Aussie dollar--jumping kangaroo or paper kangaroo?

-

Additions--27.10.2008

Debts to banks is 148% of GDP

debts from Residential ,Personal and commercial owing to banks

amounts to 1483 billion,or 148 % of GDP!!

pl read 27.10.2008 postings.

Additions on 13.10.2008

pl read my 13.10.2008 postings.

Oz gavaman banks gurantee is just a empty promises.

http://www.smh.com.au/news/national/rudd-moves-to-shore-up-700b-in-banks/2008/10/12/1223749845710.html

How much is the Oz banks's debt to foreign creditors which also under

Oz gavaman gurantee?

OMG.

http://www.rba.gov.au/Statistics/AlphaListing/alpha_listing_f.html

H05 Net Foreign Liability

599953 millions A$!! or A$600 billions or 60% of GDP!!

So, i salute to Oz gavaman so daring to gurantee local banks deposits

of A$700 billions and 600 billions in NET foreign liability,amounting

to A$1300 billions!!Oz gavamna just get A$20 b in hands!!

@@@@@@@@@

I did not post this package of info few months ago for i was

very afraid this is another anti--Aussie thread.

There are many aunties and highly educated pple

lost in the recent crash of Aussie dollars.So i just say somethings

for u guys to enjoy as laughing stocks in this sad week end!!

As usual,my postings are classified as rubbish.But i am happy

if i can make u laugh during this finaciallly difficult time.

Little well known facts:

1.RBA just announced in low profile that she already bought

A$58 billion of mortgage back security.Further,Aussie gavaman will buy another

A$4 billion RBMS.Thats equal about 6 % of Aussie GDP.USA $7000 billion

bailout plan is also about 5% of US GDP!!I wander why no body took

note of Aussie bailout,in another very low profile way.

There are many info in RBA site.

2.Dunt just look at FX rates for US $ and Sing $.

Look at the trade- weighted in index

http://www.rba.gov.au/MediaReleases/2008/mr_08_19.html

http://www.rba.gov.au/Statistics/HistoricalExchangeRates/index.html

Weights in the Trade-Weighted Index

(per cent)This Index lost 22 % in 1 year.U may just interested in ex rate to Sing $.

But the real health of Aussie $$ is in trade --weighedex rate!!

u will suprised to find out that in trade --weighed,USD is in 4th position!

Currency Trade Weight2008/09--top2007/08--bottomNo.1--Chinese renminbi

16.367215.4486No.2--Japanese yen

15.404015.4860No. 3--European euro

11.651712.1703No. 4--United States dollar

9.879710.7432No. 5--South Korean won

5.77865.9057No. 6--Singapore dollar

5.21024.5637No. 7--United Kingdom pound sterling

4.75354.1943No. 8--New Zealand dollar

4.65654.65533.Net national debt is 47.5% of GDP.

Gross national debt 79.8%,Of which: Australian dollar-denominated-- 28.4% of GDP.

The slide of Aussie will put pressure of repayment.

4.Low net official reserve in relation to imports

Net official reserves increased by $A 4 billion in the year to June 2008 and remained at about 1¾ months of imports.

This is much lower than SEA third and first world countries few years ago

in the range of few months to 10 months.

http://www.aseansec.org/macroeconomic/T23.pdf

http://www.spp.nus.edu.sg/docs/wp/wp1105.pdf

@@@@@@@@

i dunt want to spoon feed u .

Aussie $$ is one of the top 7 currency in FX game.Investor and

speculator keep it for high deposit interest it provides.

Aussie gavaman have to reduce rates to counter the tsunami,

. pple will off load Aussie $$ if they foresee A $ rate is to be cut further

this lead to lower value.

so u have seen A $$ dropped ,in trade-- weighed term,

15 % from 26 Sept 2008 to 9 Oct 2008!!.

5.Aussie still have A$126 billion RMBS in 2005

residential mortgage-backed securities (RMBS) market has grown rapidly over the past decade, with the amount outstanding reaching $126 billion in December 2005

http://www.rba.gov.au/PublicationsAndResearch/FinancialStabilityReview/Mar2006/Html/perf_aus_res_mort_sec.html

Pl note this is for resi only---i dunt think it include commercial properties .

The unusual low default rates reported is very interesting.

Since mid 2007,RMBS market is dead.

RMBS Issuance--Graph 27.

page 34 of 73 --RBA Fincial Stability Review March 2008.

Off shore funding almost all gone.So u know why RBA had to buy

few % GDP worth of RMBS etc.

