Temasek selling Merrill Lynch at a loss

-

Originally posted by maurizio13:

Increase public utilities tariffs, public transport fares, ERPs, Property Tax (Net Annual Value), etc..........our utility companies use natural gas right?

-

Originally posted by Evangel:

our utility companies use natural gas right?

Yes. They use natural gas for electricity generation, I think maybe around 85% of it is natural gas. -

Originally posted by maurizio13:

Yes. They use natural gas for electricity generation, I think maybe around 85% of it is natural gas.they are quite smart to earn more money from us... hur hur!

price increases to our utility bills are pegged to crude oil instead of natural gas.

am i right?

-

Originally posted by Evangel:

they are quite smart to earn more money from us... hur hur!

price increases to our utility bills are pegged to crude oil instead of natural gas.

am i right?

They are only smart in fleecing wool from us sheeps.Then go make overseas investments that loses billions, Global Crossing, Shin Corp, Optus, Merrill Lynch, etc.

Lose money, the most come back home shear the sheeps lor, what else can the sheeps do but maeh maeh maeh in Speakers' Corner.

-

I pity Merrill Lynch shareholders when trading starts on Monday (15/09/08), it's probably going to be a massive drop in share price again.

If Merrill Lynch files for bankruptcy, can Temasek still call it a long term investment.

-

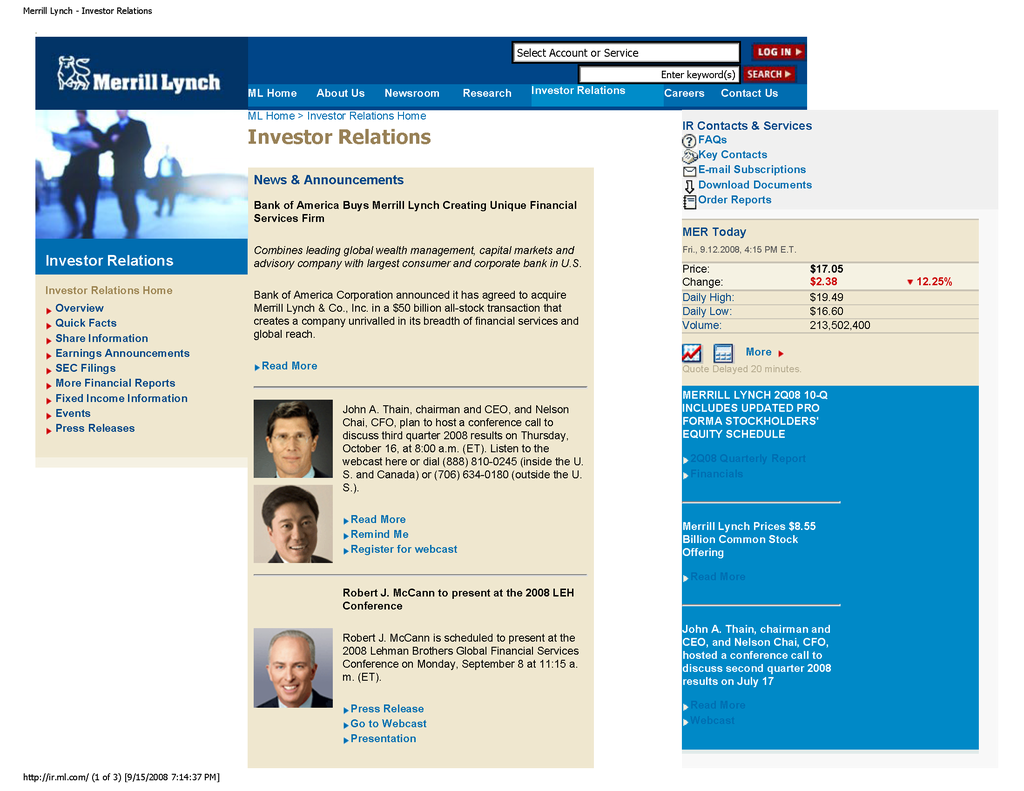

NYT reported that ML is negotiating with the Bank of America for a `rescue plan' to avert a Lehman Bros.

i bet the folks at temasek will come to office today `sweating'.

http://www.nytimes.com/2008/09/15/business/15lehman.html?_r=1&hp&oref=slogin

-

From The Times

September 15, 2008

Lehman Brothers and Merrill Lynch's lost weekend

Gerard Baker, US Editor

To lose one major investment bank in the course of a weekend, to paraphrase Oscar Wilde, might be considered a misfortune. To lose two looks dangerously like a catastrophe.

By Sunday night, after a tumultuous weekend of round-the-clock negotiations orchestrated by the US Federal Reserve and the Treasury, it looked likely that Lehman Brothers and Merrill Lynch, two of America’s most famous financial names, would cease to operate as independent institutions at the opening of business this morning.

That would mean Wall Street may have just had its most extraordinary weekend in at least the last 50 years, with the worry that even worse may still be to come.

