Aussie dollar--jumping kangaroo or paper kangaroo?

-

kkk

again dunr waste time to save Oz dollars drom your mom or wife;'s

pockets.

This news reports ANZ and NAB is in merge talks

Oz gavaman will waterdown the unlimited gurantee !!

and this make me worry!!/

quote

Meanwhile, analysts including JPMorgan's Brian Johnson warn Australian banks are "structurally flawed", given their heavy reliance on wholesale funding.

He cites a "massive mismatch between many years of strong loan growth only partly funded by the lagging retail deposit growth with the residual balance funded by way of longer-term offshore funding swapped back to the Australian dollar."

Even with a promise of a three-year blanket protection of the nation's savings, many expect the Government to water down the measures - particularly on deposits - over the next year to head off a looming moral hazard.

Many expect the Government to look to efforts to revive the collapsed bank bill market by gradually watering down the unlimited guarantee to placing cap on protected deposits to about $200,000.

end of quote

http://business.theage.com.au/business/chill-winds-reach-our-fair-shores-20081017-539r.html?page=fullpage#contentSwap2

Chill winds reach our fair shores

On the run. Photo: Getty Images

- Eric Johnston

- October 18, 2008

,,,,

-

Singapore stagflation : May 2008 exports fell most in 17 months; inflation at 26-year highs

<!-- ADDTHIS BUTTON BEGIN --> <!-- ADDTHIS BUTTON END -->

This article belongs to the Singapore stagflation watch story arc.

Singapore's exports fell the most in 17 months in May [2008] as the island's manufacturers shipped fewer electronics and other goods to the US and Europe. Non-oil domestic exports dropped 10.5% from a year earlier, the trade promotion agency said today [17 Jun 2008]. Manufacturers across Asia face easing demand amid slowing growth in the US, the region's largest overseas market. Pharmaceutical shipments dropped 48.5% in May from a year earlier, while electronics shipments slipped 8.5%, the 16th consecutive drop. Semiconductor shipments dropped 12.6%. Sales to the European Union fell 28% in May and US shipments dropped 22.3%.

- The Singapore economy continues to be confronted by stagflation as economic weakness persists and shows signs of actually worsening, while inflation continues to run at 26-year highs. As I have commented earlier, this is as classic as it gets regarding the definition of stagflation : stagnant or slowing economic growth in a time of rising inflation.

Sure, biotech manufacturing is subject to some "lumpiness" as equipment needs to be cleaned and re-setup for the next batch of medicines, but a 48.5% drop year-on-year? This is as good as "falling off the cliff", a sinking sensation that many in the peakoiler community are very, very familiar with. And electronics? 16 consecutive drops in 16 months. They could be trying for some kind of record here, together with semiconductors. A very ugly picture, especially given that inflation is still ongoing, and crude oil continues to set new record highs regularly.

This is the kind of situation that can lead to restlessness amongst the population, and in extreme cases descend into disorder and chaos and in fact it already has in some countries. You can be very sure that the government has got to be very concerned about it. Meanwhile, as an individual, in order to hedge against slowing economic growth, you might want to look into getting a job in a traditionally defensive sector, such as government, military, education, healthcare, and such. And as an investor, in order to hedge against inflation, what you can do is to buy into commodities, hold on to them, and sit tight. Gold and oil and uranium and food and other resources are going higher. Much, much higher. We ain't seen nothing yet.

Singapore CPI inflation rate for May 2008 continues at 26-year high of 7.5%

Singapore's consumer prices rose at a slower-than-expected pace last month [May 2008], reducing the need for further currency gains to rein in inflation. The consumer price index [CPI] jumped 7.5% from a year earlier, matching April's 26-year high record, the Department of Statistics said [23 Jun 2008]. The Monetary Authority of Singapore [MAS] had forecast a 5-6% inflation rate for 2008. The central bank has allowed its currency to strengthen against the US dollar, saying the exchange rate remains its most effective tool to fight inflation.

- The Singapore inflation rate is reportedly stabilizing and analysts are already predicting that it will come down in the second half of 2008. Singapore M3 money supply figures also appear to be stabilizing around the 12-13% level in the past half year, down from a high of 23.62% in 2007. But the money supply growth rate is only half the story - the other half is its relationship to the growth of available goods and services in the economy. For the inflation rate to be stable, economic growth has to at least keep up with money supply growth. With a looming global economic slowdown and imminent worldwide recession, the economic growth factor is the big wildcard.

Gold and crude oil prices may have paused from breaking new all-time record highs for the time being, but the inflationary storm is far from over as yet. We may only be passing through the eye of the hurricane here - just when people start to get lulled into complacency, the winds of inflation could well pick up with renewed force - perhaps even stronger than ever. We need to remain vigilant against inflation. This is no time to let down your guard yet.

Singapore economy stuck in mud : inflation rising, M3 falling, GDP crashing - the stagflation formula

This article belongs to the Singapore stagflation watch story arc.

mas.gov.sg -> mas.gov.sg (pdf) :

The latest Singapore money supply figures are out. For the month of Dec 2007, the Singapore M3 money supply growth has continued to slow, and it now stands at 14.14% year-on-year. However, real inflation shows no signs of abating because we are at the point where economic growth is falling (crashing) faster than M3 money supply growth is slowing. The Singapore economy is thus stuck in mud, and the stagflation formula goes as follows :

14.14% M3 growth - (-4.8% economic growth) = 18.94% real inflation rate.

For your reference, the money supply figures for the year of 2007 are as follows (click here for the spreadsheet if the inline frame is not shown) :

As you can see, in 2007 we have been roaring along with an average M3 money supply growth of 20.6% year-on-year. It was only in the last 3 months (Oct-Dec 2007) that the money supply growth has slowed down considerably.

However, if anything else, this is even worse than the time where it was reported on this blog when M3 growth hit a high of 23.62% back in Jun 2007. At the time, GDP growth was reported to be a still-healthy 8.6% so the M3-to-GDP differential was 23.62% - 8.6% = 15.02% then.

Hence, for myself and for those of you readers who subscribe to the classic Austrian-school definition of monetary inflation as money supply growth relative to economic growth, the fight to maintain our purchasing power has just gotten a lot harder, and this stagflationary environment just makes things even worse.

See also :

1. Singapore 2007Q4 GDP contracted 4.8%, 2008 economic growth forecast lowered

2. Singapore economy shrinks first time since 2003

3. Singapore CPI inflation hits new 25-year high of 4.4% in December

4. Singapore : Inflation rate could push past 6% in Q1 2008(2008-02-25 13:10:42 SGT) [Biz] Permalink Comments [1]

-

Rising inflation across Asia mauls Singapore Reits

Trusts may still get big lift from higher rents, higher hotel rates, say analystsSOARING inflation across Asia has sucked the life out of real estate investment trusts (Reits), whose high-yielding dividends have made them wildly popular among investors in recent years.

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTO

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTOReits, in general, have fallen about 32.5 per cent in value from their peaks last year, but those with assets in inflation-prone economies, such as China, have fared even worse, according to financial portal Shareinvestor.com.

CapitaRetail China Trust, for instance, has fallen 52 per cent in four months, as inflation in China galloped to 7.1 per cent - its highest level in over a decade.

Reits are financial instruments investing in real estate like shopping malls, office buildings and hotels.

Investors can buy units, which are much like shares, offering attractive dividend yields of 6 per cent to 8 per cent derived from rents.

This is far higher than the 1.5 per cent interest on one-year fixed deposits at a bank.

Historically, a low interest rate environment has been good for Reits - if accompanied by low inflation.

Take CapitaMall Trust, the first Reit listed in Singapore. Its assets include the Tampines Mall and Junction 8 shopping centres.

It received an overwhelming response from investors when it listed six years ago, rising from just 96 cents in July 2002 to a record high of $4.32 in July last year. Inflation played its part by staying at a benign 1 per cent.

As the consumer price index, however, surged from 1.3 per cent in June to 4.4 per cent in December, CapitaMall slid 20 per cent over the period.

