Investments in Merril Lynch making money for Temasek

-

...don't be led into la la land by delusional people and dont buy propaganda from asspots and assdogs...

-

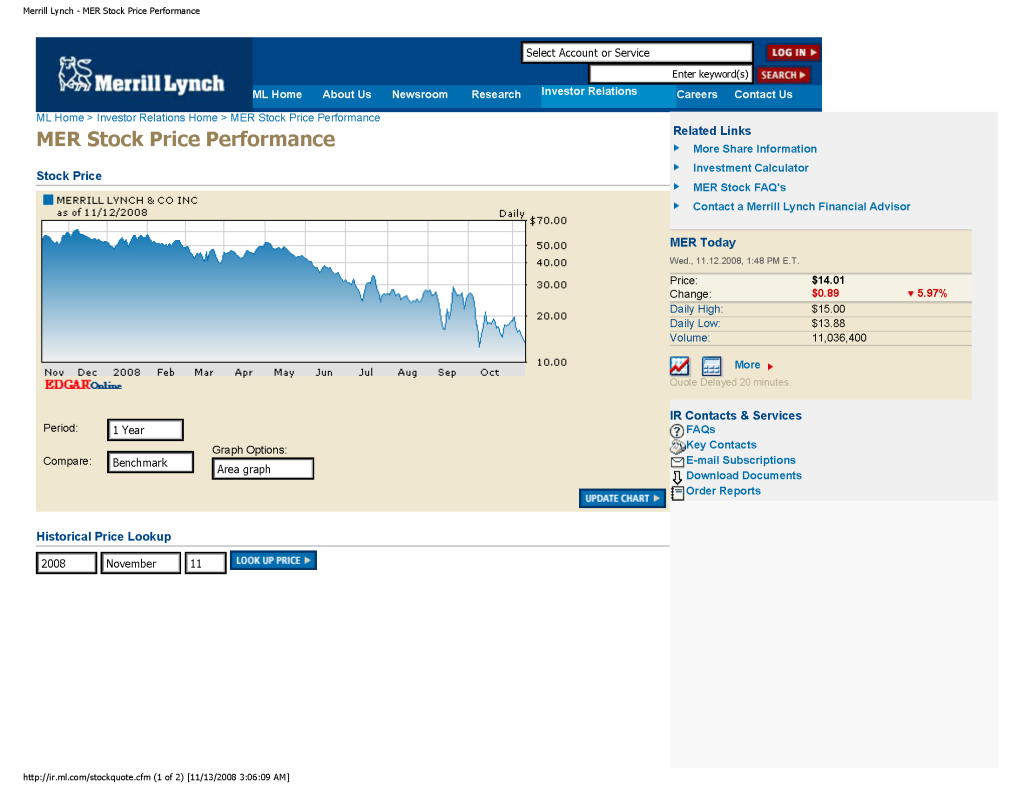

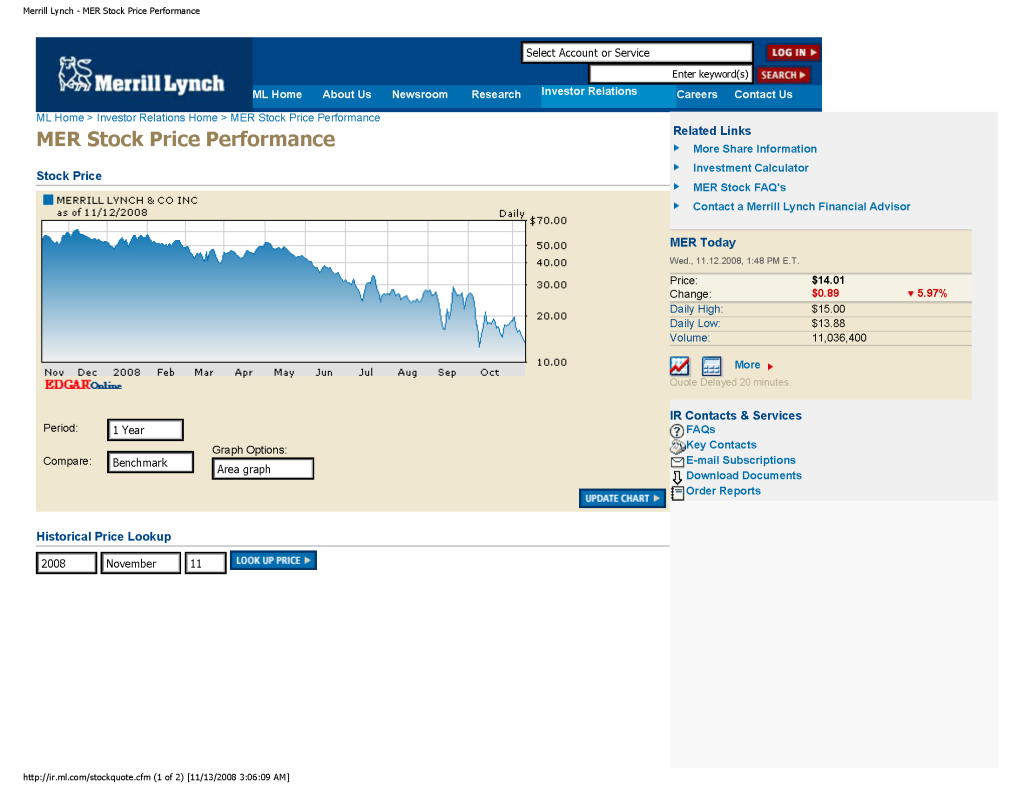

latest price for Merril Lynch, 60% off our GIC/Temasek's portfolio..

Merrill Lynch & Co., Inc. MER (NYSE) $15.46

-

*maeh maeh*

Please fleece me!

-

-

Originally posted by maurizio13:

*maeh maeh*

Please fleece me!

-

I was just wondering how many still believe that at the begining of next year, Bank of America (BoA) will keep their word and pay Merrill Lynch shareholders US$29 in a share for share exchange. The current share price of Merrill Lynch is US$14.

When BoA announced the planned buyout, her shares were trading at around US$30, meaning it's like a one to one exchange. But currently BoA shares are trading at US$20, which means they would have to issue 1.5 shares of BoA to maintain the US$29 (instead of the proposed 1 share) offer. This would mean that the present shareholders of BoA will experience a dilution of their shareholding.

So, anybody still thinks it will go through as planned?

-

Originally posted by maurizio13:

I was just wondering how many still believe that at the begining of next year, Bank of America (BoA) will keep their word and pay Merrill Lynch shareholders US$29 in a share for share exchange. The current share price of Merrill Lynch is US$14.

When BoA announced the planned buyout, her shares were trading at around US$30, meaning it's like a one to one exchange. But currently BoA shares are trading at US$20, which means they would have to issue 1.5 shares of BoA to maintain the US$29 (instead of the proposed 1 share) offer. This would mean that the present shareholders of BoA will experience a dilution of their shareholding.

So, anybody still thinks it will go through as planned?

