POA question of the a day (29 Jan 2009)

-

While revising for his O levels last yr, a student of mine passed me this question from his teacher. He said the teacher claimed nobody from St Gab's passed the paper because of this 32-mark question. Sry I can't seem to format it nicely (can't tab, insert ms doc tables, pdf?).

Incomplete records (analysis) question from 2007 St Gab's Sec Prelim:

Zaphaniah is a sole trader who started his business on 1 January 2003 at a rented premises with an annual rent of $36 000. His business ends its financial year on 31 December annually. Zaphaniah does not keep a proper set of accounts, but has made the following information available for the year ended 31 December 2006

31 Dec 2005 31 Dec 2006

$ $

Stock 3320 5621

Debtors 4290 11540

Creditors 1780 3150

Prepaid advertising expenses 222 300

Accrued motor repairs 111 70

Unused stationery 20 15

Bank Loan 20000 20000

Bank 6500 Cr ?

Motor vehicles 45000 ?

Shop fittings 12000 ?

Provision for depreciation

- Motor vehicles 18000 ?

- Shop fittings 1800 ?

Additional information:

(i) Stock costing $820 had been sent to a customer on a ‘sale or return’ basis on 29 November 2006. These goods were not sold and were returned by the customer on 2 January 2007.

(ii) Summarised Cash Book information in respect of the year’s transactions to 31

December 2006 was as follows

$

Cash takings banked 12 000

Cash payments from takings:

Stationery 90

Carriage on purchases 230

Drawings for personal use 1 560

Motor repairs 2 745

Office expenses 325

Creditors 300

Cheque banked:

Proceeds from personal investment 4 000

Debtors 54 382

Debts previously written off as bad debts 1 210

Cheques Issued:

Purchases 560

Creditors 16 670

Rent 29 000

Insurance 3 500

Household expenses 1 200

Advertising 4 200

Shop fittings 2 600

Wages 7 200

Carriage on sales 1 400

(iii) Total amount of credit note issued and received are $110 and $190 respectively.

(iv) The cash discount columns of the Cash Book show the following totals:

Debit total $ 90

Credit total 200

(v) On 31 December 2006, a contra entry was made to record Ben’s balance of $300 and $20 respectively in Zaphaniah’s Purchases Ledger and Sales Ledger.

(vi) $70 of debt owed by a customer was deemed irrecoverable and was written off during the year.

(vii) Depreciation has to be charged at 20% p.a. on the net book value of motor vehicles and 5% p.a. on the cost of shop fittings.

(viii) ¼ of wages was for packaging of goods resale.

(ix) Insurance was paid for 5 months ended 28 February 2007.

(x) A provision for doubtful debts of 2% has to be created for December 2006.

(xi) Interest on loan is to be charged at 6% p.a.

(xii) Bank statement received on 31 December 2006 revealed the following discrepancies:

$

Unpaid cheques 80

Standing order - electricity 320

Credit transfer – commission received 2 640

REQUIRED

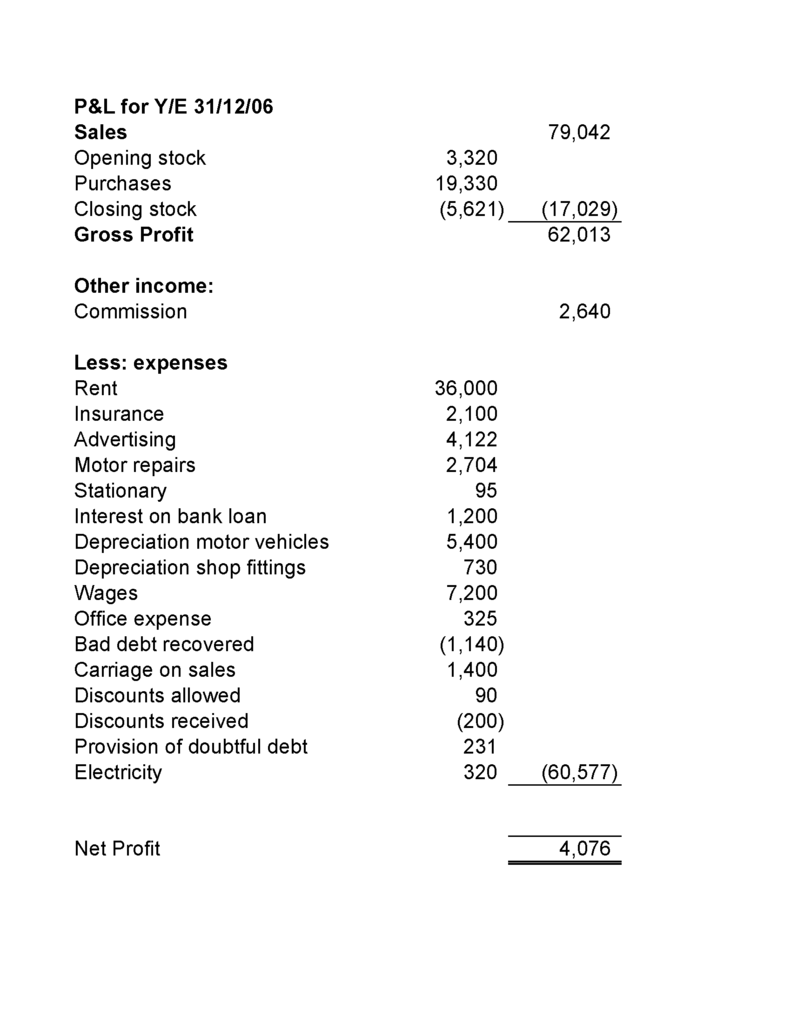

(a) Prepare the Trading and Profit and Loss Account for the year ended 31 December 2006. [22]

