Social Welfare Health costs

-

Originally posted by maurizio13:

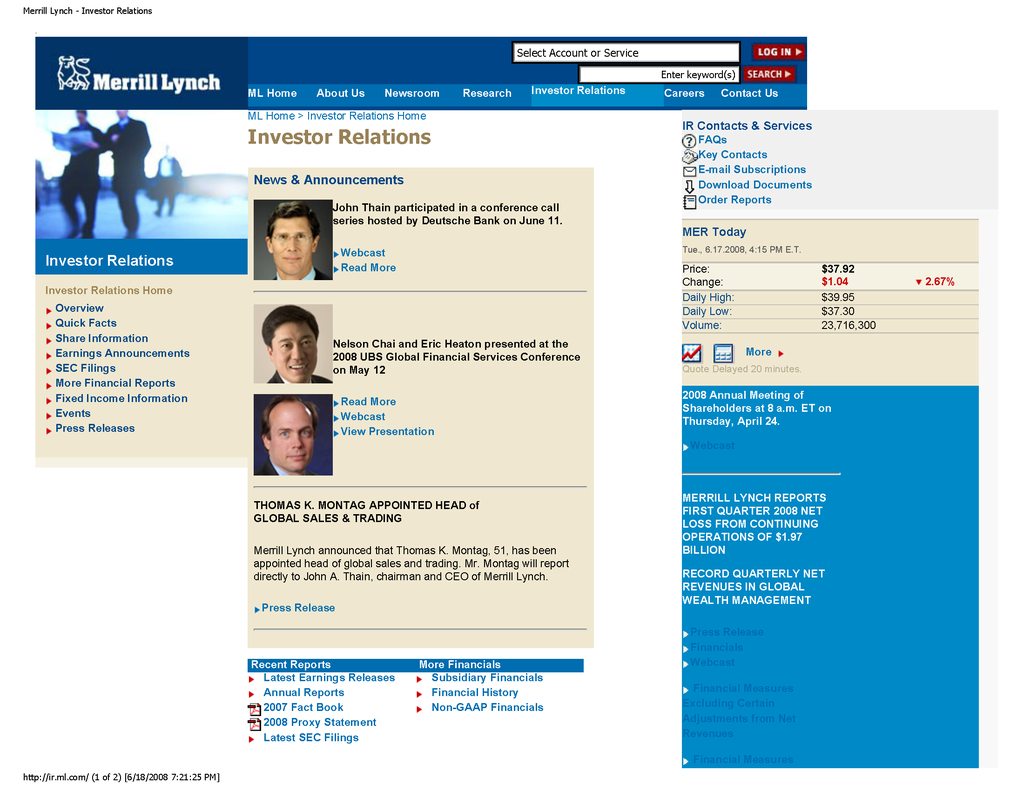

Yah. More uncertainty ahead. I read the investment that our gifted elite leaders plough into Merrill Lynch in December 2007, it's around 6 months and the share has dropped to $37.92. A lost of 21% of it's capital as our competent Temasek paid $48 for it.You know maurizio, we had too many good years.

-

Originally posted by maurizio13:

Yah. More uncertainty ahead. I read the investment that our gifted elite leaders plough into Merrill Lynch in December 2007, it's around 6 months and the share has dropped to $37.92. A lost of 21% of it's capital as our competent Temasek paid $48 for it. After Temasek paid $48 the price of this share has been below $48 for the major part of the 6 months to June 08.That's what you get when you put folks who behave like Than Shwe on the top of these GICs, they have no experience handling investment decisions in capital markets. That's why they make major blunders all along the way.

It is amazing that LKY will criticise Warren Buffet, whose wealth that he manages is based on his own personal enterprise and keen business acumen, while the wealth that LKY manages is from the accumulated funds taxed from all who reside and transact their economic activities in Singapore.

One thing is for sure, the article - ’LKY ain’t no Warren Buffet’ - is surely accurate ?

One works for his own wealth, the other is supposed to manage the wealth for others.

-

Originally posted by will4:

I think UBS also plus 1000 locals gave up their citizenship each year n getting their CPF cash.

Is there any reason why you already like to talk about 1000 local giving up their citizenship on almost every thread? -

In my opinion, PAP government has being prudent in spending on welfare. Too much welfare will put an unbearable strain on the governmental budget.

On the other hand, the government has being way too stingy in helping the poor elderly and homeless. More can be done to help these groups of people who do not have the mean to look after themselves.

Recently, the government allowed a $40 increment in monthly allowance for the poor elderly from $250 to $290. However, people have being lobbying for $300 allowance for a long long time. How are the elderly going to survive based on this $290 when inflation is at an all time high?

-

Originally posted by Spartans:

In my opinion, PAP government has being prudent in spending on welfare. Too much welfare will put an unbearable strain on the governmental budget.

On the other hand, the government has being way too stingy in helping the poor elderly and homeless. More can be done to help these groups of people who do not have the mean to look after themselves.

Recently, the government allowed a $40 increment in monthly allowance for the poor elderly from $250 to $290. However, people have being lobbying for $300 allowance for a long long time. How are the elderly going to survive based on this $290 when inflation is at an all time high?

