Electricity bills up 21%

-

anyone wan to join mi in hk?? come come come

v

v -

Originally posted by maurizio13:

What would you pay if you used exactly the same electricity (500 kwh) in Hong Kong and Singapore?

Hong Kong:

First 150 kwh: (150 kwh) x (HKD 0.959) x (Ex-Rate 0.19055) = SGD 27.41

Next 150 kwh: (150 kwh) x (HKD 1.059) x (Ex-Rate 0.19055) = SGD 30. 27

Next 200 kwh: (200 kwh) x (HKD 1.157) x (Ex-Rate 0.19055) = SGD 44.09

Total ------------------------------------------------------------------ = SGD 101.77

Ex-Rate: Exchange Rate

Singapore:

500 kwh: (500 kwh) x (SGD 0.3045) = SGD 152.25

GST 7% ---------------------------------- = SGD 10.66

Total ------------------------------------- = SGD 162.91

.

.

SGD 101.77 is the amount Singaporeans should be paying for 500 kwh usage in a free market economy, instead Singaporeans are paying SGD 162.91 inflated by the government in the form of indirect taxes probably to recover from losses in overseas investments. A stark difference of 60% between a free market economy and Temasek's (P4P) Singapore Power.

Source: Hong Kong's HEH Electricity Tariff Table

Source: Singapore Power's Electricity Tariff Table

I am worse at calculation.... How come i get such figures when I try to calculate Australia's electricity figures?

One mth

Daily charge : 0.273849$/day * 30days =$8.2155

First 333.33kWh : 0.072342$/kWh*333.33kWh =$24.1138

Balance : 0.100279*166.67kWh =$16.7135

Total : $49.0428AUD

http://www.etsautilities.com.au [pdf]This is frm aussie, a land where roads are slippery because they walk down the path of social welfare....

-

Originally posted by sunnytv:

They are going to earn twice or more of the profits. They are going to be laughing non-stop at us.

Now oils price drop to US$71.21. But they charge at US$155.

I think we have to be fair to them too, they did clarify that the charges for Oct to Dec was based on "future price" of around US$100 which amounts to around SG$150. But the thing is when I look at the historical price chart for crude oil, it shows:

May 2008 = US$130 (approximately)

June 2008 = US$135 (approximately)

July 2008 = US$145 (approximately)

August 2008 = US$115 (approximately)

September 2008 = US$ 100 (approximately)

http://www.oilnergy.com/1onymex.htm

If that's the case, then what about the charges for May to August? It was definitely way above US$100, but we still pay around 25 cents per kwh. When crude oil was US$135 we pay 25 cents per kwh, but when crude oil goes down to US$100 we pay 30 cents per kwh? Makes sense? The person doing the calculation must have some PhD in Abstract Mathematics.

The trend line for the price of crude is also on the decline. Then there is the issue of whether we actually use "crude oil" to generate electricity, when 80% of our electricity generation comes from "natural gas".

-

Originally posted by whiskers:

I am worse at calculation.... How come i get such figures when I try to calculate Australia's electricity figures?

One mth

Daily charge : 0.273849$/day * 30days =$8.2155

First 333.33kWh : 0.072342$/kWh*333.33kWh =$24.1138

Balance : 0.100279*166.67kWh =$16.7135

Total : $49.0428AUD

http://www.etsautilities.com.au [pdf]Hehehe......

Then confirm you don't have PhD in Abstract Mathematics like our Cost Accountant in Singapore Power.

-

Originally posted by skythewood:

I see alot of hong kong comparisons, but not much malaysia comparison... is the stuff there about the same price as singapore?

like, how much is a bowl of wanton mee there?

I don't know about a bowl of wanton mee there. But a plate of Mee rebus is RM4 and roti plata with egg is RM1.60.

