Cost of electricity to go up from April as oil prices rise

-

Originally posted by pisces8:

I learn something today that price of LNG ie

PLNG = A+B×PCrudeOil

is the pricing formular use by Asian LNG market. Thank you.

This clearly shows that once factors A and B are fixed, the price of Crude Oil (PCrudeOil) will affect the PLNG directly. PCrudeOil goes up PLNG will go up by a factor of B (provided B is positive, to which common sense say it is).

This explain that although power plants can be using LNG as fuel but the electricity production cost is always linked to the price of crude oil.

If possible, can you give some idea of the range of factor A and B. Thank you again.

I am glad that you learn something new because there are some forumers here who think that they have learn it all in schools and thats why they can only talk about equation instead of common sense.With regards to A and B, I believe they consist of pretty complex formulation basically to protect the interest of the seller. And I also believe that A and B do consist of certain political factor (which affect ths supply). Just take Dubai for example, the cost of their LNG is about 50% more expensive than if they were to import them from neighbouring Iran.

I think Singpoare power plants or Singapore are over dependent on Indonesia LNG and recently there have been some talk about importing LNG from Woodside in Australia and also set up a LNG storage facility in Jurong Island so that they can import from far away place like Qatar via LNG vessel.

-

Originally posted by Ed11790:

oil still going up?!

i thot oil is based on USD and recently USD dropped like falling rain to record 1 USD : 1.3x SGD right?some months ago,

1 USD : 1.6 SGD

now, its

1 USD : 1.3x SGD

1 barrel of oil at 100USD used to be 16x SGD ,

now

1 barrel of oil at 100USD should be less at 13x SGD right or not?

no meh?

why always i hear due to oil, price hike?

-

Originally posted by TCH05:

I am glad that you learn something new because there are some forumers here who think that they have learn it all in schools and thats why they can only talk about equation instead of common sense.I hope you learn something new too, about what is the meaning of correlation.

And I didn't know it was common sense to talk rubbish by using an unrelated equation to prove a point of yours.

Which school or Nobel Laureate taught you that?

Which school or Nobel Laureate taught you that?

-

Govt give income tax rebates and growth dividends not for you to keep the savings. It’s for you to ‘spend’…….kekekekeke

-

Originally posted by eagle:

I hope you learn something new too, about what is the meaning of correlation.

And I didn't know it was common sense to talk rubbish by using an unrelated equation to prove a point of yours.

Which school or Nobel Laureate taught you that?

Which school or Nobel Laureate taught you that?

1) You avoided my question when I ask you if Price of LNG and Price of Oil is coorelated.2) That is not a equation which I created, it is something which is used by ASIAN LNG market to price LNG.

