Why Singapore first into recession in Asia?

-

Originally posted by maurizio13:

You should believe your government and local media 100%.

not 100%...since u they got only 66.6% votes, u should believe them only 66.6%, the rest 33.3% u take care yourself. -

Originally posted by GHoST_18:

because in SG,

we strive to be the 1st in everything...

1st to queue free gifts...

1st to board the train...

1st in class...

1st in this and that...

it's our culture lah...

yeah, 1st to die too, 1st to kenna cheat, 1st in obeying govt too -

recession huh.. basically i dont care much about it, since it doesnt affect anything.

last resort is to migrate lor, if sg living cost is too high. so simple. :)

dont worry be happy. Cheers!

-

Originally posted by Big Pikachu:

recession huh.. basically i dont care much about it, since it doesnt affect anything.

last resort is to migrate lor, if sg living cost is too high. so simple. :)

dont worry be happy. Cheers!

Many uncles also told me, "Angel ar, dun worry, be happy hor, happy go lucky" but then i saw uncles go toilet and cry -

those unkers going to heaven soon

-

Originally posted by noahnoah:

those unkers going to heaven soon

ya, recession period are good for funeral parlour business...maybe we should open one. Hmmm..business mind. -

i kinda of agreed with medical oil that you can;t outsource your answer from this forum.

There might be opinon polls but if you want serious answer this is not the place.

-

actually on 2nd thought you should direct these questions to the so called "top Talent" namely the minister...

The same talent from all ivy league university that work for all the top investment bank that are now failing. The kind that look deep at numbers and forgot to stick up their head and look around. I am sure they have the standard handbook answer for you.....about the problems face by singapore. That most singaporean already know.

But after all these years since 80's none have the REAL answer to solve it.

-

Guys, once companies start axing people, please update here.

I think the people deserve to know what is the current situation of sacking.

If u know which company started retrenching, please update in this thread!

Nevertheless, I still hope for More Good Years.

-

Hi,

I am a diploma student doing assignment in Economics. My topic of interest is the recession in Singapore. I am trying to assess:

1. Why Singapore is the first in Asia to go into recession?

2. Is the fundamental economics of Singapore really sound?

3. How long and deep will the recession be?

4. Will the IRs have a strong impact to boost economic growth and bring us out of recession?

5. How much Singapore is still relying on the US market for its growth and how much dependence from Asia itself?

Q1`. because singapore economy grew at a faster pace among the developed nation in the past few years, and we are heavily depended on the USA and EU market for export. thus any drastically slow down in these 2 economies will affect on growth on the QtoQ or even Yto Y basis.

Q2. if u believe Tharma and LHL. kidding,fundamentally sound doesnt mean we will be save, we are still very dependent on USA, CHINA, EU for export. USA and EU is probably already in recession. china drastic drop in growth is serious and could affect some singapore industries.

Q3. 2years mini. these could be the worse of all crisis has it couple the ingredients of previous crisis and pack them into this crisis.

things to tackle in this crisis is

a. financial crisis.

b. global recession. meaning slowdown of all manufacturing and consumer spending activities.

3. inflation. high oil prices do note, OPEC will never allow oil to drop below USD50/barrel. the easiest to do, cut production and prop up the oil prices.

4. IR has open at a bad timing , that is the midst of global recession. i just come back from macau the scene is pretty sad. fewer customer compare to 6 mths ago. i hope genting does not get into financial difficulties as spiral construction cost and debts could get it into funding difficulties couple + slowdown of economy which is already hitting Las vegas and Macau.

5. USA is our biggest trading partner is i am not wrong. it is not easy to replace your biggest trading partner in few years time.

who else can you replace to? everybody is affected in this global crisis. no one could be spare. USA will remain to be dominate economies of the world even after this global financial, recession.

hope it help!

-

DBS is very secure because the government will never let it fall.

-

Originally posted by HyperionDCZ:

DBS is very secure because the government will never let it fall.

Guess who's money will be used to prop it up if it fails?

-

Cos we have mr Kiasu in SG...

-

Cos we have mr Kiasu in SG

who??

-

Originally posted by charlize:

Guess who's money will be used to prop it up if it fails?

Our money?

-

Originally posted by potatoaddict:

Hi,

I am a diploma student doing assignment in Economics. My topic of interest is the recession in Singapore. I am trying to assess:

1. Why Singapore is the first in Asia to go into recession?

2. Is the fundamental economics of Singapore really sound?

3. How long and deep will the recession be?

4. Will the IRs have a strong impact to boost economic growth and bring us out of recession?

5. How much Singapore is still relying on the US market for its growth and how much dependence from Asia itself?

why sg 1st in asia to go into recession? the gahmen want it that way! don't they want to #1 in everything?

-

I noticed that our currency fell against many liao.

-

Like to add on another question to list provided by TS.

1. How can international assessment bodies determine how healthy financially is any country IF they cannot access the information in a transparent way? Based on what ? How accurate and reliable and believable would these assessments be ?

If there is no TRANSPARENCY (which only can mean no FULL TRANSPARENCY), how reliable are financial health assessments?

Get my point?

-

Nobody in this world will be fully transparent. Everybody has something to hide.

-

rating agencies just do the Desk Bound Analysis.

How did they rate the all fallen big 5 US investments banks?

