Temasek selling Merrill Lynch at a loss

-

Yah.....I think they made the purchase a little too early in its timing....

But then again....since it is deemed 'long-term' investment...and since a perfect timing is almost impossible, I dont really know what can be concluded from it...

And thanks for posting the link as a correction...saying 5m is sold....I told you the first article is unclear and inconclusive.

Meat Pao.

-

Originally posted by Meat Pao:

Yah.....I think they made the purchase a little too early in its timing....

But then again....since it is deemed 'long-term' investment...and since a perfect timing is almost impossible, I dont really know what can be concluded from it...

And thanks for posting the link as a correction...saying 5m is sold....I told you the first article is unclear and inconclusive.

Meat Pao.

Do you have a basic degree in finance and economics?Then as a layman, how would you know the right timing. Does a plumber know what medication to prescribe for various ailments?

From the onset, lots of people already know it was a bad purchase. If Temasek were smart enough, they would have waited till end of this year to make the purchase, it would have been alot cheaper than what they paid for.

I already knew it was a bad buy in the first Merrill Lynch thread. It's just that stubborn leaders like LKY and his cronies don't see it and insist on plunging billions of dollars on sure to fail investments.

Posted 20th Feb 2008:

Don't count your chickens before they are hatched, Temasek is tied down in the investment for a year, meaning cannot sell off the investments till a year has passed. The shares was sold at a discount (so obviously the share price will be above discounted price) to Temasek, close to 2 months have passed and the share is still trading $50.39 (yes, since you last posted 2 hours ago @ 9.58AM the share price has dipped $1.07). Maybe if you had posted this immediately after Temasek bought over, the shares of Merril Lynch would be trading around $53, which you can claim that Temasek made a worthwhile investment, because the shares was sold at a discount. The share price is on a downtrend, not an uptrend since Temasek's purchase.

Temasek will buy $4.4 billion worth of Merrill stock with an option for $600 million more by March 28. Merrill gave Temasek a discount partly in exchange for a lock-up agreement that keeps the investor from selling shares for a year.

Source: http://www.cnbc.com/id/22395384/

Anything can happen in a year, if the US recession becomes a reality (which I most often think it will), there will be more job losses and defaults on mortgages exacerbating the already traumatised financial sector.

Meat Pao, just because you are deaf and blind, does not mean everybody else share your attributes, you can only speak for yourself.

-

so buying for a year or so is long term....

hmm...

-

Wow!!!