-

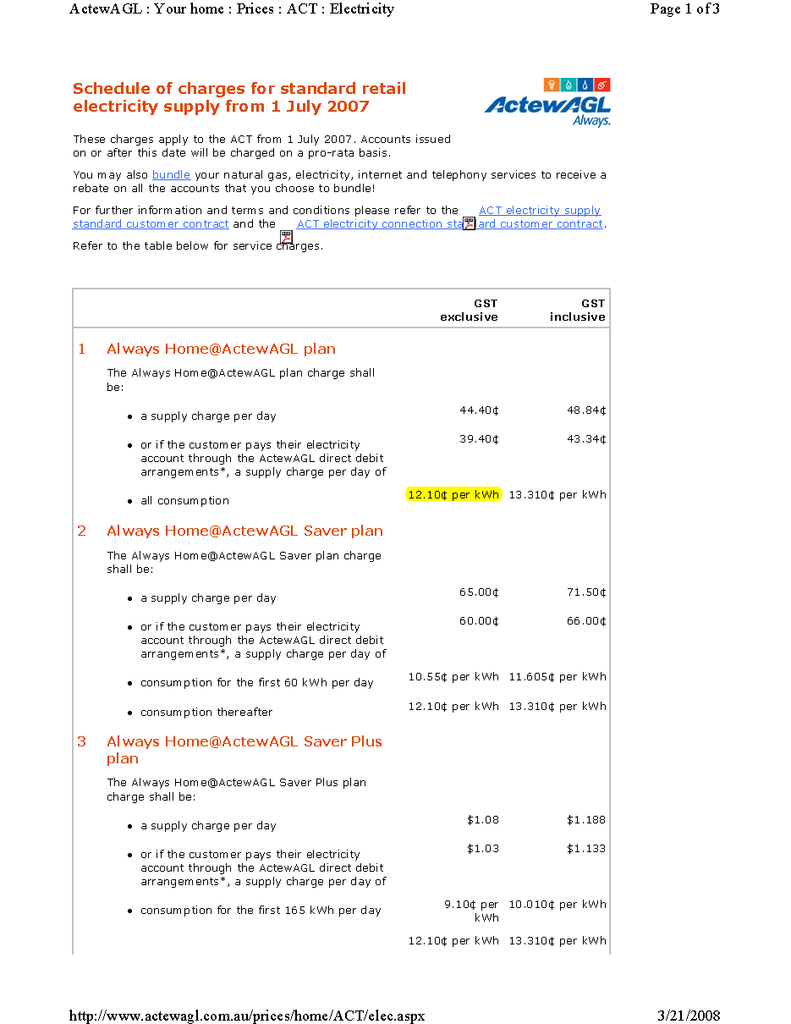

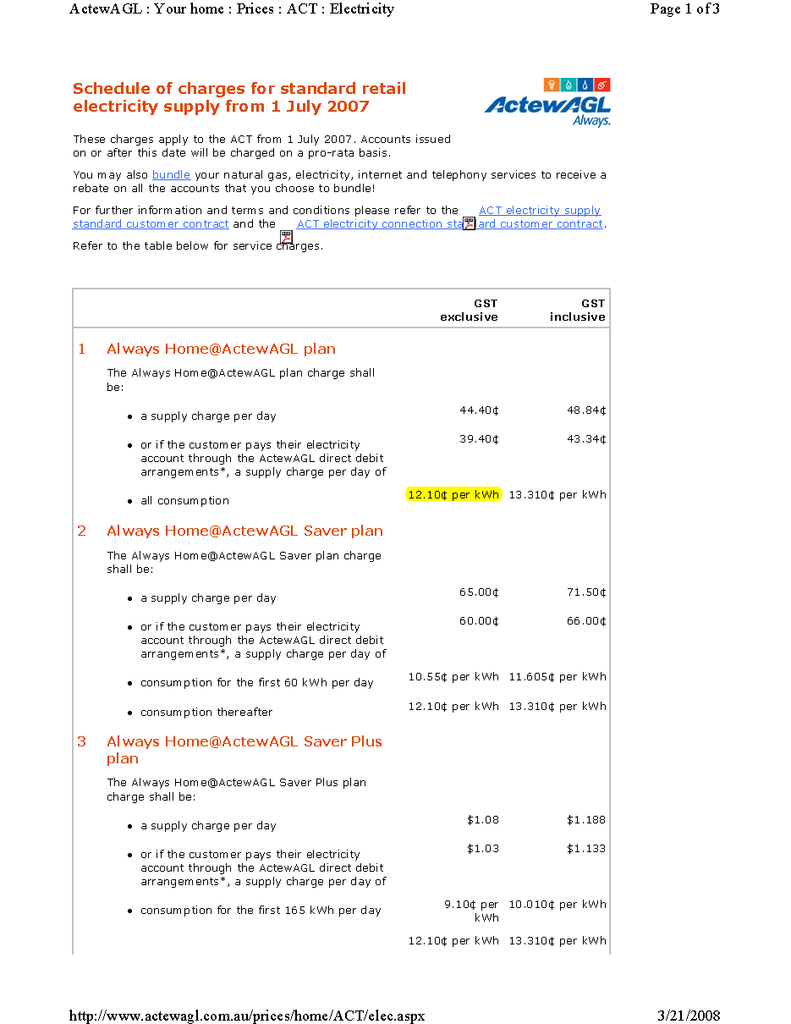

Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

Electricity rate is charged in Australia (ActewAGL) at 12.10 cents (Australian Dollars), when converted gives a Singapore Dollar rate of 15.13 cents.

