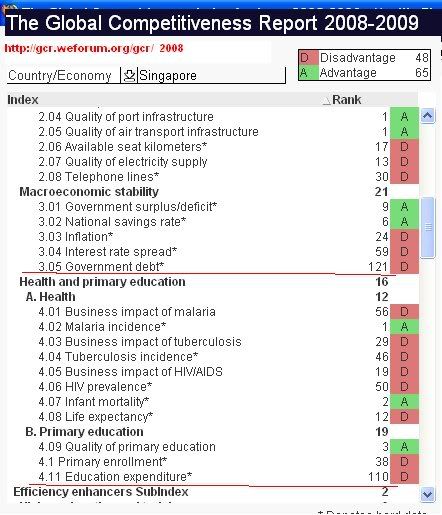

SG in heavy debt:WEF Global Competitiveness Report 2008

-

Can we trust them?

Nowadays,it seem we can trust no body.All the fallen big 5 investments

banks In USA have been rated very good,but still fall.

Again.Oz banking system has just been rated no.4 in the world.

If u look at the recent saga of Oz bank gurantee,u will wander why.

Even primary schools students know SG gavaman is not poor.

But how come WEF Global Competitiveness Report 2008/2009

ranked her Government Debt at 121 out of 131 countries?

Do they think SG government owe so much $$?

Yes They do.The problem is they just look at Gross Debt,which now

reach 100% GDP.SG net debt is negative,ie lot of reserves!!

Remember Temasek Net assets S$160 billion,GIC well over USD$100 b etc

I think our learned forumers here know SG gavaman borrows

$$ not to spend,but to:

----issue interest to CPF holders

----borrow to invest,not to spend ,among other things

Unlike many other countries, the Singapore Government does not need to finance its expenditures through the issuance of government bonds as it operates a balanced budget policy and often enjoys budget surpluses.

http://www.sgs.gov.sg/macro_overview/macrooverview_intro.html

read recent statement by Finance Minister on change of Constitution.

He talked in length about this Programme.

Will it be more realistic to comopare the net cash gavaman debt,

iso of Gross Debt?Why i say cash debt.Becos almost all gavaman

is carring burden of civil servants pensions which is very hard

to estimate.So i just restrict to cash or cash like debts.

3.05 (Singapore)Government debt*.....................................................121 out of 131 countries.

Singapore ,Australia and USA---WEF just make it damn wrong

If u arrange in ascending order of net debt for central governemnt in term of GDP,

Singapore---No net debt.(wealth minimum 100% of GDP)

Australia---net debt from o% to 5%,and is counting

USA----74% of GDP and counting(Debt clock just break 10 trillion mark!!)

But u guess how WEF ranked them,in term of Gross Debt?

WEF arrange in ascending order of Australia,USA and Singapore!!

So,u will get the impression from this well respected and widely quoted

WEF report that SG suffer from most debts in term of GDP ,followed by

USA and Australia.

Even a secondary student know that SG gets SWF while USA dunt get SWF

and in heavy debts.This report is a big Joke,even SG is ranked no.5

in overall ranking.Smart guys will not trust this kind of report

100%.So,it will be naive to believe Oz banking system is no.4 in the world!!

SG Education Expenditure raked at 110!!

i have no mood to see why.If WEF experts just look at % of budget

to determine of ranking,then i futher discount the usefulness

of this kind of Report!!

references:

http://www.weforum.org/en/initiatives/gcp/Global%20Competitiveness%20Report/index.htm

http://www.weforum.org/pdf/gcr08/Singapore.pdf

http://www.sgs.gov.sg/index.html

,,,,,,

-

hard to understand your pt.

short and sharp.

and use proper english.

-

Below is good essay on how to write clearly in english:

George Orwell, "Politics and the English Language,"

Most people who bother with the matter at all would admit that the English language is in a bad way, but it is generally assumed that we cannot by conscious action do anything about it. Our civilization is decadent and our language -- so the argument runs -- must inevitably share in the general collapse.

It follows that any struggle against the abuse of language is a sentimental archaism, like preferring candles to electric light or hansom cabs to aeroplanes. Underneath this lies the half-conscious belief that language is a natural growth and not an instrument which we shape for our own purposes...

-

Originally posted by reyes:

hard to understand your pt.

short and sharp.

and use proper english.

lionnoisy makes lots of noise, noise which nobody ever understands.

His point is, don't trust the World Economic Forum's report, instead trust lionnoisy.

I wonder which independent organisation has ever seen the reserves of Singapore, it's only known to the Lee family and the inner sanctum.

-

Sample writing to consider on clear writing:

Chapter 4: The Pattern of Change

In order to obtain perspective we sometimes divide the culture of a society, in a somewhat arbitrary fashion, into several different aspects. For example, we can divide a society into six aspects: military, political, economic, social, religious, intellectual. Naturally there are very close connections between these various aspects; and in each aspect there are very close connections between what exists today and what existed in an earlier day.

For example, we might want to talk about democracy as a fact on the political level (or aspect). In order to talk about it in an intelligent way we would not only have to know what it is today we would also have to see what relationship it has to earlier facts on the political level as well as its relationship to various facts on the other five levels of the society.

Naturally we cannot talk intelligently unless we have a fairly clear idea of what we mean by the words we use. For that reason we shall frequently define the terms we use in discussing this subject.

The Organization of Power

The military level is concerned with the organization of force, the political level with the organization of power, and the economic level with the organization of wealth. By the "organization of power" in a society we mean the ways in which obedience and consent (or acquiescence) are obtained.

The close relationships between levels can be seen from the fact that there are three basic ways to win obedience: by force, by buying consent with wealth, and by persuasion. Each of these three leads us to another level (military, economic, or intellectual) outside the political level. At the same time, the organization of power today (that is, of the methods for obtaining obedience in the society) is a development of the methods used to obtain obedience in the society in an earlier period.

Major Change in the 20th Century

These relationships are important because in the twentieth century in Western Civilization all six levels are changing with amazing rapidity, and the relationships between levels are also shifting with great speed.

When we add to this confusing picture of Western Civilization the fact that other societies are influencing it or being influenced by it, it would seem that the world in the twentieth century is almost too complicated to understand.

This is indeed true, and we shall have to simplify (perhaps even oversimplify) these complexities in order to reach a low level of understanding. When we have reached such a low level perhaps we shall be able to raise the level of our understanding by bringing into our minds, little by little, some of the complexities which do exist in the world itself.

The Military Level in Western Civilization

On the military level in Western Civilization in the twentieth century the chief development has been a steady increase in the complexity and the cost of weapons. When weapons are cheap to get and so easy to use that almost anyone can use them after a short period of training, armies are generally made up of large masses of amateur soldiers. Such weapons we call "amateur weapons," and such armies we might call "mass armies of citizen-soldiers."

The Age of Pericles in Classical Greece and the nineteenth century in Western Civilization were periods of amateur weapons and citizen-soldiers. But the nineteenth century was preceded (as was the Age of Pericles also) by a period in which weapons were expensive and required long training in their use. Such weapons we call "specialist" weapons.

Periods of specialist weapons are generally periods of small armies of professional soldiers (usually mercenaries). In a period of specialist weapons the minority who have such weapons can usually force the majority who lack them to obey; thus a period of specialist weapons tends to give rise to a period of minority rule and authoritarian government. But a period of amateur weapons is a period in which all men are roughly equal in military power, a majority can compel a minority to yield, and majority rule or even democratic government tends to rise.