6.Total RMBS is about 261 billion as at June 2007

Further to 125 b in Dec 2005,u look at

RBA Fincial Stability Review March 2008,

page 34 of 73. RMBS Issuance Graph 27.

u will find about 45 b x 3 issued from Jan 2006 to June 2007.

plus 125 b as at Dec 2005,it is 261 billion.

Conditions in the RMBS market

have been more difficult still. Over

recent months, issuance of RMBS

has been extremely limited, after

very strong growth in previous

years. Since July last year, issuance

has totalled less than $6 billion,

compared with $45 billion in the

first half of 2007 (Graph 27).I think the sudden increase in onshore in ABCP ,in Graph 26.Australian ABCP Outstanding,was caused by RBA purchase.

I have told u RBA already got 58 b mortgage.

7.U can see the quality of mortgage by reading this:

--> Securitisation isolates the assets and enhancements so that their credit quality can be analysed absent of external factors and investors can focus primarily on the performance of the assets and servicing of the debt, rather than on the credit quality of the lender.

http://securitisation.com.au/securitisation.html

this work.be patient.

8.Very low default rates make me worry

http://www.bankers.asn.au/Default.aspx?ArticleID=1069

This rosy picture may be achieved by by Securitisation!!

Total Securitisation is at about A$220 billion.

pl read RBA reports.

#################

9.How Aussie compared with countries in 1997 Asian financial crisis

I am not here to say Oz alone is facing a crisis.

In fact,all countries are facing a crisis,incl SG!!

BTW,how would u define a financial crisis?

How much trade--weighed exchange rate shall drop in %?

How many default rates in mortgage?

I dunt know how to define.

I just hope these figures will ditract u to read all red or green

screens in these days!!

Interesting to note:In East,red means price going up.But in West,

going down!!This is culture differences!!

http://www.imf.org/external/np/exr/facts/asia.pdf

pl refer to data for Thai,Indonesia and Korea in this link.

I take 1996 and 1997 average for all the 3 countries.

.................3 countries 1996/97 average......Aussie in 2007

Real GDP growth....................4.65%....................2.7%

Consumer price .......................6.85.....................4.2

below--all in % as GDP

central government balance......0.2........................-0.2

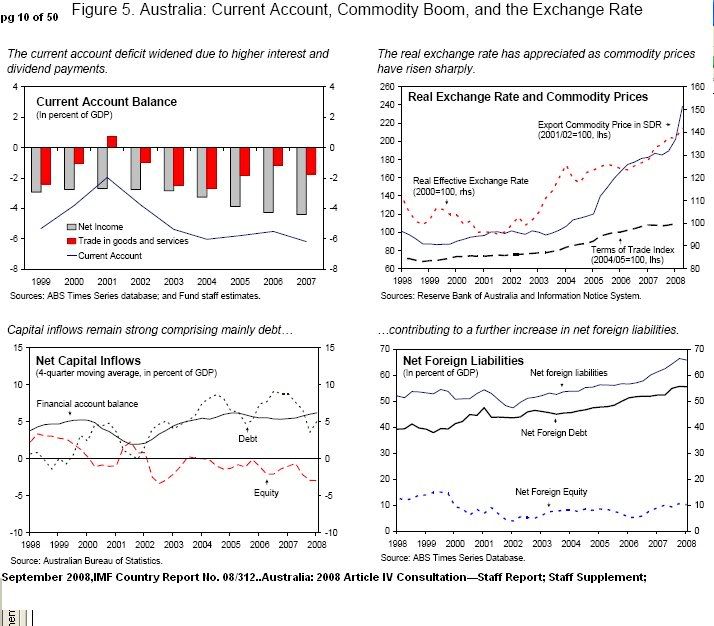

current account balance...-3.48.(for Oz 2004 to 2007)-6

External debt....................63................................48

Net foreign reserve.........??...............................2 months

as Imports in month

,,

Reference:

1.F I NANCIAL STA B I L I T Y REVIEW by Reserve Bank of Australia--Sept 2008,

page 31 of 74,

www.rba.gov.au

In such circumstances, the RBA would be prepared to conduct repurchase agreements in RMBS backed by mortgages originated by the institution undertaking the repo (so-called ‘self securitisations’). To date, 11 institutions have created these self-securitisations, with the total stock of these currently

standing at around $58 billion.http://www.theaustralian.news.com.au/story/0,25197,24409158-20142,00.html

http://www.news.com.au/business/story/0,27753,24403645-462,00.html

Crisis strategy in place for banks

The Australian

September 26, 2008

The Reserve Bank disclosed yesterday that the banks have in the last few months assembled $58 billion in mortgages for this purpose.

3.

