CPF: Why the Extra Rules & Regulations? Why Annuities?

-

Why do they have to come up with annuity scheme?

Why do they have to increase the CPF minimum sum?

Why do they have to come up with draw down age at 62 years old? Old folks used to be able to draw out all their ordinary account when they reach a certain age around 60++.

http://mycpf.cpf.gov.sg/Members/Gen-Info/Sch-Svc/S-and-S.htm#retirement

It's simple. They realised that their future payout is increasing drastically, that's why they need to restrict members full withdrawal of funds, else if they should make all these payouts, it will result in an increase in money supply, leading to more inflation (that is if they don't liquidate all their investments overseas). It's not about old folks spending all their money in Batam, though there are cases like these, but I think it's in the minorities, not all Singaporeans behave this way. It's a media propaganda campaign to brainwash the majority.

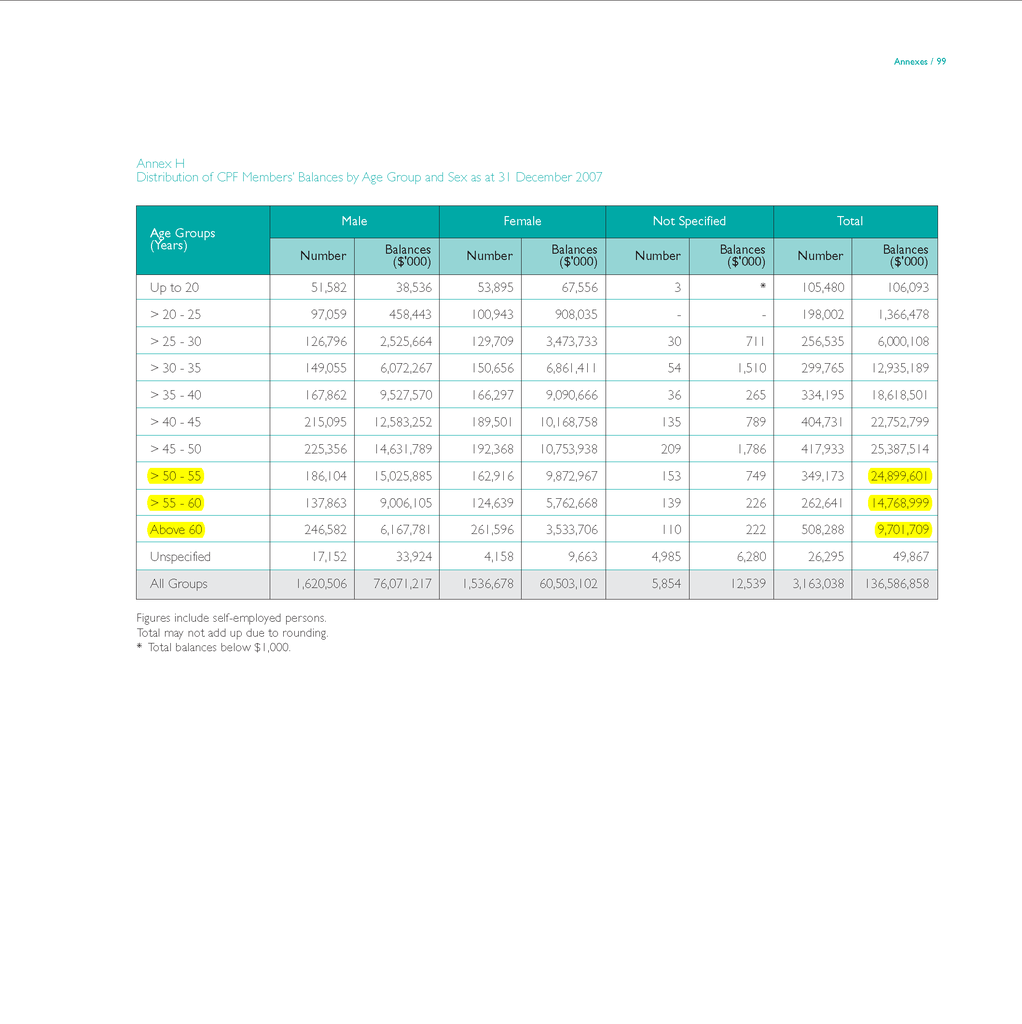

If you look at the latest CPF Annual Report, the balances in member's accounts are as follows:

Above 60 = $9.7 billion

55 - 60 = $14.8 billion

50 - 55 = $24.9 billion

As it progresses each 5 years, the liability of CPF to repay it's members gets substantially higher. The only way to make good these liabilities is to get money from MAS. The money which were contributed by members has been transferred from CPF Board to MAS, thereafter the loan was made to Temasek. Temasek current portfolio consist of Singapore companies and overseas companies, some of their major overseas investments have not made good returns. If they were to sell some of their investments, the losses will be quite substantial.