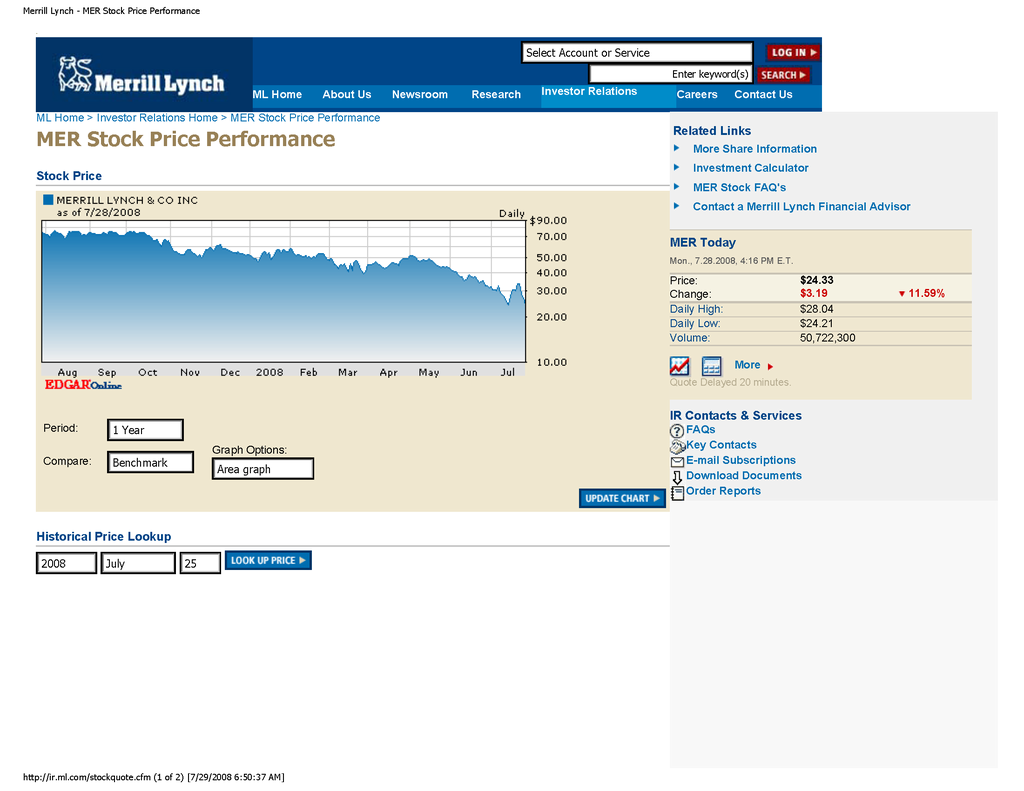

In a span of 7 months Temasek have lost half the value of it's initial investment.

An initial purchase price of US$4.4 billion of US$48 per share has dropped to a price of $24.33 per share, a lost of US$2.2 billions just for Merill Lynch.

I wonder what kind of investment strategies do dictators have?

A fool and his money are soon parted.

-

Merrill Lynch to raise US$8.5 billion through public offering.

Posted: 29 July 2008 0644 hrs

WASHINGTON: Leading US investment bank Merrill Lynch announced on Monday it was raising 8.5 billion dollars in new capital through a public offering, and said Singapore's investment fund Temasek was taking up 3.4 billion dollars of the offer.

The announcement came in the wake of Merrill's July 17 announcement that it had racked up a net loss of 4.89 billion dollars for the second quarter, another sign of the devastation of the US real estate crash on financial markets.

The Wall Street star said on Monday it was also selling off a large amount of

collateralised debt obligations (CDO) - the packaged US mortgage securities

which have ravaged bank balance sheets around the world - cutting its exposure to the sector by 11.1 billion dollars.

"The sale of the substantial majority of our CDO positions represents a significant milestone in our risk reduction efforts," said Merrill chairman and CEO John Thain in a statement.

Thain said the CDO sale and the capital hike will "materially enhance the company's capital position and financial flexibility going forward."

Merrill had already raised 15.3 billion from capital markets earlier this year.

And it announced earlier in July that it was shedding assets to raise new funds, including its 20 percent stake in financial news and data group Bloomberg for 4.425 billion dollars, and its controlling interest in Financial Data Services for at least 3.5 billion dollars.

The company said on Monday it expects to record a pre-tax write-down in the third quarter of about 5.7 billion dollars, which includes a 4.4 billion loss associated with the CDOs being sold. - AFP/de -

is this a good time to buy into Merrill Lynch now?

-

Originally posted by fishbuff1:

is this a good time to buy into Merrill Lynch now?

Any reason why you think it is a good time, since you asked?

Merrill Has $5.7 Billion of Writedowns, Sells Shares (Update2)

Bloomberg - 38 minutes ago

By Bradley Keoun and Christine Harper July 28 (Bloomberg) -- Merrill Lynch & Co. took steps to shore up its endangered credit rating by selling $8.5 billion of stock and liquidating $30.6 billion of money-losing assets at a fifth of their original ...

Merrill Plans $5.7 Billion Write-Down New York Times

Merrill to raise $8.5 bln selling new stock MarketWatch

guardian.co.uk - CNNMoney.com - Reuters - Forbes

all 409 news articles » MER - TSE:MLC

MER - TSE:MLC -

Originally posted by fishbuff1:

is this a good time to buy into Merrill Lynch now?

Revenue Breakdown of Merril Lynch

If you want to buy one of the banks, UBS or Citi bank would be a better choice as ML dervies bulk of its earnings from US. UBS i last checked dervies more of its earnings from overseas than US.

Looking at how Fed is printing money to solve problems, a US dollar fall may erase the gains from buying ML.

I am considering making a purchase on UBS or Citibank but i am still doing research. This most important thing is to limit your exposure to banks at a max of 20% of your investments. If i decide to go ahead, i would split the investment into 4 or 5 tranches to be bought over a period of 1-1.5 years.