(AUD 1 = SGD 1.25)

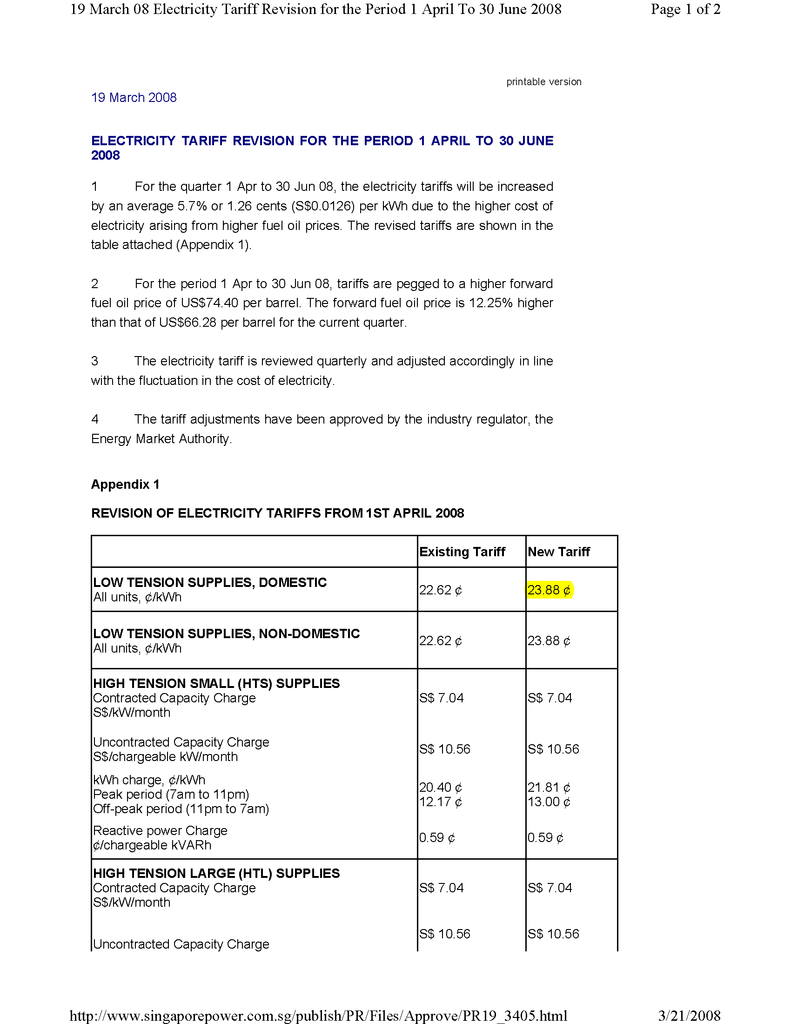

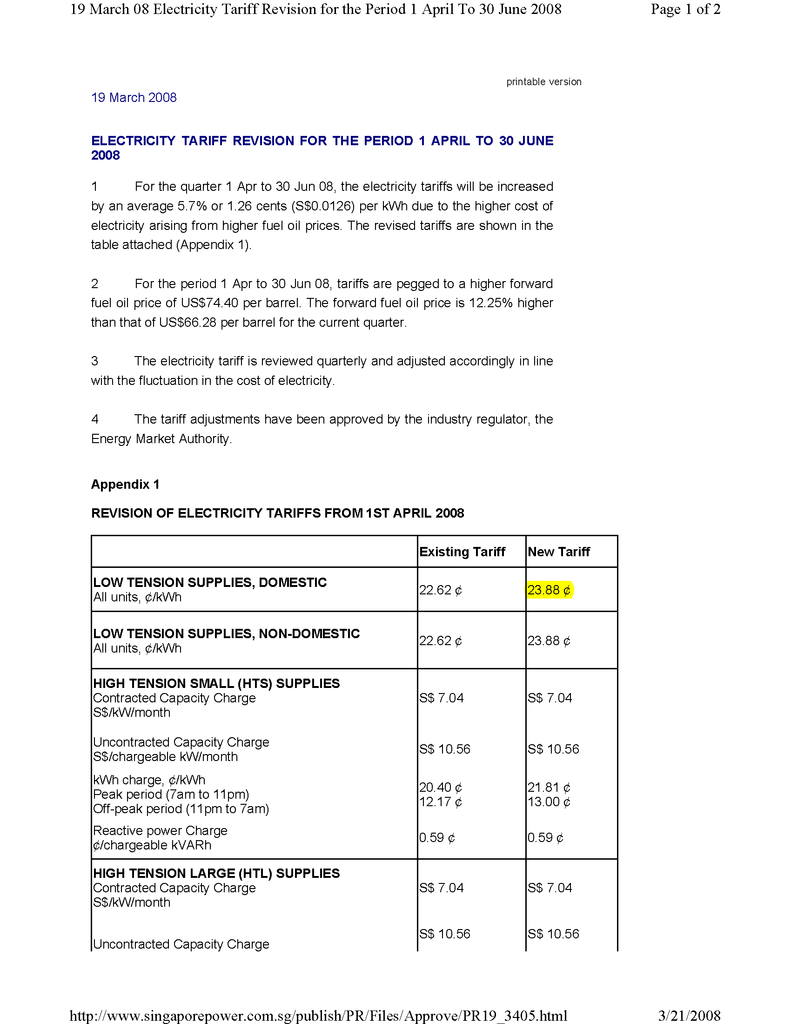

Singapore Power charges electricity rates 23.88 cents.

The difference between Singaporean electricity and Australian is 8.75 cents, a pecentage difference of 58% when compared to Australian electricity.

Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

Source: http://www.actewagl.com.au/prices/home/ACT/elec.aspx

-

Originally posted by TCH05:

1) You avoided my question when I ask you if Price of LNG and Price of Oil is coorelated.2) That is not a equation which I created, it is something which is used by ASIAN LNG market to price LNG.

1) That was not my discussion with you. I have stated clearly I'm merely pointing out what you said was wrong. In addition, why should I even discuss correlation with someone who has little idea about it.

2) I did not say that was the equation you created. I said that your conclusion that the equation shows how the two prices are correlated is wrong.

Simply and merely pointing out how your basis was wrong, you would want to say I'm discussing with you and avoiding your question. I'm merely observing the discussions, and if there is a factual mistake, no matter by who, I will still state it. Do you think that you can say rubbish on this forum and expect no one to point out to you?

That proves again, you are extremely fond of twisting and diverting away from your glaring mistakes. Seems like you are the only one here who cannot understand what is correlation.

-

Yes Crude oil and natural gas are strongly correlated so if you go and calculate the variance and standard deviation, you will probably get a strong positive correlation.