Well, quite true. But why hasn't the government been able to successfully control inflation rate? You have to ask that question 1st.

-

Originally posted by crimsontactics:

Well, quite true. But why hasn't the government been able to successfully control inflation rate? You have to ask that question 1st.

I believe the inflation is mainly due to external factors which the government has no control of. Such as fuel oil price, food price and so on.Another reason is due to some stupid taxes and charges such as the GST and ERP.

-

Originally posted by DeerHunter:

Your are entitled to your self conceptions or self deceptions. This post is just to clear up some misconceptions of yours.

So now you are telling me the taxes that Singaporeans pay is related to Singapore Power? ACTEWAGL and HEC are related to the government and government will give them money to make their electricity cheaper. How come Singapore government never give Singapore Power money to make electricity cheaper?

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.Singapore Powers is 100% owned by Temasek Holdings.Temasek is not a private enterprise but owned by the State, which is the People of Singapore. Most countries of the world right now is cutting subsidies and discouraging use of fossilized fuels. Whatever that may seemed an excess is nothing more than a fee to discourage wastage of the world's natural resources. And such fees are credited back into Temasek's profits account, which belongs to the People. How other countries, such as resource rich Australia, settle such issues, it is not for us to comment.

The government also don't serve out welfare payouts for the aging.

This is an blatant and outright attempt to mislead. Have you heard of Community Development Council ( CDC)? are you aware of the public assistance schemes for the elderly such as cash grants and free medical assistance by our govt, the ones you are bleeting like a sheep "PAP bad, SDP, other political opposition good"?

http://www.cdc.org.sg/1169433071305/1162796276360.html

You make me sick.

The government can always print money to cover the CPF payouts, if say tomorrow all our investments are lost in the stock market. Can the government raise money to pay those in retirement? Yes, because the central bank can always print more money.

What are you infering? Are you saying the central bank can just print more money even if it is not backed? Investments lost as in totally wiped out and not paper losses? Are you claiming issuing of 'banana notes?' Do you even know what you talking about or claiming??? You better be specific. I have no wish to infer or make assumptions on what you said.

CPF is an insurance scheme

It is not. Just because it has characteristics similar with insurance endowment policies, it is not. The money collected into insurance companies belongs to private hands that are not accountable to the public. It's final payout is often subjected to performance of the company. The payout is not guaranteed. Read their fine print.

CPF is guaranteed. You can use it to fund your house and medical expenses and pay only similar interest rates. You cannot with endowment policies, which if it is loaned out and not every single penny of it, you pay higher than market interest rates.

Please do not lump everything together to support your hypothesis.

Again, you are entitled to your self conceptions or self delusions.

Your are entitled to your self conceptions or self deceptions. This post is just to clear up some misconceptions of yours.

So now you are telling me the taxes that Singaporeans pay is related to Singapore Power? ACTEWAGL and HEC are related to the government and government will give them money to make their electricity cheaper. How come Singapore government never give Singapore Power money to make electricity cheaper?

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.Singapore Powers is 100% owned by Temasek Holdings.Temasek is not a private enterprise but owned by the State, which is the People of Singapore. Most countries of the world right now is cutting subsidies and discouraging use of fossilized fuels. Whatever that may seemed an excess is nothing more than a fee to discourage wastage of the world's natural resources. And such fees are credited back into Temasek's profits account, which belongs to the People. How other countries, such as resource rich Australia, settle such issues, it is not for us to comment.

I am talking about the price of electricity tariffs, you sidetrack to something totally irrelevant by telling us that Singapore Power is state owned, discouraging use of fossil fuels and wastage of natural resources. Any relevance to the reason why other countries' electricity charges cost less than Singapore? Temasek's profits belong to the people? Have you seen them transferring the profits of Temasek in to the accounts of Singapore citizens? Not only Australia lah, Hong Kong also has cheaper electricity. Since you tell us that Singapore Power is stated owned, don't they have a stronger reason to help her citizens, Hong Kong Electric Company (HEC) is a private enterprise yet they help out the citizens of Hong Kong. What more is there to say about our state owned Singapore Power.

-=-=-=-=-=-=-=-=-=-=-=-=-

The government also don't serve out welfare payouts for the aging.

This is an blatant and outright attempt to mislead. Have you heard of Community Development Council ( CDC)? are you aware of the public assistance schemes for the elderly such as cash grants and free medical assistance by our govt, the ones you are bleeting like a sheep "PAP bad, SDP, other political opposition good"?

http://www.cdc.org.sg/1169433071305/1162796276360.html

You make me sick.

There is a difference between HEC's assistance to the Hong Kong citizens as compared to Singapore's government selective help to only POOR & ELDERLY (2 criteria to satisfy). HEC's assistance is to the Elderly/Unemployed/Single Parent/Disabled, it's inclusionary, if you are under these classes, you qualify for a 60% discount. Unlike Singapore, you have to go down on your knees to beg your MPs.

-=-=-=-=-=--=-=-=-=-=-=-

The government can always print money to cover the CPF payouts, if say tomorrow all our investments are lost in the stock market. Can the government raise money to pay those in retirement? Yes, because the central bank can always print more money.

