Aussie dollar--jumping kangaroo or paper kangaroo?

-

Originally posted by maurizio13:

Your point being?

So keeping deposit interest rates at 0.8% with inflation growing at 6%-8% is your solution? A difference of more than 5%.

At present, the interest rates earned by Singapore depositors cannot even offset the cost of inflation.

Australia's inflation rate is around 4.5% for June 2008, while it's 1 year fixed deposit is paying 3.68%. A difference of less of 1%.

In Singapore, the economic policies advocated by the government is beneficial to the government but at the expense of the citizens. Whereas, the economic policies set by the Australian government is beneficial to it's citizens at the expense of the government.

Singapore's current economic situation is similar to Japan's situation (stagflation: inflation + no growth), high level of reserves, extremely low level of interest rates, inflation surpassing that of interest rates. Japan is like in a perpetual recession cycle. Japan has one of the highest trading reserves in the world.

In Singapore, the size of the government is bigger than what normally would be, therefore you see the government having lots of funds to invest in money losing investments like ML, UBS, Shin Corp, Suzhou, Optus, Global Crossing, etc. If you tax (both direct and indirect forms of taxation), you deprive the private sector from growing, less ability would the private consumers have to spend and invest, while they dwindle away our savings in money losing ventures. Having less private individuals spending, a company making investments would have to charge higher for it's products and services to make up for the loss in quantity of sales, it charges more for it.

Why do think that products are cheaper in other countries?

At present the government is so devoid of idea to help stimulate the Singapore economy except to give handouts so that private individuals could help spend the money, create a multiplier effect to help promote internal growth.

My point is----dunt keep Oz $$ lah...

Why pple continue to hold SGP when SGP in negative real deposit interest rate?

u mentioned read deposit interest rate.

i agree that if u are holding SG $$,u are receiving real negative deposit interest,

ie nominal deposit rate less than inflation.

However,why do Singaporeans and foreigners,staying here or overseas,

continue to hold SGP?They think SGP will appreciate or it is one

of the best currency during this crisis!!

very few Singaporean or foreigners continue to hold SGP becos they love

PAP or SG gavaman,Almost every one looks at her or his financial

benefits before anythings.

If holding A$ is a sure win formula,why not every one doing this?

U have just seen the The answer---rapid falling value against all major

currency!!Few days' falling can wipe out one year interest collected.

Not to mention A$ dropped 30 % against USD and SGP in 2 months.

This wiped out few years' hard earn deposit interest!!

A$ also dropped against EUR,Yen etc

http://www.ozforex.com.au/cgi-bin/chartsFast.asp

There is no free lunch in the world.Anything too good to be true sure

carrying some ricks.If u cannot find,blame your IQ!!

Yes,again,i agree with u that u can get real deposit interest rate in holding

A$.The rates u quote seem on the low side.u can get 7 % for small sum and

short period in Australia banks acct.But i dunt know the tax for local and

foreigners.7% for 5000 for 4 months,Wow,very good.

http://www.westpac.com.au/internet/publish.nsf/Content/PBTSSA+Term+Deposit+rates

http://www.uob.com.sg/redirect.jsp?direct=/mproxy?Action=INT

Why u can collect higher deposit interest rate by holding A$

One of the simple answer is A$ is not so attractive if come without

higher deposit interest than other currency.Or the potential

of appreciation is low.

Pple is holding A$ becos it give higher return without knowing

it is the price to compensate for the risks!!

REal Pretty girl dunt need heavy make up,right?

Why the ex rate of compartively lower interest rate currency like yen,SGP etc

would not drop?The demand is there.SG MAS or Japan central bank

cannot intervent the giant FX market every day.Pple around the world

determine the ex rate---not MAS!!

Good or bad of high interest rate of A$ depends on which camp u are in

If u are holding high net assets,then u prefer collecting high deposit interest rate.

But if u are house owners borrowing loans,u will prefer lower mortgage

interest rate.