The medieval period in which the best weapon was usually a mounted knight on horseback (clearly a specialist weapon) was a period of minority rule and authoritarian government. Even when the medieval knight was made obsolete (along with his stone castle) by the invention of gunpowder and the appearance of firearms, these new weapons were so expensive and so difficult to use (until 1800) that minority rule and authoritarian government continued even though that government sought to enforce its rule by shifting from mounted knights to professional pike-men and musketeers.

But after 1800, guns became cheaper to obtain and easier to use. By 1840 a Colt revolver sold for $27 and a Springfield musket for not much more, and these were about as good weapons as anyone could get at that time.

Thus, mass armies of citizens, equipped with these cheap and easily used weapons, began to replace armies of professional soldiers, beginning about 1800 in Europe and even earlier in America. At the same time, democratic government began to replace authoritarian governments (but chiefly in those areas where the cheap new weapons were available and local standards of living were high enough to allow people to obtain them)...

-

Originally posted by reyes:

hard to understand your pt.

short and sharp.

and use proper english.

You can't blame a China dude who inspires to be bluest of the blue, purer than pure Singaporean. -

hmm.. not to be rude.. but i really don't understand what's gg on.

-

Singapore stagflation : May 2008 exports fell most in 17 months; inflation at 26-year highs

<!-- ADDTHIS BUTTON BEGIN --> <!-- ADDTHIS BUTTON END -->

This article belongs to the Singapore stagflation watch story arc.

Singapore's exports fell the most in 17 months in May [2008] as the island's manufacturers shipped fewer electronics and other goods to the US and Europe. Non-oil domestic exports dropped 10.5% from a year earlier, the trade promotion agency said today [17 Jun 2008]. Manufacturers across Asia face easing demand amid slowing growth in the US, the region's largest overseas market. Pharmaceutical shipments dropped 48.5% in May from a year earlier, while electronics shipments slipped 8.5%, the 16th consecutive drop. Semiconductor shipments dropped 12.6%. Sales to the European Union fell 28% in May and US shipments dropped 22.3%.

- The Singapore economy continues to be confronted by stagflation as economic weakness persists and shows signs of actually worsening, while inflation continues to run at 26-year highs. As I have commented earlier, this is as classic as it gets regarding the definition of stagflation : stagnant or slowing economic growth in a time of rising inflation.

Sure, biotech manufacturing is subject to some "lumpiness" as equipment needs to be cleaned and re-setup for the next batch of medicines, but a 48.5% drop year-on-year? This is as good as "falling off the cliff", a sinking sensation that many in the peakoiler community are very, very familiar with. And electronics? 16 consecutive drops in 16 months. They could be trying for some kind of record here, together with semiconductors. A very ugly picture, especially given that inflation is still ongoing, and crude oil continues to set new record highs regularly.

This is the kind of situation that can lead to restlessness amongst the population, and in extreme cases descend into disorder and chaos and in fact it already has in some countries. You can be very sure that the government has got to be very concerned about it. Meanwhile, as an individual, in order to hedge against slowing economic growth, you might want to look into getting a job in a traditionally defensive sector, such as government, military, education, healthcare, and such. And as an investor, in order to hedge against inflation, what you can do is to buy into commodities, hold on to them, and sit tight. Gold and oil and uranium and food and other resources are going higher. Much, much higher. We ain't seen nothing yet.

Singapore CPI inflation rate for May 2008 continues at 26-year high of 7.5%

Singapore's consumer prices rose at a slower-than-expected pace last month [May 2008], reducing the need for further currency gains to rein in inflation. The consumer price index [CPI] jumped 7.5% from a year earlier, matching April's 26-year high record, the Department of Statistics said [23 Jun 2008]. The Monetary Authority of Singapore [MAS] had forecast a 5-6% inflation rate for 2008. The central bank has allowed its currency to strengthen against the US dollar, saying the exchange rate remains its most effective tool to fight inflation.

- The Singapore inflation rate is reportedly stabilizing and analysts are already predicting that it will come down in the second half of 2008. Singapore M3 money supply figures also appear to be stabilizing around the 12-13% level in the past half year, down from a high of 23.62% in 2007. But the money supply growth rate is only half the story - the other half is its relationship to the growth of available goods and services in the economy. For the inflation rate to be stable, economic growth has to at least keep up with money supply growth. With a looming global economic slowdown and imminent worldwide recession, the economic growth factor is the big wildcard.

Gold and crude oil prices may have paused from breaking new all-time record highs for the time being, but the inflationary storm is far from over as yet. We may only be passing through the eye of the hurricane here - just when people start to get lulled into complacency, the winds of inflation could well pick up with renewed force - perhaps even stronger than ever. We need to remain vigilant against inflation. This is no time to let down your guard yet.

Singapore economy stuck in mud : inflation rising, M3 falling, GDP crashing - the stagflation formula

This article belongs to the Singapore stagflation watch story arc.

mas.gov.sg -> mas.gov.sg (pdf) :

The latest Singapore money supply figures are out. For the month of Dec 2007, the Singapore M3 money supply growth has continued to slow, and it now stands at 14.14% year-on-year. However, real inflation shows no signs of abating because we are at the point where economic growth is falling (crashing) faster than M3 money supply growth is slowing. The Singapore economy is thus stuck in mud, and the stagflation formula goes as follows :

14.14% M3 growth - (-4.8% economic growth) = 18.94% real inflation rate.

For your reference, the money supply figures for the year of 2007 are as follows (click here for the spreadsheet if the inline frame is not shown) :

As you can see, in 2007 we have been roaring along with an average M3 money supply growth of 20.6% year-on-year. It was only in the last 3 months (Oct-Dec 2007) that the money supply growth has slowed down considerably.

However, if anything else, this is even worse than the time where it was reported on this blog when M3 growth hit a high of 23.62% back in Jun 2007. At the time, GDP growth was reported to be a still-healthy 8.6% so the M3-to-GDP differential was 23.62% - 8.6% = 15.02% then.

Hence, for myself and for those of you readers who subscribe to the classic Austrian-school definition of monetary inflation as money supply growth relative to economic growth, the fight to maintain our purchasing power has just gotten a lot harder, and this stagflationary environment just makes things even worse.

See also :

1. Singapore 2007Q4 GDP contracted 4.8%, 2008 economic growth forecast lowered

2. Singapore economy shrinks first time since 2003

3. Singapore CPI inflation hits new 25-year high of 4.4% in December

4. Singapore : Inflation rate could push past 6% in Q1 2008(2008-02-25 13:10:42 SGT) [Biz] Permalink Comments [1]

-

Rising inflation across Asia mauls Singapore Reits

Trusts may still get big lift from higher rents, higher hotel rates, say analystsSOARING inflation across Asia has sucked the life out of real estate investment trusts (Reits), whose high-yielding dividends have made them wildly popular among investors in recent years.

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTO

Investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions. They have ignored the ‘organic’ boost Reits may get from higher rents and hotel rates. - MORGAN STANLEY, in a report recommending property trusts to its clients — ST FILE PHOTOReits, in general, have fallen about 32.5 per cent in value from their peaks last year, but those with assets in inflation-prone economies, such as China, have fared even worse, according to financial portal Shareinvestor.com.

CapitaRetail China Trust, for instance, has fallen 52 per cent in four months, as inflation in China galloped to 7.1 per cent - its highest level in over a decade.

Reits are financial instruments investing in real estate like shopping malls, office buildings and hotels.

Investors can buy units, which are much like shares, offering attractive dividend yields of 6 per cent to 8 per cent derived from rents.

This is far higher than the 1.5 per cent interest on one-year fixed deposits at a bank.

Historically, a low interest rate environment has been good for Reits - if accompanied by low inflation.

Take CapitaMall Trust, the first Reit listed in Singapore. Its assets include the Tampines Mall and Junction 8 shopping centres.

