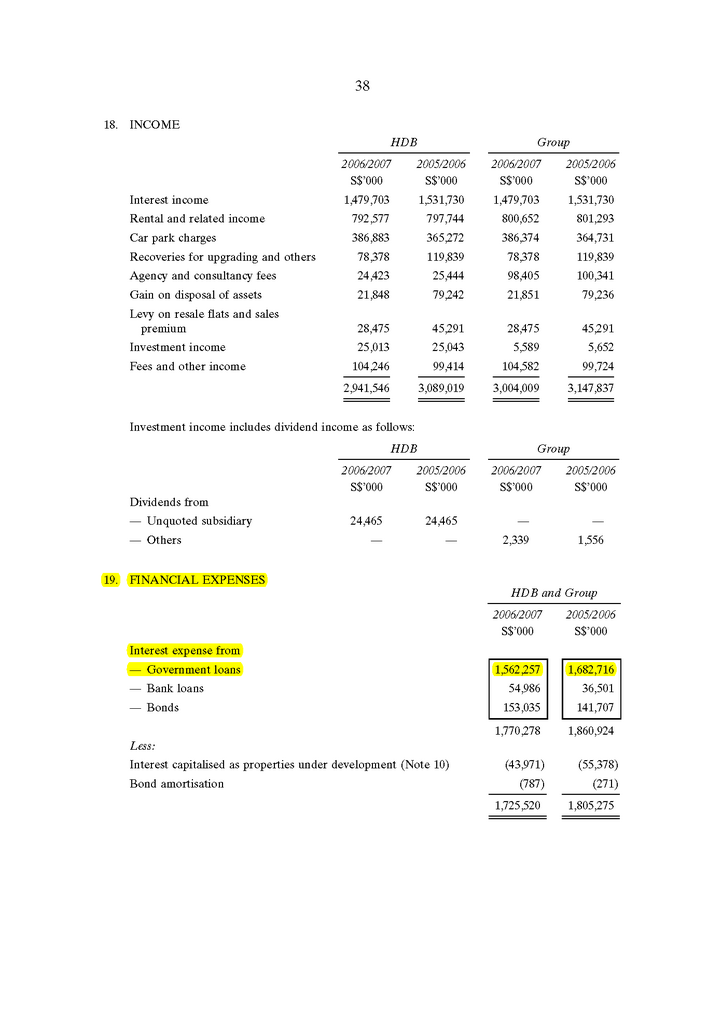

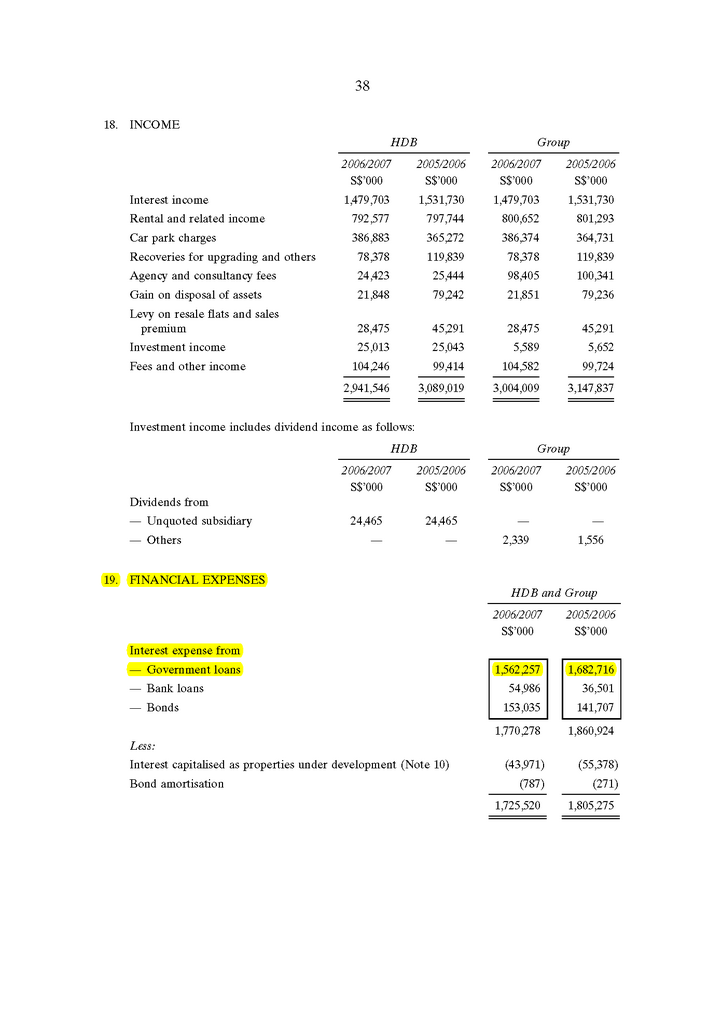

I only have one issue with the losses of HDB on it's claimed sale of "subsidized" flats.

