Can you afford retirement with just CPF in sunny Singapore?

-

With inflation hovering around 6%, my expectation is that it will continue within the range of 4% to 6% in the next 10 years. Interest rates currently pay you less than 1% a year.

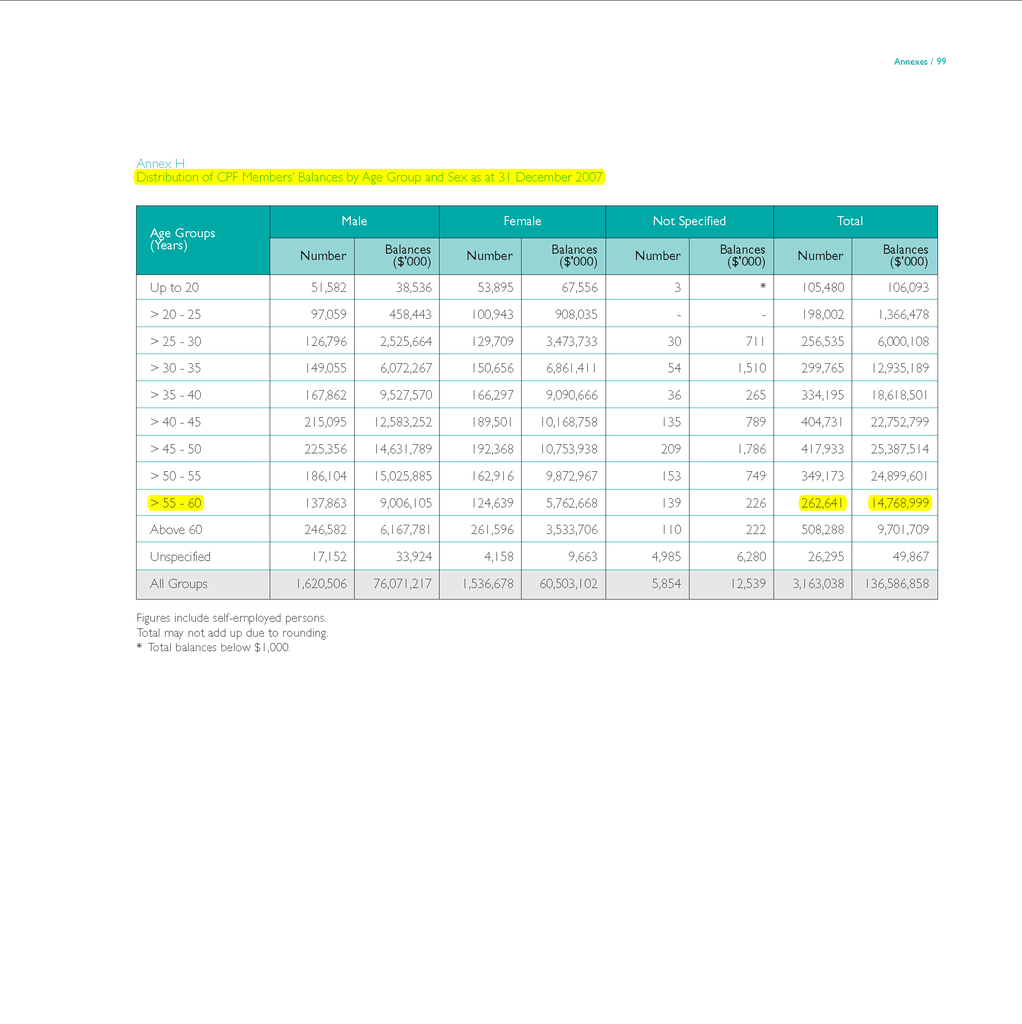

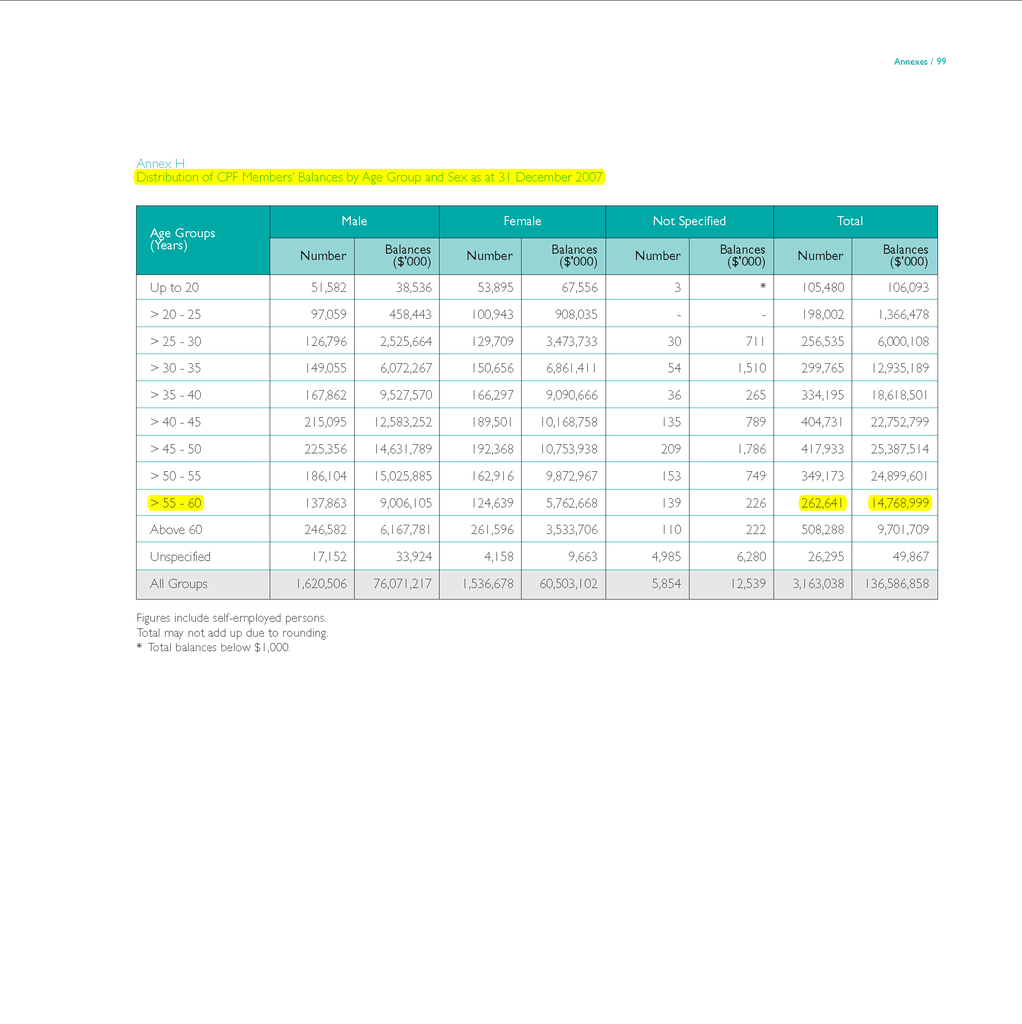

Looking at the current retiring generation of folks in their 55s to 60s. These 55s to 60s have a total of $14,768,999,000 distributed amongst themselves (262,641).

This works out to about $56,233 per each soon to be sexagenarian.

How much do you think $56,233 will last these old folks if they leave it in CPF to earn 2.5%, withdrawing $1,000 per month?

5 years!!! Provided that no chronic illness befalls them, else it will be even shorter.

With inflation hovering around 4% - 6% in the future (my guesstimate). Does the interest rates that CPF pay these old folks even make up for the increase in cost of living? We are all making negative interest rates.

Any chance of retirement for the average Joe Singaporeans?

Yes!!! But only in your wildest dreams!!!

-

That's why they need more new citizens to top up CPF and to ensure there is enough funds in the future.

Problem is, the population cannot increase in size indefinitely without social costs.

Looks like money trumps every other consideration.

-

Looks like money trumps every other consideration.

Our ministers earn the highest pay in the world after all.

When it comes to PAP, there is only one priority.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

-

i think CPF is the gahmen's plan of eliminating old people in singapore. since they are useless and cant pay tax anymore, might as well just let them burn themselves out with illnesses. so singapore becomes more of a slave society, when u cant contribute to their coffers anymore, they'll just throw you into a hole and let you die in agony.

