Aussie dollar--jumping kangaroo or paper kangaroo?

-

pl tell me if there is any mortgage securitisation or alike in SG?

securitisation just make all the rules governing banks and non--banks

instituions useless!!

-

bocos we grew too fast in the past few quarters.

So you boast a lot if we grow fast and say Singapore good...

But now recession happen you make excuses?

Where is your first-world country standards of accountability?

-

How come now we got so many problems in Singapore lionnoisy?

Pls tell us what to do, we all very scared...

-

Singapore tourism to slow despite new F1 race

SINGAPORE, Sept 18 (Reuters) - The turmoil in global financial markets will help put the brakes on Singapore's tourism industry, which was hoping to tap into the growth of Asia's middle-class and the world's first night-time Grand Prix.

Analysts said the first Formula One race to be held in Singapore this month will provide a fillip for a cooling tourism sector, but high oil prices, a weak global economy and sagging financial markets will crimp the travel business this year.

"This is a very glamorous and high profile event but it has low productivity," said Song Seng Wun, an economist from CIMB. "A weekend of good pharmaceutical output will have a far greater impact than a weekend of F1," Song said.

"It will boost tourism in September, but a slowdown in tourism is certainly on the cards," he said.

Singapore has been trying to move away from manufacturing into service industries such as finance and tourism to diversify its $170 billion economy.

A downturn in tourism, which makes up about six percent of the economy, will be an additional drag to slowing growth. Some economists say Singapore may slump into a technical recession -- usually defined as two consecutive quarters of growth contraction -- in the third quarter.

ADVERTISEMENT A slowing global economy and the deepening credit crisis have taken a toll on Asia's travel business this year after growing 25 percent every year from 2004 to 2007, said Matthew Hildebrandt, an economist at JPMorgan.

Singapore received fewer visitors for the first time in four years in June. Tourism businesses in China, Japan and Malaysia have cooled this year as well, Hildebrandt said.

Singapore's Tourism Board said last month Singapore may miss its target of drawing 10.8 million visitors this year.

The Formula One race will be in a street circuit over three days from Sept. 26 and is expected to attract 40,000 visitors from abroad, the Singapore Tourism Board said.

The race will eventually help Singapore earn about S$100 million ($70 million) a year in tourism revenue, but the Tourism Board declined to say when the target will be achieved.

The Grand Prix race is the Southeast Asian country's latest effort to turn into a livelier city. Two casinos worth up to $9.4 billion will open from the end of 2009.

As Singapore continues to modernise its economy, tourism should continue to account for much less than 10 percent of the country's GDP, Hildebrandt said. The sector was worth 9 percent of GDP in Hong Kong, he said.

The government expects its export-dependent economy to grow at the lower end of a 4-5 percent forecast in 2008, well down on last year's strong 7.7 percent expansion. (Editing by Neil Chatterjee)

-

There is just nowhere that our dear lion can hide huh?

-

no need to cry.

Singapore GDP drops from 7% to est 3 % for 2008 ,

still on par with other 1 st world countries!!

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(real)_growth_rate

SG is decribed growing at third world rate!!

Australia $$ has been a play doll in FX market

Investor and speculator buy carry trade on Aussie $$

solely becos high deposit interest rate and the incompentent

Oz gavaman cannot intervent the FX market.

The businessmen,consumers ,house owners etc borrowing on

Oz $$ pay the price for high interest rate.

The speculators enjot the profits of carry trade if they can win $$.

Falling $$ will cause the unwinding of carry trade of billions of $$.

http://www.bis.org/publ/rpfx07.pdf?noframes=1

Several currencies that have been used as targets

in carry trade strategies, in particular the Australian and New Zealand dollars, saw their share increase, even abstracting from significant positive valuation effects........The higher share for Australia (up from 3.4% to

4.2%) may partly stem from carry trade activity in the Australian dollar,Foreign exchange market turnover by currency pair1

Daily averages in April, in billions of US dollars and percentages

Table 4% share in global FX trading

USD/AUD pair

1995 ....................1998 .........2001..........2004..................... 2007

Amount % share Amount % Amount % Amount % share Amount % share

$29.......... 3 .........42 ....3.... 47...... 4..... 90 ....5 ..............175 .......6

http://www.ozforex.com.au/cgi-bin/chartsFast.asp?ccypair=AUDUSD&period=Hour

Look out got the impact on Oz if many contracts have to be unwound..