-

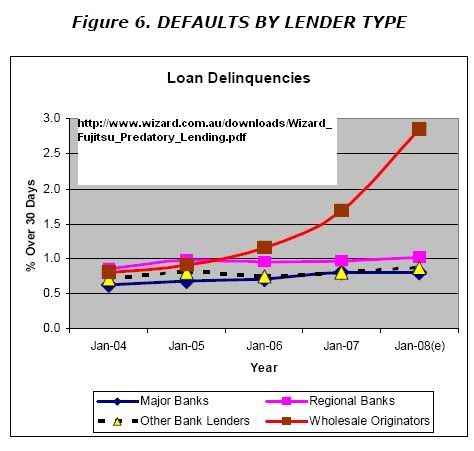

Oz official data is default banks rate is really low.

like RBA FinanciAL sTABILITY rEVIEW.or

http://www.rba.gov.au/PublicationsAndResearch/SubmissionsToParliamentaryCommittees/inquiry_into_housing_affordability_australia.pdf

page 6

hOWEVER,This report stated a higher rates!!

http://www.wizard.com.au/downloads/Wizard_Fujitsu_Predatory_Lending.pdf

,,

-

why SG shall not look for higher deposit rate?

On the other hand,we have to pay higher mortgage interest rate.

Oz is a good lesson.

http://www.abs.gov.au/AUSSTATS/[email protected]/Lookup/4102.0Chapter9102008

-

like SG,housing loans drops a lot in the past one year,at about 20%,

http://www.abs.gov.au/AUSSTATS/[email protected]/ProductsbyTopic/05DBCE56402EC566CA25723D000F2999?OpenDocument

Now u know why Oz PM ytd trible the incentives to buy new homes.

It is a bad move for existing houses owners.

Also,it is doing a good deed for developers!!

-

are you sure that it is a bad time to invest in australian dollar?

to me, it seems like a jolly good time enter.

the AUD seldom come down to 1:1 with the SGD. for the past few years, it has always been hovering at $1.20 -$1.30 : AUD$1.

assuming that you cash in ur sgd for aud now, and wait for it to rise back up to the $1.20-$1.30 mark, u stand to gain a profit of 20%-30++%.

also, rarely did a western country allow its currency to weaken for long period of time, (exclude US cos' they are fighting a very expensive war). with their consumption rate, it is not favorable for them to maintain a weak currency, with their strong reliance on cheap asian imports, they would need the leverage a strong currency brings. and given western style consumerism, this consumer-demand will never be satiated, debt or no debt.

nevermind that the oz government doesn't have the money to back up their gurrantees, neither do most of the governments in the world anyway. singapore probably doesn't have enough either.

like someone had mentioned, aus has a lot of resources to back up their lack in cash. they have gold mines, coal, oil, gas, metal, uranium, timber, agricultural produce to supplement their economy. and with increased demand for these resources from the entire world, and with currencies falling, people will be more likely to buy these resources from australia, either for consumption or for investment. so, in the near future, the aud is going to rise back up to the usual level of $1: sgd$1.30.

and look from the other perspective too. singapore is also not able to sustain having a strong currency for too long. currency trading works both ways. u can either wait for the AUD to rise, or u wait for the SGD to fall. in either cases, u will stand to gain.

singapore is an export base economy, and doesn't not have the benefit of revenues from natural resouces as australia does. so, eventually, the sgd will have to back down due to financial strain.

so, i am still betting on the AUD.

-

Despite all the mudslinging by lionnoisy (an extremely disturbed individual), I still love Australia. Given that the exchange rate is lower now, I will make more trips to Australia for shopping to help stimulate the economy. Hopefully in the not too distant future I can make leave this shithole called Singapore and make Australia or New Zealand my home.

