GlobalCrossing Revisited: Ball-Shackled 2 Sinking Investment

-

Since last year (2007), when I posted the failed restructuring of Global Crossing (a Chapter 11 bankrupted firm, which our Temasick decided to invest), our Big Ho still decides to keep the investment.

Previous thread: http://politics.sgforums.com/forums/10/topics/235957

Since Temasick's acquisition in 2003, this firm has never once made any profits. Four years have passed and they still haven't managed to turnaround the company.

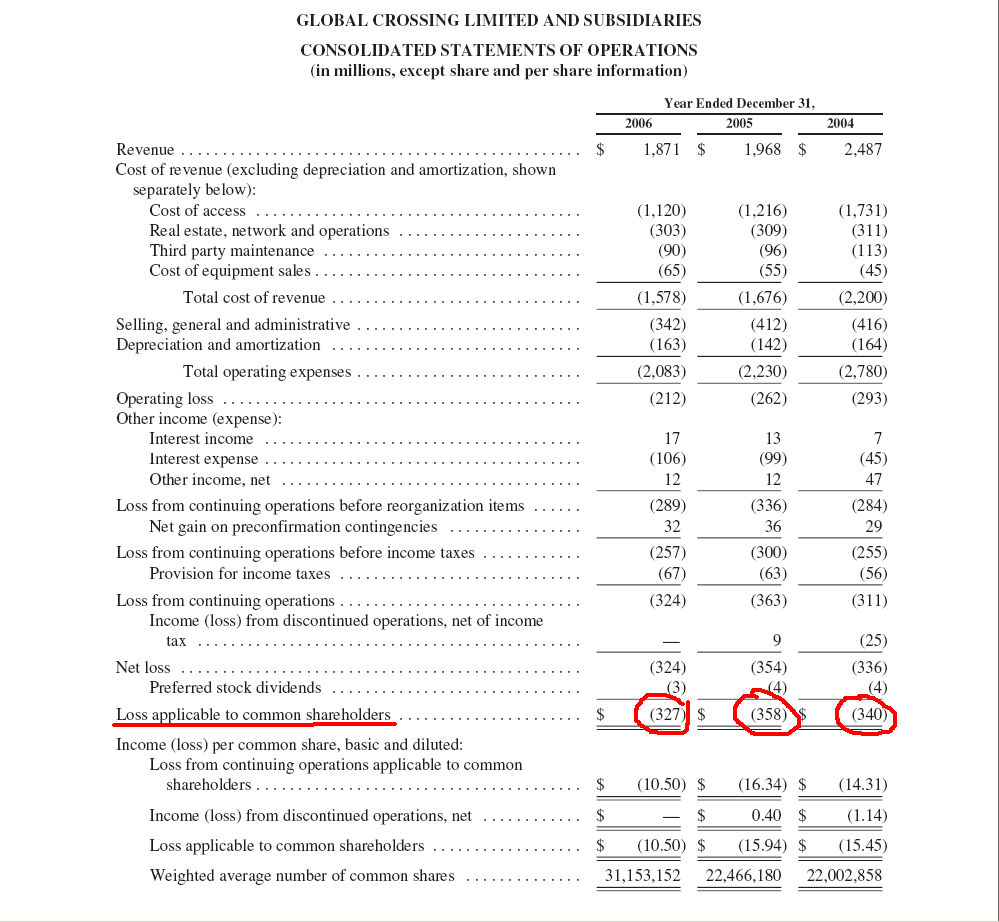

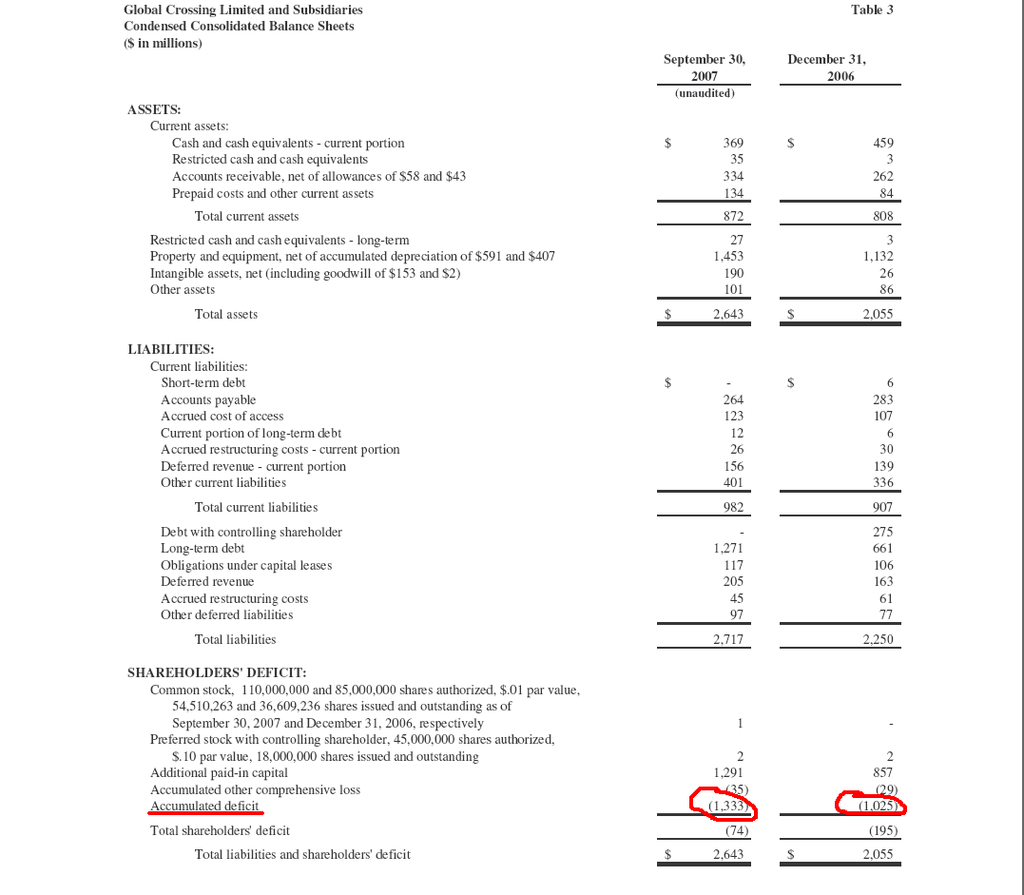

To date Global Crossing has accumulated losses of close to US$1 billion, the losses were made good through new share issues and loans provided by STT. The US$1 billion losses does not include the purchase price of US$450 million paid by STT.

Page 170 of the link

31. Also in the United States, ST Telemedia agreed in December to provide an additional US$100 million in contingency financing to Global Crossing. ST Telemedia had already invested US$450 million in Global Crossing, in which it now has a 61.5% stake and the right to appoint eight out of 10 board members. Global Crossing emerged from bankruptcy December 9.

Source: http://singapore.usembassy.gov/uploads/images/LcHzDIVG7FgFo7nqpuxsCQ/InvestDev_Oct03Mar04.pdf

I had a look at the 3rd quarter results, it doesn't look good for 2007 either. They are long overdue for the 4th quarter results, but no news from them yet, don't know what's keeping them (another bad quarter?). The accumulated losses at the end of 3rd quarter 2007 has ballooned to US$1.33 billon, an increase of US$300 million from it's 2006 Dec year end.

Page 8 of the link

This zombie company should have been put out of it's misery long time ago instead of draining on the hard earned money of Singaporeans. Every year it's at least US$300 million worth of losses.

Do you think our family related appointments make good investment decisions?