The inflation pressure is unlikely to abate in the near future.

Last week, the Government revised its estimates upwards to between 4.5 per cent and 5.5 per cent for the year, from an earlier forecast of 3.5 per cent to 4.5 per cent.

So, while fears of a United States recession are causing much grief among investors as they watch the value of their growth stocks evaporate, inflation is becoming a big threat to those with high dividend-yield plays like Reits.

One trader explained: ‘A Reit may offer 6 per cent in dividend yield. But if inflation is running at 4.5 per cent, the actual yield an investor is getting is only 1.5 per cent.’

To compensate for the lower return, an investor will demand a lower price for the Reit, which escalates the pressure on its share price.

Still, analysts have not stopped promoting Reits, despite their lacklustre performance, to clients.

Morgan Stanley made a case last month with a report arguing that investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions.

Investors have ignored the ‘organic’ boost Reits may get from higher rents as leases expire and hotel rates are jacked up during peak periods.

Citigroup noted on Tuesday that while there may not be a clear growth strategy for Reits this year, some are trading at hefty discounts to their net asset values, despite offering single-digit or even double-digit dividend yields.

‘This makes Reits potential takeover targets, if they have loose shareholding structures,’ it added.

Its top picks include Ascendas Reit, Suntec Reit and Parkway Life Reit.

Source : Straits Times - 23 Feb 2008

-

SINGAPORE, Oct 10 - Singapore has slipped into recession and the Government has revised its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

The economy shrank at an annualised, seasonally adjusted rate of 6.3 per cent in the third quarter, according to third quarter advance estimates released by the Ministry of Trade and Industry on Friday morning, pushing the export-dependent economy into its first recession since 2002.

The government also revised down its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

Economists had expected the Republic to narrowly escape a recession in the third quarter by growing 1.1 per cent, lifted by a slight improvement in electronics output.

A recession is often defined as two consecutive quarters of economic contractions.

The deepening financial crisis, which sparked banking crises in the United States, Iceland, Britain, Germany and Ireland, is threatening to drag the world economy into recession.

The advance estimate, based largely on July and August data, gives an early indication of the economy's performance during the July-September period.

MTI said the Singapore economy is estimated to contract by 0.5 per cent in the third quarter, than a year ago.

On a seasonally adjusted, annualised quarter-on-quarter basis, real GDP declined by 6.3 per cent, following a 5.7 per cent decline in the previous quarter.

On the outlook for the year, MTI said since the revised GDP forecast in August, "external economic conditions have deteriorated more than expected and some sectors of the economy have weakened significantly on account of industry-specific or domestic factors.

"The worsening of the financial crisis in the US in recent weeks has deepened the credit crunch, making it more difficult for businesses to sustain economic activities. With unemployment on the rise and house prices continuing to fall, US consumer sentiment has weakened further and will affect demand for exports from Asia and the rest of the world."

It added that Singapore's export-oriented sectors, such as manufacturing, will be affected, noting that Europe is also facing severe strains in the banking sector, tighter credit conditions, and adjustments in housing prices.

Growth in major economies such as Germany, France, Italy and the UK has dipped sharply in the second quarter.

Growth forecasts for several Asian economies, such as China, India and South Korea, have been revised downwards since the start of the year.

The estimates showed that Singapore's manufacturing sector continued to be weighed down by the negative growth in biomedical sciences, as pharmaceutical companies are still producing a mix of pharmaceutical ingredients with values lower than compared to a year ago.

The precision engineering and chemicals clusters have also slowed, because of weaker external demand.

The construction sector grew by 7.8 per cent in the third quarter, compared to the 18.3 per cent growth in the first half of 2008. Despite a strong pipeline of construction projects, a shortage of contractors, a tight labour market for engineers and project managers, and longer waiting times for equipment, have delayed the realisation of these projects.

MTI said the financial services sector is likely to see slower growth in the coming months as the ongoing global financial crisis has heightened uncertainties for sentiment-sensitive segments such as stocks trading and fund management activities.

"Taking into account the slowdown in the global economy and key domestic sectors, MTI has revised the 2008 GDP growth forecast to around 3 per cent. The inflation forecast of 6 - 7 per cent for 2008 remains unchanged," it said. - The Straits Times

Singapore First Asian Economy to fall into Recession

Singapore becomes the first Asian victim of recession

AFP, SINGAPORE

Saturday, Oct 11, 2008, Page 1Singapore has become the first Asian economy to fall into recession, analysts said yesterday, after the government revised downward its full-year growth estimate and eased monetary policy for the first time in years.

The Ministry of Trade and Industry lowered the city-state’s full-year growth forecast to around 3 percent, citing a slowdown in the global economy and key domestic sectors.

The move came as the ministry released preliminary data showing that real GDP declined by 6.3 percent in the third quarter after contracting 5.7 percent in the previous quarter, the ministry said.

While it did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

“Singapore will be the first Asia economy to fall into a technical recession,” DBS Group Research said in an assessment of the data.

In a move to confront the downturn, the Monetary Authority of Singapore (MAS) — its de facto central bank — said it was easing monetary policy for the first time in more than four years.

“The Singapore economy has weakened over the course of 2008, alongside an escalation in the turmoil in financial markets and a more severe deceleration in global economic activity,” MAS said.

These developments meant new uncertainties for the Singapore economy, while slower Asian growth would restrain activity in a range of service industries such as transportation and tourism, it said.

“The risks to external demand conditions continue to be on the downside and a more severe global downturn cannot be discounted,” the bank said.

Singapore is Southeast Asia’s wealthiest economy in terms of GDP per capita, but is heavily dependent on trade. This makes it sensitive to hiccups in developed economies, particularly key export markets the US and Europe.

Economists polled by Dow Jones Newswires had forecast a 0.3 percent quarter-on-quarter rise in GDP, the value of goods and services produced in the economy.

Compared with the third quarter of last year, the ministry said Singapore’s economy contracted by 0.5 percent in real terms, against the 0.8 percent expansion foreseen in the Dow Jones poll.Singapore in recession

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.MTI has also revised its full-year growth forecast for the second time this year, lowering it to 'around 3 per cent' from 4 to 5 per cent previously. This would make it the weakest pace in seven years.

Recognising growth concerns, the Monetary Authority of Singapore also changed its policy stance to zero appreciation of the Singapore dollar, reversing the gradual appreciation policy it has adopted since 2003.

On a quarterly basis, third-quarter GDP contracted 6.3 per cent from the second quarter, on top of a 5.7 per cent decline in the previous three months. A technical recession is generally defined as two consecutive quarters of decline.

Manufacturing led the slowdown again this time around, weighed down by a poor performance in the biomedical sciences segment. It was also hit by weakened global demand for exports as the United States-triggered financial crisis spreads around the world.

The sector shrank by 11.5 per cent in the third quarter, after declining 4.9 per cent in the previous quarter.

Growth in construction and services also slowed. Construction, in particular, saw its pace of expansion halved to single-digit growth, as projects were delayed by the construction squeeze, said MTI.

Services, touted as a key driver of growth this year, is likely to take a hit as well as financial services falters in the wake of the global credit crunch.

Most economists expect the economy to grow even more slowly next year, with the chance of a technical recession turning into a 'real' one.

'With external conditions deteriorating and the lack of domestic demand support, we expect Singapore to register no growth next year... with a muted recovery, if at all, expected only in the second half of next year at the earliest,' said Morgan Stanley economists in a report.

Inflation peaks

Inflation, which reached a 26-year high earlier this year, has peaked, said MAS. Consumer prices will rise between 6 per cent and 7 per cent this year, and gains will ease to between 2.5 per cent and 3.5 per cent in 2009, it predicted.'Against the backdrop of a weakening external economic environment and continuing stresses in global financial markets, the growth of the Singapore economy is expected to remain below potential in the period ahead,' said MAS.