What are you infering? Are you saying the central bank can just print more money even if it is not backed? Investments lost as in totally wiped out and not paper losses? Are you claiming issuing of 'banana notes?' Do you even know what you talking about or claiming??? You better be specific. I have no wish to infer or make assumptions on what you said.

Needless to say, our MAS is not an independent body distinct from the government. I asked this of you. A hypothetical question: If say tomorrow, there is a market turmoil and the investments of the GICs and Temasek is not worth more than 10% it's current market value. Can the CPF board honour all it's debt obligations to her CPF account holders? Yes, they can! They can just get the MAS to issue more currency and pay off it's existing debt obligations. If not. How else would you suggest they pay off their existing obligations to CPF account holders? I await your reply to this question, don't sidetrack.

Anyway the term "paper loss" is a non technical term used by uncle & auntie investors. In technical terms, we use realised loss and unrealised loss, else all the investment companies making losses in their investments will say it's only "paper loss" and not present it in their financial statement.

-=-=-=--=-=-=-=-=-=-=-=-

CPF is an insurance scheme

It is not. Just because it has characteristics similar with insurance endowment policies, it is not. The money collected into insurance companies belongs to private hands that are not accountable to the public. It's final payout is often subjected to performance of the company. The payout is not guaranteed. Read their fine print.

CPF is guaranteed. You can use it to fund your house and medical expenses and pay only similar interest rates. You cannot with endowment policies, which if it is loaned out and not every single penny of it, you pay higher than market interest rates.

Please do not lump everything together to support your hypothesis.

Again, you are entitled to your self conceptions or self delusions.

Are you saying that the investments that Temasek and the GICs make in Merrill Lynch, Shin Corp, Suzhou Industrial Project, Optus, UBS, Bank Danamon, Global Crossing are of zero risk? A rhetorical question, we know the answer, no need for you to reply.

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?And the Singapore government is accountable to the public? In which way have they been accountable? Releasing construction cost of HDB, earnings of GICs & Temasek, costing of hospital charges? True the payout (in excess of a certain interest rate) of insurance companies is subject to the performance of the company, but the payout definitely exceeds the 2.5% that CPF Board pays to it's account holders. If the payout (capital + interest) is below normal bond coupon rates at maturity, then all these Insurance company would not have lasted so long. I think AIA would have gone bust long long time ago.

When you buy your HDB with your CPF, the HDB apartment has already been inflated many times beyond it's true construction cost. If I own an insurance company and a company that builds "public housing" at inflated cost. I too would encourage you to withdraw from your insurance to purchase my inflated housing. Say you have an insurance policy with net value of $100,000, I constructed a flat at $50,000 but sell it at $200,000. I would more than gladly let your withdraw from your policy of $100,000 to purchase a flat which I will profit $150,000.

Lump up everything? I thought these were the points raised by you? I merely responded to your points, now you saying that you brought up points to support my hypothesis.

Funny.

You can't rebutt my points then you call it delusion.

You can't rebutt my points then you call it delusion.  You don't even make it a point to explain anything.

You don't even make it a point to explain anything.  You throwing in the towel so early in the discussion?

You throwing in the towel so early in the discussion?

Originally posted by DeerHunter on 17 Jun 08 @ 6:34pm

1.) Have you any definitive proof of such 'overcharging' - which means over and above the normal rates others' charge? For example:- healthcare - the govt charges more than private clinics and hospitals. HDB flats costs more than Condos. School fees more than what a Singaporean would have to pay if he studies in eg; Australia or US, which are of comparable if not lower standards than our high school equivalent.( Not comparing Colleges, Uni, as the standards are higher there)

2. ) How much of these investments returns will be? You left out the amounts, on purpose? Usually it is much lower and seldom more than double digits. Would that be enough to fund social spending in education, healthcare, transportation, etc?

3. ) NKF is a private charity foundation. It's monies are non-refundable. It was a good thing our media, whom you profess as a govt mouthpiece, spilt the beans on its mismanagement. Only a fool would use NKF as a comparison to our treasury.

Unlike NKF, our funds in the treasury are in terms of CPF and tax revenues and have to be returned back to the People, espacially CPF which promises 4% annual returns. How else to give such returns except to invest it prudently for slightly more than the 4% returns, and with any excess, use it for social spending so as not to tax the citizens further?

As any investor knows, risk adverse blue chip investments are in it for the long haul and seldom see double digit % annual returns. You claim a doomsday will never come. Why don't you work out how much actual medical care subsidy alone costs are, espacially with our aging population whom requires it most and tell me if even with a budget surplus used solely just for it, if we can promise full medical care for them ALL.

The only reason why our health care subsidize are not more than S$1.6billion this year is rather, fortunately or unfortunately, patients cannot even afford the 'co-pay' of 20% on the full course of treatment, and would rather take pills to sustain themselves to see another sunrise till the pain overcomes their heartbeats. I don't mind to subsidize all, pay more taxes, but what about CPF monies which must be returned with interests earned from investments? Where will other money come from other than us whom are gainfully employed? What about other funds for social spendings?

