If LNG was used by Power Stations why steep price increase

-

-

I am very keen to find out too why there is steep increase depite what Robert has mentioned.

Would the opposition MPs please ask this question in the Parliament?

I heard the reason was the contract was pegged to oil prices depsite using LNG to power the Stations.

-

Not sure if my time period is correct. My estimation:

Oil barrel US$100, exchange rate is around 1.5, SGD150

Oil barrel US$110, exchange rate is around 1.35, SGD148.5I cannot really remember the time period of the exchange rates and the oil barrel prices though... Someone pls recalculate the exact value... Thanks

-

Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

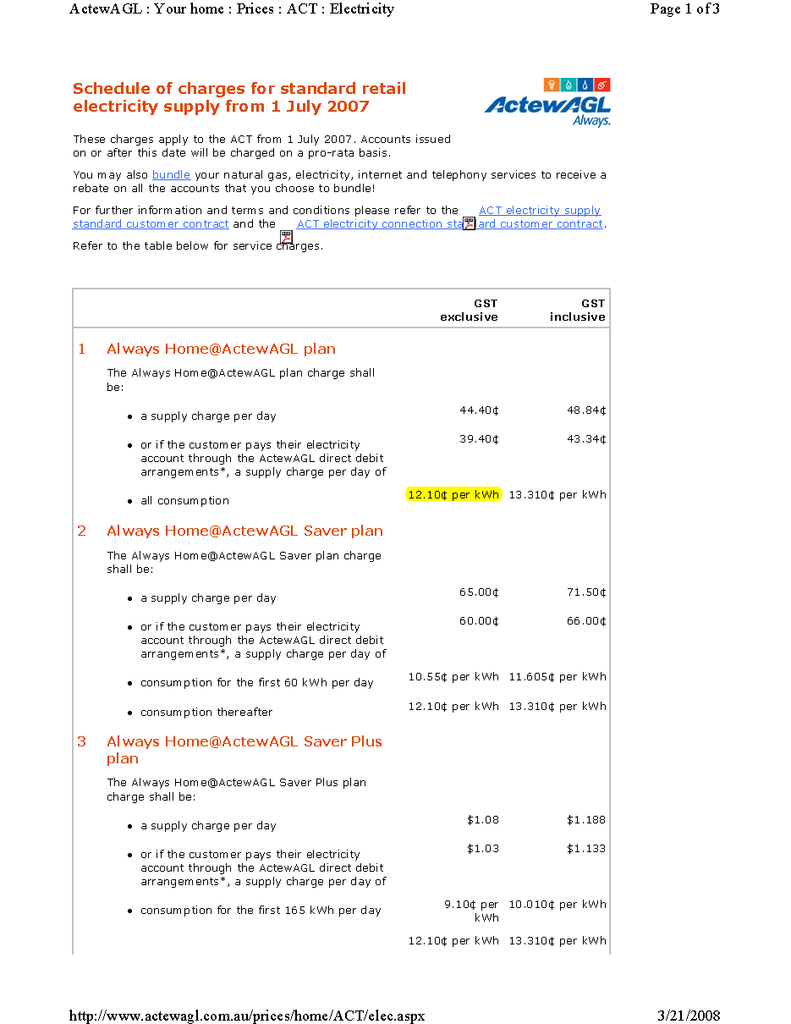

Electricity rate is charged in Australia (ActewAGL) at 12.10 cents (Australian Dollars), when converted gives a Singapore Dollar rate of 15.13 cents.

(AUD 1 = SGD 1.25)

