Oz top investment bank Macquarie;Babcock & B,lost 65 & 97%

-

Oz share lost about 32% from its peak.

But the share prices of Oz 1st and 2 nd investment banks,

Macquarie Group Ltd.and Babcock & Brown,lost 65% and 97%

from their peak respectively.

I know many of u very interested in Oz.

FYI and actions,if any.

Dunt ask me what to do.

Dr Doom said previously and recently,UK and Oz seems risky.

http://www.babcockbrown.com/

http://www.macquarie.com/

http://ftalphaville.ft.com/blog/2008/08/20/15214/dr-doom-let-us-just-assume-the-financial-system-blows-up/

,,

kmm

-

AIA trouble in Singapore

SINGAPORE : The Monetary Authority of Singapore (MAS) has urged AIA policyholders not to act hastily to terminate their insurance policies, as queues formed outside AIA's offices on Tuesday, with some clients seeking to end their policies.

AIA is a subsidiary of New York-based American International Group (AIG) - one of the world's largest insurers - which has been hit by the financial meltdown. Some Singaporeans are concerned that AIG could be the next financial giant to fall after Lehman Brothers.

With regards to AIG, MAS said: "The value of these assets is not linked to AIA's or AIG's financial condition, but like all investments, their value may be affected by general market conditions."

The MAS assured the public that "AIA currently has sufficient assets in its insurance funds to meet its liabilities to policyholders".

It advised policyholders not to act hastily to terminate their insurance policies as they may suffer losses from the premature termination and lose insurance protection.

MAS explained that there are regulatory requirements, ensuring that all insurance companies maintain statutory insurance funds, including an investment-linked fund. This fund is segregated from its head office and other shareholders' funds.

Within these funds, insurance companies must maintain sufficient assets to meet all its liabilities to policyholders, which include participating policies and investment-linked policies.

MAS monitors the situation closely, and requires insurance companies in Singapore to manage their investment risks carefully.

The MAS will continue to monitor the financial health of AIA. It added that a Policy Owners Protection Fund could also be set up, if necessary.

Meanwhile, many policyholders waited outside AIA's office to find out if AIA will be among those that will be hit by the credit crisis in the US. A queue started since morning and some had to wait for up to four hours.

A few long-term AIA policyholders told Channel NewsAsia that they wanted to surrender their policies, despite incurring losses for premature termination.

One of them, 51-year-old Morgan Krishnan, is not taking any chances. He has decided to terminate three life insurance policies - for himself and his two sons.

He said: "I have been monitoring this for a few years, and I am giving up right now... I will make some returns, I will not make any loss."

Meanwhile, another policyholder said: "I just want to cash out the policy, and I have no intention of putting my money here anymore."

Yet another said: "I contemplated surrendering it a few years ago, so I guess it's about time."

And another noted: "AIG was mentioned in those reports, so we just wanted to make sure that whatever we have is going to be safe."

However, some policy holders are optimistic and confident that the MAS has the situation under control.

AIA has about two million policies which are in force in Singapore. In a statement, AIA said it maintains separate insurance funds for all policies issued by its Singapore arm.

Despite the short-term liquidity pressures, it assured that the company has sufficient capital to meet its obligations to policyholders. - CNA/ms -

Hundreds queue to terminate AIA policies THE man in the line could not be convinced by the assurances.

WE WANT OUR MONEY: The queue of people outside AIA Tower yesterday afternoon. TNP PICTURES: CHOO CHWEE HUA The studio photographer in his 50s, who wanted to be known only as Mr Heng, said he owns several AIA life insurance and investment-linked policies.

Yesterday, he decided to terminate some of them and joined scores of people who lined up from around 9am outside AIA Singapore's Shenton Way headquarters.

This came after news on Monday that AIA Singapore's parent company, American International Group Inc (AIG), had been allowed to access US$20 billion ($29 b) of capital from its subsidiaries to help it out of its difficulties.