-

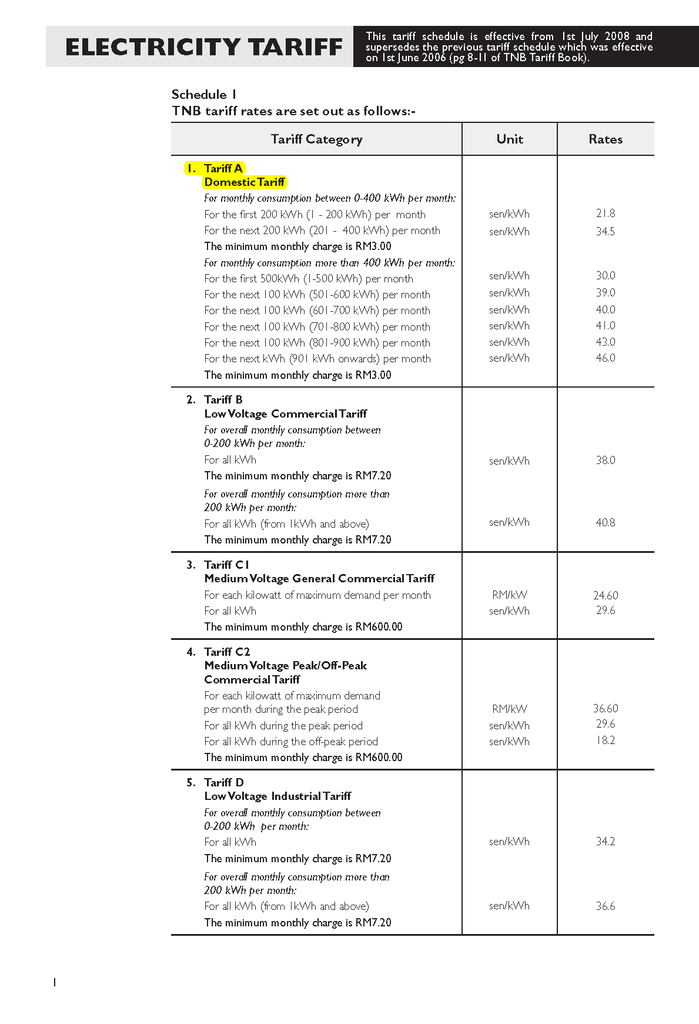

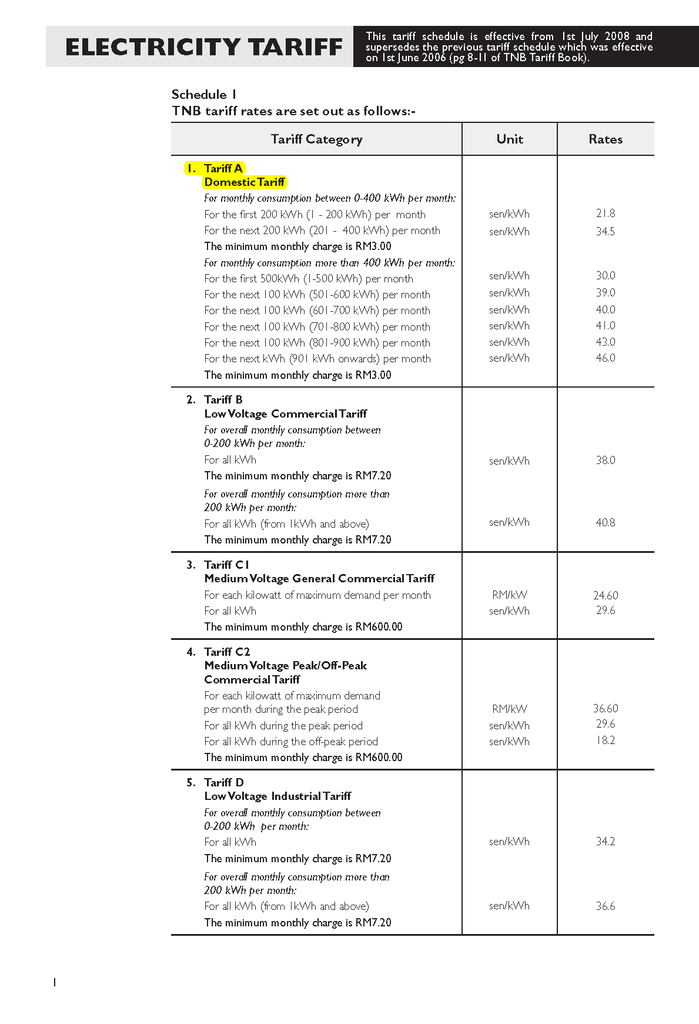

If compare to Malaysia, it's even more ridiculous, we might as well outsource our electrical needs from Malaysia since they are cheaper.