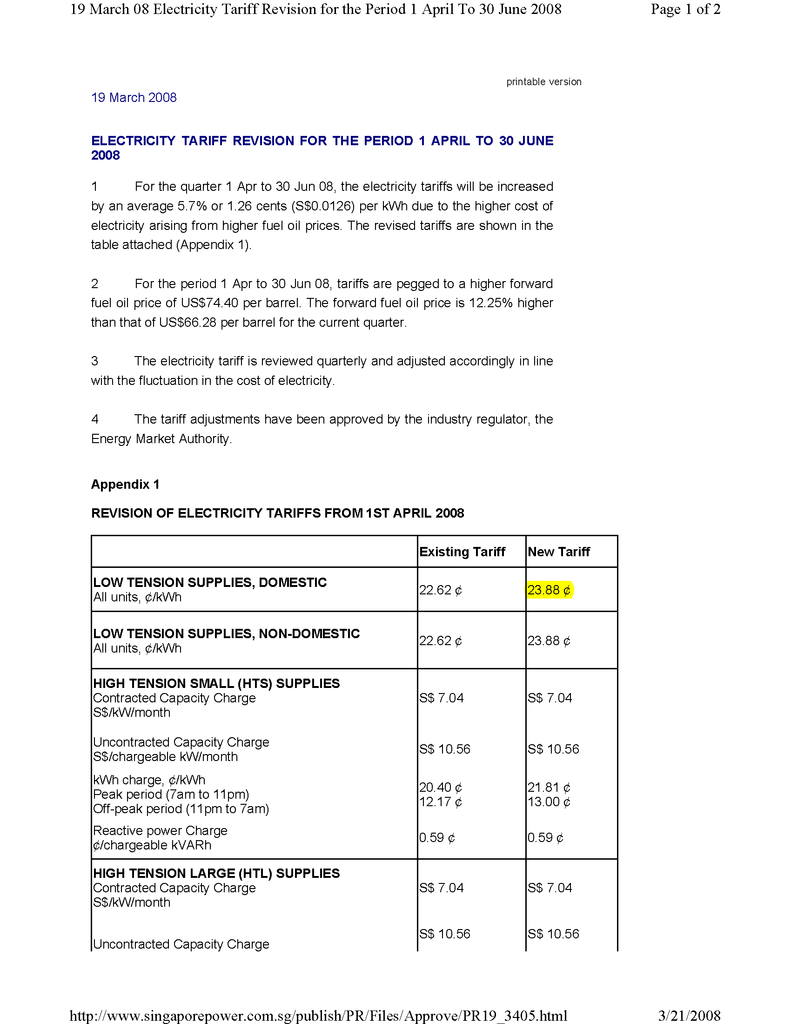

Singapore Power charges electricity rates 23.88 cents.

The difference between Singaporean electricity and Australian is 8.75 cents, a pecentage difference of 58% when compared to Australian electricity.

Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

Source: http://www.actewagl.com.au/prices/home/ACT/elec.aspx

-

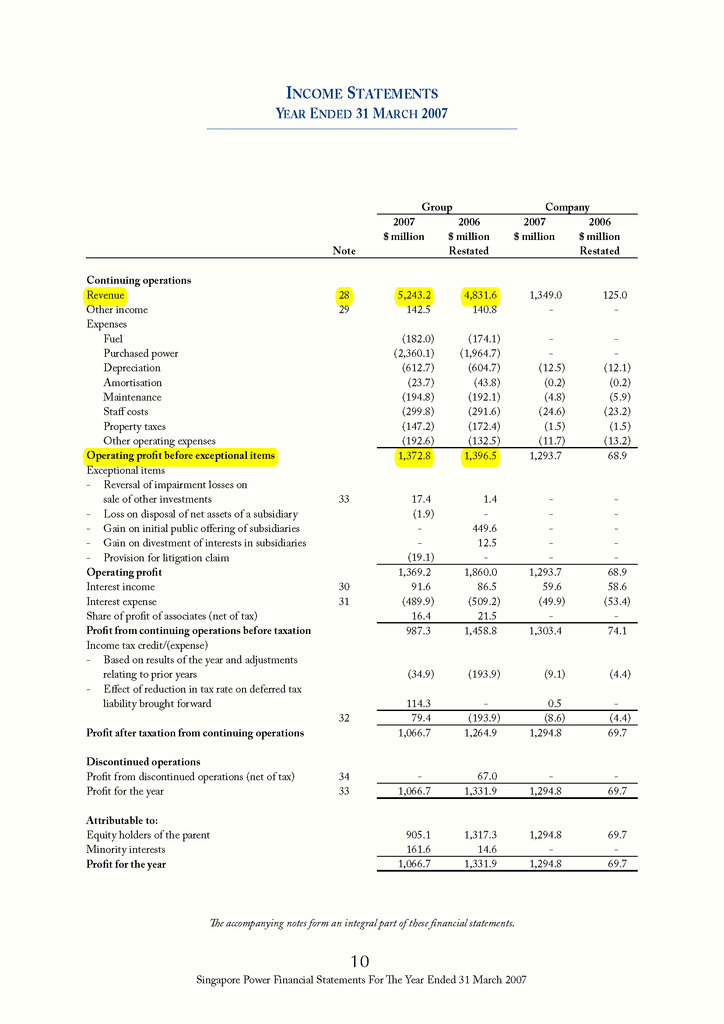

Interesting to note that Singapore Power made SG$1 billion net profit out of sales of SG$5 billion.