There is a risk that they can go "Kaput" like bear stearns. you dont know what kind of things they can hide in their balance sheets.

Anyone has any tips/info/advice on whether to buy the banks?

-

Originally posted by maurizio13:

Do you have a basic degree in finance and economics?

Are you trying to trick others to believe you understand finance and economics?Maurizio economic rule no. 1 = Property price will move inline with inflation.

E.g. if you property is value is $1m and inflation is 10%, your property will worth $1.1m next year.

Maurizio finance rule no. 1 = Changing shareholders structures will reduced taxable income.

E.g. if a company taxable income is $1m, the owner give 50% of the company shares to his wife, the taxable income will become $500,000.

hahaha....

-

Originally posted by AndrewPKYap:

Any reason why you think it is a good time, since you asked?

Merrill Has $5.7 Billion of Writedowns, Sells Shares (Update2)

Bloomberg - 38 minutes ago

By Bradley Keoun and Christine Harper July 28 (Bloomberg) -- Merrill Lynch & Co. took steps to shore up its endangered credit rating by selling $8.5 billion of stock and liquidating $30.6 billion of money-losing assets at a fifth of their original ...

Merrill Plans $5.7 Billion Write-Down New York Times

Merrill to raise $8.5 bln selling new stock MarketWatch

guardian.co.uk - CNNMoney.com - Reuters - Forbes

all 409 news articles » MER - TSE:MLC

MER - TSE:MLCTime Start Thinking Investing Stock for Long Term

Andrew, can I know how much did you pay for your armchair?

-

Like they say in the industry, "(Temasek) is catching a falling knife".

They had been too eager to pour in funds. -

Originally posted by xavier1979:

Like they say in the industry, "(Temasek) is catching a falling knife".

They had been too eager to pour in funds.Temasek has what it takes to keep ML afloat and I believe their intention is to do what Khoo Teck Phuat did to Standard Chartered Bank years ago.

Lets see

-

Originally posted by O o O:

Temasek has what it takes to keep ML afloat and I believe their intention is to do what Khoo Teck Phuat did to Standard Chartered Bank years ago.

Lets see

Well, they (Temasek) may have gotten their VAR calculations wrong.

-

Originally posted by xavier1979:

Well, they (Temasek) may have gotten their VAR calculations wrong.

Honestly speaking, during the time of purchase nobody actually know how bad and deep the CDOs are and how long this crisis is going to last, more analysts are simply guessing. Those like Jim Roger who short financial will tell you bad things while others will say that it is a rare opportunity to buy such big financial institution.If you have live long enough to witness the past economic cycle, you would have realised that those who dare to buy when everyone are staying out always end up as the biggest winner.

-

Originally posted by O o O:

Honestly speaking, during the time of purchase nobody actually know how bad and deep the CDOs are and how long this crisis is going to last, more analysts are simply guessing. Those like Jim Roger who short financial will tell you bad things while others will say that it is a rare opportunity to buy such big financial institution.If you have live long enough to witness the past economic cycle, you would have realised that those who dare to buy when everyone are staying out always end up as the biggest winner.

True. But we buy on the way up, not on the way down. Buying on the way down is called "loss averaging".

Uncertainty is working against Temasek now. When would ML shares come back to their original purchasing price? Nobody knows.

And would ML require a bailout just like Bear Stearns did? Again, nobody knows.

Indeed, this isn't investing anymore. This is speculating.

-

hold on to your horses, its not over yet, it may take a U turn and they might make huge profits., if thats what Temasek is hoping for...

-

temasek big lelong ah? sell power plant and merril lynch..and what more i don noe one.

cham lor...will they run off with the money...

-

Originally posted by xavier1979:

True. But we buy on the way up, not on the way down. Buying on the way down is called "loss averaging".

Uncertainty is working against Temasek now. When would ML shares come back to their original purchasing price? Nobody knows.

And would ML require a bailout just like Bear Stearns did? Again, nobody knows.

Indeed, this isn't investing anymore. This is speculating.

