Aussie dollar--jumping kangaroo or paper kangaroo?

-

Originally posted by AndrewPKYap:

What sold off my Aussie dollars when it bounced back?

My wife wanted to migrate to Australia (talking about it a few years back) but I was thinking about Thailand, 3rd world but we will live like kings because everything is so cheap. Live better than 1st world in a 3rd world country because everything so cheap.

So I asked her yesterday, "Do you have Aussie dollars?"

"Yes," she said.

"How much?" I asked her.

"About twenty" she said.

"Twenty thousand?" I asked

"Twenty dollars," she said, "left over from the last holiday there."

So as to your question, "have u sold all of your A$ when it bounces back?"

The answer is "no, I haven't sold off the AUD$20.00 when it bounced back."

I am more concerned about the Singapore dollar....

Uncle, auntie dun trust Thai gals lah. She -

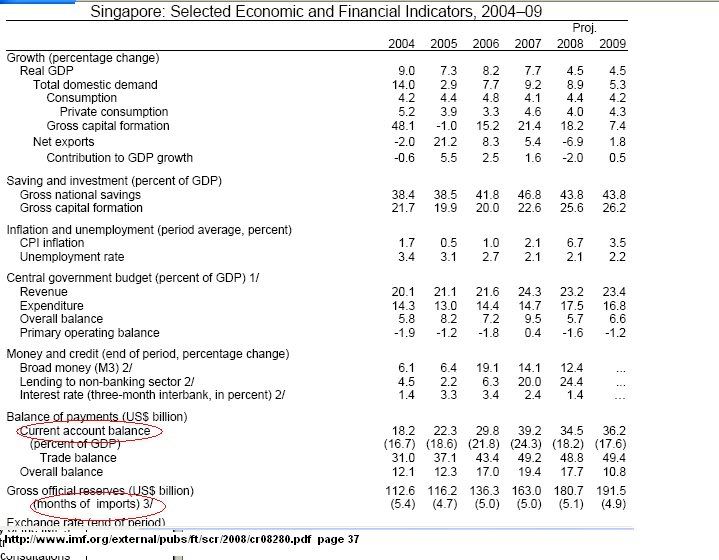

u can also examinae SG by reading IMF report.

http://www.imf.org/external/pubs/ft/scr/2008/cr08280.pdf

Pl note the government domestic debts of 100 % GDP is bonds

issued to CFP BOARD.No worry.

under p 25

Gross government domestic debt 9/

9/ Data for end of calendar year. The table reports gross debt and does not reflect large net asset position of the government. Gross debt is

(for a large part) issued to the Central Provident Fund (CPF) and as part of the Singapore Government Securities (SGS) program.

-

A simple reason why Singapore does not have much foreign debt.

Singapore exploits it's citizens under the CPF, where it uses funds at extremely low interest rates of 2.5% (while inflation hovers around 6% - 8%). If there is such cheap funds available, wherefore there be need to raise funds through the foreign or domestic market at prevailing inflation rates (afterall which fool would loan you at 1% if inflation is at 6%?). We do not have foreign debt, but our domestic debt owed to CPF members is valued at SGD 136 billon. If the government issues domestic debt, it is unlikely to suffer from payments issues, afterall all it has to do is print more currency (fiat currency).

Then they charge you excessively for HDB and Medical services, making it hard for average folks to plan for retirement. Should any major illness befall you, then as an average Singaporean, you can kiss half your retirement savings adios.

-

u can also examinae SG by reading IMF report.

http://www.imf.org/external/pubs/ft/scr/2008/cr08280.pdf

What does that tiny picture of the merlion have anything to do with your post?

It only detracts from your post and is a distraction, lending an disjointed air to your entire point and making it irrelevant and hard to understand.

Bad choice of picture lionnoisy, bad choice.

-

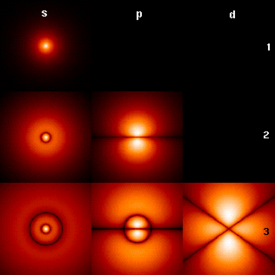

I think lionnoisy's post is as legible to the layman as Quantum mechnics:

Quantum mechanics

From Wikipedia, the free encyclopedia

For a generally accessible and less technical introduction to the topic, see Introduction to quantum mechanics.Quantum mechanics

Uncertainty principle Introduction to...

Mathematical formulation of...

[show]Background [show]Fundamental concepts [show]Experiments [show]Formulations [show]Equations [show]Interpretations [show]Advanced topics [show]Scientists  Fig. 1: Probability densities corresponding to the wavefunctions of an electron in a hydrogen atom possessing definite energy (increasing downward: n = 1, 2, 3, ...) and angular momentum (increasing across: s, p, d,...). Brighter areas correspond to higher probability density for a position measurement. Wavefunctions like these are directly comparable to Chladni's figures of acoustic modes of vibration in classical physics and are indeed modes of oscillation as well: they possess a sharp energy and thus a keen frequency. The angular momentum and energy are quantized, and only take on discrete values like those shown (as is the case for resonant frequencies in acoustics).

Fig. 1: Probability densities corresponding to the wavefunctions of an electron in a hydrogen atom possessing definite energy (increasing downward: n = 1, 2, 3, ...) and angular momentum (increasing across: s, p, d,...). Brighter areas correspond to higher probability density for a position measurement. Wavefunctions like these are directly comparable to Chladni's figures of acoustic modes of vibration in classical physics and are indeed modes of oscillation as well: they possess a sharp energy and thus a keen frequency. The angular momentum and energy are quantized, and only take on discrete values like those shown (as is the case for resonant frequencies in acoustics).Quantum mechanics is the study of mechanical systems whose dimensions are close to the atomic scale, such as molecules, atoms, electrons, protons and other subatomic particles. Quantum mechanics is a fundamental branch of physics with wide applications. Quantum theory generalizes classical mechanics to provide accurate descriptions for many previously unexplained phenomena such as black body radiation and stable electron orbits. The effects of quantum mechanics become evident at the atomic and subatomic level, and they are typically not observable on macroscopic scales. Superfluidity is one of the known exceptions to this rule.

Contents

[hide][edit] Overview

The word “quantum” came from the Latin word which means "how great" or "how much." In quantum mechanics, it refers to a discrete unit that quantum theory assigns to certain physical quantities, such as the energy of an atom at rest (see Figure 1, at right). The discovery that waves have discrete energy packets (called quanta) that behave in a manner similar to particles led to the branch of physics that deals with atomic and subatomic systems which we today call quantum mechanics. It is the underlying mathematical framework of many fields of physics and chemistry, including condensed matter physics, solid-state physics, atomic physics, molecular physics, computational chemistry, quantum chemistry, particle physics, and nuclear physics. The foundations of quantum mechanics were established during the first half of the twentieth century by Werner Heisenberg, Max Planck, Louis de Broglie, Albert Einstein, Niels Bohr, Erwin Schrödinger, Max Born, John von Neumann, Paul Dirac, Wolfgang Pauli and others. Some fundamental aspects of the theory are still actively studied.

Quantum mechanics is essential to understand the behavior of systems at atomic length scales and smaller. For example, if classical mechanics governed the workings of an atom, electrons would rapidly travel towards and collide with the nucleus, making stable atoms impossible. However, in the natural world the electrons normally remain in an unknown orbital path around the nucleus, defying classical electromagnetism.

Quantum mechanics was initially developed to provide a better explanation of the atom, especially the spectra of light emitted by different atomic species. The quantum theory of the atom was developed as an explanation for the electron's staying in its orbital, which could not be explained by Newton's laws of motion and by Maxwell's laws of classical electromagnetism.

In the formalism of quantum mechanics, the state of a system at a given time is described by a complex wave function (sometimes referred to as orbitals in the case of atomic electrons), and more generally, elements of a complex vector space. This abstract mathematical object allows for the calculation of probabilities of outcomes of concrete experiments. For example, it allows one to compute the probability of finding an electron in a particular region around the nucleus at a particular time. Contrary to classical mechanics, one can never make simultaneous predictions of conjugate variables, such as position and momentum, with arbitrary accuracy. For instance, electrons may be considered to be located somewhere within a region of space, but with their exact positions being unknown. Contours of constant probability, often referred to as “clouds” may be drawn around the nucleus of an atom to conceptualize where the electron might be located with the most probability. Heisenberg's uncertainty principle quantifies the inability to precisely locate the particle.

The other exemplar that led to quantum mechanics was the study of electromagnetic waves such as light. When it was found in 1900 by Max Planck that the energy of waves could be described as consisting of small packets or quanta, Albert Einstein exploited this idea to show that an electromagnetic wave such as light could be described by a particle called the photon with a discrete energy dependent on its frequency. This led to a theory of unity between subatomic particles and electromagnetic waves called wave–particle duality in which particles and waves were neither one nor the other, but had certain properties of both. While quantum mechanics describes the world of the very small, it also is needed to explain certain “macroscopic quantum systems” such as superconductors and superfluids.

Broadly speaking, quantum mechanics incorporates four classes of phenomena that classical physics cannot account for: (i) the quantization (discretization) of certain physical quantities, (ii) wave-particle duality, (iii) the uncertainty principle, and (iv) quantum entanglement. Each of these phenomena is described in detail in subsequent sections.

[edit] History

The history of quantum mechanics began essentially with the 1838 discovery of cathode rays by Michael Faraday, the 1859 statement of the black body radiation problem by Gustav Kirchhoff, the 1877 suggestion by Ludwig Boltzmann that the energy states of a physical system could be discrete, and the 1900 quantum hypothesis by Max Planck that any energy is radiated and absorbed in quantities divisible by discrete ‘energy elements’, E, such that each of these energy elements is proportional to the frequency ν with which they each individually radiate energy, as defined by the following formula:

where h is Planck's Action Constant. Although Planck insisted that this was simply an aspect of the absorption and radiation of energy and had nothing to do with the physical reality of the energy itself, in 1905, to explain the photoelectric effect (1839), i.e. that shining light on certain materials can function to eject electrons from the material, Albert Einstein postulated, as based on Planck’s quantum hypothesis, that light itself consists of individual quanta, which later came to be called photons (1926). From Einstein's simple postulation was borne a flurry of debating, theorizing and testing, and thus, the entire field of quantum physics.

[edit] Relativity and quantum mechanics

The modern world of physics is founded on two tested and demonstrably sound theories of general relativity and quantum mechanics —theories which appear to contradict one another. The defining postulates of both Einstein's theory of relativity and quantum theory are indisputably supported by rigorous and repeated empirical evidence. However, while they do not directly contradict each other theoretically (at least with regard to primary claims), they are resistant to being incorporated within one cohesive model.

Einstein himself is well known for rejecting some of the claims of quantum mechanics. While clearly inventive in this field, he did not accept the more philosophical consequences and interpretations of quantum mechanics, such as the lack of deterministic causality and the assertion that a single subatomic particle can occupy numerous areas of space at one time. He also was the first to notice some of the apparently exotic consequences of entanglement and used them to formulate the Einstein-Podolsky-Rosen paradox, in the hope of showing that quantum mechanics has unacceptable implications. This was 1935, but in 1964 it was shown by John Bell (see Bell inequality) that Einstein's assumption that quantum mechanics is correct, but has to be completed by hidden variables, was based on wrong philosophical assumptions: according to the paper of J. Bell and the Copenhagen interpretation (the common interpretation of quantum mechanics by physicists for decades), and contrary to Einstein's ideas, quantum mechanics is

- neither a "realistic" theory (since quantum measurements do not state pre-existing properties, but rather they prepare properties)

- nor a local theory (essentially not, because the state vector

determines simultaneously the probability amplitudes at all sites,

determines simultaneously the probability amplitudes at all sites,  ).