HOWEVER, Correlation does not imply causation. (pls refer to google if you dont understand the meaning of causation) Hence if it has not been proven, you cannot anyhow insert an equation:

The pricing formula for LNG is

PLNG = A+B×PCrudeOil

-

y = mx+c does not really prove correlation; it just shows a regressive relationship. It can just mean that x is an independent variable, while y is a related variable.

-

If TCH05's formula is an accurate representation of the correlation between Oil and Natural Gas.

Only way to proof it, substitute the variables into the equation and see if it fits like TCH05 said it would.

Can TCH05 do the honours, since he came up with the formula?

There are spikes in the Natural Gas when Oil is constant and there are dips in the Natural Gas when Oil is spiking.

Maybe it has negative covariance.

-

Must be holiday today, the P4P lackeys don't work today, so no responses.

-

Can we compile the Electricity tariffs of the neighbouring countries?

Hong Kong Govt gives the power Company 10% ROE(link), and academics says the returns are too high (link)

and the tariffs the academics say, are one of the highest among all developed countries.

Guess what?

Hong Kongs tariffs are cheaper than Singapore!

Per Unit Charge inculding Fuel adjustment charges is only 0.96HKD (0.17SGD) (link)

Hong Kongers sure know how to whine when they tarriffs are so cheap. These academics have the nerve to complain their tarrifs are expensive. Its just not the same when Singapore Power needs 20% return on investment.