Any person would realize the importance of saving up monies. Can you tell what the future will be? You can't. Better to be safe, than sorry, for the sake of our future generations, just as the previous generations sacrificed for us all now. $100 million in our coffers in 1965 didn't grow to become US$300 billion by magic, but by prudent management with strict controls, so that we can still afford within our ability to help most, if not all of those less well off than us.

-

Hi M13,

Good reply given.

Increasing the money supply simply to meet the shortfall in available cash account to payout on savings owed to the citizens ?

This is surely the thoughts of a desparado autocrat - who believe he can get away with financial rape.

There is enough evidence to note that the TS has his own version of political and economic idiot-logy.

The MIW will surely be embarrassed to have a fool debating for their interest.

-

Originally posted by maurizio13:

Your are entitled to your self conceptions or self deceptions. This post is just to clear up some misconceptions of yours.

So now you are telling me the taxes that Singaporeans pay is related to Singapore Power? ACTEWAGL and HEC are related to the government and government will give them money to make their electricity cheaper. How come Singapore government never give Singapore Power money to make electricity cheaper?

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.Singapore Powers is 100% owned by Temasek Holdings.Temasek is not a private enterprise but owned by the State, which is the People of Singapore. Most countries of the world right now is cutting subsidies and discouraging use of fossilized fuels. Whatever that may seemed an excess is nothing more than a fee to discourage wastage of the world's natural resources. And such fees are credited back into Temasek's profits account, which belongs to the People. How other countries, such as resource rich Australia, settle such issues, it is not for us to comment.

I am talking about the price of electricity tariffs, you sidetrack to something totally irrelevant by telling us that Singapore Power is state owned, discouraging use of fossil fuels and wastage of natural resources. Any relevance to the reason why other countries' electricity charges cost less than Singapore? Temasek's profits belong to the people? Have you seen them transferring the profits of Temasek in to the accounts of Singapore citizens? Not only Australia lah, Hong Kong also has cheaper electricity. Since you tell us that Singapore Power is stated owned, don't they have a stronger reason to help her citizens, Hong Kong Electric Company (HEC) is a private enterprise yet they help out the citizens of Hong Kong. What more is there to say about our state owned Singapore Power.

-=-=-=-=-=-=-=-=-=-=-=-=-

The government also don't serve out welfare payouts for the aging.

This is an blatant and outright attempt to mislead. Have you heard of Community Development Council ( CDC)? are you aware of the public assistance schemes for the elderly such as cash grants and free medical assistance by our govt, the ones you are bleeting like a sheep "PAP bad, SDP, other political opposition good"?

http://www.cdc.org.sg/1169433071305/1162796276360.html

You make me sick.

There is a difference between HEC's assistance to the Hong Kong citizens as compared to Singapore's government selective help to only POOR & ELDERLY (2 criteria to satisfy). HEC's assistance is to the Elderly/Unemployed/Single Parent/Disabled, it's inclusionary, if you are under these classes, you qualify for a 60% discount. Unlike Singapore, you have to go down on your knees to beg your MPs.

-=-=-=-=-=--=-=-=-=-=-=-

The government can always print money to cover the CPF payouts, if say tomorrow all our investments are lost in the stock market. Can the government raise money to pay those in retirement? Yes, because the central bank can always print more money.

What are you infering? Are you saying the central bank can just print more money even if it is not backed? Investments lost as in totally wiped out and not paper losses? Are you claiming issuing of 'banana notes?' Do you even know what you talking about or claiming??? You better be specific. I have no wish to infer or make assumptions on what you said.

Needless to say, our MAS is not an independent body distinct from the government. I asked this of you. A hypothetical question: If say tomorrow, there is a market turmoil and the investments of the GICs and Temasek is not worth more than 10% it's current market value. Can the CPF board honour all it's debt obligations to her CPF account holders? Yes, they can! They can just get the MAS to issue more currency and pay off it's existing debt obligations. If not. How else would you suggest they pay off their existing obligations to CPF account holders? I await your reply to this question, don't sidetrack.

Anyway the term "paper loss" is a non technical term used by uncle & auntie investors. In technical terms, we use realised loss and unrealised loss, else all the investment companies making losses in their investments will say it's only "paper loss" and not present it in their financial statement.

-=-=-=--=-=-=-=-=-=-=-=-

CPF is an insurance scheme

It is not. Just because it has characteristics similar with insurance endowment policies, it is not. The money collected into insurance companies belongs to private hands that are not accountable to the public. It's final payout is often subjected to performance of the company. The payout is not guaranteed. Read their fine print.

CPF is guaranteed. You can use it to fund your house and medical expenses and pay only similar interest rates. You cannot with endowment policies, which if it is loaned out and not every single penny of it, you pay higher than market interest rates.

Please do not lump everything together to support your hypothesis.

Again, you are entitled to your self conceptions or self delusions.

Are you saying that the investments that Temasek and the GICs make in Merrill Lynch, Shin Corp, Suzhou Industrial Project, Optus, UBS, Bank Danamon, Global Crossing are of zero risk? A rhetorical question, we know the answer, no need for you to reply.