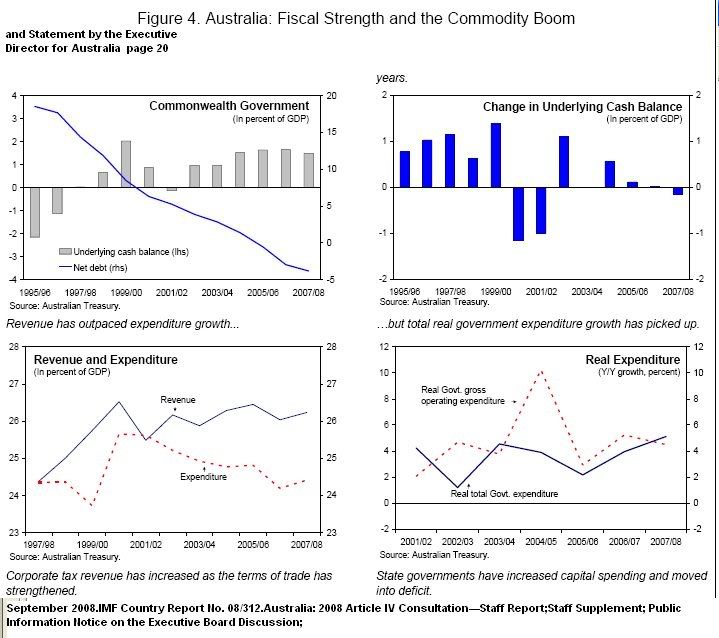

September 2008

IMF Country Report No. 08/312

[Month, Day], 2001 August 2, 2001 January 29, 2001

[Month, Day], 2001 August 2, 2001

Australia: 2008 Article IV Consultation—Staff Report; Staff Supplement; Public

Information Notice on the Executive Board Discussion; and Statement by the Executive

Director for AustraliaTable 3. Australia: Balance of Payments, 2004–09

(In percent of GDP) page 29 of 50.4.as 3--page 17 of 50

ADB

Key Indicators

for Asia and the Paci fic 2008

39th Edition

,,,,

-

I tot u r the mudder of all kangs? hee hee ha ha ha yibah yibah untooneh!

whose your dd?

-

-

Against the currency of this country during the troubles....

soon to become assdollar at the hands of the asspots with support of the assdogs (with a lion delusion)

-

can you explain your pt so that most ppl can explain.

your pt is?

-

i mean explain your pt so that most ppl can understand. conclusion of your pt is?

-

Originally posted by reyes:Originally posted by reyes:

i mean explain your pt so that most ppl can understand. conclusion of your pt is?

end of quote

Aussie is like USA,suffer from over lending and the genis of securitization.

Dunt fall in love with any currency blindly.Look at the basic.

The drop of 30 % in Aussie ex rates vs Sing $$ alrady wipe out few years

of deposit rates earnings.From 1.35 to 1.00.

There is no free lunch in the world.

Why pple bought mini Bonds.----mainly becos of high yield.

Why u buy A $$ is the same reason.May be u want to migrate

to there or u have kids studying there or going to study there.

High yield always come with high risks.Now u know lah.

But high risks dunt always come with high yield.

But SG also suffer from Mini bonds and the highly gearings of banks

in unknown investments and bettings.

Again,look at the basic of Aussie economy.

Aussie economy mix is very narrow than SG!!

Have u read news PRC ask Aussie delay shipping iron

ore to PRC from 4Q 2008?

http://www.interfax.cn/news/6004/2.No currency in history can be supported by high interest rateAussie $$ is no exception.I dunt look at short term ex rates.I look at long term ,the trade--weightedindex and the basic of Aussie country.Also,read RBA reports this week end to know Aussie better.For example,oz suffered for budget deficits for almost2 decades and the very low foreign reserve.Aussie cannot support or fine tune Aussie $$ rates.Reason----short of bullets.showAussie cant fight with speculators.,,

-

Originally posted by reyes:

can you explain your pt so that most ppl can explain.

your pt is?

i think he is trying to say australia sucks. -

orhh.. now i understand. but Australia economy is not as fragile as we thought it is. the australia govt are not poor. they have kinda reasonable reserves that is why we can see there ant any currency speculators this time round compare to asian crisis where govt reserves are generally low. the recent drop in aussie currency could be partially due to the recent rate cut and dropping of commodity prices strucking them at the sametime.

Australia govt still has bullets such as interest rate cut.

this is just the second rate cut in last few years and at current rate there are more room to cut unless the USA at 1.5%. australia will not have property bust like in USA, because many ppl are still in rental and have cash to enter the property market once it start to come down and interest rate lower. with the exception of Perth.