-

Waiting for Global Crossing 4th Quarter Earnings Report.

-

i'm not sure who told you how to look at investments by funds.

First off let's get it straight. All funds, all investors make losing trades. It's the net profit/loss that interests us.

Just because a single investment is doing badly doesn't mean the fund is making mistakes. What, you'll only be satisfied when the fund is managed by a fortune teller?

-

Originally posted by deathbait:

i'm not sure who told you how to look at investments by funds.

First off let's get it straight. All funds, all investors make losing trades. It's the net profit/loss that interests us.

Just because a single investment is doing badly doesn't mean the fund is making mistakes. What, you'll only be satisfied when the fund is managed by a fortune teller?

Use abit of your things in between your ears.If the loss is so great for these major investments,

where are they going to recover the loss from?

They use monopolistic government controlled businesses in Singapore like the Telcos,

Transport and Utilities to increase charges, so that they can make up the loss of these

investments and get a healthy profit.

So logical and you don't know,

no wonder you are not doing finance for a living.

-

If say I have 10 investments (8 local investments + 2 overseas investment),

2 investments overseas are making big losses.

How do I make my income statement and balance sheet look good?

I increase the prices of the other 8 local companies so that

I can recover the loss of the overseas investment and show good profits.

Therefore I have to increase prices to the point where I can recover the losses

from my overseas investment, profits for the overseas investment and profits

for my local investments.

There are some of us who persist in stupidity, either that or they are

paid by the regime to be stupid or make others stupid.