How did we get here? There are two answers to this basic question

The immediate explanation is that the US government decided that it simply could not afford - in the interests of prudential supervision - to rescue yet another bank. Someone had to be shown to be not too big to fail, and it looks like it was Lehman.

In March, the Federal Reserve helped JP Morgan acquire Bear Stearns, a controversial decision that could cost the authorities almost $30bn. The Fed defended the move as essential to saving the whole US financial system from going down.

But having dipped its hands in the blood of the financial markets the Fed decided it simply could not do so again without in effect committing itself to a completely open-ended guarantee of every financial institution that found itself in trouble.

The second, deeper explanation, is that this is merely the most dramatic symptom yet of the disease that continues to ravage the US financial system.

The balance sheets of too many US banks are awash in toxic assets. Most of them can be traced back to wildly negligent investment decisions made during the boom in house prices and other assets in the last five years. In the last eighteen months US house prices have fallen by more than at any time in the last 70 years and a whole host of assets that were backed by that market have become worthless.

This may be more than just another catastrophic end to another financial cycle, however. It could be the end of a whole financial model - investment banking itself.

“It’s probably no exaggeration to say we are witnessing the end of an era’ said one seasoned financial executive watching events unfold at the weekend.

A fool (Temasek) and his money is easily parted.

-

Originally posted by redDUST:

NYT reported that ML is negotiating with the Bank of America for a `rescue plan' to avert a Lehman Bros.

i bet the folks at temasek will come to office today `sweating'.

http://www.nytimes.com/2008/09/15/business/15lehman.html?_r=1&hp&oref=slogin

BOA agrees to buy ML at US$29 a share, what is Temasek average cost per share? -

Tell me again, why do we care about this?

-

Originally posted by Veneta:

BOA agrees to buy ML at US$29 a share, what is Temasek average cost per share?

this would be an easy answer if temasek has been forthcoming with its info....it is rumored that temasek bought ML @ high $40s at their first bite.

ML is languishing as $17s now, so even with the premium, we are not likely to see it anywhere what temasek paid.

i think the biggest hurdle/threat to temasek's so called long term horizon/outlook is actually its new owner, BoA itself. BoA is typically a consumer bank, not a brokerage bank. if BoA mishandles the ML asset, this could potentially screw up the reason why temasek bought ML in the first place. kinda like when compaq computers swallowed digital about 10years back. the entire integration was a farce. compaq struggled thru'out the years after it made major acquisitions and ended up being swallowed by hp.

-

temasek total committment in ML is about 4.9b (dec07) + 3.4b (aug08) = US$8.3b for a 13 to 14% stake. However Temasek did receive a rebate of $2.5b from ML for a capital protection clause negotiated in Dec07, hence Temasek total exposure at ML will be US$5.8b.

If BOA acquire ML for US$49b then the value of Temasek's 14% stake should amount to US$6.86b. Which means, Temasek might potentally make about US$1b profit from their investment in ML.

-

ML sold to BOA for $50Bn. Temasek hasn't commented on this yet.

-

With BofA's takeover, Temasek is still 17% in the black. Of course, we will have to see how much BofA stocks will fall when market opens. I hope Temasek has the brains to make a quick pullout while it still can.

-

Temasek May Reap $1.5 Billion Gain From Merrill Lynch Takeover

http://www.bloomberg.com/apps/news?pid=20601080&sid=aydBphNeL.Cw&refer=asia

-

Provided the deal doesn't fall through.

The deal could be a share for share offer, not cash for shares.

Merrill Lynch might be spared a downward spiral today.

-

no matter what, m13 and andrew yap now look like lay men. oh yes, lay men just filed for chapter 11. once a lay man always a lay man. haha!

-

Originally posted by Daddy!!:

no matter what, m13 and andrew yap now look like lay men. oh yes, lay men just filed for chapter 11. once a lay man always a lay man. haha!

You mean from the current price Temasek made money?

They were lucky this time around because there was another bigger idiot in the market.

If Temasek had bought the shares about last week, they could have gotten it for US$17 - US$18, compared to the $22.50 they paid for 1-2 months ago.

This deal could turn south like Lehman Brothers if there was no idiot in the market.

-

if the world works on "if" scenerios, there won't be beggers around.

-

Originally posted by Daddy!!:

if the world works on "if" scenerios, there won't be beggers around.

It's already a foregone conclusion since last year that financials will be deeply hurt by sub prime mortgage crisis, many like Jim Rogers have already seen it. Jim Rogers came out publicly to say that Temasek's purchase of Merrill Lynch was a bad investment decision, which was a fact, because in a span of 7 months the stock dropped from it's high of US$48 per share paid for by Temasek to a low of US$16.90.Yah. There would be no beggars in the world if it works on "if" scenarios, that's why you see more Singaporeans worse off from the investment decisions by the Singapore government. "If" only our goverment was smarter and not practise cronyism (like putting family members on board when they have irrelevant academic qualifications). So we can't change the "IF" that's related to P4P government, hence Singaporeans are made poorer as a result of their bad investment decisions overseas, leading to government practising more money supply tightening through higher ERPs, higher public transport fares, higher fines, higher property taxes through increases in NAV, etc.