).

The Einstein-Podolsky-Rosen paradox shows in any case that there exist experiments by which one can measure the state of one particle and instantaneously change the state of its entangled partner, although the two particles can be an arbitrary distance apart; however, this effect does not violate causality, since no transfer of information happens. These experiments are the basis of some of the most topical applications of the theory, quantum cryptography, which works well, although at small distances of typically

1000 km, being on the market since 2004.

1000 km, being on the market since 2004.There do exist quantum theories which incorporate special relativity—for example, quantum electrodynamics (QED), which is currently the most accurately tested physical theory [1]—and these lie at the very heart of modern particle physics. Gravity is negligible in many areas of particle physics, so that unification between general relativity and quantum mechanics is not an urgent issue in those applications. However, the lack of a correct theory of quantum gravity is an important issue in cosmology.

[edit] Attempts at a unified theory

Inconsistencies arise when one tries to join the quantum laws with general relativity, a more elaborate description of spacetime which incorporates gravitation. Resolving these inconsistencies has been a major goal of twentieth- and twenty-first-century physics. Many prominent physicists, including Stephen Hawking, have labored in the attempt to discover a "Grand Unification Theory" that combines not only different models of subatomic physics, but also derives the universe's four forces—the strong force, electromagnetism, weak force, and gravity— from a single force or phenomenon.

[edit] Quantum mechanics and classical physics

Predictions of quantum mechanics have been verified experimentally to a very high degree of accuracy. Thus, the current logic of correspondence principle between classical and quantum mechanics is that all objects obey laws of quantum mechanics, and classical mechanics is just a quantum mechanics of large systems (or a statistical quantum mechanics of a large collection of particles). Laws of classical mechanics thus follow from laws of quantum mechanics at the limit of large systems or large quantum numbers.

Main differences between classical and quantum theories have already been mentioned above in the remarks on the Einstein-Podolsky-Rosen paradox. Essentially the difference boils down to the statement that quantum mechanics is coherent (addition of amplitudes), whereas classical theories are incoherent (addition of intensities). Thus, such quantities as coherence lengths and coherence times come into play. For microscopic bodies the extension of the system is certainly much smaller than the coherence length; for macroscopic bodies one expects that it should be the other way round.

This is in accordance with the following observations:

Many “macroscopic” properties of “classic” systems are direct consequences of quantum behavior of its parts. For example, stability of bulk matter (which consists of atoms and molecules which would quickly collapse under electric forces alone), rigidity of this matter, mechanical, thermal, chemical, optical and magnetic properties of this matter—they are all results of interaction of electric charges under the rules of quantum mechanics.

Whilst seemingly exotic behavior of matter posited by quantum mechanics and relativity theory become more apparent when dealing with extremely fast-moving or extremely tiny particles, the laws of classical “Newtonian” physics still remain accurate in predicting the behavior of surrounding (“large”) objects—of the order of the size of large molecules and bigger—at velocities much smaller than the velocity of light.

[edit] Theory

There are numerous mathematically equivalent formulations of quantum mechanics. One of the oldest and most commonly used formulations is the transformation theory proposed by Cambridge theoretical physicist

-

I disagree with the Grand Unification Theory part though... why must have a constant?

-

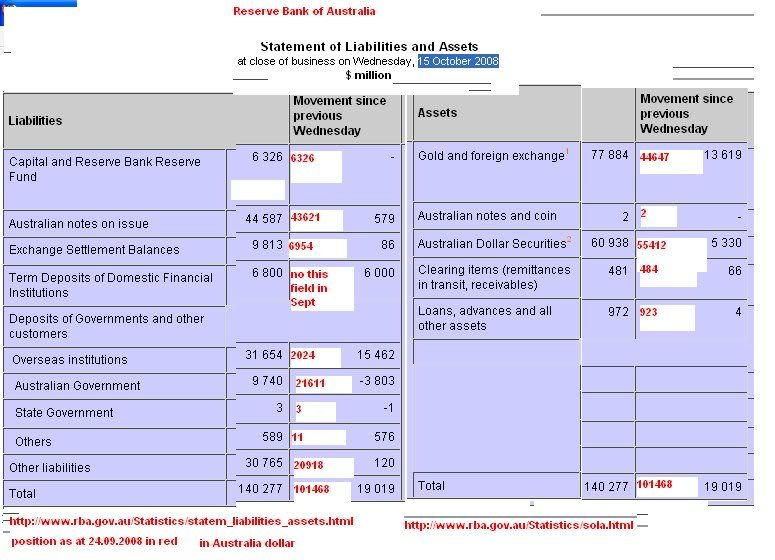

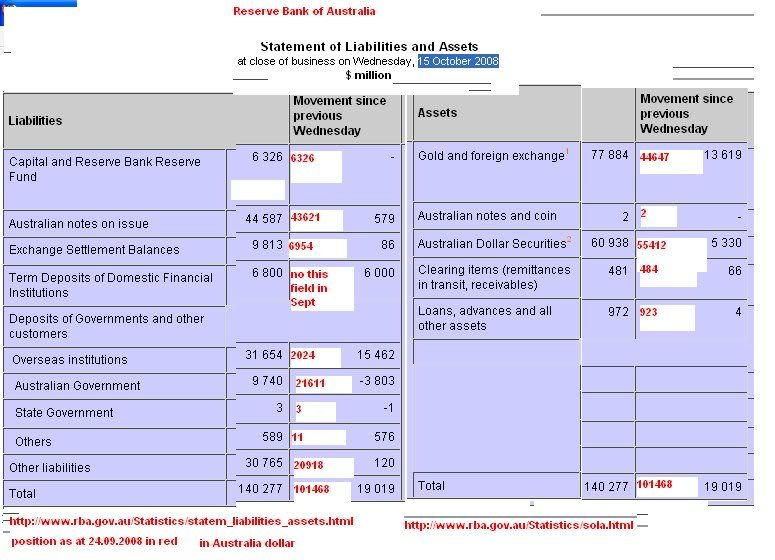

How would u feel if your CPF was used to funds

national infrastructures projects ?

Some one would rally u to Speaker Corner.Right?

There is report in Oz that Rudd 747 may tab on A$1 trillion

Superannuation Funds – Outside Life Offices - B15

to fund infrastructures projects.

This is really a hard sale!

Australians keen to put super into building projects: Albanese

Friday October 17, 2008, 1:04 pmFederal Infrastructure Minister Anthony Albanese says Australians are keen to see their superannuation funds invested in national building projects.

http://au.biz.yahoo.com/081017/31/202xn.html

This is another news of the Super funds.

http://www.theaustralian.news.com.au/story/0,25197,24444072-5013404,00.html

Superannuation 'drains bank funds', says IMF

A$372 b Short term wholesale funds of Oz banks post a threat

http://www.bankers.asn.au/default.aspx?ArticleID=1233

Deposits - Retail

$634

48%

Short-term funds - total

$372

28%

-

Long-term funds - total

$319

24%

Total

$1,326

100%

Oz journalist also take note of the threat,so does IMF report.

http://www.theaustralian.news.com.au/story/0,25197,24451395-5017885,00.html

Yes, the big four banks make big profits, but they're exposed to having to roll over $160 billion or so in short-term debt on offshore wholesale markets.

i can bet with u other regional banks ,building socity and credit unions

also took this smart move of "Borrow low and lend high"!!

...

-

Originally posted by lionnoisy:

How would u feel if your CPF was used to funds

national infrastructures projects ?

Some one would rally u to Speaker Corner.Right?

There is report in Oz that Rudd 747 may tab on A$1 trillion

Superannuation Funds – Outside Life Offices - B15

to fund infrastructures projects.

This is another news of the Super funds.

http://www.theaustralian.news.com.au/story/0,25197,24444072-5013404,00.html

Superannuation 'drains bank funds', says IMF

A$372 b Short term wholesale funds of Oz banks post a threat

http://www.bankers.asn.au/default.aspx?ArticleID=1233

Deposits - Retail

$634

48%

Short-term funds - total

$372

28%

Hahaha..............

You pwn yourself!!!

In the 1980s CPF was used to fund SMRT, also other infrastructure projects like Singapore Power, else where you think they get the money.

After they have constructed these projects using our money, they charge you excessively for the use of such services.

-

Originally posted by maurizio13:

Hahaha..............

You pwn yourself!!!

In the 1980s CPF was used to fund SMRT, also other infrastructure projects like Singapore Power, else where you think they get the money.

After they have constructed these projects using our money, they charge you excessively for the use of such services.

On the other hand,CPF members need not to take risks,

just take the minimum 2.5% interest.

how about Oz?Do Oz Super member gets any minimum interest if they

dunt invest in anything?

Australian banks ranked fourth in WEF financial institutions survey

Australia's banks have been ranked fourth in a survey of the strength of the world's financial institutions.

Australian Prime Minister Kevin Rudd says the World Economic Forum report confirms the importance of having a stable banking sector, in the current global economic turmoil.http://www.radioaustralia.net.au/news/stories/200810/s2387008.htm

u will know one or two year laters if this is a correct assessment.

Rating agencies also gave AAA to many fallen giant companies,

.......

The Short term wholesale Oz banks funds will kill them.

...

-

Originally posted by lionnoisy:

On the other hand,CPF members need not to take risks,

just take the minimum 2.5% interest.

how about Oz?Do Oz Super member gets any minimum interest if they

dunt invest in anything?

Australian banks ranked fourth in WEF financial institutions survey

http://www.radioaustralia.net.au/news/stories/200810/s2387008.htm

u will know one or two year laters if this is a correct assessment.

Rating agencies also gave AAA to many fallen giant companies,

.......

The Short term wholesale Oz banks funds will kill them.

...

Singapore Dollar Crashes!

People experiencing psychosis may report hallucinations or delusional beliefs, and may exhibit personality changes and disorganized thinking. This may be accompanied by unusual or bizarre behavior, as well as difficulty with social interaction and impairment in carrying out the activities of daily living.

A wide variety of central nervous system diseases, from both external toxins, and from internal physiologic illness, can produce symptoms of psychosis. This disease link has led to the metaphor of psychosis as the 'fever' of CNS illness—a serious but nonspecific indicator.[1][2]

However, many people have unusual and distinct (unshared) experiences of different realities at some point in their lives, without being impaired or even distressed by these experiences. For example, many people have experienced visions of some kind, and some have even found inspiration or religious revelation in them.[3] As a result, it has been argued that psychosis is not fundamentally separate from normal consciousness, but rather, is on a continuum with normal consciousness.[4] In this view, people who are clinically found to be psychotic may simply be having particularly intense or distressing experiences (see schizotypy).

In contemporary culture, the term "psychotic" is often incorrectly used interchangeably with "psychopathic" (which describes a more long-term condition prone to violence, rarely having hallucinations).

Contents

[hide][edit] Signs and symptoms

People with psychosis may have one or more of the following: hallucinations, delusions, thought disorder, or lack of insight (each described below). The symptoms are similar in nature to mental confusion and delirium. [5]

[edit] Hallucinations

Hallucinations are defined as sensory perception in the absence of external stimuli. They are different from illusions, or perceptual distortions, which are the misperception of external stimuli.[6] Hallucinations may occur in any of the five senses and take on almost any form, which may include simple sensations (such as lights, colors, tastes, and smells) to more meaningful experiences such as seeing and interacting with fully formed animals and people, hearing voices and complex tactile sensations.

