Investments in Merril Lynch making money for Temasek

-

Late last year 2007, Temasek, a Singapore state fund, bought $4.4 billion worth of Merrill shares at $48 a share as the U.S. brokerage, hit by subprime mortgage losses, sought to raise capital.

As of 9:58 AM EST 19 February 2008 Merril Lynch's stock is at $51.46 USD -

when got profits...the GIC management gets big bonuses and pats on the back.

when suffer losses...the management goes unscatched...its after all taxpayers money not theirs.

"head i win tails u lose"

-

when temasek makes money, you critisise them.

When they lose money you also blame them.

Heads they lose, tails you win.

-

Don't count your chickens before they are hatched, Temasek is tied down in the investment for a year, meaning cannot sell off the investments till a year has passed. The shares was sold at a discount (so obviously the share price will be above discounted price) to Temasek, close to 2 months have passed and the share is still trading $50.39 (yes, since you last posted 2 hours ago @ 9.58AM the share price has dipped $1.07). Maybe if you had posted this immediately after Temasek bought over, the shares of Merril Lynch would be trading around $53, which you can claim that Temasek made a worthwhile investment, because the shares was sold at a discount. The share price is on a downtrend, not an uptrend since Temasek's purchase.

Temasek will buy $4.4 billion worth of Merrill stock with an option for $600 million more by March 28. Merrill gave Temasek a discount partly in exchange for a lock-up agreement that keeps the investor from selling shares for a year.

Source: http://www.cnbc.com/id/22395384/

Anything can happen in a year, if the US recession becomes a reality (which I most often think it will), there will be more job losses and defaults on mortgages exacerbating the already traumatised financial sector.

-

http://youtube.com/watch?v=ThXpjmfyiMQ

Do you think Singapore is part of the whole crime syndicate, aware or unaware?

-

when temasek makes money, you critisise them.

When they lose money you also blame them.

Heads they lose, tails you win.

You are wrong there......

To certain ppl here.... the thinking is this -

If Temasek makes money..... no good, I wouldn't be getting any of the profit.

If Temasek loss money.... very good, again I can blame govt for everythings that's wrong with my life.

-

Originally posted by maurizio13:

Don't count your eggs before they are hatched,

I dont see you making such comment in those anti Temasek/GIC investment thread. :D

-

which ever the case, they good you good they bad you will be worst off.

So i rather wish then all the best, else my pocket pain pain

-

Originally posted by spade1:

http://youtube.com/watch?v=ThXpjmfyiMQ

Do you think Singapore is part of the whole crime syndicate, aware or unaware?

Apparently the whole world is and it's a legalised system. By logic of this video, inflations and taxes actually improves the lives of the people since the dollar value will be strengthened, however the goverment cannot explain this due to essential anonymity. -

Originally posted by Daddy!!:

Late last year 2007, Temasek, a Singapore state fund, bought $4.4 billion worth of Merrill shares at $48 a share as the U.S. brokerage, hit by subprime mortgage losses, sought to raise capital.

As of 9:58 AM EST 19 February 2008 Merril Lynch's stock is at $51.46 USDThe $48 per share that Temasek paid for Merrill Lynch is now almost about breakeven.

The daily low was $48.05.

Like I said, don't count your chicks before they are hatched.

You still convinced that Temasek made a positive net present value investment?

The only good investments that Temasek has are those under it's belt in Singapore, where they have monopoly power, they can choose to increase

prices to consumers, so that they can get very good earnings figure.

Perhaps it's still too early to tell, maybe by end of the year, the price would have shot up to $100.

-

Beside counting the eggs, one should also remember that early bird catches the worms.

-

Originally posted by TCH05:

Beside counting the eggs, one should also remember that early bird catches the worms.

Provided the birds are not blind and daft,

they are indeed catching worms

and not mistakingly taking dead twigs for worms.

With past investments like Global Crossing, Suzhou Industrial Project and Shin Corp,

one has to question the intelligence of these blind birds.

-

Originally posted by maurizio13:

Provided the birds are not blind and daft,

they are indeed catching worms

and not mistakingly taking dead twigs for worms.

With past investments like Global Crossing, Suzhou Industrial Project and Shin Corp,

one has to question the intelligence of these blind birds.

