''Australian oz housing market holds sub-prime danger''

-

Why don't we get such negative news in Singapore like they do in Australia?

Simple. The press is 100% controlled by the PAP government.

-

lionnoisy I hate to say this, but you really do have sub-normal intelligence. Your parents are much better off raising a parrot instead of you.

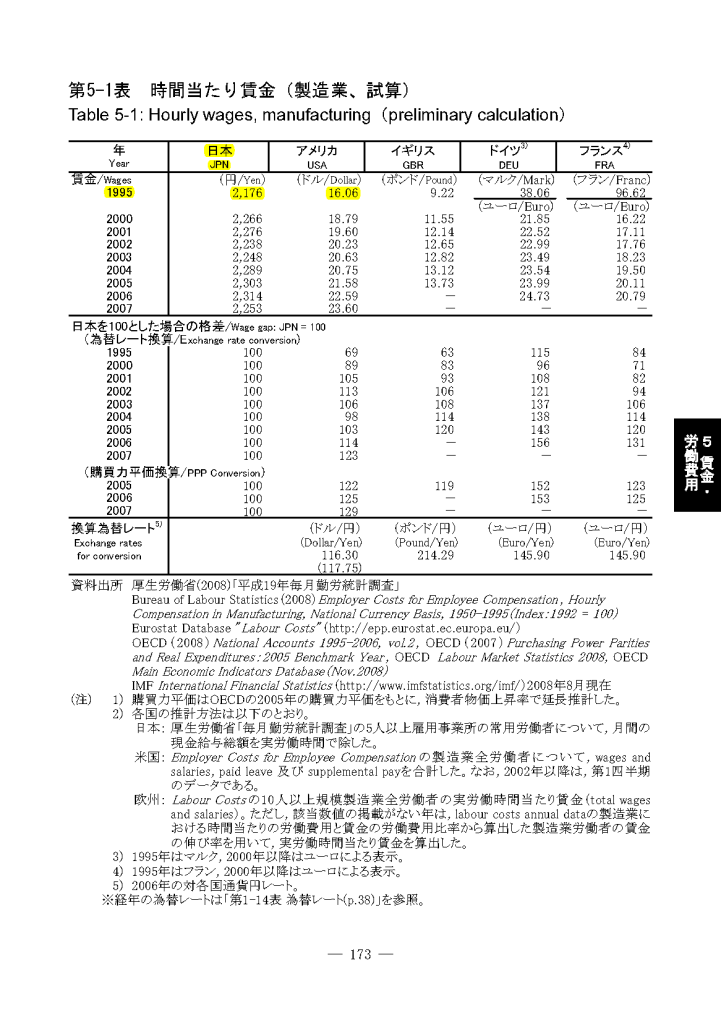

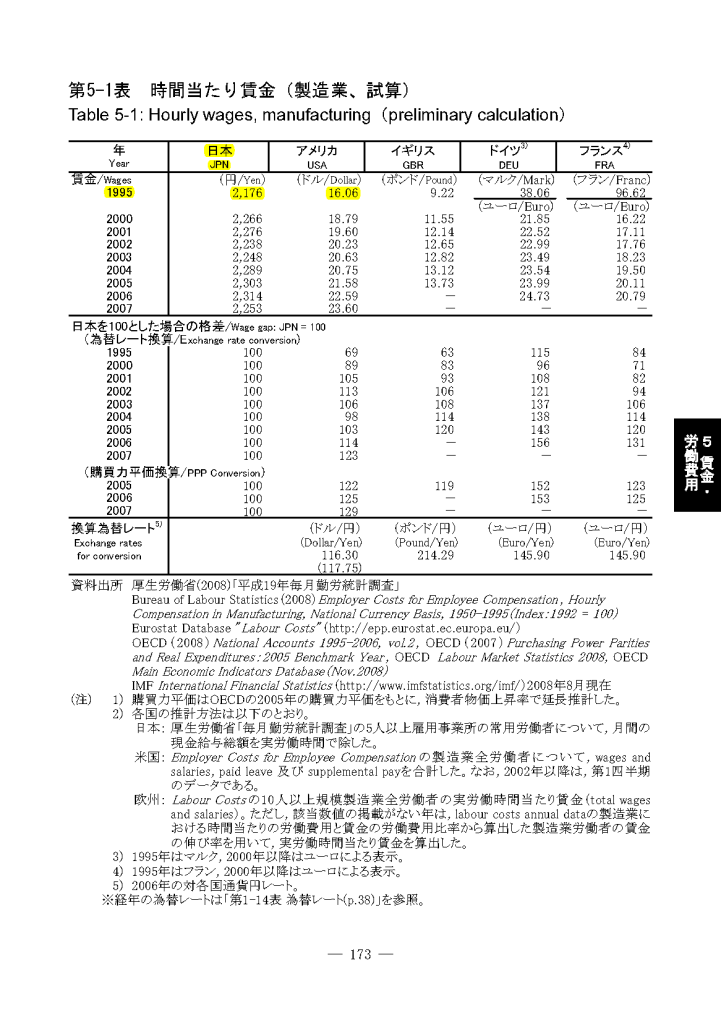

You always claim that Singapore's GDP per capita (PPP) is higher than Swiss and Japan. Do you know what is the average wage rate of blue collar workers in these countries? In 1995, Japan had a JPY 2,176 [SG$ 32] per hour rate for it's manufacturing workers. What do you think is the manufacturing wage rate for Singapore in 2007 (when economy was at it's prime)? Is it anywhere near $10?

In most countries, GDP per capita is a good gauge of living standards, but sad to say, it's not the case for Singapore.

If you don't have any intelligence, it's best to keep quiet and keep others guessing, rather than make stupid post to confirm your stupidity.

http://www.jil.go.jp/kokunai/statistics/databook/2009/05/p173_t5-1.pdf

-

I hope it happens and I can buy some Australian properties to invest in and later live in when I migrate there.

-

Originally posted by AndrewPKYap:

I hope it happens and I can buy some Australian properties to invest in and later live in when I migrate there.

After you have migrated there, you can register a nick "kangaroonoisy" in AUForums and start bad mouthing Singapore.

Ooops....think you smart enough not to do what lionnoisy is doing now, can't even manage Singapore, yet want to worry about Australia. Also, if you are a citizen of Australia, you should be more concerned about Australia rather than Singapore, unlike lionnoisy.