(MYR 1 = SGD 0.42)

Malaysia 500 kwh of electricity:

500 kwh x 30 sen x 0.42 = SG$63

.

.

Singapore 500 kwh of electricity:

500 kwh: (500 kwh) x (SGD 0.3045) = SGD 152.25

GST 7% ---------------------------------- = SGD 10.66

Total ------------------------------------- = SGD 162.91

Source: http://www.tnb.com.my/tnb/tariff/download/new_tariff_booklet_Eng.pdf

-

If a typical family uses 500kwh in Taiwan during summer months, they will pay:

Taiwan 500 kwh of electricity:

110 kwh x NT$2.10 x (1/22) = SG$10.50

220 kwh x NT$3.02 x (1/22) = SG$30.20

170 kwh x NT$4.05 x (1/22) = SG$31.30

Total for 500kwh electricity = SG$72.00

SG$ 1 = NT$ 22

.

http://www.taipower.com.tw/TaipowerWeb/upload/files/4/RateSchedules.pdf

Singapore 500 kwh of electricity:

500 kwh: (500 kwh) x (SGD 0.3045) = SGD 152.25

GST 7% ---------------------------------- = SGD 10.66

Total ------------------------------------- = SGD 162.91

-

Originally posted by maurizio13:

If compare to Malaysia, it's even more ridiculous, we might as well outsource our electrical needs from Malaysia since they are cheaper.

(MYR 1 = SGD 0.42)

Source: http://www.tnb.com.my/tnb/tariff/download/new_tariff_booklet_Eng.pdf

why we dun follow what e do with our water?? buy from m'sia cheap cheap then treat it and sell it back ex ex...... so buy raw electricity from m'sia at the above rate then treat it and sell them buy as electric 98 .................. hmm... but will they fall for it again??? -

Should sporeanos be happy and proud that electricity has gotten more expensive?

When so many things got more expensive, should sporeanos be more proud than ever?

I went out and see that shopping mall foods have skyrocketed to easily 6 bucks for 1 simple item or disk!! A simple date will cost the man on average easily 100 bucks just for basic entertainment for 2. Does this form a marriage barrier? Pls exclude those who got rich fudder mudder aunty and god-dudder-mudder.

When discussion about cost of living in spore, we must always remind ourselves that we EXCLUDE all rich and filthy rich who could have earned their wealth either by inheritance or strange means. If I am one of them, I certainly would have no compraing about ALL and EVERY HIKE of the past, present and future. I would feel that things are moving in the right direction - when less car ply the roads, and i still can , i feel even more haughty.

since sporeanos accept all and every hikes by way of continuing to Pay and Pay for hiked items, I must congratulate sporeans for more good years where expensive lifestyle makes you feel very the 1st world. yahooo! 1st world citizen leh! Proud ah!

Huat Ah!

I welcome all hikes. The more the better ..... for business and the country.

-

Originally posted by Stevenrstn:

It just make my blood boil to see that time and again, the Singapore Govt is always using Oil Prices in Middle-East to justify higher and higher tarrifs for electricity!

Note: Singapore signed a very long-term contract with Indonesia to supply the former with Natural Gas so as to convert them into supplying electricity to Singaporeans. And the price is already fixed in the contract at very low rate and will therefore NOT fluctuate.

Hence, since we are not relying on Oil to make electricity, why penalised Singaporeans for Higher Tarrifs! When Oil Prices have dropped since Sept, why the need to raise Electricity Tarrifs again! I was expecting it to come down and not up!

Since the last Election, Govt has increased almost everything except pay! From more ERP gantries being build, increase taxi Fuel Surcharge (so fast to implement but not fast enough to remove, especially since the fuel price has come down significantly, there is no reason for these taxi drivers to earn that extra Fuel Surcharge also), increase in Bus and MRT fares, increase in electricity tarrifs, etc.... Infact, for those forgetful ones, it was the Govt who has decided to increase GST from 3% to 5% right after the GE! And the lame excuse was that the Govt did not know that they would need to increase the GST so soon... completely bullshit.