It received an overwhelming response from investors when it listed six years ago, rising from just 96 cents in July 2002 to a record high of $4.32 in July last year. Inflation played its part by staying at a benign 1 per cent.

As the consumer price index, however, surged from 1.3 per cent in June to 4.4 per cent in December, CapitaMall slid 20 per cent over the period.

The inflation pressure is unlikely to abate in the near future.

Last week, the Government revised its estimates upwards to between 4.5 per cent and 5.5 per cent for the year, from an earlier forecast of 3.5 per cent to 4.5 per cent.

So, while fears of a United States recession are causing much grief among investors as they watch the value of their growth stocks evaporate, inflation is becoming a big threat to those with high dividend-yield plays like Reits.

One trader explained: ‘A Reit may offer 6 per cent in dividend yield. But if inflation is running at 4.5 per cent, the actual yield an investor is getting is only 1.5 per cent.’

To compensate for the lower return, an investor will demand a lower price for the Reit, which escalates the pressure on its share price.

Still, analysts have not stopped promoting Reits, despite their lacklustre performance, to clients.

Morgan Stanley made a case last month with a report arguing that investors had wrongly penalised Reits with concerns over acquisition growth and credit-tightening conditions.

Investors have ignored the ‘organic’ boost Reits may get from higher rents as leases expire and hotel rates are jacked up during peak periods.

Citigroup noted on Tuesday that while there may not be a clear growth strategy for Reits this year, some are trading at hefty discounts to their net asset values, despite offering single-digit or even double-digit dividend yields.

‘This makes Reits potential takeover targets, if they have loose shareholding structures,’ it added.

Its top picks include Ascendas Reit, Suntec Reit and Parkway Life Reit.

Source : Straits Times - 23 Feb 2008

-

SINGAPORE, Oct 10 - Singapore has slipped into recession and the Government has revised its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

The economy shrank at an annualised, seasonally adjusted rate of 6.3 per cent in the third quarter, according to third quarter advance estimates released by the Ministry of Trade and Industry on Friday morning, pushing the export-dependent economy into its first recession since 2002.

The government also revised down its 2008 growth forecast to around 3 per cent from a previous estimate of 4 to 5 per cent.

Economists had expected the Republic to narrowly escape a recession in the third quarter by growing 1.1 per cent, lifted by a slight improvement in electronics output.

A recession is often defined as two consecutive quarters of economic contractions.

The deepening financial crisis, which sparked banking crises in the United States, Iceland, Britain, Germany and Ireland, is threatening to drag the world economy into recession.

The advance estimate, based largely on July and August data, gives an early indication of the economy's performance during the July-September period.

MTI said the Singapore economy is estimated to contract by 0.5 per cent in the third quarter, than a year ago.

On a seasonally adjusted, annualised quarter-on-quarter basis, real GDP declined by 6.3 per cent, following a 5.7 per cent decline in the previous quarter.

On the outlook for the year, MTI said since the revised GDP forecast in August, "external economic conditions have deteriorated more than expected and some sectors of the economy have weakened significantly on account of industry-specific or domestic factors.

"The worsening of the financial crisis in the US in recent weeks has deepened the credit crunch, making it more difficult for businesses to sustain economic activities. With unemployment on the rise and house prices continuing to fall, US consumer sentiment has weakened further and will affect demand for exports from Asia and the rest of the world."

It added that Singapore's export-oriented sectors, such as manufacturing, will be affected, noting that Europe is also facing severe strains in the banking sector, tighter credit conditions, and adjustments in housing prices.

Growth in major economies such as Germany, France, Italy and the UK has dipped sharply in the second quarter.

Growth forecasts for several Asian economies, such as China, India and South Korea, have been revised downwards since the start of the year.

The estimates showed that Singapore's manufacturing sector continued to be weighed down by the negative growth in biomedical sciences, as pharmaceutical companies are still producing a mix of pharmaceutical ingredients with values lower than compared to a year ago.

The precision engineering and chemicals clusters have also slowed, because of weaker external demand.

The construction sector grew by 7.8 per cent in the third quarter, compared to the 18.3 per cent growth in the first half of 2008. Despite a strong pipeline of construction projects, a shortage of contractors, a tight labour market for engineers and project managers, and longer waiting times for equipment, have delayed the realisation of these projects.

MTI said the financial services sector is likely to see slower growth in the coming months as the ongoing global financial crisis has heightened uncertainties for sentiment-sensitive segments such as stocks trading and fund management activities.

"Taking into account the slowdown in the global economy and key domestic sectors, MTI has revised the 2008 GDP growth forecast to around 3 per cent. The inflation forecast of 6 - 7 per cent for 2008 remains unchanged," it said. - The Straits Times

Singapore First Asian Economy to fall into Recession

Singapore becomes the first Asian victim of recession

AFP, SINGAPORE

Saturday, Oct 11, 2008, Page 1Singapore has become the first Asian economy to fall into recession, analysts said yesterday, after the government revised downward its full-year growth estimate and eased monetary policy for the first time in years.

The Ministry of Trade and Industry lowered the city-state’s full-year growth forecast to around 3 percent, citing a slowdown in the global economy and key domestic sectors.

The move came as the ministry released preliminary data showing that real GDP declined by 6.3 percent in the third quarter after contracting 5.7 percent in the previous quarter, the ministry said.

While it did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

“Singapore will be the first Asia economy to fall into a technical recession,” DBS Group Research said in an assessment of the data.

In a move to confront the downturn, the Monetary Authority of Singapore (MAS) — its de facto central bank — said it was easing monetary policy for the first time in more than four years.

“The Singapore economy has weakened over the course of 2008, alongside an escalation in the turmoil in financial markets and a more severe deceleration in global economic activity,” MAS said.

These developments meant new uncertainties for the Singapore economy, while slower Asian growth would restrain activity in a range of service industries such as transportation and tourism, it said.

“The risks to external demand conditions continue to be on the downside and a more severe global downturn cannot be discounted,” the bank said.

Singapore is Southeast Asia’s wealthiest economy in terms of GDP per capita, but is heavily dependent on trade. This makes it sensitive to hiccups in developed economies, particularly key export markets the US and Europe.

Economists polled by Dow Jones Newswires had forecast a 0.3 percent quarter-on-quarter rise in GDP, the value of goods and services produced in the economy.

Compared with the third quarter of last year, the ministry said Singapore’s economy contracted by 0.5 percent in real terms, against the 0.8 percent expansion foreseen in the Dow Jones poll.Singapore in recession

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.

Written by Webmaster Friday, 10 October 2008SINGAPORE'S economy has slid into its first technical recession since 2002, as a slump in exports pushed quarterly growth into negative territory for the second quarter in a row.The economy shrank by a worse-than-expected 0.5 per cent in the third quarter compared to the same period last year, according to estimates from the Ministry of Trade and Industry (MTI) released on Friday morning.MTI has also revised its full-year growth forecast for the second time this year, lowering it to 'around 3 per cent' from 4 to 5 per cent previously. This would make it the weakest pace in seven years.

Recognising growth concerns, the Monetary Authority of Singapore also changed its policy stance to zero appreciation of the Singapore dollar, reversing the gradual appreciation policy it has adopted since 2003.

On a quarterly basis, third-quarter GDP contracted 6.3 per cent from the second quarter, on top of a 5.7 per cent decline in the previous three months. A technical recession is generally defined as two consecutive quarters of decline.

Manufacturing led the slowdown again this time around, weighed down by a poor performance in the biomedical sciences segment. It was also hit by weakened global demand for exports as the United States-triggered financial crisis spreads around the world.