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?And the Singapore government is accountable to the public? In which way have they been accountable? Releasing construction cost of HDB, earnings of GICs & Temasek, costing of hospital charges? True the payout (in excess of a certain interest rate) of insurance companies is subject to the performance of the company, but the payout definitely exceeds the 2.5% that CPF Board pays to it's account holders. If the payout (capital + interest) is below normal bond coupon rates at maturity, then all these Insurance company would not have lasted so long. I think AIA would have gone bust long long time ago.

When you buy your HDB with your CPF, the HDB apartment has already been inflated many times beyond it's true construction cost. If I own an insurance company and a company that builds "public housing" at inflated cost. I too would encourage you to withdraw from your insurance to purchase my inflated housing. Say you have an insurance policy with net value of $100,000, I constructed a flat at $50,000 but sell it at $200,000. I would more than gladly let your withdraw from your policy of $100,000 to purchase a flat which I will profit $150,000.

Lump up everything? I thought these were the points raised by you? I merely responded to your points, now you saying that you brought up points to support my hypothesis.

Funny.

You can't rebutt my points then you call it delusion.

You can't rebutt my points then you call it delusion.  You don't even make it a point to explain anything.

You don't even make it a point to explain anything.  You throwing in the towel so early in the discussion?

You throwing in the towel so early in the discussion?

I am talking about the price of electricity tariffs, you sidetrack to something totally irrelevant by telling us that Singapore Power is state owned, discouraging use of fossil fuels and wastage of natural resources. Any relevance to the reason why other countries' electricity charges cost less than Singapore? Temasek's profits belong to the people? Have you seen them transferring the profits of Temasek in to the accounts of Singapore citizens? Not only Australia lah, Hong Kong also has cheaper electricity. Since you tell us that Singapore Power is stated owned, don't they have a stronger reason to help her citizens, Hong Kong Electric Company (HEC) is a private enterprise yet they help out the citizens of Hong Kong. What more is there to say about our state owned Singapore Power.

Tariffs are defined as "a schedule of duties imposed by a government". I ask you, Mr Know-it-all, how is electricity generated?2ndly, why is Msia petrol scrapping its petrol subsidy, when it produces its own petrol? You asked 'Temasek's profits belong to the people and had it been transferred into accounts of Singaporeans. Are you daft? What is given back to us in the form of social spending. If you want to compare cheap utility costs, why not use africa and other natural resource rich countries? You are the one who is sidetracking and using insane comparisons to justify your delusions.

There is a difference between HEC's assistance to the Hong Kong citizens as compared to Singapore's government selective help to only POOR & ELDERLY (2 criteria to satisfy). HEC's assistance is to the Elderly/Unemployed/Single Parent/Disabled, it's inclusionary, if you are under these classes, you qualify for a 60% discount. Unlike Singapore, you have to go down on your knees to beg your MPs.

Please don't use other nations selectively to support your fantasy illusions. Why don't you use America, where social welfare is one of the highest around and so is their national debt?

You original and i repeat, original statement was The government also don't serve out welfare payouts for the aging. After shooting down your blatant lie with facts, you now twist your words and change your tune? I am getting sick of this and disgusted your kind.

"Why pocket the excess of these earnings into the coffers?"

You ingrate! If our previous generations had not been frugal, work hard to sustain themselves without using much of our coffers, do you think we would enjoy no direct personal tax for most, 7% GST based on free will of purchase, Efficient MRT lines, beautiful schools and highly paid effective teachers, etc, etc? Where did you think the money came from - dropped from the sky? given by USA? Amnesty International? Gopalan Nair?

If I own an insurance company and a company that builds "public housing" at inflated cost

Irrelevant and sidetracking nonsense that don't even deserve a reply.

Needless to say, our MAS is not an independent body distinct from the government. I asked this of you. A hypothetical question: If say tomorrow, there is a market turmoil and the investments of the GICs and Temasek is not worth more than 10% it's current market value. Can the CPF board honour all it's debt obligations to her CPF account holders? Yes, they can! They can just get the MAS to issue more currency and pay off it's existing debt obligations. If not. How else would you suggest they pay off their existing obligations to CPF account holders? I await your reply to this question, don't sidetrack.

THIS IS A SERIOUS CHARGE YOU ARE TALKING! It is worse than teenagers printing fake money on a printer. Money has to be backed before it can be minted or printed. You are seriously alleging that it is NOT! You are claiming our money is not worth the paper it is printed on. IT WOULD LEAD TO A COLLAPSE OF OUR MONETARY SYSTEM! THERE WOULD BE NO CONFIDENCE IN OUR DOLLAR! FOR YOUR SAKE, i hope you have evidence to prove it.

PLEASE NOTE. I WILL NOT ASK YOU TO REPLY TO ANY THING EXCEPT FOR THE ALLEGATION OF 'BANANA NOTES'. PLEASE DO NOT EVADE! PLEASE DO NOT SIDETRACK!

DO YOU HAVE ANY EVIDENCE? THIS IS MORE SERIOUS THAN YOU CAN POSSIBLY IMAGINE! I DEMAND YOU REPLY, OR RETRACT YOUR STATEMENT, OR I WILL HAVE TO DO AS I SEE FIT.

