AmericaÂ’s in Recession - Are you ready?

-

Ai ya now is not the time to argue about silly trivial stuff and call names lah. Now is the time to sit back and watch the global saga. The longer the markets stay down, the more people are going to be unfortunate. So let's see what happens first .

-

layoffs in the banking sector will happen. property prices in orchard road, prime district crash. temasek holding's 38% exposure to financial stocks is another sad story to tell. -

Anybody got updated charts of STI ?

-

aiya...quote.yahoo.com or www.sgx.com lorOriginally posted by kramnave:Anybody got updated charts of STI ? -

i am considering ICBC which is the largest state owned bank in China which has trillions of US dollars for asset injection into this bank..so probability of this bank going under is zero per cent. i think at current price, its dividend yield exceed 5% -

Not to mention the poor buggers who borrow beyond their means to buy stuff they cannot really afford. The interest rates will be going up to match inflation if I am not wrong.Originally posted by Daddy!!:layoffs in the banking sector will happen. property prices in orchard road, prime district crash. temasek holding's 38% exposure to financial stocks is another sad story to tell.

As for the property prices, it happens with plenty of sellers and no buyers. Actually it is the time for fire sales if this crash prolongs. The 'take it or leave it' mode always work in economic crisis. That is if you have the cash at hand. -

when ppl paid millions for their condos at city area, they were counting on their continued bonuses and salaries for the next ten years to repay their debt. that was b4 the sub prime crisis. Now they suddenly realised that there would be retrenchment, layoffs and bonuses would be cut to zero. Within one year, they realised they actually could not afford their debt. -

The ones I really pity are those families who buy their HDB flats on loan and then get into trouble with the banks when they lose their jobs.Originally posted by Daddy!!:when ppl paid millions for their condos at city area, they were counting on their continued bonuses and salaries for the next ten years to repay their debt. that was b4 the sub prime crisis. Now they suddenly realised that there would be retrenchment, layoffs and bonuses would be cut to zero. Within one year, they realised they actually could not afford their debt. -

commercial banks dont really like to loan HDB flats buyers because they know that it is more difficult, emotionally and politically, to foreclose them.Originally posted by fymk:The ones I really pity are those families who buy their HDB flats on loan and then get into trouble with the banks when they lose their jobs.

those ppl who take HDB loans are safer. till now, i have not known or heard b4 that HDB foreclosed one HDB flat based on late or no mortgage payments. -

I wonder what happens tho with if the person and their family really cannot pay HDB because of recession.Originally posted by Daddy!!:commercial banks dont really like to loan HDB flats buyers because they know that it is more difficult, emotionally and politically, to foreclose them.

those ppl who take HDB loans are safer. till now, i have not known or heard b4 that HDB foreclosed one HDB flat based on late or no mortgage payments. -

maybe HDB will buy and then lease back? I have not heard and encountered a case like that though.Originally posted by fymk:I wonder what happens tho with if the person and their family really cannot pay HDB because of recession.

in any case, even if the person is debt-free, it is already a struggle to break even with the cost of living. -

I'm not sure if I'm still on topic but here's my 2 cents:

During the last 2 decades, USA borrowed and bought while much of the rest of the world lent and sold. Simply put, the main reason why an American recession might cause the whole world to crash is because they are one of the world's biggest consumers and have one of the world's biggest demands.

Now, the global economy seems to be taking a turn. American exporters are finding overseas markets for their products while Asia, the Middle East and Africa are absorbing more of the world's imports than they did before. So, instead of depending as heavily on USA for demand, the world economy could become more balanced.

More importantly, we have the power of a new engine. And that is China. For several decades, Asian economies like Taiwan, Korea, Singapore, Hong Kong etc have actually accounted for more of global GDP growth than America has. Now, I have read that by the end of this year, China alone will for the first time accomplish the same growth as the 4 or 5 other Asian countries did, all on its own.

Of course, if America suffers a recession, then Asia's exports will also weaken. But there is still Europe (and the African countries), China and most other Asian countries are now exporting more to the European Union than to America. Besides, the Chinese government is trying to keep the yuan artificially weak against the dollar, and this masks the influence that the China will be exerting on the world economy.

So you see what I'm getting at? Even if USA falls in the next decade (which they probably won't), chances of the world going down with them is not as high as it used to. -

the only weapon from the poor Fed

Fed cuts interest rate 3/4 of a point,22.01.2008--no joke

By MARTIN CRUTSINGER, AP Economics Writer 3 minutes ago,Singapore time

(10.20pm,22.01.2008 posted on this forum)

WASHINGTON - The Federal Reserve, confronted with a global stock sell-off fanned by increased fears of a recession, slashed a key interest rate by three-quarters of a percentage point on Tuesday and indicated further rate cuts were likely.