The sector shrank by 11.5 per cent in the third quarter, after declining 4.9 per cent in the previous quarter.

Growth in construction and services also slowed. Construction, in particular, saw its pace of expansion halved to single-digit growth, as projects were delayed by the construction squeeze, said MTI.

Services, touted as a key driver of growth this year, is likely to take a hit as well as financial services falters in the wake of the global credit crunch.

Most economists expect the economy to grow even more slowly next year, with the chance of a technical recession turning into a 'real' one.

'With external conditions deteriorating and the lack of domestic demand support, we expect Singapore to register no growth next year... with a muted recovery, if at all, expected only in the second half of next year at the earliest,' said Morgan Stanley economists in a report.

Inflation peaks

Inflation, which reached a 26-year high earlier this year, has peaked, said MAS. Consumer prices will rise between 6 per cent and 7 per cent this year, and gains will ease to between 2.5 per cent and 3.5 per cent in 2009, it predicted.'Against the backdrop of a weakening external economic environment and continuing stresses in global financial markets, the growth of the Singapore economy is expected to remain below potential in the period ahead,' said MAS.

'Inflation is expected to trend down in 2009 as the global and domestic economies slow.'(Straits Times Singapore)

Wednesday, 10 October, 2001, 04:56 GMT 05:56 UK

Singapore economy in recession

<!-- NOLImage --><!-- /NOLImage -->The recession-hit economy of Singapore has shrunk by a record 5.6% during July to September.

The sharp contraction was expected by analysts, and the government is now forecasting that the economy will contract by 3% for the full year.

"In the light of the uncertainty in the global economy, Singapore has now revised its full year growth forecast to minus 3.0%," said Trade Minister George Yeo.

Previously the government had forecast 0.5-1.5% growth.

US ties

The country is suffering from its exposure to the US - its biggest trading partner - which is battling with its own economic problems.

Last month's terrorist attacks on the US have also exacerbated problems by denting consumer confidence.

"The appalling attacks on September 11 and the resulting train of events have probably tipped the global economy into a recession," said Mr Yeo.

Electronics downturn

The sharp contraction in the third quarter was blamed on the downturn in the electronics sector.

The goods producing sector in the trade-driven country fell by 15% while manufacturing output fell by 21% compared with a year ago.

This constitutes the sharpest fall since the 1985 recession.

"From the data so far, it certainly describes the economy is in a far worse shape than it has ever been," said Song Seng Wun, a regional economist at GK Goh brokerage.

However, Aberdeen Asset Management's Hugh Young told the BBC's World Business Report:"The feeling on the streets is not nearly as bad or as gloomy as it was when the Asian crisis hit. Certainly there is a lot of fear over job security right through Singapore at the moment."

Singapore slides into recession

Singapore has become the first Asian country to fall into recession, after growth fell for the second successive quarter.

By Jamie Dunkley

Last Updated: 11:13AM BST 10 Oct 2008The Ministry of Trade and Industry also revised downwards full-year growth forecast to around 3pc, citing a slowdown in the global economy and key domestic sectors.

Southeast Asia's wealthiest economy saw gross domestic product fall by 6.3pc during the third quarter having previously contracted by 5.7pc.

While the ministry did not describe the economy as being in recession, a technical recession is generally defined as two consecutive quarters of contraction in economic output.

In a move to confront the downturn, the Monetary Authority of Singapore - its de facto central bank - said it was also easing monetary policy for the first time in more than four years.

Singapore's economy expanded by 7.7pc last year but have been signs of a slowdown following contractions in Singapore's key manufacturing sector, which includes the country's electronic and pharmaceutical industries.

Construction growth slowed to 7.8pc from 19.8pc, during the quarter, although service industries grew by 6.1pc, marginally down from 7pc in the second quarter.

Singapore's last technical recession was recorded in 2002, when the economy contracted by 2.4pc during the year. The country is seen as an important indicator of economic trends in the rest of Asia due to its export-dependent economy.

Singapore Prime Minister Lee Hsien Loong said Asian economies face a "rough ride" for at least the next year as weakening consumer demand from developed countries hurt the region's exports.

TODAYonline, Weekend, October 11, 2008

................The Singapore dollar, already battered in recent weeks, is expected to weaken further against its United States counterpart. Goldman Sachs predicts the Singapore dollar would weaken to $1.54 to the greenback in the next six months, while UBS expects it to reach $1.50 by the end of the year, according to Bloomberg. The Singapore dollar was trading at around $1.48 yesterday evening, almost 10 per cent off its recent high of $1.35 on July 16. .............

-

Singapore Biodiesel Gloomy in 2008

Wilmar International, an integrated biodiesel producer is badly affected by high crude palm oil (CPO), feedstock for its its biodiesel plants in Indonesia and Malaysia. The biodiesel plants are running at 20% capacity for the first three months of 2008.

Despite the gloomy biofuels sector, Wilmar International, posted on the Singapore-listed firm reported a four-fold surge in fourth-quarter operating profits to $394.2m from $98.8m. Wilmar is also expanding its joint ventures with local companies in Africa, China and Europe.S'pore manufacturers cautious on next 6 months: survey <!-- headline one : end --><!-- more than 7 paragraphs --><!-- story content : start -->

SINGAPORE manufacturers are cautious about the business prospects in the next six months, a Government survey released on Thursday showed, reflecting concerns over a slowing global economy.

In the latest quarterly survey conducted by the Economic Development Board (EDB) among manufacturers, 87 per cent said the outlook for the next six months will not improve from the previous quarter when manufacturing output contracted 5.6 per cent.

A separate survey by the Department of Statistics showed companies in the services sector sharing the same cautious sentiment over the six-month period.

According to the survey, 24 per cent of the services firms polled expected business conditions to improve, while 22 per cent were less optimistic.

The responses are weighted by operating receipts and value added.

<!-- show media links starting at 7th para -->Chemical makers had the gloomiest outlook, with a net weighted 23 per cent of firms expecting business conditions to worsen on the back of high material costs.

Producers in the general manufacturing industries, which include the food, tobacco and printing sectors, were the most optimistic, with a net weighted 11 per cent expecting business to improve.

Singapore's economy shrank 6.6 per cent in the second quarter after seasonal adjustments, its biggest contraction in five years amid a slowdown in key export markets the United States and the European Union.

The less positive business outlook comes against a backdrop of rising unemployment in Singapore.

The jobless rate in the second quarter went up to 2.3 per cent after seasonal adjustments, compared to the previous quarter's 2 per cent, according to latest estimates released by the Ministry of Manpower on Thursday morning.

The data showed that employment grew by 70,600 in the second quarter this year, which is slightly lower than the increase of 73,200 in the previous quarter.

In his National Day message for Singaporean workers, NTUC chief Lim Swee Say on Thursday urged workers to moderate their wage expecations for this year, warning that pushing wages up to fully offset inflation is a risky move, as they will end up paying ever higher prices.

'Instead of pushing wages up to fully offset inflation, we must continue to link built-in wage increase to productivity gain and help our people through various non-wage measures', he said.

This will prevent a 'price-wage spiral', he said.

Singapore still faces woes despite millions spent to boost visitor numbers

With 100,000 set to flock at F1, Singapore tourism is still slowing down

19 Sep 2008 37 views

37 viewsTourism makes up nearly to 10 per cent of Singapore total GDP and the local tourism industry will take a ‘battering’ as analyst predicts Singapore tourism to slow despite our upcoming inaugural F1 first ever night race

The global credit crisis and slowing economy also didn’t help in the slowdown in Singapore tourism. Some 100,000 visitors are expected for the F1 weekend and some 40,000 of those are from overseas

F1 Singapore Grand Prix is part of our nation plan to make it a more global and a unique place. Not only we’re attracting international act of F1 which will earn around S$100 million ($70 million) a year in tourism revenue, there’s also our integrated casino which will open end of next year

MAKEPEACE, MAKE CLONES?