'Inflation is expected to trend down in 2009 as the global and domestic economies slow.'(Straits Times Singapore)

Wednesday, 10 October, 2001, 04:56 GMT 05:56 UK

Singapore economy in recession

<!-- NOLImage --><!-- /NOLImage -->The recession-hit economy of Singapore has shrunk by a record 5.6% during July to September.

The sharp contraction was expected by analysts, and the government is now forecasting that the economy will contract by 3% for the full year.

"In the light of the uncertainty in the global economy, Singapore has now revised its full year growth forecast to minus 3.0%," said Trade Minister George Yeo.

Previously the government had forecast 0.5-1.5% growth.

US ties

The country is suffering from its exposure to the US - its biggest trading partner - which is battling with its own economic problems.

Last month's terrorist attacks on the US have also exacerbated problems by denting consumer confidence.

"The appalling attacks on September 11 and the resulting train of events have probably tipped the global economy into a recession," said Mr Yeo.

Electronics downturn

The sharp contraction in the third quarter was blamed on the downturn in the electronics sector.

The goods producing sector in the trade-driven country fell by 15% while manufacturing output fell by 21% compared with a year ago.

This constitutes the sharpest fall since the 1985 recession.

"From the data so far, it certainly describes the economy is in a far worse shape than it has ever been," said Song Seng Wun, a regional economist at GK Goh brokerage.

However, Aberdeen Asset Management's Hugh Young told the BBC's World Business Report:"The feeling on the streets is not nearly as bad or as gloomy as it was when the Asian crisis hit. Certainly there is a lot of fear over job security right through Singapore at the moment."

Singapore slides into recession

Singapore has become the first Asian country to fall into recession, after growth fell for the second successive quarter.

By Jamie Dunkley

Last Updated: 11:13AM BST 10 Oct 2008The Ministry of Trade and Industry also revised downwards full-year growth forecast to around 3pc, citing a slowdown in the global economy and key domestic sectors.

Southeast Asia's wealthiest economy saw gross domestic product fall by 6.3pc during the third quarter having previously contracted by 5.7pc.

While the ministry did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

In a move to confront the downturn, the Monetary Authority of Singapore - its de facto central bank - said it was also easing monetary policy for the first time in more than four years.

Singapore's economy expanded by 7.7pc last year but have been signs of a slowdown following contractions in Singapore's key manufacturing sector, which includes the country's electronic and pharmaceutical industries.

Construction growth slowed to 7.8pc from 19.8pc, during the quarter, although service industries grew by 6.1pc, marginally down from 7pc in the second quarter.

Singapore's last technical recession was recorded in 2002, when the economy contracted by 2.4pc during the year. The country is seen as an important indicator of economic trends in the rest of Asia due to its export-dependent economy.

Singapore Prime Minister Lee Hsien Loong said Asian economies face a "rough ride" for at least the next year as weakening consumer demand from developed countries hurt the region's exports.

TODAYonline, Weekend, October 11, 2008

................The Singapore dollar, already battered in recent weeks, is expected to weaken further against its United States counterpart. Goldman Sachs predicts the Singapore dollar would weaken to $1.54 to the greenback in the next six months, while UBS expects it to reach $1.50 by the end of the year, according to Bloomberg. The Singapore dollar was trading at around $1.48 yesterday evening, almost 10 per cent off its recent high of $1.35 on July 16. .............

-

Singapore Biodiesel Gloomy in 2008

Wilmar International, an integrated biodiesel producer is badly affected by high crude palm oil (CPO), feedstock for its its biodiesel plants in Indonesia and Malaysia. The biodiesel plants are running at 20% capacity for the first three months of 2008.

Despite the gloomy biofuels sector, Wilmar International, posted on the Singapore-listed firm reported a four-fold surge in fourth-quarter operating profits to $394.2m from $98.8m. Wilmar is also expanding its joint ventures with local companies in Africa, China and Europe.S'pore manufacturers cautious on next 6 months: survey <!-- headline one : end --><!-- more than 7 paragraphs --><!-- story content : start -->

SINGAPORE manufacturers are cautious about the business prospects in the next six months, a Government survey released on Thursday showed, reflecting concerns over a slowing global economy.

In the latest quarterly survey conducted by the Economic Development Board (EDB) among manufacturers, 87 per cent said the outlook for the next six months will not improve from the previous quarter when manufacturing output contracted 5.6 per cent.

A separate survey by the Department of Statistics showed companies in the services sector sharing the same cautious sentiment over the six-month period.

According to the survey, 24 per cent of the services firms polled expected business conditions to improve, while 22 per cent were less optimistic.

The responses are weighted by operating receipts and value added.

<!-- show media links starting at 7th para -->Chemical makers had the gloomiest outlook, with a net weighted 23 per cent of firms expecting business conditions to worsen on the back of high material costs.

Producers in the general manufacturing industries, which include the food, tobacco and printing sectors, were the most optimistic, with a net weighted 11 per cent expecting business to improve.

Singapore's economy shrank 6.6 per cent in the second quarter after seasonal adjustments, its biggest contraction in five years amid a slowdown in key export markets the United States and the European Union.

The less positive business outlook comes against a backdrop of rising unemployment in Singapore.

The jobless rate in the second quarter went up to 2.3 per cent after seasonal adjustments, compared to the previous quarter's 2 per cent, according to latest estimates released by the Ministry of Manpower on Thursday morning.

The data showed that employment grew by 70,600 in the second quarter this year, which is slightly lower than the increase of 73,200 in the previous quarter.

In his National Day message for Singaporean workers, NTUC chief Lim Swee Say on Thursday urged workers to moderate their wage expecations for this year, warning that pushing wages up to fully offset inflation is a risky move, as they will end up paying ever higher prices.

'Instead of pushing wages up to fully offset inflation, we must continue to link built-in wage increase to productivity gain and help our people through various non-wage measures', he said.

This will prevent a 'price-wage spiral', he said.

Singapore still faces woes despite millions spent to boost visitor numbers

With 100,000 set to flock at F1, Singapore tourism is still slowing down

19 Sep 2008 37 views

37 viewsTourism makes up nearly to 10 per cent of Singapore total GDP and the local tourism industry will take a ‘battering’ as analyst predicts Singapore tourism to slow despite our upcoming inaugural F1 first ever night race

The global credit crisis and slowing economy also didn’t help in the slowdown in Singapore tourism. Some 100,000 visitors are expected for the F1 weekend and some 40,000 of those are from overseas

F1 Singapore Grand Prix is part of our nation plan to make it a more global and a unique place. Not only we’re attracting international act of F1 which will earn around S$100 million ($70 million) a year in tourism revenue, there’s also our integrated casino which will open end of next year

-

MAKEPEACE, MAKE CLONES?

A REPORT ON ATTEMPTED ASTROTURFING AND SOCKPUPPETING BY LIONNOISY

a lion puppet

For those who wondered what happened.

Lionnoisy created a clone called "makepeace" which he used in speakers corner to further his own agenda, trying to give people the impression that there are others out there that would agree with him.

Unfortunately he did a very poor job of hiding it.

This kind of behaviour is called sockpuppeting, ie. creating a false online identity to praise, defend or create the illusion of support for one’s self, allies or company.

A sockpuppet is an online identity used for purposes of deception within an Internet community. In its earliest usage, a sockpuppet was a false identity through which a member of an Internet community speaks while pretending not to, like a puppeteer manipulating a hand puppet.[1]

In current usage, the perception of the term has been extended beyond second identities of people who already post in a forum to include other uses of misleading online identities. For example, a NY Times article claims that "sock-puppeting" is defined as "the act of creating a fake online identity to praise, defend or create the illusion of support for one’s self, allies or company."[2]

The key difference between a sockpuppet and a regular pseudonym (sometimes termed an "alt") is the pretense that the puppet is a third party who is not affiliated with the puppeteer.

To "flame wars" and "phishing" we can now add "sock puppet." A sock puppet, for those still boning up, is a false identity through which a member of an Internet community speaks while pretending not to, like a puppeteer manipulating a hand puppet. Recently, a senior editor at The New Republic got in trouble for some particularly colorful sock puppetry.

