Krugman:SG growth,like USSR,'pure. thru mobili'n of resource

-

The full thread shall be--

Paul Krugman:SG economic growth,like Soviet Union,"achieved purely through mobilization of resources".

Now i know why USA falls.

When the Noble prize winner falls into this standard,it is no suprise

that USA falls from heaven.

I wont say too much .Ten thousand words cant express my anger

to this article.BTW,i cant write too long in English!!

This article is not just a insult to Singapore,as well as to the economists.

2.So,facts speaks volume.

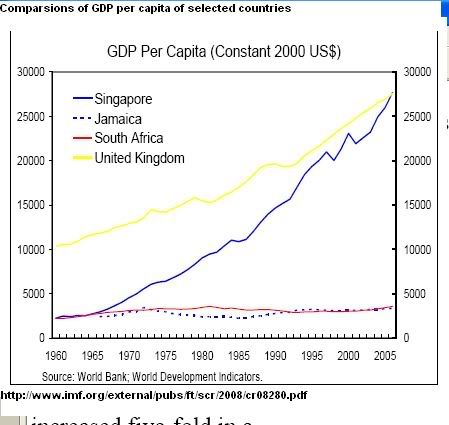

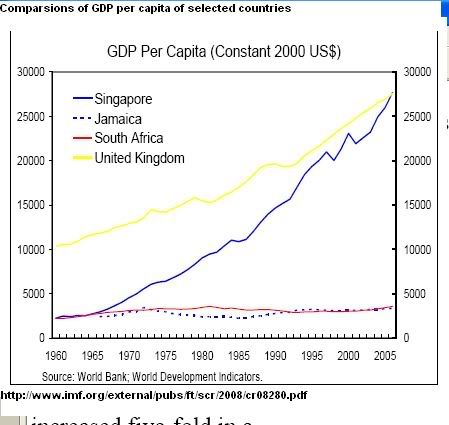

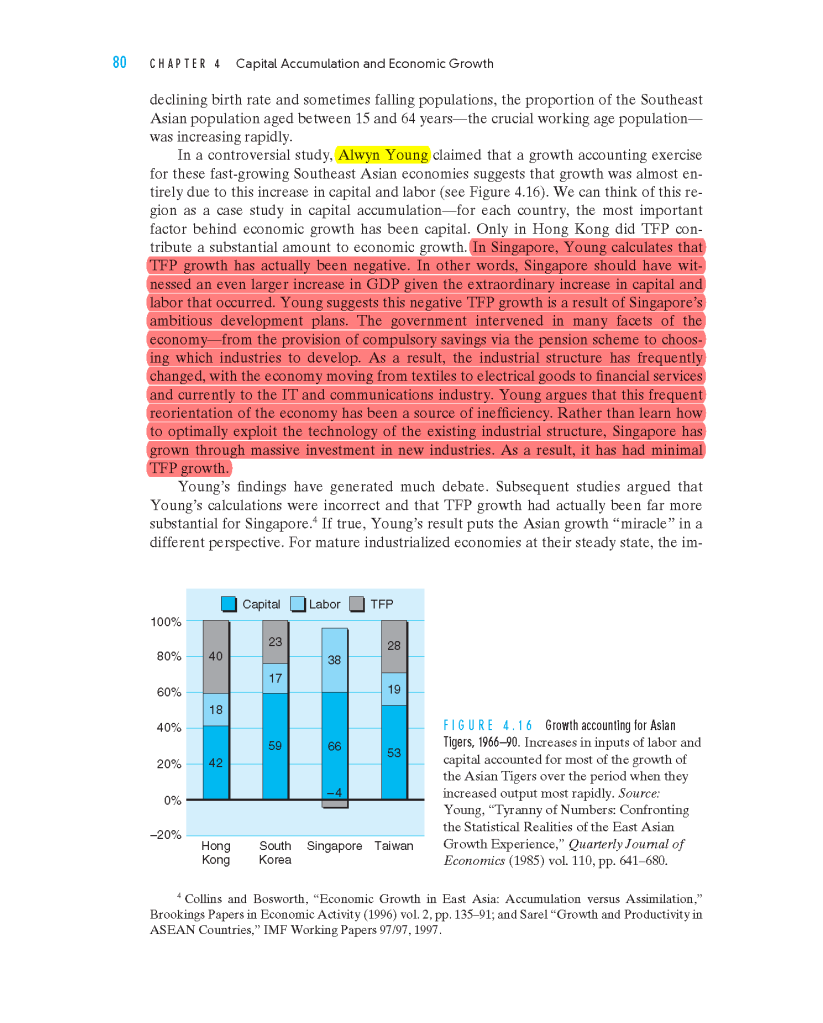

In the first image below,

u can see SG,through many politically incorrect measures,catch up

the former Colony Master UK!!

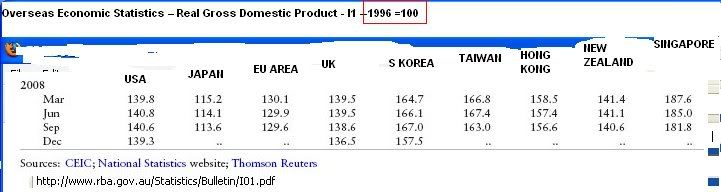

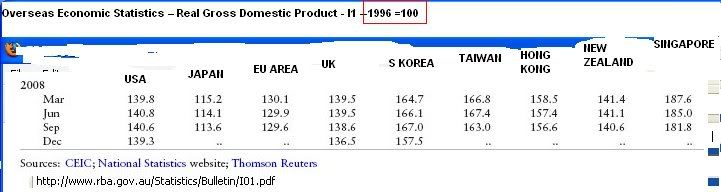

In the second image,u can see SG grew faster than

a no. of G8 countries,after Krugman 's prediction in 1994.

BTW,Australia grew abt 55% in the same period fr 1996

to end 2008.

3.Do u agree with Krugman?

And yet there are surprising similarities. The newly industrializing countries of Asia, like the Soviet Union of the 1950s, have achieved rapid growth in large part through an astonishing mobilization of resources. Once one accounts for the role of rapidly growing inputs in these countries' growth, one finds little left to explain, Asian growth, like that of the Soviet Union in its high-growth era, seems to be driven by extraordinary growth in inputs like labor and capital rather than by gains in efficiency.

Consider, in particular, the case of Singapore. Between 1966 and 1990, the Singaporean economy grew a remarkable 8.5 percent per annum, three times as fast as the United States; per capita income grew at a 6.6 percent rate, roughly doubling every decade. This achievement seems to be a kind of economic miracle. But the miracle turns out to have been based on perspiration rather than