Also, the Return on Equity (ROE) for Singapore Power in 2007 was 20.70%,

whereas the industry average for electric companies was around 10%.

El Paso Electric Company only has a ROE of 11.20%.

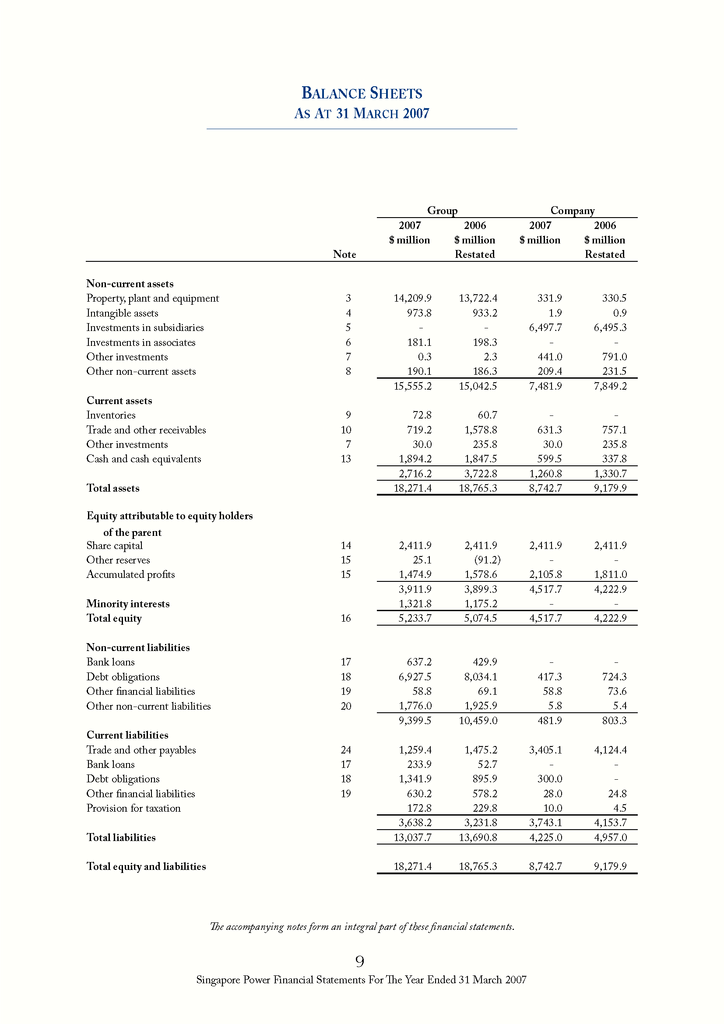

ROE = Net Income / Average Total Equity

ROA = 1066.7m / 5154.1m = 20.70%

Obviously they haven't been making enough money, that's why they need to increase prices

to make more money.

Maybe they need to recover the cost of our recent failed investments in Merrill Lynch.

For a highly stable industry such as utilities 20% net profit is alot by industrial standards.

http://goliath.ecnext.com/coms2/gi_0199-4442447/Can-diversification-create-value-Evidence.html

http://www.oreilly.com/catalog/onlineinvesthks/chapter/hack30.pdf

-

Banks should be a highly lucrative investment as compared to a utilities company,

but in Singapore's case, there is a role reversal.