Auditory hallucinations, particularly the experience of hearing voices, are a common and often prominent feature of psychosis. Hallucinated voices may talk about, or to the person, and may involve several speakers with distinct personas. Auditory hallucinations tend to be particularly distressing when they are derogatory, commanding or preoccupying. However, the experience of hearing voices need not always be a negative one. Research has shown that the majority of people who hear voices are not in need of psychiatric help.[7] The Hearing Voices Movement has subsequently been created to support voice hearers, regardless of whether they are considered to have a mental illness or not.

[edit] Delusions

Psychosis may involve delusional beliefs, some of which are paranoid in nature. Karl Jaspers classified psychotic delusions into primary and secondary types. Primary delusions are defined as arising suddenly and not being comprehensible in terms of normal mental processes, whereas secondary delusions may be understood as being influenced by the person's background or current situation (e.g., ethnic or sexual orientation, religious beliefs, superstitious belief).[8]

[edit] Thought disorder

Formal thought disorder describes an underlying disturbance to conscious thought and is classified largely by its effects on speech and writing. Affected persons may show pressure of speech (speaking incessantly and quickly), derailment or flight of ideas (switching topic mid-sentence or inappropriately), thought blocking, and rhyming or punning.

[edit] Lack of insight

One important and puzzling feature of psychosis is usually an accompanying lack of insight into the unusual, strange, or bizarre nature of the person's experience or behaviour.[9] Even in the case of an acute psychosis, people may be completely unaware that their vivid hallucinations and delusions are in any way "unrealistic". This is not an absolute, however; insight can vary between individuals and throughout the duration of the psychotic episode.

It was previously believed that lack of insight was related to general cognitive dysfunction[10] or to avoidant coping style.[11] Later studies have found no statistical relationship between insight and cognitive function, either in groups of people who only have schizophrenia,[12] or in groups of psychotic people from various diagnostic categories.[13]

[edit] Classification

In medical practice today, a descriptive approach to psychosis (and to all mental illness) is used, based on behavioral and clinical observations. This approach is adopted in the standard guide to psychiatric diagnoses employed in the United States, the Diagnostic and Statistical Manual of Mental Disorders (DSM). Since the DSM provides a widely-used standard of reference, the description presented here will largely reflect that point of view.

According to the DSM-IV-TR, the term psychosis has had many definitions in the past, both broad and narrow. The broadest was not being able to meet the demands of everyday life. The narrowest was delusions or hallucinations without insight. A middle ground may be delusions, hallucinations with or without insight, as well as disorganized behavior or speech. Thus, psychosis can be a symptom of mental illness, but it is not a mental illness in its own right. For example, people with schizophrenia often experience psychosis, but so can people with bipolar disorder (manic depression), unipolar depression, delirium, or drug withdrawal.[14][1] People diagnosed with these conditions can also have long periods without psychosis, and some may never experience them again. Conversely, psychosis can occur in people who do not have chronic mental illness (e.g. due to an adverse drug reaction or extreme stress).[15]

Psychosis should be distinguished from:

- insanity, which is a legal term denoting that a person is not criminally responsible for his or her actions.[16] "Insanity is no longer considered a medical diagnosis..." [17]

- psychopathy, a general term for a range of personality disorders characterized by lack of empathy, socially manipulative behavior, and occasionally criminality or violence.[18] Despite both being abbreviated to the slang word "psycho", psychosis bears little similarity to the core features of psychopathy, particularly with regard to violence, which rarely occurs in psychosis,[19][20] and distorted perception of reality, which rarely occurs in psychopathy.[21]

- delirium: a psychotic individual may be able to perform actions that require a high level of intellectual effort in clear consciousness, whereas a delirious individual will have impaired memory and cognitive function.

The DSM-IV-TR lists 9 formal psychotic disorders, but many other disorders may have psychotic symptoms. The formal psychotic disorders are:

- Schizophrenia

- Schizoaffective disorder

- Schizophreniform disorder

- Brief psychotic disorder

- Delusional

- Shared psychotic disorder (Folie à deux)

- Substance induced psychosis

- Psychosis due to a general medical condition

- Psychosis - Not otherwise specified

[edit] Causes

Causes of symptoms of mental illness were customarily classified as "organic" or "functional". Organic conditions were primarily medical or pathophysiological, whereas, functional conditions are primarily psychiatric or psychological. The DSM-IV-TR no longer classifies psychotic disorders as functional or organic. Rather it lists traditional psychotic illnesses, psychosis due to General Medical conditions, and Substance induced psychosis.

[edit] Psychiatric

Functional causes of psychosis include the following:

- schizophrenia

- bipolar disorder (manic depression)

- severe clinical depression

- severe psychosocial stress

- sleep deprivation

- some focal epileptic disorders especially if the temporal lobe is affected

A psychotic episode can be significantly affected by mood. For example, people experiencing a psychotic episode in the context of depression may experience persecutory or self-blaming delusions or hallucinations, while people experiencing a psychotic episode in the context of mania may form grandiose delusions.

Stress is known to contribute to and trigger psychotic states. A history of psychologically traumatic events, and the recent experience of a stressful event, can both contribute to the development of psychosis. Short-lived psychosis triggered by stress is known as brief reactive psychosis, and patients may spontaneously recover normal functioning within two weeks.[15] In some rare cases, individuals may remain in a state of full-blown psychosis for many years, or perhaps have attenuated psychotic symptoms (such as low intensity hallucinations) present at most times.

Sleep deprivation has been linked to psychosis.[22][23][24] However, this is not a risk for most people, who merely experience hypnagogic or hypnopompic hallucinations, i.e. unusual sensory experiences or thoughts that appear during waking or drifting off to sleep. These are normal sleep phenomena and are not considered signs of psychosis.[25]

Vitamin B12 deficiency can also cause symptoms of mania and psychosis.[26][27]

[edit] General medical

Psychosis arising from "organic" (non-psychological) conditions is sometimes known as secondary psychosis. It can be associated with the following pathologies:

- neurological disorders, including:

- electrolyte disorders such as:

- hypoglycemia[47]

- lupus[48]

- AIDS[49]

- leprosy[50][51]

- malaria[52]

- Adult-onset vanishing white matter leukoencephalopathy[53]

- Late-onset metachromatic leukodystrophy[54][55][56]

Psychosis can even be caused by apparently innocuous ailments such as flu[57][58] or mumps.[59]

[edit] Psychoactive drug use

Psychotic states may occur after ingesting a variety of substances both legal and illegal and both prescription and non prescription. Drugs whose use, abuse or withdrawal are implicated include:

- alcohol[60][61][62]

- OTC drugs, such as:

- Dextromethorphan

- Certain antihistamines at high doses.[63][64][65][66]

- Cold Medications[67] (ie. containing Phenylpropanolamine, or PPA)

- prescription drugs:

- Illegal drugs, including:

- Stimulants

- Stimulants

-

List of Falling Singapore Stocks:

- Ahmes (c. 1650 B.C.E.) *MT

700 B.C.E.

- Baudhayana (c. 700)

600 B.C.E.

- Thales of Miletus (c. 630-c 550) *MT

- Apastamba (c. 600)

- Anaximander of Miletus (c. 610-c. 547) *SB

- Pythagoras of Samos (c. 570-c. 490) *SB *MT

- Anaximenes of Miletus (fl. 546) *SB

- Cleostratus of Tenedos (c. 520)

500 B.C.E.

- Katyayana (c. 500)

- Nabu-rimanni (c. 490)

- Kidinu (c. 480)

- Anaxagoras of Clazomenae (c. 500-c. 428) *SB *MT

- Zeno of Elea (c. 490-c. 430) *MT

- Antiphon of Rhamnos (the Sophist) (c. 480-411) *SB *MT

- Oenopides of Chios (c. 450?) *SB

- Leucippus (c. 450) *SB *MT

- Hippocrates of Chios (fl. c. 440) *SB

- Meton (c. 430) *SB

- Hippias of Elis (fl. c. 425) *SB *MT

- Theodorus of Cyrene (c. 425)

- Socrates (469-399)

- Philolaus of Croton (d. c. 390) *SB

- Democritus of Abdera (c. 460-370) *SB *MT

400 B.C.E.

- Hippasus of Metapontum (or of Sybaris or Croton) (c. 400?)

- Archytas of Tarentum (of Taras) (c. 428-c. 347) *SB *MT

- Plato (427-347) *SB *MT

- Theaetetus of Athens (c. 415-c. 369) *MT

- Leodamas of Thasos (fl. c. 380) *SB

- Leon (fl. c. 375) *SB

- Eudoxus of Cnidos (c. 400-c. 347) *SB *MT

- Callipus of Cyzicus (fl. c. 370) *SB

- Xenocrates of Chalcedon (c. 396-314)

- Heraclides of Pontus (c. 390-c. 322)

- Bryson of Heraclea (c 350?)

- Menaechmus (c. 350) *SB

- Theudius of Magnesia (c. 350?)

- Thymaridas (c. 350)

- Dinostratus (fl. c. 350) *SB

- Speusippus (d. 339)

- Aristotle (384-322) *SB *MT

- Aristaeus the Elder (fl. c. 350-330) *SB *MT

- Eudemus of Rhodes (the Peripatetic) (fl. c. 335) *SB

300 B.C.E.

- Autolycus of Pitane (fl. c. 300) *SB

- Euclid (fl. c. 295) *SB *MT

- Aristarchus of Samos (c. 310-230) *SB *MT

- Archimedes of Syracuse (287-212) *SB *MT

- Philo of Byzantium (fl. c. 250) *SB

- Nicoteles of Cyrene (c. 250)

- Strato (c. 250)

- Persius (c. 250?)

- Eratosthenes of Cyrene (c. 276-c. 195) *SB *MT

- Chrysippus (280-206)

- Conon of Samos (fl. c. 245) *SB

- Apollonius of Perga (c. 260-c. 185) *SB *MT

- Nicomedes (c. 240?) *SB *MT

- Dositheus of Alexandria (fl. c. 230) *SB

- Perseus (fl. 300-70 B.C.E.?) *SB

200 B.C.E.

- Dionysodorus of Amisus (c. 200?) *SB

- Diocles of Carystus (fl. c. 180) *SB *MT

- Hypsicles of Alexandria (fl. c. 175) *SB *MT

- Hipparchus of Nicaea (c. 180-c. 125) *MT

- Umaswati (c. 150)

100 B.C.E.

- Zenodorus (c. 100?? BCE?)

- Posidonius (c. 135-c. 51) *SB

- Marcus Terentius Varro (116-27)

- Zeno of Sidon (c. 79 BCE)

- Geminus of Rhodes (fl. c. 77 BCE) *SB

- Cleomedes (c. 40? BCE?) *SB

1 C.E.

- Theodosius of Tripoli (c. 50? CE?)

- Pamphila (c. 60 CE)

- Heron of Alexandria (fl. 62 C.E.) (Hero) *SB *MT

100 C.E.

- Balbus (fl. c. 100) *SB

- Menelaus of Alexandria (c. 100 CE) *MT *SB

- Nicomachus of Gerasa (c. 100) *SB

- Zhang Heng (78-139)

- Theon of Smyrna (c. 125)

- Ptolemy (Claudius Ptolemaeus) (c. 100-c. 170) *SB *MT

- Marinus of Tyre (c. 150)

- Nehemiah (c. 150)

- Apuleius of Madaura (Lucius Apuleius) (c. 124-c. 170)

200 C.E.

- Diogenes Laertius (c. 200)

- Liu Hong (fl. 178-187)

- Wang Fan (217-257)

- Diophantus of Alexandria (c. 250?) *SB *MT

- Sun Zi (c. 250?)