AIG reported larger than expected losses in the first quarter of this year, and by end-June, had lost US$13.2 billion. This, with the collapse of investment bank Lehman Brothers and the takeover of its rival Merrill Lynch by the Bank of America, has plunged the world financial system into turmoil.

The Monetary Authority of Singapore (MAS) urged policyholders not to act in haste.

AIG's problems

But Mr Heng said: 'Hong Kong-based websites which I read state that AIG's problems could cause it to be bankrupt in a short time. I think it is better for me to cash in my policies and get as much returns now. If I wait too long, I may lose out.'

Three middle-aged men in the queue, who did not want to give their names, were also adamant about terminating their life insurance policies.

This, despite reassurances from staff and copies of press reports pasted at the customer care centre to show that AIA is not affected by the recent financial firestorm.

One of them said: 'I would rather do it now and get some money than wait for more bad news later, by which time it may be too late for me to get any money.'

One of his friends said: 'MAS made all those assurances in order to prevent a panic. What will they be able to do if and when the situation really gets worse? I don't want to wait until that time.'

They were also not losing much money as their policies were near maturity.

But there were others who were willing to give up their policies even though they stand to lose more.

Finance company executive Manu Tandon, 25, said his brother authorised him to terminate his AIA policy, although it was only in effect for 10 years.

He said: 'Despite the MAS assurances, I do not feel confident and I will carry out my brother's wishes, even though the surrender value will be low.'

Bank employee C Y Ang, who is in her 30s, also said she wanted to terminate her life insurance policy although it was only in effect for about 10 years.

Agreeing with her was finance executive Liza Tham, 45, who said: 'We have only heard from MAS, but we have not heard anything from AIA or AIG. That is why I went to AIA Tower today, to find out what they have to say about the matter.'

One AIA agent, who did not want to be named, said many of her clients had called her during the last few days. 'Many of them wanted to terminate their policies but I managed to assure them to keep their policies. I promised them I would update them as soon as I got more news,' she said.

An AIA Singapore spokesman said the firm could meet the liabilities of all its policyholders.

-

Worried policy holders besiege AIA

Wednesday, 17 September 2008  Singapore Democrats

Singapore Democrats

The financial meltdown causing havoc to the US economy has inevitably spread to the shores of Singapore.

For the second day today, Singaporeans continued to line up to encash their policies at the American International Assurance (AIA) at Robinson Road for fear of AIA's parent body in the US going bankrupt.

AIA is Singapore's subsidiary of the insurance giant American International Group (AIG) that has sought and obtained $85 billion from the US Federal Reserve to prevent it from going under.

As early as 8 am, a long queue started to build up from the AIA Customer Service Centre at 1 Finlayson Green. Within two hours the queue expanded to about 500, snaking its way around to Shenton Way.

One of them was dispatch rider Hassan bin Maideen, who was in the queue to "foreclose" his 25-year policy, five years before its maturity.

"There is some doubt about the assurance that our money is safe. We don't know what would happen next," the 50-year-old Hassan told the SDP.

Another was clerk Peter Lam who was not prepared to wait in the long queue. Mr Lam, 45, said: "I will take a day off tomorrow and come early so that I can get my money back."

Despite assurance from the Monetary Authority of Singapore that the insurance company is backed by liquid funds to meet any demand, anxious policy holders were eager to withdraw their money.

From 9.00 am till 5.30 pm AIG staff handed out cheques to customers who wanted to withdraw their funds.

A security guard at the entrance said clients who had been given queue numbers would be attended to no matter how late it was. He said the management expects the same situation tomorrow.

-

Long queues were formed again outside the AIA building at Raffles Place despite MAS assuring policy holders that their policies will be honoured - irrespective of the turmoil.

Queues outside the AIA building have been seen since yesterday. This occurring after AIA, one of the biggest financial services firm in the world, came to be on the brink of collapse. The Federal Reserve Bank of New York is to lend up to $85 billion to the American International Group (AIG) to help with the crisis.

A STOMPer, who sent in the picture above, says:

“Policyholders queue up in front of AIA customer service centre at Raffles Place, way before opening time. This photo was taken at 8am."

