Investments in Merril Lynch making money for Temasek

-

....to cure the cancer, you need to cut off the infected parts.... otherwise, the cancer will destroy the whole country.... it might be too late.....

-

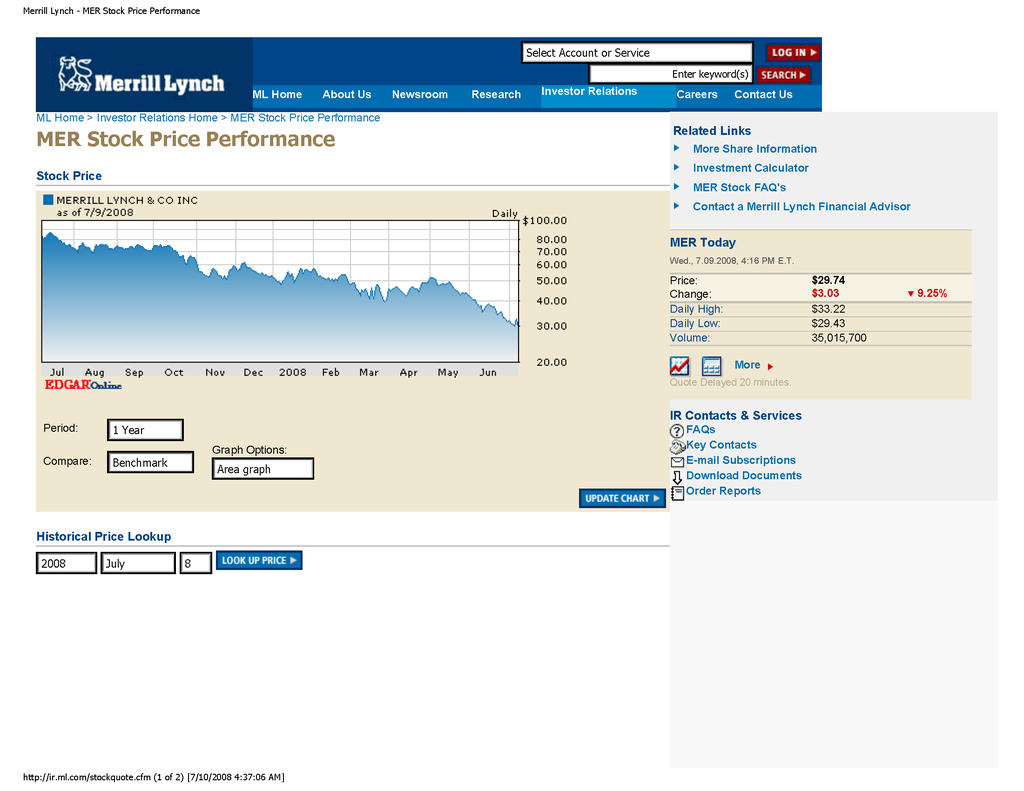

Temasek invested US$4.4 billion in Merrill Lynch at the end of December 07 for US$48 per share, at present the shares are trading at US$29.74 per share. A loss of US$1,674 million, or almost 40% of it's purchase price gone down the drain. How smart exactly are our leaders in making financial investment decisions? Well, they can claim it is a paper loss as it was a long term investment, if they had the foresight they would have known that share prices will tumble after more losses are reported from the subprime crisis.

-

"paper loss" is "LOSS"

You said a loss of US$1,674 million and they say it is not a loss, only a paper loss. They can use that US$1,674 million to buy somethings with it because it is not a loss and only a "paper loss"?

A loss is a loss, whether you realize it or not. If you realized it, you cannot use the US$1,674 million because it is lost. If you do not realize it, you cannot use the US$1,674 million because it is lost. "Paper loss" is propaganda. You cannot use whatever you have lost.

The despots are making Singaporeans stressed out everyday withe high costs of living and low quality of life. Singapore and Singaporeans can do so much better.

The cost of living is so high because of all these money they take from Singaporeans and losing to foreigners.