I think all is AAA!!

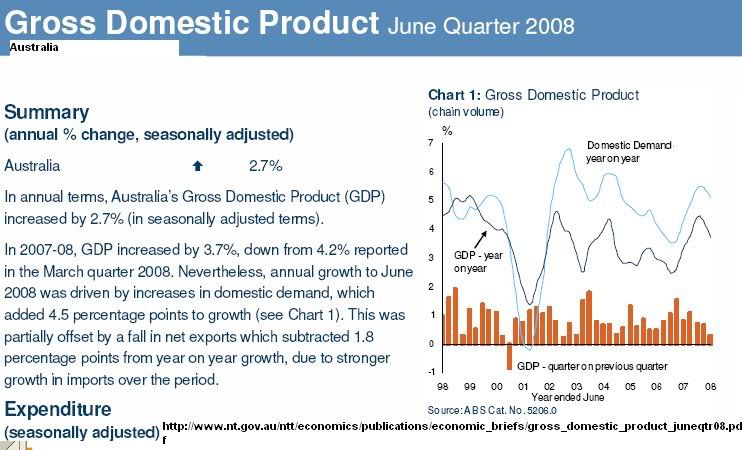

can i repeat mt stand that Why SG is the first becos we grew too fast.

Have u guys how to define recessions?

This is slower GDP

"growth is negative for two or more consecutive quarters."

Let us see this example:

Real figures,annual GDP growth

Quarter...SG......aussie

2007

3Q--........9.5

4Q--.......5.4

2008

1Q..........7.0.......3.6

2Q..........2.3........1.9

3Q.........--0.5..........4.3

so SG is in recession,technically.while Oz is not!!

This measure fails to register several official (NBER defined) US recessions.[2]

http://en.wikipedia.org/wiki/Recession

So,which country is in better shape even SG is in recession?

SG lah stupid!!SG growth is STILL higher than Aussie!!

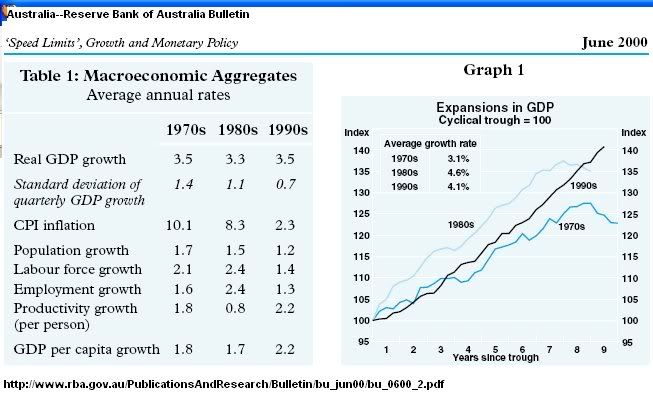

2.Aussie averge growth rate for 40 years not more than 4% pa

http://www.nt.gov.au/ntt/economics/publications/economic_briefs/gross_domestic_product_juneqtr08.pdf

This is a typical 1 st world country growth.

In %,we still creates more jobs than Oz!!

below---1970 to 1999 Real growth not more than 3.5% pa

Mining is only 9% in Oz GDP

http://www.rba.gov.au/Speeches/2008/sp_gov_211008.pdf

table 1

So,now we shall not suprised that oz cant improve fiscal accounts too much

despite booming mining exports!!

wwwwwwwww

-

freeze on funds redemptions just like bank do

not allow withdrawal of your hard earned $$!!

today ,another Oz funds just stops redemption,

Last week, Challenger locked up redemptions on its high-yield fund. Today, it is expected they will announce a redemption freeze on flagship mortgage fund, Challenger Howard, which is also the country's biggest mortgage fund with $2.9 billion under management.

As for Challenger, it has some $14.9 billion of investor savings in its funds management division and some 80,000 investors.

http://www.challenger.com.au/2008.asp

nnn

-

Singapore is not in a recession, really.

Rising prices and decreasing growth is stagflation.

They pump more money into the economy, but growth still declining, while because of the extra money pumped in prices inflate.

-

GDP = -0.5%

CPI = 6.4%

Stagflation is an economic situation in which inflation and economic stagnation occur simultaneously and remain unchecked for a period of time. The portmanteau "stagflation" is generally attributed to British politician Iain Macleod, who coined the term in a speech to Parliament in 1965. The concept is notable partly because, in postwar macroeconomic theory, inflation and recession were regarded as mutually exclusive, and also because stagflation has generally proven to be difficult and costly to eradicate once it gets started.

http://en.wikipedia.org/wiki/Stagflation

-

i think Oz is in recession at end of second quarter 2008!!

It is strange that why no medias report this bad news.

http://www.rba.gov.au/Statistics/Bulletin/index.html

Gross Domestic Product - G10 at A$ muillion

GDP year to year %

1.041883 1.045019 1.04158 1.032899 1.027411 Jun-2007 253986--4.2 Sep-2007 256690--4.5 Dec-2007 258464--4.2 Mar-2008 260210--3.3 Jun-2008 260948--2.7 Jun-2007 253986-- Sep-2007 256690 Dec-2007 258464 Mar-2008 260210 Jun-2008 260948 Dec-2007 258464 Mar-2008 260210 Jun-2008 260948