Are these the only "dead twigs" you can think of? -

Reuters - 23 minutes ago

Hana Bank buys $50 mln Merrill shares from Temasek

SEOUL, March 4 - South Korea's Hana Bank bought $50 million worth of shares in Merrill Lynch from Singapore fund Temasek in February, Hana's parent group said on Tuesday.

"The bank had made that investment last month," Hana Financial Group spokesman Ahn Young-geun said by telephone, confirming a Yonhap News report that Hana Bank had signed the contract on Feb. 27.

Ahn declined to give the per-share value of the deal.

-

woa.. alot of PAP supporters here. can u all upload PAP logo as your avatar? it will make our lives alot easier to identify u all as pap moles. thanks.

-

Originally posted by fishbuff:

woa.. alot of PAP supporters here. can u all upload PAP logo as your avatar? it will make our lives alot easier to identify u all as pap moles. thanks.

please dont simply rush into labelling others as PAP supporter lah. They are just doing what you like to do, sharing news. -

Merrill Lynch, one of the prized possession of Temasek Holding's investment has dropped to a new low level.

The "discounted" (the price of Merrill Lynch was trading around US$53 at the time of offer, a discount was given for Temasek to purchase it at US$48) price acquired by Temasek in Dec of 2007 was US$48, on 6th of Mar 2008 the share price has dropped below the discounted price to US$45.70.

The discounted shares also contain certain agreements, one of such agreement is that Temasek cannot trade in the discounted shares for a year from the date of sale.

Once again signalling the bad investment decisions by the government, Temasek and her Chief HO.

I wonder what does TS think of Temasek & the government's investment decisions?

Is TS a P$P propagandist willing to present a fair and truthful account about the state of affairs of

Temasek, or is it going to be another mistake from the numerous mistakes made by Temasek.

For that matter, does any of the pro P$P present a fair and truthful picture of affairs related to the P$P government?

All the pro P$P do in here is to pass positive comments about the P$P government regardless of the negative outcomes.

I wonder which hole is TS burying his head in now?

Source: http://ir.ml.com/

-

This is what I call a fine weather P4P supporter, when it's bright and sunny they shout our loud "long live P4P", when it starts to rain shit,

they seek refuge under a table.

Goes with class 90.5FM slogan, "hear only the good stuff".

-

just like to ask something not related to this topic.

can i say that a bank is actually the borrower of money from those who put money in the bank since it then takes the money to invest. nothing but invest ?

so is it correct to say that a bank is borrowing money from others so that it can invest?

-

Banks accepts deposits and loans from customers.

The profits is what it gets from loans less the interest it pays to the depositors.