When Lee Siegel began blogging for The New Republic, he found, as many others have, that Internet posters tend to be fairly outspoken — and a good number of the posters on the blog were harshly critical. An exception was ''sprezzatura,'' who regularly offered extravagant praise. After Mr. Siegel was criticized for his writing about Jon Stewart, host of ''The Daily Show,'' sprezzatura wrote: ''Siegel is brave, brilliant and wittier than Stewart will ever be. Take that, you bunch of immature, abusive sheep.'' A reader charged that sprezzatura was in fact Mr. Siegel, but sprezzatura denied it.

The reader turned out to be right. ...

After making some lame and hasty excuse about his account being hacked, lionnoisy suddenly abandoned all this threads in which him being sockpuppeting was being mentioned. Unfortunately his excuse cannot stand up to logic as he was seen responding to and talking back TO HIS OWN ACCOUNT.

This is what happened:

29th April 0932hrs a "user" called "makepeace" that had never posted before created a lionnoisy-sounding titled thread called "Oz Judge ban TV drama & interview glorify gangland wars "

Already suspisions were raised because the structure and phrasing of the title was signature of lionnoisy. The first post by this "makepeace" was as such:

Originally posted by makepeace:

Oz Supreme Judge Justice Betty King

bans TV drama serices & interviews

glorifying those in the gangland war.The bans to prevent

jurors to be affected while the trial of a murder case is in progress.

U hardly expect democratic and free country like Oz will

ban TV programmes .Right?

U wont know TV programmes on Oz gangsters

are so hot there.Right?

u wont know ganglang wars there also so frequent.Right?

1.Judge cuts down(TV) Nine's Underbelly

Milanda Rout | February 12, 2008

http://www.theaustralian.news.com.au/story/0,25197,23200497-7582,00.html

2.Judge bans 'crime mums' interview

Peter Gregory | April 22, 2008

Barbara Williams and Judith Moran,

the mothers of defendant Evangelos Goussis

and the widow of the murdered Lewis Moran

respectively,were interviewed.

Its damn interesting that this news was under

Entertainment section!!

http://www.brisbanetimes.com.au/news/entertainment/judge-bans-underbelly-report/2008/04/21/1208742836107.html?s_cid=rss_news

3.The Morgan family----the story of the murdered

http://www.melbournecrime.bizhosting.com/moran.family.htm

4.The story of the Boss ,Carl Williams,behind the killing

http://www.melbournecrime.bizhosting.com/carl.williams.htm

5.u can learn more by seraching Justice Betty King

in www.yahoo.com.au

6.Questions

A.Why the media want to air the interview while the trial

is still on?

B.How are the gang activities in Down Under?

C.Am i look like anti--Oz?

D.How true are the postings in 3 and 4 listed above.

i dunt expect the there are so many details about

Oz gangsters.Can any one tell me more?

Note that other then for the user name, this post is virtually indistinguishable from the countless of other lionnoisy posts we can compare it with. The excessive reliance on the media, posting of hyperlinks, using warped logic that takes issues out of their context, and most tellingly the horrible english which make typos and grammatical errors right down to what lionnoisy would EXACTLY make is exactly what you'd expect from lionnoisy.

Hence lionnoisy must have been someone disappointed because after 20 minutes still nobody bothered to reply to his post under makepeace. Hence he decided to bump his own thread.

But after a few lackluster replies, he finally decided to "talk" to makepeace

Originally posted by lionnoisy:

3.The Morgan family----the story of the murdered

http://www.melbournecrime.bizhosting.com/moran.family.htm

4.The story of the Boss ,Carl Williams,behind the killing

http://www.melbournecrime.bizhosting.com/carl.williams.htm

I cant believe there are so many killings

in the above links !!!

More excited than Holloywood movies!!

Note the bad acting, where he pretended to be "excited" and "surprised" about what he wrote himself.

Now this is the funny part, if his account was really hacked as he claimed it to be, he would certainly not be replying back to his "hacked" account so happily in such a way.

But in any case when he was exposed he made this very funny, frantic and desperate post trying to suddenly divorce himself from the actions of his sockpuppetry by claiming he was hacked. Unfortunately all a basic look at the thread will reveal what really happened, and that is nothing other then lionnoisy was caught red-handed sockpuppeting.

Originally posted by lionnoisy:

Why did u check IP and English of forumers?

i just know my acct has been hijacked and u post it!!

It seems u are faster than me?Looks so strange!!

Looks like it is a cyber crime and /or frame up.

Hv anyone(u know who i mean) hacked into my e mails and computers ?

Do i have to hire armed guards to stay outside my

pigeon hole?

I am seeking helps from ISD,CIA,FBI,MI 5 and 6,

PRC Kong Ang, etc to check who hijack my acct

and make me appearing as ''makepeace'' after

i click submit.How safe in this forum??

I will buy you Ya Kun coffee if your info can lead to

catch the criminal,

Forums owners and mods are hereby notified my formal ,written and distressing complaints to cyber crimes!!

Another paethetic, and desperate reply from him when he was cornered:

Originally posted by lionnoisy:

oh it is good.Then can help me saving time to see counsellors How to get rid of computers addicts!!bye

Those who want to see what happened can go here:

http://sgforums.com/forums/10/topics/315326

And some screencaps, so the evidence is preserved:

"mysterous" makepeace appears:

and of course his own excited and poorly acted "reply" to his own clone.

and his own desperate and feeble attempts to wriggle out of the situtation:LOL, what a joker!

-

again,no one can discuss rationally for this topics.

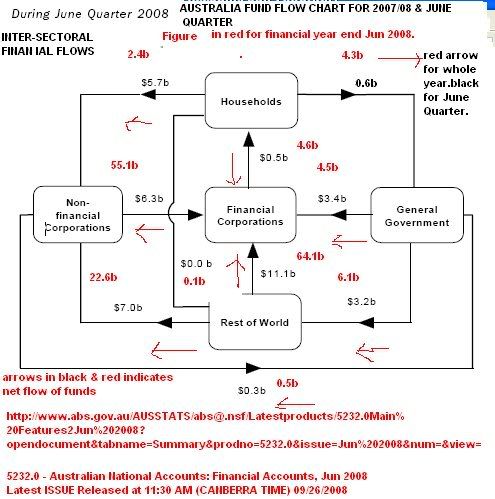

How can u explain that in the Apr to June 2008 quarter,

what did the oz financial coprs(Banks and non--banks)

use the extra funds of A$20.3

(3.4+11.1+6.3-0.5)they borrowed from

non--financial corp,gavamna and foreigners?

This A20 b represent 1.5% of all banks funds.

Oz banks almost go for banks run if there is no gavaman gurantee

We are in this forum to air our views and pick up somethings

useful.u can express different views but not insult others.

Before the announcement of gavaman gurantee all banks deposit,

bankers in Oz felt clients split their deposit in a amount

below the original deposit insurance cover.

Funds in non--big foure were withdrawn and deposited into

big four.

While there has been no run on an Australian bank, anecdotal reports have circulated of some customers splitting their savings into $20,000 lots and depositing them with different institutions in the lead-up to the October 12 package. This was driven by the previous cap on deposit insurance.

A "flight to quality" had also started, with customers withdrawing funds from smaller institutions and placing them with the Big Four.

According to one banker, the environment had declined to the point where a bank run was likely in "a week or two", if the situation remained unaddressed.

But this is not a unanimous view, with former RBA governor Ian Macfarlane describing the deposit guarantee as ineffective policy. With Australia boasting four of only 18 AA-rated global banks, Mr Macfarlane reportedly told a private audience that the industry was better-placed here than offshore. Not only that, the haste with which the Government had acted showed it had been backed into a corner.

http://www.theaustralian.news.com.au/business/story/0,28124,24520338-643,00.html

However,this gentleman failed to tell u short term wholesale

funds supplied 28% for banks funds!!