- Zhao Shuang (Jun Qing) (c. 260)

- Liu Hui (c. 263) *SB

- Porphyry (c. 234-c. 305) (Malchus the Tyrian, Porphyrius)

- Anatolius of Alexandria (fl. c. 269) *SB

- Sporus (c. 280)

- Iamblichus (c. 250-c. 350) *SB

- Xiahou Yang (c. 350?)

300 C.E.

- Pappus of Alexandria (fl. c. 300-c. 350) *SB *MT

- Serenus of Antinopolis (c. 350)

- Pandrosion (c. 350)

- Theon of Alexandria (c. 390)

- Martianus Capella (c. 365-440) *SB

- Synesius of Cyrene (c. 370-c. 413)

- Hypatia of Alexandria (c. 370-415) *SB *MT

400 C.E.

- Dominus of Larissa (fl. c. 450) *SB

- Proclus Diadochus (410-485) *SB *MT

- Zhang Qiujian [Chang Ch'iu-chien] (c. 450?)

- Zu Chongzhi (Wenyuan) [Tsu Ch'ung-chih] (429-500) *MT

- Eutocius of Ascalon (fl. c. 480) *SB

- Marinus of Sichem (Neapolis) (c. 480?) *SB

500 C.E.

- Metrodorus (c. 500)

- Anicius Maulius Severinus Boethius (c. 480-524) *MT

- Simplicius of Cilicia (c. 530)

- Anthemius of Tralles (d. c. 534) *SB *MT

- Aryabhata (476-c. 550) *SB *MT

- Flavius Magnus Aurelius Cassiodorus (c. 480-c. 575) *SB

- John Philoponus (c. 490) *SB

- Varahamihira (c. 505-c. 558)

- Isidorus of Miletus (c. 540?) *SB

- Eutocius of Ascalon (c. 550?)

- Liu Zhuo (544-610)

- Zhen Luan (Shuzun) (fl. 566)

- Isidore of Seville (c. 560-636) *SB

600

- Brahmagupta (c. 598-c. 670) *MT

- Wang Xiaotong [Wang Hs'iao-t'ung] (fl. c. 625)

- Li Chunfeng (fl. 664)

- Bede (673-735) *SB

700

- Yi Xing (683-727)

- Levensita (fl. 718)

- Alcuin of York (c. 735-804) *SB *MT

- Muhammad ibn Ibrahim al-Fazari (fl. c. 771) *SB

800

- Banu Musa (Muhammad, Ahmand, and al-Hasan, sons of Musa ibn Shakir) (ninth century) *SB

- al-Hajjaj ibn Matar (c. 800)

- Abu Jafar Muhammad ibn Musa al-Khwarizmi (c. 780-c. 850) *SB *MT

- Hrabanus Maurus (784-856)

- Leo the Mathematician (c. 790-post 869) *SB

- Govindaswami (c. 800-850)

- al-Abbas ibn Said al-Jawhari (fl. c. 830) *SB

- Hunayn ibn Ishaq (Johannitius) (808-873)

- Pruthudakaswami (c. 850)

- `Abd al-Hamid ibn Turk (c. 850)

- Ahmad ibn `Abdullah al-Marwazi Habash al-Hasib (fl. 825-870) *SB

- Mahavira (Mahaviracharya) (c. 850) *SB

- Abu `Abd Allah Muhammad ibn Isa al-Mahani (fl. c. 860, d. c. 880) *SB

- Thabit ibn Qurra (836-901) *MT

- al-Fadl al-Nayrizi (c. 880)

- Qusta ibn Luka (d. 912)

- Abu Kamil Shuja ibn Aslam ibn Muhammad ibn Shuja (c. 850-c. 930) *SB

- Abu Bakr Muhammad ibn Zakariya al-Razi (Rhazes) (c. 865-c. 932) *SB

- Abu `Abd Allah Mohammad ibn Jabir al-Battani (Albatenius) (c. 858-929) *SB *MT

- Abu Nasr Muhammad ibn Muhammad Tarkhan ibn Awzalagh al-Farabi (Alpharabius) (c. 870-c. 950) *SB

- Abu'l-Abbas al-Fadl ibn al-Nayrizi (fl. c. 897, d. c. 922) *SB

900

- Sridhara (c. 900)

- Ahmad ibn Yusuf (fl. c. 900-905) *SB

- Ibrahim ibn Sinan ibn Thabit ibn Qurra (909-946) *SB

- Manjula (c. 930)

- Abu Sahl al-Kuhi (c. 950)

- Abu l'Hasan al-Uqlidisi (c. 952)

- `Abd al-`Aziz al-Qabisi (c. 950) *SB

- Prashastidhara (fl. 958)

- Abu Jafar Muhammad ibn al-Hasan al-Khorasani al-Khazin (d. c. 965) *SB

- Aryabhata II (fl. c.? 950-1100) *SB

- Muhammad Abu'l-Wafa al-Buzjani (940-998) *SB *MT

- Gerbert d'Aurillac, Pope Sylvester II (c. 945-1003) *SB

- Abd al-Jalil al-Sijzi (c. 970)

- Abu'l-Hasan ibn Yunus (950-1009) *MT

- Abu Mahmud Hamid ibn al-Knidr al-Khujandi (d. c. 1000) *SB

- Abu `Ali al-Hasan ibn al-Haytham (Alhazen) (c. 965-c. 1039) *SB *MT

- Abu l-Rayhan Muhammad ibn Ahmad al-Biruni (973-1055)

- Halayudha (c. 975)

- Abu Sahl Wayjan ibn Rustam al-Quhi (fl. 970-1000) *SB

- Abu l-Quasim Maslama ibn Ahmad al-Faradi al-Majriti (fl. 980-1000) *SB

1000

- Jayadeva (c. 1000)

- Abu Ali al-Husain ibn 'Abdullah ibn Sina (Avicenna) (980-1037)

- Abu Bakr ibn Muhammad ibn al-Husayn al-Karaji (al Karkhi) (c. 1000) *SB

- Abu `Abdallah al-Hasan ibn al-Baghdadi (c. 1000)

- Al-Jili Kushyar ibn Labban ibn Bashahri (c. 1000) *SB

- Abu Nasr ibn Ali Mansur ibn Iraq (d. 1030) *SB

- Abu Abd Allah Muhammad ibn Muadh al-Jayyani (c. 990-post 1079) *SB

- Abu Mansur al-Baghdadi (c. 1025)

- Ali ibn Ahmad al-Nasawi (fl. 1029-1044) *SB

- Hermann of Reichenan (Contractus) (1013-1054) *SB

- Sripathi (fl. 1039)

- Michael Constantine Psellus (1018-1078) *SB

- Jia Xian (c. 1050)

- Shen Kuo (1031-1095)

- `Umar al-Khayyami (Omar Khayyam) (c. 1048-c. 1131) *SB *MT

- Adelard of Bath (1075-1164) *SB *MT

1100

- Peter Abelard (1079-1142)

- Hemachandra Suri (b. 1089)

- Abraham ben Meir ibn Ezra (Avenare) (c. 1090-c. 1167) *SB

- Abu Bakr Muhammad ibn Yahya ibn al-Sa'igh ibn Bajja (Avenpace) (d. 1139) *SB

- Abu Muhammad Jabir ibn Aflah al-Ishbili (Geber) (c. 1125) *SB

- John of Seville (c. 1125)

- Domingo Gundisalvo (c. 1125)

- Abraham bar Hiyya ha-Nasi (Savasorda) (c. 1125) *SB

- Plato of Tivoli (c. 1125) *SB

- Girard of Cremona (1114-1187) *MT

- Abu-l-Walid Muhammad ibn Ahmad ibn Muhammad ibn Rushd (Averroes) (1126-1198)

- Bhaskara (1114-c. 1185) *MT

- Ibn Yahya al-Samaw'al (1125-1180)

- Gerard of Cremona (c. 1114-1187)

- `Abd al-Rahman al-Khazini (c. 1150)

- Robert of Chester (c. 1150)

- Sharaf al-Din at-Tusi (c. 1175)

- Robert Grosseteste (c. 1168-1253) *SB *MT

- Leonardo Fibonacci of Pisa (C. 1170-post 1240) *SB *MT

1200

- Cangadeva (fl. 1205)

- Li Zhi (Li Ye) (Jingzhai) (1192-1279) *SB

- Albertus magnus (1193-1280)

- William Sherwood (c. 1195-1249)

- Albertus Magnus (c. 1200-1280) *SB

- Nasir al-Din at-Tusi (1201-1274)

- Zakariya ibn Muhammad ibn Mahmud al-Qazwini (c. 1203-1283) *SB

- Alexandre de Villedieu (c. 1225)

- Liu Yi (fl. c. 1225)

- Michael Scot (d. c. 1235) *SB

- John of Halifax (Sacrobosco) (c. 1200-1256)

- Qin Jiushao (Daogu) [Chin Chiu-shao] (c. 1202-c. 1261) *SB

- Campanus of Novara (c. 1205-1296) *SB

- Peter of Spain (1210-1277)

- Jordanus de Nemore (fl. 1220-1260) *SB *MT

- John of Palermo (fl. 1221-1240) *SB

- Girard of Brussels (fl. c. 1235) *SB

- Roger Bacon (c. 1219-c. 1292) *SB

- William of Moerbeke (c. 1225-1286) *SB

- John Pecham (c. 1230-1292) *SB

- Guo Shoujing (1231-1316)

- Yang Hui (Qianguang) (fl. 1261-1275) *MT

- Muhammad al-Khalili (c. 1250)

- Witelo (Vitellio) (fl. 1250-1275)

- Muhyi 'l-Din al-Maghribi (fl. ca. 160-1265) *SB

- Raymond Lully (1234-1315)

- Wang Xun (1235-1281)

- Georgios Pachymeres (1242-1316)

- Maximos Planudes (c. 1255-1310)

- ibn al-Banna al Marrakushi (1256-1321) *SB

- John Duns Scotus (c. 1266-1308) *SB

- Peter Philomena of Dacia (fl. 1290-1300) *SB

- Walter Burleigh (1273-1357)

1300

- Manuel Moschopoulos (c. 1300)

- Kamal al-Din Abul Hasan Muhammad ibn al-Hasan al-Farisi (d. 1320) *SB

- Zhu Shijie (Hanqing, Songting) [Chu Shih-chieh] (fl. c. 1280-1303) *SB

- Francis of Meyronnes (c. 1285-c. 1330) *SB

- William of Ockham (c. 1285-c. 1349) *SB *MT

- Levi ben Gerson (1288-1344) *SB

- Richard of Wallingford (c. 1291-1336) *SB

- Thomas Bradwardine (c. 1295-1349) *MT

- Nicholas Rhabdas (d. 1350)

- Jean Buridan (c. 1300-1358)

- Gergory of Rimini (d. 1358)

- John of Meurs (Johannes de Muris) (c. 1343) *SB

- Albert of Saxony (c. 1316-1390) *SB *MT

- Nicole Oresme (c. 1320-1382) *SB *MT

- John of Dumbleton (d. c. 1349)