-

if u look at a boarder picture,u wil wander if Oz is in the rank

of yankee----heavy debt!!

''Net foreign debt declined to $674.2 billion in the March quarter, representing 57.1 per cent of year‑ended December quarter 2008 nominal GDP. Australia's debt servicing ratio – the percentage of export earnings required to meet Australia's debt servicing repayments – fell in the March quarter to 9.8 per cent.''

http://www.treasurer.gov.au/listdocs.aspx?doctype=0&PageID=003&min=wms

075 02/06/2009 Balance of Payments – March Quarter 2009 -

Originally posted by lionnoisy:

if u look at a boarder picture,u wil wander if Oz is in the rank

of yankee----heavy debt!!

''Net foreign debt declined to $674.2 billion in the March quarter, representing 57.1 per cent of year‑ended December quarter 2008 nominal GDP. Australia's debt servicing ratio – the percentage of export earnings required to meet Australia's debt servicing repayments – fell in the March quarter to 9.8 per cent.''

http://www.treasurer.gov.au/listdocs.aspx?doctype=0&PageID=003&min=wms

075 02/06/2009 Balance of Payments – March Quarter 2009

Is that the best reply you can give?

When I ask you question A, you tell me about B?

You don't have answers why Singapore's GDP per capita is higher than Japan, yet the per hour rate for manufacturing is SG$32 / hour?

Believe me when I say, Singapore's recession is going to be worse. FYI, Australia is not even in a recession now, on an annual basis, Australia's GDP grew 0.3%, Singapore's GDP declined 10.1%.

http://www.abs.gov.au/AUSSTATS/[email protected]/mf/1345.0?opendocument?utm_id=LN

http://www.singstat.gov.sg/news/news/gdp1q2009.pdf

-

Singapore's debt is 99% of GDP.