I just hope that the next GE will be here soon...... Guess who shall we vote for?

The Govt even said that they do not need any opposition to do any audit on them or to have a Check & balance scheme. If this was the case, we will not have expose the NKF Saga and the Peanut joke...

So for the forgetful Singaporeans, everytime when it comes to GE, the Govt will give us one Chicken drumstick and most of us will feel like Heaven... In Reality, they demand one whole chicken back from us! Now we are in Hell!

Enough is Enough. The Govt must be checked. Policies to increase prices should not be done at will....

This price is fixed by a formula,not fixed.

http://politics.sgforums.com/forums/10/topics/311605?page=3

-

Dear people petition for tariff hike is here. We should not let the government think that we can quietly accept all this ridiculous hike when oil price has come down to this level. Please read, sign up and spread around to friends and relatives to support.

Thank you.

http://www.petitiononline.com/sptariff/petition.html

-

Increasing costs is to help the poor.

Just like increasing GST.

Without these increases, how will the poor get their vouchers and rebates and all that?

-

people buy the news

now at 100cents a pop up from 90cents.

huat ah! 4 -d results...

-

One thing I don't understand is, why not they outsource from Malaysia, it's so much cheaper, I don't think it has anything to do with sovereignty right now, since they are already lehlonging our power companies to foreigners.

Lehlong electric companies to foreigners so that these foreigners can overcharge us and the Singapore government can deny responsibility, while they already happily enjoying the profits from the sale???

-

since everything from malaysia or taiwan or hong kong is cheap

why not outsource everything? why keep comparing price with them? how much is the food in HK and taiwan? is their electricity comparitively cheaper when you compare to food? or is their electricity cheaper because everything is cheaper there?

-

Outsource already government will put a 100% tax on it, else with no profits from Singapore Power, who is going to pay their multi-million dollar salaries.

It's a LPPL strategy.

It's a LPPL strategy.The only way is to get rid of the P4P government, then commoners can have a better life.

-

Surprisingly, quite alot of developed countries like Australia, New Zealand, Japan, South Korea, UK, Taiwan, USA and Hong Kong (SAR) all have cheaper rates of electricity than Singapore.

Something must be really wrong with the P4P system of governance.

-

Originally posted by maurizio13:

Surprisingly, quite alot of developed countries like Australia, New Zealand, Japan, South Korea, UK, Taiwan, USA and Hong Kong (SAR) all have cheaper rates of electricity than Singapore.

Something must be really wrong with the P4P system of governance.

Why har?

From an engineering standpoint, there must be something grossly inefficeint going on in the loop, that part have to be removed or corrected. If its too many useless, cost too much, hamsters or white pappies on the wheel, its time to remove them

-

The States Times has very low credibility in covering Singapore Issues.At least Today covered in greater details showing the obscene profits made by the Govt passing oil prices moving the same as Electricity Tarrifs.

http://www.todayonline.com/articles/282434.asp

Is this the best deal?

Next quarter should see fall in electricity tariffs, given steep decline in oil pricesSHOCKING! No pun intended but that was how the recent 22-per-cent hike in electricity tariffs by Singapore Power (SingPower) was described by many. Households and other users have to pay 30.45 cents a kilowatt hour till the end of the year.

The power distributor’s subsidiary SP Services explained that the increase was due to higher oil prices and that for the October to December quarter, the tariffs were pegged to a higher forward fuel oil price of $155.14 per barrel, compared with the previous quarter’s $112.35 per barrel.

Mr Dave Ernsberger, the Asia editorial director of energy news service provider Platts, told this newspaper: “Fuel oil prices hit that record high for about one month only and we have to pay the high power prices for three months, which seems a little unlucky for all of us, really.”

But as the new fuel price was 38 per cent higher than the previous quarter’s, SP was trying to tell us that it was not passing on the entire increase in the cost of the fuel oil.

What made the announcement even more egregious was that it came at a time when the price of oil — on which the tariffs are based despite the fact that 80 per cent of the electricity produced here comes from natural gas — was on its way down.