A$372 b Short term wholesale funds of Oz banks post a threat

http://www.bankers.asn.au/default.aspx?ArticleID=1233

as % of all Oz banks funding sources .......in A $billions

Deposits - Retail

$634

48%

Short-term funds - total

$372

28%

Long-term funds - total

$319

24%

Total

$1,326

100%

Pl read my 17.10.2008 posts.

Gavaman bank gurantee is not a free lunch

Oz banks,like banks in USA,UK, HK and Korea,have to pay a fee--like premium

in insurance--- for for gavaman gurantee.So far,Singapore MAS never mentioned

that this fee will be charged.u can see the confidences of MAS!!

But u can also see the fee charged by US,UK,Oz ,HK and Korea are just a excuse

to increase revenue!!US charges 0.75%,while UK 0.5% plus

the median of the bank's credit default swap spread over the last six months.

The premium will est into the profits of shareholders or banks borrowers

have to bear this cost!!

http://www.theaustralian.news.com.au/business/story/0,28124,24520338-643,00.html

If MAS really no need to charge SG banks for this gurantee,

we will be more than happy.

....

-

some guys still hope the exports of oz commodity can buffer the recent

expected down down and supprt the A$$ .

I am afraid i have to disappoint u!!

Look at this

the Baltic Dry Index which reflects demand and prices for bulk carriers has hit its lowest point since November 2002 when metals demand was in the doldrums.

The vessels that carry iron ore from Australia and Brazil constitute a large part of the index.

The Baltic Dry Index stood at 1506 as the week ended -- a massive fall from the 11,893 points at which it stood as recently as May.

Baltic Exchange Dry Index (BDI),exponential average in red.200 day exp. avr. green

Baltic Exchange Dry Index (BDI),exponential average in red.200 day exp. avr. greenhttp://www.theaustralian.news.com.au/business/story/0,28124,24520340-643,00.html

http://investmenttools.com/futures/bdi_baltic_dry_index.htm

We shall have hopes in life.But not false hopes and be realistic!!

The wind has changed the directions.

Dunt live on your old knowleadge and preceptions!

jmmm

-

Since July,Korea Won depreciates 40% agianst USD,but Aussie depreciates 55%

News reports Korea is suffering a 1997 Asian crisis attacks on Won.

Why did no media report Oz $$ worse than Won?

WEF recent report put Oz banking system as No.4 in the world.

USDKRW=X Won in USD$1---dropped 40% at worst since July.

USDAUD=X A$ in USD$1--dropped 55% at worst since July!!

The international medias,international financial advisory agencies,like WEF,IMF etc

and international rating agencies are digging grave indirectly for Oz economics.

The should sounding timely and direct alarms on Oz situations.

May be Oz is a ang moh country!!

Short term debts in foreign currencies

What are their burdens in the above?

,,,,

-

CPI in Oz may may be understated:Australian wrote

I am not spreading the news.This Oz mate did.

Oz gavaman,like other western gavaman,understates the CPI

so they can give pensioners less to use in other areas!!

Interesting,isnt it?This may answer a question in this forum why

Oz CPI is much lower than SG!!

http://business.smh.com.au/business/pensioners-ripped-off-20081020-54d5.html?page=fullpage#contentSwap1

As to the latest (Oz)fiscal stimulus package, Beavan asks ``why should pensioners look to the thief who is now returning only a small portion of what has been stolen and say thank you? Rather let the thief explain just how much has been stolen and then how it has been used.''

Pensioners could hardly have known, he says, that they voted to fuel a debt-driven housing craze that ensured endless streams of cash heading overseas in the form of interest payments which had been funded through tax cuts.

''What's worse, and a real curse, is this money is going to foreign nationals which is distorting our current account figures and has mortally stabbed in the heart a whole younger generation of Australians with a dagger of debt.''

nnnn

-

Australia CPI is a big joke,if not big cheat

u are welcome to show the game of SG CPI.

Let us discuss which one is better and more realistic!

Unless u are damn innovative,u will think the CPI shall be measured by

same package of goods and services in SAME QUALITY AND QUANTITY

in two different periods .

U are wrong!Oz ABS methodlogy is that if the price go up,

u will buy less !!Read what did this Aussie columist wrote:

(i dunt think u will say he is anti--Oz)

Doing your dough

Let's look at a loaf of bread.

As an example of how removed from reality the ABS calculations and assumptions can be, imagine that a loaf of bread costs $5 and you buy four loaves a week. If it cost $3 previously, you would be worse off to the tune of $8 a week. The ABS, however, might argue that you are in fact better off and that inflation has fallen.

The ABS could assume under their new calculations that, at $5 a loaf, we would only buy three loaves a week instead of four loaves thereby saving $5.

This is known as a quantative assumption. Quantative assumptions, though, are based on consumption trend data that is 12- to 18-months old.

Further, the ABS may assume that another less-price-inflated item is substituted for another loaf saving you another $2.

http://business.smh.com.au/business/pensioners-ripped-off-20081020-54d5.html?page=fullpage#contentSwap1

u can see how ABS explain to u here,if u can understand!!

http://www.abs.gov.au/AUSSTATS/[email protected]/66f306f503e529a5ca25697e0017661f/9E4D75AEF4ACDD50CA25705F001

TABLE 3.1: COMPILING PRICE INDEXES OVER TWO PERIODS

ECA40?opendocument

6461.0 - Australian Consumer Price Index: Concepts, Sources and Methods, 2005Latest ISSUE Released at 11:30 AM (CANBERRA TIME) 08/17/2005CONTENTS

Is it reasonable by capping the weight in certain expenses groupand not include mortgage payment ?For example,Oz caps housing at 19.75% of the calculations.Further,only the House Purchase in included,ignoringrising mortgage interest rates and sky rocketing monthlymortgage repayments!!19.75---main groupred ---sub grouplight green---Expenditure classHOUSING 19.75

4.1 Rents  5.60

5.60

4.1.1 Rents

5.60

5.604.2 Utilities  3.23

3.23

4.2.1 Electricity

1.66

1.664.2.2 Gas and other household fuels

0.70

0.704.2.3 Water and sewerage

0.87

0.874.3 Other housing  10.91

10.914.3.1 House purchase

7.86

7.864.3.2 Property rates and charges

1.20

1.204.3.3 House repairs and maintenance

1.85

1.85There is no place for mortgage interest repyment in CPI!!

http://realestateview.com.au/propertydata/

There is 24 % population rent properties to stay.

Own---35%(i assume mortgage free)

Purchase---35%( iassume under mortgage)

http://www.abs.gov.au/AUSSTATS/[email protected]/66f306f503e529a5ca25697e0017661f/DB7A365FA6856480CA25705F001ECAFE?opendocument

Old methods more reasonable by including mortgage interest payment

http://www.aph.gov.au/LIBRARY/Pubs/cib/1997-98/98cib14.htm

Current Issues Brief 14 1997-98CPI: Past, Present and Future

Stephen Barber

Statistics Group

6 April 1998......

Appendix A: Weighting pattern for the Consumer Price Index in June quarter 1992

Eight capital cities combined

Housing

15.900

Rents

4.865

Privately-owned dwelling rents

4.483

Government-owned dwelling rents

0.382

Home ownership

11.035

Mortgage interest charges

6.608

Local government rates and charges

2.190

House repairs and maintenance

1.827

House insurance

0.410

,,,,

,,,,,

-

Singapore also is making the same mistake by ignoring

the change in mortgage repayment and property purchase prices!!

http://www.singstat.gov.sg/pubn/papers/economy/ip-e28.pdf

page 3 and 15.

I think we shall put a weighted index by refering to % of pple

owner --occupied and renting properties to stay.

Purchase prices and the overall mortgage repayment

shall be considered.

mmmm

-

2 out of 3 famous ratings agencies rated Oz Sovereign ratings

at AAA ,while Fitchrated at AA+.However,banks external debts

is a potential problems.May i add the short term wholesale loans,too.