-

the elderly would be "conviniently" forgotten by the society and the government, and left to rot in nursing homes.

-

Originally posted by Poh Ah Pak:

Our ministers earn the highest pay in the world after all.

When it comes to PAP, there is only one priority.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY. MONEY.

*clap*clap*

-

i think its quite straightforward...

we cant jus rely on cpf funds...

worse for those youngsters..as e minimum sum will only go up..not down...in time to come..by e time we hit 55..not much left to withdraw

-

Originally posted by alfagal:

i think its quite straightforward...

we cant jus rely on cpf funds...

worse for those youngsters..as e minimum sum will only go up..not down...in time to come..by e time we hit 55..not much left to withdraw

Quite ironic don't you think?

The CPF was conceived out of helping average Singaporeans plan their retirement savings, since it is no longer a credible source of retirement savings to rely on, shouldn't the government do something to prop up this source of retirement funds.Those elderly (60 y.o. born in 1948) who contributed their salary since they started working in 1968 are retiring soon. But the sum they have in their CPF, is not even sufficient for them to live for 5 years without medical illness.

If the PAP government chooses not to prop up the retirement savings of the average Singaporeans, shouldn't they scrap the CPF scheme altogether. Afterall, why give the average Singaporeans a false sense of security by making them think that CPF would see them through their old age.

Or, they should consider raising the interest rates to a ceiling to match the inflation rate and a floor equivalent to their current calculation of 2.5% now.

All those multi-million dollar salaries and they can't even keep their word of CPF as a source of funds for retirement.

-

Actually for prudent financial planning's sake, perhaps people should disregard the money in their CPF. Use as much of it for financing their mortgage loans. (What other good use is there other than this?)

This would force them to calculate their retirement savings based on whatever they have outside CPF. If this is enough, then when they finally get their CPF, it would be considered a "bonus".

Alas, a huge majority of the population won't have sufficient retirement funds even if CPF was included.

Haiz.

-

Retirement, I can't even afford a flat.

-

Hope I live long enough to see some of my CPF

-

Originally posted by ditzy:

Retirement, I can't even afford a flat.

Maybe this recession will push HDB prices down by 50%.

Voila, you might just afford that nice little 3 room flat.

-

HDB 400k.. nice hor? some more 4 room only..

100k for 1 room

-

Originally posted by charlize:

Actually for prudent financial planning's sake, perhaps people should disregard the money in their CPF. Use as much of it for financing their mortgage loans. (What other good use is there other than this?)

This would force them to calculate their retirement savings based on whatever they have outside CPF. If this is enough, then when they finally get their CPF, it would be considered a "bonus".

Alas, a huge majority of the population won't have sufficient retirement funds even if CPF was included.

Haiz.

very well said.....CPF is as good as useless in time to come...so use it on housing instead

-

Not possible... unless you live in other country...

-

HDB 400k.. nice hor? some more 4 room only..

100k for 1 room

why buy this stupid 400k HDB in the first place?

u can alwasy choose jurong west.

my 5 room flat in jurong west cost me only 200k 3 yr ago.

-

The question is not whether we can afford retirement with just our CPF, it should be whether we can actually get our CPF.

-

Originally posted by caleb_chiang:

Not possible... unless you live in other country...

To get immigration status in another advanced country, you need to be young and highly qualified, if one is old he needs to be filthy rich, else which country would want to take in. Unless we go lower down the line and choose Vietnam or China.

-

Originally posted by maurizio13:

With inflation hovering around 6%, my expectation is that it will continue within the range of 4% to 6% in the next 10 years. Interest rates currently pay you less than 1% a year.

Looking at the current retiring generation of folks in their 55s to 60s. These 55s to 60s have a total of $14,768,999,000 distributed amongst themselves (262,641).

This works out to about $56,233 per each soon to be sexagenarian.

How much do you think $56,233 will last these old folks if they leave it in CPF to earn 2.5%, withdrawing $1,000 per month?

5 years!!! Provided that no chronic illness befalls them, else it will be even shorter.

With inflation hovering around 4% - 6% in the future (my guesstimate). Does the interest rates that CPF pay these old folks even make up for the increase in cost of living? We are all making negative interest rates.