1) The majority of expenses incurred which resulted in the losses is from loans made from the government to itself. The financial impact of the government loan interest is around $1.5 billions, which could have been the profits made on the "subsidized" flats sale. It's one way of extracting the profits and showing to the public that losses were made from the subsidized sales and indeed "real subsidies" were given, therefore the huge losses.

Does it make sense to make a loan to myself and charge myself interest? If I have control of ownership of Company A and Company B, I can shift my profits around by charging higher interest for Company A (higher profits) and shifting my profits to Company B (lower profits). Ultimately, Company B which was suppose to be making a loss, makes a hefty profit.

The "interest charges" paid by HDB to the government of $1.5 billions is alot alot alot of interest.

"FRS 27 - Intragroup balances should be eliminated in full (para 24).

To illustrate, assume that P Ltd gives a loan of $1,000,000 to its subsidiary, S Ltd. In their respective balance sheets, P Ltd correctly carries a loan receivable account, and S Ltd correctly carries a loan payable account. However, in the consolidated financial statement, where P Ltd and S Ltd are treated as a single economic entity, it does not make sense to show that the entity borrows from or lend to itself. Thus, in the consolidation process, the intra-group balances (that is, the intra-group loan payable and receivable) should be eliminated in full." (Ng, 2005)

Source: http://www.hdb.gov.sg/fi10/fi10297p.nsf/ImageView/FS0607/$file/HDB-fy06(FS).pdf

References:

1) E.J., Ng, A practical guide to financial reporting standards (Singapore), 2005, CCH. -

Originally posted by maurizio13:

Thanks for providing the account relating to HDB sale. However to my mind, this accounts only reflect the interest incomes when are extra profits made over the land and construction. If we add this extra interest income HDB has made even more profits than disclosed.

I only have one issue with the losses of HDB on it's claimed sale of "subsidized" flats.

1) The majority of expenses incurred which resulted in the losses is from loans made from the government to itself. The financial impact of the government loan interest is around $1.5 billions, which could have been the profits made on the "subsidized" flats sale. It's one way of extracting the profits and showing to the public that losses were made from the subsidized sales and indeed "real subsidies" were given, therefore the huge losses.

Does it make sense to make a loan to myself and charge myself interest? If I have control of ownership of Company A and Company B, I can shift my profits around by charging higher interest for Company A (higher profits) and shifting my profits to Company B (lower profits). Ultimately, Company B which was suppose to be making a loss, makes a hefty profit.

The "interest charges" paid by HDB to the government of $1.5 billions is alot alot alot of interest.

"FRS 27 - Intragroup balances should be eliminated in full (para 24).

To illustrate, assume that P Ltd gives a loan of $1,000,000 to its subsidiary, S Ltd. In their respective balance sheets, P Ltd correctly carries a loan receivable account, and S Ltd correctly carries a loan payable account. However, in the consolidated financial statement, [b]where P Ltd and S Ltd are treated as a single economic entity, it does not make sense to show that the entity borrows from or lend to itself. Thus, in the consolidation process, the intra-group balances (that is, the intra-group loan payable and receivable) should be eliminated in full." (Ng, 2005)

Source: http://www.hdb.gov.sg/fi10/fi10297p.nsf/ImageView/FS0607/$file/HDB-fy06(FS).pdf

References:

1) E.J., Ng, A practical guide to financial reporting standards (Singapore), 2005, CCH.

[/b]

The HDB account does not include the land sale profits made from lands by SLA which are taken into the consolidated account acquired under the Land Acquisition Act with taxpayers' monies amounting to S$20 billions for the period 1900-2000 alone.

Effectively lands are at zero value since lands were paid by taxpayers. So when HDB flats are built on these acquired lands government should be selling HDB flats to the taxpaying citizens at cost of construction. If it sells so much as above construction cost government will be making a profit.

If government sells the HDB flats at market value or close to market value with a discount it will be making profit one more time on the land. That is my case that government has been profiteering and making double land from its citizens and HDB and minister Mah are telling lies when they say government is subsidizing the public housing. -

Originally posted by googoomuck:

sigh... a freehold condo built on private land in downtown Bangkok or KL cost so little compare to here...

[b]It's confirmed: New HDB flat not subsidized

[/b]

... HDB is built on public land, land that belongs to the public... meaning zero costs to the people of Singapore...

...what subsidy? Profiteering more like it... policies to make Singaporeans indebted more like it...

Support Dr Chee Soon Juan for real change in Singapore... -

I am still trying to figure out how the HDB or government is making a loss selling those "subsidized flats".Originally posted by robertteh:Thanks for providing the account relating to HDB sale. However to my mind, this accounts only reflect the interest incomes when are extra profits made over the land and construction. If we add this extra interest income HDB has made even more profits than disclosed.