- William of Heytesbury (fl. c. 1335) *SB

- Dominicus de Clavasio (fl. c. 1346) *SB

- Immanuel Bonfils (c. 1350)

- Giovanni di Casali (c. 1350)

- Narayama Pandit (c. 1350) *SB

- Richard Swineshead (Suiseth, Calculator) (c. 1350)

- Ding Ju (fl. 1355)

- Marsilius of Inghen (c. 1330-1396) *SB

- John of Cornubia (fl. c. 1360)

- Peter of Mantua (fl. c. 1360)

- Madhava of Sangamagramma (c. 1340-1425)

- Ralph Strode (fl. 1370)

- He Pingzi (fl. 1373)

- Antonio de Mazzinghi (b. c. 1353)

- Qadi Zada al-Rumi (Salah al-Din Musa Pasha) (c. 1364-c. 1436) *SB

1400

- Filippo Brunelleschi (1377-1446)

- Paramesvara (c. 1380-c. 1460) *SB

- John of Gmunden (c. 1382-1442) *SB

- Ghy`iyath al_d`Din Jamshid Masud al-Kashi (d. 1429) *SB

- Nicolette Paulus of Venice (d. 1429)

- Ulugh Beg (1394-1449) *MT

- Paolo del Pozzo Toscanelli (1397-1482)

- Liu Shilong (fl. 1424)

- Nicolas of Cusa (1401-1464) *SB *MT

- Leone Battista Alberti (1404-1472) *SB *MT

- Ghiyath al-Din al-Kashi (d. 1429) *MT

- Piero della Francesca (c. 1410-1492) *MT

- Abu l'Hasan Ali ibn Muhammad ibn Ali al-Qalasadi (1412-1486) *SB

- George Peurbach (1423-1461)

- Johannes Campanus (c. 1450)

- Wu Jing (fl. 1450)

- Piero Borgi (d. c. 1484) *MT

- Johann Müller of Königsberg (Regiomontanus) (1436-1476) *SB *MT

- Luca Pacioli (c. 1445-c. 1514) *SB *MT

- Nicolas Chuquet (c. 1445-c. 1500) *SB *MT

- Nilakantha Somayaji (1445-1545)

- Leonardo da Vinci (1452-1519) *SB *MT

- Jacques le Fèvre d'Estaples (Stapulensis) (c. 1455-c.1536)

- Nilakantha Somayaji (1455-1555)

- Johann Widman (1462-1498) *MT

- Scipione del Ferro (1465-1526) *SB *MT

- Peter of Tartaret (fl. 1490-1500)

- Johannes Werner (1468-1522) *MT

- John Maior (1469-1550) *SB

- Jean Dullaert of Chent (c. 1470-1513) *SB *W

- Charles de Bouvelles (c. 1470-c. 1553) *W

- Pedro Sánchez Ciruelo (c. 1470-1554) *SB

- Albrecht Dürer (1471-1528) *SB *MT *W

- Federico Grisogono (Federicus de Chrysogonius) (1472-1538) *W

- Nicolas Copernicus (1473-1543) *SB *MT *W

- Cuthbert Tonstall (1474-1559) *MT *W

1500

- Johann Mayoris Scott (1478-1540)

- Alvarus Thomas (fl. 1509) *W

- Gaspar Lax (1487-1560) *SB *W

- Michael Stifel (c. 1487-1567) *MT *W

- Francisco de Mello (1490-1536) *W

- Juan de Celaya (c. 1490-1558) *SB *W

- Estienne de La Roche (fl. c. 1520) *SB *W

- Adam Riese (1492-1559) *SB *W

- Johannes Buteo (c. 1492-1570) *W

- Luis Vives (1492-1589)

- Oronce Fine (Fineus) (1494-1555) *W

- Johann Scheubel (1494-1570)

- Francesco Maurolico (1494-1575) *SB *W

- Peter Apian (1495-1552) *W *SB

- Philip Schwartzerd (Melanchthon) (1497-1560)

- Andrias Osiander (1498-1552) *W

- William Buckley (d. c. 1550)

- Christoff Rudolff (c. 1500-c. 1545) *SB *MT *W

- Niccolò Fontana of Brescia (Tartaglia) (c. 1500-1557) *MT *W

- Sankara Variar (c. 1500-1560)

- Narayana (c. 1500-1575)

- Girolamo Cardano (1501-1576) *SB *MT *W

- Pedro Nunes (Nonius) (1502-1578) *SB *W

- Johannes Sturm (1507-1589)

- Gemma Regnier (Frisius) (1508-1555)

- Federico Commandino (1509-1575) *SB *W

- Robert Recorde (1510-1558) *SB *MT *W

- Gerardus Mercator (Kremer) (1512-1594) *SB *MT *W

- Georg Joachim Rheticus (1514-1574) *SB *MT *W

- Pierre de la Ramée (Ramus) (1515-1572) *SB *W

- Jacques Peletier (1517-1582) *SB *W

- Leonard Digges (c. 1520-1559) *SB *W

- Ludovico Ferrari (1522-1565) *SB *MT *W

1550

- Raphael Bombelli (c. 1526-1572) *MT *W

- John Dee (1527-1608) *SB *W

- Francesco Patrizi (1529-1597) *SB *W

- Giovanni Battista Benedetti (1530-1590) *SB *W

- Cunradus Dasypodius (c. 1530-1600) *SB *W

- Jyesthadeva (c. 1550)

- Wilhelm Holzmann (Xylander) (1532-1576)

- Giambattista della Porta (1535-1615) *SB *W

- Egnatio Danti (1536-1586) *SB *W

- Francesco Barozzi (1537-1604) *SB *W

- Christophorus Clavius (Christolf Klau) (1537-1612) *SB *MT *W

- François Viète (Vieta) (1540-1603) *MT *W

- Ostilio Ricci (1540-1603) *SB *W

- Ludolph van Ceulen (1540-1610) *SB *MT *W

- Adriaan Anthonisz (c. 1543-1620) *W

- Guidobaldo del Monte (1545-1607) *SB *W

- Paul Wittich (c. 1546-1586) *W

- Thomas Digges (c. 1546-1595) *SB *MT *W

- Tycho Brahe (1546-1601) *MT *W

- François d'Aguilon (1546-1617) *W *SB

- Xu Xinlu (fl. 1573)

- Giodano Bruno (1548-1600) *W

- Simon Stevin (1548-1620) *MT *W

- Henry Savile (1549-1622) *MT

- John Napier (1550-1617) *SB *MT *W

- Valintin Otho (1550-1605)

- Michael Mästlin (1550-1631) *W

- Acyuta Pisarati (c. 1550-1621)

- Juan Battista Villalpando (1552-1608) *W

- Matteo Ricci (1552-1610) *SB *W

- Luca Valerio (1552-1618) *MT *W

- Pietro Antonio Caltaldi (1552-1626) *SB *MT *W

- Jobst Bürgi (1552-1632) *MT *W

- Bernadino Baldi (1553-1617) *SB *W

- Giovanni Antonio Magini (1555-1617) *SB *W

- Niccolo Longobardi (1559-1654)

- Thomas Harriot (c. 1560-1621) *SB *MT *W

- Bartholomäus Pitiscus (1561-1613) *SB *W

- Adriaen van Roomen (Adrianus Romanus) (1561-1615) *SB *MT *W

- Edward Wright (1561-1615) *W

- Francis Bacon (1561-1626) *SB *W

- Henry Briggs (1561-1631) *MT *W

- Philip van Lansberge (1561-1632) *SB *W

- Thomas Fink (1561-1656) *SB *W

- Xu Guangqi (1562-1633)

- Galileo Galilei (1564-1642) *SB *MT *W

- Li Zhizao (Zhenzhi) (1565-1630)

- Marin Getaldic (Marino Ghetaldi) (1568-1626) *SB *MT *W

- Cheng Dawei (Rusi, Binqu)(fl. 1592)

- Johannes Kepler (1571-1630) *SB *MT *W

- Adriaen Metius (1571-1635) *SB *W

- Samuel Marolois (c. 1572-1627)

1600

- William Oughtred (1575-1660) *SB *MT *W

- Mori Kambei Shigeyoshi (fl. 1600-1628)

- Johann Terrenz Schreck (1576-1630)

- Paul Guldin (1577-1643) *W

- Li Tianjing (1579-1659)

- Willebrond Snel (1580-1626) *MT *W

- Denis Henrion (c. 1580-1632) *SB *W

- Johann Faulhaber (1580-1635) *SB *W

- Edmund Gunter (1581-1626) *SB *MT *W

- Claude-Gaspar Bachet de Méziriac (1581-1638) *SB *RB *MT *W

- Alexander Anderson (1582-c. 1620)

- Giulio Aleni (1582-1649)

- Gregory of St. Vincent (1584-1667) *RB *W

- Claude Mydorge (1585-1647) *SB *MT *W

- Jan Brozek (Broscius) (1585-1652) *W

- Joachim Jungius (1587-1657) *SB *W

- Isaac Beeckman (1588-1637) *SB *W

- Johann Heinrich Alsted (1588-1638)

- Marin Mersenne (1588-1648) *SB *RB *MT *W

- Étienne Pascal (1588-1651) *SB *MT *W

- Thomas Hobbes (1588-1679) *W

- Girard Desargues (1591-1661) *SB *MT *W

- Johann Adam Schall von Bell (1591-1666)

- Jean Leurechon (c. 1591-1670) *SB

- Wilhelm Schickard (1592-1635) *W

- Giacomo Rho (1593-1638)

- Pierre Hérigone (d. c. 1643) *SB *W

- Albert Girard (c. 1595-1632) *SB *MT *W

- Jean Beaugrand (c. 1595-1640) *SB *MT *W

- René du Perron Descartes (1596-1650) *SB *RB *MT *W

- Richard Delamain (d. c. 1645) *SB *MT *W

- Jean-Charles de la Faille (1597-1652) *SB *W

- Bonaventura Cavalieri (1598-1647) *RB *MT *W

- Yoshida Shichibei Koyu (1598-1672)

- Claude Hardy (c. 1598-c. 1678) *SB *W

1625

- Antoine de Lalouvère (1600-1664) *SB *RB *W

- Adriaan Vlacq (Vlaccus) (1600-1667) *W *W

- Pierre de Carcavi (c. 1600-1684) *SB *W

- Florimond Debeaune (1601-1652) *SB *MT *W

- Pierre de Fermat (1601-1665) *RB *MT *W

- B\Jacques de Billy (1602-1675) *W

- Gilles Personne de Roberval (1602-1675) *SB *RB *MT *W

- Abraham Bosse (1602-1676) *W

- Bernard Frénicle de Bessy (c. 1605-1675) *SB *RB *W

- Juan Caramuel y Lobkowitz (1606-1682) *SB *W

- Honoré Fabri (1607-1688) *SB *MT *W

- Evangelista Torricelli (1608-1647) *RB *MT *W

- Giovanni Alfonso Borelli (1608-1679) *W

- Jan Jansz de Jonge Stampioen (1610-post 1689) *W

- Jean Nicolas Smogulecki (1611-1656)

- John Pell (1611-1685) *SB *RB *MT *W

- Jacques-Alexandre Le Tenneur (fl. 1640-1650) *SB *W

- André Tacquet (1612-1660) *W

- Antoine Arnaule (1612-1694) *SB *W

- Jean-François Niceron (1613-1616) *SB *W

- John Wilkins (1614-1672) *MT

- Frans van Schooten (1615-1660) *RB *MT *W

- John Wallis (1616-1703) *RB *MT *W

- Claude Mylon (c. 1618-c.1660) *SB *W

- Alfons Anton de Sarasa (1618-1667)