BofA is NOT paying $29 for Merrill. They are exchanging 1 Merrill share for 0.8595 BofA shares.

15 Sep 2008 ... Each Merrill share will be exchanged for 0.8595 shares of Bank of America stock, according to Bank of America's statement. That works out to $29 a share, based onBank of America's closing price of $33.74 on Sept. 12. Because the payment is in stock, Merrill shareholders would get less if Bank of America's share price falls. The deal is scheduled to close in the first quarter of next year.The $29 estimate came about because BofA was trading at $33.74 on Sept. 12.

With BofA at $20, Merril is worth $17.19

With BofA at $2, Merrill is worth $1.719

Farking despots, dishonorable to the hilt, losing massive amounts of public money while laughing all the way to the bank for themselves. Curse these public money grabbing farking despots.

-

hmm ... a scrip offer. smart of BoA...

-

Merrill Lynch Stock is now $10.88 leh...

Was $15.86 in Oct... who bought ah?

-

treat as long term investment....sell at next boom

-

Originally posted by TCH05:

maurizio13, you seems to have a very negative view on GIC and Temasek's investment in the few bluechip banks. I am just wondering if you dare to put your money and bet against GIC and Temasek ability to make a profit from these investment in let say 12 to 18 months?

It's 10 months.... 8 more months

-

Taken from Yahoo Finance :

Merrill Lynch & Co. Inc - Last trade : $9.01

Bank of America Corp - Last trade : $7.18

-

Bank of America (BAC):

Bank of America (BAC 8.32) reported terrible fourth quarter results and received an additional $20 billion from the U.S. government under the TARP.

For the quarter, Bank of America reported a loss of $0.48 per share, much worse than the First Call consensus which actually called for a profit of $0.08 per share. The loss excludes a $15.31 billion loss from recently acquired Merrill Lynch.

