SIA's offer to CEA @ 30% premium& NAVx6

-

SIA 's offer to buy stakes in China Eastern Airlines(CEA)

is 30% premium of 6 months average share prices

before SIA's offer!This is damn reasonable,considering

CEA is losing money for many years and the share price is almost

sleeping for many years.

BTW,who will so stupid to sell a money making company.

CEA need SIA's money ,reputation,know how and expertise

to make more money.SIA need to have higher market share

in PRC.Win --win ,why not.

But

other people think other wise.

They know once SIA step into PRC,they will face tough competition,

losing the ''monopoly''.There are rumors that civil servants has to take designated airlines...

2.This article can tel why the offer is reasonable

Pl read the reasons,not discard it being from zaobao.

Use Dragon Air as reference--by net asset value

Since CEA is in deficits,SIA cant use profits ratio to value.

SIA and CEA use the reference of China National Aviation Corp (CNAC) selling

Dragon Air to Cathay Pacific(CX) as reference.CNAC sold Dragon Air at

3.17 times of the Net Assets value.

But now SIA bought CEA at more than 6 times of CEA net asstes value of

HK$0.58 per share!!

Use CNAC and CX as reference--by net asset value

When CNAC and CX cross holding the shares,CX sold CNAC at 1.3

of CX net assets,while CNAC sold to CX at 1.68 of net assets.

now SIA bought CEA at more than 6 times of CEA net asstes value is very reasonable.

The jump in share prices after the proposed purchase is irrelevant

Have CEA performance changed after SIA's offer?NO.

Why the price jump so far?

SIA is the answer.People hope SIA can turn around CEA.

Also CNAC and CX wanted to compete is another factor.

But they were stopped by PRC Authority in 2007,but not in 2008.

SIA need CEA more than CEA need SIA

There are many CEA like airlines in the world.

But there is only one SIA,the most profitable AL!!

Sleeping stock for many yearsBlue 0670.HK CEA,Red=HSI

3.CNAC $5 is rubbish

It is NOT a formal and legal binding offer .

In the statement.CNAC said the $5 is subject to every parties agreement

and 2 weeks later!!

It is rubbish.Empty promises.

4.news from little peck

5.SG never want and can buy other assets at ''done on the cheap"

The deal approved by CEA management and PRC National Assets Authority.

It seems some pple have changed their mind.

SIA wont get the deal.Lets see how the share price go.

Like SIA chief says.''There is no must--have''

Some thing if u insist to have may not be good.

Only history can tell.

Remember the HK Cable and Wireless/HK Telephone.

Sing Tel lost the deal.It turned out that Singtel was damn lucky

to lose the deal.

2007 to date.pl note the share once dropped more than 40% from its peak.

Blue 0670.HK CEA,Red=HSI

6.SIA is very brave to take the rotten company

Short term debt is 10 times of cash in hand and long term debt is 11

times.Debts Total 21 times of cash in hand.

And the sales,not profits dear,is equal to total of all debts.

Losing money almost every years......

some times it is not wise to be a White Knight...

7.Lets us witness power of SIA--how CEA price runs in Shanghai

Spore need come out of this kind of stock info.

price jump from RMB 5.1 in April 2007 to 22.80.Now at 21.57....

8.read the saga in Chinese

9.pl read the carefully draft non--binding $5 sweeties misleading statement...2,984,850,000 H share,..not less than HK$5.The final

Discussions only.Dear.Dunt be too happy.

price shall subject to discussions of all parties..

This is not a formal offer...

10.SIA gave binding offer at some 35 % premium of share

prices at 6 months preceeding making the offer of HK$3.80 in 2007

But CNAC just do the lip services of non--binding talking and a discount of not more than $5.00,a discount of at least 25 % at preceeding close price of $6.60 in early Jan 2008.

So,tell me who is good guy and who is bad?

Remember CEA is losing money and the sum of short and long terms debts

is equal to the sales figure. -

Temasek, GLCs and GIC have a history of overpaying for takeovers. They seem desperate to buy anything and everything that they can. A result of having too much capital in the coffers and no financial savviness(due to heavy taxes, fines and overcharging for necessities) which are not earning proper rate of returns for Singapooreans.

-

pls respect other country's nationalist policies. at least ppl have pride in their country's companies and willing to give business to fellow countrymen.

not like some country without any sense of pride and ever ready to trample upon other's pride just for the money.

-

will the day come when a massive worldwide event renders all these assets useless?Originally posted by maurizio13:Temasek, GLCs and GIC have a history of overpaying for takeovers. They seem desperate to buy anything and everything that they can. A result of having too much capital in the coffers (due to heavy taxes, fines and overcharging for necessities) which are not earning proper rate of returns for Singapooreans.