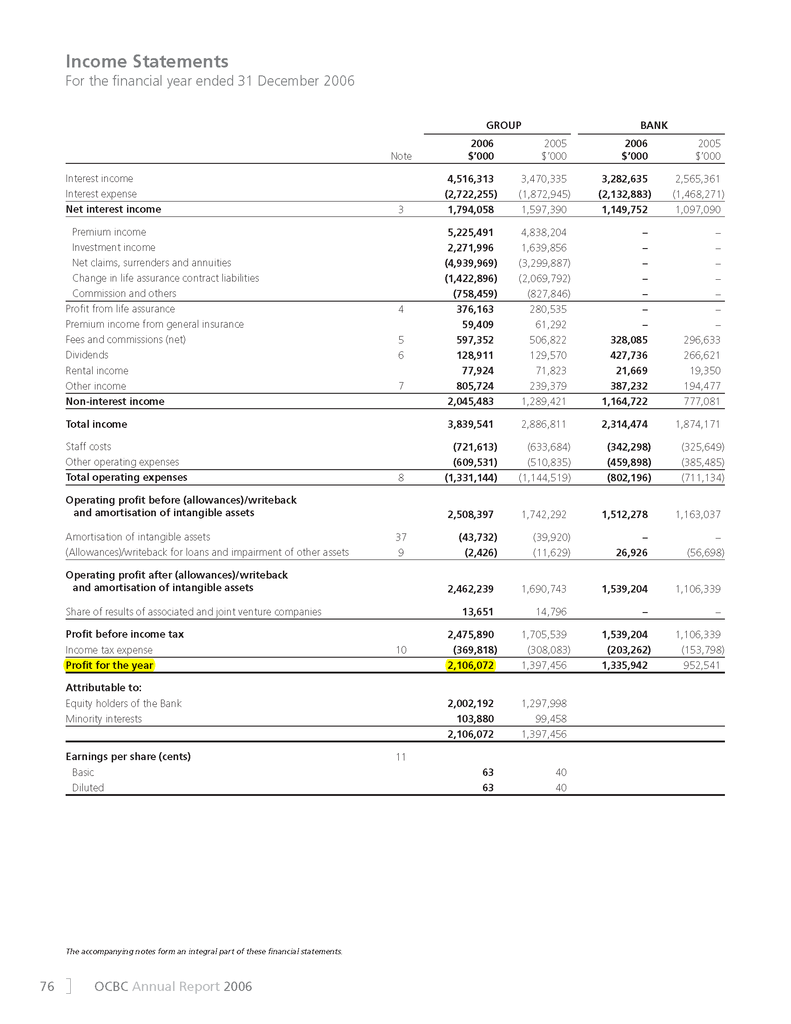

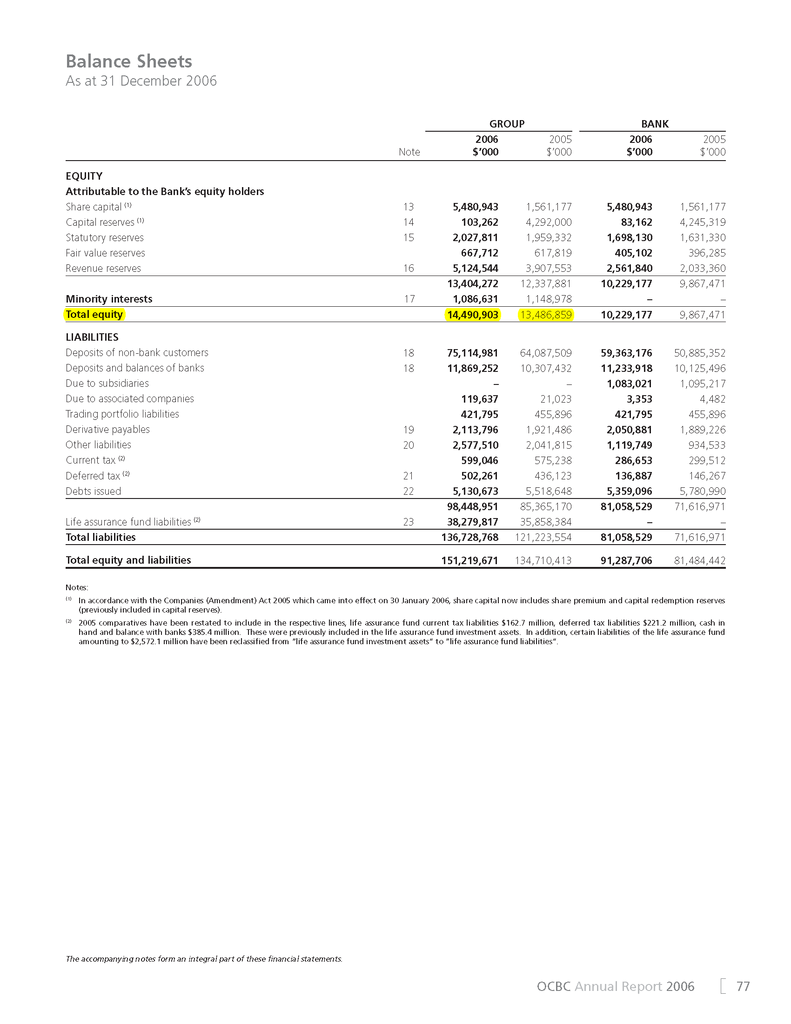

OCBC only managed to generate a ROE of 15.06% for the year ended 2006.

The ROE of OCBC (15.06%) is dwarfed by the ROE of Singapore Power (20.70%).

OCBC's ROE = 2,106,072 / 13,988,881 = 15.06%

-

I read that Tuas station is going to sold to Huaneng but if not wrong, Huaneng is in the red already.