mmm

-

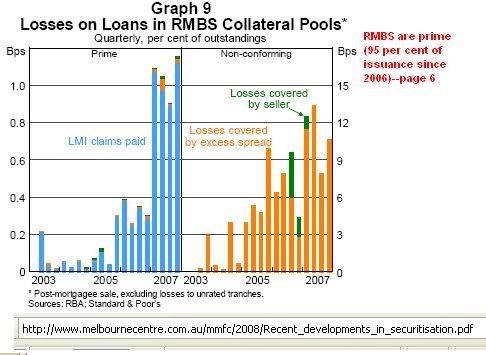

what make me worry is the figures of default in Oz is so low.

u can read from my previous posting that the owner

of the biggest debt collector said the real figures shall be 4 times more.

In US,the rates are few % and over 15% for prime and sub prime loans

respectively.For Oz ,they are only 0.01% to 0.15%!!

non--conformig loan is sub prime loans!!

Also,they are called No doc or low document loans.

95 % of loan in Oz are considered prime loans!!

This is also lower than about 15% in USA!!

doc = document

Bps=basic point.100 basic point=1 %.

-

Originally posted by lionnoisy:

no need to cry.

Singapore GDP drops from 7% to est 3 % for 2008 ,

still on par with other 1 st world countries!!

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(real)_growth_rate

SG is decribed growing at third world rate!!

Australia $$ has been a play doll in FX market

Investor and speculator buy carry trade on Aussie $$

solely becos high deposit interest rate and the incompentent

Oz gavaman cannot intervent the FX market.

The businessmen,consumers ,house owners etc borrowing on

Oz $$ pay the price for high interest rate.

The speculators enjot the profits of carry trade if they can win $$.

Falling $$ will cause the unwinding of carry trade of billions of $$.

http://www.bis.org/publ/rpfx07.pdf?noframes=1

Foreign exchange market turnover by currency pair1

Daily averages in April, in billions of US dollars and percentages

Table 4% share in global FX trading

http://www.ozforex.com.au/cgi-bin/chartsFast.asp?ccypair=AUDUSD&period=Hour

Look out got the impact on Oz if many contracts have to be unwound..

mmm

Lionnoisy, would it be ok if you don't write in this manner, and also try to summarise what you are writing? I can't make much out of it.

-

Originally posted by crimsontactics:

Lionnoisy, would it be ok if you don't write in this manner, and also try to summarise what you are writing? I can't make much out of it.

It's normal, nobody really understand lionnoisy anyway, he is just here to show you the meaning of "empty vessel makes the most noise".

-

Originally posted by maurizio13:

It's normal, nobody really understand lionnoisy anyway, he is just here to show you the meaning of "empty vessel makes the most noise".

Yeah, it would be to his advantage though if he could at least present his thoughts well.

-

Originally posted by maurizio13:

It's normal, nobody really understand lionnoisy anyway, he is just here to show you the meaning of "empty vessel makes the most noise".

Hence the username noisylion

-

He does not seem to understand that he is wasting his energy in making his posts because nobody bothers to read them, and those who are not aware of his antics who do can't understand his gibberish anyway...

Nope, he just keeps on posting and posting without showing any shred of self-awareness... it seems he's more of writing to himself then anything else, convincing himself this is the world he wants to believe...

What more can be said about him except he's a lion that only posts in here in total ignorance of any shred of decent behaviour mainly to sastify himself?

-

Additionally, lionnoisy, you have still not responded to this:

Why did you use clones in Sgforums?

-

pl tell me why Oz foreign reserve reduced by more than 60%

in 7 month from May 2007?

dunt waste time make fun on my language.

save the pockets of your family and fans in Oz lah....

tx for all your feedback.

u guys are fans of Oz right?

pl tell me why Oz foreign reserve reduced by more than 60%

in 7 month from May 2007?

http://www.rba.gov.au/

i am sad to read that Australia dunt list her reserve in Aussie dollar unit.

It is ok listed in US $$.But do Aussie pple dunt have pride in Oz dollars

and therefore they dunt list reserve in Oz $$?