- Gabriel Mouton (1618-1694) *SB *W

- Michelangelo Ricci (1619-1682) *SB *W

- William Brouncker (1620-1684) *RB *MT *W

- Nicolas Mercator (Kaufman) (1620-1687) *RB *MT *W

- Claude François Milliet Descheles (1621-1678) *SB *W

- Bernhard Varenius (1622-c. 1650) *W

- Johann Heinrich Rahn (1622-1676) *MT

- René François Walther de Sluse (1622-1685) *RB *MT *W

- Adrien Auzout (1622-1691) *SB *W

- Vincenzo Viviani (1622-1703) *RB *MT *W

- Stefano degli Angeli (1623-1697) *SB *MT *W

- Blaise Pascal (1623-1662) *SB *RB *MT *W

1650

- Arnold Geulincx (1625-1669)

- Jan De Witt (1625-1672) *MT *W

- John Collins (1625-1683) *SB *RB *W

- Pietro Mengoli (1625-1686) *MT*SB *W

- Samuel Morland (1625-1695) *SB *W

- Erasmus Bartolin (1625-1698) *SB *W

- Jean-Dominique Cassini (1625-1712) *SB *MT *W

- Robert Boyle (1627-1691) *MT

- Jan Hudde (1628-1704) *SB *RB *MT *W

- Christiaan Huygens (1629-1695) *SB *RB *MT *W

- Isaac Barrow (1630-1677) *SB *RB *MT *W

- Xue Fengzuo (d. 1680)

- Christopher Wren (1632-1723) *RB *MT *W

- Hendrik van Heuraet (1633-c. 1660) *SB *W

- Fang Zhongtong (1633-1698)

- Mei Wending (1633-1721)

- Robert Hooke (1635-1702) *SB *RB *MT *W

- William Neile (1637-1670) *MT

- James Gregory (1638-1675) *SB *RB *MT *W

- Georg Mohr (1640-1697) *SB *MT *W

- Bernard Lamy (1640-1715) *SB *W

- Jacques Ozanam (1640-1717) *SB *MT *W

- Phillipe de La Hire (1640-1718) *SB *RB *MT *W

- Seki Shinsuke Kowa (1642-1708) *MT

- Isaac Newton (1642-1727) *SB *RB *MT *W

- Olof Roemer (1644-1710) *RB *W

- Gottfried Wilhelm Leibniz (1646-1716) *SB *RB *MT *W

- Giovanni Ceva (1647-1734) *SB *MT *W

- Joseph Raphson (1648-1715) *MT

- Tomasso Ceva (1648-1737) *SB *W

1675

- Ehrenfried Walther von Tchirnhausen (1651-1708) *MT *RB *W

- Michel Rolle (1652-1719) *SB *RB *MT *W

- Jacques Bernoulli (James, Jakob) (1654-1705) *RB *MT *W

- Bernard Nieuwentijt (1654-1718) *SB *W

- Pierre Varignon (1654-1722) *RB *MT *W

- John Craig (d. 1731) *SB *W

- Charles René Reyneau (1656-1728) *SB *W

- Edmund Halley (1656-1743) *SB *RB *MT *W

- Bernard le Bouyer du Fontenelle (1657-1757) *SB *W

- David Gregory (1659-1708) *SB *RB *MT *W

- Joseph Saurin (1659-1737) *RB *W

- Thomas-Fantet de Lagny (1660-1734) *SB *W

- Putumana Somayaji (c. 1660-1740)

- Guillaume-François-Antoine de l'Hospital (1661-1704) *SB *RB *MT *W

- Nakane Genkei (1661-1733)

- Jean-Pierre de Crousaz (1663-1750) *W

- Takebe Kenko (1664-1739)

- Antoine Parent (1666-1716) *RB *W

- Girolamo Saccheri (1667-1733) *MT *W

- John Arbuthnot (1667-1735) *SB *MT

- Jean Bernoulli (John, Johann) (1667-1748) *RB *MT *W

- William Whiston (1667-1752) *MT *W

- Abraham De Moivre (1667-1754) *SB *RB *MT *W

- Leonty Filippovich Magnitsky (1669-1739) *SB *W

- John Keill (1671-1721) *W

- Guido Grandi (1671-1742) *SB *MT *W

- George Cheyne (1671-1743) *SB *W

- Johann Gabriel Doppelmayr (c. 1671-1750) *SB *W

- Christian Wolff (1674-1754) *W

- Humphry Ditton (1675-1715) *RB

- William Jones (1675-1749) *SB *W

1700

- Jaganath Pandit (fl. 1700)

- Chen Shiren (1676-1722)

- Jacopo Francesco Riccati (1676-1754) *SB *RB *MT *W

- Joseph Privat de Molieres (1677-1742) *W

- Jacques Cassini (1677-1756) *SB *W

- Jacques-François Le Poivre (fl. c. 1704) *SB *W

- Pierre-Rémond de Montmort (1678-1719) *SB *RB *W

- Jacob Hermann (1678-1733) *SB *MT *W

- Charles Hayes (1678-1760)

- John Machin (1680-1751)

- Roger Cotes (1682-1716) *SB *RB *MT

- Nicholas Saunderson (1682-1739)

- Giulio Carlo Fagano dei Toschi (1682-1766) *SB *RB

- François Frézier (1682-1773)

- François Nicole (1683-1758) *RB

- Jean-Philippe Rameau (1683-1764)

- Brook Taylor (1685-1731) *RB *MT

- George Berkeley (1685-1733) *MT

- Nicholas Bernoulli (1687-1759) (nephew of Jean) *MT

- Robert Simson (1687-1768) *MT

- Wilhelm Jabob Storm van s'Gravesande (1688-1742) *SB

- Louis Bertrand Castel (1688-1757) *SB *MT

- Christian Goldbach (1690-1764) *SB *MT

- James Sterling (1692-1770) *MT

- Matsunaga Ryohitsu (fl. 1718-1749)

- Jagannatha (fl. c. 1720-1740) *SB

- Nicholas Bernoulli (1695-1726) (son of Jean) *MT

- Colin Maclaurin (1698-1746) *SB *RB *MT

- Pierre Bouguer (1698-1758) *MT

- Pierre-Louis Moreau de Maupertuis (1698-1759) *SB *MT

- Charles-Étienne-Louis Camus (1699-1768) *SB

1725

- William Braikenridge (c. 1700-post 1759)

- Daniel Bernoulli (1700-1782) *RB *MT

- Nakane Genjun (1701-1761)

- Kurushima Yoshita (d. 1757)

- Thomas Bayes (1702-1752) *SB *MT

- Antoine Deparcieux (1703-1768) *SB

- Gabriel Cramer (1704-1752) *SB *RB *MT

- Alexis Fontaine des Bertins (1704-1771) *SB

- Johann Andrea Segner (1704-1777)

- Johann Castillon (1704-1791) *SB *MT

- Gabrielle-Émilie du Breteuil, Marquise du Châtelet (1706-1749) *SB

- Benjamin Robins (1707-1751)

- Vincenzo Riccati (1707-1775) *SB

- Leonhard Euler (1707-1783) *SB *MT

- Compte de Buffon (1707-1788) *MT

- Thomas Simpson (1710-1761) *RB *MT

- Jean Bernoullii (1710-1790) (son of Jean 1667-1748) *MT

- Rudjer Joseph Boskovic (1711-1787) *MT

- Johann Samuel Koenig (1712-1757) *SB

- Jean-Paul de Gua de Malves (c. 1712-1786) *SB *RB

- Alexis-Claude Clairaut (1713-1765) *SB *RB *MT

- Arima Raido (1714-1783)

- Joachim Georg Darjes (1714-1791)

- Giovanni Francesco Fagano dei Toschi (1715-1797) *SB

- Ming Antu (d. 1765)

- Gottfried Ploucquet (1716-1790)

- Jean le Rond d'Alembert (1717-1783) *SB *R *MT

- Matthew Stewart (1717-1785) *RB

- Maria Gaetana Agnesi (1718-1799) *SB *MT

- John Landen (1719-1790) *SB

- Abraham Gotthelf Kästner (1719-1800) *SB

- Franz Ulrigh Theodosius Aepinus (1724-1802) *SB

1750

- Patrick d'Arcy (1725-1779) *SB

- Jean-Etienne Montucla (1725-1799) *SB *MT

- Johann Heinrich Lambert (1728-1777) *SB *MT

- Paolo Frisi (1728-1784) *SB

- Étienne Bézout (1730-1783) *MT

- Giovanni Francesco Malfatti (1731-1807) *SB

- Francis Maseres (1731-1824) *SB

- W. J. G. Karsten (1732-1787)

- Ajima Naonobu (Chokuyen) (c. 1732-1798) *SB

- Jean Charles Borda (1733-1799) *MT

- Edward Waring (1734-1798) *MT

- François Daviet de Foncenex (1734-1799)

- Fujita Sadasuke (1734-1807)

- Alexandre-Théophile Vandermonde (1735-1796) *MT

- Erland Samuel Bring (1736-1798) *MT

- Charles Augustin Coulomb (1736-1806) *SB *MT

- Joseph Louis Lagrange (1736-1813) *SB *MT

- Charles Hutton (1737-1823) *SB

- José Antonio Alzate y Ramírez (1738-1799) *SB

- Ajima Chokuyen (1739-1783)

- Georg Simon Klügel (1739-1812) *SB

- Anders Johan Lexell (1740-1784) *SB

- John Wilson (1741-1793) *MT

- Carl Friedrich Hindenburg (1741-1808) *SB

- Marie-Jean-Antoine-Nicolas Caritat, Marquis de Condorcet (1743-1794) *SB *MT

- José Anastácio da Cunha (1744-1787)

- Jean-Charles Callet (1744-1799)

- Jean Bernoullie (1744-1807) (son of Jean 1710-1790) *MT

- George Atwood (1745-1807) *SB

- Caspar Wessel (1745-1818) *MT

- Gaspard Monge (1746-1818) *SB *MT

- G. F. Castillon (1747-1800)

- Aida Yasuaki (Ammei) (1747-1817) *SB

- Pietro Cossali (1748-1815)

- John Playfair (1748-1819) *SB *MT

- Trembley (1749-1811)

- Jean-Baptiste Joseph Delambre (1749-1822) *SB *MT

- Pierre Simon de Laplace (1749-1827) *SB *MT

1775

- Lorenzo Mascheroni (1750-1800) *SB *MT

- Simon-Antoine-Jean Lhuiler (1750-1840) *SB *MT

- Adrien-Marie Legendre (1752-1833) *SB *MT

- Salomon Maimon (1753-1800)

- Lazare-Nicolas-Marguerite Carnot (1753-1823) *SB *MT

- Jean-Baptiste-Marie-Charles Meusnier de La Place (1754-1793) *SB

- Jurij Vega (1754-1802) *MT

- Nicolaus Fuss (1755-1826) *SB

- Marc-Antoine Parseval des Chênes (1755-1836) *SB

- Gaspard Clair François Marie Rich de Prony (1755-1839) *MT

- John West (1756-1817) *MT

- Heinrich W. M. Olbers (1758-1840)

- Louis Franç Antoine Arbogaste (1759-1803) *SB

- Sakabe Kohan (1759-1824)