S$255 million / S$257 million = 99%

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa44.pdf

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa11.pdf

-

Originally posted by deepak.c:

Is that the best reply you can give?

When I ask you question A, you tell me about B?

You don't have answers why Singapore's GDP per capita is higher than Japan, yet the per hour rate for manufacturing is SG$32 / hour?

Believe me when I say, Singapore's recession is going to be worse. FYI, Australia is not even in a recession now, on an annual basis, Australia's GDP grew 0.3%, Singapore's GDP declined 10.1%.

http://www.abs.gov.au/AUSSTATS/[email protected]/mf/1345.0?opendocument?utm_id=LN

http://www.singstat.gov.sg/news/news/gdp1q2009.pdf

1.hourly rate and GDP

There is no direct relationship between cost and value.

If there is,then the big four car makers in USA ould not fall.

I read that hourly cost of GM worker is US70,if u include their pension.

Following your logic,these big makers will not fall.

Their cars would be sold at very high price.

Pl note that Japan overall GDP grew 10% and SG grew 80 % from 1996

up to end 2008.

I dunt know how japan to cope with so many young graduates from

secondary and U!

2.Is Oz RECESSION proof?

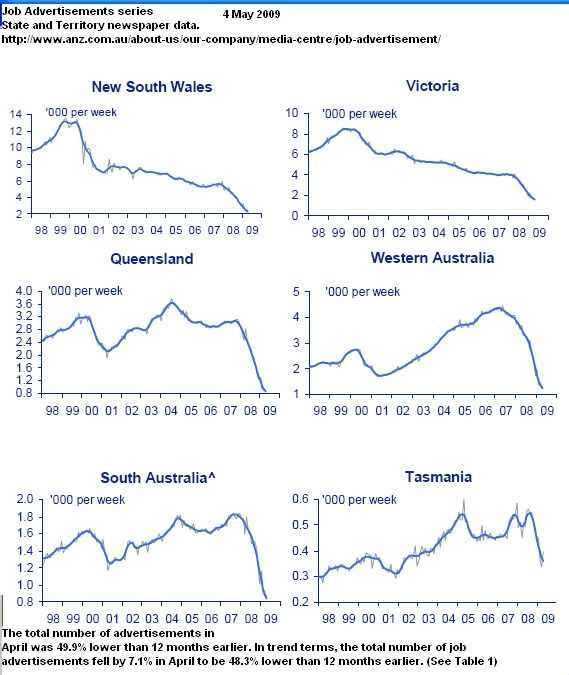

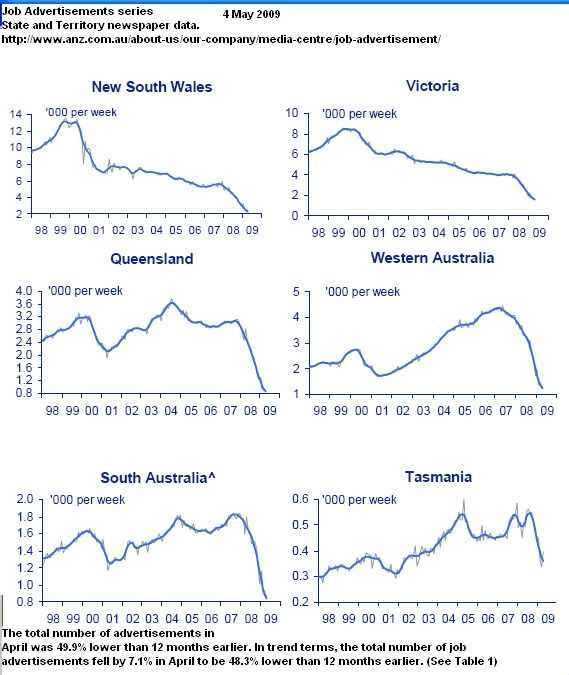

The OZ jobs advertisements drops half in a year ,like SG.