-

The money that they use to support foreign companies like Merrill Lynch, if they did not take it from Singapore/Singaporeans, would have allowed the private companies to become world class, but as it is, Singapore is and will always be coolies to the Multinationals.

With the despots grabbing so much money, Singapore private companies cannot become world class multinationals. The money will be channelled to their cronies and relatives.

-

I really admire the investment strategy of Temasek, only 6.5 months and their highly rated Merrill Lynch has loss half it's value, it's currently trading at US$25.88.

Alright, we should increase more ERP, GST, Fines, Transport Fares & Electricity Tariffs to recover some of the losses, else balance sheet will look very bad at year end.

-

I am still waiting for those who supported the purchase of Merrill Lynch to come back in here to tell us that it was a good buy.

-

Originally posted by maurizio13:

I am still waiting for those who supported the purchase of Merrill Lynch to come back in here to tell us that it was a good buy.

I want to know if there is a possibility to raise the present to GST to 10% in the near future mayb after the election? -

Wow!!!

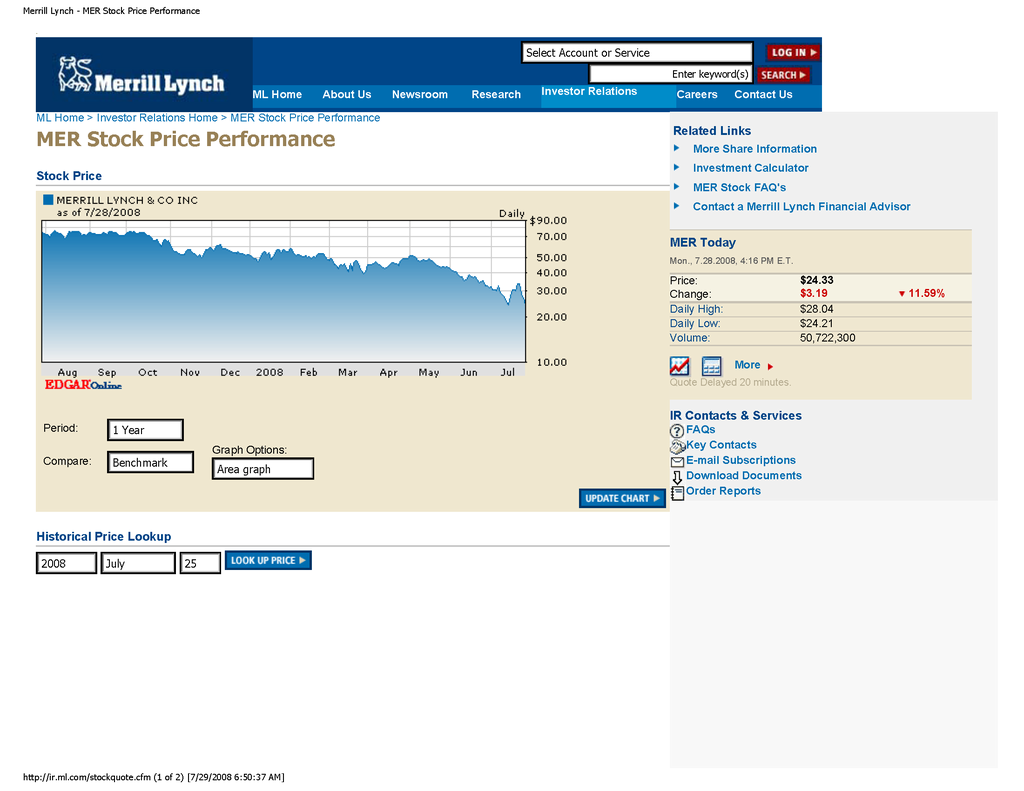

In a span of 7 months Temasek have lost half the value of it's initial investment.

An initial purchase price of US$4.4 billion of US$48 per share has dropped to a price of $24.33 per share, a lost of US$2.2 billions just for Merill Lynch.

I wonder what kind of investment strategies do dictators have?