- Christian Kramp (1760-1826) *SB

- Li Huang (d. 1811)

- Jiao Xun (1763-1820)

- Kusaka Sei (1764-1839)

- Ruan Yuan (1764-1849)

- Fujita Kagen (1765-1821)

- Paolo Ruffini (1765-1822) *SB *MT

- Johann Friedrich Pfaff (1765-1825) *SB *MT

- James Ivory (1765-1842) *SB

- Sylvestre-François Lacroix (1765-1843) *SB *MT

- François Joseph Français (1768-1810) *SB

- Wang Lai (Xiaoying, Hengzhai) (1768-1813)

- Jean-Robert Argand (1768-1822) *SB *MT

- Jean Baptiste Joseph Fourier (1768-1830) *SB *MT

- Pietro Abbati (1768-1842)

- Willaim Wallace (1768-1843) *MT

- François-Joseph Servois (1768-1847) *MT

- Jean-Nicolas-Pierre Hachette (1769-1834) *SB *MT

- Johann Martin Bartels (1769-1836)

- Louis Puissant (1769-1843)

- Marc-Antoine Parseval (?-1836)

- Pasquale Galuppi (1770-1846)

- Joseph Diez Gergonne (1771-1859) *SB *MT

- Li Rui (Shangzhi, Sixiang) (1773-1817)

- Robert Woodhouse (1773-1827) *MT

- Nathaniel Bowditch (1773-1838) *MT

- J. P. Kulik (1773-1863)

- Karl Brandon Mollweide (1774-1825) *SB

- Jean-Baptiste Biot (1774-1862) *MT

1800

- Sankara Varman (c. 1800)

- Jacques Frédéric Français (1775-1833) *SB

- André-Marie Ampère (1775-1836) *SB *MT

- Robert Adrain (1775-1843) *SB

- K. F. Gauber (1775-1851)

- Wolfgang Farkas Bolyai (1775-1856)

- Sophie Germain (1776-1831) *SB *MT

- Peter Barlow (1776-1862) *SB

- Daniel Friedrich Hecht (1777-1833) *SB

- Carl Friedrich Gauss (1777-1855) *SB *MT

- Louis Poinsot (1777-1859) *SB *MT

- Josef Maria Hoene-Wronski (1778-1853) *MT

- John Farrer (1779-1853) *SB

- Benjamin Gumpertz (1779-1865) *SB

- August Leopold Crelle (1780-1855) *SB *MT

- Ferdinand Karl Schweikart (1780-1859)

- Mary Fairfax Greig Somerville (1780-1872)

- Siméon-Denis Poisson (1781-1840) *MT

- Bernhard Bolzano (1781-1848) *MT

- Furukawa Ken (c. 1783-1838)

- Charles-Julien Brianchion (1783-1864) *MT

- Friedrich Wilhelm Bessel (1784-1846) *MT

- Pierre-Charles-François Dupin (1784-1873) *SB *MT

1810

- Claude-Louis-Marie-Henri Navier (1785-1836) *SB *MT

- Petr Scheutz (1785-1873)

- Luo Tengfeng (fl. 1815)

- William George Horner (1786-1837) *SB *MT

- Dominique-François-Jean Arago (1786-1853) *MT

- Jacques-Philippe-Marie Binet (1786-1856) *SB *MT

- Wada Yenzo Nei (1787-1840)

- Augustin Jean Fresnel (1788-1827) *SB *MT

- William Hamilton (1788-1856) *SB

- Jean-Victor Poncelet (1788-1867) *SB *MT

- Xiang Mingda (1789-1850)

- Luo Shilin (1789-1853)

- Georg Simon Ohm (1789-1854) *MT

- Augustin-Louis Cauchy (1789-1857) *SB *MT

- A. D. Twesten (1789-1876)

- Ludwig Immanuel Magnus (1790-1861)

- Augusus Ferdinand Möbius (1790-1868) *SB *MT

- Dong Youcheng (Fangli) (1791-1823)

- George Peacock (1791-1858) *SB *MT

- Friedrich Ludwig Wachter (1792-1817)

- Gaspard Gustave de Coriolis (1792-1843) *SB *MT

- Nicolai Ivanovich Lobachevsky (1792-1856) *SB *MT

- Charles Babbage (1792-1871) *SB *MT

- John Frederick William Herschel (1792-1871) *MT

- Martin Ohm (1792-1872)

- George Green (1793-1841) *MT

- Theodore Olivier (1793-1853)

- Ludwig Seeber (1793-1855)

- Michel Chasles (1793-1880) *SB *MT

- Germinal Pierre Dandelin (1794-1847) *SB *MT

- Olinde Rodrigues (1794-1851)

- William Whewell (1794-1866)

- Franz Adolf Taurinus (1794-1874)

1820

- Louis Paul Émile Richard (1795-1849) *SB

- Bernt Michael Holmboe (1795-1850) *SB *MT

- Gabriel Lamé (1795-1870) *SB *MT

- Thomas Carlyle (1795-1881) *MT

- Nicolas-Léonard-Sadi Carnot (1796-1832) *SB *MT

- Gokai Ampon (1796-1862)

- Shiraishi Chochu (1796-1862)

- Jacob Steiner (1796-1863) *MT

- Nikolai Dmetrivich Brashman (1796-1866) *MT

- Lambert Adolphe Jacques Quételet (1796-1874) *SB *MT

- Andreas von Ettinghausen (1796-1878)

- Koide Shuki (1797-1865)

- Jean-Marie-Constant Duhanel (1797-1872) *SB *MT

- Johann August Grunert (1797-1872)

- Barré de Saint-Venant (1797-1886)

- Étienne Bobillier (1798-1840) *MT

- Christopf Gudermann (1798-1852) *SB

- Karl Georg Christian von Staudt (1798-1867) *MT

- Michael Chasles (1798-1880)

- Franz Ernst Neumann (1798-1895) *SB *MT

- Gu Guanjuang (1799-1862)

- Benoit Paul Emile Clapeyron (1799-1864) *MT

- Karl Heinrich Gräffe (1799-1873) *SB .

- Shen Qinpei (fl. 1829)

- Karl Wilhelm Feuerbach (1800-1834) *SB *MT

- Gaspare Mainardi (1800-1879)

- George Bentham (1800-1884)

- Mikhail Vasilevich Ostrogradsky (1801-1862) *SB *MT

- Julius Plücker (1801-1868) *SB *MT

- Antoine-Augustin Cournot (1801-1879) *SB

- Joseph Antoine Ferdinand Plateau (1801-1883) *SB

- Thomas Clausen (1801-1885) *SB *MT

- George Biddle Airy (1801-1892) *SB *MT

- Zhang Dunren (fl. 1831)

- Niels Henrik Abel (1802-1829) *SB *MT

- János Bolyai (1802-1860) *MT

- Moritz Wilhelm Drobisch (1802-1896)

- Johann Christian Doppler (1803-1853) *SB *MT

- Jacques Charles François Sturm (1803-1855) *MT

- Giusto Bellavitus (1803-1880) *SB

- Pierre François Verhulst (1804-1849) *MT

- Carl Gustav Jacob Jacobi (1804-1851) *SB *MT

- George Birch Jerrard (1804-1863) *SB *MT

- Victor Jacoulevich Bouniakouski (1804-1889)

- Wilhelm Eduard Weber (1804-1891) *MT

1830

- Dai Xu (1805-1860)

- William Rowan Hamilton (1805-1865) *SB *MT

- Gustav Peter Lejeune Dirichlet (1805-1859) *SB *MT

- Robert Murphy (1806-1843)

- Augustus De Morgan (1806-1871) *SB *MT

- Ernst Ferdinand Adolf Minding (1806-1885) *SB

- Thomas Penyngton Kirkman (1806-1895) *SB *MT

- Moritz Abraham Stern (1807-1894)

- Athanase Louis Victoire Dupré (1808-1869) *SB

- Friedrich Julius Richelot (1808-1875)

- Johann Benedict Listing (1808-1882) *MT

- John Henry Pratt (1809-1871) *SB

- Hermann Günter Grassmann (1809-1877) *SB *MT

- Benjamin Peirce (1809-1880) *SB *MT

- Joseph Liouville (1809-1882) *SB *MT

- Ernst Eduard Kummer (1810-1893) *SB *MT

- Évariste Galois (1811-1832) *SB *MT

- Auguste Bravais (1811-1863)

- Ludwig Otto Hesse (1811-1874) *SB *MT

- Urbain Jean Joseph Le Verrier (1811-1877) *MT

- Li Shanlan (1811-1882)

- Andrew Serle Hart (1811-1890)

- Adolph Göpel (1812-1847) *SB

- William Shanks (1812-1882) *MT

- Duncan Farquharson Gregory (1813-1844) *SB

- Pierre-Alphonse Laurent (1813-1854) *MT

- Pierre Laurent Wantzel (1814-1848)

- Eugène Charles Catalan (1814-1894)

- Ludwig Schläfli (1814-1895) *MT

- James Joseph Sylvester (1814-1897) *MT

1840

- Ada Lovelace (1815-1852)

- George Boole (1815-1864) *MT

- Fukuda Riken (1815-1889)

- Karl Weierstrass (1815-1897) *MT

- Charles-Eugene Delaunnay (1816-1872) *SB *MT

- Johann Georg Rosenhain (1816-1887) *SB

- Johann Rudolf Wolf (1816-1893) *MT

- Jean-Fréderic Frénet (1816-1900) *SB *MT

- Thomas Weddle (1817-1853)

- Carl Wilhelm Borchardt (1817-1880) *MT

- Charles Auguste Albert Briot (1817-1882)

- Ferdinand Joachimsthal (1818-1861) *SB

- Heinrich Richard Baltzer (1818-1887)

- Jean-Claude Bouquet (1819-1885) *MT

- Seigfried Heinrich Aronhold (1819-1884)

- Joseph Alfred Serret (1819-1885) *MT

- Pierre Ossian Bonnet (1819-1892) *MT

- John Couch Adams (1819-1892) *MT

- George Gabriel Stokes (1819-1903) *MT

- George Salmon (1819-1904) *MT

- William John Macquorn Rankine (1820-1872) *MT

- Victor Alexandre Puiseux (1820-1883) *SB *MT

- Isaac Todhunter (1820-1884) *MT

- Ernest Jean Philippe Fauqede Jonquiéres (1820-1901) *SB

- Heinrich Eduard Heine (1821-1881) *SB *MT

- Takaku Kenjiro (1821-1883)

- Arthur Cayley (1821-1895) *SB *MT

- Pafnuty Lvovich Chebyshev (1821-1894) *SB *MT

- Hermann Ludwig Ferdinand von Helmholtz (1821-1894) *SB *MT

- Philipp Ludvig von Seidel (1821-1896)

- Jules Antoine Lissajous (1822-1880) *SB *MT

- Rudolph Jusius Emmanuel Clausius (1822-1888) *MT

- Joseph-Louis-François Bertrand (1822-1900) *MT

- Charles Hermite (1822-1901) *SB *MT

- Francis Galton (1822-1911) *SB *MT

- Ferdinand Gotthold Max Eisenstein (1823-1852) *SB *MT

- Guillaume-Jules Hoüel (1823-1886) *SB

- Leopold Kronecker (1823-1891) *SB *MT

- Enrico Betti (1823-1892) *MT

- Jakob Amsler-Laffon (1823-1912) *SB

- Zacharias Dase (1824-1861) *MT

- Delfino Codazzi (1824-1873) *SB

- Gustav Robert Kirchhoff (1824-1887) *SB *MT

- Francesco Brioschi (1824-1847) *MT

- Omura Isshu (1824-1891)