Any chance of retirement for the average Joe Singaporeans?

Yes!!! But only in your wildest dreams!!!

Then dun be average lor ;D

-

no chance la... unless u r elite...

-

Originally posted by charlize:

Actually for prudent financial planning's sake, perhaps people should disregard the money in their CPF. Use as much of it for financing their mortgage loans. (What other good use is there other than this?)

This would force them to calculate their retirement savings based on whatever they have outside CPF. If this is enough, then when they finally get their CPF, it would be considered a "bonus".

Alas, a huge majority of the population won't have sufficient retirement funds even if CPF was included.

Haiz.

some pple keep thinking retirement nest got CPF cover, then they dun bother to go plan for their finances for retirement

-

Originally posted by BrUtUs:

no chance la... unless u r elite...

not true lor

still got many rags to riches stories around

-

the average singaporean never retires.

-

Originally posted by eagle:

not true lor

still got many rags to riches stories around

yes unless u managed to struck rich... else an average sg wun b able to b so relax... -

Originally posted by maurizio13:

Quite ironic don't you think?

The CPF was conceived out of helping average Singaporeans plan their retirement savings, since it is no longer a credible source of retirement savings to rely on, shouldn't the government do something to prop up this source of retirement funds.Those elderly (60 y.o. born in 1948) who contributed their salary since they started working in 1968 are retiring soon. But the sum they have in their CPF, is not even sufficient for them to live for 5 years without medical illness.

If the PAP government chooses not to prop up the retirement savings of the average Singaporeans, shouldn't they scrap the CPF scheme altogether. Afterall, why give the average Singaporeans a false sense of security by making them think that CPF would see them through their old age.

Or, they should consider raising the interest rates to a ceiling to match the inflation rate and a floor equivalent to their current calculation of 2.5% now.

All those multi-million dollar salaries and they can't even keep their word of CPF as a source of funds for retirement.

After 51 Years of LKY at the helm, and finding out the "double speak" in most of his words documented - {read "a nation cheated"} - can we believe that the CPF was all about helping Singaporeans to save for retirement ?When LKY stepped into the seat of a Self-Governing Singapore, the British Colonial Government had already set up the Provident Fund, while LKY, Toh Chin Chye and Goh Keng Swee were toying with the idea of some form of Social Welfare.

But with an empty State Treasury after Lim Yew Hock short rule at the helm, the easiest route to create money for the PAP to rule effectively was to expand aggressively on the Colonial Government's Provident Fund scheme.

Over time, with the easy accessiblity to a cheap source of fund for public projects that can be accumulated in such geometrical proportions by legislations, the scheme was popularly promoted as a scheme towards "Home Ownership".

The CPF became a permanent feature in Singapore.

Sadly, the "Home Ownership" scheme was no better then borrowing our money at below market interest rates, and selling the homes to us with a huge profit, all of which resulted in the "Singapore Government laughing all the way to their Bank".

Over time, realising that the accumulated funds from a large population of Post-War Babies cannot be returned in full even at such low interest rates paid to the CPF accounts, and with the CPF not being supported by new accounts from an expanding population to match the numbers of retiring "Post-War Babies" - this Government began a series of measure that restrict the amounts to be returned to the CPF Account Holders by holding back initial sums paid out by instalments, then an ingenious plan to transfer fractions from the Main CPF Account into some new scheme separately named as the Medi-Save and Medi-Shield.

The sophistication in designing withdrawal restrictions on Singaporean CPF Accounts have now reached the ultimate stage - with the imposition of the minimum sum to be held until the median age of death determined separately for Singaporean Males and Females.

Even the Colonial Government will not take as much from Singaporeans to be locked into its Provident Fund scheme, as they had realised at the early stage that too much taken will remove the ability for Singaporeans to make alternative arrangements for themselves - that included being enterprising.

With the large amounts removed from the control of individual Singaporeans, and still expecting Singaporeans to look after ourselves during crisis, has this Government placed unnecessary burden on Singaporeans ?

‘Lessons of the Singapore Central Provident Fund’

‘Central Provident Fund in Singapore’

‘Compulsory Savings in Singapore : An Alternative to the Welfare State’