And in the third quarter, customers had already been subjected to a 5-per-cent increase, again the result of high fuel prices — with the US$82.61 per barrel being 11 per cent higher than the US$74.40 per barrrel cost of the second quarter.

According to a source, the price of natural gas supplied to the gencos (the power generating companies like Tuas Power, PowerSeraya and Senoko Power) has fallen in recent times in tandem with the decline in the price of High Sulphur Fuel Oil.

Furthermore, the latest hike comes in the wake of the financial crisis, rising costs and commodity prices, and, when everyone else is being exhorted to tighten their belts.

For the year ended March 31 this year, SingPower made a whopping $1.09 billion on revenues of $5.45 billion. In fact, in the last three years, the power distributor has been raking more than a billion dollars a year in net profits.

The gencos, too, have been making good money.

For instance, Tuas Power, which provides 25 per cent of the electricity consumed here, reported an Ebitda (earnings before interest, tax, depreciation and amortisation) of$331 million on revenues of $2.27 billion for the financial year ended March 31, last year. Net profit before tax rose to $218.7 million from $130 million the year before, and it had a healthy return on equity (ROE) of 16.5 per cent.

Senoko, the country’s largest power generator, with an installed capacity of3,300 megawatts and providing 30 per cent of the power supply, posted revenues of $2.49 billion, an Ebitda of $245 million and net income of $130 million for the year ended March this year.

With an installed capacity of 3,100 MW, PowerSeraya had for the year ended March this year, revenues of $2.8 billion, after-tax net profits of $218 million, and an ROE of 19 per cent.

But some suspect the hike was due to pressure from the gencos to maintain their profit margins, especially in the case of Tuas and Senoko, which were recently sold for $4.2 billion and $4 billion respectively. Tuas was bought by China Huaneng Group, while Senoko was acquired by a consortium led by Japan’s Marubeni. PowerSeraya has been put up for sale.

One observer noted: “With the gencos being sold for high prices now, there might be pressure for the new genco owners to recover their capital from increasing the cost of electricity. As two of the gencos are now in foreign hands, the government (through the Energy Market Authority) may have less influence going forward to get the gencos to keep their prices low.”

Furthermore, aren’t the three main gencos supposed to be in competition with each other? Why do they then appear to be ordering their fuel at the same time and paying exactly the same price?

In the case of Singapore Power, perhaps we are paying the price for it achieving “one of the best network performance worldwide, surpassing its peers operating comparable underground networks”.

For sure, the next quarter should see a sharp fall in electricity tariffs, given the recent steep decline in oil prices, but are we really getting the best deal?PAP knows Singaporeans cant vote them out because their dirty politics has resulted in good people unwilling to join opposition politics. Combined with supersized GRCs anchored with a Minister, its no wonder PAP hikes prices at its whims and fancies.

-

Originally posted by kilua:

The States Times has very low credibility in covering Singapore Issues.At least Today covered in greater details showing the obscene profits made by the Govt passing oil prices moving the same as Electricity Tarrifs.

http://www.todayonline.com/articles/282434.asp

Is this the best deal?

Next quarter should see fall in electricity tariffs, given steep decline in oil pricesSHOCKING! No pun intended but that was how the recent 22-per-cent hike in electricity tariffs by Singapore Power (SingPower) was described by many. Households and other users have to pay 30.45 cents a kilowatt hour till the end of the year.

The power distributor’s subsidiary SP Services explained that the increase was due to higher oil prices and that for the October to December quarter, the tariffs were pegged to a higher forward fuel oil price of $155.14 per barrel, compared with the previous quarter’s $112.35 per barrel.

Mr Dave Ernsberger, the Asia editorial director of energy news service provider Platts, told this newspaper: “Fuel oil prices hit that record high for about one month only and we have to pay the high power prices for three months, which seems a little unlucky for all of us, really.”

But as the new fuel price was 38 per cent higher than the previous quarter’s, SP was trying to tell us that it was not passing on the entire increase in the cost of the fuel oil.

What made the announcement even more egregious was that it came at a time when the price of oil — on which the tariffs are based despite the fact that 80 per cent of the electricity produced here comes from natural gas — was on its way down.