Total holdings--in million (US$ equivalent) A04 RESERVE BANK OF AUSTRALIA - FOREIGN EXCHANGE TRANSACTIONS AND HOLDINGS OF OFFICIAL RESERVE ASSETS 69752 May --2007 67626 68873 57790 46489 33163 29005 26908---Dec 2007 -

if u cant get the answers.

read this:

http://www.globalspeculator.com.au/documents/AussieDollarFundamentallyPoor.pdf

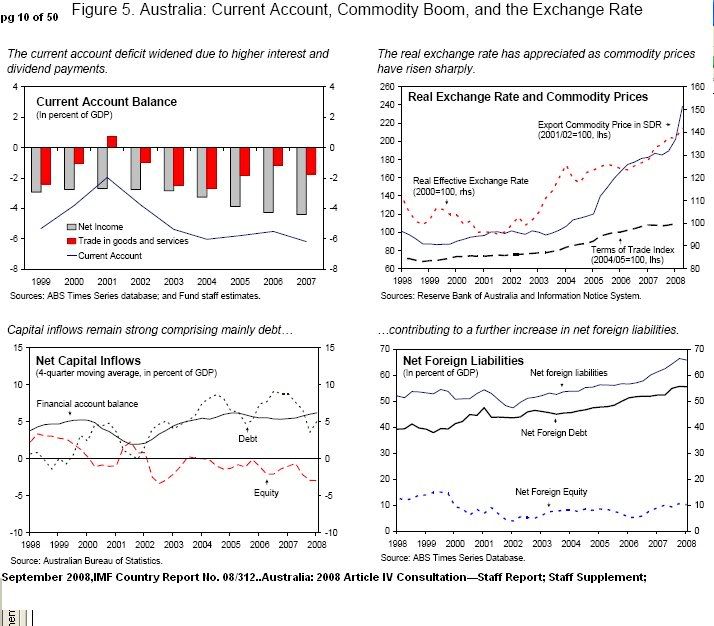

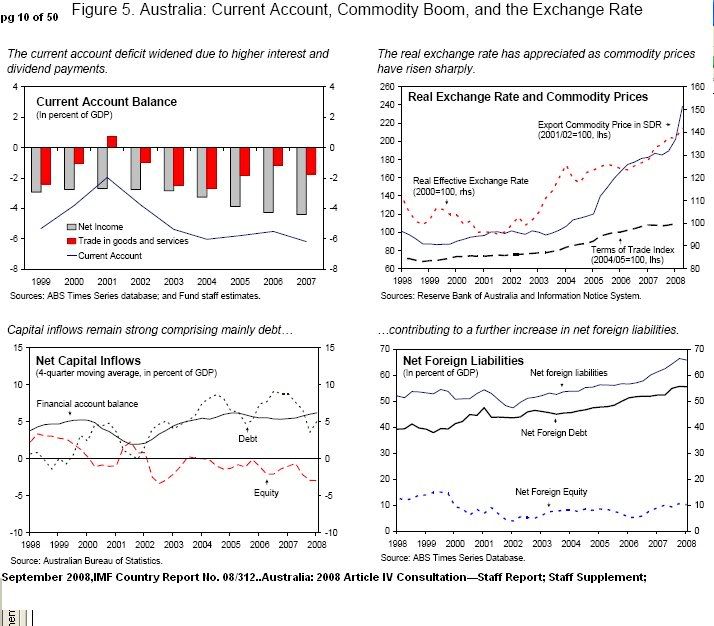

Bank borrowing offshore is the key to the unusual structure of Australia’s Balance of Payments. Australia runs a large and growing CAD. In most quarters Imports largely exceed Exports. This is the Trade Deficit and makes up one component of the CAD. Australia also pays interest and dividends on AUD$659B in Net Foreign Liabilities which is the accumulated result of past CAD’s.

Together these two deficits make up the CAD. In the Sept Qtr 07 the CAD came in at a record AUD$17.5B.