-

Merrill Lynch to raise US$8.5 billion through public offering.

Posted: 29 July 2008 0644 hrs

WASHINGTON: Leading US investment bank Merrill Lynch announced on Monday it was raising 8.5 billion dollars in new capital through a public offering, and said Singapore's investment fund Temasek was taking up 3.4 billion dollars of the offer.

The announcement came in the wake of Merrill's July 17 announcement that it had racked up a net loss of 4.89 billion dollars for the second quarter, another sign of the devastation of the US real estate crash on financial markets.

The Wall Street star said on Monday it was also selling off a large amount of

collateralised debt obligations (CDO) - the packaged US mortgage securities

which have ravaged bank balance sheets around the world - cutting its exposure to the sector by 11.1 billion dollars.

"The sale of the substantial majority of our CDO positions represents a significant milestone in our risk reduction efforts," said Merrill chairman and CEO John Thain in a statement.

Thain said the CDO sale and the capital hike will "materially enhance the company's capital position and financial flexibility going forward."

Merrill had already raised 15.3 billion from capital markets earlier this year.

And it announced earlier in July that it was shedding assets to raise new funds, including its 20 percent stake in financial news and data group Bloomberg for 4.425 billion dollars, and its controlling interest in Financial Data Services for at least 3.5 billion dollars.

The company said on Monday it expects to record a pre-tax write-down in the third quarter of about 5.7 billion dollars, which includes a 4.4 billion loss associated with the CDOs being sold. - AFP/de -

Originally posted by maurizio13:

Wow!!!

In a span of 7 months Temasek have lost half the value of it's initial investment.

An initial purchase price of US$4.4 billion of US$48 per share has dropped to a price of $24.33 per share, a lost of US$2.2 billions just for Merill Lynch.

I wonder what kind of investment strategies do dictators have?

What to do ?Ho Ching is a risk taker.

