Social Welfare Health costs

-

Originally posted by jojobeach:

Crimsonstatic,

Are you a NUS grad ?

Do they teach you how to think outside the box ?

Corruption or not.. I tell ya......

Using Anti-corruption as an argument is only to throw smoke screen at the people. A means of diversion.

Ask yourself.. why do they need to have anti-corruption NOW ?

Did someone just took over the helm ? Are the ministers leaving in droves ? Why ?

Is it really because of the money ? Or is it because of the leadership ?

Could it be that the money is to buy loyalty ?

What made it so different before ?

Nope I'm not an NUS grad.

Yes its true, using such argument is nothing but diversion. Using our common knowledge, it is really apparent that all countries will experience some form of corruption, its a straight lie to say that a country is corruption free.

However, like what is stated in the rules, evidences are needed to carry your point. So unless evidences can be shown, we can only take it that they are indeed corrupt-free.

Every country has a anti-corruption rules for the main purpose of preventing corruption. It is not just to eradicate corruption.That means that even a corrupt-free country would have a anti-corrupt law to maintain such intergrity.

I think you kind of mess up SG's politics to MY's politics. When did our ministers start leaving?

The root source of corruption comes from money. To have money you gotta have a rank or position and that is when all the chaos happens. But before we push the blame on them we must ensure that we are guilt-free. We must ask ourselves " Are we giving them enough for what they are contributing?"

Until we can confrim that indeed they have gotten what they deserve, then can we point our fingers at them.

I believe that, like what you've said, some form of financial gains are given in exchange for support. However, i do not have any proofs on this and thus my statement and yours hold no strength. Unless, of course, you do have evidences.

-

Originally posted by crimsontactics: Nope I'm not an NUS grad.

Yes its true, using such argument is nothing but diversion. Using our common knowledge, it is really apparent that all countries will experience some form of corruption, its a straight lie to say that a country is corruption free.

However, like what is stated in the rules, evidences are needed to carry your point. So unless evidences can be shown, we can only take it that they are indeed corrupt-free.

Every country has a anti-corruption rules for the main purpose of preventing corruption. It is not just to eradicate corruption.That means that even a corrupt-free country would have a anti-corrupt law to maintain such intergrity.

I think you kind of mess up SG's politics to MY's politics. When did our ministers start leaving?

The root source of corruption comes from money. To have money you gotta have a rank or position and that is when all the chaos happens. But before we push the blame on them we must ensure that we are guilt-free. We must ask ourselves " Are we giving them enough for what they are contributing?"

Until we can confrim that indeed they have gotten what they deserve, then can we point our fingers at them.

I believe that, like what you've said, some form of financial gains are given in exchange for support. However, i do not have any proofs on this and thus my statement and yours hold no strength. Unless, of course, you do have evidences.

Dude.. you got watch that " Just Follow LAw " ?

Got one scene.. is that 3 men sit around the pantry table and one of them say...

" What is obvious is not always in black and white".

It is really up to you .. to believe or not. I am not here to brain wash you.

Singaporean fums over minister's pay hike.

And how much do they think they deserve ?

5 million ? 10 million ? 20 Million ?

I think I am priceless.. how much you do think I deserve ?

-

Originally posted by jojobeach:

Oh gawd, I see already want to puke.

Capability ? Yah.. for a tiny little dot .. that's a whole lot of capability.

I agree lah.. LKY did good lah... back then.

We should pay him 50 million per year .. how bout that ? Why stop at 3, right ?

Then the people can go eat shyt lor.

Oh.. wait.. to recognise his great works and personal sacrifice.. how about we erect a 1 story height bronze statue of LKY and have it sit infront of Changi Airport ?

Then we also can put up HUGE 2 storey high posters of LKY and hang it on ALL the schools and public buildings ?

Like that can I do away with his 3 million annual salary ? LOL.

I ask you go visit first world country to ask about their living standards, and pro-people policies .

You think 3 million will stop corruption ah ? LOL.. you xiao boh ?

When an organization wants to buy top brass information or get things moving .. the offers are more than 20 years our minister's annual pay lah. Kaoz...small fry want to talk big.

Yah I had to pay "admin fee" before.. and dude.. my ROI is much much more than that little "token" I gift to the officers lah. The officers are ground workers.. must we also pay the junior- middle management civil officers million lollar too ?

You do what business ? Sell your backside issit ?

Singapore want to be corrupt is the ministers digging their own grave. You go think about it lah.

I resent the fact that you resort to uncalled for insults to back your statements. Does it lend more credence to your presentation or only to show you up as an irrational beast of the wild?

You seem to enjoy belittling others here in this forum. Could the truth be that you suffer from an inferiority complex in real? Low self esteem, so low that you need to indulge in fantasy to project a deluded super image of yourself to others here?

For all the words you use in your post, I can only feel pity for you as a response.

Enjoy your blustering, but do know that not everyone is a fool as you wish or think them to be. They know better.

-

Originally posted by DeerHunter:

I resent the fact that you resort to uncalled for insults to back your statements. Does it lend more credence to your presentation or only to show you up as an irrational beast of the wild?

You seem to enjoy belittling others here in this forum. Could the truth be that you suffer from an inferiority complex in real? Low self esteem, so low that you need to indulge in fantasy to project a deluded super image of yourself to others here?

For all the words you use in your post, I can only feel pity for you as a response.

Enjoy your blustering, but do know that not everyone is a fool as you wish or think them to be. They know better.

Wah.. you so sensitive one ah ? Sorry lor.. I didn't know your ego so fragile one.

Ok Ok.. I sayang you... want some beer ?

-

Originally posted by jojobeach:

Wah.. you so sensitive one ah ? Sorry lor.. I didn't know your ego so fragile one.

Ok Ok.. I sayang you... want some beer ?

Jojo, there is a very contrasting difference from the way you write in this thread. Your earlier post seem normal to me, but suddenly for some reason, you switch yourself to a "retarded" mode.

May I know the reason why? Trying to act cute and innocent to hide your weakness?

Originally posted by jojobeach:The people in USA under adequate insurance coverage are not afraid to go to the doctors, and they will not hesitate to go for frequent checkup. They won't be dead broke after a serious illness.

Unlike Singaporeans, who have to pay from their pocket. Yes, ours is called consumer driven health care. If you can afford, you go see doctor.. if not.. you try to fix it with some chinese medicine.

FYI. USA is not a universal health care system.

It is just a system controlled by the Health Care insurance industry. And it is the organization that sucks, not the health care professionals.

But if you can afford to go with better HC insurance company.. your life is really well taken care of. Every visit is a breeze and you pay a very low deductables. Best part is you have no worries about the cost of your visit even if it shows thousands on your invoice, because this invoice goes to the insurance company. Ofcors, this option is not cheap.

So if you cannot afford HC insurance, you're still screwed.

-

Originally posted by £Ä¬€Ú°:

Jojo, there is a very contrasting difference from the way you write in this thread. Your earlier post seem normal to me, but suddenly for some reason, you switch yourself to a "retarded" mode.

May I know the reason why? Trying to act cute and innocent to hide your weakness?

Please lah.. I am a human.. not a robot.

When I am in a notti mood.. I write notti things. When I am in a normal mood I write normal things. When I am in a sexy mood.. I can also write very sexy stuff...

My weakness can sometimes be my strength.. so why would I need to hide it ?

-

Originally posted by crimsontactics:

I agree with your views. But there are some misconceptions that i want to highlight to you.

1st, HK is not a far better country than SIngapore. Yes its HDI won SG's by a little, but its GDP per capita and living space cannot be matched with SG's. I think it would be more appropiate if we say that both countries are of an equal standard with its own high points and low points.

2nd, Senior management are supposed to get more than the lower rung. If not, why would there be promotions?

3rd, Yes, FTs have been and will be a challenge to us local men, who needs to go through NS and thus delay our career. However, the only people whom i hear have problem over job issues are those who dosen't want to improve themselves or don't have the die-die-must-fight mentality that is crucial for success. It is not that they are better than us in any way, its just that some of us can't take up the challenge.