1) The only way that MAS could contain the inflation is to ask Temasek to liquidate it's position overseas or locally, so that it could make good the loan given to it by MAS. (aka sterilized foreign exchange intervention)

2) Otherwise, MAS will have to resort to increasing the money supply without sterilization. Which will inevitably lead to a higher inflation rate for Singapore.

3) Else, they will have to delay the withdrawals of CPF members by increasing the draw down age, minimum sum and annuities. This method will ensure that Temasek, GICs and GLCs will not have to liquidate their overseas investments suffering a loss, while at the same time placating the retiring CPF members.

This is like a foolproof plan, even if opposition's win the majority vote in the next election, they will have this headache left by the current ruling elites. There's a term in investment that describes this situation, it's called "the Winner's Curse".

**This is just my opinion based on my knowledge, as with any opinion, it could be wrong or right. So readers will need to exercise due judgement.

-

wow u really go study all these in details

damn smart boi u

-

For the benefit of those who have not updated themselves, compulsory annuity (CPF Life) will be in effect in 2013 (it is 5 years later), to cater for those currently in the 55 y.o. - 60 y.o. age group.

Looks like despite all the public disapproval, they unilaterally passed the regulation and enforced it. It's compulsory, you do not have a choice.

CPF Life (aka Life Annuity):

http://mycpf.cpf.gov.sg/Members/Gen-Info/CPF_LIFE/CPF_LIFE

**This is just my opinion based on my knowledge, as with any opinion, it could be wrong or right. So readers will need to exercise due judgement.

-

Originally posted by JerryYan:

wow u really go study all these in details

damn smart boi u

I didn't go read everything, I guess that they might forsee problems with payout to CPF members, so I look at the right spot and found the information.

-

I miss Gazelle's opposing post.

-

To get rid of all these CPF schemes by the Govt that manipulate your money, is dun contribute lor, like me, be the boss lah,....save in bank better mah. But CPF got 4% interest, damn attractive.

-

And if you are young like me, dun worry about CPF, cos by our time, many thing would had changed, i bet in another 5 years time, a new law/policy will come out again.

-

very informative for people like me who cant understand financial and politicals talks... Thanks...

And they want 6mill pop... I am nt financial literate... but its common sense that someone will have to foot the bill of these 6mil people when they thenselves get old... Some where along the line, this system is going to fail. sooner or later -

Their strategy could also be called a "poison pill" investment strategy.

Poison pill is a term referring to any strategy, generally in business or politics, to increase the likelihood of negative results over positive ones for a party that attempts any kind of takeover. It derives from its original meaning of a literal poison pill carried by various spies throughout history, taken when discovered to eliminate the possibility of being interrogated for the enemy's gain.

-

im not surprise especially come you realise the return from temasek and GIC due to fail investment would reduce in coming years. what kind of impact it will create in years ahead. be sure the changes will be amended again in 2-3 yrs time, if US credit crunch do turn out to be full blown world wide recession.

my worry is, can we ever see our money in our living lifetime.

-

Originally posted by reyes:

im not surprise especially come you realise the return from temasek and GIC due to fail investment would reduce in coming years. what kind of impact it will create in years ahead. be sure the changes will be amended again in 2-3 yrs time, if US credit crunch do turn out to be full blown world wide recession.

my worry is, can we ever see our money in our living lifetime.

In the past (around the 1980s), there were high retention of CPF money because the bulk of the workforce was in their 20s to 30s, so nobody was qualified to withdraw the money. Inflation was very low in the sub 1% to 2%, this was due to the reduction in money supply through our CPF system.But as the years progresses those that were in the 20s and 30s are now approaching retirement age. Their past saving in CPF is going to be released to them, increasing the money supply, leading to compounded inflation (because these savings earn interest annually).

Moreover with their half baked investment strategies leading to losses soon after purchase, I wonder how are they going to make good the retiring CPF member's money without causing inflation. It's really a sad case for those retirees when they realise that their $2 no longer buys a plate of chicken rice.

I guess in the next decade, we have the fact that our inflation is not going to be in the sub 1% to 2%, it is more likely to be around 3% to 5% range.

At this point in time, they concocted this CPF Life (Life Annuity) Scheme, it just means your money will be left with them till you die, then it will be transferred to your children. It's compulsory!!! A good way to curb the growth in money supply, but will incur the wrath of fellow citizens.

-

It is definitely to their advantage that buying annuity is made compulsory. They want to make sure that by the time the population consists of higher percentage of old people, they will not be burdened to part with large lump sum of money to take care of the old. Money is their motivation in implementing the buying of annuity.

No money no talk. I don't remember they ever implement policy and so and so base on meeting the needs of the people, correct me if I am wrong.

-

hmmm.. I need to go examine the CPF system in detail, lots to read man!

I opted out of Medishield haha...

-

Originally posted by Fantagf:

No money no talk. I don't remember they ever implement policy and so and so base on meeting the needs of the people, correct me if I am wrong.