Revenues at Bank of America rose 22.5% year-over-year to $15.68 billion, but were well short of the $20.72 billion consensus.

Bank of America ended 2008 with a Tier 1 capital ratio of 9.15%.

Credit costs were steep for BAC at $8.54 billion, which includes boosting its reserves by $3 billion -- nearly double estimates as the consumer credit environment continues to deteriorate.

The government has stepped in to assist Bank of America, making a $20 billion investment under the TARP. The government will receive preferred stock carrying an 8% dividend rate. Additionally, the government has agreed to a loss sharing program on $118 billion in selected capital. Under the agreement, Bank of America would cover the first $10 billion in losses and the government would cover 90% of any subsequent losses.

Bank of America said that fourth quarter results were driven by escalating credit costs, including additions to reserves, and significant write-downs and trading losses in the capital markets businesses.

In light of continuing severe economic and financial market conditions, Bank of America slashed its dividend to $0.01 per share from $0.32 per share.

Source : Briefing.com

-

CORRECTION: Bank of America says John Thain quits

Thursday January 22, 2009, 2:24 pm EST

(Corrects in 4th paragraph to say that Bank of America shares fell, not Merrill)

By Jonathan Stempel and Elinor Comlay

NEW YORK (Reuters) - John Thain, former chief executive of Merrill Lynch, has been ousted from Bank of America Corp, just three weeks after the companies merged.

Bank of America Chief Executive Kenneth Lewis expressed dismay last week about the scope of losses from mortgages and toxic debt on Merrill's books. Investors and analysts said the losses made Thain's position as head of global banking, securities and wealth management more tenuous.

"Ken Lewis flew to New York today, met with John Thain, and it was mutually agreed that his situation was not working out, and he would resign," Bank of America spokesman Robert Stickler said. The resignation is effective immediately. Thain could not be reached for comment immediately.

Bank of America shares fell 6.4 percent in afternoon trading.

Bank of America had threatened to back out of the merger, following the December 5 shareholder votes at both companies, but Lewis said regulators pressed him to complete the deal.

Last week, the government agreed to inject $20 billion in capital into Bank of America and to share in losses on $118 billion of debt.

Bank of America said Merrill lost $15.31 billion in the fourth quarter, separate from Bank of America's own $1.79 billion quarterly loss -- its first in 17 years.

"This is a huge crisis of credibility," said David Dietze, chief investment officer at Point View Financial Services in Summit, New Jersey. "Someone has to fall on a sword."

Separately, CNBC reported the 53-year-old Thain had hired well-known Los Angeles interior designer Michael Smith to redecorate his Merrill office a year ago. CNBC said Thain ran up a bill of $1.22 million that included $35,115 for a "commode on legs" and $1,405 for a parchment waste can.

Smith's designing company could not be immediately reached for comment. The bank declined to confirm the report and Merrill representatives declined to comment.

Bank of America said the terms of Thain's departure would be disclosed later.

OTHER EXECUTIVES DEPART

Thain's departure leaves Lewis without several top executives at Merrill, which it acquired on January 1 for $19.4 billion. Just a week ago, Lewis told investors he was happy that Thain was staying on.

Other top Merrill executives to recently leave include Robert McCann, who was to lead the combined brokerage, and investment banking chief Greg Fleming.

The bank said Tom Montag, another former Merrill executive who took over Bank of America's sales, trading and research operations, is staying, contrary to a CNBC report he was leaving. Montag could not be reached for comment.

Lewis, who has spent some $130 billion on major mergers to build Bank of America, has raised the hackles of investors who believe the Merrill purchase was too many.

Pessimistic analysts have speculated the government may eventually need to nationalize one or more large banks if the global recession and credit crisis get worse.

Bank of America stock "is remarkably cheap by traditional measures," said Jack Ablin, chief investment officer of Harris Private Bank in Chicago. But he said, "The investment is still fraught with risk because of the potential for nationalization or the need for dilutive capital raising."

Shares of Bank of America were down 43 cents at $6.25 on the New York Stock Exchange, far below the 52-week high of $45.08 set last February 1.

EXPENSIVE TASTE

Reports of Thain's office redecorating came on the heels of $12.2 billion in net losses at Merrill in the second half of 2007, as writedowns on mortgages and other toxic debt began to mount. Thain became Merrill CEO in December 2007.