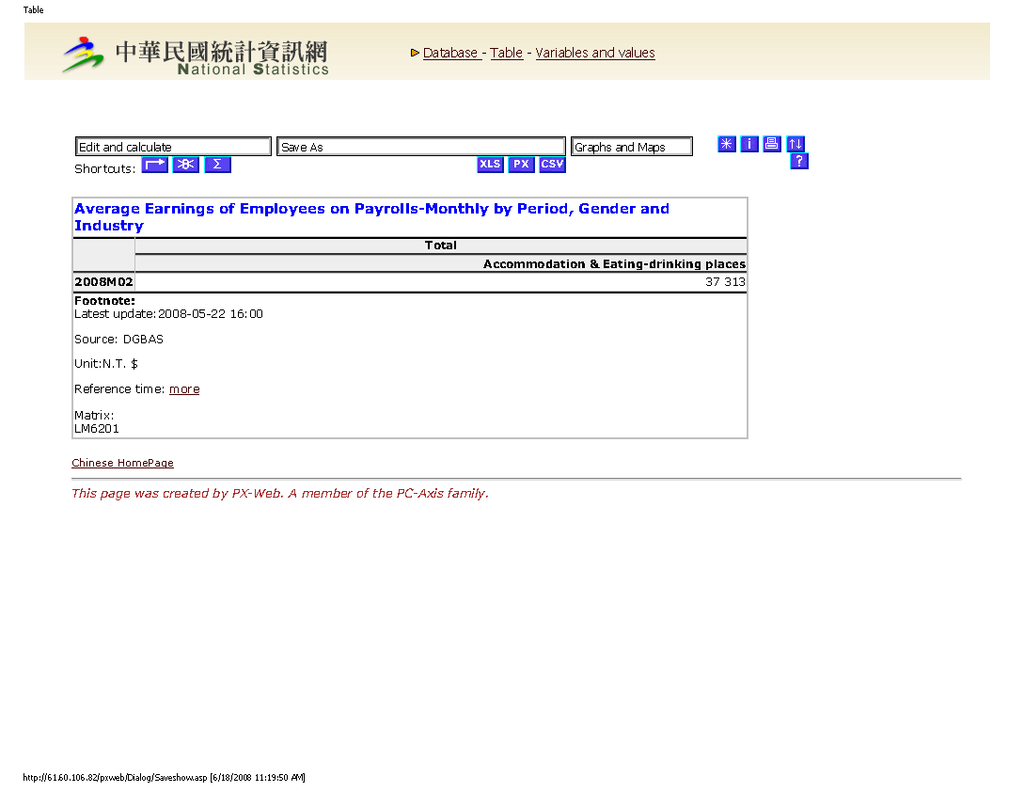

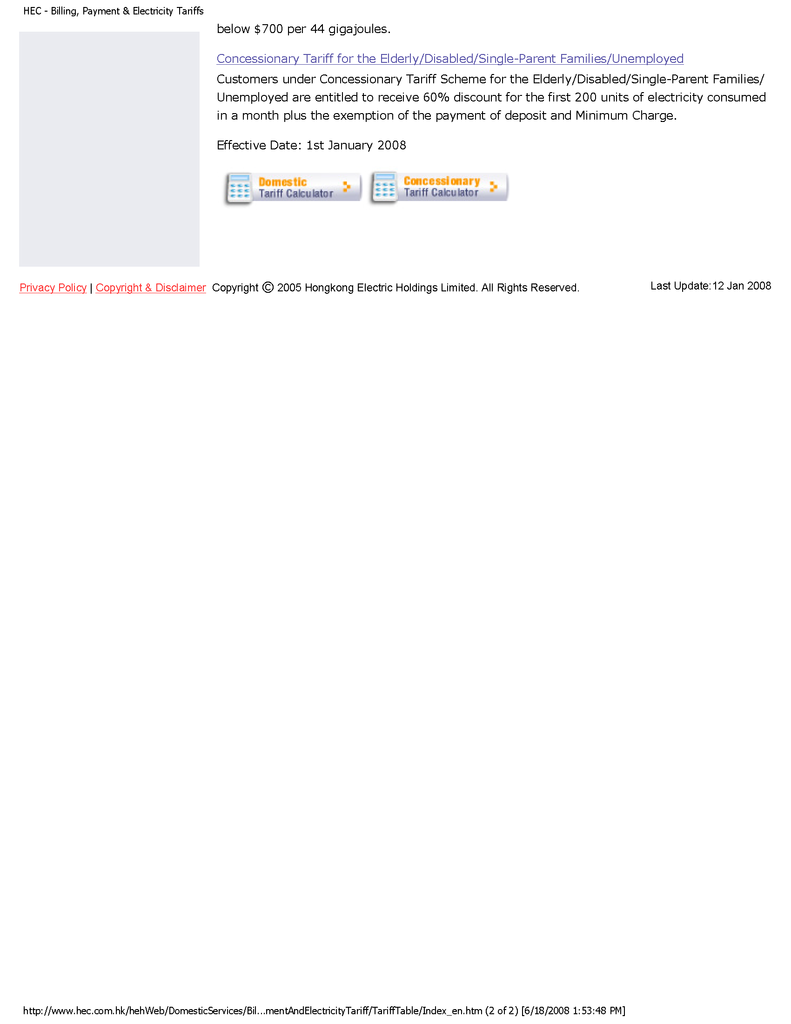

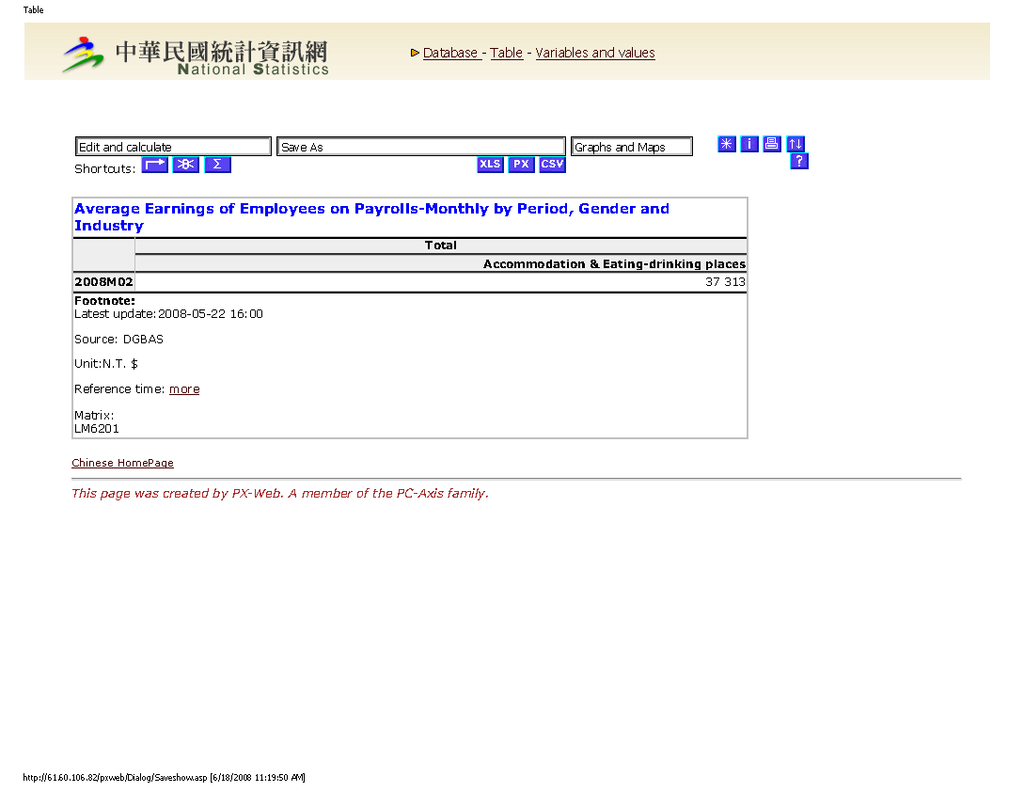

1) GDP per capita is not a precise yardstick to measure the standard of living. Take Taiwan for instance, a GDP per capita of USD 16,500 while Singapore with a GDP per capita of USD 35,000.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)_per_capita