If you say australia economy is narrower than singapore, maybe less diversify do have its advantages afterall as we are second in asia to slip into technical recession but they had not.

therefore i dont think we can judge a country economy solely on the currency performance. in fact it could be a blessing in disguise as it can help to booast exports and attract tourist at a time, when tourist revenue are expected to fall worldwide.

-

Even in world recession, because australian homes and cars are cheap and education is free, i believe many can weather the storm. They also have lots of natural resources to fall back on.

Spore leh? many still slogging to pay the loans for the ever price increasing flats and cars and education. tougher to weather the storm, imho.

-

on the otherhand i wouldnt say australia are good.

as the TS has said before, crime rate are pretty awful, racism in certain states are rampant, inflation in the past few years are terrible, where prices such as food and housing are kinda out of control.

i would rather focus on our own singapore economy, USA, EU, china, Japan than to worry about aussie issues coz they are still relatively small player in international standard.

-

Even in world recession, because australian homes and cars are cheap and education is free, i believe many can weather the storm. They also have lots of natural resources to fall back on.

Spore leh? many still slogging to pay the loans for the ever price increasing flats and cars and education. tougher to weather the storm, imho.

partially i agree.

car is cheap.

Home is not cheap. average perth houses are ar AUD400k. unless you have straight cash, you had to take loan at over 8%.

education not free. still have to pay. although not as much as singapore.

-

see doctor free. medicine must buy at pharmacy.

at least we know the reason why we die.

in singapore if no money see doctor, die without knowing why.

-

S'pore is in recession

Fri, Oct 10, 2008

AFP

SINGAPORE - Singapore's trade-sensitive economy has declined for a second straight quarter, the government said Friday, meaning the city-state has entered a recession for the first time in six years.

On a seasonally adjusted quarter-on-quarter annualised basis, real GDP declined by 6.3 percent in the third quarter after contracting 5.7 percent in the previous quarter, estimates from the Ministry of Trade and Industry said.Is Singapore the first Asian country in recession?

-

Ok, now its OFFICIAL - Singapore, the 1st world is now officially in RECESSION!!!!!!!!!!!!!!!!!!!

I call for improvement to this situation immediately!

Singaporeans expect more !

-

Originally posted by reyes:

on the otherhand i wouldnt say australia are good.

as the TS has said before, crime rate are pretty awful, racism in certain states are rampant, inflation in the past few years are terrible, where prices such as food and housing are kinda out of control.

i would rather focus on our own singapore economy, USA, EU, china, Japan than to worry about aussie issues coz they are still relatively small player in international standard.

Well, its a wishful thinking to assume any country is perfect.

The bottomline is Australia in many ways is better than Spore.

Vice versa.

No one can say Singapore is Perfect.

Ask IBA.

-

S'pore is in recession

Fri, Oct 10, 2008

AFP

SINGAPORE - Singapore's trade-sensitive economy has declined for a second straight quarter, the government said Friday, meaning the city-state has entered a recession for the first time in six years.

On a seasonally adjusted quarter-on-quarter annualised basis, real GDP declined by 6.3 percent in the third quarter after contracting 5.7 percent in the previous quarter, estimates from the Ministry of Trade and Industry said.Is Singapore the first Asian country in recession?

yeah, if we exclude new zealand.

damn.. the ruling party must be angry we couldnt get first this time. first in recession in asia, i mean.

-

i have added some in opening postings.pl go to read some graph.

9.How Aussie compared with countries in 1997 Asian financial crisis

I am not here to say Oz alone is facing a crisis.

In fact,all countries are facing a crisis,incl SG!!

BTW,how would u define a financial crisis?

How much trade--weighed exchange rate shall drop in %?

How many default rates in mortgage?

I dunt know how to define.

I just hope these figures will ditract u to read all red or green

screens in these days!!

Interesting to note:In East,red means price going up.But in West,

going down!!This is culture differences!!

http://www.imf.org/external/np/exr/facts/asia.pdf

pl refer to data for Thai,Indonesia and Korea in this link.

I take 1996 and 1997 average for all the 3 countries.

.................3 countries 1996/97 average......Aussie in 2007

Real GDP growth....................4.65%....................2.7%

Consumer price .......................6.85.....................4.2

below--all in % as GDP

central government balance......0.2........................-0.2

current account balance...-3.48.(for Oz 2004 to 2007)-6

External debt....................63................................48

Net foreign reserve..........??...............................2 MONTHS

as Imports in month

Why SG get recessions

We are in recession becos in the past SG have done too well.