So how?

I am wandering why the loan size going up and more

first time house buyers in the market.

This do not tally with the falling jobs market.

http://computerworld.co.nz/news.nsf/care/9AF9014B670FD8BBCC2575AC00733A8E

Job ads drop by half | PerthNow

http://www.news.com.au/business/money/story/0,28323,25615088-5013951,00.html

First-home buyers at all-time high

NEWS.com.au

June 10, 2009

nnnnn

-

Originally posted by lionnoisy:

1.hourly rate and GDP

There is no direct relationship between cost and value.

If there is,then the big four car makers in USA ould not fall.

I read that hourly cost of GM worker is US70,if u include their pension.

Following your logic,these big makers will not fall.

Their cars would be sold at very high price.

Pl note that Japan overall GDP grew 10% and SG grew 80 % from 1996

up to end 2008.

I dunt know how japan to cope with so many young graduates from

secondary and U!

2.Is Oz RECESSION proof?

The OZ jobs advertisements drops half in a year ,like SG.

So how?

I am wandering why the loan size going up and more

first time house buyers in the market.

This do not tally with the falling jobs market.

http://computerworld.co.nz/news.nsf/care/9AF9014B670FD8BBCC2575AC00733A8E

Job ads drop by half | PerthNow

http://www.news.com.au/business/money/story/0,28323,25615088-5013951,00.html

First-home buyers at all-time high

By Chelsea Mes

NEWS.com.au

June 10, 2009

nnnnn

There you go off the tangent again, not replying to what I asked and bringing in new issues to sidetrack everything. Is this the tactic they teach you at PAP cyber counter intelligence?

No direct relationship between cost and value?

You pay the cost of $1,000 for a diamond ring, you get the market value of $1,000 for the diamond ring.

You mean to tell me when you pay $1,000 for a diamond ring, you get the market value of $100,000 for the diamond ring?

You make a good comedian.

-

Originally posted by deepak.c:

lionnoisy I hate to say this, but you really do have sub-normal intelligence. Your parents are much better off raising a parrot instead of you.

You always claim that Singapore's GDP per capita (PPP) is higher than Swiss and Japan. Do you know what is the average wage rate of blue collar workers in these countries? In 1995, Japan had a JPY 2,176 [SG$ 32] per hour rate for it's manufacturing workers. What do you think is the manufacturing wage rate for Singapore in 2007 (when economy was at it's prime)? Is it anywhere near $10?

In most countries, GDP per capita is a good gauge of living standards, but sad to say, it's not the case for Singapore.

If you don't have any intelligence, it's best to keep quiet and keep others guessing, rather than make stupid post to confirm your stupidity.

http://www.jil.go.jp/kokunai/statistics/databook/2009/05/p173_t5-1.pdf

U are welcome to open thread to talk abt negative side of SG.

Do u think is it a negative Speaker Corner alreday?

It seem i am the one of the few to talk another side of oz and positive

side of SG.

2.I agree with at u say that

''In most countries, GDP per capita is a good gauge of living standards, but sad to say, it's not the case for Singapore.''

u mean Dunt trust the figure.Trust the reality.

I cant agree any more.

Reality count.If u ignore the Monoster called REALITY,

u will regret when the MONSTER knocks on your door

in one mid night.

3.unemployment rate

Wat is the point to say Oz is NOT in recession when the unemployment

is climbing fast!!Pl note Oz dunt have too much FT to cushion the jobs cut.

I dunt need to tell u in SG,many employee have the pay cut by 10 % and above.

But they still can keep the jobs.The half socialist PAP gavaman knows

if u loss a job,u are 100% job less!!

http://www.tradingeconomics.com/Economics/Unemployment-rate.aspx?Symbol=AUD

NOT to scale!!

-

Originally posted by lionnoisy:

U are welcome to open thread to talk abt negative side of SG.

Do u think is it a negative Speaker Corner alreday?