A REPORT ON ATTEMPTED ASTROTURFING AND SOCKPUPPETING BY LIONNOISY

a lion puppet

For those who wondered what happened.

Lionnoisy created a clone called "makepeace" which he used in speakers corner to further his own agenda, trying to give people the impression that there are others out there that would agree with him.

Unfortunately he did a very poor job of hiding it.

This kind of behaviour is called sockpuppeting, ie. creating a false online identity to praise, defend or create the illusion of support for one’s self, allies or company.

A sockpuppet is an online identity used for purposes of deception within an Internet community. In its earliest usage, a sockpuppet was a false identity through which a member of an Internet community speaks while pretending not to, like a puppeteer manipulating a hand puppet.[1]

In current usage, the perception of the term has been extended beyond second identities of people who already post in a forum to include other uses of misleading online identities. For example, a NY Times article claims that "sock-puppeting" is defined as "the act of creating a fake online identity to praise, defend or create the illusion of support for one’s self, allies or company."[2]

The key difference between a sockpuppet and a regular pseudonym (sometimes termed an "alt") is the pretense that the puppet is a third party who is not affiliated with the puppeteer.

To "flame wars" and "phishing" we can now add "sock puppet." A sock puppet, for those still boning up, is a false identity through which a member of an Internet community speaks while pretending not to, like a puppeteer manipulating a hand puppet. Recently, a senior editor at The New Republic got in trouble for some particularly colorful sock puppetry.

When Lee Siegel began blogging for The New Republic, he found, as many others have, that Internet posters tend to be fairly outspoken — and a good number of the posters on the blog were harshly critical. An exception was ''sprezzatura,'' who regularly offered extravagant praise. After Mr. Siegel was criticized for his writing about Jon Stewart, host of ''The Daily Show,'' sprezzatura wrote: ''Siegel is brave, brilliant and wittier than Stewart will ever be. Take that, you bunch of immature, abusive sheep.'' A reader charged that sprezzatura was in fact Mr. Siegel, but sprezzatura denied it.

The reader turned out to be right. ...

After making some lame and hasty excuse about his account being hacked, lionnoisy suddenly abandoned all this threads in which him being sockpuppeting was being mentioned. Unfortunately his excuse cannot stand up to logic as he was seen responding to and talking back TO HIS OWN ACCOUNT.

This is what happened:

29th April 0932hrs a "user" called "makepeace" that had never posted before created a lionnoisy-sounding titled thread called "Oz Judge ban TV drama & interview glorify gangland wars "

Already suspisions were raised because the structure and phrasing of the title was signature of lionnoisy. The first post by this "makepeace" was as such:

Originally posted by makepeace:

Oz Supreme Judge Justice Betty King

bans TV drama serices & interviews

glorifying those in the gangland war.The bans to prevent

jurors to be affected while the trial of a murder case is in progress.

U hardly expect democratic and free country like Oz will

ban TV programmes .Right?

U wont know TV programmes on Oz gangsters

are so hot there.Right?

u wont know ganglang wars there also so frequent.Right?

1.Judge cuts down(TV) Nine's Underbelly

Milanda Rout | February 12, 2008

http://www.theaustralian.news.com.au/story/0,25197,23200497-7582,00.html

2.Judge bans 'crime mums' interview

Peter Gregory | April 22, 2008

Barbara Williams and Judith Moran,

the mothers of defendant Evangelos Goussis

and the widow of the murdered Lewis Moran

respectively,were interviewed.

Its damn interesting that this news was under

Entertainment section!!

http://www.brisbanetimes.com.au/news/entertainment/judge-bans-underbelly-report/2008/04/21/1208742836107.html?s_cid=rss_news

3.The Morgan family----the story of the murdered

http://www.melbournecrime.bizhosting.com/moran.family.htm

4.The story of the Boss ,Carl Williams,behind the killing

http://www.melbournecrime.bizhosting.com/carl.williams.htm

5.u can learn more by seraching Justice Betty King

in www.yahoo.com.au

6.Questions

A.Why the media want to air the interview while the trial

is still on?

B.How are the gang activities in Down Under?

C.Am i look like anti--Oz?

D.How true are the postings in 3 and 4 listed above.

i dunt expect the there are so many details about

Oz gangsters.Can any one tell me more?

Note that other then for the user name, this post is virtually indistinguishable from the countless of other lionnoisy posts we can compare it with. The excessive reliance on the media, posting of hyperlinks, using warped logic that takes issues out of their context, and most tellingly the horrible english which make typos and grammatical errors right down to what lionnoisy would EXACTLY make is exactly what you'd expect from lionnoisy.

Hence lionnoisy must have been someone disappointed because after 20 minutes still nobody bothered to reply to his post under makepeace. Hence he decided to bump his own thread.

But after a few lackluster replies, he finally decided to "talk" to makepeace

Originally posted by lionnoisy:

3.The Morgan family----the story of the murdered

http://www.melbournecrime.bizhosting.com/moran.family.htm

4.The story of the Boss ,Carl Williams,behind the killing

http://www.melbournecrime.bizhosting.com/carl.williams.htm

I cant believe there are so many killings

in the above links !!!

More excited than Holloywood movies!!

Note the bad acting, where he pretended to be "excited" and "surprised" about what he wrote himself.

Now this is the funny part, if his account was really hacked as he claimed it to be, he would certainly not be replying back to his "hacked" account so happily in such a way.

But in any case when he was exposed he made this very funny, frantic and desperate post trying to suddenly divorce himself from the actions of his sockpuppetry by claiming he was hacked. Unfortunately all a basic look at the thread will reveal what really happened, and that is nothing other then lionnoisy was caught red-handed sockpuppeting.

Originally posted by lionnoisy:

Why did u check IP and English of forumers?

i just know my acct has been hijacked and u post it!!

It seems u are faster than me?Looks so strange!!

Looks like it is a cyber crime and /or frame up.

Hv anyone(u know who i mean) hacked into my e mails and computers ?

Do i have to hire armed guards to stay outside my

pigeon hole?

I am seeking helps from ISD,CIA,FBI,MI 5 and 6,

PRC Kong Ang, etc to check who hijack my acct

and make me appearing as ''makepeace'' after

i click submit.How safe in this forum??

I will buy you Ya Kun coffee if your info can lead to

catch the criminal,

Forums owners and mods are hereby notified my formal ,written and distressing complaints to cyber crimes!!

Another paethetic, and desperate reply from him when he was cornered:

Originally posted by lionnoisy:

oh it is good.Then can help me saving time to see counsellors How to get rid of computers addicts!!bye

Those who want to see what happened can go here:

http://sgforums.com/forums/10/topics/315326

And some screencaps, so the evidence is preserved:

"mysterous" makepeace appears:

and of course his own excited and poorly acted "reply" to his own clone.

and his own desperate and feeble attempts to wriggle out of the situtation:LOL, what a joker!

-

lionnoisy makes lots of noise, noise which nobody ever understands.

His point is, don't trust the World Economic Forum's report, instead trust lionnoisy.

LOL, how true...

Sorry lionnoisy, nobody can understand you, let alone trust you...

-

He does have a point to a certain extent.

Does anybody really KNOW for certain her money is safe?

-

Singapore shares close 8.33% lower

Posted: 24 October 2008 1743 hrs

Photos 1 of 1

SINGAPORE : Singapore shares plunged 8.33 per cent on Friday on fears of a global recession hurting corporate earnings, dealers said.