-

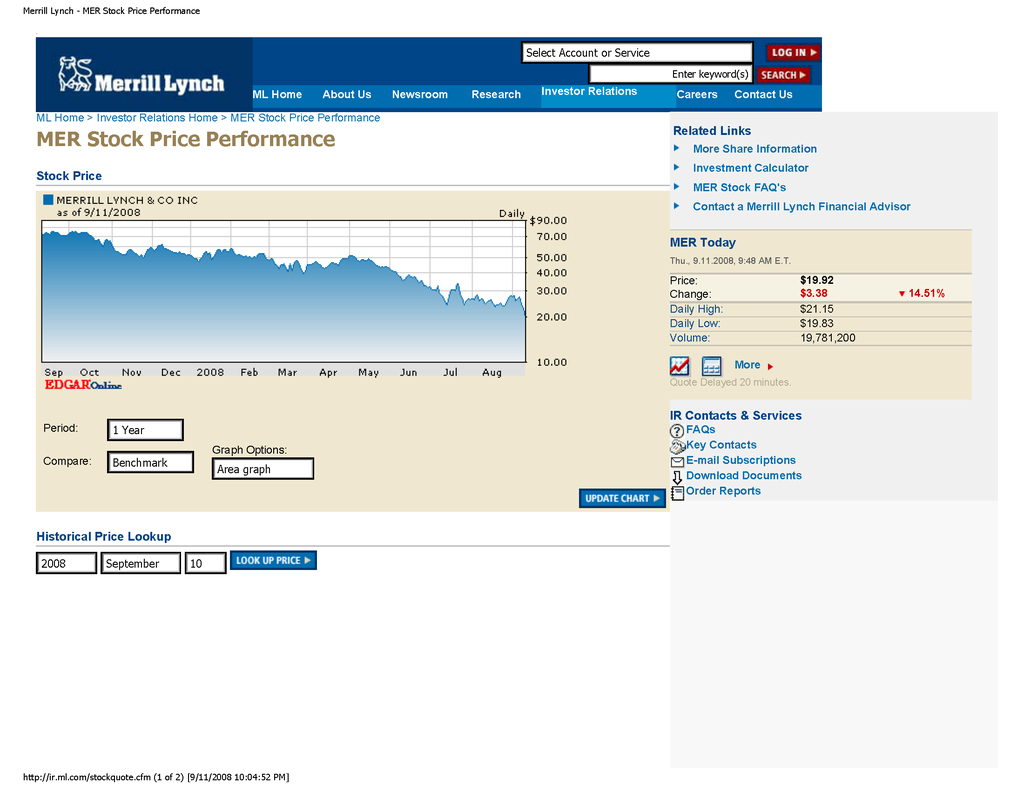

As expected Merrill Lynch drops to an all time low of $19.83, the $22.50 paid for by Temasek 1-2 months ago was overpriced as usual.

Ho Ching, please get your act together, if you can't shape up (obviously you can't even if your life depended on it), please ship out. Cronism is bad for the country, putting relatives in important position when they are incompetent leads to the demise of the country.

Stop using Singaporeans' retirement funds for you punting bouts!!!

-

merril lynch's shares closed at usd 29.50 on 19 sep 2008. so Temasek has now a significant paper gain. Good invesment decision.

-

Originally posted by Daddy!!:

merril lynch's shares closed at usd 29.50 on 19 sep 2008. so Temasek has now a significant paper gain. Good invesment decision.

Truth, but not realized yet, u hv to concern the inflation and going concern ya -

hey i tot there i a clause that tamesek got bak 2.5b?

-

Originally posted by elementalangel:

hey i tot there i a clause that tamesek got bak 2.5b?

The problem is temasaki dun disclose their account to us, as stake holders, we should get the know, so now one said this, the other say that..no facts and orders at all.And even if they show us their account, most likely it is massaged at the thai foot massage centres

-

It's just amazing that lesser folks here still thinks that Temasek made a wise and prudent investment decision when they decided to buy into Merrill Lynch in December 2007. Are they in denial or just plain stupid?

The most notable failures so far, however, have been those of three major U.S. investment banks: Bear Stearns, Lehman Brothers, and Merrill Lynch. Bear Stearns collapsed on March 16, 2007, after facing major liquidity problems, and was sold to JP Morgan after Federal Reserve Bank of New York agreed to take over Bear Stearns' US$30 billion portfolio of mortgage-back securities. Lehman Brothers files for Chapter 11 bankruptcy protection on September 14th, 2008 after failed attempts to sell the bank to private parties. Merrill Lynch was acquired by Bank of America on September 15th, 2008.

Source IMF: http://www.imf.org/external/pubs/ft/wp/2008/wp08224.pdf

-

Temasek making money or making a cover up of loss? The contridiction of news from both side is confusing Singaporeans. Isn't not it?

-

Originally posted by (human):

Temasek making money or making a cover up of loss? The contridiction of news from both side is confusing Singaporeans. Isn't not it?

Why u want to know about Temasek?? U got yr paid right, you got foods to eat right, u got a shelter right, u still got CPF right, so, what is the problem, what you want to know?? -

Originally posted by angel7030:

Why u want to know about Temasek?? U got yr paid right, you got foods to eat right, u got a shelter right, u still got CPF right, so, what is the problem, what you want to know??Temasek is using tax money, isn't this not national interest? Singaporeans not interested to know?

-

Temasek makes money with its investments in Merril Lynch. Calling others stupid will not change this fact. You lose.

.

.Of course, you wished very hard that Temasek would lose money on Merril Lynch because you are "Anti". However, being unable to accept the fact that Temasek eventually made some money out from Merril Lynch and even tried to "condemn" this investments makes you a lousy loser.

.

. -

It still makes me wonder why TH cannot be like WB and buy into banks like Goldman Sachs around this time

-

Originally posted by (human):

Temasek is using tax money, isn't this not national interest? Singaporeans not interested to know?