(Fitch)Mr McCormack estimated Australian banks' external debt to GDP ratio was more than 40 per cent, compared with the median for AA countries at minus 10 per cent. Australian banks have borrowed heavily from abroad due to a limited domestic savings pool to finance a mortgage boom in the past decade.

For triple A rated United Kingdom, the percentage of banks' external debt was at around 25 per cent of GDP while for Canada, also AAA, it was less than 10 per cent...................

Australia's public debt of five per cent of GDP is small in comparison to United States' 60 per cent and Japan's 150 per cent. The tax-to-GDP ratio is around 30 per cent, buoyed in recent years by the global commodities boom which has showered cash on Australia's resource companies like Rio Tinto and helped fill government coffers.references:

http://www.fitchratingsasia.com/CoverageList/document_display_index.asp?id=8135271134157685

k,,,

-

2 out of 3 famous ratings agencies rated Oz Sovereign ratings

at AAA ,while Fitchrated at AA+.However,banks external debts

is a potential problems.May i add the short term wholesale loans,too.

(Fitch)Mr McCormack estimated Australian banks' external debt to GDP ratio was more than 40 per cent, compared with the median for AA countries at minus 10 per cent. Australian banks have borrowed heavily from abroad due to a limited domestic savings pool to finance a mortgage boom in the past decade.

For triple A rated United Kingdom, the percentage of banks' external debt was at around 25 per cent of GDP while for Canada, also AAA, it was less than 10 per cent...................

Australia's public debt of five per cent of GDP is small in comparison to United States' 60 per cent and Japan's 150 per cent. The tax-to-GDP ratio is around 30 per cent, buoyed in recent years by the global commodities boom which has showered cash on Australia's resource companies like Rio Tinto and helped fill government coffers.references:

http://www.fitchratingsasia.com/CoverageList/document_display_index.asp?id=8135271134157685

k,,,

-

lionnoisy,

why are you still crapping here, that the Aus dollar had start to rise from the $1:A$1 mark?

-

Icaland is the future of Australia which bears interest of foreign debts

as high as 4 % GDP,twice the burden of USA!!

1.Another Iceland

It gets worse. Redeker continued: "There is a risk, however remote, that Australia could face some of the foreign funding difficulties we have seen in Iceland."

http://www.brisbanetimes.com.au/articles/2008/10/19/1224351113115.html?page=2

Why real estate spending could make Australia the new Iceland

Paul Sheehan | October 19, 2008

2. Just the interest of foreign debts is 4 % of GDP,twice of USA

Gabriel Stein, from Lombard Street Research, said Australia could prove vulnerable once the global commodity cycle turns down. It has racked up a current account deficit of 6.2pc of GDP despite enjoying a coal, wheat, and metals boom, effectively spending its resources bonanza in advance. Household debt has reached 177pc of GDP, almost a world record.

"It is amazing that in the midst of the biggest commodity boom ever seen they have still been unable to get a current account surplus. They have been living beyond their means for 10 years. What worries me is that productivity growth has been very low: they have coasting after their reforms in the 1990s," he said.

Australia's Reserve Bank has had to grapple with vast inflows of Asian capital, especially Japanese money fleeing near zero rates at home. Short of imposing currency controls, it would have been almost impossible to stop the inflows.

"The easy money went straight into real estate," said Hans Redeker, currency chief at BNP Paribas.

"Australia will now have to generate 4pc of GDP to meet payments to foreign holders of its assets," he said. This is twice as high as the burden faced by the US.

http://www.telegraph.co.uk/finance/newsbysector/banksandfinance/2794032/Australia-faces-worse-crisis-than-America.html

Australia faces worse crisis than America

By Ambrose Evans-Pritchard, International Business Editor

Last Updated: 3:24PM BST 22 Sep 2008

kkkkk

-

3.Short term funds.Long term loans.

Carry trade is not a free lunch

Australia has allowed its net foreign liabilities to reach 60pc of GDP during a decade-long boom, twice the level of the US. The country will, in effect, have to pay 4pc of GDP in the form of rents to foreign asset-holders as the bill for such extravagance falls due.

“Yes, Australia has a fiscal surplus, but that does not offer as much protection as people think. If the government boosts spending further, the current account deficit will spiral out of control. There is a risk – however remote – that it could face some of the foreign funding difficulties we have seen in Iceland,” said Mr Redeker.

The current account deficit has been running at 6.2pc of GDP this year despite bumper prices for Australia’s coal, iron ore and farm exports. The commodity crash over the last two months has now yanked the rug from under an economy that was already buckling.

Governor Stevens said household debt has risen from around 50pc of disposable income to 160pc since the 1990s, one of the highest levels in the world.

The immediate problem for Australia’s banks is that they gorged on offshore US dollar markets to fund expansion because the interest costs were lower.

They were playing a version of the dollar “carry trade” on a huge scale with leverage. The window has now jammed shut on these markets, leaving lenders struggling to roll over loans.

European banks face much the same problem as dollar liabilities come back to haunt, but Australian lenders have pushed their luck even further.

http://www.telegraph.co.uk/finance/markets/3154689/Australia-cuts-rates-by-1pc-to-restore-confidence.html

Australia cuts rates by 1pc to restore confidence

By Ambrose Evans-Pritchard

Last Updated: 1:20PM BST 08 Oct 2008@@@@@@@@@

what can i say ?

mmm

-

heavy debt doesn't mean that a currency will collapse.

as long as there are takers willing to buy up these debts, a nation with a big national debt can still maintain a strong currency.

though australia is located down under geographically, it is unlikely that its economy will also go down under.

-

Singapore stagflation : May 2008 exports fell most in 17 months; inflation at 26-year highs

<!-- ADDTHIS BUTTON BEGIN --> <!-- ADDTHIS BUTTON END -->

This article belongs to the Singapore stagflation watch story arc.

Singapore's exports fell the most in 17 months in May [2008] as the island's manufacturers shipped fewer electronics and other goods to the US and Europe. Non-oil domestic exports dropped 10.5% from a year earlier, the trade promotion agency said today [17 Jun 2008]. Manufacturers across Asia face easing demand amid slowing growth in the US, the region's largest overseas market. Pharmaceutical shipments dropped 48.5% in May from a year earlier, while electronics shipments slipped 8.5%, the 16th consecutive drop. Semiconductor shipments dropped 12.6%. Sales to the European Union fell 28% in May and US shipments dropped 22.3%.

- The Singapore economy continues to be confronted by stagflation as economic weakness persists and shows signs of actually worsening, while inflation continues to run at 26-year highs. As I have commented earlier, this is as classic as it gets regarding the definition of stagflation : stagnant or slowing economic growth in a time of rising inflation.

Sure, biotech manufacturing is subject to some "lumpiness" as equipment needs to be cleaned and re-setup for the next batch of medicines, but a 48.5% drop year-on-year? This is as good as "falling off the cliff", a sinking sensation that many in the peakoiler community are very, very familiar with. And electronics? 16 consecutive drops in 16 months. They could be trying for some kind of record here, together with semiconductors. A very ugly picture, especially given that inflation is still ongoing, and crude oil continues to set new record highs regularly.

This is the kind of situation that can lead to restlessness amongst the population, and in extreme cases descend into disorder and chaos and in fact it already has in some countries. You can be very sure that the government has got to be very concerned about it. Meanwhile, as an individual, in order to hedge against slowing economic growth, you might want to look into getting a job in a traditionally defensive sector, such as government, military, education, healthcare, and such. And as an investor, in order to hedge against inflation, what you can do is to buy into commodities, hold on to them, and sit tight. Gold and oil and uranium and food and other resources are going higher. Much, much higher. We ain't seen nothing yet.