inspiration: Singapore grew through a mobilization of resources that would have done Stalin proud. The employed share of the population surged from 27 to 51 percent. The educational standards of that work force were dramatically upgraded: while in 1966 more than half the workers had no formal education at all, by 1990 two-thirds had completed secondary education. Above all, the country had made an awesome investment in physical capital: investment as a share of output rose from 11 to more than 40 percent.

Even without going through the formal exercise of growth accounting, these numbers should make it obvious that Singapore's growth has been based largely on one-time changes in behavior that cannot be repeated. Over the past generation the percentage of people employed has almost doubled; it cannot double again. A half-educated work force has been replaced by one in which the bulk of workers has high school diplomas; it is unlikely that a generation from now most Singaporeans will have Ph.D's. And an investment share of 40 percent is amazingly high by any standard; a share of 7O percent would be ridiculous. So one can immediately conclude that Singapore is unlikely to achieve future growth rates comparable to those of the past.

But it is only when one actually does the quantitative accounting that the astonishing result emerges: all of Singapore's growth can be explained by increases in measured inputs. There is no sign at all of increased efficiency. In this sense, the growth of Lee Kuan Yew's Singapore is an economic twin of the growth of Stalin's Soviet Union growth achieved purely through mobilization of resources. Of course, Singapore today is far more prosperous than the U.S.S.R. ever was--even at its peak in the Brezhnev years--because Singapore is closer to, though still below, the efficiency of Western economies. The point, however, is that Singapore's economy has always been relatively efficient; it just used to be starved of capital and educated workers.