It seem i am the one of the few to talk another side of oz and positive

side of SG.

2.I agree with at u say that

''In most countries, GDP per capita is a good gauge of living standards, but sad to say, it's not the case for Singapore.''

u mean Dunt trust the figure.Trust the reality.

I cant agree any more.

Reality count.If u ignore the Monoster called REALITY,

u will regret when the MONSTER knocks on your door

in one mid night.

3.unemployment rate

Wat is the point to say Oz is NOT in recession when the unemployment

is climbing fast!!Pl note Oz dunt have too much FT to cushion the jobs cut.

I dunt need to tell u in SG,many employee have the pay cut by 10 % and above.

But they still can keep the jobs.The half socialist PAP gavaman knows

if u loss a job,u are 100% job less!!

http://www.tradingeconomics.com/Economics/Unemployment-rate.aspx?Symbol=AUD

NOT to scale!!

I am not here to talk about the negative side, I am here merely to state FACTS, unlike you posting here on the positive side to angkat PAP's balls and brainwash people.

Doesn't make sense for me to have any meaningful discussion with you at all, this will go on with me asking question A and you responding with answer B, when I give you reply to B, you will give me reply for C.

-

Originally posted by deepak.c:

I am not here to talk about the negative side, I am here merely to state FACTS, unlike you posting here on the positive side to angkat PAP's balls and brainwash people.

Doesn't make sense for me to have any meaningful discussion with you at all, this will go on with me asking question A and you responding with answer B, when I give you reply to B, you will give me reply for C.

ok

I am now telling u facts.

Australia Unemployment climbs to 5.7pc

MORE than 35,300 Australians were left jobless in May as unemployment hits 5.7 per cent.

-

-

Originally posted by lionnoisy:

ok

I am now telling u facts.

Australia Unemployment climbs to 5.7pc

MORE than 35,300 Australians were left jobless in May as unemployment hits 5.7 per cent.

Actual figure less foreigners convert P.R and citizens for unemployment is higher compared to that of foreigners.

Calling you stupid is an insult to the word stupid. You understand?

-

Here are the good and bad news.

Good is growth forecast which i dunt read forecast.

Bad is clear and present danger to house owners!!

10 bp is not big.But it may signal the U turn of interest rate!!

Sharp rise in IMF 2010 growth forecast

THE IMF has increased its growth forecast for next year by more than 25pc, fuelling hopes of recovery.

-

Welcome back, lion. How was your mum's funeral?

-

The Spore economy is expecting to contract as it relied too much on exports to other countries.

-

Originally posted by Gedanken:

Welcome back, lion. How was your mum's funeral?

Wasn't it your Mum's funeral???Are you alright or not?

-

wwww

u can paint a rosy picture for oz.

But to some IMG guys,they still have some reservations.

read bewteen the lines,then u will know wat the risks

oz is facing.....

U have to digest every words,if u bet your money on Oz $$.

para 4

Domestically, a sharper than expected deterioration in banks’ asset quality, possibly stemming from lower house prices, could constrain credit and deepen the downturn. A high impact tail risk would be a decline of investor confidence in the banks or the sovereign. However, this is highly unlikely given the low level of public debt and track record of sound macroeconomic policies.

13. Although Commonwealth government debt is projected to remain low compared with other advanced economies, several factors argue for continued prudence. While the probability is extremely low, the government may need to assume additional debt on behalf of the banks should they be unable to rollover their significant short-term external liabilities. Guarantees on banks’ deposits and wholesale funding as well as state-government debt, presents an additional, although again similarly low probability risk.