Singapore CPI inflation rate for May 2008 continues at 26-year high of 7.5%

Singapore's consumer prices rose at a slower-than-expected pace last month [May 2008], reducing the need for further currency gains to rein in inflation. The consumer price index [CPI] jumped 7.5% from a year earlier, matching April's 26-year high record, the Department of Statistics said [23 Jun 2008]. The Monetary Authority of Singapore [MAS] had forecast a 5-6% inflation rate for 2008. The central bank has allowed its currency to strengthen against the US dollar, saying the exchange rate remains its most effective tool to fight inflation.

- The Singapore inflation rate is reportedly stabilizing and analysts are already predicting that it will come down in the second half of 2008. Singapore M3 money supply figures also appear to be stabilizing around the 12-13% level in the past half year, down from a high of 23.62% in 2007. But the money supply growth rate is only half the story - the other half is its relationship to the growth of available goods and services in the economy. For the inflation rate to be stable, economic growth has to at least keep up with money supply growth. With a looming global economic slowdown and imminent worldwide recession, the economic growth factor is the big wildcard.

Gold and crude oil prices may have paused from breaking new all-time record highs for the time being, but the inflationary storm is far from over as yet. We may only be passing through the eye of the hurricane here - just when people start to get lulled into complacency, the winds of inflation could well pick up with renewed force - perhaps even stronger than ever. We need to remain vigilant against inflation. This is no time to let down your guard yet.

Singapore economy stuck in mud : inflation rising, M3 falling, GDP crashing - the stagflation formula

This article belongs to the Singapore stagflation watch story arc.

mas.gov.sg -> mas.gov.sg (pdf) :

The latest Singapore money supply figures are out. For the month of Dec 2007, the Singapore M3 money supply growth has continued to slow, and it now stands at 14.14% year-on-year. However, real inflation shows no signs of abating because we are at the point where economic growth is falling (crashing) faster than M3 money supply growth is slowing. The Singapore economy is thus stuck in mud, and the stagflation formula goes as follows :

14.14% M3 growth - (-4.8% economic growth) = 18.94% real inflation rate.

For your reference, the money supply figures for the year of 2007 are as follows (click here for the spreadsheet if the inline frame is not shown) :

As you can see, in 2007 we have been roaring along with an average M3 money supply growth of 20.6% year-on-year. It was only in the last 3 months (Oct-Dec 2007) that the money supply growth has slowed down considerably.

However, if anything else, this is even worse than the time where it was reported on this blog when M3 growth hit a high of 23.62% back in Jun 2007. At the time, GDP growth was reported to be a still-healthy 8.6% so the M3-to-GDP differential was 23.62% - 8.6% = 15.02% then.

Hence, for myself and for those of you readers who subscribe to the classic Austrian-school definition of monetary inflation as money supply growth relative to economic growth, the fight to maintain our purchasing power has just gotten a lot harder, and this stagflationary environment just makes things even worse.

See also :

1. Singapore 2007Q4 GDP contracted 4.8%, 2008 economic growth forecast lowered

2. Singapore economy shrinks first time since 2003

3. Singapore CPI inflation hits new 25-year high of 4.4% in December

4. Singapore : Inflation rate could push past 6% in Q1 2008(2008-02-25 13:10:42 SGT) [Biz] Permalink Comments [1]

-

Rising inflation across Asia mauls Singapore Reits

Trusts may still get big lift from higher rents, higher hotel rates, say analystsSOARING inflation across Asia has sucked the life out of real estate investment trusts (Reits), whose high-yielding dividends have made them wildly popular among investors in recent years.

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTO

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTOReits, in general, have fallen about 32.5 per cent in value from their peaks last year, but those with assets in inflation-prone economies, such as China, have fared even worse, according to financial portal Shareinvestor.com.

CapitaRetail China Trust, for instance, has fallen 52 per cent in four months, as inflation in China galloped to 7.1 per cent - its highest level in over a decade.

Reits are financial instruments investing in real estate like shopping malls, office buildings and hotels.

Investors can buy units, which are much like shares, offering attractive dividend yields of 6 per cent to 8 per cent derived from rents.

This is far higher than the 1.5 per cent interest on one-year fixed deposits at a bank.

Historically, a low interest rate environment has been good for Reits - if accompanied by low inflation.

Take CapitaMall Trust, the first Reit listed in Singapore. Its assets include the Tampines Mall and Junction 8 shopping centres.

It received an overwhelming response from investors when it listed six years ago, rising from just 96 cents in July 2002 to a record high of $4.32 in July last year. Inflation played its part by staying at a benign 1 per cent.

As the consumer price index, however, surged from 1.3 per cent in June to 4.4 per cent in December, CapitaMall slid 20 per cent over the period.

The inflation pressure is unlikely to abate in the near future.

Last week, the Government revised its estimates upwards to between 4.5 per cent and 5.5 per cent for the year, from an earlier forecast of 3.5 per cent to 4.5 per cent.

So, while fears of a United States recession are causing much grief among investors as they watch the value of their growth stocks evaporate, inflation is becoming a big threat to those with high dividend-yield plays like Reits.

One trader explained: ‘A Reit may offer 6 per cent in dividend yield. But if inflation is running at 4.5 per cent, the actual yield an investor is getting is only 1.5 per cent.’

To compensate for the lower return, an investor will demand a lower price for the Reit, which escalates the pressure on its share price.

Still, analysts have not stopped promoting Reits, despite their lacklustre performance, to clients.

Morgan Stanley made a case last month with a report arguing that investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions.

Investors have ignored the ‘organic’ boost Reits may get from higher rents as leases expire and hotel rates are jacked up during peak periods.

Citigroup noted on Tuesday that while there may not be a clear growth strategy for Reits this year, some are trading at hefty discounts to their net asset values, despite offering single-digit or even double-digit dividend yields.

‘This makes Reits potential takeover targets, if they have loose shareholding structures,’ it added.

Its top picks include Ascendas Reit, Suntec Reit and Parkway Life Reit.

Source : Straits Times - 23 Feb 2008

-

SINGAPORE, Oct 10 - Singapore has slipped into recession and the Government has revised its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

The economy shrank at an annualised, seasonally adjusted rate of 6.3 per cent in the third quarter, according to third quarter advance estimates released by the Ministry of Trade and Industry on Friday morning, pushing the export-dependent economy into its first recession since 2002.

The government also revised down its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

Economists had expected the Republic to narrowly escape a recession in the third quarter by growing 1.1 per cent, lifted by a slight improvement in electronics output.

A recession is often defined as two consecutive quarters of economic contractions.

The deepening financial crisis, which sparked banking crises in the United States, Iceland, Britain, Germany and Ireland, is threatening to drag the world economy into recession.

The advance estimate, based largely on July and August data, gives an early indication of the economy's performance during the July-September period.

MTI said the Singapore economy is estimated to contract by 0.5 per cent in the third quarter, than a year ago.

On a seasonally adjusted, annualised quarter-on-quarter basis, real GDP declined by 6.3 per cent, following a 5.7 per cent decline in the previous quarter.

On the outlook for the year, MTI said since the revised GDP forecast in August, "external economic conditions have deteriorated more than expected and some sectors of the economy have weakened significantly on account of industry-specific or domestic factors.

"The worsening of the financial crisis in the US in recent weeks has deepened the credit crunch, making it more difficult for businesses to sustain economic activities. With unemployment on the rise and house prices continuing to fall, US consumer sentiment has weakened further and will affect demand for exports from Asia and the rest of the world."

It added that Singapore's export-oriented sectors, such as manufacturing, will be affected, noting that Europe is also facing severe strains in the banking sector, tighter credit conditions, and adjustments in housing prices.

Growth in major economies such as Germany, France, Italy and the UK has dipped sharply in the second quarter.

Growth forecasts for several Asian economies, such as China, India and South Korea, have been revised downwards since the start of the year.

The estimates showed that Singapore's manufacturing sector continued to be weighed down by the negative growth in biomedical sciences, as pharmaceutical companies are still producing a mix of pharmaceutical ingredients with values lower than compared to a year ago.

The precision engineering and chemicals clusters have also slowed, because of weaker external demand.