1) It was a bad investment decision to buy Merrill Lynch from the start.

2) "IF" the cronies in government can see it through their inexperience in capital markets.

3) Hence the big "IF" is a result of the incompetence of the government in financial markets.

If you think they have made good investments choices, maybe you can explain Global Crossing, Shin Corp and Optus.

-

cannot understand what a lay man tries to say.

-

Originally posted by Daddy!!:

cannot understand what a lay man tries to say.

Of course you can't understand, you don't have the technical knowledge, you are just a heckler.

Would you pay $22.50 for something worth $17?

-

Originally posted by maurizio13:

Provided the deal doesn't fall through.

The deal could be a share for share offer, not cash for shares.

Merrill Lynch might be spared a downward spiral today.

its a share offer, didnt you read the news? even then, Temasek will still make quite a substantial profit if they sell away their BoA share.

-

Originally posted by Veneta:

temasek total committment in ML is about 4.9b (dec07) + 3.4b (aug08) = US$8.3b for a 13 to 14% stake. However Temasek did receive a rebate of $2.5b from ML for a capital protection clause negotiated in Dec07, hence Temasek total exposure at ML will be US$5.8b.

If BOA acquire ML for US$49b then the value of Temasek's 14% stake should amount to US$6.86b. Which means, Temasek might potentally make about US$1b profit from their investment in ML.

''Temasek might potentally make about US$1b profit from their investment in ML.''

Agree.

There is only one fact,but thousand of opinions are wellcome.

Many guys here just cannot make the facts straight before barking

at wrong trees.Even,i say even,Temasek make $$ from Merrill's deal

after acquistion by BA,u can still say Temasek acted risky in 2007

and 2008 or whatever u like.

But pl first get the facts and figures CORRECT.

digest this

http://online.wsj.com/article/SB122146386813335747.html

Temasek Is Still Sitting Pretty With Its Stake in Merrill

By Mohammed Hadi and John JannaroneWord Count: 299 | Companies Featured in This Article: Merrill Lynch, Bank of America, Standard Chartered, BarclaysDevelopments on Wall Street over the weekend are no doubt turning some investors red in the face. Temasek Holdings finds itself in a position that should make them green with envy.

It is part luck and part smart risk management.

Temasek paid $48 a share for Merrill Lynch when it first bought the stock back in December, but downside protections .....http://www.marketwatch.com/news/story/merrill-raising-85-bln-selling/story.aspx?guid={A7AF92E3-5F8A-45A6-AEF8-59B966E260DF}&dist=msr_1

i can tell u the Management in Temasek die die

wants to keep the share.

Why!Lehman Brothers is game over then Merrill can get bigger market

share,stupid!!

i invite u guys go to ML web site to dig put original news.

Dunt just rely on news.

-

I still believe that TH's investment in the banks at the inopportune time is not 100% due to investments, but also in international politics and economics. Of course, they might earn more if they wait further... but the banks cannot wait le...

If these banks fall, they might affect Sg much much more than if banks like Freddie fall.

True a not, I wouldn't know, but that's what I think....

-

Originally posted by Veneta:

its a share offer, didnt you read the news? even then, Temasek will defintely make quite substantial profit if they sell away their BoA share.

I guess from the start of the investment when Temasek purchase the shares for USD48 (when it was then trading at USD52), they forsaw that the Merrill Lynch's share price will drop to USD17, they also forsaw that Merrill Lynch will need to raise more money through share capital instead of debt like bonds, they also forsaw that Bank of America will take over the company at premium way above the USD 17 current market price.I didn't know Temasek is into fortune telling?

Let's face it, this Bank of America deal is just a stroke of luck, it might fall through.

1) The offer made by Bank of America is a share for share offer, no cash, there might be covenants attached to it, like a vesting period before you can trade it. If so, then you are still locked in on the US financial crisis.

2) The offer made by the director of Bank of America is still subject to shareholder approval, which may or may not go through.

3) Bank of America believes that there is synergy resulting from the takeover.

4) Why do you think Merrill Lynch's John Thian was so eager to close the deal at the expense of losing his castle? There might be possibility of greater financial distress with the company this coming 1-2 quaters. There is always information asymmetry in cases such as this, one who is an insider (John Thian) who has more information regarding his company than Bank of America. If the takeover goes through, only 3 directors from Merrill Lynch will be absorb into Bank of America, the rest is made redundant. Anybody would know that John Thian will be in the party of 3 directors.

5) If Bank of America waits another 2 quarters, they could acquire Merrill Lynch at basement prices. A company faced with liquidity issues will see share prices drop like a brick.