Bomb ticking for Oz banks off-balance gearings of 117 times

-

During my research on Oz subprime exposures,i find out

the more horrible data.

Altogether,oz banks have OFF BALANCE SHEET items

of gearings of 117 times , exposed to derivative positions.

Even one % of loss will wipe out all the banks'

share holders funds.

http://www.theaustralian.news.com.au/story/0,,23229288-7583,00.html

''Bomb ticking for off-balance banks''

Adele Ferguson | February 18, 2008

A TICKING bomb for the banking sector is its off-balance sheet activities, which at last count stood at $12.9 trillion.

Australian banks have a big exposure to derivative markets. Their total shareholder value of $110 billion is dwarfed by the size of the banks' collective exposure to derivative markets of $12.9 trillion.

Put simply, the total derivative positions of the banks are 117 times as big as the banks' shareholder value. If even 1 per cent of these derivatives contracts default because third parties at the other end get into trouble, the whole shareholder wealth would be wiped out and our banks could be broke.

Given total bank assets are $2.1 trillion, it begs the question why Australia's banks have exposure to $12.9 trillion of derivatives positions. All banks hedge to reduce risk, but this is a big amount of hedging.

For example, Westpac has a face value of $1.4 trillion in derivatives at September 30, 2007, compared with an equity base of $16 billion, which is a multiple of almost 100 times.

oz GDP is about A$1 trillion or 1,000,000 million or 1,000 billion.

US GDP is about US$14 trillion.

If u are a stake holder of oz,i suggest u spend ALL the free time of

next week to study this topic .

Fannies Mae gearings is about 70.

I am not belittle Oz,just want to blow the whistle!!

reference

http://www.rba.gov.au/Statistics/Bulletin/

Assets and Liabilities of Financial Institutions and Non-financial Sectors (B Tables)

Assets of Financial Institutions - B1

Banks – Assets - B2

Banks – Liabilities - B3

Banks – Consolidated Group Off-balance Sheet Business - B4

Sy Tr,pl dunt waste time.This is really a serious matter.

Help your frens in Oz and tell them,Let them decide.

u can quote the newspaper if u dunt want to offend them.

Tell them u come across this info .

May be he want to read.

or u pretend send the e mails to wrong person.

My dear fren,THis is not a drill.It is supported by official figures.

Dr Doom says he worry about UK and Oz.

i understand why now.

Insurers also fail

All company think they can hedge against the risks by buying insurance.

The fall of AIG speaks volume for this protection also not fool

proof.

Oz banks,i think,also adopt similiar protections.

The points are

U can see in the past 2 weeks u have to bite the bullets,even

u are very big.So,if oz banks loss in this gamble by little bit,

the consequences is not one or two or 3 big banks in trouble.

But the whole finance system.Possible outcome

-----oz dollar will drop like stone

-----share price drops fast

what else?

But,there is a slim chance that Oz banks may win.

What is the chance?

If u use $1 to do $ 117 business,it is not brave,but foolish.

@@@@@@@@@@@@@@

u can know every things about oz housing,finances,monetary

,reserves here:

http://www.rba.gov.au/PublicationsAndResearch/

PUBLICATIONS & RESEARCH

Statement on Monetary Policy

The Reserve Bank issues a Statement on Monetary Policy four times a year. These Statements assess current economic conditions and the prospects for inflation and output growth. A listing of these statements/reports is available under Reserve Bank Bulletin.Reserve Bank Bulletin

A monthly publication that contains economic commentary, feature articles, speeches and a set of statistical tables.Financial Stability Review

The Reserve Bank issues a Financial Stability Review half-yearly. These Reviews assess the current condition of the financial system and potential risks to financial stability, and survey policy developments designed to improve financial stability. -

So?

-

This is happening in Singapore....

AIG Singapore head resigns amid crisis

19/09/2008 - 08:03:54

The head of the Singapore unit of troubled insurance giant American International Group has resigned with immediate effect, the country’s central bank said today.