June 24, 2009 Australia -- 2009 Article IV Consultation Concluding Statement

vvvvv

-

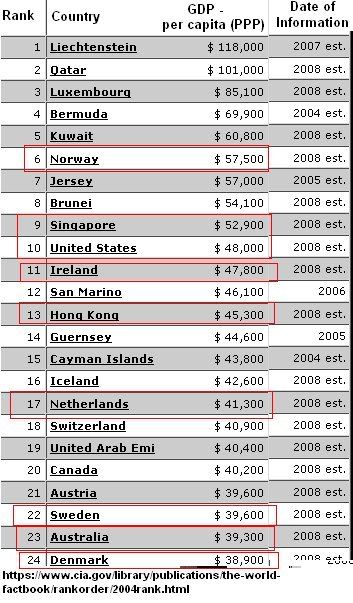

Originally posted by reyes:

i am not sure how this figure is derive.

seem like the opposite is true.

in singapore, how many of us really get $52k/yr?

in aussie, how many of your friends get 38k/yr?

OMG.This is gross domestic products ,not salary.

BTW,why dunt u spent few clicks to check for your self?

i think u can read much better than me.

I think some of u have many perceptions which may not be true.

read think.Dunt trust anyone.we have been brain

washed by western medias too long..

Australia GDP per capita slips to 26 th position!!!

$38,100 (2008 est.)country comparison to the world: 26--click me

$38,100 (2008 est.)country comparison to the world: 26--click mehttps://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html?countryName=Australia&countryCode=AS®ionCode=au#AS

https://www.cia.gov/library/publications/the-world-factbook/rankorder/2004rank.html?countryName=Australia&countryCode=AS®ionCode=au#AS

-

Oh talking abt living standard

-----Living space

We live in a bigger house than Japan and HK.I mean space per person.

-----small crimes---u know lah..

----organised crimes,incl drugs,loan sharks,prostitutions,gambling

----corruptions---??

----..

The question is over all situation!!

Do your home work.Think.Decide.Take action.Good luck.

Dunt waste time in this forum.

-

Originally posted by deepak.c:

Singapore's debt is 99% of GDP.

S$255 million / S$257 million = 99%

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa44.pdf

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa11.pdf

Oh dear,u make a mistake like CSJ.

Other governemnts borrow money to spend.

Majority of Spore gavaman debts are ''borrowing '' from CPF to stuff

interest to CPF members.CPF Board cant take risks to invest .

Therefore CPF members enjoying risk free interest fr

3.5 to 5 % pa.

Wat u quote is gross debt and not for spending.

Singapore Government Securities - Homepage

www.sgs.gov.sg/

2.If u include net assets of Temasek and GIC,which are totally estimated

at US$400 billions,then Spore is just not debt free,but have few bucks!!

International ranking shall take net debt of gavaman,not gross debts!!

3.Many first world dunt take debts as debts.SG do take it very seriouly.

read more.

August 13, 2008 Public Information Notice: IMF Executive Board Concludes 2008 Article IV Consultation with Singapore

one

-

Originally posted by deepak.c:

Singapore's debt is 99% of GDP.

S$255 million / S$257 million = 99%

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa44.pdf

http://www.singstat.gov.sg/stats/themes/economy/ess/aesa11.pdf

Hi,

No other country dare to write Sect A for reasons of issuing bonds.

They ,incl Oz,just BS the reasons in Sect B.

But there is only one reason--they run out of money!!

http://www.sgs.gov.sg/macro_overview/macrooverview_intro.html

sect A

Unlike many other countries, the Singapore Government does not need to finance its expenditures through the issuance of government bonds as it operates a balanced budget policy and often enjoys budget surpluses. The principal objectives of developing the SGS market are to:

sect B

i. provide a liquid investment alternative with little or no risk of default for individual and institutional investors; ii. establish a liquid government bond market which serves as a benchmark for the corporate debt securities market; and iii. encourage the development of skills relating to fixed income securities and broaden the spectrum of financial services available in (country name). gggg

-

read page 11 here then u know SG get a lot of cash...

http://www.imf.org/external/np/sec/pn/2008/pn08107.htm

This is a common sense that Temasek and GIC get few bucks

in banks,US $300 to 400 billions as usually quoted...

So,why do SG really need issuing bond to survive?

But many other countries have to!!

Sovereign Wealth Fund Institute™

US$ Billion: 247.5

Singapore - Temasek HoldingsUS$ Billion: 85

@@@@@@@@@@@@@2

This is called