Thats why our PAP government cannot catch the terrorist Mas Selemat without giving out rewards,coz now Singaporeans also talk money to those miser PAP ministers now.

-

Sometimes,i really feel sad for those PAP ministers n leaders.They dont know anything about investment,and yet,they act like a stupid businessman anyhow investing in global markets.

They thought that by simply gathering huge sum of money n let the "Experts" manage the money through investment,they will see money keep flowing into their pockets,LOL!!!...Those PAP(Pigs And Pigs) are really damn naive.

-

Originally posted by maurizio13:

In the past (around the 1980s), there were high retention of CPF money because the bulk of the workforce was in their 20s to 30s, so nobody was qualified to withdraw the money. Inflation was very low in the sub 1% to 2%, this was due to the reduction in money supply through our CPF system.But as the years progresses those that were in the 20s and 30s are now approaching retirement age. Their past saving in CPF is going to be released to them, increasing the money supply, leading to compounded inflation (because these savings earn interest annually).

Moreover with their half baked investment strategies leading to losses soon after purchase, I wonder how are they going to make good the retiring CPF member's money without causing inflation. It's really a sad case for those retirees when they realise that their $2 no longer buys a plate of chicken rice.

I guess in the next decade, we have the fact that our inflation is not going to be in the sub 1% to 2%, it is more likely to be around 3% to 5% range.

At this point in time, they concocted this CPF Life (Life Annuity) Scheme, it just means your money will be left with them till you die, then it will be transferred to your children. It's compulsory!!! A good way to curb the growth in money supply, but will incur the wrath of fellow citizens.

maurizio,Thanks for the links.

But I've went through the CPF website, the more I read.. the more questions start to pop in my head leh.

Very confusing lor.

The web says ... there are exemptions to MS.

People with pension and those who already have life annuities with private insurance companies are exempted from MS.

So then.. is it still compulsory for those exempted from MS to be included in CPF Life ????

Then also.. if a person don't meet MS , they can pledge their properties to CPF...

Then if the money is in the property.. how to pay premium with the pledged sum ??? Then pledge already.. who is the owner of the property ??? Does ownership transfer to CPF ???

Then hor.. under MS.. got the gahmen buyback scheme for old people's remainder of the HDB lease.. that means if that person die.. the HDB flat belongs to the CPF right ??? Like reverse mortgage leh.. not a good idea mah.....If price goes down.. are the elderly going to top up to CPF ? And when price goes up.. then will the pledge sum increase ???

Somemore.. the monthly payout is not guaranteed leh... that means the payout will fluctuate lor... like sibeh risky leh.

-

Originally posted by maurizio13:

I miss Gazelle's opposing post.

where is he?the forum will not be interesting without these folks around.

-

Originally posted by drawer:

Thats why our PAP government cannot catch the terrorist Mas Selemat without giving out rewards,coz now Singaporeans also talk money to those miser PAP ministers now.

Money money money is all pap go for. Annuity is good source of revenue for them. I wonder how they use the CPF for the annuity. Nobody can guarantee that they will be employed all throughout their life. What happen if they are unemployed for a long period of time and no more CPF for paying annuity?

My relative who bought annuity from insurance company said that the annuity implemented by govt using the CPF not a good deal compared to what she is paying for.

-

Originally posted by maurizio13:

I miss Gazelle's opposing post.

May be moderated or banned. Short of entertainment without gazelle.

-

Annuity is when you don't work, but have a capital sum in CPF and the government will deduct an amount from it to pay you.

e.g.

If you have $40,000 with an interest rate of 4% and you want an annual payment of $4,800. Your $40,000 will only last 10.34 years.

-

The people at CPF are panicking already.

Hence the PM's call for more children so that they can top up CPF next time.

-

Originally posted by maurizio13:

Annuity is when you don't work, but have a capital sum in CPF and the government will deduct an amount from it to pay you.

e.g.

If you have $40,000 with an interest rate of 4% and you want an annual payment of $4,800. Your $40,000 will only last 10.34 years.

When one still has not reached the retirement age and jobless for a long while, CPF money goes to pay housing loan. What will happen? Will the govt get the people to pay cash for the annuity?

I can't stand it when buying annuity is by force. It is our life, we don't need them to run our life for us. If I ever want to buy annuity, will opt for insurance companies.

LHL treats us as kids, force this upon us and the latest is teaching us manners. I don't need another father. He is not fit to be father to anyone of us.

-

Originally posted by charlize:

The people at CPF are panicking already.

Hence the PM's call for more children so that they can top up CPF next time.

No wonder they need to increase the population, to help pay for the elder's CPF.

-

Originally posted by maurizio13:

No wonder they need to increase the population, to help pay for the elder's CPF.

You mean you didn't know?

You think he wants you to have babies to enrich your boring 60 hour work week life?

-

Originally posted by charlize:

You mean you didn't know?

You think he wants you to have babies to enrich your boring 60 hour work week life?

shucks!!!i've been suckered by them again.