Singapore's case is admittedly, the most extreme. Other rapidly growing East Asian economics have not increased their labor force participation as much, made such dramatic improvements in educational levels, or raised investment rates quite as far. Nonetheless, the basic conclusion is the same: there is startlingly little evidence of improvements in efficiency. Kim and Lau conclude of the four Asian "tigers" that "the hypothesis that there has been no technical progress during the postwar period cannot be rejected for the four East Asian newly industrialized countries." Young, more poetically, notes that once one allows for their rapid growth of inputs, the productivity performance of the "Tigers" falls "from the heights of Olympus to the plains of Thessaly.

This conclusion runs so counter to conventional wisdom that it is extremely difficult for the economists who have reached it to get a hearing. As early as 1982 a Harvard graduate student, Yuan Tsao.) found little evidence of efficiency growth in her dissertation on Singapore, but her work was, as Young puts it, "ignored or dismissed as unbelievable." When Kim and Lau presented their work at a 1992 conference in Taipei, it received a more respectful hearing, but had little immediate impact But when Young tried to make the case for input-driven Asian growth at the 1993 meetings of the European Economic Association, he was met with a stone wall of disbelief.

references-

The Myth of Asia's Miracle--by Paul Krugman.

this article first appeared in Foreign Affairs 1994.

Comments on Paul Krugman and Alwyn Young on The Myth of Asia's ...

-

mmm

-

So what is the secret of Singapore economic growth lionnoisy?

-

Originally posted by Ah Chia:

So what is the secret of Singapore economic growth lionnoisy?

No secret.Just do any industries that is suitable to the then situation.like

land cost,labour cost,tariff agreements,.We just climb up the value chain.

1.Just do it to reduce unemployment

Right after 1965,we just get local and foreign investors from HK

etc to create jobs to tackle the abt 14% unemployment rate.

Our grand/parents just went to make noodle,incense papers,mosquito

coils etc to feed the families.If u dig history,u will know that we faced

labour shortage in early 1970's!!Why?u tell me?

2.Export oriented v import substitution

LKY and old guards picked the former,after listening to Dutch Dr Albert Winsemius.

3.Non sense to shift from export oriented to domestic consumption

U have heard in the past 1 year from western and local academics

and reporters that SG shall do the above.

If domestic consumption can help improve people living standard,

then PRC no need open her door.Likewise,N Korea also can

do lah,stupid!!

Only export can earn foreign currency and help to improve

living standard.Where do u get $$ to spend in domestic consumption.

Do u wan people fr Red Hill earn profits from people in Woodlands?

Dunt tell me the current high domestic consumption (above 60% of economy)

in UK and USA.SG cant print IOU to survive!!

u shall read Heart Works from EDB.Then u know how can can climb

the value chain!!

Heart Work

作者:Chin Bock Chan, Singapore, Economic Development Board4.can u tell me why we can provide jobs to 900,000 foreign workers?Of course,we have paid some prices for this situation.But can u tell me wat are the better options?Do u think u or me will work in shipyards or wafer fab factories or construction sites?Said is much easier than done.If minimum wages,no--foreign workers etc policy can work,then your maid would work in her home country lah!!Not in your home.How can a barren island feed 7.2 million people (3.6m citizen & PR + 3.6 m foreigners,## read below)?Total population 4.83 million=Singapore Residents 3.64m+1.20m foreigners.

1.Singapore Residents--3,642700=

3.19m citizens and 0.45 m PR (permanent residents,)。(excluding abt 200,000 citizens in overseas)

2.1.20m foreigners

A.abt 900,000 foreign workers ## and abt 200,000 their family

B.95,000 foreign students and abt 10,000 their grand/aprents##If one foreign worker feed another 3 family members,then SG feed 3.6 million foreigners!!

3.one third of work force is foreigners. -

Originally posted by lionnoisy:

The full thread shall be--

Paul Krugman:SG economic growth,like Soviet Union,"achieved purely through mobilization of resources".

Now i know why USA falls.

When the Noble prize winner falls into this standard,it is no suprise

that USA falls from heaven.

I wont say too much .Ten thousand words cant express my anger

to this article.BTW,i cant write too long in English!!