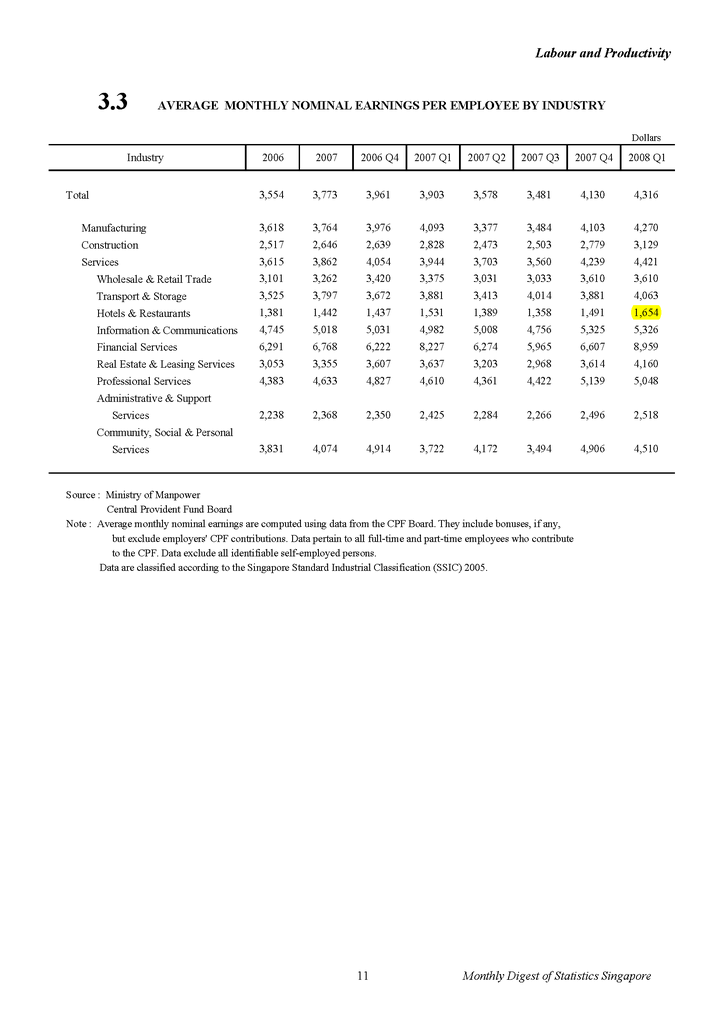

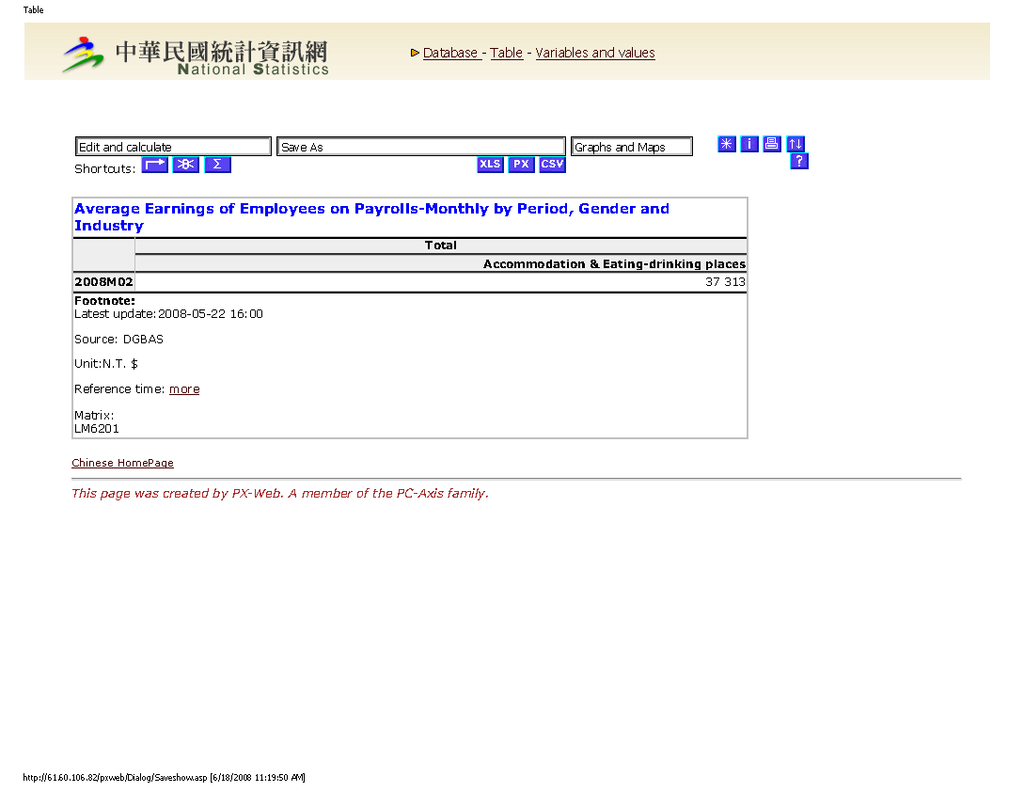

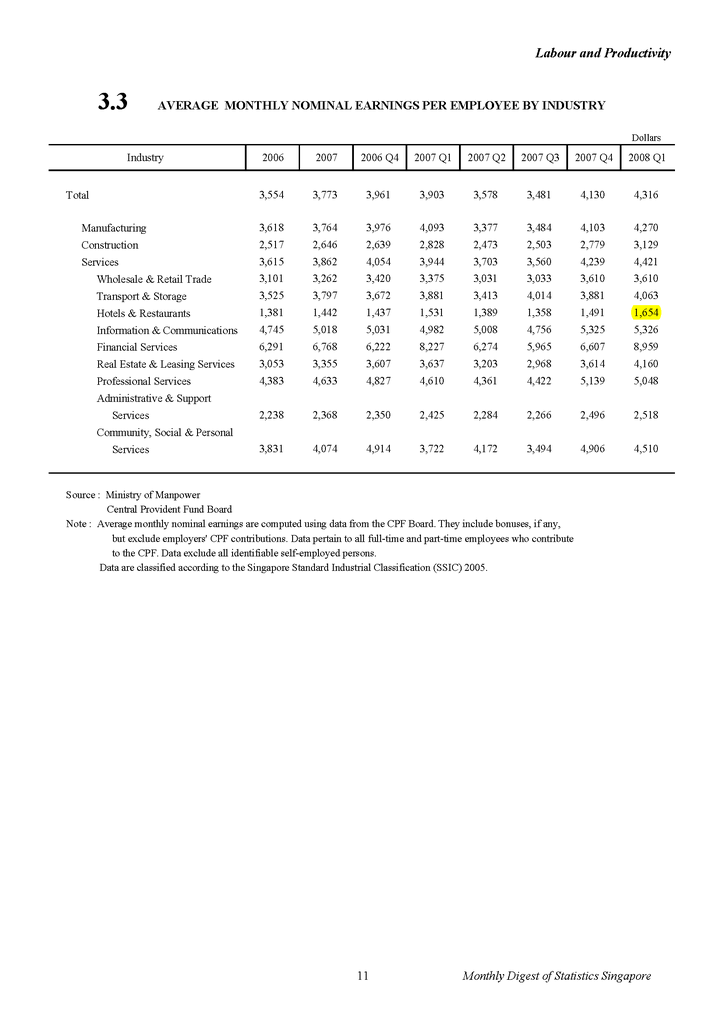

Taiwanese food & beverage workers get paid NT$ 37,313 per month (SG$1,696), while Singapore food & beverage workers get paid SG$1,654. Singaporean F&B workers actually get paid less than their Taiwanese counterparts, the Taiwanese GDP per capita is actually half that of Singapore. (SG$ 1 = NT$ 22)

http://eng.stat.gov.tw/mp.asp?mp=5

http://www.singstat.gov.sg/pubn/reference/mdsmay08.pdf

2) Did I question why senior management should get more, don't put words in my mouth again.

I said that in a crunch most senior management will take a higher percentage pay cut than the lower rank and file workers.

I said that in a crunch most senior management will take a higher percentage pay cut than the lower rank and file workers.3) Not that Singaporeans can compete on an equal footing, it's just that we are being made to compete on uneven ground. The foreign talent (FT), does not have much liabilities in Singapore. Compare a FT who sends back SG$100 to his folks in China, his parents will get RMB500, the parents can probably survive for above 2 weeks with that amount. Take a Singaporean who gives his parents SG$100. How long can SG$100 last in Singapore? With each meal costing $5 multiply by 2 person and 3 meals a day, it would cost $30 a day to maintain 2 elderlies (housing, transport and utilities not included). If both are frugal, most likely the $100 would last 3 days.

Don't be daft in thinking that we have to keep importing foreigners to maintain a competitive edge, only a regime deprive of any other ideas will resort to low balling a 3rd world country in terms of wages. If you keep importing FT without limits, you essentially deprive the citizen population of normal work, driving down wages to that of 3rd world countries like China and India and lowering standards of living for the entire population.

-

Originally posted by DeerHunter:

Speculations? Do you even read the newpapers?"Don't have the mentality to understand" - so you do? The only thing i see you understand is that with a budget surplus, and you claim from 'overcharging her citizens through monopolies'.

1.) Have you any definitive proof of such 'overcharging' - which means over and above the normal rates others' charge? For example:- healthcare - the govt charges more than private clinics and hospitals. HDB flats costs more than Condos. School fees more than what a Singaporean would have to pay if he studies in eg; Australia or US, which are of comparable if not lower standards than our high school equivalent.( Not comparing Colleges, Uni, as the standards are higher there)

2. ) How much of these investments returns will be? You left out the amounts, on purpose? Usually it is much lower and seldom more than double digits. Would that be enough to fund social spending in education, healthcare, transportation, etc?