ADVERTISEMENT

The surprise reduction in the federal funds rate from 4.25 down to 3.5 percent marked the biggest one-day rate move by the central bank since it cuts its discount rate by a full percentage point in December 1991, a period when the country was struggling to get out of a recession.

Analysts said the Fed will likely delay cutting rates further at its Jan. 29-30 meeting but will probably keep moving rates down aggressively as the economy continues to weaken.

"This move is not an instant fix," said Ian Shepherdson, chief U.S. economist at High Frequency Economics. "The economy is still staring recession in the face, but at least the Fed now gets it."

In addition to cutting the funds rate, the Fed said it was reducing its discount rate, the interest it charges to make direct loans to banks, by a similar three-quarters of a percentage point, pushing this rate down to 4 percent.

Commercial banks responded to the Fed's action on the funds rate by announcing similar cuts of three-quarter of a percent on its prime lending rate, the benchmark for millions of business and consumer loans. The action will mean the prime lending rate will drop from 7.25 percent down to 6.50 percent.

The Fed action was the most dramatic signal it can send that it is concerned about a potential recession in the United States.

The Fed decision was taken during an emergency telephone conference with Fed officials on Monday night. Those discussions occurred after global financial markets had plunged Monday as investors grew more concerned about the possibility that the United States, the world's largest economy, could be headed into a recession.

In a brief statement, the Fed said it had decided to cut the federal funds rate "in view of a weakening of the economic outlook and increasing downside risks to growth."

The central bank said that the strains in short-term funding markets have eased a bit, but "broader financial market conditions have continued to deteriorate and credit has tightened further for some businesses and households. Moreover, incoming information indicates a deepening of the housing contraction as well as some softening in labor markets."

The move caught financial markets by surprise. Many had expected the central bank would wait until its meeting next week to make any move in interest rates. The Fed made the move before markets had opened in the United States, hoping that the bold move would limit the decline in U.S. stocks.

Before Tuesday's move, the Fed had cut interest rates three times, beginning in September, the month after a severe credit crunch had roiled Wall Street and global financial markets. The Fed cut the funds rate by a half-point in September and then by smaller quarter-point moves in October and December.

In its statement, the Fed said, that "appreciable downside risks to growth remain" and held out the prospect of further rate cuts.

"The committee will continue to assess the effects of financial and other developments on economic prospects and will act in a timely manner as needed to address those risk," the Fed statement said.

The Fed's action was approved on an 8-1 vote with William Poole, president the Fed's regional bank, dissenting. The statement said that Poole objected because he did not believe current conditions justified a rate move before the Fed's meeting next week.

-

will you hold US$ (low and getting lower interest rates) ?

will you hold US stocks (earnings down-grade) ?

will you hold US assets (over supply of properties) ? -

as at 10.28 pm 22.01.2008

http://finance.sina.com.cn/ already report

Fed rate cut of 3/4 %

but zao bao and Channel news asia still reports old news....few hours ago..

2.http://www.marketwatch.com/ very good,almost live,--10.36 pm,22.01.2008Latest news|More

9:33[C] Citigroup shares fall 8% in early trade

9:33U.S. stocks plunge after opening bell

9:33[AXP] American Express shares fall 4.3% in early trade

9:33[$INDU] Dow Jones Industrial Average off 452.4 points to 11,647.1

9:32[BAC] Bank of America shares fall 7% in early trade

9:32[NASDAQ] Nasdaq Composite Index down 112 points to 2,228

9:32[ABK] Ambac shares fall 4.4% in early trade

9:32[SPX] S&P 500 Index down 34 points to 1,290

9:31[$RLX] Retail shares drop despite Fed's emergency rate cut

9:31Earnings Watch: Updates, advisories and surprises

scroll upscroll down

Top Stories|Market Pulse|Headlines|Press Releases

-

Originally posted by Daddy!!:

S&P futures now at 1300 on 22 Jan 2008 10:54pm. take profits.

buy some S&P futures now at [b]1277 21 jan 2008 7:30pm. Dont worry too much. if you are not sure, take your profits by this friday lor.[/b] -

every cloud has a silver lining, if you have half the holding appetite of the ohama sage, u cld be sitting on some pretty profit in the mid term.

the fools are those who over commit, or came in late despite all the tell tale signs of the sub-prime crisis, etc.. if you muck around the stock market wif your spare cash, it shouldn't worry you one bit. -

What i am not ready for is US tends to invade other countries when she is in recession. I am not surprised to hear warring words from the US to attack Iran or China within this year 2008.