The Straits Times Index fell 145.39 points to 1,600.28. It was the index's lowest closing level since September 2003.

Volume was 1.36 billion shares. Losers led gainers 486 to 116.

"The mood on the trading floor is just terrible, the Nikkei is collapsing... There are worries over the banks' results," a trader with a local house told Dow Jones Newswires.

Japan's Nikkei index plunged more than nine per cent on Friday, coming close to its post-bubble low after the yen surged and technology giant Sony slashed its profit forecasts.

"Absolute carnage in Asia as recession fears spread like a wild fire. Risk aversion is happening on a massive scale," Knight Equity Markets vice president Ioan Smith said.

Among Singapore's leading blue chips, Singapore Airlines plunged S$1.22 to S$10.52, Singapore Telecommunications was off 22 cents to S$2.06 and Neptune Orient Lines dropped 13 cents to S$1.03.

Property stocks also closed weaker after the latest figures showed private residential property prices fell in the third quarter, the first decline in more than four years.

CapitaLand sank 19 cents to S$2.58, City Developments retreated 46 cents to S$6.10 and Keppel Land was nine cents lower at S$1.59.

As for banks, DBS gave up 94 cents to S$10.04, United Overseas Bank lost S$1.72 to S$12.08 and Oversea-Chinese Banking Corp was down 61 cents at S$4.88. - AFP/ms -

Originally posted by charlize:

He does have a point to a certain extent.

Does anybody really KNOW for certain her money is safe?

Should be quite safe, afterall the PAP government guarantees that the reserves is safe somewhere, but the whereabouts have since the dawn of time befuddled many a citizens.

It's a secret stash fund, that can be made avail by the summoning of PAP wizards or is it alchemist.

-

Looks like there will be a lot of people waiting to buy those cheap blue chip stocks in the next 6 months or so.

Problem is, will even these bluechip stocks do a Lehman?

-

Originally posted by maurizio13:

Should be quite safe, afterall the PAP government guarantees that the reserves is safe somewhere, but the whereabouts have since the dawn of time befuddled many a citizens.

It's a secret stash fund, that can be made avail by the summoning of PAP wizards or is it alchemist.

Guess they can always print more money.

Like what the US is doing.

-

Originally posted by charlize:

Guess they can always print more money.

Like what the US is doing.

CPI for Sept is 6.7%, if they can't print fast enough, they can use banana leaves also, works just as well.

The other day, there was this Indian Professor for Finance or was it Economics that was interviewed on channelnewsasia, he said something like "we don't have to worry about US not being able to have sufficient currency notes, because the printing presses these days are very advanced, they can churn out ...................".

-

Originally posted by maurizio13:

CPI for Sept is 6.7%, if they can't print fast enough, they can use banana leaves also, works just as well.

The other day, there was this Indian Professor for Finance or was it Economics that was interviewed on channelnewsasia, he said something like "we don't have to worry about US not being able to have sufficient currency notes, because the printing presses these days are very advanced, they can churn out ...................".

When this crisis is over, all these excess cash will be flooding the market.

Yes, inflation will hit double digits and another asset bubble begins.

-

Originally posted by charlize:

When this crisis is over, all these excess cash will be flooding the market.

Yes, inflation will hit double digits and another asset bubble begins.

Bad money drives out good money.

-

wah lionnoisy, no need to hide your embaressment lah, already exposed to light.

-

llll

In this WEF report,SG public debts was ranked as 121 worse

out of 132 coutries.While it is correct according to their definition,ie

gross debts ,it is just against common sense that SG is holding

one of highest SWF per capita,if not the highest,

and one of highest in absolutevalues.

Nvm,Li Ka Shing dunt need people call him a rich man.

one more funny thing to share,SG education was ranked

110!may be they use % of expenditures to assess.

May be they conclude SG students dunt know

how to think.

SG schools hard wares sure suppress many western countries.

can people in Oz tell us more in schools hardwares?

@@@@@@@@@22222

we are ranked no.7 as Global City by a yankee org.

If any one rank us high,we say Thank You.

If anyone rank us low,we see how we can improve.

But we shall have confidences and not dance with their music.

Talking is cheap .They dunt have to bear consequences of

our policy decided and excuted.

Like after SG kicked out from Malaysia,some foreign experts

adviced SG shall adopt import substitution.

But the old guards just adopted the export oriented policy .

This proved eliminated high unemployment rates of over 10% in few years!!

In early 1970's,SG was facing a happy problems of labour shortages!!

The rest is history.

http://www.foreignpolicy.com/story/cms.php?story_id=4509&page=1

lllll

-

Rising Costlist of 2008

Jan 3: Second Link tolls to go up from Feb 1. The tolls for all motorists at Tuas Second Link will be raised by between 10 cents and S$4.40 from 1 February. Motorcyclists will need to pay 10 cents more than the current toll of 60 cents. Cars will be tolled S$4.60, while vans and small lorries will be charged S$10.50. The largest jump is for big lorries, which will have to pay S$21 – S$4.40 more than the current S$16.60. (Channel NewsAsia)

Jan 08: Motorists to face five new ERP gantries. MOTORISTS can expect to pay more over the next few months to use the roads when five new ERP gantries are up, many in the heart of residential areas. (Straits Times) (Straits Times)

Jan 14: Prices of CNY goodies to go up. BE PREPARED to spend 10 per cent to 20 per cent more on foodstuffs this Chinese New Year. (Straits Times)

Jan 15: Inflation in S’pore may hit 6.5% this month. CONSUMER prices in Singapore may surge a staggering 6.5 per cent this month, bringing full- year average inflation to an equally eye-popping 5 per cent, according to Citigroup. (Straits Times)

Jan 18: Lunar New Year dinner prices set to rise by at least 10 per cent. Prices for restaurant dinners are set to rise by at least 10 per cent. (CNA)

Jan 23: Prices of suckling pigs double due to supply shortage in China. The prices of suckling pigs have doubled recently due to a drop in supply from China, and a 5kg pig is going for as much as S$180. (CNA)

Jan 24: Singapore’s consumer price index (CPI) … rose 4.4 per cent last month from a year earlier, with transport contributing the most. (TODAY)

Jan 25: Resale HDB flat prices up 30% above valuation in Q4. BUYERS of resale Housing Board flats found themselves paying $22,000 above the valuation from October to December - a whopping 30 per cent increase more than the previous quarter. (Straits Times)

Jan 29: ERP rates to go up by S$0.50 at certain gantries from Feb 4. Electronic Road Pricing (ERP) rates are set to go up by S$0.50 starting 4 February, according to the Land Transport Authority. (CNA)

Jan 30: ERP rates, more gantries to go up - but road tax cut by 15%. Minister Lim said 16 new gantries will go on between April and November, bringing the total number in operation to 71. This is just the start. The base ERP rate will be upped from $1 to $2, with the increments in $1 instead of the current 50 cents. To make ERP more effective in a rising affluent community, these changes will be made gradually. (Straits Times)

Jan 30: MediShield premiums to go up for better cover. YEARLY premiums for basic MediShield insurance are set to increase - by about $120 for most people - to ensure that subsidised patients saddled with big hospital bills will get better payouts. (Straits Times)

Jan 30: Prime Taxis to raise fares from March. AFTER holding out for over a month, Singapore’s smallest cab operator, Prime Taxis, will raise its fares to come in line with other companies here. (Straits Times)

Jan 30: Prices for tickets for all Cathay cineplexes to go up on Jan 31. Expect to pay up to $10.50 on a weekend. (TODAY)