• To be able to run a CAD on an ongoing basis Australia needs to match this by an equivalent Foreign Capital Inflow. The inflow in fact needs to exceed this deficit due to increased globalization by Australian businesses (Net Foreign Investment). Over the past decade additional offshore borrowing by Australian banks has supplied most of this capital inflow. In the decade to June 07, total Net Foreign Liabilities increased by AUD$372B (Accumulation of CAD’s). Over this same period, the net foreign debt of Australian financial institutions increased AUD$343B, providing more than 90% of the CAD financing.• In the September Quarter 07 financial borrowing abroad came to a dramatic halt. Australian banks actually reduced foreign debt by AUD$4B. For their part, non-financial businesses increased their offshore borrowing by a net of AUD$5.9B. The total increase in private business

borrowing was therefore just under AUD$2B against a required debt inflow of AUD$29.9B (17.5 for the CAD plus 12.4 for Net Foreign Investment). Which begs the question, where did the missing AUD$28B shortfall come from?

• Enter the Reserve Bank of Australia (RBA). The RBA supplied the required capital. The ABS numbers show the foreign exchange reserves fell sharply in August and September and have continued to fall since. At just AUD$32.7B in November, the RBA foreign Reserves were less than half the level of July 07.

• If Australian banks remain reluctant to borrow offshore in 2008, something has to eventually give. The RBA will be reluctant to use its modest remaining foreign exchange reserves to support the currency or finance the CAD. If the banks do not borrow to match it and there is not a big turnaround in equity flows, the Australian dollar will take a tumble. It would have to fall enough to persuade offshore buyers that Australian assets were cheap. Interest rates would rise

because banks would more than likely borrow domestically, increasing the demand for domestic borrowingnn

-

Dear fren pl help explain why

A.Oz foreign reserve now reverts back to 2003!!

Like other countries,Foreign reserve is not Aussie gavaman's money.

B.Oz Commonwealth Net debt is currently estimated at $43 billion for 2007‑08

!!Say interest paid

out average is 6 %,annual interest burden is A 2.6 b.

A small sum in term of revenue of 300b!!

Chart 3: Fixed coupon Treasury Bond outstandings expected

at 30 June 2009

http://www.budget.gov.au/2008-09/content/bp1/html/bp1_bst7-01.htm

http://www.budget.gov.au/2008-09/content/bp1/html/bp1_bst7-03.htm

But the civil pensions post a potential huge burdens!!

Public sector employee superannuation liabilities

Public sector employee superannuation entitlements relating to past and present employees constitute the largest financial liability on the Government's balance sheet. The Government's superannuation liability is estimated to be around $108 billion as at 30 June 2008.

Chart 2: Public sector superannuation liability(a)

Pl note recent revenue of oz is 300 b pa.

2.Oz Commonwealth net debts now stands at A43 billion,4% of GDP

and 14% of the average of 2007/08 and 2008/09 revenue.

http://www.aofm.gov.au/content/borrowing/commonwealth/QuarterlyData/june2008.asp

http://www.budget.gov.au/2008-09/content/overview/html/overview_34.htm

Unlike SG gavaman internal debts which provide interest to CPF account

holders(not for expenditure),Oz Commonweath's debts is most likely

for expenditures.I cant understand why Oz still need new debts when they

just cleared the huge debts and starts to have suprlus.

With cash balance.i cant understand why Oz debts

increases from Dec 2006

Gross outstanding debt56,182,688,000to 60 billion 2008.

Also.there is debts called

USAGE OF SECURITIES LENDING FACILITY amounts to A$ 9 billion.So,total gross debts managed by AOFM

is 69 billions!!

This is not the same as Commonwealth general government gross debt, as published in the Budget Papers, which includes other liabilities including those not managed by the AOFM.

http://www.aofm.gov.au/content/borrowing/securities.asp

Historical data on securities lending facility usage

http://www.aofm.gov.au/content/mvd/downloads/Portfolio_Overview_June08.pdf

-

LOL, another post that is so messed up in english that nobody bothers to read, much less reply.

Here lionnoisy, try this:

-

do this homework lionnoisy, it'll help you:

asic English the Mikie Metric Way

Introduction: The eight (8) lessons in this section cover such topics as Basic Sentence Structure, Making Questions, Giving Information About Yourself, Using Pronouns Correctly and How to Tell People What You Want or Have or Need. Exercises and Answers follow each lesson. If you have a question about any of the lessons or about English in general, please send us an e-mail. We answer all questions. (Links to other English sites.) Just for fun, visit this page: Fun With English <!-- google_ad_client = "pub-4445799420042074"; google_ad_width = 468; google_ad_height = 60; google_ad_format = "468x60_as"; google_ad_type = "text_image"; google_ad_channel =""; google_color_border = "000099"; google_color_bg = "FFFFCC"; google_color_link = "000099"; google_color_url = "FF0066"; google_color_text = "000099"; //--> window.google_render_ad();

Lesson 1: How to talk about yourself.