3. ) NKF is a private charity foundation. It's monies are non-refundable. It was a good thing our media, whom you profess as a govt mouthpiece, spilt the beans on its mismanagement. Only a fool would use NKF as a comparison to our treasury.

Unlike NKF, our funds in the treasury are in terms of CPF and tax revenues and have to be returned back to the People, espacially CPF which promises 4% annual returns. How else to give such returns except to invest it prudently for slightly more than the 4% returns, and with any excess, use it for social spending so as not to tax the citizens further?

As any investor knows, risk adverse blue chip investments are in it for the long haul and seldom see double digit % annual returns. You claim a doomsday will never come. Why don't you work out how much actual medical care subsidy alone costs are, espacially with our aging population whom requires it most and tell me if even with a budget surplus used solely just for it, if we can promise full medical care for them ALL.

The only reason why our health care subsidize are not more than S$1.6billion this year is rather, fortunately or unfortunately, patients cannot even afford the 'co-pay' of 20% on the full course of treatment, and would rather take pills to sustain themselves to see another sunrise till the pain overcomes their heartbeats. I don't mind to subsidize all, pay more taxes, but what about CPF monies which must be returned with interests earned from investments? Where will other money come from other than us whom are gainfully employed? What about other funds for social spendings?

Any person would realize the importance of saving up monies. Can you tell what the future will be? You can't. Better to be safe, than sorry, for the sake of our future generations, just as the previous generations sacrificed for us all now. $100 million in our coffers in 1965 didn't grow to become US$300 billion by magic, but by prudent management with strict controls, so that we can still afford within our ability to help most, if not all of those less well off than us.

1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards).

When you compared Hong Kong's SGD 62.38 with Singapore's equivalent class ward of SGD 160.50, we are heavily overpriced.

If you find that the comparison between Hong Kong's private hospital and Singapore's public subsidised healthcare is distorted. Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

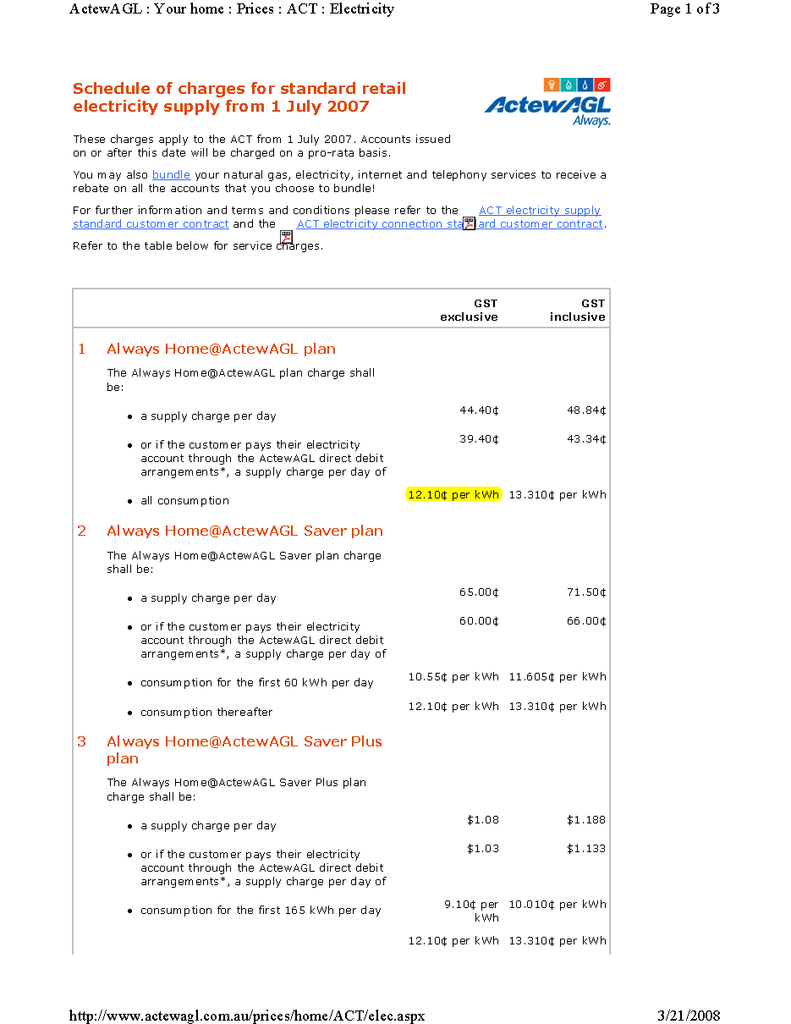

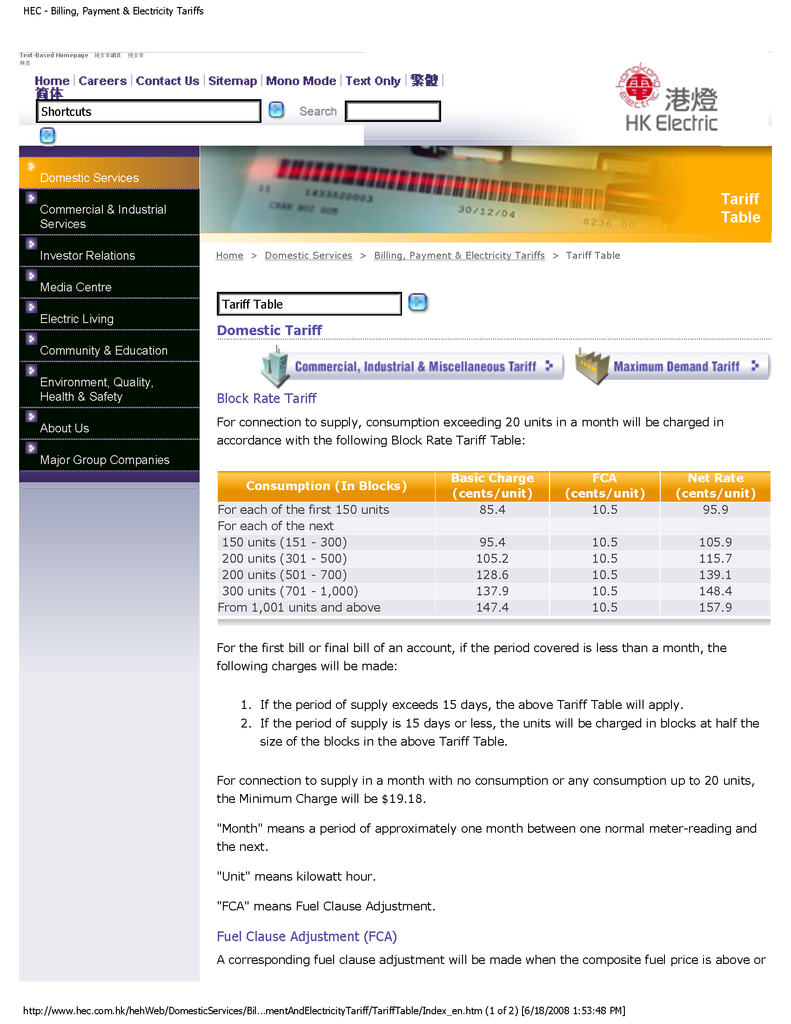

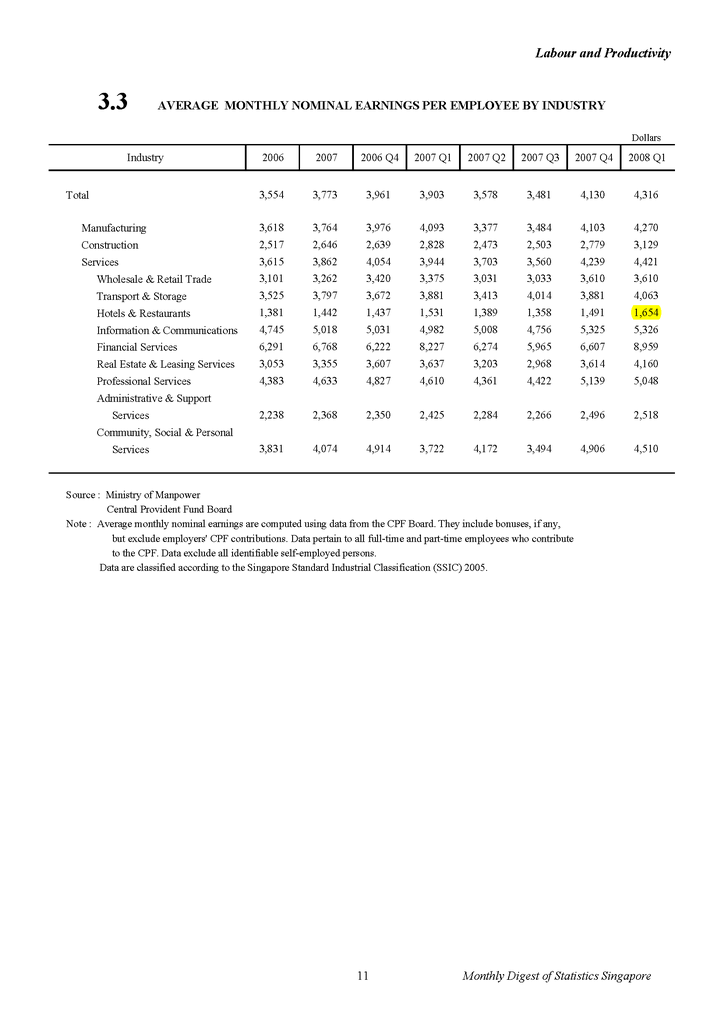

Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

Electricity rate is charged in Australia (ActewAGL) at 12.10 cents (Australian Dollars), when converted gives a Singapore Dollar rate of 15.13 cents.