-

1.Pl tell us more.Originally posted by maurizio13:Temasek, GLCs and GIC have a history of overpaying for takeovers. They seem desperate to buy anything and everything that they can. A result of having too much capital in the coffers and no financial savviness(due to heavy taxes, fines and overcharging for necessities) which are not earning proper rate of returns for Singapooreans.

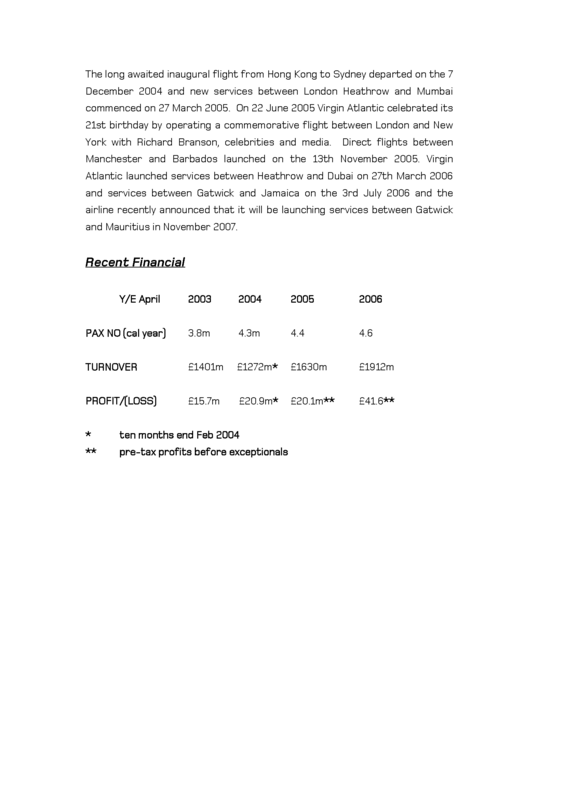

2.SAI bought Virgin at SIA paid 600 million pounds and may worth 900 million pounds and 1.0 billion pounds.Seems not bad,but not good enough,says SAI chief.

3.Of course SIA bought New Zealand and Oz airlines and the returns

not so good.But,who can make money every times? -

Originally posted by lionnoisy:

Really SAI.

1.Pl tell us more.

2.[b]SAI bought Virgin at SIA paid 600 million pounds and may worth 900 million pounds and 1.0 billion pounds.Seems not bad,but not good enough,says SAI chief.

3.Of course SIA bought New Zealand and Oz airlines and the returns

not so good.But,who can make money every times?[/b]

Ya ya, when you don't earn, you shrug it off, blame this blame that, everything but yourself.

-

British Airways has been fined about £270m after it admitted collusion in fixing the prices of fuel surcharges.

The US Department of Justice has fined it $300m (£148m) for colluding on how much extra to charge on passenger and cargo flights, to cover fuel costs.

It followed a decision by the UK's Office of Fair Trading to fine BA £121.5m, after it held illegal talks with rival Virgin Atlantic.

Surcharges were added to passenger fares in response to rising oil prices.

Virgin has been given immunity after it reported the collusion and is not expected to be fined, the OFT said.

BA now faces the possibility of legal challenges by customers on both sides of the Atlantic who believe they lost money as a result of the collusion.

The BBC's Adam Brookes in Washington said the airline could face multiple lawsuits for damages in the US from aggrieved passengers.

Record fines

The OFT and the DoJ began investigating BA's price-fixing in June 2006.

However, he acknowledged that the conduct of some of the carrier's employees had been wrong and could not be excused.

"Anti-competitive behaviour is entirely unacceptable and we condemn it unreservedly," Mr Walsh said.

"We have a long-standing competition compliance policy which requires all staff to comply with the law at all times.

"I am satisfied that we have the right controls in place. However, it is deeply regrettable that some individuals ignored our policy."

Scott Hammond of the DoJ's antitrust division said that "virtually every American business and consumer was impacted by these crimes".

"American companies rely on competitive shipping rates to export their goods to foreign markets, American consumers rely on imports for so many consumer and household goods, American families flew these airlines on international destinations.

"In every instance American businesses and consumers ended up paying more as a result of these crimes."

'Blatant breach'

OFT chairman Philip Collins said that the hefty fine would "send an important message" to companies and business leaders about its intention to enforce the law.

"This serves to remind companies of the substantial risks involved if they are found to engage in such behaviour," he said.

Virgin Atlantic said that it had informed the OFT as soon as its lawyers were made aware of the nature of contacts that had occurred between individuals from the two airlines.

"We take complying with competition laws extremely seriously and regret that contacts were made between the two companies," it said.

"As a criminal investigation is continuing, we are unable to give further details until the regulators publish their full findings."

