Investments in Merril Lynch making money for Temasek

-

-

-

-

Singaporeans money going down the drain instead of being paid decent interest rates for their money in their CPF accounts....

-

-

-

-

Andrew finally back!

-

Originally posted by TCH05:

Not sure did anybody catch the CNBC interview with Warren Buffet. They ask him if you were to start all over again, what sort of business will you pick.

He said Financial and Wealth Management, because he believe that is the sector where you can make most money.

Making money does not mean that markets will always be favourable to everyone.There is always someone making money and someone losing money.

Markets will always favour those with a knack for information and analysis.

-

Originally posted by TCH05:

maurizio13, you seems to have a very negative view on GIC and Temasek's investment in the few bluechip banks. I am just wondering if you dare to put your money and bet against GIC and Temasek ability to make a profit from these investment in let say 12 to 18 months?

I only present an honest picture of the state of events in Temasek, they make very poor investment decisions. Apart from the very few overseas investments thatmakes good returns, most of their investments with good returns come from Singapore.

Why you might ask?

Reason being they have stake in all these so called free and competitive corporations, it's possible to control the price.

Is there somewhere I can place those bets?

Or are you thinking of betting against me?

-

Originally posted by maurizio13:

I only present an honest picture of the state of events in Temasek, they make very poor investment decisions. Apart from the very few overseas investments thatmakes good returns, most of their investments with good returns come from Singapore.

Why you might ask?

Reason being they have stake in all these so called free and competitive corporations, it's possible to control the price.

Is there somewhere I can place those bets?

Or are you thinking of betting against me?

Nah, you are presenting the snap shot picture of SELECTIVE events and selective investments.

If you are so confident about them losing money in ML, UBS, Citi etc, you should bet against these stocks in the stock market.

You claim that Temasek and GIC are lousy investors, relative to?

AFAIK, one of Australia biggest pension fund recently reported a negative 5-7% return on their OVERALL investment portfolio .

I wonder why didnt they just put their money in Australia fixed deposits?

-

Originally posted by TCH05:

Nah, you are presenting the snap shot picture of SELECTIVE events and selective investments.

If you are so confident about them losing money in ML, UBS, Citi etc, you should bet against these stocks in the stock market.

You claim that Temasek and GIC are lousy investors, relative to?

AFAIK, one of Australia biggest pension fund recently reported a negative 5-7% return on their OVERALL investment portfolio .

I wonder why didnt they just put their money in Australia fixed deposits?

Snap shot of selective events?Isn't that's what TS is doing in his first post?

I thought you were confident that they would make money, so I challenged you to put your money where you mouth is.

But you back away, pushing me to some other sources, if you have full confidence then you should take up the challenge.

Lousy investors compared to above average investors in the market.

Don't need to sidetrack to another pension fund.

Do you feel good comparing to someone worse than you?

-

I guess in the longer term, Temasek will do fairly well. But not great.

Nobody can predict the future. Short term losses are inevitable. Moreover, Merril Lynch is not a company that goes bust easily looking at its financial statements.

However, i dont think Temasek is buying at a price with enough margin of safety. The management is making impatient decisions. When you have lots of cash at hand, you always feel like doing something, which may be a mistake. In the longer term, i dont think they will incur losses, but their gains also will not be fantastic. I do not blame them because Temasek is not like Warren Buffett. If they dont beat the market in the long term what can we do? Suck thumb only, let them play with the country's money. They should report their annual returns using the STI and S&P as yardstick to compare performance. GIC also!

I'm not happy as they didn't disclose their returns. What kind of transparency is the garmen talking about? LOL

-

Expect transparency from dishonorable despots? lol...

-

Originally posted by maurizio13:

Snap shot of selective events?Isn't that's what TS is doing in his first post?

I thought you were confident that they would make money, so I challenged you to put your money where you mouth is.

But you back away, pushing me to some other sources, if you have full confidence then you should take up the challenge.

Lousy investors compared to above average investors in the market.

Don't need to sidetrack to another pension fund.

Do you feel good comparing to someone worse than you?

I am already betting that these are good investment and it will yield reasonably good returns in 12 to 18 months considering the limited investment opportunities available right now.

I am just responding to what some forumers (might include you) are saying that they can make better returns from putting money in Australia fixed deposit than CPF 3.5%. So I am asking why didnt the australia pension fund deposit their money in fixed deposit?

If you are confident about Temasek and GIC making wrong decision on ML, Citi, and UBS, are you willing to bet against this investments?

Place you bet here and we revisit this thread in 12 months time?

-

Anyone buying any of the 3 counters now would be so much better than them.

In the case of Barclays bank, which has dropped by half... they would be doing 100% better.

If the counters come down from here, they lose less and if the counters go up, they do much better.

They take so much of the people's money to lose and claim that they are doing ok because in 1 years time they MIGHT be ok? CRAPZ...

Invest money like this the ah pek and ah soh in the coffee shop can also do it. Take public money and then buy anything they want and when they want and then say, just wait.

Dishonorable despots that take so much public money for their own pockets and lose the people's money in their investments instead of paying the people a decent return for the CPF money they are forced to contribute.

-

Most definitely better than what Temasek paid for US$48 per share.

If Temasek hadn't provided a capital injection to Merrill Lynch,

the share price would have gone much lower.

If they had adopted that strategy of not providing funds to Merrill Lynch,

Merrill Lynch fails to get funds from other sources, the price could

possibly be US$40 now.

I think there is another 2-3 quarters of reporting for the sub-prime

debacle to unravel itself. More foreclosures, more unsold houses,

fall in property price, loss in equity value of properties, more losses

in the mortgage funds.

Funny how the Fed manages a credit crunch, it lowers Fed Fund Rate

to increase borrowing, which in reality should be increase Fed Fund Rate

to decrease borrowing to rein in the credit.