Yes. Despite the stronger Singapore dollar, Singapore is not a place to call my home. Why? Simple because you don't have a say in how things are run here, if nobody in your house listen to your ideas on how to run things, then certainly you are not a family member in that household, because family members contribute and share everything. A country where you can be free from the persecutions of the "elites", liberty of the human spirit and equality for all.

http://www.youtube.com/watch?v=fcMuf8wE52k

-

Originally posted by maurizio13:

Despite all the mudslinging by lionnoisy (an extremely disturbed individual), I still love Australia. Given that the exchange rate is lower now, I will make more trips to Australia for shopping to help stimulate the economy. Hopefully in the not too distant future I can make leave this shithole called Singapore and make Australia or New Zealand my home.

Yes. Despite the stronger Singapore dollar, Singapore is not a place to call my home. Why? Simple because you don't have a say in how things are run here, if nobody in your house listen to your ideas on how to run things, then certainly you are not a family member in that household, because family members contribute and share everything. A country where you can be free from the persecutions of the "elites", liberty of the human spirit and equality for all.

http://www.youtube.com/watch?v=fcMuf8wE52k

But still, Singapore sure do have its good point. And you will defeintely miss the local food here.

-

Originally posted by crimsontactics:

But still, Singapore sure do have its good point. And you will defeintely miss the local food here.

Well there are pros and cons, to me Singapore has more cons (with all the elite conmen running the show) then pros. Australia or New Zealand would be a more conducive environment to stay for my retirement, at least I don't have to worry about the P4P government fleecing from me. Common cons are decreasing property tax rate but increasing the net annual value, it's a LPPL strategy for them to retain the status quo; increasing electricity charges, increasing transport, increasing GST, increasing medical cost, increasing ERP, increasing the immigrants to compete, increasing.........................

Between Australia and Singapore, I choose the lesser of the two evils, which is Australia.

-

Originally posted by maurizio13:

Well there are pros and cons, to me Singapore has more cons (with all the elite conmen running the show) then pros. Australia or New Zealand would be a more conducive environment to stay for my retirement, at least I don't have to worry about the P4P government fleecing from me. Common cons are decreasing property tax rate but increasing the net annual value, it's a LPPL strategy for them to retain the status quo; increasing electricity charges, increasing transport, increasing GST, increasing medical cost, increasing ERP, increasing the immigrants to compete, increasing.........................

Between Australia and Singapore, I choose the lesser of the two evils, which is Australia.

While, theres always a reason to go or to stay. But i do think that sitting back in a beautiful backdrop filled with fresh air is sure a nice thing to do for retirement. The sheeps are kindda cute too.

-

U are right.So i copy and paste figures.

I want to burst the bubble on Oz rosy ballon.

How you going to burst the bubble on Oz rosy "ballon"

When you make your posts unreadable with all that garbage?

You want to communicate to the french you use german ah?

Communication, it's all about communciation, getting your points across.

Our govt ask us to improve our english to communicate better.

How come you after 3 years in here never listen or improve yourself?

In first world country is this acceptable?

-

Originally posted by maurizio13:

Despite all the mudslinging by lionnoisy (an extremely disturbed individual), I still love Australia. Given that the exchange rate is lower now, I will make more trips to Australia for shopping to help stimulate the economy. Hopefully in the not too distant future I can make leave this shithole called Singapore and make Australia or New Zealand my home.

Yes. Despite the stronger Singapore dollar, Singapore is not a place to call my home. Why? Simple because you don't have a say in how things are run here, if nobody in your house listen to your ideas on how to run things, then certainly you are not a family member in that household, because family members contribute and share everything. A country where you can be free from the persecutions of the "elites", liberty of the human spirit and equality for all.

if a country is run by the ideas of all people,then we dunt need MP and Cabinets

in all country,including Oz.

We just need instal a voting system that every one can propose ideas

and everything is determined by referandum!!

Selling all assets in GIC and Temasek and distributed equally to all

Citizens.Happy?.

Ask all foreigner and PR leave in 30 days.Happy?

Reduce SAF to a platoon of Guard of Honor for Istana ceremony.Happy?

Allow all drugs like heroin ,K etc selling in supermarkets.Happy?

@@@@@@@@@@2

Oz dollar approaching to a new low !!