And in the third quarter, customers had already been subjected to a 5-per-cent increase, again the result of high fuel prices — with the US$82.61 per barrel being 11 per cent higher than the US$74.40 per barrrel cost of the second quarter.

According to a source, the price of natural gas supplied to the gencos (the power generating companies like Tuas Power, PowerSeraya and Senoko Power) has fallen in recent times in tandem with the decline in the price of High Sulphur Fuel Oil.

Furthermore, the latest hike comes in the wake of the financial crisis, rising costs and commodity prices, and, when everyone else is being exhorted to tighten their belts.

For the year ended March 31 this year, SingPower made a whopping $1.09 billion on revenues of $5.45 billion. In fact, in the last three years, the power distributor has been raking more than a billion dollars a year in net profits.

The gencos, too, have been making good money.

For instance, Tuas Power, which provides 25 per cent of the electricity consumed here, reported an Ebitda (earnings before interest, tax, depreciation and amortisation) of$331 million on revenues of $2.27 billion for the financial year ended March 31, last year. Net profit before tax rose to $218.7 million from $130 million the year before, and it had a healthy return on equity (ROE) of 16.5 per cent.

Senoko, the country’s largest power generator, with an installed capacity of3,300 megawatts and providing 30 per cent of the power supply, posted revenues of $2.49 billion, an Ebitda of $245 million and net income of $130 million for the year ended March this year.

With an installed capacity of 3,100 MW, PowerSeraya had for the year ended March this year, revenues of $2.8 billion, after-tax net profits of $218 million, and an ROE of 19 per cent.

But some suspect the hike was due to pressure from the gencos to maintain their profit margins, especially in the case of Tuas and Senoko, which were recently sold for $4.2 billion and $4 billion respectively. Tuas was bought by China Huaneng Group, while Senoko was acquired by a consortium led by Japan’s Marubeni. PowerSeraya has been put up for sale.

One observer noted: “With the gencos being sold for high prices now, there might be pressure for the new genco owners to recover their capital from increasing the cost of electricity. As two of the gencos are now in foreign hands, the government (through the Energy Market Authority) may have less influence going forward to get the gencos to keep their prices low.”

Furthermore, aren’t the three main gencos supposed to be in competition with each other? Why do they then appear to be ordering their fuel at the same time and paying exactly the same price?

In the case of Singapore Power, perhaps we are paying the price for it achieving “one of the best network performance worldwide, surpassing its peers operating comparable underground networks”.

For sure, the next quarter should see a sharp fall in electricity tariffs, given the recent steep decline in oil prices, but are we really getting the best deal?PAP knows Singaporeans cant vote them out because their dirty politics has resulted in good people unwilling to join opposition politics. Combined with supersized GRCs anchored with a Minister, its no wonder PAP hikes prices at its whims and fancies.

Makes one wonder doesn't it.

If all the national power companies are sold off to foreigners, even if the opposition takes over and wants to made a reduction in tariffs, it won't be possible. By that time, PAP will have the profits from the sale locked into their reserves account and no opposition members can touch it.

-

Originally posted by maurizio13:

Makes one wonder doesn't it.

If all the national power companies are sold off to foreigners, even if the opposition takes over and wants to made a reduction in tariffs, it won't be possible. By that time, PAP will have the profits from the sale locked into their reserves account and no opposition members can touch it.

Huh, but that is our national property that they sold, it our money too, what reserve are they talking about, personal reserve or national reserve??? That word National imply a Nation, a country, the citizens of the country. -

$$$ you earn in Singapore is never your own money.

Unless you save it in some way, which to some, the process means laundering.

-

Higher rates are to help the poor.

Really.

-

Originally posted by charlize:

Higher rates are to help the poor.

Really.

Higher rates means at the end of the year, they will show higher GDP growth.

-

Originally posted by kilua:

The States Times has very low credibility in covering Singapore Issues.At least Today covered in greater details showing the obscene profits made by the Govt passing oil prices moving the same as Electricity Tarrifs.

http://www.todayonline.com/articles/282434.asp

Is this the best deal?