Mark O’Dell, general manager of AIA Singapore, has taken a leave of absence and Executive Vice President Kenneth Juneau will take over, said the bank, known as the Monetary Authority of Singapore.

AIG customers throughout Asia have cancelled policies this week amid fears AIG would follow investment bank Lehman Brothers Holdings into bankruptcy.

AIA Singapore headquarters has been flooded this week with thousands of nervous policyholders seeking to find out the status of their policies or cash them out, even after the US Federal Reserve pledged an 85 billion-dollar loan to prop up AIG.

The company said in a statement today that any policyholder who terminated their policy this week would be allowed to reinstate it during the next two weeks without penalty.

“We have received feedback that many of our customers are now more reassured of AIA Singapore’s financial position,” said Mark Wilson, regional president of AIG Life Companies in Asia Pacific.

“So we have offered this policy conservation programme to those policyholders who reacted to the uncertainty of recent developments at AIG.”

Less than 0.1 %, or about 2,000, of the company’s 2 million in force policies in Singapore – a nation of 4.6 million people – have been terminated this week, the company said.

Both AIA Singapore and the central bank reiterated that the company’s policies are safe.

“AIA maintains separate insurance funds for all policies,” the company said.

“AIA Singapore has more than sufficient capital and reserves above the regulatory minimum requirements to meet our obligations.”

AIG provides services in 130 countries, including China, Japan, South Korea and Taiwan. -

This is also not a drill:

Singapore AIA chief resigns as surrendered policies rise (2nd Roundup)

Singapore - The Singapore chief of American International Assurance Co (AIA) resigned Thursday as surrendered policies mounted with hundreds of customers unconvinced of the insurer's soundness.

Mark O'Dell - who has been trying to persuade policyholders that AIA, a unit of the troubled American International Group (AIG) Inc, could meet its obligations - was said to be joining a rival firm and a new general manager would start Friday.

The company said O'Dell's decision was not related to the three days of customers withstanding long lines and sweltering heat to enter its service center. By the end of Thursday, those waiting were given numbers and told to return Friday.

'Even with the AIG bailout by the US government, everything is still uncertain,' said Karen Tan, a 42-year-old woman with no intention of keeping her policies.

The US Federal Reserve's 85-billion-US-dollar loan to AIG provided little solace and so many more questions in Singapore that the insurer opened a second service centre in the AIA Tower next door.

AIA said 2,500 policies had been returned by customers.

'Our response is to focus on serving their needs as they come in,' O'Dell said earlier. 'If they want a loan or if they want to surrender, we're going to process it as properly as we can.'

Wary policyholders were also lining up in Taiwan and Hong Kong.

Reassuring statements from AIA and the Monetary Authority of Singapore that the insurer could meet its obligations were on prominent display.

The insurer was said to be studying the option of allowing customers who terminated their policies to reinstate them without having to pay a penalty.

The Monetary Authority, the city-state's central bank, urged customers against terminating their policies, noting they could lose coverage and suffer losses.

'Things might get worse, and they'll need more money,' a businessman who requested anonymity said. 'I won't take that risk.'

With 4,000 agents and more than 2 million policies in force, AIA is the largest insurance company in the city-state.

-

Temasek Selling Merrill Lynch

Half or total of 87m shares have been sold off at a loss, according to US recorded filings. By Seah Chiang Nee

Jul 24, 2008Temasek Holdings has sold off half its ill-timed investment in Merrill Lynch - or about 87m shares, according to a mutual funds report on institutional trades on US stocks.

The online report, MFFAIRS (Mutual Fund Facts About Individual Stocks), reported it sold off 86,949,594 shares (50%), leaving a current holdings of 86,949,594 shares (50%), according to the filings made public.

The report gave no exact date or price of the sale.

(Update: Making no reference to Mffairs reported sale, aTemasek source says its ML shareholding has remained unchanged at 86.9m since March. See accompanying story).Neither has there been any confirmation from Temasek, which had paid US$48 a share last year. http://www.mffais.com/newsarticles/2008-07-22/2473637-211738.html

Last week Merrill Lynch was traded at $31.