If we always low in GDP growth every quarter,say 2 to 4 %,

then we wont be in recession so fast.

American newspapers often quote the rule of thumb that a recession occurs when real gross domestic product (GDP) growth is negative for two or more consecutive quarters.

Gross Domestic Product at 2000 Prices

(Percentage change over corresponding period of previous year)3Q07

4Q07

2007

1Q08

2Q08

3Q08*

Overall GDP 9.5

5.4

7.7

7.0

2.3

-0.5

http://app.mti.gov.sg/default.asp?id=148&articleID=15561

Friends,I am serious.SG is growing at a third world speed.

nnnn

-

Aussie situation looks not so good.

RBA takes RMBS as collateral.read 10.10.2008 statement.

- The current restriction that prevents an institution from using residential mortgage-backed securities (RMBS) and asset-backed commercial paper (ABCP) of a related party as collateral in its repo operations with the Bank will be relaxed. This also applies to the US dollar term repo facility.

- The Bank will offer six-month and one-year repos each day in its market operations.

- Restrictions

on substituting collateral within an existing repo, with the exception

of general collateral, will be removed. Where the substitution includes

a change in the asset class of collateral, the margin applying to that

collateral will be adjusted accordingly.

http://www.rba.gov.au/

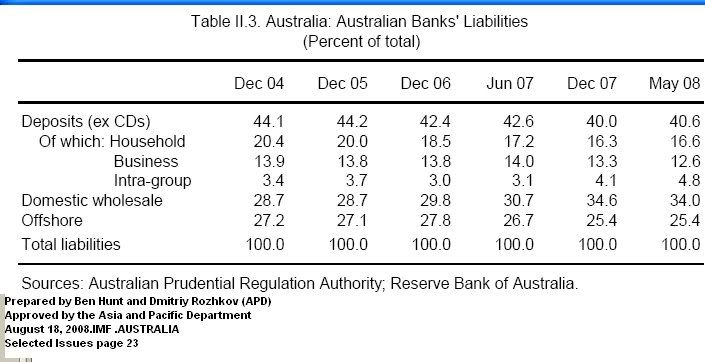

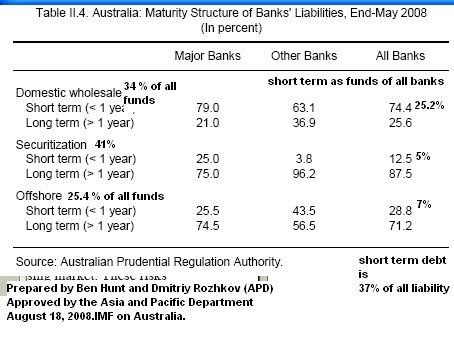

2.Australian banks rely heavily on wholesale funding and external funds

How RBS to fill the gap of 60 % funding is interesting!!

Australian banks rely heavily on wholesale funding. Wholesale funds (domestic and

offshore) account for about 60 percent of total funding of the banking system, and more than 40 percent of wholesale funds come from offshore (Table II.3).Furthermore, a significant share of wholesale funds are short-term.

7. Available data on Australian external debt indicates that debt with residual maturity of less than 90 days accounts for about 36 percent of total debt, and 73 percent of debt with residual maturity of less than one year.

Since financial corporations account for about 75 percent of total external debt, the stress test scenario assumed a similar structure for external debt of the banking system.September 2008

IMF Country Report No. 08/311

Australia: Selected Issues--Prepared by Ben Hunt and Dmitriy Rozhkov (APD)

pages 24--26

3.Sources of funds and short term liabilities

hjhh

-

can you drive your pt short and sharp?

what is your pt after showing so many clipping and chart?

what is the consequences?

-

Your post is unreadable, it's full of terrible grammar and way too many random facts that you threw in.

If you want to be understood, improve your english and keep your posts concise and to the point.

-

TS has a personal vendetta against Aussie?

-

What happenend to AUD? why suddenly drop so much?

-

Don't really have to know why it dropped. If you know the Aus currency's fluctuation trend over the years, you can make a bundle.

You may have to buy and hold for a few years.

-

Originally posted by googoomuck:

Don't really have to know why it dropped. If you know the Aus currency's fluctuation trend over the years, you can make a bundle.

You may have to buy and hold for a few years.

Ya true..... Haha

Investors were ditching riskier assets ahead of this weekend's Group of Seven (G7) meeting in Washington, Mr Solar said, which was another negative for the Australian dollar.

"Unfortunately, at these times, the Aussie does get sold off when there are high levels of risk aversion."???

I have no idea what they talking abt...

Lionnoisy... can summarize ur points ornot? Its quite a mess