This article is not just a insult to Singapore,as well as to the economists.

2.So,facts speaks volume.

In the first image below,

u can see SG,through many politically incorrect measures,catch up

the former Colony Master UK!!

In the second image,u can see SG grew faster than

a no. of G8 countries,after Krugman 's prediction in 1994.

BTW,Australia grew abt 55% in the same period fr 1996

to end 2008.

3.Do u agree with Krugman?

references-

The Myth of Asia's Miracle--by Paul Krugman.

this article first appeared in Foreign Affairs 1994.

Comments on Paul Krugman and Alwyn Young on The Myth of Asia's ...

-

mmm

lionnoisy can also write his 3 page thesis and wait for the Nobel Institute to select him for Nobel Prize.

Also, you need English lessons to understand what the author Paul Krugman is saying, he said Singapore achieved high growth through resource mobilization and you just showed us that Singapore achieved high growth. What kind of rebuttal is that?

Say a person tell you that the glacier melting is due to greenhouse gases, then you us that the glacier melting is increasing at an extraordinary rate, does this make any sense to you.

Singapore's growth is based on the Solow Growth Model (large capital accumulation) and low balling her own foreign exchange rate, it's not based on gains in efficiency, the only setback is, diminishing returns will set in once a threshold is reached. Why do you think that the gov is increasing the minimum sum and withdrawal age? With the recent losses of $100 billion in their investments, their investments will need to earn a higher return to make good the sum owed to CPF retirees, else higher rates of inflation will result.

-

Originally posted by deepak.c:

lionnoisy can also write his 3 page thesis and wait for the Nobel Institute to select him for Nobel Prize.

Also, you need English lessons to understand what the author Paul Krugman is saying, he said Singapore achieved high growth through resource mobilization and you just showed us that Singapore achieved high growth. What kind of rebuttal is that?

Say a person tell you that the glacier melting is due to greenhouse gases, then you us that the glacier melting is increasing at an extraordinary rate, does this make any sense to you.

Singapore's growth is based on the Solow Growth Model (large capital accumulation) and low balling her own foreign exchange rate, it's not based on gains in efficiency, the only setback is, diminishing returns will set in once a threshold is reached. Why do you think that the gov is increasing the minimum sum and withdrawal age? With the recent losses of $100 billion in their investments, their investments will need to earn a higher return to make good the sum owed to CPF retirees, else higher rates of inflation will result.

1.can u show me the graph when we wil reach the threshold?I wil consider sel

off all sing dollars,if u can convince me this theory is valid.

2.Has any country experienced this

"diminishing returns"?

3.How do u prove that G8,like UK,USA

"based on gains in efficiency"?

Thanks you.I am waiting for your valuable input,

-

mutton beriyani...give me 1

-

Originally posted by tERMINATOR20000000:

mutton beriyani...give me 1

-

lionnoisy obvious does not understand what he is talking about that why he ask for graphs. this is because graphs are graphical and does not contain english which he might find hard to understand despite the fact that he abuses english to make his posts in here but if he does not understand english then how can he understand his posts to make his point? it is not logical. if the mighty us fall like he says then how can he use english to make his point?

of course singapore is experiencing diminishing returns based on its growth model... diminishing is spelt like dim sum and dim sum in singapore has obviously reached a threshold because you dun see any more significant expansion in dim sum outlets in singapore so now you must go ding tai fung or bao qing tian to eat. have you seen lionnoisy in ding tai fung or bao qing tian? no because he only understand graphs but not dim sum that's why he cannot understand dimishing returns.

by the way have you seen the raise in CPF age? the money in CPF to Singaporeans is like energon to transformers did you see what happen to jetfire when he never get enought energon in his old age? he starts breaking down.

lionnoisy obviously does not understand anything

-

Originally posted by tERMINATOR20000000:

mutton beriyani...give me 1

what about laksa?

lionnoisy does not understand this that why he asks for graphs

-

Krugman is an eminent economist and even won a nobel prize to boot, so who am I, a mere nobody to challenge his precious assumptions, publish in both best seller books and even had articles reproduced in respected newspapers.