(AUD 1 = SGD 1.25)

Source: http://www.actewagl.com.au/prices/home/ACT/elec.aspx

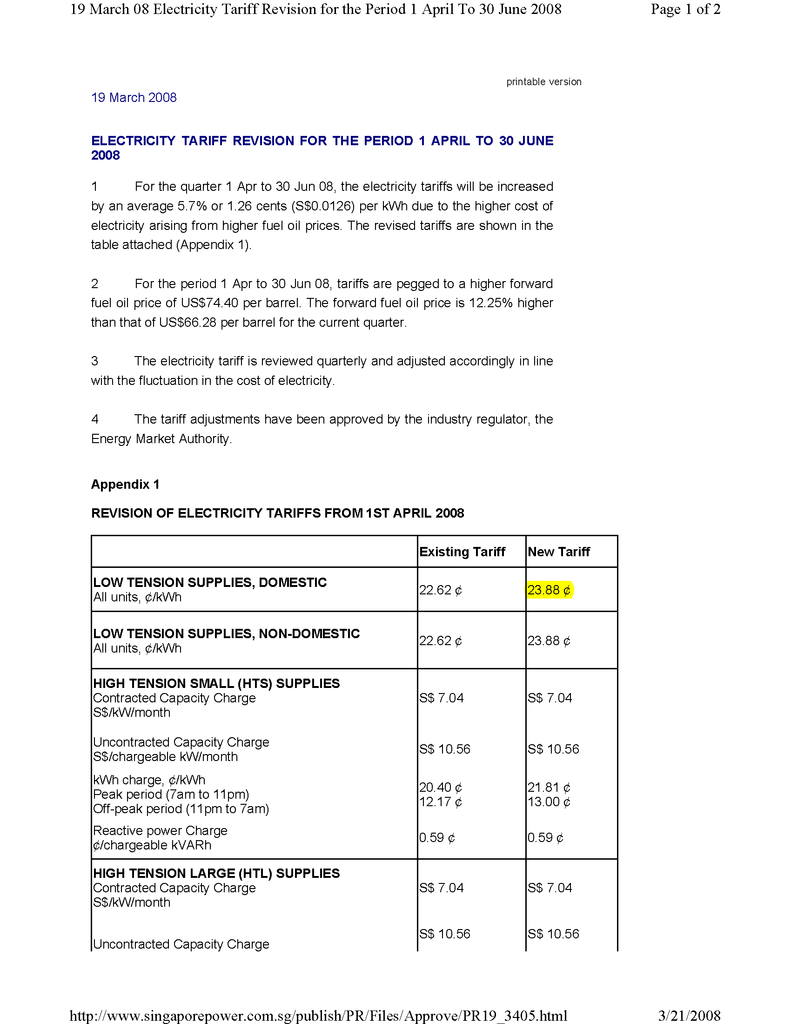

Singapore Power charges electricity rates 23.88 cents.

The difference between Singaporean electricity and Australian is 8.75 cents, a pecentage difference of 58% when compared to Australian electricity.

Also the electricity rates for Hong Kong. The typical charges for say 500 kwh, which is what a typical family uses. It will cost us SG$119.40. While for this same amount of usage in Hong Kong, it will only cost SG$93.63. They even have a concessionary rate of 60% discount for eldery / disabled / single parent / unemployed. I am sure Gazelle will qualify for this concessionary rate there.

http://www.singaporepower.com.sg/

Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in. If there was no public outcry, it would probably be swept under the carpet like most issues in the government.

We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future and retirement.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time. Putting money into CPF is alot like an insurance scheme, but it's just that the government turns CPF into a savings account instead of an insurance scheme where rates of returns are much higher, closer to 10%.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.  I don't have time to argue new topics each time you lose the current issue at hand.

I don't have time to argue new topics each time you lose the current issue at hand. -

Originally posted by maurizio13:

1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading, seems like you quoted a cheaper private hospital.

When you compared Hong Kong's SGD 62.38 with Singapore's equivalent class ward of SGD 160.50, we are heavily overpriced. Thanks again OM.

I keep wondering why someone keeps shooting himself in the foot. Is he a sadist that actually enjoys such acts.

It would be more productive if you can produce links to your so called attendance fees. Else, you are just gropping for a needle in the haystack in the dark.

If you find that the comparison between Hong Kong's private hospital and Singapore's public subsidised healthcare is distorted. Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

Electricity rate is charged in Australia (ActewAGL) at 12.10 cents (Australian Dollars), when converted gives a Singapore Dollar rate of 15.13 cents.

(AUD 1 = SGD 1.25)

Singapore Power charges electricity rates 23.88 cents.

The difference between Singaporean electricity and Australian is 8.75 cents, a pecentage difference of 58% when compared to Australian electricity.

Also the rates for Hong Kong. The typical charges for say 500 kwh, which is what a typical family uses. It will cost us SG$119.40. While for this same amount of usage in Hong Kong, it will only cost SG$93.63.

Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

Source: http://www.actewagl.com.au/prices/home/ACT/elec.aspx

2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.  I don't have time to argue new topics each time you lose the current issue at hand.

I don't have time to argue new topics each time you lose the current issue at hand."You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities."

Right now, you are putting words into my mouth and making unfounded claims on my person. You just lost your credibility, and i will demolish every single one of your arguments easily, and with facts. Don't be smug, wiseguy.

"1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading,........ Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Oxford mushroom had proven your misleading statements. Must you continue to tell half truth to support your useless overinflated ego? Others may want to click on that link above. I have no wish to continue to argue on the old point with a fool, debunked already by someone else.

"b. )Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

.......Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

"

"You fool! How much tax do the Australians pay? Do you know they are one of the highest in the world? Of course they can show a lower cost to their direct charges. And you had been carrying on with this power costing to prove our govt of 'over-charging' as a smoking gun. But it only makes you look like another complete village idiot!

2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

Doomsday scenario that will never happen? It's your belief, but the fact is, the country is facing an aging population whose tax contribution will dwindle down eventually. Then what? Add more taxes to our young. Go on with your beliefs, but people prefer facts than your fantasies.

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

You are maligning the govt without evidence. NKF is an individual issue by itself. If you have evidence of mismanagement on the management of our coffers, then prove it. IF not, then you are doing nothing more than to speculate and spread sedition.

We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Again you malign the govt. Are you claiming that the investments returns went into the Lee's pockets? You better be more specific and back it up with facts, otherwise, you are again giving wild speculations and not facts. The returns belong to the People to be used for savings and further investments to generate more returns so that taxes can be kept low in years to come, more so when we have no resources to depend on.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

You are the only one daft here. The CPF returns are guaranteed by the govt. As with guarantees, it is a promise which must be upheld. The safest way to ensure such promises can be realized is to offer lower returns. 18% returns today does not mean we will get 18% tomorrow. Whatever the excess, it is plough back into our coffers for savings, investments and social spending.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

I fully agree with you on this. Only thing is, no one knows for sure when is the exact time. Thus the need for caution, and calls for capable managers to watch over funds.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.  I don't have time to argue new topics each time you lose the current issue at hand.

I don't have time to argue new topics each time you lose the current issue at hand.NO new issues. I answered all of them. Anything else? But you in your stubborn way will never agree to what i had written. So be it. YOu keep to your beliefs, and me mine. But the readers out there will be better able to discern the truth themselves.

-

Originally posted by DeerHunter:

"You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities."

Right now, you are putting words into my mouth and making unfounded claims on my person. You just lost your credibility, and i will demolish every single one of your arguments easily, and with facts. Don't be smug, wiseguy.

"1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading,........ Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Oxford mushroom had proven your misleading statements. Must you continue to tell half truth to support your useless overinflated ego? Others may want to click on that link above. I have no wish to continue to argue on the old point with a fool, debunked already by someone else.