Feb 02: Prices of vegetables are up between 5 and 10 per cent because higher oil prices. YOUR shopping basket will be a little more expensive this year, no thanks to a rise in vegetable prices. (The New Paper)

Feb 4: Singapore inflation may exceed 5 percent this year - PM Lee. Inflation in the city-state could accelerate to 5 percent this year after rising 2.1 percent in 2007 given rising commodity prices worldwide, the Business Times newspaper quoted Singapore Prime Minister Lee Hsien Loong as saying. (Forbes)

Feb 04: Businesses say new ERP gantries may increase operating costs. The rise in Electronic Road Pricing and increase in the number of ERP gantries is worrying at least one business - the couriers. (CNA)

Feb 14: Varsities up tuition fees by 4% to 20%. TUITION fees at the three local universities will go up by between 4 per cent and 20 per cent for the new batch of undergraduates entering in August. (Straits Times)

Feb 26: INFLATION accelerated last month to a 26-year high of 6.6 per cent with housing, food and transport costs registering steep increases over the past year. (Straits Times)

Mar 3: Caltex increases petrol and diesel pump prices. The company increased all grades of petrol by 4 cents per litre at 11am on Monday. Its Regular 95 petrol is now priced at S$2.046 a litre, Regular 98 at S$2.12 and Premium 98 petrol is S$2.286 per litre before discount. (CNA)

March 10: Park in Orchard area? It’ll cost you even more. Parking fees have gone up at 18 out of 20 malls, in one case by 36 per cent. (Straits Times, AsiaOne)

March 12: Fishball prices increase 20% due to rising cost of raw ingredients. Retailers said the prices of fishballs have risen by 20 per cent since last July due to rising cost of raw ingredients. (CNA)

March 17: Price of Chinese herbs to increase by 10%-20%. The price of Chinese herbs is set to increase by 10-20 percent. (CNA)

March 18: Barely two weeks after an increase in pump prices … all four petrol companies raised prices yesterday. Petrol and diesel prices went up by four cents and five cents per litre respectively, with the exception of Shell’s V-Power, which went up by three cents, and Caltex Platinum Techron, which remained unchanged. Regular 98-octane petrol at all four petrol chains now costs $2.160 a litre, while diesel is $1.613 a litre, before discounts. (TODAY)

March 19: Cost of electricity to go up from April as oil prices rise. Electricity tariffs will go up by an average of 1.26 cents (S$0.0126) per kilowatt starting 1 April. (CNA)

March 25: Singapore’s CPI up 6.5 pct year-on-year in February. Singapore’s consumer price index (CPI) jumped 6.5 percent in February from a year earlier, after gaining a 25-year high of 6.6 percent in January. (Trading Markets)

March 25: Singapore inflation stays at 26-year high. Prices of meat and poultry, cooking oils and dairy products clocked double-digit gains, while rice, cereal and fruit cost almost 10 per cent more than they did last year. High oil prices also made themselves felt in electricity bills and at petrol pumps. Indeed, transport costs jumped 9.6 per cent, boosted also by higher taxi fares and car prices. (Straits Times)

March 25: Prices of coffee, milk, sugar rise. In the past six months, the price of a 40-sachet bag of Nescafe 3-in-1 Regular Coffeemix has risen by 14 to 19 per cent across most major supermarkets. It costs $5.20 at Cold Storage and NTUC FairPrice. Super 3-in-1 Coffeemix is up 5 to 9 per cent, and now costs $4.95 at Cold Storage and $4.80 at NTUC FairPrice. (Straits Times)March 26: Price of paper up by as much as 40%. The price of paper around the world has gone up by as much as 40 percent over the past year. This has caused the price of recycled paper to increase by 100 percent. (CNA)

March 28: NETS revises pricing for NETS CashCard. Consumers are going to have pay more for their NETS CashCard come May, as it will include the cost of the CashCard as well. (CNA)

March 29: Prices of rice rise. FairPrice raises price of its house brand varieties after Thai rice jumps 30% overnight. A 5kg bag of FairPrice Thai White Fragrant Rice now costs $5.30, up from $4.70, and a 10kg bag of Double FairPrice Thai Hom Mali Rice now goes for $17.90, up from $16.25. (Straits Times)

April 5: FairPrice ups price for one premium rice brand. SINGAPORE‘S biggest supermarket chain, NTUC FairPrice, on Friday hiked the price of one of its in-house brands of premium rice. The rise is NTUC’s second in as many weeks: It hiked prices of three other in-house brands of rice by between 60 cents and $1.65 last week. (Straits Times)

April 23: Singapore’s March inflation rate up 6.7% on-year. The CPI for the first quarter of this year was 6.6 percent higher compared with the same quarter of previous year. On a seasonally adjusted basis, the CPI in March was 0.3% higher compared with February. Singapore’s inflation rate has been hovering at its highest level in 26 years. (CNA)

April 23: Pump prices up across all brands. THE OTHER oil companies have all followed Caltex’s move to raise pump prices here. ExxonMobil, Singapore Petroleum Co and Shell on Wednesday upped petrol prices by three cents a litre and diesel by five cents. The latest pump price adjustment is the 10th consecutive increase since July last year - 11th if the GST-triggered increase on July 1, 2007 were to be included. (Straits Times)

April 25: Sharp hike in kindergarten fees. SOME 1,500 students attending the seven PAP Community Foundation (PCF) kindergartens in Woodlands will see their fees shoot up by 30 to 100 per cent. (TODAY, April 25.)

May 3: Rice and cooking oil lead price rise. Yes, the price of rice is going up. But so too are the prices of cooking oil and other items such as instant noodles. (Straits Times)

May 3: SIZZLING HOT: Cooking oil prices on the boil. In the last two months, retail prices have jumped between 9per cent and 56 per cent, depending on the brand.. (Straits Times)

May 9: Expect to pay higher electricity bills. Soaring crude oil prices drove the benchmark market price of electricity to a record last month, and there is not much relief in sight. (Straits Times)

May 16: Caltex pump prices up. Prices at Caltex were increased as of 10.00am today. Prices of Silver, Gold and Platinum petrol grades went by $0.02 to $2.136, $2.210 and $2.336 respectively. (AsiaOne) (TODAY)

May 19: Food operators to charge more for home deliveries. A Straits Times check with 25 food-delivery services found that more than half have increased their menu prices by at least a dollar in the last few months. Five have also upped their delivery fees, while three have increased their minimum order amount. (AsiaOne)

May 23: Singapore inflation rate hits new 26-year high of 7.5% in April. Singapore’s annual inflation rate rose to a new 26-year high of 7.5 percent in April as food, housing and transportation costs soared and is now a risk to the economy, the government said on Friday. (CNA)

May 24: Pump prices up for second time in a week. The latest jump - the 12th consecutive increase since last July - was sparked when oil giant Shell upped petrol prices by five cents a litre and diesel by seven cents at 5pm on Thursday. (Straits Times)

June 5: Poultry prices to rise due to higher transportation costs. The cost of every kilogramme of duck to go up by five cents. The price of chicken products is also expected to increase. (CNA)

June 7: Singapore consumers to feel knock-on effects. THE fuel price hike in Malaysia is going to bite Singaporeans soon, and hard. Prices of a range of goods are set to go up as the cost of trucking them in rises, and fresh food tops the list. (Straits Times)

June 7: Singapore’s poor turn to temples to fill bellies. Many Singaporeans increasingly turning to free meals at temples to fill their stomachs, as surging global commodity prices hurt, even in a country that is one of the richest in Asia. (Reuters)