I = the word used to talk about myself. I am Mr. G. I am a man. I am fuzzy. I am smiling.

am = a form of the verb "to be" used only with I.

(Note: In spoken English, "I" and "am" are often joined to form a "contraction" that looks like this in writing - "I'm" - and rhymes with words like "time" and "lime".)

I am + adjective. An adjective tells who I am, what kind of person I am, what I look like, how I feel.

I am tall. I am awake. I am sleepy. I am tired. I am hungry. I am dirty. I am pretty. I am English. I am afraid. I am short. I am fat. I am thin. I am happy. I am smart. I am French. I am young. I am rich. I am sick. I am healthy. I am single. I am quiet. I am Italian. I am sad. I am old. I am angry. I am poor. I am clean. I am noisy. I am married. I am American. I am unemployed. I am confused. I am Iraqi. I am + -ing verb. This sentence tells what I am doing at this moment. "I am writing this lesson now."

I am eating. I am sleeping. I am working. I am crying. I am walking. I am shopping. I am driving. I am babysitting. I am watching tv. I am writing. I am + article + noun. Articles are little words that point out Nouns. They tell us that there will be a Noun ahead in the sentence. Articles are A, AN, THE. Nouns are words that name a person, a place, a thing, an idea, a feeling or an action. Any word we use to name something is a Noun.

THE is used to point out a definite noun, the only one of its kind, a special one.

Example: "I am the driver" In this group, I am the only one who can drive or who is responsible for driving.

Example: If I say "I am the doctor.", I mean that I am the only doctor here on this case or in this situation.

I am the teacher. I am the boss. I am the janitor. I am the cook. I am the driver. I am the supervisor. I am the mailman. I am the doctor. I am the president. I am the owner. A and AN are used with singular nouns. A and AN mean the same thing, but they are used in different situations. AN is used before words that begin with a Vowel sound (a, e, i, o, u) . A is used before words that begin with a consonant sound (all the other letters). This is to make it easier to pronounce the Article and the Noun together. A and AN refer to one of a group of similar things - not a special one or a particular one, just one of them.

Example: "I am a driver." There are other drivers; I am just one of them.

Example: If I say "I am a doctor.", I mean that I am not the only doctor; I am just one of them, a member of the medical profession.

I am a salesman. I am a boxer. I am a gambler. I am a mother. I am a Muslim. I am an organ-player. I am an undertaker. I am an ice skater. I am an angel. I am an elephant. A, AN and THE must come before the noun they point out, but there can be other describing words between them and the Noun. Remember, use A before words beginning with a consonant (a boy, a dog) and AN before words beginning with a vowel (an ugly boy, an old dog).

I am the only doctor. I am the school janitor. I am the main man. I am the boy's father. I am a good doctor. I am a careful janitor. I am a tall man. I am a young father. I am an awful doctor. I am an honest janitor. I am an old man. I am an angry father. With these models, you can say just about anything you want about yourself.

I am + Adjective. I am + Article + Noun. I am + -ing Verb. Exercise A: Use words from the box below to complete the following sentences.

good, carpenter, happy, mechanic, dirty, eating, singer, driver, single, married, horse, pizza, diving, funny, doctor, unemployed, tall, old, sick, honest, teacher, woman, battleship, choking, proud, cook, running, decent 1. I am ____________________________. 4. I am _____________________________. 2. I am ____________________________. 5. I am _____________________________. 3. I am ____________________________. 6. I am _____________________________. Exercise B: Use words from the box above to complete the following sentences.

1. I am a ____________________________. 5. I am an _________________________________. 2. I am the _____________________________. 6. I am the _________________________________. 3. I am a ______________________________. 7. I am a ___________________________________. 4. I am an ______________________________. 8. I am the _________________________________. -

remember to do your exercise and practive your english okay? if not the kors kors here will not play with you leh...

-

Plunging Australian dollar at five-year low

Posted: 13 October 2008 1457 hrsSYDNEY: The Australian dollar has plunged more than 14 per cent in the past week to new five-year lows as investors panicked by global financial turmoil dumped the unit to buy the US dollar, dealers said Monday.