BBC business editor Robert Peston said that the collusion between BA and Virgin Atlantic was "as blatant a breach of competition law as it's possible to imagine".

"This was not a careless accident. The two big birds... were not competing properly on price over an extended period: they were giving each other comfort that they would not undercut each other on the fuel surcharge."

He added: "Virgin won't pay a penny in fines and actually emerges as a winner, since all the opprobrium of the rule-breach has been heaped on BA."

--------------------------------------------------------------------------------

Here is a selection of comments received by the BBC News website.

Willie Walsh states that customers were not overcharged, however, if the surcharges were fixed between Virgin and BA and not competitive then surely the customers must have lost out, they would have paid over the odds. What happens to the money from the fines? Will any customers be re-imbursed?

Andy Sharman, Peterborough

Sir Richard and the Virgin brand won over so many hearts when the details of British Airways` 'dirty tricks' campaign came to light in the early 90s. To me, if there were ever two businesses that wouldn`t have colluded in such a way - it would be these. Shame on you Virgin Atlantic.

Gareth Reid, Wellingborough, Northants

It is an outrage that Virgin are not being penalised in the same way and to the same extent. How can we know that they had not planned this all along, a real possibility given the history between the firms? It takes two to collude and with only BA being fined the message this sends is not constructive for any party or any industry. It sets a dangerous precedent. In no way do I condone the action taken by BA but I think that the fine is excessive - and why are they being fined twice? I would still fly with both companies and probably BA before Virgin.

Chris Cecil, Haddington, East Lothian

I flew BA in June 2006 to India and back. Did the price gouging affect me? If so, then 'B' for British should be replaced with another "B" that stands for illegitimate.

Robert Tavaris, Florida, USA

I have been flying the Atlantic for 50 years and I find the anti-competition laws a joke. The price of a trans-Atlantic ticket has not fallen in real terms since the IATA rules were suspended. All that has happened is that conveniences such as no-charge trip cancellation, free seat selection and inter-airline open-jaw bookings have been withdrawn.

Jim Garner, Ottawa, Canada

Source: http://news.bbc.co.uk/2/hi/business/6925397.stm -

Virgin Atlantic baotoa British Airways.

Hehehe....

Smart move.

No wonder Virgin Atlantic made alot more profits in 2006, it's because of price fixing with British Airways to overcharge customers over fuel surcharge.

Virgin Atlantic's profit for 2006 was £41.6 million increased by 100%, double that of 2006, while their sales (turnover) only increased 17%, quite an impossibility unless the profit margins rise considerably.

Looks like SIA's plan to sell Virgin Atlantic at a good price has fallen through, as it known that without the price fixing, Virgin Atlantic's next year's profit will not be as optimistic as this years.

I like the way this government controlled company is doing business overseas, it tries to manipulate other markets the way other government controlled company does in Singapore by anti-competitive acts, such as cross holdings of company to gain monopoly or collusion with other competitors to fix price.

Source: Virgin Atlantic -

Is a £600 million investment that pays £900 million in 8 years a good investment?

If you have £600 million you invest in a 5.20% zero coupon bond for 8 years (1999 to 2007), the final investment value would be £900 million.

£600 x (1.052)^8 = £900

Extremely good investment?

NO!

It's an average investment only, but considering Temasick, GLCs and GICs past record in overpaying for investments, it's pretty good to see some investments where we don't actually lose money but breakeven. -

1.who still control VirginOriginally posted by maurizio13:Virgin Atlantic baotoa British Airways.

I like the way this government controlled company is doing business overseas, it tries to manipulate other markets the way other government controlled company does in Singapore by anti-competitive acts, such as cross holdings of company to gain monopoly or collusion with other competitors to fix price.

skip image

Source: Virgin Atlantic

not SIA lah. the adventureous boss still control 51%.

Dunt count SIA in price fixing.

SIA win so many no1 is not for nothing.

u can have many opinions.But pl make the facts straight.

Poor SIA cant get control from Sir Branson. -

You also have to take into account that the analyst might have used a profit figure of £41.6 million profits for valuation.

The £41.6 million profits was a result of Virgin Atlantic's use of price collusion with British Airways.

If you notice in 2005, sales was £1,640 million, while in 2006, sales increased by only 17.3%, whereas profits have increased 100.69%. Makes sense to you?

If profits have increased by 100.69%, a normal person would expect sales to have gone up by more than 100%. Unless there was some radical changes to the industry like, they being the monopoly (no budget airlines exist), wages have gone done dramatically and fuel prices have dropped substantially.