"b. )Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

.......Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

"

"You fool! How much tax do the Australians pay? Do you know they are one of the highest in the world? Of course they can show a lower cost to their direct charges. And you had been carrying on with this power costing to prove our govt of 'over-charging' as a smoking gun. But it only makes you look like another complete village idiot!

2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

Doomsday scenario that will never happen? It's your belief, but the fact is, the country is facing an aging population whose tax contribution will dwindle down eventually. Then what? Add more taxes to our young. Go on with your beliefs, but people prefer facts than your fantasies.

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

You are maligning the govt without evidence. NKF is an individual issue by itself. If you have evidence of mismanagement on the management of our coffers, then prove it. IF not, then you are doing nothing more than to speculate and spread sedition.

We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Again you malign the govt. Are you claiming that the investments returns went into the Lee's pockets? You better be more specific and back it up with facts, otherwise, you are again giving wild speculations and not facts. The returns belong to the People to be used for savings and further investments to generate more returns so that taxes can be kept low in years to come, more so when we have no resources to depend on.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

You are the only one daft here. The CPF returns are guaranteed by the govt. As with guarantees, it is a promise which must be upheld. The safest way to ensure such promises can be realized is to offer lower returns. 18% returns today does not mean we will get 18% tomorrow. Whatever the excess, it is plough back into our coffers for savings, investments and social spending.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

I fully agree with you on this. Only thing is, no one knows for sure when is the exact time. Thus the need for caution, and calls for capable managers to watch over funds.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.  I don't have time to argue new topics each time you lose the current issue at hand.

I don't have time to argue new topics each time you lose the current issue at hand.NO new issues. I answered all of them. Anything else? But you in your stubborn way will never agree to what i had written. So be it. YOu keep to your beliefs, and me mine. But the readers out there will be better able to discern the truth themselves.

"You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities."

Right now, you are putting words into my mouth and making unfounded claims on my person. You just lost your credibility, and i will demolish every single one of your arguments easily, and with facts. Don't be smug, wiseguy.

"1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading,........ Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Oxford mushroom had proven your misleading statements. Must you continue to tell half truth to support your useless overinflated ego? Others may want to click on that link above. I have no wish to continue to argue on the old point with a fool, debunked already by someone else.

Where did oxford mushroom prove to me that the cost of hospitalisation is less in Singapore as compared to Hong Kong? Please quote.

"b. )Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

.......Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

"

"You fool! How much tax do the Australians pay? Do you know they are one of the highest in the world? Of course they can show a lower cost to their direct charges. And you had been carrying on with this power costing to prove our govt of 'over-charging' as a smoking gun. But it only makes you look like another complete village idiot!

So now you are telling me the taxes that Singaporeans pay is related to Singapore Power? ACTEWAGL and HEC are related to the government and government will give them money to make their electricity cheaper. How come Singapore government never give Singapore Power money to make electricity cheaper?

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

Doomsday scenario that will never happen? It's your belief, but the fact is, the country is facing an aging population whose tax contribution will dwindle down eventually. Then what? Add more taxes to our young. Go on with your beliefs, but people prefer facts than your fantasies.

Tax contribution dwindle then? The government also don't serve out welfare payouts for the aging. It's time they learn how to balance their budget by taking less pay, trim the fats from the Ministers, do away with redundant SM and MM. If you company makes less sales. 1) Do you as a CEO control your cost? or 2) Charge a higher price for all your products? What you are doing is raising your price with lower sales to boost profit margins so as to squeeze out more from consumers to pay for the astronomical salaries of your CEO, CFO, CIO, etc. Hardly a logical move for any competent CEO.

Don't worry our honourable Ministers will import more foreign talents to snuff out the old folks. Leave the old folks to their own devices on the MRT tracks lor. Less old folks, more foreign talents means more taxes and foreign workers levy. So a situation of more aging is quite impossible with the current influx of young foreign talents.

Not to mention the logic of your thinking is not sound, I have seen old folks in their 70s and 80s working, contributing to the economy. Having an active income which is taxed by the IRAS. Haven't the government promoted the idea of old folks working to the grave? What happened to this scheme? You threw out the government's scheme single handedly?

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

You are maligning the govt without evidence. NKF is an individual issue by itself. If you have evidence of mismanagement on the management of our coffers, then prove it. IF not, then you are doing nothing more than to speculate and spread sedition.

Hahaha.....What did I malign?

You are just a sheepdog herding the sheeps with threats when you can't post a credible response. I am not a sheep, thus you can't herd me.

You are just a sheepdog herding the sheeps with threats when you can't post a credible response. I am not a sheep, thus you can't herd me.We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Again you malign the govt. Are you claiming that the investments returns went into the Lee's pockets? You better be more specific and back it up with facts, otherwise, you are again giving wild speculations and not facts. The returns belong to the People to be used for savings and further investments to generate more returns so that taxes can be kept low in years to come, more so when we have no resources to depend on.

I said what I said, whatever you infer from the statements with your limited comprehension ability is of your own maleficence, none of my doing. It's the usual threats from you when you can't respond to questions and points.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

You are the only one daft here. The CPF returns are guaranteed by the govt. As with guarantees, it is a promise which must be upheld. The safest way to ensure such promises can be realized is to offer lower returns. 18% returns today does not mean we will get 18% tomorrow. Whatever the excess, it is plough back into our coffers for savings, investments and social spending.

We are not talking about tomorrow we will be getting less than 18% dude. It's a cradle to death situation, you buy the stock, you hold it, reap the dividends and share price growth. Anybody would know that if you (as an individual) purchase the stock, the share price might decrease tomorrow, but in time, it will increase again. But with constraints to your needs of liquidity, you might need to sell at a lower price when you are in dire need of cash. But as the government holds the CPF money of all it's citizens, the citizens are locked in till retirement at 65 (assuming), there is no need for the government to force sell the investment to raise cash for somebody's retirement (only those above 65 or 70) will cash out. The government only need maintains a certain percentage in liquid assets and the rest in equity. The government can always print money to cover the CPF payouts, if say tomorrow all our investments are lost in the stock market. Can the government raise money to pay those in retirement? Yes, because the central bank can always print more money.

CPF is an insurance scheme that pays less than average bond coupon rates. It has all the attributes of an insurance scheme, long term in excess of 40-50 years and no withdrawals from account is allowed. Guess what are the returns for insurance held to maturity. Shouldn't an investment with the characteristics of an insurance scheme be paid rates similar to an insurance scheme?

- The payout on a Scottish Life £50 per month 25-year with profits endowment is £48,618 . With total premiums on the policy of £15,000 this represents an annualised return of 8.4%.

- The payout on a Scottish Life 20-year £200 per month with profits pension is £142,089, an annualised return of 9.8%.

- The payout on a Scottish Life 20-year single premium £10,000 pension contribution is £77,329 , an annualised return of 10.8%.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

I fully agree with you on this. Only thing is, no one knows for sure when is the exact time. Thus the need for caution, and calls for capable managers to watch over funds.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.

You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities.  I don't have time to argue new topics each time you lose the current issue at hand.

I don't have time to argue new topics each time you lose the current issue at hand.NO new issues. I answered all of them. Anything else? But you in your stubborn way will never agree to what i had written. So be it. YOu keep to your beliefs, and me mine. But the readers out there will be better able to discern the truth themselves.

-

Originally posted by maurizio13:

1) GDP per capita is not a precise yardstick to measure the standard of living. Take Taiwan for instance, a GDP per capita of USD 16,500 while Singapore with a GDP per capita of USD 35,000.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)_per_capita

Taiwanese food & beverage workers get paid NT$ 37,313 per month (SG$1,696), while Singapore food & beverage workers get paid SG$1,654. Singaporean F&B workers actually get paid less than their Taiwanese counterparts, the Taiwanese GDP per capita is actually half that of Singapore. (SG$ 1 = NT$ 22)

http://eng.stat.gov.tw/mp.asp?mp=5

http://www.singstat.gov.sg/pubn/reference/mdsmay08.pdf

2) Did I question why senior management should get more, don't put words in my mouth again.

I said that in a crunch most senior

management will take a higher percentage pay cut than the lower

rank and file workers.

I said that in a crunch most senior

management will take a higher percentage pay cut than the lower

rank and file workers.3) Not that Singaporeans can compete on an equal footing, it's just that we are being made to compete on uneven ground. The foreign talent (FT), does not have much liabilities in Singapore. Compare a FT who sends back SG$100 to his folks in China, his parents will get RMB500, the parents can probably survive for above 2 weeks with that amount. Take a Singaporean who gives his parents SG$100. How long can SG$100 last in Singapore? With each meal costing $5 multiply by 2 person and 3 meals a day, it would cost $30 a day to maintain 2 elderlies (housing, transport and utilities not included). If both are frugal, most likely the $100 would last 3 days.