Honestly I see opportunites on both sides, if the share price goes up, it will be profit. If it goes down, it could give Temasek the opportunity to increase its stake at a lower cost, or even arrange a bail out to make the bank private. -

Originally posted by laURanaBabe:

temasek big lelong ah? sell power plant and merril lynch..and what more i don noe one.

cham lor...will they run off with the money...

They are not selling ML, they are buying. A bit a reading before you post will go a long way. -

Originally posted by O o O:

Honestly I see opportunites on both sides, if the share price goes up, it will be profit. If it goes down, it could give Temasek the opportunity to increase its stake at a lower cost, or even arrange a bail out to make the bank private.I disagree because Singapore already has a large exposure to banks. Buying a losing stock increases the risks of the portfolio. Singapore already has many big losing investment in banks and they are thinking of increasing more exposure?

How can one be 100% sure there is nothing hidden beneath the balance sheets?

Only a fool is 100% certain a stock would go up. If they buy more banks stocks we can called them GPC instead of GIC. Government Punting Corporation. They are punting on the reserves of Singaporeans.

-

Originally posted by kilua:

I disagree because Singapore already have a large exposure to banks. Buying a losing stock and increases the risks of the portfolio. Singapore already has three big losing investment in banks and they are thinking of increasing more exposure?

How can one be 100% sure there is nothing hidden beneath the balance sheets?

Only a fool is 100% certain a stock would go up.

The only time when such banking stocks will not recover is when the company goes belly up. And as long as Singapore government has reasonable amount of confident and ability to prevent banks from folding, then I am 99% certain that the stock price will recover.

You have got to remember that banking stocks are usually the one that recovers ahead of the rest and in good times, these banks are making billions every quarter. And also in time of high inflation and slow economic growth like now, the opportunities for high return investments will also get rarer and rarer and the risk of investment across the board will also get higher.

If not banks, where else should Singapore government be increasing their investment?

-

Originally posted by O o O:

Time Start Thinking Investing Stock for Long Term

Andrew, can I know how much did you pay for your armchair?

A bit of history lesson....

July 2007

BTW you people know that the market crashed today? [page: 1, 2, 3,... 25, 26, 27]

November 2007

Looks like its getting really serious.... [page: 1, 2, 3,... 42, 43, 44]

Jan 2008

It no longer just Looks like its getting really serious..... [page: 1, 2, 3,... 13, 14, 15]31st Jan

Time start thinking of investing...

Looks like it is getting serious again....

Don't be an idiot...

-

Originally posted by O o O:

The only time when such banking stocks will not recover is when the company goes belly up. And as long as Singapore government has reasonable amount of confident and ability to prevent banks from folding, then I am 99% certain that the stock price will recover.

You have got to remember that banking stocks are usually the one that recovers ahead of the rest and in good times, these banks are making billions every quarter. And also in time of high inflation and slow economic growth like now, the opportunities for high return investments will also get rarer and rarer and the risk of investment across the board will also get higher.

If not banks, where else should Singapore government be increasing their investment?

I took a post from M13. This is a possible scenario

Anything can happen in a year, if the US recession becomes a reality (which I most often think it will), there will be more job losses and defaults on mortgages exacerbating the already traumatised financial sector.

The kind of analysis you are giving is self justification for holding for a losing stock. Believing that a stock would definitely go up.

In investments there are no certainties, only Risks versus Rewards.To prevent a complete wipe out of investment like bear stearns, one has to control the percentage of exposure of a portfolio.

Whether to buy banking stocks depends on your current portfolio. If you have zero exposure, maybe now its a time to consider buying a little.(if you have an appetitie for risks) If you bought at the same timing as GIC or Temasek, its simply foolish to average down your losses.

-

Originally posted by xavier1979:

Well, they (Temasek) may have gotten their VAR calculations wrong.

Hahaha....You talk to him about VAR, he will probably tell you it's variance.

Keep in mind that you are talking to an autistic child.

-

Originally posted by maurizio13:

Hahaha....You talk to him about VAR, he will probably tell you it's variance.

Keep in mind that you are talking to an autistic child.

An autistic troll who thinks he knows more of everything than anyone else here, and frequently tell others that they do not have little or no knowledge in many fields