Another Stomper, who sent in the picture below, says:

“This is closest to a bank run equivalent you will ever witness in Singapore. There are plenty of panicky people outside the AIA office."

With regard to this issue, an article in the Straits Times page A1 today (Sept 17) states “The Monetary Authority of Singapore (MAS) yesterday urged jumpy AIA policy-holders not to rush to surrender their policies, saying that the insurer is still able to meet all its liabilities.

“Surrendering policies early might mean financial losses for customers and the loss of potentially important insurance protection, the regulator warned.

“The MAS statement came as about 1,000 anxious policy holders thronged insurer AIA Singapore’s Customer Service Centre in Finlayson Green yesterday.” -

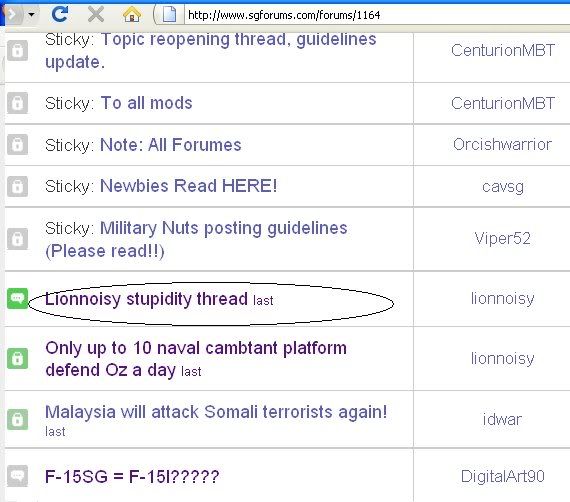

how lionnoisy? we are very scared....

can you save us from ourselves?

-

Singapore Stocks May Plummet

(RTTNews) - The Singapore stock market has finished lower now in two straight sessions and in three of the last four. Now the Straits Times Index is tipped to extend those losses and move further to the downside on Friday - perhaps crashing through support at 2,600 points.

The global forecast for the Asian markets is decidedly grim after weaker than expected employment numbers out of the United States rekindled fears over the health of the world's largest economy, while some retail numbers also were disappointing. Another retreat in the price of crude oil was virtually ignored in the stampede to the downside, and it also contributed to weakness among some of the commodity plays. That condemned the U.S. markets to a sharply lower finish, and the Asian markets are forecast to follow suit.

The STI finished sharply lower again on Thursday, falling to a fresh 22-month low. The financials and property stocks continued their losing streaks and were a major factor in the market's lowest close since October 20, 2006.

For the day, the index plummeted 80.48 points or 2.97 percent to close at the daily low of 2,626.05 after peaking at 2,686.14. Volume was 1.22 billion shares worth 1.62 billion Singapore dollars. Among the decliners, property heavyweight City Developments dropped 6 percent, while top lender DBS was 1 percent lower and Noble Group tumbled 7.5 percent.

Wall Street provides a sharply negative lead as stocks turned in a dismal performance on Thursday after a pair of disappointing employment reports raised concerns about the health of the economy. Sluggish retail sales numbers also gave investors cause for concern, sending the Dow Jones down more than 340 points.

Automatic Data Processing (ADP) set a negative tone before the markets opened when it released its report on employment in the private sector, showing a bigger than expected loss of jobs in August. The ADP report showed that non-farm private sector employment fell by 33,000 jobs in August following a revised increase of 1,000 jobs in July. Economists had expected employment to fall by 30,000 jobs compared to the increase of 9,000 jobs originally reported for the previous month.

Later, the Labor Department said that jobless claims in the week ended August 30 rose to 444,000 from the previous week's revised figure of 429,000. Economists had expected jobless claims to fall to 420,000 from the 425,000 from the originally reported for the previous week. Weakness in the retail sector also made investors jittery after most retailers reported sluggish same store sales for the month of August.

Adding to the negative sentiment, Dallas Federal Reserve Bank President Richard Fisher stood by his gloomy economic forecast Thursday, calling for sluggish economic growth "for some time" into 2009 before the economy gets back on track. He also cautioned that there is a distinct risk that inflation will become embedded and be more than a "one-off" event.