@@@@@@@@@@\

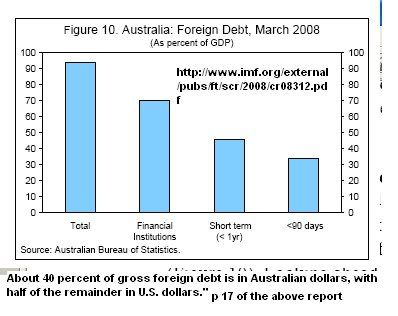

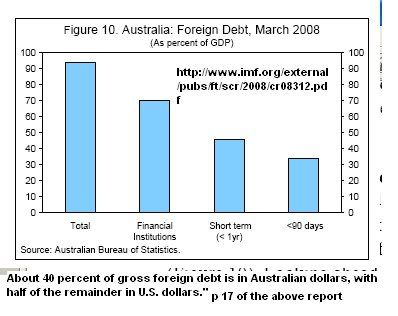

out of oz A$692 bILLION NET FOREIGN LIABILITY,

how much in foreign currency and how much is short term?

@@@@@@@@@@@

Oz financial health is comparable to indonesia and Phillipines:

Country.....External debt.....Current account....Budget Balance

.................as % in GDP.......as % in GDP....as % in GDP

Australia.......67*...................--6.0..............1.5

Indonesia......32....................2.8................--2.0

Phillpines......43.....................4.4..............0.2

Vietnam........31......................--13.6.........--1.7

U can say becos of Oz credibility,therefore Oz can borrowed

so much money.Other 3 rd world countries's poor credit

made them cannot raise so much funds.

Pl remember O$P$ is a basic principal in human being.

Oz is unlike USA in the past few decades to print IOU

then can survive.

Oz $$ is just a play doll in the Forex.

The sole purposes of holding Oz $$ is for high deposit interest rate.

*

http://www.imf.org/external/np/sec/pn/2008/pn08123.htm

read the Staff report--page 8

5. The current account deficit widened in 2007 to more than 6 percent of GDP,despite the commodity boom (Figure 5, Tables 3 and 4). The trade deficit deteriorated, as export volume growth was constrained by drought disrupting rural exports and bottlenecks in the export supply chain. Imports also grew strongly owing to buoyant domestic demand and an appreciation of the real effective exchange rate (REER). In addition, the investment income deficit increased,

reflecting higher interest payments on foreign debt and large dividend payments, particularly from the resource sector. Net foreign liabilities rose to 67 percent of GDP at end-March 2008, mainly owing to an increase in foreign debt,

channeled primarily through financial institutions.@@@@@@@@@@2

The major problems is oz foreign short term debts in foreign currecny to support

long term expenses or lending converted Oz dollars.This is like

what u have seen in Thailand ,Indonesia and Korea in 1997 crisis.

The sudden surge in foreign debt caught the eyes of IMF.

Directors noted that the banking sector remains profitable and well capitalized. However, they encouraged the authorities to monitor carefully the sector's vulnerability to rollover risks arising from short-term wholesale funding and to the risks associated with the large indebtedness of the household sector.

http://www.imf.org/external/np/sec/pn/2008/pn08123.htm

u can read more from this.

@@@@@@@@@@@@

no crisis is formed by over night:

http://www.imf.org/external/np/sec/pn/2008/pn08123.htm

Australia: Selected Economic Indicators, 2004-08

u can read more

current account runs in deficit for about 6% for the above period.

Why?i heard the commodity export was very storng.