The HDB account does not include the land sale profits made from lands by SLA which are taken into the consolidated account acquired under the Land Acquisition Act with taxpayers' monies amounting to S$20 billions for the period 1900-2000 alone.

Effectively lands are at zero value since lands were paid by taxpayers. So when HDB flats are built on these acquired lands government should be selling HDB flats to the taxpaying citizens at cost of construction. If it sells so much as above construction cost government will be making a profit.

If government sells the HDB flats at market value or close to market value with a discount it will be making profit one more time on the land. That is my case that government has been profiteering and making double land from its citizens and HDB and minister Mah are telling lies when they say government is subsidizing the public housing.

They are profiting from the land sales and interest charges. -

Did you ever ask yourself if the land which HDB used to build their flats actually belongs to the government or HDB?Originally posted by maurizio13:I am still trying to figure out how the HDB or government is making a loss selling those "subsidized flats".

They are profiting from the land sales and interest charges. -

Huh???Originally posted by Gazelle:Did you ever ask yourself if the land which HDB used to build their flats actually belongs to the government or HDB?

I am sorry, you mean HDB and government are two different entities??? -

Ultimately they are both government entities, but they serve difference purpose and function.Originally posted by maurizio13:Huh???

I am sorry, you mean HDB and government are two different entities???

Just like if your family's name is dick, you can expect all dicks to have entitlement to your wife isnt it?

just joking!!

-

Obviously you have no understanding of company structure in groups.Originally posted by Gazelle:Ultimately they are both government entities, but they serve difference purpose and function.

Just like if your family's name is dick, you can expect all dicks to have entitlement to your wife isnt it?

just joking!!

You are correct in stating that if your surname is D|ck, your father, mother, brothers, sisters and cousins have no entitlement to your wife. But this is company structure we are dealing in, not personal structure. A company is a legal entity with the right to own properties and other companies. Whereas you as Mr. Dick cannot own another person.

-

Can a Singtel staffs get free flight on SIA ?Originally posted by maurizio13:Obviously you have no understanding of company structure in groups.

You are correct in stating that if your surname is D|ck, your father, mother, brothers, sisters and cousins have no entitlement to your wife. But this is company structure we are dealing in, not personal structure. A company is a legal entity with the right to own properties and other companies. Whereas you as Mr. Dick cannot own another person.

Can you SIA get free office space from Capitaland?

Can HDB office get free power supply from Singapore Power?

Over to you dick!! -

It simply a matter of transferring money from the left pocket to the right pocket. Left pocket is incurring a deficit but right pocket is making the mother of all profit. But ultimately those are still my money.

We look at the government who are doing the transaction with us and not how they transfer the money between different government departments.

For as long as we sees fail to see outside the scope of HDB account, we will never get the bigger pictures. -

it is indeed a left and right pocket transaction however I would rather the money goes into state fund rather than HDB buying plasma TV, leather sofa etcOriginally posted by Seant7:It simply a matter of transferring money from the left pocket to the right pocket. Left pocket is incurring a deficit but right pocket is making the mother of all profit. But ultimately those are still my money.

We look at the government who are doing the transaction with us and not how they transfer the money between different government departments.

For as long as we sees fail to see outside the scope of HDB account, we will never get the bigger pictures. -

Frankly, I don't expect you to understand all these, because you have limited knowledge about accounting, you have limited intelligence and you only support the government's view.Originally posted by Gazelle:Can a Singtel staffs get free flight on SIA ?

Can you SIA get free office space from Capitaland?

Can HDB office get free power supply from Singapore Power?

Over to you dick!!

First of all, we are talking about company structures, not about staffs working in the company. Your question about staffs getting free flights on SIA is totally ludicrous. So are you telling me that since a person works in the Ministry of Home Affairs, he/she would be given special discount if he/she committed a crime? Company structure! Don't distort the picture, that's what P4P politicians are good at doing, which I am sure you will never be.

Does SIA have control over CapitaLand? Does SIA own more than 50% of the voting shares? Whereas, HDB is 100% owned by the government.

Same with HDB and Singapore Power, though Singapore Power is partially owned by the Government. Finally, if the government has to produce a Balance Sheet and Income & Expenditure statement, they will need to take out intra company accounts. Else the accounts would make no sense in the ultimate holding company (which is the government).

If there are two companies (Co. A & Co. B), Co. A sells $100 of goods to Co. B, then Co. B sells back the same goods back to Co. A for $1,000.

At the end of the day.

Co. A

Sales $100

Cost of Sales (say) ($50)

Profit = $50

Co. B

Sales $1,000

Cost of Sales ($100)

Profit $ 900

When all that has happened here is goods have only changed hands, but profits have sky rocketed.

This time around seems like you have started name calling early, even when we have only started the discussion. Is it a preamble that you would lose this discussion again?