Don't be daft in thinking that we have to keep importing foreigners to maintain a competitive edge, only a regime deprive of any other ideas will resort to low balling a 3rd world country in terms of wages. If you keep importing FT without limits, you essentially deprive the citizen population of normal work, driving down wages to that of 3rd world countries like China and India and lowering standards of living for the entire population.

This was what you wrote on page 6,

While they persist in self authorizing their pay increments to afew millions, concomitantly asking that low wage workers bite the bullet by taking pay cuts. Hardly the case for most large organisations, most of the time senior management takes a higher pay cut than the lower rungs.

This was what i wrote on page 6,

2nd, Senior management are supposed to get more than the lower rung. If not, why would there be promotions?

Am i, by anyways, putting words in your mouth?

1) Yes, you are right. GDP is not a precise measure for every industries. However, it is the average amount of salary earned by the people of that particular country. So for fair comparision, I think its fair to use GDP as a form of measurement. We have to judge a country's progress as a whole, not by indiviual industries.

3) Yes, we are competing with FTs on an uneven ground. However, that uneven ground refers to the knowledge and experience, not monetary gains.

Yes, the living cost in their homeland is low, $100 can last their parents for 2 weeks there while it only last for 3 days here, but have you considered that most FTs coming from such countries are actually your construction or factory workers?

So are you telling me that its fair to compare our pay with theirs?

Those FTs that are earning big bucks here mostly comes from first-world countries. They may earn more than us when we start, but we have to know that cost of living in their countries are higher than ours.

If you keep importing FT without limits, you essentially deprive the citizen population of normal work, driving down wages to that of 3rd world countries like China and India and lowering standards of living for the entire population.

That will depend on the occupation you are aiming for. However, the likelihood of a wage war is very little. Its something like quality vs quantity. Yes, such FTs are trained engineer and IT consultants, however, they are some sort like "mass-produced", when it comes to R&D and anything that doesn't do with the basic work ( like repairing and such), i think we, local folks, have more knowledge and are more reliable than them.

-

Originally posted by DeerHunter:

"You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities."

Right now, you are putting words into my mouth and making unfounded claims on my person. You just lost your credibility, and i will demolish every single one of your arguments easily, and with facts. Don't be smug, wiseguy.

"1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading,........ Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Oxford mushroom had proven your misleading statements. Must you continue to tell half truth to support your useless overinflated ego? Others may want to click on that link above. I have no wish to continue to argue on the old point with a fool, debunked already by someone else.

"b. )Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

.......Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

"

"You fool! How much tax do the Australians pay? Do you know they are one of the highest in the world? Of course they can show a lower cost to their direct charges. And you had been carrying on with this power costing to prove our govt of 'over-charging' as a smoking gun. But it only makes you look like another complete village idiot!

2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

Doomsday scenario that will never happen? It's your belief, but the fact is, the country is facing an aging population whose tax contribution will dwindle down eventually. Then what? Add more taxes to our young. Go on with your beliefs, but people prefer facts than your fantasies.

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

You are maligning the govt without evidence. NKF is an individual issue by itself. If you have evidence of mismanagement on the management of our coffers, then prove it. IF not, then you are doing nothing more than to speculate and spread sedition.

We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Again you malign the govt. Are you claiming that the investments returns went into the Lee's pockets? You better be more specific and back it up with facts, otherwise, you are again giving wild speculations and not facts. The returns belong to the People to be used for savings and further investments to generate more returns so that taxes can be kept low in years to come, more so when we have no resources to depend on.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

You are the only one daft here. The CPF returns are guaranteed by the govt. As with guarantees, it is a promise which must be upheld. The safest way to ensure such promises can be realized is to offer lower returns. 18% returns today does not mean we will get 18% tomorrow. Whatever the excess, it is plough back into our coffers for savings, investments and social spending.

Risk on a long term horizon with a massive funds company (Singapore) is always negligible, because stock markets will always rebound after a certain period (be it recession). If they don't, we'd all be jobless and dead.

I fully agree with you on this. Only thing is, no one knows for sure when is the exact time. Thus the need for caution, and calls for capable managers to watch over funds.

Doubtless that you will bring up new issues again and start putting words in my mouth again. Please retort the facts presented here with facts and analysis instead of bringing in new issues. Settle the current issues presented here before squirming away with new issues to detract from the discussion.

You are the guru in running away from the

discussion by bringing in new issues, putting words in others mouth

and profanities.

You are the guru in running away from the

discussion by bringing in new issues, putting words in others mouth

and profanities.  I don't have time to argue new topics

each time you lose the current issue at hand.

I don't have time to argue new topics

each time you lose the current issue at hand.NO new issues. I answered all of them. Anything else? But you in your stubborn way will never agree to what i had written. So be it. YOu keep to your beliefs, and me mine. But the readers out there will be better able to discern the truth themselves.

1. Charges for HK is for bed only so is SGH 's cost. OM is a doctor in UK - I won't trust what he says . He does not work in HongKong. Did you know SGH also charges patients for what you have mentioned? They have a sticker system :) . Peel the sticker and paste it on the patient's charge sheet. Toilet paper also charged .

2. Australian wages are also high to cover the costs of taxes. Plus hospital stay is free with heavily subsidised medicare and Pharmaceutical Benefits Scheme. Welfare is also covered as well. So don't wrongly state that their electricity charges are lower because of the taxation system. Some states have privatised their electricity utilities and Temasek has a share in one of Victoria's many privatised electricity companies.

3. Ask the government to open its accounting books ,then for the sake of transparency . I await it with bated breath.

-

Originally posted by maurizio13:

1) GDP per capita is not a precise yardstick to measure the standard of living. Take Taiwan for instance, a GDP per capita of USD 16,500 while Singapore with a GDP per capita of USD 35,000.

http://en.wikipedia.org/wiki/List_of_countries_by_GDP_(nominal)_per_capita

Taiwanese food & beverage workers get paid NT$ 37,313 per month (SG$1,696), while Singapore food & beverage workers get paid SG$1,654. Singaporean F&B workers actually get paid less than their Taiwanese counterparts, the Taiwanese GDP per capita is actually half that of Singapore. (SG$ 1 = NT$ 22)

http://eng.stat.gov.tw/mp.asp?mp=5

http://www.singstat.gov.sg/pubn/reference/mdsmay08.pdf

2) Did I question why senior management should get more, don't put words in my mouth again.

I said that in a crunch most senior management will take a higher percentage pay cut than the lower rank and file workers.

I said that in a crunch most senior management will take a higher percentage pay cut than the lower rank and file workers.3) Not that Singaporeans can compete on an equal footing, it's just that we are being made to compete on uneven ground. The foreign talent (FT), does not have much liabilities in Singapore. Compare a FT who sends back SG$100 to his folks in China, his parents will get RMB500, the parents can probably survive for above 2 weeks with that amount. Take a Singaporean who gives his parents SG$100. How long can SG$100 last in Singapore? With each meal costing $5 multiply by 2 person and 3 meals a day, it would cost $30 a day to maintain 2 elderlies (housing, transport and utilities not included). If both are frugal, most likely the $100 would last 3 days.

Don't be daft in thinking that we have to keep importing foreigners to maintain a competitive edge, only a regime deprive of any other ideas will resort to low balling a 3rd world country in terms of wages. If you keep importing FT without limits, you essentially deprive the citizen population of normal work, driving down wages to that of 3rd world countries like China and India and lowering standards of living for the entire population.

I think u statement is a reflection on the brain drain happening in this country in which 1000 locals gave up their local citizenship. -

Originally posted by fymk:

1. Charges for HK is for bed only so is SGH 's cost. OM is a doctor in UK - I won't trust what he says . He does not work in HongKong. Did you know SGH also charges patients for what you have mentioned? They have a sticker system :) . Peel the sticker and paste it on the patient's charge sheet. Toilet paper also charged .

2. Australian wages are also high to cover the costs of taxes. Plus hospital stay is free with heavily subsidised medicare and Pharmaceutical Benefits Scheme. Welfare is also covered as well. So don't wrongly state that their electricity charges are lower because of the taxation system. Some states have privatised their electricity utilities and Temasek has a share in one of Victoria's many privatised electricity companies.

3. Ask the government to open its accounting books ,then for the sake of transparency . I await it with bated breath.

Talk about brain drain. If post such as yours are a reflection of brain drain, it would literally be brains down the drain. What a waste of cerebral matter.How big is Australia?

What is their population size?

What are their resources?

What are their personal income tax?

Comparing Australia with Singapore on health care?

-

Originally posted by DeerHunter:

Talk about brain drain. If post such as yours are a reflection of brain drain, it would literally be brains down the drain. What a waste of cerebral matter.How big is Australia?