2004 2005 2006 2007 2008 Net foreign liability in GDP-- %56 56 60 67 67 Proj. http://www.theaustralian.news.com.au/story/0,25197,24443103-28737,00.html

Financial rescue squad

Michael Stutchbury, Economics editor | October 04, 2008

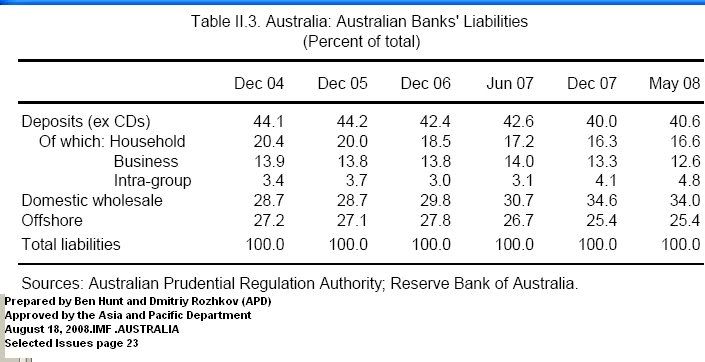

It helps when the banks are offering 8 per cent to lock up your money with them for six months. The Aussie banks are offering such high saving rates because they're desperate to get back their old deposit base, which defected to tax-preferred super over the past 15 years. That funding gap has forced the banks to turn to wholesale markets, producing the rollover funding vulnerability highlighted by the International Monetary Fund.

Great opportunity to earn high interest rate.Only the risk of exchange rate

and taxation!!

100% capital protection by Oz government.No hidden cost.

So now u understand more why Oz PM need to guarantee all banks and non--

banks deposit.If not,Oz financial instiutions will face short of funds.

,,,,,,

,,,

-

Singapore dollars

-

I dont knw if its me, but i dont understand wad the fark lionnoisy is talking abt???

-

Originally posted by seotiblizzard:

I dont knw if its me, but i dont understand wad the fark lionnoisy is talking abt???

.. and why the Australian kangaroo is stuck inside lionnoisy's assole....

-

...at a time when Singapore is in recession, when the despots has lost maybe a hundred biilion dollars of Singaporeans sweat money, causing the Singapore dollars to fall, and he is so worried about Australia!

-

Originally posted by AndrewPKYap:

.. and why the Australian kangaroo is stuck inside lionnoisy's assole....

because the baby kangaroo thot his ass is it mother pocket -

at last i find this.

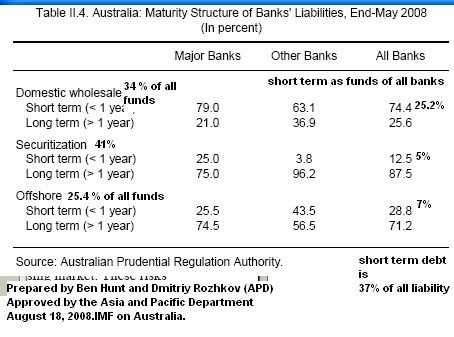

Up to A$240 billion need to be raised before March 2009

As at March 2008,short term loans amounting to 40 % of GDP will be matured in 0ne years.I wander how Oz can settle this amount of A$400 billion in one year from

March 2008.

http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

Risks of depreciation of Oz $$

u can read in the following IMF report that

60 % of Oz gross foreign debt in non--oz currency.

If we follow 60%,then A$240 billion in foreign currency need to

be settled before March 2009.

FYI,annual budget of Oz Ferderal gavaman is A$300 b!!

Let assume out of this A$400 billion loan to be settled before March 2009,

there is only 30 % in foreign currrecy,ie A$120 billion or equivalent.

we ignore the depreciation of Oz dollars.In this credit crunch crisis,i wander who are willing to lend A$120 billion to Oz.If we assume depreciation of Oz dollar at 20%,

then A$144 billion or equivalent will need to be raised.

FYI,one year budget of Ferderal gavaman is A$300 billion.

@@@@@@@@@

IMF reports states that:

http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

40%of Oz gross foreign debt in Oz dollars,

about 30 % of Oz foreign debt is in USD and 30 % in other currency.

Of the other currency,,i think majority is in Yen for its very low

interest rate.