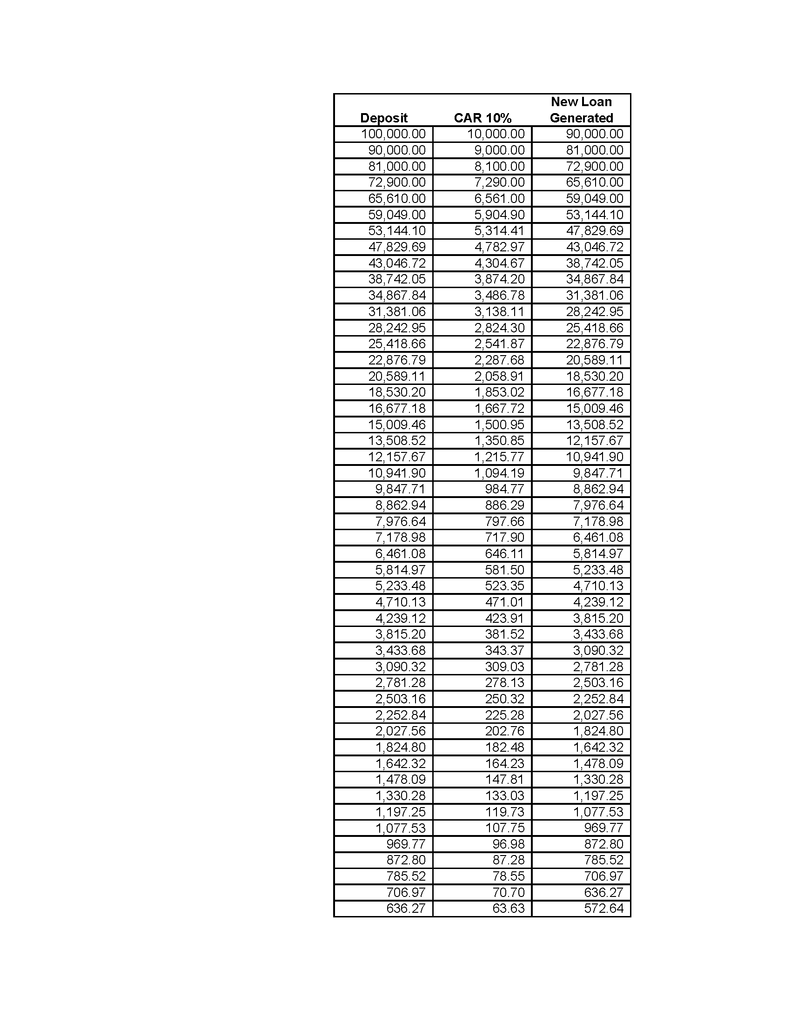

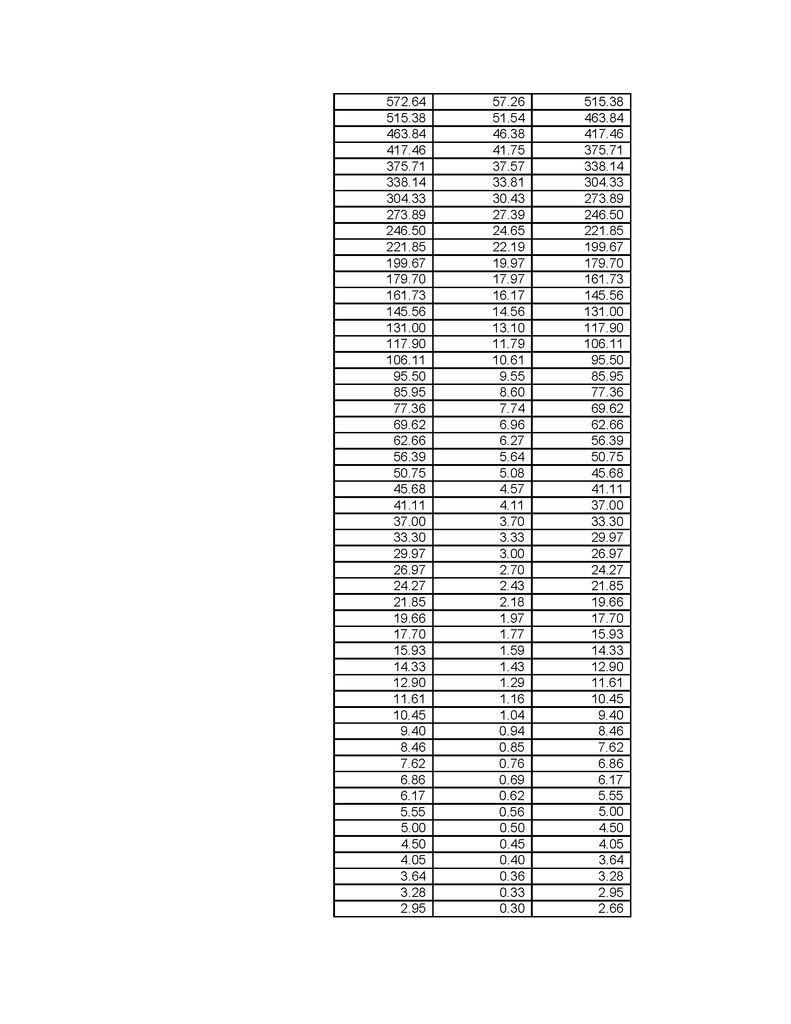

Incidentally, banks can generate money based on the Capital Adequacy Ratio (CAR) set by Monetary Authority of Singapore (MAS).