-

Originally posted by TCH05:

I am glad that you learn something new because there are some forumers here who think that they have learn it all in schools and thats why they can only talk about equation instead of common sense.With regards to A and B, I believe they consist of pretty complex formulation basically to protect the interest of the seller. And I also believe that A and B do consist of certain political factor (which affect ths supply). Just take Dubai for example, the cost of their LNG is about 50% more expensive than if they were to import them from neighbouring Iran.

I think Singpoare power plants or Singapore are over dependent on Indonesia LNG and recently there have been some talk about importing LNG from Woodside in Australia and also set up a LNG storage facility in Jurong Island so that they can import from far away place like Qatar via LNG vessel.

After givning the whole thing more thoughts, I now understand what you are trying to say.

I think Factor A and B depends a lot including when is the time you enter the agreement, what is the base price of oil at the point the agreement is being inked, whether the oil price is on the up trend or down trend, the bargaining power, the relationship, political and etc. Thank you.

-

Originally posted by maurizio13:

Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

Electricity rate is charged in Australia (ActewAGL) at 12.10 cents (Australian Dollars), when converted gives a Singapore Dollar rate of 15.13 cents.

(AUD 1 = SGD 1.25)

Singapore Power charges electricity rates 23.88 cents.

The difference between Singaporean electricity and Australian is 8.75 cents, a pecentage difference of 58% when compared to Australian electricity.

Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

Source: http://www.actewagl.com.au/prices/home/ACT/elec.aspx

I think to a certain extend you are right that electricity rate in Singapore is more expensive than Australia, when you are talking about low tension rate. This is the rate all house holds are paying to SP Services. This is one of the main reasons that Singapore Power is making billion net profit.

The picture is different when you look at high tension electricity rate. Depend how efficient you are in "managing the electricty usage and with your supplier contract", the price can be comparable to that of Australia.

-

Originally posted by eagle:

y = mx+c does not really prove correlation; it just shows a regressive relationship. It can just mean that x is an independent variable, while y is a related variable.

I think we can be enlightened by looking a little bit more into the link introduced by TCH05.

http://www.med.govt.nz/templates/MultipageDocumentTOC____23939.aspx

"A Formula for LNG Pricing" by Gary Eng, Independent Consultant,

A report that explores the relationship between liquefied natural gas (LNG) prices and oil prices in the Pacific Basin, and suggests a formula relating the price of imported LNG in NZ to the price of oil.

-

Originally posted by Lin Yu:

what's new.

This sums up nicely.

-

Originally posted by pisces8:

I think we can be enlightened by looking a little bit more into the link introduced by TCH05.

http://www.med.govt.nz/templates/MultipageDocumentTOC____23939.aspx

"A Formula for LNG Pricing" by Gary Eng, Independent Consultant,

A report that explores the relationship between liquefied natural gas (LNG) prices and oil prices in the Pacific Basin, and suggests a formula relating the price of imported LNG in NZ to the price of oil.

The report is a forumla for LNG pricing. It does not tell us there is correlation between LNG and and oil prices. Sure, no one disagreed that the equation is likely to be valid; it definitely shows a relation between the two values.

However, being related and being correlated are two different events altogether. True, the two values raised might be correlated, but neither the article nor the formula presents to us this conclusion; they merely tells us that there is a relation, that LNG price is dependent on Oil prices.

The confusion here is the understanding of the concept of correlation. TCH has shown in another thread he cannot comprehend simple set theory. It's of no surprise that he cannot comprehend the difference between these two concepts too, since they are of the same nature.

-

oil prices is gonna keep going higher and higher....

nuclear energy on the cards?

-

Originally posted by eagle:

The report is a forumla for LNG pricing. It does not tell us there is correlation between LNG and and oil prices. Sure, no one disagreed that the equation is likely to be valid; it definitely shows a relation between the two values.

However, being related and being correlated are two different events altogether. True, the two values raised might be correlated, but neither the article nor the formula presents to us this conclusion; they merely tells us that there is a relation, that LNG price is dependent on Oil prices.

The confusion here is the understanding of the concept of correlation. TCH has shown in another thread he cannot comprehend simple set theory. It's of no surprise that he cannot comprehend the difference between these two concepts too, since they are of the same nature.