,,,,,

-

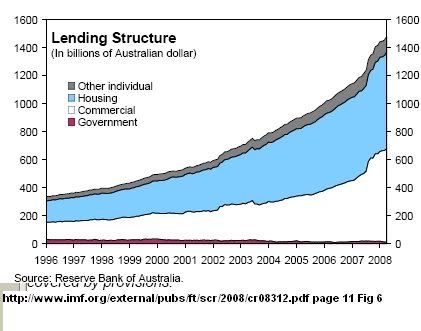

Wow!!Majority of oz banks funds come from wholesale sources.

Wholesale funds account for about 60 percent of total funding of the banking

system, and more than 40 percent of wholesale

funds come from offshore. Furthermore, about

30 percent of offshore funds and 75 percent of

domestic wholesale funds of Australian banks

have residual maturity of less than one year. This

funding structure makes the banks dependent on

a stable international and domestic funding

environment, and leaves them vulnerable to

increases in the cost of funds and to the

protracted loss of access to international shortterm

debt markets.http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

page 10,Box 1.

mmmm

-

I am sorry to tell u that oz financial institutuions,

ie banks,Financial company ,Building Society and

are in urgent need of cash.

One even give u 10% deposit interest rate!!

There are quite a few give u 8% and above.See to believe.

Ask your mom transfer to Oz lah..

http://www.interest.com.au/Borrowing/Mortgages/index.htm

http://www.interest.com.au/Investing/Term%20Deposits/index2.htm

INSTITUTION Minumum Deposit 1 yr 18mth 2 yrs 3 yrs 4 yrs 5 yrs $10,0009.009.50$5,00010.00Capital Insured$5,0008.75$5,0008.50 -

why do oz need to cover even credit unions and building society?

Have they been supervised as good as banks?

if not,then poor taxpayers have to protect the deposits

of rich men!!

http://www.treasury.gov.au/documents/1424/HTML/docshell.asp?URL=default.htm

Building Societies

- ABS Building Society Ltd

- B & E Ltd

- Greater Building Society Ltd

- Heritage Building Society Limited

- Home Building Society Ltd

- Hume Building Society Ltd

- IMB Ltd

- Lifeplan Australia Building Society Limited

- Maitland Mutual Building Society Limited

- Newcastle Permanent Building Society Limited

- The Rock Building Society Limited

- Wide Bay Australia Ltd

Credit Unions

- Alliance One Credit Union Ltd

- AMP Credit Union Ltd

- Austral Credit Union Limited

- Australian Central Credit Union Ltd

- Australian Country Credit Union Ltd (trading as Reliance Credit Union)

- Australian Defence Credit Union Limited

- AWA Credit Union Limited

- Bananacoast Community Credit Union Ltd

- Bankstown City Credit Union Ltd

- Berrima District Credit Union Ltd

- Big Sky Credit Union Ltd

- Broadway Credit Union Ltd

- CAPE Credit Union Limited

- Capital Credit Union Ltd

- Capricornia Credit Union Ltd

- Central Murray Credit Union Limited

- Central West Credit Union Limited

- Circle Credit Co-operative Limited

- Coastline Credit Union Limited

- Collie Miners Credit Union Ltd

- Community Alliance Credit Union Limited

- Community CPS Australia Limited

- Community First Credit Union Limited

- Companion Credit Union Limited

- Comtax Credit Union Limited (including the former Security Credit Union)