I think you have to take a logical stance and not always err on the side of the government, else it would seem dubious as to whether you are on the government payroll. -

Wah, Virgin Atlantic stab BA in the back

-

Originally posted by lionnoisy:

If you are a shareholder and you aren't even aware to the price fixing in your company, it's pathetic.

1.[b]who still control Virgin

not SIA lah. the adventureous boss still control 51%.

Dunt count SIA in price fixing.

SIA win so many no1 is not for nothing.

u can have many opinions.But pl make the facts straight.

Poor SIA cant get control from Sir Branson.

[/b]

The original intention for S|A to acquire V.A. was to prevent V.A. from competing in another route. Another anti-competitive move by S|A.

Just like the anti competitive allegations in Thailand & Indonesia. I guess all of it is made up?

You mean other Airlines have not won No.1 in these competitions? Only S|A wins year after year?

2007: 1st = S|A

2006: 1st = British Airways, 7th = S|A

2005: 1st = Cathay Pacific, 4th = S|A

One thing is certain, all the GICs and GLCs only way to generate supernormal profits is through controlling the market. A good example is our Telcos here. -

2.SIA cant decide the policy.Originally posted by maurizio13:If you are a shareholder and you aren't even aware to the price fixing in your company, it's pathetic.

.......

One thing is certain, all the GICs and GLCs only way to generate supernormal profits is through controlling the market. A good example is our Telcos here.

Biz is like jungle.Who strong wins.This is biz. -

China Eastern shareholders reject SIA's US$923m offer

http://www.channelnewsasia.com/stories/singaporebusinessnews/view/321325/1/.html -

Why the miniority share holders accept SIA Chairman and CEO into\

CEA Board but rejected the HK$3.8 offer? -

Today's ST headlines must have been one of the best news to start the year. Timely reality check for the GIC and Temasek.

-

like they say, its all just good business.. nothing personal..

-

All the while Lee Kuan Yew boot-lick mainland China government effort has gone to drain.

-

I am not sure if this means anything but there seemed to be a continuing distance of Temasek investment on PRC since last Nov.

Is there a crack in the relationship? -

Low attendance in voting

1.Only 40 % of H share holders attended the voting--that is 6.18 billion share out of total H share issued of 1.567 b share.

Of those attended,75 % voted against the proposal.

2.A share was worse.Only 4.7 % of shares holders attended---

that is 18.56 million of 3.96 billion shares holders attended!!

Out of those attended,94% said no.

Out of those voted against the proposals,99 % from 2 funds.

Why attendance so low

on .4 Jan 2008,PRC Assets Supervision & Adminstartion Commission (SASAC)

issued a 2 sentence statement.It support foreign co to be partners of

national enterprises,but let the market to decide!!

The fate of the proposal was sealed.

Minority holders know the proposals involved the crash of

powerful in PRC.They will offend if they give the support to either

party...

Impact of failed bid

The deal was approved by PRC relevant Authority.

Now ,who can trust the Authority in PRC?

But if u are investor,what would you think?

PRC loss investments in the long run.No body can tell how much. -

Jan. 21 (Bloomberg) -- Air China Ltd., the nation's largest carrier by market value, fell the most in three years in Hong Kong trading after China Eastern Airlines Corp. snubbed a bid to buy a stake.

Today HSI dropped 5.5%...

The airline dropped 15 percent to HK$8.38, after China Eastern said it ``doubted the sincerity'' of an offer from an Air China affiliate to buy as much as 30 percent for at least HK$14.9 billion ($1.9 billion). ...China Eastern said the bid is ``informal and doesn't conform to legal procedures'' in an e-mailed statement late yesterday.. -

and STI dropped 6.03% leh..Originally posted by lionnoisy:[b][url=http://www.blommberg.com/apps/news?pid=20601080&sid=a.lhKoNbK6DA&refer=asia]

Today HSI dropped 5.5%...

-

http://finance.sina.com.cn/

where is the formal offers?

-

CHina Eastern Air dropped below SIA offer of $3.80 during interday trade on 11.03.2008.

SIA is damn right in not increasing offer.But investment in long term at right price.

http://hk.finance.yahoo.com/q/bc?s=0670.HK&t=6m&l=on&z=m&q=l&c=^HSI

code 0670

時期:

1日5日3月 �年 1年2年5年 最長時期Period:

1 day,5 day,3 mon,6 mon,1 yr,2 yr,3 yr, longest

$3.750 - 3.980 traded on 交易時間: 3月11日(11Mar 2008)

52 weeks range: 52週波幅:$ 2.140 - 10.500.

2.SIA 's offer to buy stakes in China Eastern Airlines(CEA) is 30% premium of 6 months average share prices before SIA's offer!This is damn reasonable,considering

CEA is losing money for many years and the share price is almost

sleeping for many years.

BTW,who will so stupid to sell a money making company.