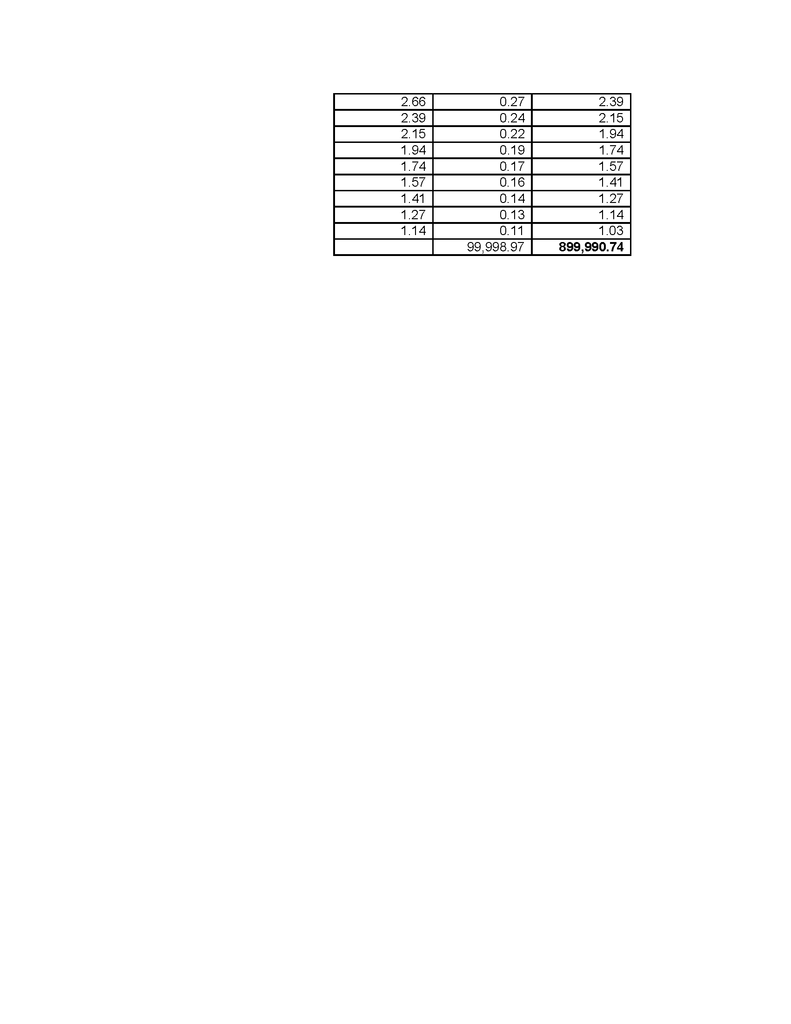

If you have a deposit of say $100,000, the bank only need retain 10% of $100,000 in physical cash as required by MAS.

Therefore the amount of money generated out of your deposit of $100,000 is approximately $900,000 (i.e. 90,000 / 0.10).

If Mr.A deposits in the bank $100,000, the bank loans out $90,000 to Mr.B (even if Mr.B spends all his money, the person who made the money will

need to deposit the money into the bank), so the $90,000 ends up in the bank and the bank will retain $9,000 and loan out $81,000......................

So ultimately, out of the loans generated of $900,000, the bank only has $100,000 physical cash to back up.

This principle works on the assumption that not everyone will withdraw 100% of their money everytime.

Source: http://www.mas.gov.sg/news_room/press_releases/2007/Change_to_Capital_Adequacy_Requirements.html

-

Not sure did anybody catch the CNBC interview with Warren Buffet. They ask him if you were to start all over again, what sort of business will you pick.

He said Financial and Wealth Management, because he believe that is the sector where you can make most money.

-

maurizio13, you seems to have a very negative view on GIC and Temasek's investment in the few bluechip banks. I am just wondering if you dare to put your money and bet against GIC and Temasek ability to make a profit from these investment in let say 12 to 18 months?

-

The thing is, they were too eager to buy. Usually the first big drops shows that the markets are in big trouble (unless there are clear short term reasons, like Iraq war).

When the markets are in big trouble, you do not buy but you wait as invariably, after the initial big drop, the markets will decline.

It is tax payers money and that is why they can simply jump in recklessly.

-

The money come from Singaporeans and it is only right that they give it back instead of using it to play around. They could and should pay higher interest rates for CPF funds, for example.

As it is, CPF money is being eaten up by inflation.

They longer you hold, the less the money in your CPF can buy (even after adding the interest rates they pay you).

Why? Because the take Singaporeans money and refuses to give back but prefer to lose it to foreigners.

-