-

Originally posted by DeerHunter:

RETRACT YOUR STATEMENT, OR I WILL HAVE TO DO AS I SEE FIT.

-

Originally posted by DeerHunter:

I am talking about the price of electricity tariffs, you sidetrack to something totally irrelevant by telling us that Singapore Power is state owned, discouraging use of fossil fuels and wastage of natural resources. Any relevance to the reason why other countries' electricity charges cost less than Singapore? Temasek's profits belong to the people? Have you seen them transferring the profits of Temasek in to the accounts of Singapore citizens? Not only Australia lah, Hong Kong also has cheaper electricity. Since you tell us that Singapore Power is stated owned, don't they have a stronger reason to help her citizens, Hong Kong Electric Company (HEC) is a private enterprise yet they help out the citizens of Hong Kong. What more is there to say about our state owned Singapore Power.

Tariffs are defined as "a schedule of duties imposed by a government". I ask you, Mr Know-it-all, how is electricity generated?2ndly, why is Msia petrol scrapping its petrol subsidy, when it produces its own petrol? You asked 'Temasek's profits belong to the people and had it been transferred into accounts of Singaporeans. Are you daft? What is given back to us in the form of social spending. If you want to compare cheap utility costs, why not use africa and other natural resource rich countries? You are the one who is sidetracking and using insane comparisons to justify your delusions.

There is a difference between HEC's assistance to the Hong Kong citizens as compared to Singapore's government selective help to only POOR & ELDERLY (2 criteria to satisfy). HEC's assistance is to the Elderly/Unemployed/Single Parent/Disabled, it's inclusionary, if you are under these classes, you qualify for a 60% discount. Unlike Singapore, you have to go down on your knees to beg your MPs.

Please don't use other nations selectively to support your fantasy illusions. Why don't you use America, where social welfare is one of the highest around and so is their national debt?

You original and i repeat, original statement was The government also don't serve out welfare payouts for the aging. After shooting down your blatant lie with facts, you now twist your words and change your tune? I am getting sick of this and disgusted your kind.

"Why pocket the excess of these earnings into the coffers?"

You ingrate! If our previous generations had not been frugal, work hard to sustain themselves without using much of our coffers, do you think we would enjoy no direct personal tax for most, 7% GST based on free will of purchase, Efficient MRT lines, beautiful schools and highly paid effective teachers, etc, etc? Where did you think the money came from - dropped from the sky? given by USA? Amnesty International? Gopalan Nair?

If I own an insurance company and a company that builds "public housing" at inflated cost

Irrelevant and sidetracking nonsense that don't even deserve a reply.

Needless to say, our MAS is not an independent body distinct from the government. I asked this of you. A hypothetical question: If say tomorrow, there is a market turmoil and the investments of the GICs and Temasek is not worth more than 10% it's current market value. Can the CPF board honour all it's debt obligations to her CPF account holders? Yes, they can! They can just get the MAS to issue more currency and pay off it's existing debt obligations. If not. How else would you suggest they pay off their existing obligations to CPF account holders? I await your reply to this question, don't sidetrack.

THIS IS A SERIOUS CHARGE YOU ARE TALKING! It is worse than teenagers printing fake money on a printer. Money has to be backed before it can be minted or printed. You are seriously alleging that it is NOT! You are claiming our money is not worth the paper it is printed on. IT WOULD LEAD TO A COLLAPSE OF OUR MONETARY SYSTEM! THERE WOULD BE NO CONFIDENCE IN OUR DOLLAR! FOR YOUR SAKE, i hope you have evidence to prove it.

PLEASE NOTE. I WILL NOT ASK YOU TO REPLY TO ANY THING EXCEPT FOR THE ALLEGATION OF 'BANANA NOTES'. PLEASE DO NOT EVADE! PLEASE DO NOT SIDETRACK!

DO YOU HAVE ANY EVIDENCE? THIS IS MORE SERIOUS THAN YOU CAN POSSIBLY IMAGINE! I DEMAND YOU REPLY, OR RETRACT YOUR STATEMENT, OR I WILL HAVE TO DO AS I SEE FIT.

I am talking about the price of electricity tariffs, you sidetrack to something totally irrelevant by telling us that Singapore Power is state owned, discouraging use of fossil fuels and wastage of natural resources. Any relevance to the reason why other countries' electricity charges cost less than Singapore? Temasek's profits belong to the people? Have you seen them transferring the profits of Temasek in to the accounts of Singapore citizens? Not only Australia lah, Hong Kong also has cheaper electricity. Since you tell us that Singapore Power is stated owned, don't they have a stronger reason to help her citizens, Hong Kong Electric Company (HEC) is a private enterprise yet they help out the citizens of Hong Kong. What more is there to say about our state owned Singapore Power.

Tariffs are defined as "a schedule of duties imposed by a government". I ask you, Mr Know-it-all, how is electricity generated?2ndly, why is Msia petrol scrapping its petrol subsidy, when it produces its own petrol? You asked 'Temasek's profits belong to the people and had it been transferred into accounts of Singaporeans. Are you daft? What is given back to us in the form of social spending. If you want to compare cheap utility costs, why not use africa and other natural resource rich countries? You are the one who is sidetracking and using insane comparisons to justify your delusions.