- William Thomson, Lord Kelvin (1824-1907) *MT

1850

- William Spottiswoode (1825-1883)

- Johann Jakob Balmer (1825-1898) *SB

- Georg Friedrich Bernhard Riemann (1826-1866) *SB *MT

- Henry John Stephen Smith (1826-1883) *MT

- Giuseppe Battaglini (1826-1894)

- Ludwig Christian Wiener (1826-1896) *MT

- Théodore Florentin Moutard (1827-1901) *SB

- Karl Mikhailovich Peterson (1828-1881) *SB

- Hagiwara Teisuke (1828-1909)

- Ludvig Valentin Lorenz (1829-1891)

- Elwin Bruno Christoffel (1829-1900) *SB *MT

- Moritz Benedict Cantor (1829-1920) *MT

- Antonio Luigi Gaudazio Giuseppe Cremona (1830-1903) *SB *MT

- James Clerk Maxwell (1831-1879) *SB *MT

- Paul David Gustav Du Bois-Reymond (1831-1889) *SB

- Peter Guthrie Tait (1831-1901) *MT

- Victor Mayer Amédée Mannheim (1831-1906) *SB *MT

- Julius Wilhelm Richard Dedekind (1831-1916) *SB *MT

- Charles Lutwidge Dodgson (Lewis Carroll) (1832-1898) *SB *MT

- Rudolph Otto Sigismund Lipschitz (1832-1903) *SB *MT

- Robert Tucker (1832-1905)

- Eugène Rouché (1832-1910)

- Wilhelm Fiedler (1832-1912)

- J. Lachelier (1832-1918)

- Ludwig Sylow (1832-1918) *MT

- Carl Gottfried Neumann (1832-1925) *SB *MT

- Rudolf Friedrich Alfred Clebsch (1833-1872) *SB *MT

- Immanuel Lazarus Fuchs (1833-1902) *SB *MT

- Hua Hengfan (Ruo Ting) (1833-1902)

- Edmund Nicolas Laguerre (1834-1886) *SB *MT

- John Venn (1834-1923) *MT

1860

- William Stanley Jevons (1835-1882) *SB

- Felice Casorati (1835-1890)

- Émile-Léonard Mathieu (1835-1890) *SB *MT

- Joseph Stefan (1835-1893) *MT

- Eugenio Beltrami (1835-1899) *SB *MT

- Charles Méray (1835-1911) *SB

- Ludwig Hermann Kortum (1836-1909)

- Julius Weingarten (1836-19010 *MT

- E. L. W. Maximilian Curtze (1837-1903) *SB

- Aleksandr Nikolaevich Korkin (1837-1908)

- Hugh McColl (1837-1909) *SB

- Paul Albert Gordon (1837-1912) *SB *MT

- Wilhelm Lexis (1837-1914) *MT

- Paul Gustav Heinrich Bachmann (1837-1920) *SB

- Leo Königsberger (1837-1921)

- Maurice Lévy (1838-1910) *SB

- George William Hill (1838-1914) *SB

- Theodor Reye (1838-1919) *SB

- Camille Jordan (1838-1921) *SB *MT

- Hermann Hankel (1839-1873) *SB *MT

- Gustav Roch (1839-1866)

- Joseph-Émile Barbier (1839-1889) *SB

- Ernst Kossak (1839-1902)

- Josiah Willard Gibbs (1839-1903) *SB *MT

- Christian Gustav Adolph Mayer (1839-1908) *SB

- Julius Peter Christian Petersen (1839-1910) *SB *MT

- Charles Sanders Peirce (1839-1914) *SB

- Hieronymus Georg Zeuthen (1839-1920) *MT

- Émile Michel Hyacinthe Lemoine (1840-1912) *SB

- Emory McClintock (1840-1916)

- Franz Mertens (1840-1927)

- Friedrich Wilheml Karl Ernst Schröder (1841-1902) *MT

- Matthieu Paul Hermann Laurent (1841-1908) *SB

- Sam Loyd (1841-1911) *MT

- Rudolf Sturm (1841-1919)

- François-Edouard-Anatole Lucas (1842-1891) *SB *MT

- François Marius Sophus Lie (1842-1899) *SB *MT

- Otto Stolz (1842-1905)

- John William Strutt, Lord Rayleigh (1842-1909)

- Heinrich Weber (1842-1913) *MT

- Jean-Gaston Darboux (1842-1917) *SB *MT

- Jakob Rosanes (1842-1922) *SB

- Alexander Wilhelm von Brill (1842-1935) *MT

- Giulio Ascoli (1843-1896)

- Paul Tannery (1843-1904) *MT

- Victor Schlegel (1843-1905)

- Gaston Tarry (1843-1913) *MT

- Hermann Amandus Schwarz (1843-1921) *MT

- Moritz Pasch (1843-1930) *SB *MT

- Karl Friedrich Geiser (1843-1934) *SB

- Huang Zongxian (fl. 1873)

- Shi Richun (fl. 1873)

- Georges-Henri Halphen (1844-1889) *SB *MT

- Ludwig Boltzmann (1844-1906) *MT

- Jakob Lueroth (1844-1910) *SB

- Charles Smith (1844-1916)

- Paul Mansion (1844-1919) *SB

- Max Noether (1844-1921) *SB *MT

- Albert Wangerin (1844-1933) *MT

1870

- William Kingdon Clifford (1845-1879) *SB *MT

- Albert Ribacour (1845-1893) *SB

- Albert Victor Bäcklund (1845-1912)

- Georg Cantor (1845-1918) *SB *MT

- Ulisse Dini (1845-1918) *SB *MT

- Henri Brocard (1845-1922)

- Francis Ysidro Edgeworth (1845-1926) *MT

- Platon Sergeevich Poretsky (1846-1907) *SB *MT

- Eugenio Bertini (1846-1933) *MT

- Eugen Netto (1846-1919)

- Gösta Magnus Mittag-Leffler (1846-1927) *SB *MT

- Egor Ivanovich Zolotarev (1847-1878) *MT

- Galileo Ferraris (1847-1897)

- Cesare Arzelà (1847-1912)

- Gaston Floquet (1847-1920)

- Nicolay Egorovich Zhukovsky (1847-1921) *MT

- Wilhelm K. J. Killing (1847-1923) *MT

- William Weyr (1848-1894) *MT

- Jules Tannery (1848-1910) *MT

- Hermann Caesar Hannibal Schubert (1848-1911) *MT

- Eugen Netto (1848-1919) *SB *MT

- Adam Wilhelm Siegmund Guenther (1848-1923) *SB

- Friedrich Ludwig Gottlob Frege (1848-1925) *SB *MT

- J. W. L. Glaisher (1848-1928) *SB

- Diederik Johannes Korteweg(1848-1941) *SB *MT

- Julius König (1849-1914) *SB

- George Ferdinand Frobenius (1849-1917) *SB *MT

- Alfred Kempe (1849-1922) *MT

- Christian Felix Klein (1849-1925) *SB *MT

- Horace Lamb (1849-1934) *SB *MT .

- Sofya Vasilyevna Kovalevskaya (1850-1891) *SB *MT

- Walter William Rouse Ball (1850-1925) *MT

- Oliver Heaviside (1850-1925) *SB *MT

- William Edward Story (1850-1930)

- Alfred Pringsheim (1850-1941) *SB *MT

- George Francis Fitzgerald (1851-1901) *MT

- Anton Puchta (1851-1903)

- George Chrystal (1851-1910) *SB *MT

- Alexander Macfarlane (1851-1913)

- Arthur Schuster (1851-1934)

- Samuel Dickstein (1851-1939) *SB

- William Burnside (1852-1927) *MT

- Constantin LePaige (1852-1929) *SB

- Carl Louis Ferdinand Lindemann (1852-1939) *SB *MT

- Heinrich Maschke (1853-1908)

- Evgraf Stepanovich Fyodorov (1853-1919) *SB

- George Bruce Halsted (1853-1922) *SB

- Gregorio Ricci-Curbastro (1853-1925) *SB *MT

- Johan Ludvig Heiberg (1853-1928)

- Hendrik Antoon Lorentz (1853-1928) *SB *MT

- Arthur Moritz Schoenflies (1853-1928) *MT

- Salvatore Pincherle (1853-1936) *SB *MT

- Fabian Franklin (1853-1939)

- Jules Henri Poincaré (1854-1912) *SB *MT

- Benjamin Osgood Pierce, II (1854-1914) *SB

- Giuseppe Veronese (1854-1917) *MT

- Percy Alexander MacMahon (1854-1929) *SB

- Marcel Louis Brillouin (1854-1948) *MT

1880

- Giovanni Battista Guccia (1855-1914)

- Karl Rohn (1855-1920) *SB

- Paul Appell (1855-1930) *SB

- Sophus Christian Juel (1855-1935)

- Thomas Jan Stieltjes (1856-1894) *MT

- Giacinto Morera (1856-1909)

- Andrei Andreyevich Markov (1856-1922) *SB *MT

- Carl David Tolmé Runge (1856-1927) *SB *MT

- Luigi Bianchi (1856-1928) *MT

- Ferdinand Rudio (1856-1929) *SB

- Friedrich Schur (1856-1932)

- Walther Franz Anton von Dyck (1856-1934) *SB *MT

- Wilhelm Franz Meyer (1856-1934) *SB

- Charles Émile Picard (1856-1941) *SB *MT

- Cypoarissos Stéphanos (1857-1917)

- Aleksandr Mikhailovich Liapunov (1857-1918) *SB *MT

- Henry Ernest Dudeney (1857-1931) *MT

- Karl Pearson (1857-1936) *SB *MT

- Oscar Bolza (1857-1942)

- Gaston Milhaud (1858-1918) *SB

- Henry Buchard Fine (1853-1928) *SB

- Gabriel Koenigs (1858-1931) *SB

- Oscar Minkowski (1858-1931) *SB

- Charlotte Angas Scott (1858-1931)

- Giuseppe Peano (1858-1932) *SB *MT

- Édouard Jean-Baptiste Goursat (1858-1936) *SB *MT

- Arthur Russell Forsythe (1858-1942) *SB *MT

- Max Karl Ernst Ludwig Planck (1858-1947) *SB *MT

- Ernesto Cesàro (1859-1906) *SB *MT

- Adolf Hurwitz (1859-1919) *SB *MT

- Marie-Georges Humbert (1859-1921) *SB

- Johan Ludwig William Valdemar Jensen (1859-1925) *SB *MT

- Otto Ludwig Hölder (1859-1937) *SB *MT

- Mario Pieri (1860-1913) *SB

- Mathias Lerch (1860-1922) *SB

- Henry Taber (1860-1936)

- Frank Morley (1860-1937)

- David Eugene Smith (1860-1944)

- Vito Volterra (1860-1946) *MT

- D'Arcy Wentworth Thompson (1860-1948) *MT

- Heinrich Burkhard (1861-1914) *MT

- Pierre-Maurice-Marie Duhem (1861-1916) *SB *MT

- George Ballard Mathews (1861-1922) *SB

- Frank Nelson Cole (1861-1926) *SB *MT

- Cesare Burali-Forti (1861-1931) *MT

- Thomas Little Heath (1861-1940) *SB *MT

- Friedrich Engel (1861-1941) *SB *MT