The construction sector grew by 7.8 per cent in the third quarter, compared to the 18.3 per cent growth in the first half of 2008. Despite a strong pipeline of construction projects, a shortage of contractors, a tight labour market for engineers and project managers, and longer waiting times for equipment, have delayed the realisation of these projects.

MTI said the financial services sector is likely to see slower growth in the coming months as the ongoing global financial crisis has heightened uncertainties for sentiment-sensitive segments such as stocks trading and fund management activities.

"Taking into account the slowdown in the global economy and key domestic sectors, MTI has revised the 2008 GDP growth forecast to around 3 per cent. The inflation forecast of 6 - 7 per cent for 2008 remains unchanged," it said. - The Straits Times

Singapore First Asian Economy to fall into Recession

Singapore becomes the first Asian victim of recession

AFP, SINGAPORE

Saturday, Oct 11, 2008, Page 1Singapore has become the first Asian economy to fall into recession, analysts said yesterday, after the government revised downward its full-year growth estimate and eased monetary policy for the first time in years.

The Ministry of Trade and Industry lowered the city-state’s full-year growth forecast to around 3 percent, citing a slowdown in the global economy and key domestic sectors.

The move came as the ministry released preliminary data showing that real GDP declined by 6.3 percent in the third quarter after contracting 5.7 percent in the previous quarter, the ministry said.

While it did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

“Singapore will be the first Asia economy to fall into a technical recession,” DBS Group Research said in an assessment of the data.

In a move to confront the downturn, the Monetary Authority of Singapore (MAS) — its de facto central bank — said it was easing monetary policy for the first time in more than four years.

“The Singapore economy has weakened over the course of 2008, alongside an escalation in the turmoil in financial markets and a more severe deceleration in global economic activity,” MAS said.

These developments meant new uncertainties for the Singapore economy, while slower Asian growth would restrain activity in a range of service industries such as transportation and tourism, it said.

“The risks to external demand conditions continue to be on the downside and a more severe global downturn cannot be discounted,” the bank said.

Singapore is Southeast Asia’s wealthiest economy in terms of GDP per capita, but is heavily dependent on trade. This makes it sensitive to hiccups in developed economies, particularly key export markets the US and Europe.

Economists polled by Dow Jones Newswires had forecast a 0.3 percent quarter-on-quarter rise in GDP, the value of goods and services produced in the economy.

Compared with the third quarter of last year, the ministry said Singapore’s economy contracted by 0.5 percent in real terms, against the 0.8 percent expansion foreseen in the Dow Jones poll.Singapore in recession

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.MTI has also revised its full-year growth forecast for the second time this year, lowering it to 'around 3 per cent' from 4 to 5 per cent previously. This would make it the weakest pace in seven years.

Recognising growth concerns, the Monetary Authority of Singapore also changed its policy stance to zero appreciation of the Singapore dollar, reversing the gradual appreciation policy it has adopted since 2003.

On a quarterly basis, third-quarter GDP contracted 6.3 per cent from the second quarter, on top of a 5.7 per cent decline in the previous three months. A technical recession is generally defined as two consecutive quarters of decline.

Manufacturing led the slowdown again this time around, weighed down by a poor performance in the biomedical sciences segment. It was also hit by weakened global demand for exports as the United States-triggered financial crisis spreads around the world.

The sector shrank by 11.5 per cent in the third quarter, after declining 4.9 per cent in the previous quarter.

Growth in construction and services also slowed. Construction, in particular, saw its pace of expansion halved to single-digit growth, as projects were delayed by the construction squeeze, said MTI.

Services, touted as a key driver of growth this year, is likely to take a hit as well as financial services falters in the wake of the global credit crunch.

Most economists expect the economy to grow even more slowly next year, with the chance of a technical recession turning into a 'real' one.

'With external conditions deteriorating and the lack of domestic demand support, we expect Singapore to register no growth next year... with a muted recovery, if at all, expected only in the second half of next year at the earliest,' said Morgan Stanley economists in a report.

Inflation peaks

Inflation, which reached a 26-year high earlier this year, has peaked, said MAS. Consumer prices will rise between 6 per cent and 7 per cent this year, and gains will ease to between 2.5 per cent and 3.5 per cent in 2009, it predicted.'Against the backdrop of a weakening external economic environment and continuing stresses in global financial markets, the growth of the Singapore economy is expected to remain below potential in the period ahead,' said MAS.

'Inflation is expected to trend down in 2009 as the global and domestic economies slow.'(Straits Times Singapore)

Wednesday, 10 October, 2001, 04:56 GMT 05:56 UK

Singapore economy in recession

<!-- NOLImage --><!-- /NOLImage -->The recession-hit economy of Singapore has shrunk by a record 5.6% during July to September.

The sharp contraction was expected by analysts, and the government is now forecasting that the economy will contract by 3% for the full year.

"In the light of the uncertainty in the global economy, Singapore has now revised its full year growth forecast to minus 3.0%," said Trade Minister George Yeo.

Previously the government had forecast 0.5-1.5% growth.

US ties

The country is suffering from its exposure to the US - its biggest trading partner - which is battling with its own economic problems.

Last month's terrorist attacks on the US have also exacerbated problems by denting consumer confidence.

"The appalling attacks on September 11 and the resulting train of events have probably tipped the global economy into a recession," said Mr Yeo.

Electronics downturn

The sharp contraction in the third quarter was blamed on the downturn in the electronics sector.

The goods producing sector in the trade-driven country fell by 15% while manufacturing output fell by 21% compared with a year ago.

This constitutes the sharpest fall since the 1985 recession.

"From the data so far, it certainly describes the economy is in a far worse shape than it has ever been," said Song Seng Wun, a regional economist at GK Goh brokerage.

However, Aberdeen Asset Management's Hugh Young told the BBC's World Business Report:"The feeling on the streets is not nearly as bad or as gloomy as it was when the Asian crisis hit. Certainly there is a lot of fear over job security right through Singapore at the moment."

Singapore slides into recession

Singapore has become the first Asian country to fall into recession, after growth fell for the second successive quarter.

By Jamie Dunkley

Last Updated: 11:13AM BST 10 Oct 2008The Ministry of Trade and Industry also revised downwards full-year growth forecast to around 3pc, citing a slowdown in the global economy and key domestic sectors.

Southeast Asia's wealthiest economy saw gross domestic product fall by 6.3pc during the third quarter having previously contracted by 5.7pc.

While the ministry did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

In a move to confront the downturn, the Monetary Authority of Singapore - its de facto central bank - said it was also easing monetary policy for the first time in more than four years.

Singapore's economy expanded by 7.7pc last year but have been signs of a slowdown following contractions in Singapore's key manufacturing sector, which includes the country's electronic and pharmaceutical industries.

Construction growth slowed to 7.8pc from 19.8pc, during the quarter, although service industries grew by 6.1pc, marginally down from 7pc in the second quarter.

Singapore's last technical recession was recorded in 2002, when the economy contracted by 2.4pc during the year. The country is seen as an important indicator of economic trends in the rest of Asia due to its export-dependent economy.

Singapore Prime Minister Lee Hsien Loong said Asian economies face a "rough ride" for at least the next year as weakening consumer demand from developed countries hurt the region's exports.

TODAYonline, Weekend, October 11, 2008

................The Singapore dollar, already battered in recent weeks, is expected to weaken further against its United States counterpart. Goldman Sachs predicts the Singapore dollar would weaken to $1.54 to the greenback in the next six months, while UBS expects it to reach $1.50 by the end of the year, according to Bloomberg. The Singapore dollar was trading at around $1.48 yesterday evening, almost 10 per cent off its recent high of $1.35 on July 16. .............

-

Singapore Biodiesel Gloomy in 2008

Wilmar International, an integrated biodiesel producer is badly affected by high crude palm oil (CPO), feedstock for its its biodiesel plants in Indonesia and Malaysia. The biodiesel plants are running at 20% capacity for the first three months of 2008.