The reported outlays recalled heavy spending on personal items by senior executives at other companies, including a $6,000 shower curtain owned by former Tyco International Ltd chief Dennis Kozlowski, who is in prison for fraud and other charges.

U.S. Sen. Richard Shelby of Alabama, the top Republican on the Senate Banking Committee, commenting on the report, said the office decorations would reflect "bad judgment" on Thain's part.

"I know John Thain and like him, but that was terrible precedent he set and a terrible decision," Shelby told reporters. "I wouldn't want my money spent that way."

Thain was considered a candidate to become U.S. Treasury Secretary if U.S. Sen. John McCain had defeated Barack Obama in the race for the White House.

HASTY MERGER

By joining Bank of America, Thain immediately became a top candidate to succeed Lewis, 61, but analysts have long speculated that he would not want to be in a subordinate role for long. Before running Merrill, Thain was CEO of NYSE Euronext.

Lewis and Thain negotiated the merger in less than 48 hours, on the same weekend Lehman Brothers Holdings Inc slid into bankruptcy.

Thain has received credit for possibly saving Merrill from a similar fate. but he was later pilloried in the media for not being more forthcoming to Bank of America.

Lewis, meanwhile, has been criticized by investors and analysts for overpaying, and not renegotiating the terms once Merrill's losses became evident.

"There are no winners in this situation," said Michael Holland, founder of money manager Holland & Co.

Several lawsuits were filed this week against Bank of America, claiming it rushed into the merger too quickly and failed to disclose the losses sooner.

"If they can make it through this, two to three years from now we'll see an IPO of Merrill," said William Smith, CEO of Smith Asset Management. "We'll go back to how it used to be. Banks are banks, brokers are brokers, and investment banks are investment banks."

(Reporting by Elinor Comlay, Juan Lagorio, Deepa Seetharaman, Jonathan Stempel, Phil Wahba, Dan Wilchins and Lilla Zuill in New York and Susan Heavey in Washington, D.C.; editing by John Wallace and Jeffrey Benkoe)

http://finance.yahoo.com/news/Former-Merrill-head-Thain-out-rb-14130109.html

I think John Thian was a patsy, he became CEO December 2007 just as the subprime financial crisis was beginning to unfold.

-

-

Is this the guy that managed to lose for Merrill more money than they have ever made in their entire history ?

-

Originally posted by maxtor:

Is this the guy that managed to lose for Merrill more money than they have ever made in their entire history ?

Can't blame John Thian, he was just a patsy, he took CEO position Dec 2007, when the storm was just brewing.

At least now we know what kind of "insanity" befell Lewis (Bank of America) when he made the decision to acquire Merrill Lynch, he was forced by the government, because no rational finance professional would buy it.

-

Wondering if anyone is still going to say ML was a good bargain by Temasek

-

Originally posted by Gensis:

Wondering if anyone is still going to say ML was a good bargain by Temasek

Merrill has a "great franchise, which has existed through many crises through a long period of time," said Michael Dee, Temasek's international senior managing director.

Temasek, whose profit doubled in the year ending in March, said its decision to further increase its stake was based on Thain and his management team.

"We had great confidence in John Thain; we had great confidence in the rest of the management and the board," Dee said.

Following the stake it took in December, Manish Kejriwal, Temasek's senior managing director of investments, said Temasek's involvement was "a vote of confidence for the management team, and the underlying strengths of Merrill Lynch's franchise."

References:

http://www.iht.com/articles/2008/08/27/business/temasek.php

http://www.wallstraits.com/wsforum/showthread.php?tid=980

-

i can never beat FI

-

Originally posted by maxtor:

Is this the guy that managed to lose for Merrill more money than they have ever made in their entire history ?

Take it whichever way you want.

His critics would argue his time at Merrill was nothing but shameless profiteering through a short-lived excessive indulgence during the firm's darkest hour. The other school of thought would suggest, despite having held the fort in times of unprecedented trouble, he was instrumental in ensuring Merrill didn't go bust even though the firm's stature as a 93-year independent entity came to an end under his watch.

Personally, I'd say the rot at Merrill had set in during Stan O'Neal's time as they were rather infamous in the industry for dishing out excessive compensation for mediocre performances (relative to their 4 major rivals then) and the culture merely persisted into Thain's reign for which he could have done little...

-

Originally posted by Gensis:

Wondering if anyone is still going to say ML was a good bargain by Temasek

It's only paper losses...

-

i suck very big time!

-

John Thain quits

Ho Ching steps down

Hmmmmm