I think TCH05 interpreted "correlations" in a non-mathematical way. -

Originally posted by maurizio13:

I think TCH05 interpreted "correlations" in a non-mathematical way.He wanted to 'show off' that he took more than elementary maths in school mah.

Originally posted by TCH05:My guess is that you only took elementary maths in school, thats why you cant see the coorelationship in both. Maybe to you, everything has to be a straight line graph or else it doesnt make any sense.

-

Originally posted by tripwire:

oil prices is gonna keep going higher and higher....

nuclear energy on the cards?

Nuclear energy is being used on US aircraft carriers / submarines. This does not mean that it is cheaper than fossil fueled generator, after taking into consideration of the initial cost of construction, even at today oil price.

Similarly solar powered electricity is 3 times more expansive than that of electricity from existing power plant after taking into consideration of the cost of installation and life span of solar panels.

So no nuclear energy nor solar panel for the time being, as there is no subsidy in their installation by the government.

-

erm... Singapore has a scheme in generation of power from solar sources. The government is sponsoring elec engineering phd students in their studies (with 2-3plus k allowance a month) for power generation, especially in the field of solar power.

If solar cells go into mass production, they might one day be cheaper than electricity generated by oil now. There are talks of having solar trees, etc etc...

Even for civil engineering, in some bridges, there are electrostatic generators for generating power from vibrations coming from trucks and vehicles moving over the bridge, or maybe vibrations due to wind, etc...

-

Originally posted by eagle:

erm... Singapore has a scheme in generation of power from solar sources. The government is sponsoring elec engineering phd students in their studies (with 2-3plus k allowance a month) for power generation, especially in the field of solar power.

If solar cells go into mass production, they might one day be cheaper than electricity generated by oil now. There are talks of having solar trees, etc etc...

Even for civil engineering, in some bridges, there are electrostatic generators for generating power from vibrations coming from trucks and vehicles moving over the bridge, or maybe vibrations due to wind, etc...

The government here is sponsoring PhD students in their studies in the development of fabrication of solar panel, DC energy conversion to AC power suitable for household use, etc. All this is with the aim of finding ways in doing thing more cheaply to bring the total cost down to that acceptable to the market place.

The government here is not going to subsidise the installation of solar panel for power generation. So do not expect to see many solar panels installation in Singapore in the near future.

Solar cells and solar panels are in mass production in many countries eg South Korea, and with many solar panel installations. This is because the government there subsidise the installation and operation costs.

-

I wish you guys would stop using prices from other countries as an argument that the sg gov is charging too much.

It's not like we have the same resources or suppliers. Next you'll demand to know why we need to recycle water.

And here's an important concept it's time you learnt. If the gov was earning more than another gov on a utility, there is no reason to believe the government should ABSORB the price hike of raw materials just because it was earning more.

Let's pretend we're actually old enough to understand why comparing apples with pears is wrong despite the fact that they are both fruits.

-

Originally posted by pisces8:

The government here is sponsoring PhD students in their studies in the development of fabrication of solar panel, DC energy conversion to AC power suitable for household use, etc. All this is with the aim of finding ways in doing thing more cheaply to bring the total cost down to that acceptable to the market place.

The government here is not going to subsidise the installation of solar panel for power generation. So do not expect to see many solar panels installation in Singapore in the near future.

Solar cells and solar panels are in mass production in many countries eg South Korea, and with many solar panel installations. This is because the government there subsidise the installation and operation costs.

I apologize if I caused some misunderstanding earlier. I mean the solar cells might one day be cheaper than electricity from oil. Disregard the mass production part.

Well, the government is subsidizing the research to bring down the costs of production. I would say that it is better in the long run than blindly subsidizing a technology that is still rather high costs as of now. And solar trees are things envisioned by a certain govt agency (I forgot name at the moment), the one which is subsidizing the research.

Instead of finding more ways to generate energy, another way would be to ensure less energy being consumed. The things Singapore are doing can be considered rather interesting, but whether other countries are doing better in this area, I have not yet researched enough to comment. I'm currently doing a report on sustainable development (which includes energy). Perhaps I can post it when my team finishes it?