HOWEVER, he made one blatant and obvious fallacy to support his hypothesis and spittle upon our beloved motherland.

He FAILED to realize that education and technology is NEVER STAGNANT. It evolves at astonishing rapid rates, not even on a yearly basis, but almost on a daily basis, and such advances can be effectively and efficiently translated INTO PRODUCTIViTY, EVEN ON DAILY BASIS!

So how can our people be deemed to have met the limit of our productivity? There is so much more yet to be discovered, improvised and create and it will be technology that will lead our evolution on productivity, as it will also charge our social evolution into greater heights, overtaking ancient societies. These are facts that cannot be denied!...unless one is as blind as him, caught up in his nobel prize hubris to sniff his nose at other nations.

Alfred Nobel would turn in his grave if he ever saw krugman's article! But hell, I aint gonna wait for kruggie's stamp of approval. We have a good thing going on and to hell with him I say.

-

Originally posted by lionnoisy:

1.can u show me the graph when we wil reach the threshold?I wil consider sel

off all sing dollars,if u can convince me this theory is valid.

2.Has any country experienced this

"diminishing returns"?

3.How do u prove that G8,like UK,USA

"based on gains in efficiency"?

Thanks you.I am waiting for your valuable input,

1. Why? You wanna short Singapore dollars and long Australian dollars?

Diminishing returns does not mean collapse of Singapore dollar, you don't see me telling you that. Don't tell me you wrote a 3 page Ph.D thesis on this topic?

Diminishing returns does not mean collapse of Singapore dollar, you don't see me telling you that. Don't tell me you wrote a 3 page Ph.D thesis on this topic?

http://en.wikipedia.org/wiki/Diminishing_returns

2. Singapore. Real GDP per capita growth has decreased compared to earlier decades.

3. Productivity.

-

Of the 4 Asian Tigers, Singapore is the only country with negative productivity growth.

This is probably due to appointing high level superscale civil servants and retired politicians to directorship in GLCs with no knowledge of private enterprise management.

It will probably be called a "golden mouth gag" in financial terms.

It will probably be called a "golden mouth gag" in financial terms.

By the way, this abstract is not from Paul Krugman, it's from another source.

-

Originally posted by deepak.c:

1. Why? You wanna short Singapore dollars and long Australian dollars?

Diminishing returns does not mean collapse of Singapore dollar, you don't see me telling you that. Don't tell me you wrote a 3 page Ph.D thesis on this topic?

Diminishing returns does not mean collapse of Singapore dollar, you don't see me telling you that. Don't tell me you wrote a 3 page Ph.D thesis on this topic?

http://en.wikipedia.org/wiki/Diminishing_returns

2. Singapore. Real GDP per capita growth has decreased compared to earlier decades.

3. Productivity.

Decreased my f*king foot! How the hell can you compare against data from a nation of no resource of the 60s to the new century of advances in science ,tech and education we had been investing? Are you another f*king moron in the making?

What the hell is f*king 'REAL GDP' you are alluding to in a fully globalised world that we are competting against today?

How in the f*king hell are we gonna compete against our humanly self within the normal 8 friggnin hours of work than we can possibly work? We are not of the 'terminator' class robots and hell, if you work the figures, they will get to a point whereby their productivity will max out too! There is only a number of F*king hours a man or machine can work using current tech! GET IT THRU YOU F*KING PEA BRAIN FOR ONCE, FOR GOODNESS SAKE!

What the friggin hell is PRODUCTIVITY when we are talking about humans, not robots, other than technology than can replace current machines to enhance our role and production of goods for sale to others?

Dammit it, are you f*king blind or talking way over your friggin pea brain as usual over subjects and data you know nuts about to CON vince others to your way of perception????!!!!

-

Damn, the savignon cabernet 1998 certainly had come from a good harvest. May i not regret what i had posted on some threads......

-

The only regret you might have from this thread is actually spending the irreplacable moments of your life taking them seriously.

It's yet another anti-oz lionnoisy thread for goodness sake.

Seriously I think the man-hours and energy he spends on trying to slime Australia would do our nation some actual good if he actually spends it doing something that makes sense... but no...