Even after the removal of subsidiy in Malaysia, it's still a whole lot cheaper than Singapore petrol. Currently Malaysian petrol is approximately M$2.70 (SG$1.134). What is the price of Singapore petrol? Hong Kong also resource rich? But Hong Kong electricity charges still about SG$30 cheaper for 500kwh usage per month.

-=-=-=-=-=-=-=-=-=-=-=-=

There is a difference between HEC's assistance to the Hong Kong citizens as compared to Singapore's government selective help to only POOR & ELDERLY (2 criteria to satisfy). HEC's assistance is to the Elderly/Unemployed/Single Parent/Disabled, it's inclusionary, if you are under these classes, you qualify for a 60% discount. Unlike Singapore, you have to go down on your knees to beg your MPs.

Please don't use other nations selectively to support your fantasy illusions. Why don't you use America, where social welfare is one of the highest around and so is their national debt?

You original and i repeat, original statement was The government also don't serve out welfare payouts for the aging. After shooting down your blatant lie with facts, you now twist your words and change your tune? I am getting sick of this and disgusted your kind.

"Why pocket the excess of these earnings into the coffers?"

You ingrate! If our previous generations had not been frugal, work hard to sustain themselves without using much of our coffers, do you think we would enjoy no direct personal tax for most, 7% GST based on free will of purchase, Efficient MRT lines, beautiful schools and highly paid effective teachers, etc, etc? Where did you think the money came from - dropped from the sky? given by USA? Amnesty International? Gopalan Nair?

There is a difference between subsidising only "poor and eldery" and subsidising elderly/unemployed/disabled/single paret, for HEC they are willing to give discount to either of these 4 classes of people. In Singapore you need to be BOTH elderly and poor before they even subsidise you. HEC subsidises these less privilege folks with a 60% discount, at the prices they charge (which is SG$30 lower for 500kwh usage per month per individual) they are already providing a big discount of 60% to these less privilege people of Hong Kong. What more can be said about the inflated prices of Singapore Power? They should be making even more money than HEC, that's why you see their their Financial Statements which show a 20% Return On Equity (ROE). For utilities company, a stable industry, you hardly see rates of return so high. Stable in the sense that everybody has to use it's services regardless of circumstances. OCBC a bank only made less than 15% ROE in it's previous year Financial Statements.

Nadah! I am not an ingrate, I am just being honest in my analysis and criticism of the ruling elite. Yes, agree with you that previous generations slog their hearts out to make Singapore what it is today. But today only the Lee family has benefited much from their grossly exaggerated salary increases. What is left from those older generations who slog so hard for Singapore? They are out in the streets picking aluminium cans and cardboard boxes. There is no justice in terms sacrifices and rewards.

True that there are no direct tax in the form of income tax. But there is a 7% indirect tax in the form of GST and other taxes in the form of high charges for equivalent usage. A good example is MRT and Electricity. In other countries, the transportation company would help alleviate the burden of the working class by implementing monthly travel MRT passes, but why has SMRT not implement this system to help those who take trains on a permanent basis to work. I need not say more about electricity charges, as from my earlier post, it's been shown that Hong Kong for an equivalent 500kwh usage a month, it's SG$30 cheaper than Singapore.

Maybe it's time that Singapore Ministers bite the humble pie and learn from their more economic, efficient and effective Hong Kong counterparts. No GST, low electricity tariffs, similar income tax, cheaper healthcare, etc.....

I thought it's common practice that the government should provide for the income and spending. You mean these days the Singapore government is seeking funds from Gopalan Nair, Amnesty International and USA? Which country seeks it's operating funds from them?

-=-=-==-=-=-=-=-=-=-=-=-

If I own an insurance company and a company that builds "public housing" at inflated cost

Irrelevant and sidetracking nonsense that don't even deserve a reply.

You were talking about usage for CPF for housing purchases. I replied saying,

"Are you saying that the investments that Temasek and the GICs make in Merrill Lynch, Shin Corp, Suzhou Industrial Project, Optus, UBS, Bank Danamon, Global Crossing are of zero risk? A rhetorical question, we know the answer, no need for you to reply.

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?

If the government face the same risk as other investors like Warren Buffett and Insurance Companies, I am sure Warren Buffett or the Insurance Companies won't buy into companies such as Global Crossing, Merrill Lynch and Shin Corp at those prices that Temasek or the GICs pay. Which makes Warren Buffett and Insurance companies less risky. How do they guarantee the interest and capital in your CPF accounts? Fiat money, centrals banks have the exclusive authority to print money as required. But what they have done is secured compulsory retirement savings at low interest rates, make investments in the stock exchange, the difference from the returns in the stock market (10% to 15%) and the CPF interest rates (2.5% to 4%), they pocket into the coffers. If the funds belong to Singaporeans, the government serves the citizens, why not distribute the excess of these funds back into the citizens' CPF accounts. Why pocket the excess of these earnings into the coffers?And the Singapore government is accountable to the public? In which way have they been accountable? Releasing construction cost of HDB, earnings of GICs & Temasek, costing of hospital charges? True the payout (in excess of a certain interest rate) of insurance companies is subject to the performance of the company, but the payout definitely exceeds the 2.5% that CPF Board pays to it's account holders. If the payout (capital + interest) is below normal bond coupon rates at maturity, then all these Insurance company would not have lasted so long. I think AIA would have gone bust long long time ago.