Prove to me that temasek is using tax money?? U may get sue for defamation -

the timing into merril lynch purchase can be better as what they admitted as well. the paper gain so far seem to me as 50% judgement and 50% luck.

i once read an chinese forums articles from the chief of some china banks questioning why china as not make it move into the american investment earlier or now. he said, no point investing when you are not sure what would happen next in the american financial crisis.

that pretty smart!

isnt taht the reason why local banks such as DBS, OUB, UOB or OCBC are not jumping into this temasek or GIC bandwagon?

-

dbs could not jump in because it is dtill licking the wounds from its acquisitions of dao heng bank and thai danu bank. dont know lar!

-

Originally posted by Daddy!!:

Temasek makes money with its investments in Merril Lynch. Calling others stupid will not change this fact. You lose.

.

.Of course, you wished very hard that Temasek would lose money on Merril Lynch because you are "Anti". However, being unable to accept the fact that Temasek eventually made some money out from Merril Lynch and even tried to "condemn" this investments makes you a lousy loser.

.

.

Hahaha.......(ROTFLMAO)Did I call you stupid? If not, then why do you feel insulted? Guilty conscious?

First of all I don't deny that Temasek "might" possibly make money from the purchase of Merrill Lynch. But you have to understand the facts of the case, instead of being in constant denial and subvening on blind faith regarding Temasek's investment decisions.

1) Temasek acquired Merrill Lynch in December 2007, when the share price was trading at USD 52 per share, the price sold to Temasek was USD 48, which was a discount, already a gain for Temasek.

2) In a matter of 6 months the share price plummeted to half price around USD 25. Due to liquidity constraints the bank was force to seek extra cash. There are various ways of raising cash.

a) They could have used bonds to get cash, I don't know why they didn't use this avenue of raising cash. It would have denied Temasek from gaining the USD 23, that they overpaid for the shares in December 2007, because the clause in the share purchase agreement only if only new equity shares were issued within a year, Merill Lynch will have to make good the difference of the USD 48 and the new share issue price. Perhaps they foresaw the difficulty of raising finance through the debt (bond) maket because of the financial statements exposure to subprime.

b) The other way to get finance is to issue new share capital, to which current equity stareholders will buy, else they lose shareholding in Merill Lynch. The new share issue was at USD 22.50 when Merrill Lynch was trading at USD 25, it was the same scenario as in December 2007, it was given a discount for the new share issues.

i) One thing you have to ask yourself is, was it really a profit for Temasek. Why would any company issue shares at USD 22.50 when the share is currently trading in stock exchange for USD 25? The only reason why anybody would do that is because they fear that the new share issues will not be bought up by the public, therefore they need to give a discount to ensure that the new share issue is a success.

ii) The so called "profit" of USD 2.50 for Temasek was the same as the discount given to Temasek when they purchased the Merrill Lynch shares in December 2007. They received USD 4.00 discount for the share purchase in December 2007, which is close to double the current discount of USD 2.50. The "profit" is not in the form of cash, it is paid out in new shares, so Temasek received more bad shares.

3) Afew months after the new share issue, the company's share dipped to a new low of USD 16.50, this is a loss USD 6 from the new share issue price of USD 22.50. During this period, Merrill Lynch was also a candidate for bankruptcy like AIG, Lehman Brothers and Bear Stearns. Then appeared a White Knight (Bank of America) which offered to buy the Merrill Lynch for USD 29, when the share price in the stock exchange was trading at USD 17. In any takeover, the share price of the target company will always rise because a higher share price entices current shareholder to sell their shares. But the "profit" "if" Bank of America goes ahead with the deal in early 2009 is not going to be paid in cash, but in equity shares in Bank of America, most likely these shares will have conditions attached to them like Merrill Lynch, which forbids them to sell the shares within a certain period.

The appearance of a White Knight was pure luck, Merrill Lynch could have winded up like Lehman Brothers or Bear Stearns. They did make a so call "profit" (barring any unforseen circumstances arising in early 2009) out of Merrill Lynch, but was it investment or gambling? Investment requires knowledge and intelligence, judging from Temasek's past acquisition of other companies, they haven't been very good in this category, they always overpay for their investments.