-

S&P futures now at 1348 on 24 Jan 2008 7:20am. If you kept the position from 1277, you would have made a pretty sum of money.Originally posted by Daddy!!:

buy some S&P futures now at 1277 21 jan 2008 7:30pm. Dont worry too much. if you are not sure, take your profits by this friday lor.S&P futures now at 1300 on 22 Jan 2008 10:54pm. take profits. -

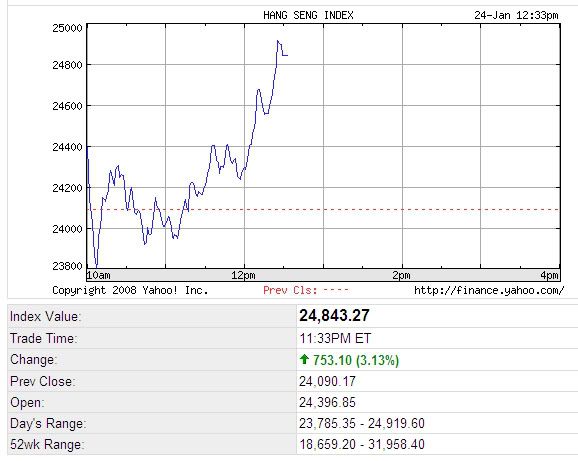

days like this.... not sure andrew will post....

... so doing it on his behalf. -

1) Exporters to USA are suffering from rising raw material (cost) weakening US Dollar (selling price) and weakening consumer spending (strinking market).Originally posted by Birkin_H:I'm not sure if I'm still on topic but here's my 2 cents:

During the last 2 decades, USA borrowed and bought while much of the rest of the world lent and sold. Simply put, the main reason why an American recession might cause the whole world to crash is because they are one of the world's biggest consumers and have one of the world's biggest demands.

Now, the global economy seems to be taking a turn. American exporters are finding overseas markets for their products while Asia, the Middle East and Africa are absorbing more of the world's imports than they did before. So, instead of depending as heavily on USA for demand, the world economy could become more balanced.

More importantly, we have the power of a new engine. And that is China. For several decades, Asian economies like Taiwan, Korea, Singapore, Hong Kong etc have actually accounted for more of global GDP growth than America has. Now, I have read that by the end of this year, China alone will for the first time accomplish the same growth as the 4 or 5 other Asian countries did, all on its own.

Of course, if America suffers a recession, then Asia's exports will also weaken. But there is still Europe (and the African countries), China and most other Asian countries are now exporting more to the European Union than to America. Besides, the Chinese government is trying to keep the yuan artificially weak against the dollar, and this masks the influence that the China will be exerting on the world economy.

So you see what I'm getting at? Even if USA falls in the next decade (which they probably won't), chances of the world going down with them is not as high as it used to.

2) USA import about US$1,800 billions worth of goods a year, which is more than half size of China GDP. Plus lets not forget that Japan (the second largest economy in the world) is already heading for recession.

Lets not kid ourselves. when the USA goes into a recession, all hell will break loose, China stock market will crashed and this will lead to the burst of the China red hot property bubble and then global recession begin. -

then those sitting on a pile will rub their hands with glee becos tt will be the time to `go in'....god is fair when he/she created cycles...Originally posted by Love Supreme:1) Exporters to USA are suffering from rising raw material (cost) weakening US Dollar (selling price) and weakening consumer spending (strinking market).

2) USA import about US$1,800 billions worth of goods a year, which is more than half size of China GDP. Plus lets not forget that Japan (the second largest economy in the world) is already heading for recession.

Lets not kid ourselves. when the USA goes into a recession, all hell will break loose, China stock market will crashed and this will lead to the burst of the China red hot property bubble and then global recession begin. -

The EU and american politicians will come out with new policies to protect themselves, and terror threat will be the main excuse to block middle eastern funds.Originally posted by weiqimun:then those sitting on a pile will rub their hands with glee becos tt will be the time to `go in'....god is fair when he/she created cycles... -

when global recession starts while US becomes a poor country, be ready for world war 3.Originally posted by Love Supreme:1) Exporters to USA are suffering from rising raw material (cost) weakening US Dollar (selling price) and weakening consumer spending (strinking market).

2) USA import about US$1,800 billions worth of goods a year, which is more than half size of China GDP. Plus lets not forget that Japan (the second largest economy in the world) is already heading for recession.

Lets not kid ourselves. when the USA goes into a recession, all hell will break loose, China stock market will crashed and this will lead to the burst of the China red hot property bubble and then global recession begin. -

Contrary to popular belief, US is unable to launch both a full scale attack and mount a proper defence at the same time.Originally posted by Daddy!!:when global recession starts while US becomes a poor country, be ready for world war 3.

There's a reason why the US army is resorting to rotating the national guard when it comes to the small scale invasion of iraq. It simply doesn't have the troops.

Basically, their world war 3 strategy HAS to be the exact same one as their world war 2 one...defend until everyone else is tired of fighting, then claim victory.