The Australian currency, which dealers had predicted would reach parity with the greenback just three months ago, was trading at 0.6584 to the US unit at 5:20 pm (0620 GMT) on Monday, compared with 0.7750 during trade on October 6.

"We have seen the largest daily drops in the Aussie since the currency was floated in the early 1980s," Josh Williamson, senior strategist at TD Securities in Sydney, told AFP.

The unit was some 32 per cent below its July 15 high of 0.98 US dollars after declining commodities prices and Australian interest rates led to a fall that significantly sped up as the global financial crisis erupted, he said...........CNA -

Originally posted by SingaporeTyrannosaur:

LOL, another post that is so messed up in english that nobody bothers to read, much less reply.

Here lionnoisy, try this:

I would say at least 90% of the time, I don't know what the fook this animal is talking about.

-

Originally posted by maurizio13:

I would say at least 90% of the time, I don't know what the fook this animal is talking about.

U are right.So i copy and paste figures.

I want to burst the bubble on Oz rosy ballon.

Like USA being a paper eagle,Oz is not far away from being a paper kangaroo.

http://images.businessweek.com/ss/08/10/1010_nations_at_risk/14.htm

http://images.businessweek.com/ss/08/10/1010_nations_at_risk/index.htm

NZ is marked as one of the

Countries Are at Economic Risk

I saw this news from http://www.news.com.au/.

After i read the data and get more from CIA.gov/,i think Australia

is eiligible to be put on this watching list, unforuntaely!!

GDP taken at Official Exchange Rate in cia.gov web site

Country.....External debt.....Current account....Budget Balance

.................as % in GDP.......as % in GDP....as % in GDP

Australia.......65...................--6.0..............1.5

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

Pakastan.....27.................--8.6................--6.4

Argentina.....52

serbia.........63

turkey..........37

indonesia.......32

phillphines......43

vietnam..........31

romania.......45

kazakhastan...92

latvia.......126

hungary.....91

korea.....23

new zealand..40

@@@@@@@@@@@@@@@@@@@@@@@@@@@

Country.....External debt.....Current account....Budget Balance

.................as % in GDP.......as % in GDP....as % in GDP

1.Average of all....54..................--6.2................--1.67

countries

except Australia

2.Australia.......65...................--6.0..............1.5

@@@@@@@@@@@@@@@@@@@@@@@@@@@

u can verify the data of oz and other countries in

http://www.rba.gov.au/Statistics/AlphaListing/alpha_listing_g.html

may i repeat my proof here---no empty words.

@@@@@@@@@

There is only one facts and subject to 1000 opinons.

u can know more by reading

http://www.rba.gov.au/PublicationsAndResearch/

http://www.rba.gov.au/ChartPack/index.html

How many of u know oz now cannot export rice?

What would happen when prices and demand of commodities drop?

How do Oz pay back huge foreign debt in foreign currency

,if Oz $$ do not climb up?

SG dropped 10% against USD recently,while Oz dropped 30%!!

www.ozforex.com.au

The high deposit interest rate of oz dollar just paving the road to hell......

My point is----dunt keep Oz $$ lah...

,,,

,,

-

Originally posted by idwar:

Plunging Australian dollar at five-year low

Posted: 13 October 2008 1457 hrsSYDNEY: The Australian dollar has plunged more than 14 per cent in the past week to new five-year lows as investors panicked by global financial turmoil dumped the unit to buy the US dollar, dealers said Monday.

The Australian currency, which dealers had predicted would reach parity with the greenback just three months ago, was trading at 0.6584 to the US unit at 5:20 pm (0620 GMT) on Monday, compared with 0.7750 during trade on October 6.

"We have seen the largest daily drops in the Aussie since the currency was floated in the early 1980s," Josh Williamson, senior strategist at TD Securities in Sydney, told AFP.

The unit was some 32 per cent below its July 15 high of 0.98 US dollars after declining commodities prices and Australian interest rates led to a fall that significantly sped up as the global financial crisis erupted, he said...........CNA -

Originally posted by lionnoisy:

U are right.So i copy and paste figures.

I want to burst the bubble on Oz rosy ballon.