Next quarter should see fall in electricity tariffs, given steep decline in oil pricesSHOCKING! No pun intended but that was how the recent 22-per-cent hike in electricity tariffs by Singapore Power (SingPower) was described by many. Households and other users have to pay 30.45 cents a kilowatt hour till the end of the year.

The power distributor’s subsidiary SP Services explained that the increase was due to higher oil prices and that for the October to December quarter, the tariffs were pegged to a higher forward fuel oil price of $155.14 per barrel, compared with the previous quarter’s $112.35 per barrel.

Mr Dave Ernsberger, the Asia editorial director of energy news service provider Platts, told this newspaper: “Fuel oil prices hit that record high for about one month only and we have to pay the high power prices for three months, which seems a little unlucky for all of us, really.”

But as the new fuel price was 38 per cent higher than the previous quarter’s, SP was trying to tell us that it was not passing on the entire increase in the cost of the fuel oil.

What made the announcement even more egregious was that it came at a time when the price of oil — on which the tariffs are based despite the fact that 80 per cent of the electricity produced here comes from natural gas — was on its way down.

And in the third quarter, customers had already been subjected to a 5-per-cent increase, again the result of high fuel prices — with the US$82.61 per barrel being 11 per cent higher than the US$74.40 per barrrel cost of the second quarter.

According to a source, the price of natural gas supplied to the gencos (the power generating companies like Tuas Power, PowerSeraya and Senoko Power) has fallen in recent times in tandem with the decline in the price of High Sulphur Fuel Oil.

Furthermore, the latest hike comes in the wake of the financial crisis, rising costs and commodity prices, and, when everyone else is being exhorted to tighten their belts.

For the year ended March 31 this year, SingPower made a whopping $1.09 billion on revenues of $5.45 billion. In fact, in the last three years, the power distributor has been raking more than a billion dollars a year in net profits.

The gencos, too, have been making good money.

For instance, Tuas Power, which provides 25 per cent of the electricity consumed here, reported an Ebitda (earnings before interest, tax, depreciation and amortisation) of$331 million on revenues of $2.27 billion for the financial year ended March 31, last year. Net profit before tax rose to $218.7 million from $130 million the year before, and it had a healthy return on equity (ROE) of 16.5 per cent.

Senoko, the country’s largest power generator, with an installed capacity of3,300 megawatts and providing 30 per cent of the power supply, posted revenues of $2.49 billion, an Ebitda of $245 million and net income of $130 million for the year ended March this year.

With an installed capacity of 3,100 MW, PowerSeraya had for the year ended March this year, revenues of $2.8 billion, after-tax net profits of $218 million, and an ROE of 19 per cent.

But some suspect the hike was due to pressure from the gencos to maintain their profit margins, especially in the case of Tuas and Senoko, which were recently sold for $4.2 billion and $4 billion respectively. Tuas was bought by China Huaneng Group, while Senoko was acquired by a consortium led by Japan’s Marubeni. PowerSeraya has been put up for sale.

One observer noted: “With the gencos being sold for high prices now, there might be pressure for the new genco owners to recover their capital from increasing the cost of electricity. As two of the gencos are now in foreign hands, the government (through the Energy Market Authority) may have less influence going forward to get the gencos to keep their prices low.”

Furthermore, aren’t the three main gencos supposed to be in competition with each other? Why do they then appear to be ordering their fuel at the same time and paying exactly the same price?

In the case of Singapore Power, perhaps we are paying the price for it achieving “one of the best network performance worldwide, surpassing its peers operating comparable underground networks”.

For sure, the next quarter should see a sharp fall in electricity tariffs, given the recent steep decline in oil prices, but are we really getting the best deal?PAP knows Singaporeans cant vote them out because their dirty politics has resulted in good people unwilling to join opposition politics. Combined with supersized GRCs anchored with a Minister, its no wonder PAP hikes prices at its whims and fancies.

<One observer noted: “With the gencos being sold for high prices now, there might be pressure for the new genco owners to recover their capital from increasing the cost of electricity. As two of the gencos are now in foreign hands, the government (through the Energy Market Authority) may have less influence going forward to get the gencos to keep their prices low.”>

even our own gahmen is overcharging us and this joker except foreign firms to be kind to us!