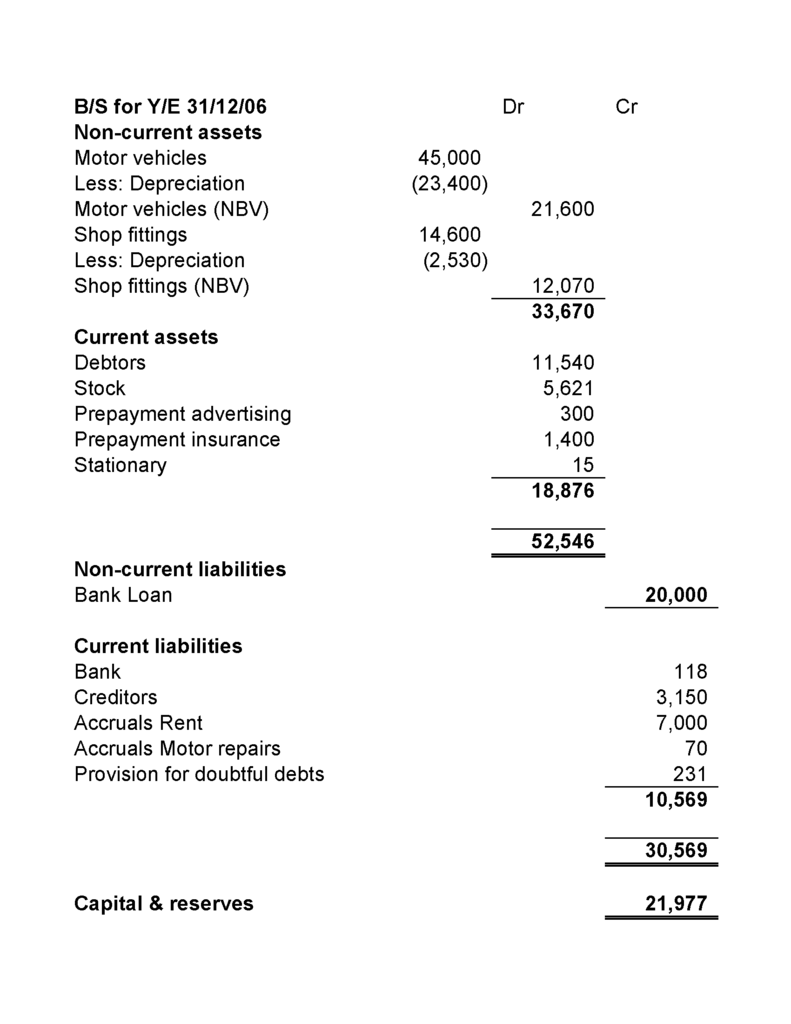

(b) Prepare the Balance Sheet as at 31 December 2006. [10]

[Total : 32] -

Atempted the question. I find it quite alright except for the least common (i) and (v).

Other than that, it basically covers lots of chapters from Bank recon to sales/purchases ledgers, and most important balanced day adjustment.

Definitely slight higher standard question for stronger students.

Time-wise, I guess the setter miss out this. Even an experience student like me takes 20min at this Q. *faint*

-

Post answer post topic

Me copy paste into examworld

-

-

I just attempted the question and I think your accounts teacher is MAD.

He/she is farking MAD MAD MAD!!!!

Either that or he/she doesn't like any of the students from your school.

Suggest you complain MOE, see if any reasonable accounts teacher (from another school) can do this within the alloted time.

-

After finishing this, I only got one thing to say to the teacher from St. Gab.

!@$!@%$@!%*)!!!!!!

This is beyond O level standard lah!!!!