The major averages saw further selling pressure in the final hour of trading, with the Nasdaq ended the session at its intraday low. With the declines, the majors closed at their worst levels in well over a month. The Dow closed down 344.65 points or 3 percent at 11,188.23, the Nasdaq closed down 74.69 points or 3.2 percent at 2,259.04 and the S&P 500 closed down 38.16 points or 3 percent at 1,236.82.

In economic news, Singapore and China have successfully concluded negotiations on a bilateral free trade agreement, Singapore said in a statement on Thursday. The bilateral deal builds on a free trade agreement already reached between China and the 10-member Association of Southeast Asian Nations (ASEAN), to which Singapore belongs. The latest deal covers trade in goods, rules of origin, trade remedies, trade in services, movement of persons, investment, customs procedures, technical barriers to trade, sanitary measures and economic cooperation.

In corporate news, Singapore property giant CapitaLand has sold its indirect wholly-owned subsidiary, Hua Lei Holdings Pte Ltd, for 498 million Singapore dollars, the company said on Thursday. Hua Lei Holdings Pte Ltd indirectly owns 100 per cent of office property, Capital Tower Beijing. The sale of Capital Tower Beijing, which comprises two 35-storey office towers, will yield CapitaLand a gain of 163 million Singapore dollars. -

-

Creative Technology Reports Earnings Results for the Fourth Quarter and Full Year Ended June 30, 2008; Provides Revenue Guidance for the First Quarter Ending September 30, 200808/7/2008

Creative Technology reported earnings results for the fourth quarter and full year ended June 30, 2008. For the quarter, the company posted a net loss of $31.7 million compared with a loss of $19.3 million for last year. On a per share basis, the net loss came to 40 cents, compared with a net loss of 23 cents previously. The company sales slumped 15.6% to $139.5 million, from $165.2 million a year earlier. An $11.7 million restructuring charge has dragged the company to its biggest loss in nine quarters, as revenue fell 15.6% from a year earlier. For the full year, the company reported net loss totaled $19.7 million. This compares with a net income of $28.2 million last year, but that result was helped by $100 million paid by Apple for its use of Creative's ZEN patent in its products. Full-year revenue came to $736.8 million, 19.5% than $914.9 million previously. The company provided revenue guidance for the first quarter ending September 30, 2008. For the quarter, the company revenue expected is to be between $130 and $140 million.

-

Now you all know Insurance is not good, where is that Insurance agent forumer again?

-

good luck to those who buy share they are all in deep shit

-

This topic and it's contents is as good as telling us that during an economic crisis all economies are affected, Australia, Singapore, Japan, Taiwan, Hong Kong, etc. Instead some retarded anti-Australian here chose to use this as ammunition to bash Australia again.

Singapore's ST Index has dropped from it's lofty perch of 3,300 points to around 2,400, a drop of close to 1/3 it's value. Singapore's own banking industry seems to be in a nose dive as well, with DBS and UOB both losing almost half it's share value from their high of $24 per share.

-

i am talking about the 2 banks and some unique features of oz

different from SG but like very familiar to US.

Securitisation---total A$264 b,inclusive mortgage $202b,as at Mar 2008

No--doc,low doc mortgage----

http://www.theaustralian.news.com.au/story/0,20867,21739387-2702,00.html

I am concerned by the very similiar mind set of US.

Securitisation isolates the assets and enhancements so that their credit quality can be analysed absent of external factors and investors can focus primarily on the performance of the assets and servicing of the debt, rather than on the credit quality of the lender.

http://securitisation.com.au/securitisation.html

The % of

Residential Mortgage-backed Securities1

in Oz is much lower than in US,about

17% of GDP.

