Singapore finmin says economic woes deepening

-

Reuters - 2 hours 38 minutes ago

SINGAPORE, Feb 5 - Singapore's finance minister said on Thursday the economic downturn was worsening and the government may have to tap its multi-billion dollar pool of reserves for another fiscal stimulus package next year.

Singapore was the first country in Asia to fall into recession last year and Finance Minister Tharman Shanmugaratnam reiterated a forecast made before the country's January stimulus package that the economy could shrink up to 5 percent this year.

"We are seeing continued momentum in the decline week by week," Tharman told parliament at a budget debate.

Singapore, a tiny city-state of 4.6 million, last month took the unprecedented step of drawing on its reserves to help finance a S$20.5 billion stimulus package as its economy shrunk for the third straight quarter. [ID:nSP404398].

Tharman said the stimulus package was sufficient. It will result in a budget deficit of about 6 percent of gross domestic product for 2009/2010 before investment income and the top-up from reserves.

"There is a possibility the government may have to go back to the president and the CPA in a year's time to seek a further draw," Shanmugaratnam said, referring to the Council of Presidential Advisers. Singapore's president, whose role is otherwise largely ceremonial, is the formal guardian of the reserves.

A senior politician said on Sunday the government would dip into the reserves only in times of crisis and to pay for welfare.

"As a general principle, the government must continue to fund such programmes out of revenues raised in the current term of government, not past reserves," former Prime Minister Goh Chok Tong said

Singapore's two sovereign funds, Temasek [TEM.UL] and the Government of Singapore Investment Corp, or GIC, together manage an estimated $400 billion in assets. (Reporting by Kevin Lim; Writing by Nopporn Wong-Anan; Editing by Jan Dahinten)

-

Don't have trust in this botak.

-

it is no fault of the gabrament this time

-

Nope, but it will be their fault if they muck up the usage of the reserves this round.

By drawing upon the reserves, they need to ensure that they will be able steer Singapore towards a speedier recovery. In other words, we fall into recession first, we should also recover first, especially if we were to tap into our reserves.

-

In case anyone forgets, this is not the Finance Minister that brought Singapore to this point. It was the the son of the cursed despot that has cancer of the anus.

-

-

i like the sentence president is ceremonial, which is true.

-

what's happened is not their fault either...

now it is how they deal with the situation.

-

it like slap back on their face now. remember how they claim credit and shamelessly increase their own salary to millions when the economy is good.

nobody born to hate PAP. its their lust for power and money that irks most singaporeans.

-

the way the people are Queing buying TOTO, do u think they need to have another Singapore Draw?

-

what the..

-

Those who can afford better spend more to help the economy & save jobs!

-

Originally posted by angel7030:

the way the people are Queing buying TOTO, do u think they need to have another Singapore Draw?

that has nothing to do with the topic. -

Originally posted by reyes:

it like slap back on their face now. remember how they claim credit and shamelessly increase their own salary to millions when the economy is good.

nobody born to hate PAP. its their lust for power and money that irks most singaporeans.

Yes, it irks me to think the filthy obscene salary they pay themselves during this financial woes and others have to slog to make ends meet and living with fear of rice bowls being broken. They are shameless, most money faced politicians in the whole world. Guiness Book should give them the title the world's greediest politicians. -

Originally posted by Fantagf:

Reuters - 2 hours 38 minutes ago

SINGAPORE, Feb 5 - Singapore's finance minister said on Thursday the economic downturn was worsening and the government may have to tap its multi-billion dollar pool of reserves for another fiscal stimulus package next year.

Singapore was the first country in Asia to fall into recession last year and Finance Minister Tharman Shanmugaratnam reiterated a forecast made before the country's January stimulus package that the economy could shrink up to 5 percent this year.

"We are seeing continued momentum in the decline week by week," Tharman told parliament at a budget debate.

Singapore, a tiny city-state of 4.6 million, last month took the unprecedented step of drawing on its reserves to help finance a S$20.5 billion stimulus package as its economy shrunk for the third straight quarter. [ID:nSP404398].

Tharman said the stimulus package was sufficient. It will result in a budget deficit of about 6 percent of gross domestic product for 2009/2010 before investment income and the top-up from reserves.

"There is a possibility the government may have to go back to the president and the CPA in a year's time to seek a further draw," Shanmugaratnam said, referring to the Council of Presidential Advisers. Singapore's president, whose role is otherwise largely ceremonial, is the formal guardian of the reserves.

A senior politician said on Sunday the government would dip into the reserves only in times of crisis and to pay for welfare.