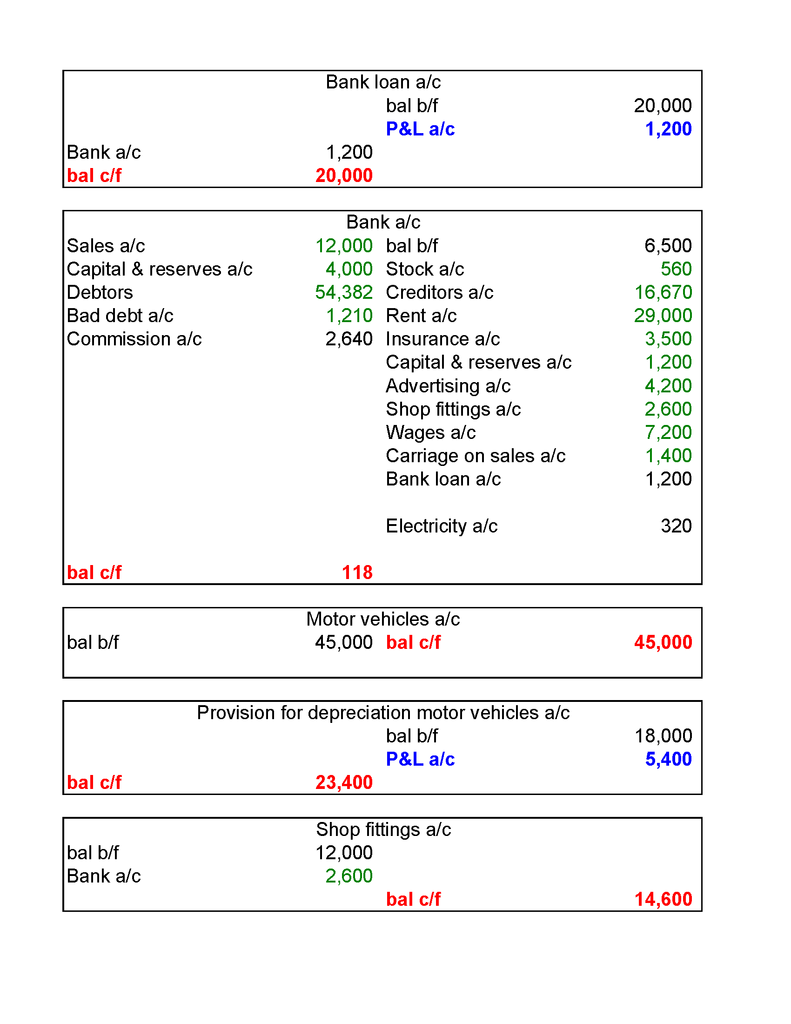

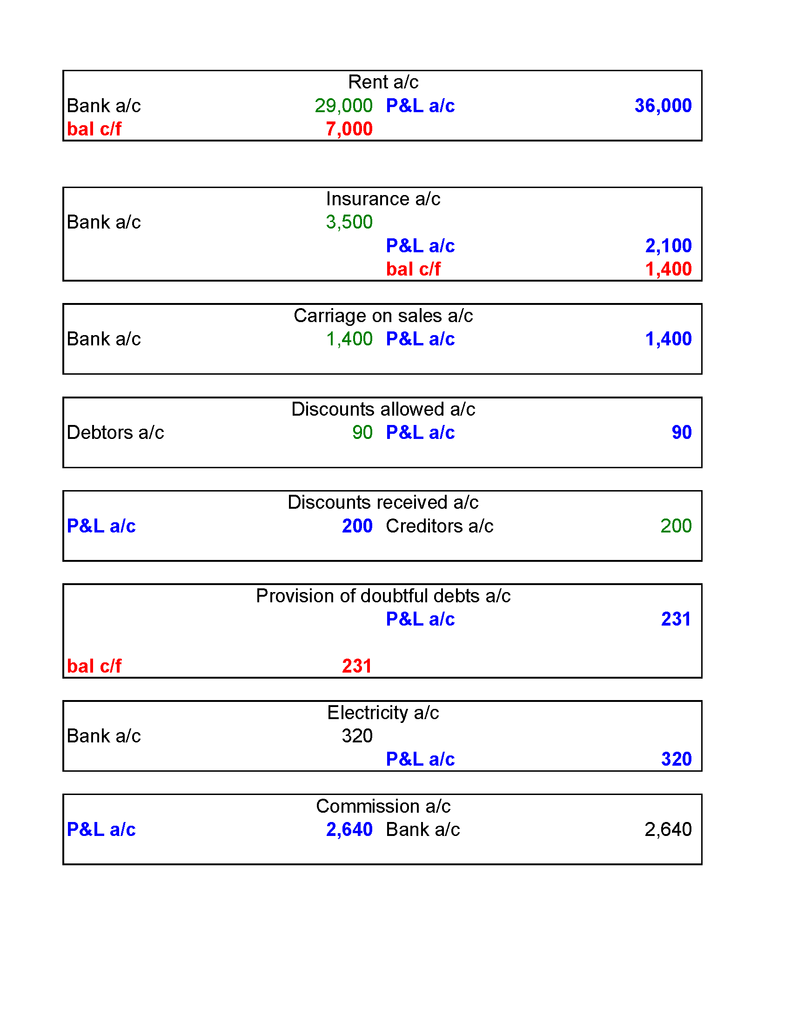

This is the best that I can do, if anybody has better suggestion, let me know.

Blue goes to P&L a/c.

Red goes to B/S.

Green you can ignore because I used it to re-check working. It is the same as figures in black.

***Didn't do adjustment for item v), not sure if there is a need to.