But the sharp falls of the top 2 investments banks

speak volume for the market perceptions.

http://www.macquarie.com.au/au/about_macquarie/investor_information/mqg_share_price.htm

http://www.babcockbrown.com/bnb-investor-information/share-price.aspx

references

FINANCIAL STABILITY REVIEW – MARCH 2006

The Performance of Australian Residential Mortgage-backed Securities1

http://www.rba.gov.au/PublicationsAndResearch/FinancialStabilityReview/Mar2006/Html/perf_aus_res_mort_sec.html

True rate of home defaults hidden

-> http://www.theaustralian.news.com.au/story/0,25197,23880976-25658,00.html

http://www.iht.com/articles/2008/07/31/properties/31reaus-story.php

Australia facing housing slump

-

There are many co in any stock markets.

There is no point to guage the health of any sector

of any market from any single co.

if u look at more co in any sector and u find common grounds,

ie sharp fall in share prices

i think u need to sit up and take a good look.

Many puzzles form a pictures.Right?

Allco Finance Group (Allco) is a a fully integrated global financial services business

http://www.asx.com.au/asx/research/CompanyInfoSearchResults.jsp?searchBy=asxCode&allinfo=on&asxCode=AFG&companyName=&principalActivity=&industryGroup=NO#chart

http://www.allco.com.au/home.aspx?m=2

mmm

-

Originally posted by youyayu:

good luck to those who buy share they are all in deep shit

i think this is now the time to buy shares and mutual funds/unit trusts if you got idle cash sitting around `sun bathing'.

-

Originally posted by lionnoisy:

i am talking about the 2 banks and some unique features of oz

different from SG but like very familiar to US.

Securitisation---total A$264 b,inclusive mortgage $202b,as at Mar 2008

No--doc,low doc mortgage----

http://www.theaustralian.news.com.au/story/0,20867,21739387-2702,00.html

I am concerned by the very similiar mind set of US.

http://securitisation.com.au/securitisation.html

The % of

Residential Mortgage-backed Securities1

in Oz is much lower than in US,about

17% of GDP.

But the sharp falls of the top 2 investments banks

speak volume for the market perceptions.

http://www.macquarie.com.au/au/about_macquarie/investor_information/mqg_share_price.htm

http://www.babcockbrown.com/bnb-investor-information/share-price.aspx

references

FINANCIAL STABILITY REVIEW – MARCH 2006

The Performance of Australian Residential Mortgage-backed Securities1

http://www.rba.gov.au/PublicationsAndResearch/FinancialStabilityReview/Mar2006/Html/perf_aus_res_mort_sec.html

True rate of home defaults hidden

<!--[if gte mso 9]><xml> <w:WordDocument> <w:View>Normal</w:View> <w:Zoom>0</w:Zoom> <w:Compatibility> <w:UseFELayout /> </w:Compatibility> <w:DoNotOptimizeForBrowser /> </w:WordDocument> </xml><![endif]--> -> http://www.theaustralian.news.com.au/story/0,25197,23880976-25658,00.html

http://www.iht.com/articles/2008/07/31/properties/31reaus-story.php

Australia facing housing slump

<!-- /kicker & headline --> <!-- subhead --> <!-- /subhead --> <!-- byline -->

Bloomberg NewsPublished: July 31, 2008

Bloomberg NewsPublished: July 31, 2008 http://luxuryasiahome.wordpress.com/2008/08/26/aussie-mortgage-bonds-offer-worlds-best-value-pimco/

http://luxuryasiahome.wordpress.com/2008/08/26/aussie-mortgage-bonds-offer-worlds-best-value-pimco/thanks for the insights!

-

warning!!

This forum is not safe.

My account has been hacked here.

MOD know who did it and dunt take

any action against the criminal.

-

Originally posted by lionnoisy:

warning!!

This forum is not safe.

My account has been hacked here.

MOD know who did it and dunt take

any action against the criminal.

You don't know the meaning of "hack" even if your life depended on it.

Suggest you go back to school and get a proper secondary education.

-

Actually that's not a hack, it's more of a editing of the thread title to something that more precisely describes it's content.

LOL, looks like he just got pwned by the kangeroo...

-

obviously you don't know anything about economics... please go back to your cage.... thanks...