"As a general principle, the government must continue to fund such programmes out of revenues raised in the current term of government, not past reserves," former Prime Minister Goh Chok Tong said

Singapore's two sovereign funds, Temasek [TEM.UL] and the Government of Singapore Investment Corp, or GIC, together manage an estimated $400 billion in assets. (Reporting by Kevin Lim; Writing by Nopporn Wong-Anan; Editing by Jan Dahinten)

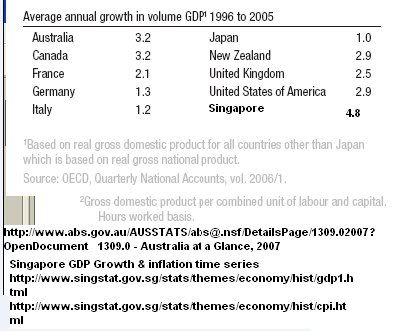

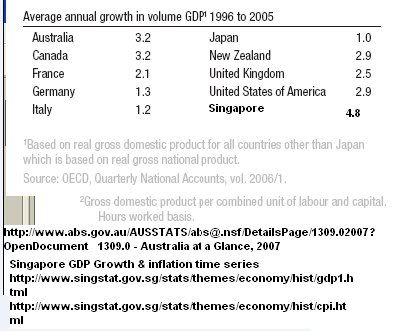

Why do u guys just pin point on the few quarters growth or first country into recession?

Take Oz and SG as a example.The Down Under has been growing at much lower

rate than SG for many years.So,do u want much higher growth rate for years

or not first country in recession but lower growth rate for decades?

u calculate the compound growth rate for 10 years than u know

the big differences for one or two % points growth rate in a year?

SG--1.048 to power 10=1.59

oz ---1.032 to power 10=1.37

so SG grew 59 % in ten years ,oz by 37%.

kk

kkk

-

Originally posted by lionnoisy:

Why do u guys just pin point on the few quarters growth or first country into recession?

Take Oz and SG as a example.The Down Under has been growing at much lower

rate than SG for many years.So,do u want much higher growth rate for years

or not first country in recession but lower growth rate for decades?

u calculate the compound growth rate for 10 years than u know

the big differences for one or two % points growth rate in a year?

SG--1.048 to power 10=1.59

oz ---1.032 to power 10=1.37

so SG grew 59 % in ten years ,oz by 37%.

kk

kkk

Do not compare with Australia, we are in shit state right now and steps must be taken to solve the problem before it spiral into some worse shite. Oz GDP is 7 times larger than Singapore.

What, you are into Ku Klux Klan now eh? Whats with the KKK?

-

Originally posted by Man!x:

Do not compare with Australia, we are in shit state right now and steps must be taken to solve the problem before it spiral into some worse shite. Oz GDP is 7 times larger than Singapore.

What, you are into Ku Klux Klan now eh? Whats with the KKK?

I concur, that is why I can't be bothered to respond to the noisy lion. -

We need to watch out for how the billions of dollars in economic stimulus is being handed out. Is this given mostly tp those who know how to exploit these ...with just some $2 HongBao for rest of us.. I am troubled by a report in Channel New Asia abvout a recently announced funding scheme.

This was send to me my a friend on Facebook. See his Note

"The initiative, called the Incubator Development Programme, aims to help young firms gain better support and access to resources.

The programme will provide funds to enhance the services provided by organisations that help nurture and grow promising new start-ups.

Under the scheme, such groups - nicknamed "incubators" or "venture accelerators" - can obtain up to 70 per cent grant support to develop fledgling firms.

However, they will need to provide a full suite of services to qualify for funding.

Five such organisations have already benefited during a pilot phase of the programme over the past year.

These organisations are NUS Enterprise Incubator, iAxil Venture Accelerator Centre, NTU Nanofrontier, Business Angel Network and Microsoft Innovation Centre."These companies don't need state funding....they should be funded by the capitalists who have and are still making big money funding start-ups. These people are so good at raising capital that they have even persuaded the state to give them some?

In any case...with the extent of the problem and serious job losses....the last thing the govt need think about at this stage is funding incubated startups.

Fund people who have lost their jobs and want to start of small business to make a living instead.

span.jajahWrapper { font-size:1em; color:#B11196; text-decoration:underline; } a.jajahLink { color:#000000; text-decoration:none; } span.jajahInLink:hover { background-color:#B11196; }

-

How can our economic woes deepen when the Govt have been sucking our blood and money thru unnecessary paying of bills, ERP, tax raise etc??? Don't tell me after this everything oso go up again...

-

Everything went up including our blood.Little wonders why most of our cock cannot went up.Morning you wake up already think of $$.Pay here pay there.Those driving more worse have to think of the blardy ERP.

-

Why not migrate to Israel I believe their economy will be doing great once this global crisis fade away. Its people can feel relief and lucky that their economy is doing great once this crisis is over......eeerrrr unlike Singapore in my opinion. Stuck with the PAP and the FamiLEE LEEgime.

can Singapore ride on the next wave of global economy growth? or stagnation is the new growth?

But then again what do I know so we shall see . .what become of Singapore and its famiLEE LEEgime

-

Hmm not to mention that most Israelis are intelligent in doing bussiness too.

-

Hmm yea and unexploded Hamas rocket can be sold at a fortune for a second relaunch lol.

-

-

Originally posted by Cram:

ya, it getting worst, but peoples still got money to Q up at singapore pool to buy toto and 4D, so do you think it is getting worst???And also hor, Nata travel tour exhibition was fully booked, so do you think it is getting worst??