I think the lowering of Fed Fund Rate is to increase borrowing and increase

spending because they forecast a recessionary economy this year.

-

Can we see it as 'buying' the 'goodwill' of the financial sector? Financial sector is one of the pillars of Singapore economy. Some tangible benefits might be lost, but the intangible benefits are definitely still there. Eg, while Citigroup is retrenching people in the US, they are still employing fresh graduates this year (4 were employed this year, 3 from SMU and 1 (my friend) from NUS )

But then, to counter my own argument, the buying of the telecomms in Thailand is a total flop.

-

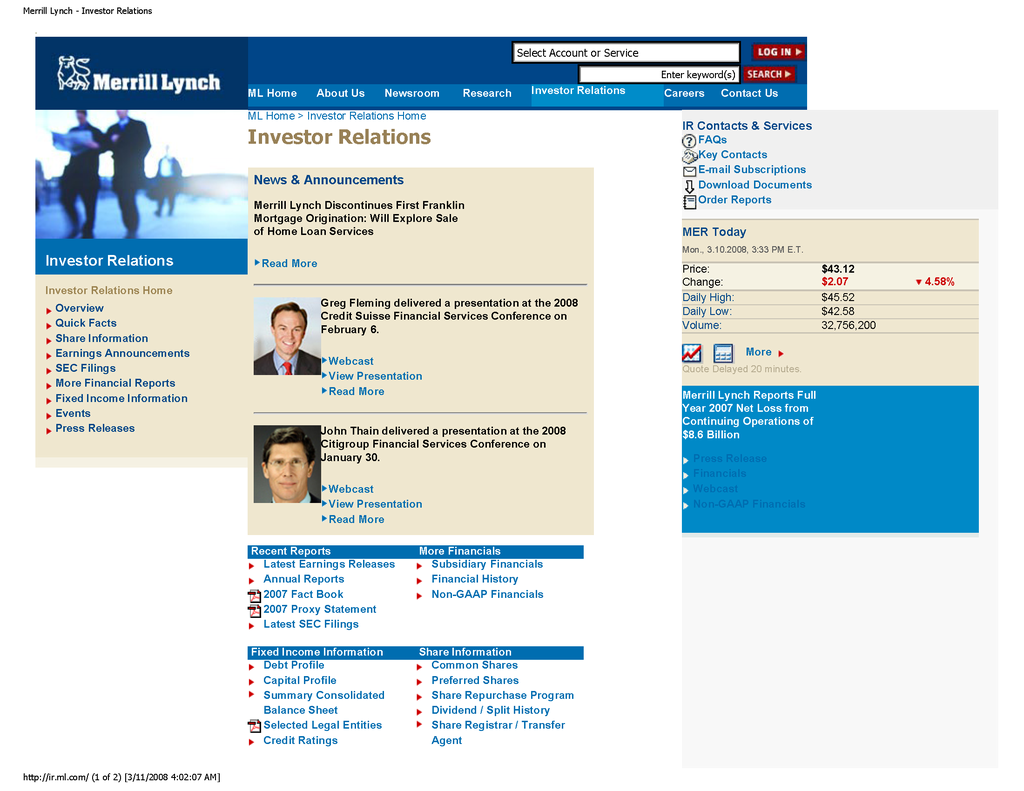

Today Merrill Lynch's share price drop to a daily low of US$42.58 per share as

compared to the discounted purchase price of US$48 per share Temasek took.

In a span of 3 months, the initial amount of US$4.4 billion invested by Temasek

has shrunk to US$3.9 billions, a loss of US$500 million for Singapore.

The investment is denominated in US Dollars, with the depreciation of the US dollar

with respect to other currencies and the Singapore dollar, by the time we can cash

out our investment, the exchange rate would most probably be (US$1 = SG$1.25 or SG$1.30).

Even if we managed to breakeven with US$4.4 billion (exchange rate of US$1 = SG$1.42),

we would have loss during the conversion to Singapore dollars.

We paid approximately SG$6.248 billions (US$1 = SG$1.42) for it in Dec 2007, but we will be getting back SG$5.50 billions (US$1 = SG$1.25).

A breakeven investment but a resultant SG$748 million loss in capital during foreign exchange conversion.

I guess it should be alright for the government, afterall what's another few percentage point increase in GST to recover the loss.

Maybe increases in MRT fares, phone charges, postal charges, electricity, water, bus, etc

-

Originally posted by AndrewPKYap:

Anyone buying any of the 3 counters now would be so much better than them.

In the case of Barclays bank, which has dropped by half... they would be doing 100% better.

If the counters come down from here, they lose less and if the counters go up, they do much better.

They take so much of the people's money to lose and claim that they are doing ok because in 1 years time they MIGHT be ok? CRAPZ...

Invest money like this the ah pek and ah soh in the coffee shop can also do it. Take public money and then buy anything they want and when they want and then say, just wait.

Dishonorable despots that take so much public money for their own pockets and lose the people's money in their investments instead of paying the people a decent return for the CPF money they are forced to contribute.

Talking is cheap.

-

at the rate

-

at the rate the investment are done, it is not transparent and i can do better than them

-

Originally posted by kangyk:

at the rate the investment are done, it is not transparent and i can do better than them

suppose if you have $1b, what will you invest now? -

Originally posted by TCH05:

suppose if you have $1b, what will you invest now?

Do you have $1 billion to invest?I will help you invest, if I lose money, I will resign, unlike some Ho of Temasick.

-

Originally posted by maurizio13:

Do you have $1 billion to invest?I will help you invest, if I lose money, I will resign, unlike some Ho of Temasick.

Sorry to say that I have zero confident in you managing my wealth.