June 7: Coach fares to Malaysia up. The Express Bus Agencies Association (EBAA), which accounts for six in 10 buses heading across the Singapore border, has raised its fuel and insurance surcharges from a previous flat fee of $3, to between $5 and $16 — that’s up to five times more — depending on your destination. (TODAY)

June 11: Up prices of eggs and some vegetables. The prices of eggs and some vegetables have jumped at wet markets across the island, according to a Straits Times check. This comes barely a week after Malaysia - Singapore’s biggest food supplier - trimmed domestic fuel subsidies. (Straits Times)

June 18: ERP rates in CBD to go up, 5 new gantries added. About half of existing ERP gantries islandwide will see their rates increase from July 7. (CNA) (Straits Times)

June 19: Housebrand rice prices up. The Consumers Association of Singapore (Case) has found that prices for housebrands rose between 14 and58 per cent last month. The most dramatic jump was for Cold Storage’s First Choice Thai Fragrant Rice: :From between $8.75 and $9.10 for a 5kg-pack, to $13.80. (TODAY)

June 25: Pump prices up for 13th time since last July. PUMP prices have risen again, with petrol going up by five cents a litre and diesel, 10 cents.This latest increase, the 13th consecutive rise since last July, started when oil giant Shell raised rates at 4pm yesterday. By evening, Caltex and ExxonMobil had followed suit.(Straits Times) (TODAY)

June 25: Electricity tariffs to rise 4.98% from next quarter. Electricity tariffs will go up by 4.98 per cent or by 1.19 cents per kilo watt per hour (kWh) for all households from the next quarter, beginning July 1. (CNA)

June 28: Premium bus fares to go up. PREMIUM bus fares will soon go up, as operators here feel the pinch from higher fuel prices. SBS Transit, which runs more than half of such services, will raise fares by 30 to 60 cents, up to a maximum of $3.60 per trip. The fare hike will affect all of its 40 premium services. (Straits Times)

July 2: Private bus operators up prices over diesel price hikes. FACED with skyrocketing diesel prices, private bus operators are charging more to transport workers and rent out coaches. Ten bus companies contacted by The Straits Times said they have raised prices by at least 10 per cent in the last few months due to rising rising diesel prices, which have almost doubled in the last year. (Straits Times)

July 6: 5 S’pore River ERP gantries kick in on Monday. The new gantries, which will bring the total number of gantries in Singapore to 65, will charge $2 from 6pm to 7.30pm and $1 from 7.30pm to 8pm. (Straits Times)

July 7: Expect to see more of these gantries in coming months. New KPE will have 16, taking grand total from 60 to more than 80. When it opens fully on Sept 20, it will have the most ERP gantries among all roads here. New KPE will have 16, taking grand total from 60 to more than 80 (Straits Times)

July 12: 30-cent fuel levy for cab rides from Thursday. MOST cab rides will cost 30 cents more from next Thursday, after Singapore’s largest taxi operator ComfortDelGro yesterday announced its decision to levy a fuel surcharge on all trips. (Straits Times)

July 14: School bus fares going up on Aug 1. SCHOOL bus operators, bitten by skyrocketing diesel prices, could soon start charging parents $10 to $15 more a month to ferry schoolchildren. (Straits Times)

July 19: SMRT Taxis to levy 30 cents fuel surcharge. SMRT Taxis will levy a fuel surcharge of 30 cents per trip for all taxi trips from July 26. The fuel surcharge will apply to all flag down trips, as well as call centre and advanced bookings, SMRT said in a press release on Saturday. SMRT’s move came after ComfortDelGro implemented the surcharge on Thursday. (Straits Times)

July 22: High power bills: Record number of cases probed. A RECORD number of complaints about overcharging for electricity were investigated by Singapore Power last month. SP Services, the power company’s customer service arm, said it looked into 1,093 cases where customers had complained that their bills for May were higher than in previous months. (Straits Times)

July 23: S’pore June inflation rises 7.5% on higher food, housing costs. Singapore’s consumer inflation stood at a 26-year high in June, rising 7.5 per cent compared with a year ago, according to latest figures from the Department of Statistics. (CNA)

July 24: Singapore ranked fifth most expensive city in Asia. Singapore is now the fifth most expensive city in Asia, according to Mercer Worldwide Cost of Living Survey. In world standings, Singapore is in 13th position, one notch higher than in 2007. (CNA)

July 30: Heartland shoppers hit hardest by Nets fee hike. SOME mom-and-pop stores in the heartland are passing on an increase in Nets fees to consumers, despite being barred from doing so. (Straits Times)

25 August: CPI for households up 7.1% in first six months. The Consumer Price Index (CPI) for households increased by 7.1 per cent in the first half of 2008 compared with the same period last year. (CNA)

Aug 29: More unable to pay electricity bills. 35% of families with power bill woes stay in larger 4- or 5-room flats. As of June this year, about 13,700 households have been put on a pre-paid metering scheme after they had their power supply cut off or were in danger of having the supply disconnected. (Straits Times)

August 30: SINGAPORE‘S public hospitals have raised ward charges in the last two months. The increases at Alexandra Hospital (AH), Changi General Hospital, KK Women’s and Children’s Hospital and SGH took effect at the beginning of July. Tan Tock Seng Hospital and the National University Hospital (NUH) raised their fees this month. (Straits Times).

Sept 12: Bus and train fares up on October 1. The Public Transport Council (PTC) has given the green light for an overall net fare adjustment that will result in fare changes that will range from a 7-cent reduction to a 4-cent increase per journey. (CNA)

Sept 28: Childcare fees going up. The average monthly fees for childcare and infant care now are $684 and $1,184 respectively. A Sunday Times check with 20 childcare centres found that all but three intend to charge $30 to $120 more a month. (Straits Times)

Sept 29: Households to see average rise of about 22% in electricity bills from Oct. On average, all SP Services customers will face a 21.89 per cent increase. (CNA)

Sept 28: Some papers to cost more. The subscription and newsstand prices of both The Straits Times and The Sunday Times, currently at 70 cents and 80 cents respectively, will increase by 10 cents for the Sunday to Friday editions, and by 20 cents for the bumper Saturday edition. (Straits Times)

Oct 6: SingTel increases local fixed line subscription and call rates. SingTel is increasing its local fixed line subscription by S$10 a year from January 1, 2009. Residential customers will therefore pay S$110 per year in subscription and business customers will pay S$160 per year. (CNA)

Oct 21: 3rd ERP gantry on PIE to kick in. MOTORISTS heading west on the Pan-Island Expressway (PIE) will have to pay Electronic Road Pricing (ERP) charges to drive beyond Eunos from Nov 3. The gantry along the expressway near the Eunos exit will be activated, charging $2 between 7am and 7.30am, and $1 between 7.30am and 8am. (Straits Times)

Oct 23: Singapore’s September inflation up 6.7% on-year. Singapore’s consumer price index rose 6.7 per cent in September compared with the same period last year. (CNA)

-

debt or no debt, is it that important?

as long as they can sustain their facade of being wealthy, having alot of debt shdn't be an issue.

there are lots of poor men out there who borrowed millions, and living as if they are millionaires. no one cares.

-

Originally posted by reyes:

hard to understand your pt.

short and sharp.

and use proper english.

Well put, reyes. In the interest of brevity, let me put this to Noisy Pussy:

Do you really think that your misinformed opinion carries more weight than that of the World Economic Forum? They got onto that forum by establishing their credentials as people who are knowledgeable in economics. You got onto this forum by sending your email address to FireIce.

The government refuses to tell the people anything about the CPF money. Unless you've been blowing Hsien Loong lately, how, pray tell, do you have information that the CPF explains away the gross figures?

Silly fucker.