Like USA being a paper eagle,Oz is not far away from being a paper kangaroo.

http://images.businessweek.com/ss/08/10/1010_nations_at_risk/14.htm

http://images.businessweek.com/ss/08/10/1010_nations_at_risk/index.htm

NZ is marked as one of the

Countries Are at Economic Risk

I saw this news from http://www.news.com.au/.

After i read the data and get more from CIA.gov/,i think Australia

is eiligible to be put on this watching list, unforuntaely!!

GDP taken at Official Exchange Rate in cia.gov web site

Country.....External debt.....Current account....Budget Balance

.................as % in GDP.......as % in GDP....as % in GDP

Australia.......65...................--6.0..............1.5

@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@

Pakastan.....27.................--8.6................--6.4

Argentina.....52

serbia.........63

turkey..........37

indonesia.......32

phillphines......43

vietnam..........31

romania.......45

kazakhastan...92

latvia.......126

hungary.....91

korea.....23

new zealand..40

@@@@@@@@@@@@@@@@@@@@@@@@@@@

Country.....External debt.....Current account....Budget Balance

.................as % in GDP.......as % in GDP....as % in GDP

1.Average of all....54..................--6.2................--1.67

countries

except Australia

2.Australia.......65...................--6.0..............1.5

@@@@@@@@@@@@@@@@@@@@@@@@@@@

u can verify the data of oz and other countries in

http://www.rba.gov.au/Statistics/AlphaListing/alpha_listing_g.html

may i repeat my proof here---no empty words.

@@@@@@@@@

There is only one facts and subject to 1000 opinons.

u can know more by reading

http://www.rba.gov.au/PublicationsAndResearch/

http://www.rba.gov.au/ChartPack/index.html

How many of u know oz now cannot export rice?

What would happen when prices and demand of commodities drop?

How do Oz pay back huge foreign debt in foreign currency

,if Oz $$ do not climb up?

SG dropped 10% against USD recently,while Oz dropped 30%!!

www.ozforex.com.au

The high deposit interest rate of oz dollar just paving the road to hell......

My point is----dunt keep Oz $$ lah...

,,,

,,

Your point being?

So keeping deposit interest rates at 0.8% with inflation growing at 6%-8% is your solution? A difference of more than 5%.

At present, the interest rates earned by Singapore depositors cannot even offset the cost of inflation.

Australia's inflation rate is around 4.5% for June 2008, while it's 1 year fixed deposit is paying 3.68%. A difference of less of 1%.

In Singapore, the economic policies advocated by the government is beneficial to the government but at the expense of the citizens. Whereas, the economic policies set by the Australian government is beneficial to it's citizens at the expense of the government.

Singapore's current economic situation is similar to Japan's situation (stagflation: inflation + no growth), high level of reserves, extremely low level of interest rates, inflation surpassing that of interest rates. Japan is like in a perpetual recession cycle. Japan has one of the highest trading reserves in the world.

What caused Japan's recession?

Japan has been suffering stagnant economic growth and a series of recessions for more than 10 years. How has a country once seen as the ruler of the 21st century come to such a pass? And what, if anything, can the government do about it?http://news.bbc.co.uk/1/hi/business/2193853.stm

In Singapore, the size of the government is bigger than what normally would be, therefore you see the government having lots of funds to invest in money losing investments like ML, UBS, Shin Corp, Suzhou, Optus, Global Crossing, etc. If you tax (both direct and indirect forms of taxation), you deprive the private sector from growing, less ability would the private consumers have to spend and invest, while they dwindle away our savings in money losing ventures. Having less private individuals spending, a company making investments would have to charge higher for it's products and services to make up for the loss in quantity of sales, it charges more for it.

Why do think that products are cheaper in other countries?

At present the government is so devoid of idea to help stimulate the Singapore economy except to give handouts so that private individuals could help spend the money, create a multiplier effect to help promote internal growth.

-

The effect of the Singapore government's handout is only to cause short term inflationary growth (meaning increasing prices instead of output). Why? It's because the private individuals deemed the handout as a once off, something that is not long term, therefore individuals are more likely to spend the handouts rather than put it in some long term investments.

So is it better to have a large government sector or a large private sector? Government sector spending / investments would be similar to centrally planned policies of the communist regimes, where government decides on where and what to invest in, whereas private sector spending is stochastic.