- Country First Credit Union Ltd

- Credit Union Australia Ltd

- CSR and Rinker Employees Credit Union Limited

- Defence Force Credit Union Limited

- Dnister Ukrainian Credit Co-operative Limited

- Electricity Credit Union Ltd

- Encompass Credit Union Limited

- Esso Employees' Credit Union Ltd

- Eurobodalla Credit Union Ltd

- Family First Credit Union Limited

- Fire Brigades Employees' Credit Union Limited

- Fire Service Credit Union Limited

- Firefighters & Affiliates Credit Co-operative Limited

- First Choice Credit Union Ltd

- First Option Credit Union Limited

- Fitzroy & Carlton Community Credit Co-operative Limited

- Ford Co-operative Credit Society Limited

- Gateway Credit Union Ltd

- Geelong & District Credit Co-operative Society Limited

- GMH (Employees) Q.W.L. Credit Co-operative Limited

- Goldfields Credit Union Ltd

- Gosford City Credit Union Limited

- Goulburn Murray Credit Union Co-operative Limited

- H.M.C. Staff Credit Union Ltd

- Heritage Isle Credit Union Limited

- Holiday Coast Credit Union Ltd

- Horizon Credit Union Ltd

- Hunter Mutual Limited

- Hunter United Employees' Credit Union Limited

- Industries Mutual Credit Union Limited

- Intech Credit Union Limited

- Karpaty Ukrainian Credit Union Limited

- La Trobe Country Credit Co-operative Limited

- La Trobe University Credit Union Co-operative Limited

- Laboratories Credit Union Limited

- Latvian Australian Credit Co-operative Society Limited

- Lithuanian Co-operative Credit Society "Talka" Limited

- Lysaght Credit Union Ltd

- MacArthur Credit Union Ltd

- Macquarie Credit Union Limited

- Maleny and District Community Credit Union Limited

- Manly Warringah Credit Union Limited

- Maritime, Mining & Power Credit Union Limited

- Maroondah Credit Union Ltd

- MECU Limited

- Melbourne University Credit Union Limited

- MemberFirst Credit Union Limited

- MyState Financial Credit Union of Tasmania Limited

- New England Credit Union Ltd

- Newcom Colliery Employees Credit Union Ltd

- Northern Inland Credit Union Limited

- Nova Credit Union Limited

- NSW Teachers Credit Union Ltd

- Old Gold Credit Union Co-operative Limited

- Orange Credit Union Limited

- Phoenix (N.S.W.) Credit Union Limited

- Plenty Credit Co-operative Limited

- Police & Nurses Credit Society Limited

- Police Association Credit Co-operative Limited

- Police Credit Union Limited

- Polish Community Credit Union Ltd

- Powerstate Credit Union Ltd

- Pulse Credit Union Limited

- Qantas Staff Credit Union Limited

- Queensland Country Credit Union Limited

- Queensland Police Credit Union Limited

- Queensland Professional Credit Union Ltd

- Queensland Teachers' Credit Union Limited

- Queenslanders Credit Union Limited

- Railways Credit Union Limited

- RegionalOne Credit Union Limited

- Resources Credit Union Limited

- R.T.A. Staff Credit Union Limited

- Satisfac Direct Credit Union Limited

- Savings and Loans Credit Union (S.A.) Ltd

- Security Credit Union (which was taken over by Comtax Credit Union on 1 October 2008)

- Select Credit Union Limited

- Service One Credit Union Limited

- SGE Credit Union Limited

- Shell Employees' Credit Union Limited

- South West Slopes Credit Union Ltd

- Southern Cross Credit Union Ltd

- South-West Credit Union Co-operative Limited

- St Mary's Swan Hill Co-operative Credit Society Limited

- StateWest Financial Services Limited

- Sutherland Credit Union Ltd

- Sutherland Shire Council Employees' Credit Union Ltd

- Sydney Credit Union Ltd

- Tartan Credit Union Ltd

- The Broken Hill Community Credit Union Ltd

- The Gympie Credit Union Ltd

- The Police Department Employees' Credit Union Limited

- The Summerland Credit Union Limited

- The TAFE and Community Credit Union Ltd

- The University Credit Society Limited

- Traditional Credit Union Limited

- TransComm Credit Co-operative Limited

- United Credit Union Limited

- Victoria Teachers Credit Union Limited

- Wagga Mutual Credit Union Ltd

- Warwick Credit Union Ltd

- WAW Credit Union Co-operative Limited

- Westax Credit Society Ltd

- Woolworths Employees' Credit Union Limited

- Wyong Council Credit Union Ltd

Other ADIs

- Cairns Penny Savings & Loans Limited

- Australian Settlements Limited

- Cuscal Limited

- Indue Ltd

-

Originally posted by lionnoisy:

at last i find this.