What is their population size?

What are their resources?

What are their personal income tax?

Comparing Australia with Singapore on health care?

Tax paying Australians I know are all cursing at the public hospital. most end up buying their own health insurance and seek private medical care. One of them even told me how impressed she was when she accompany her singaporean mum to our polyclinic. -

Originally posted by will4:

I think u statement is a reflection on the brain drain happening in this country in which 1000 locals gave up their local citizenship.

Strange isn't it? A country like Taiwan with half the value of GDP per capita as compared to Singapore, has a slightly higher average wage for it's workers.The issue with Singapore is the distribution of income, the bulk of it is concentrated at the top, while the poor gets pittance. They drive down the wages of below average income earners by increasing the supply of foreign talents. The lower wages increases the profitability of the company, which goes into paying off the stellar salaries of the CEO and higher management. A good part of those high flying CEOs are relatives of the regime. Folks such as LHY sitting in comfy seats getting big fat salary, bonus and stock options.

-

Originally posted by maurizio13:

Strange isn't it? A country like Taiwan with half the value of GDP per capita as compared to Singapore, has a slightly higher average wage for it's workers.The issue with Singapore is the distribution of income, the bulk of it is concentrated at the top, while the poor gets pittance. They drive down the wages of below average income earners by increasing the supply of foreign talents. The lower wages increases the profitability of the company, which goes into paying off the stellar salaries of the CEO and higher management. A good part of those high flying CEOs are relatives of the regime. Folks such as LHY sitting in comfy seats getting big fat salary, bonus and stock options.

There is a book on this country in which the investment for Suzhou or Biopolis went awry.

-

Originally posted by maurizio13:

"You are the guru in running away from the discussion by bringing in new issues, putting words in others mouth and profanities."

Right now, you are putting words into my mouth and making unfounded claims on my person. You just lost your credibility, and i will demolish every single one of your arguments easily, and with facts. Don't be smug, wiseguy.

"1) The charges for the 12 private hospitals ranges from HKD 320 (SGD 62.38 ) to HKD 900 (First Class Wards). I used HKD 450 to HKD 550 which is misleading,........ Maybe we should try comparing Hong Kong's Public Hospital and so called "heavily subsidised" Singapore Public Hospital.http://politics.sgforums.com/forums/10/topics/270194?page=2

Oxford mushroom had proven your misleading statements. Must you continue to tell half truth to support your useless overinflated ego? Others may want to click on that link above. I have no wish to continue to argue on the old point with a fool, debunked already by someone else.

Where did oxford mushroom prove to me that the cost of hospitalisation is less in Singapore as compared to Hong Kong? Please quote.

"b. )Our electricity rate is grossly overpriced when compared to a comparable country like Australia (in terms of GDP per capita).

.......Well I guess so long as Singaporeans are lapping it up, then it's not a big issue.

"

"You fool! How much tax do the Australians pay? Do you know they are one of the highest in the world? Of course they can show a lower cost to their direct charges. And you had been carrying on with this power costing to prove our govt of 'over-charging' as a smoking gun. But it only makes you look like another complete village idiot!

So now you are telling me the taxes that Singaporeans pay is related to Singapore Power? ACTEWAGL and HEC are related to the government and government will give them money to make their electricity cheaper. How come Singapore government never give Singapore Power money to make electricity cheaper?

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.

We pay more taxes than Hong Kong, we have GST and Hong Kong has low income tax rates and NO GST. Evidence already given to you, if you can't comprehend, I can't help it.2) 18% of $160 billions is $28.8 billions. $28.8 billions is the amount of investment revenue that the government has deprived it's citizen from, instead it is insistent on increasing GST and other charges to build up NKF type reserves for doomsday scenario that will never happen.

Doomsday scenario that will never happen? It's your belief, but the fact is, the country is facing an aging population whose tax contribution will dwindle down eventually. Then what? Add more taxes to our young. Go on with your beliefs, but people prefer facts than your fantasies.

Tax contribution dwindle then? The government also don't serve out welfare payouts for the aging. It's time they learn how to balance their budget by taking less pay, trim the fats from the Ministers, do away with redundant SM and MM. If you company makes less sales. 1) Do you as a CEO control your cost? or 2) Charge a higher price for all your products? What you are doing is raising your price with lower sales to boost profit margins so as to squeeze out more from consumers to pay for the astronomical salaries of your CEO, CFO, CIO, etc. Hardly a logical move for any competent CEO.

Don't worry our honourable Ministers will import more foreign talents to snuff out the old folks. Leave the old folks to their own devices on the MRT tracks lor. Less old folks, more foreign talents means more taxes and foreign workers levy. So a situation of more aging is quite impossible with the current influx of young foreign talents.

Not to mention the logic of your thinking is not sound, I have seen old folks in their 70s and 80s working, contributing to the economy. Having an active income which is taxed by the IRAS. Haven't the government promoted the idea of old folks working to the grave? What happened to this scheme? You threw out the government's scheme single handedly?

3) They couldn't cover up the NKF issue any more. I still remember when the mismanagement of NKF was raised, alot of the politicians said it's normal and even a politician's wife claim that it was peanuts compared to what the politicians are receiving. But as the event unfolds, more public anger ensued, that's only when the government stepped in.

You are maligning the govt without evidence. NKF is an individual issue by itself. If you have evidence of mismanagement on the management of our coffers, then prove it. IF not, then you are doing nothing more than to speculate and spread sedition.

Hahaha.....What did I malign?

You are just a sheepdog herding the sheeps with threats when you can't post a credible response. I am not a sheep, thus you can't herd me.

You are just a sheepdog herding the sheeps with threats when you can't post a credible response. I am not a sheep, thus you can't herd me.We have a surplus budget every year and we have investments from Temasek that are giving them 18% a year. The budget is separate from the investments in Temasek. Budget has surpluses and Temasek has investment returns of 18%. To whom does the money in Temasek belong to? Singaporeans or the Leegime? Isn't it common practice to return excess funds back to shareholders, in terms of share price increases or share repurchase schemes.

Again you malign the govt. Are you claiming that the investments returns went into the Lee's pockets? You better be more specific and back it up with facts, otherwise, you are again giving wild speculations and not facts. The returns belong to the People to be used for savings and further investments to generate more returns so that taxes can be kept low in years to come, more so when we have no resources to depend on.

I said what I said, whatever you infer from the statements with your limited comprehension ability is of your own maleficence, none of my doing. It's the usual threats from you when you can't respond to questions and points.

Don't be daft in telling us that CPF is risk free, but is it inflation risk free? Essentially any investment guaranteed by the central bank is risk free, because central banks have the authority to issue money. But issuing money indiscriminately would only result in inflation. The current forecasted inflation is in the region of 7-8% this year, interest rates in CPF only hovers around 2-3%. So citizens have been forcibly tied down into CPF decreasing their purchasing power for the future.

Investments on a short time frame is always risky, but the Singapore government with it's collective of CPF savings is able to iron out the creases from investments cycles (where stocks go down and up). Why are they able to iron out the uncertainty in investment cycles? It's because not everyone draws on their retirement savings at the same time.

Say with age bands from 20s, 30s, 40s, 50s, 60s and 70s. While the 70s year old band are drawing out on their retirement savings, the 20s to 60s are still contributing to their CPF accounts. Therefore if there was an investment downturn when the 70s are drawing on their retirement savings, the government is still able to hold on to their investments till the next boom of the investment cycles.

But what the government has done is take out the average returns from equity market of about 10% to 15% and replace it with a low yield 2% to 3% interest rate for CPF account holders. They have profitted the difference of 12% into the state coffers at the expense of CPF account holders.

You are the only one daft here. The CPF returns are guaranteed by the govt. As with guarantees, it is a promise which must be upheld. The safest way to ensure such promises can be realized is to offer lower returns. 18% returns today does not mean we will get 18% tomorrow. Whatever the excess, it is plough back into our coffers for savings, investments and social spending.

We are not talking about tomorrow we will be getting less than 18% dude. It's a cradle to death situation, you buy the stock, you hold it, reap the dividends and share price growth. Anybody would know that if you (as an individual) purchase the stock, the share price might decrease tomorrow, but in time, it will increase again. But with constraints to your needs of liquidity, you might need to sell at a lower price when you are in dire need of cash. But as the government holds the CPF money of all it's citizens, the citizens are locked in till retirement at 65 (assuming), there is no need for the government to force sell the investment to raise cash for somebody's retirement (only those above 65 or 70) will cash out. The government only need maintains a certain percentage in liquid assets and the rest in equity. The government can always print money to cover the CPF payouts, if say tomorrow all our investments are lost in the stock market. Can the government raise money to pay those in retirement? Yes, because the central bank can always print more money.