When you buy your HDB with your CPF, the HDB apartment has already been inflated many times beyond it's true construction cost. If I own an insurance company and a company that builds "public housing" at inflated cost. I too would encourage you to withdraw from your insurance to purchase my inflated housing. Say you have an insurance policy with net value of $100,000, I constructed a flat at $50,000 but sell it at $200,000. I would more than gladly let your withdraw from your policy of $100,000 to purchase a flat which I will profit $150,000."

Is it because you do not have the mental capacity to retort it, that's why you choose to ignore it.

-=-=-=-=-=-=-=-=-=

Needless to say, our MAS is not an independent body distinct from the government. I asked this of you. A hypothetical question: If say tomorrow, there is a market turmoil and the investments of the GICs and Temasek is not worth more than 10% it's current market value. Can the CPF board honour all it's debt obligations to her CPF account holders? Yes, they can! They can just get the MAS to issue more currency and pay off it's existing debt obligations. If not. How else would you suggest they pay off their existing obligations to CPF account holders? I await your reply to this question, don't sidetrack.

THIS IS A SERIOUS CHARGE YOU ARE TALKING! It is worse than teenagers printing fake money on a printer. Money has to be backed before it can be minted or printed. You are seriously alleging that it is NOT! You are claiming our money is not worth the paper it is printed on. IT WOULD LEAD TO A COLLAPSE OF OUR MONETARY SYSTEM! THERE WOULD BE NO CONFIDENCE IN OUR DOLLAR! FOR YOUR SAKE, i hope you have evidence to prove it.

Money has to be backed up by the MAS before it's printed? Backed up with what? Gold reserves? Please tell me what is the Singapore currency backed up with?

Take out your Singapore currency, tell me if it's written "Legal Tender" or "Promise to Pay the Bearer in Gold or Silver"? If it doesn't say "Legal Tender", then it's very valuable.

Gradually, governments assumed a supervisory role. They specified legal tender, defining the type of payment that legally discharged a debt when offered to the creditor and that could be used to pay taxes. Governments also set the weight and metallic composition of coins. Later they replaced fiduciary paper money—promises to pay in gold or silver—with fiat paper money—that is, notes that are issued on the “fiat” of the sovereign government, are specified to be so many dollars, pounds, or yen, etc., and are "legal tender" but are not promises to pay something else.

http://www.britannica.com/eb/article-247595/money#362600.hook

-=-=-=-=-=-=-=-=-=-=

PLEASE NOTE. I WILL NOT ASK YOU TO REPLY TO ANY THING EXCEPT FOR THE ALLEGATION OF 'BANANA NOTES'. PLEASE DO NOT EVADE! PLEASE DO NOT SIDETRACK!

DO YOU HAVE ANY EVIDENCE? THIS IS MORE SERIOUS THAN YOU CAN POSSIBLY IMAGINE! I DEMAND YOU REPLY, OR RETRACT YOUR STATEMENT, OR I WILL HAVE TO DO AS I SEE FIT.

I don't know who or what you are. Serious.

-

Originally posted by crimsontactics:

Well, quite true. But why hasn't the government been able to successfully control inflation rate? You have to ask that question 1st.

Wrong on two counts. The government has stabilised the inflation rate, but you are also asking for far too much to stop inflation entirely. There is always a low rate of inflation in all healthy economies, and when events happen on a global scale that drive or pull up general price levels, it's impossible for a small and open economy like Singapore's to not be affected.

-

Originally posted by Ariedartin:

Wrong on two counts. The government has stabilised the inflation rate, but you are also asking for far too much to stop inflation entirely. There is always a low rate of inflation in all healthy economies, and when events happen on a global scale that drive or pull up general price levels, it's impossible for a small and open economy like Singapore's to not be affected. In fact, I regard the government's management of this potential crisis as a job well done indeed. It may not be over, but it's certainly going fine so far.

Yah.The government has stabilised inflation at a high rate.

Inflation is at low rates for mature economies, but Singapore's inflation rate is equivalent to some booming 3rd world's rate. Perhaps a result of their exchange rate policy (dirty float).

Not entirely true that inflation cannot be controlled, Singapore is entirely import reliant, any fluctuations in the exchange rates would greatly influence Singaporean's purchasing power.

Their management is nothing more than the reduction of money supply through higher ERP rates, higher & extended retention of CPF balances, also compulsory low rate of returns for certain sums.

-

Why should the money be in government and not private citizen's hands? So they can lose billions to foreigners? Despots.

-

Truth is, they just want to take as much as possible and make life as difficult as possible (think old people working, unable to retire because of the high costs and low pay) for silliporeans. This so that they can take as much as possible and continue to take as much as possible. The real people that benefit are the foreigners and themselves/their cronies. That is why there are so many traitorous as- lickers that support them, because they get crumps for the as- they lick.