Up to A$240 billion need to be raised before March 2009

As at March 2008,short term loans amounting to 40 % of GDP will be matured in 0ne years.I wander how Oz can settle this amount of A$400 billion in one year from

March 2008.

http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

Risks of depreciation of Oz $$

u can read in the following IMF report that

60 % of Oz gross foreign debt in non--oz currency.

If we follow 60%,then A$240 billion in foreign currency need to

be settled before March 2009.

FYI,annual budget of Oz Ferderal gavaman is A$300 b!!

Let assume out of this A$400 billion loan to be settled before March 2009,

there is only 30 % in foreign currrecy,ie A$120 billion or equivalent.

we ignore the depreciation of Oz dollars.In this credit crunch crisis,i wander who are willing to lend A$120 billion to Oz.If we assume depreciation of Oz dollar at 20%,

then A$144 billion or equivalent will need to be raised.

FYI,one year budget of Ferderal gavaman is A$300 billion.

@@@@@@@@@

IMF reports states that:

http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

40%of Oz gross foreign debt in Oz dollars,

about 30 % of Oz foreign debt is in USD and 30 % in other currency.

Of the other currency,,i think majority is in Yen for its very low

interest rate.

,,,,,

I wonder if people can be banned for spamming their own threads.

-

Oz bank analysts says interest rate will be cut 1.5% point more.

One Assoc. Professor,(lah,not Professor)says will drop to zero0000000000.

Zero per cent

University of Western Sydney associate professor of economics and finance Steve Keen is radically bullish on interest rates, predicting a 2% cash rate by the end of 2009, dropping to 0% in 2010.

Dr Keen said the RBA would become more concerned about high household debt levels than inflation, as deep rate cuts in 2009 failed to stimulate the economy.

''The debt bubble is bursting and when it bursts, people stop spending and borrowing,'' he said.

http://business.smh.com.au/business/zero-interest-rate-a-possibility-20081016-524u.html

@@@@@@@@@@@@@@@

do u guys know Oz ganvaman and consumers' debts is 1,400 billions or

140% of GDP!!Oz budget is A$300 b a year.

http://www.imf.org/external/pubs/ft/scr/2008/cr08312.pdf

say interest rate 7 % pa.then interest burden is A$4900 per capita!!

or about A$20,000 per family in a year!!

@@@@@@@@2

Oz is rich to enjoy loan of 140% of GDP!!

Singapore is so poor that all debts to GDP ratio is 0.95!!

http://www.singstat.gov.sg/stats/themes/economy/ess/essa11.pdf

http://www.singstat.gov.sg/stats/themes/economy/ess/essa135.pdf

SG all loans---S$ 233 billion at end of 2007

GDP---at end of 2007 at current market price--S$ 243 b!!

lll.

-

still spamming... but after that warning, the post is not as long...

-

Originally posted by AndrewPKYap:

still spamming... but after that warning, the post is not as long...

hi uncle yap,i think u dunt know much about oz before i shared here right?

have u sold all of your A$ when it bounces back?

Major portions of loans are granted by non--banks

which are at most risks.

-

Originally posted by lionnoisy:

hi uncle yap,i think u dunt know much about oz before i shared here right?

have u sold all of your A$ when it bounces back?

Major portions of loans are granted by non--banks

which are at most risks.

What sold off my Aussie dollars when it bounced back?

My wife wanted to migrate to Australia (talking about it a few years back) but I was thinking about Thailand, 3rd world but we will live like kings because everything is so cheap. Live better than 1st world in a 3rd world country because everything so cheap.

So I asked her yesterday, "Do you have Aussie dollars?"

"Yes," she said.

"How much?" I asked her.

"About twenty" she said.

"Twenty thousand?" I asked

"Twenty dollars," she said, "left over from the last holiday there."

So as to your question, "have u sold all of your A$ when it bounces back?"

The answer is "no, I haven't sold off the AUD$20.00 when it bounced back."

I am more concerned about the Singapore dollar....