At that price Temasek would have suffered a loss of $17 a share - or a total loss of about US$1.48b for the 87mil shares.

Despite massive write-downs and capital injection, Merrill Lynch's outlook remains uncertain, reports Bloomberg.

The company's equity capital position is weak relative to competitors, said Brad Hintz, a New York-based analyst at Sanford C Bernstein, reports Ambereen Choudhury.

"With $19.9b in CDOs still frozen on the balance sheet and with counterparty risk rising on the hedges underlying these troubled positions, the potential for additional material write-downs remains a concern,” Hintz said.

The New York-based firm's credit rating was cut last week by Moody's Investors Service to A2 from A1.

The third-biggest US securities firm probably will report a loss of $6.57 a share this year, compared with an earlier forecast of $1.07, Hintz said.

The revised estimate assumes the company generates no earnings in the second half.

Merrill may have to take an additional $10 billion of pre-tax write-downs related to its holdings of mortgage securities, Moody's estimates.

Huge paper losses

The disposal leaves Temasek Holdings and the Government Investment Corporation (GIC) still holding substantial parts of big troubled Western banks.Its remaining investments in UBS (Switzerland), Citigroup, Barclays and Merrill Lynch - at an original cost of US$21.88b - have declined on by some 47 percent in value.

That is a paper loss of US$10.28b. However, Minister Mentor Lee Kuan Yew had said these investments were made as a long-term strategy of 30 years.

But as the Merrill Lynch sale shows, Temasek is not inflexible about cutting losses, if things threaten to get worse.

The political leadership has defended its investment of these sub-prime banks as “an opportunistic” foray that can happen once in a long while.

It believes these companies will survive the crisis and emerge stronger.

Some experts believe that Temasek has made an error of judgment.

Investment guru Jim Rogers said in July he believed that US bank stocks could fall further and predicted that Singapore's state investors would lose money on Citigroup and Merrill Lynch.

"I'm shorting investment banks on Wall Street," the successful investor said. "It grieves me to see what Singapore is doing. They are going to lose money."

At the Nomura Dialogue recently, Minister Mentor Lee Kuan Yew reported to investment mistakes, but that no one had benefited from it.

Singaporeans who want to see greater transparency in the government’s investments in troubled companies are unhappy with this vague answer to a serious problem.

One writer said, “Should we just move on? I do not think so. The patently huge mistake is not merely the result of recklessness but rather a systemic lack of accountability in making some of our largest investments.

“Let it be clear, the harm is terminally done. The entire reserves system must be re-examined and audited.”

Said slohand, "I saw the interview on TV last night and felt shortchanged.

"He brushed aside the issues with the logic that since the officers who made the decisions were not the beneficiaries in any sense of the word, such lapses are mistakes and are therefore acceptable...

"..The size indicates that it can only come from the very top."

The skies are dark but the storm has not broke yet.

By Seah Chiang Nee -

http://www.todayonline.com/articles/267205.asp

With Merrill shares now selling at a huge discount to the US$48 ($65) apiece that Temasek paid last year, this would have meant a massive loss of some US$1.48 billion at Thursday’s close of US$31 a share.

Dismissing the rumours, Temasek’s managing director for corporate affairs said: “Temasek does not comment on speculation from dubious sources.” Warning investors against trading on such rumours, she added: “Investors and interested public are advised to refer only to official sources of information for announcements on major transactions.”

.Bloomberg said that according to data that it compiles, there were no filings relating to Temasek’s stake in Merrill in the past week. It also said that the New York-based company ranks second behind Citigroup in posting the most amount of writedowns and losses triggered by a global credit contraction..Last week, Merrill reported a wider-than-estimated second-quarter loss of US$4.65 billion..Besides its stake in Merrill, Temasek and the Government of Singapore Investment Corporation (GIC) invested some US$22 billion in Swiss banking giant UBS, Citigroup, and Barclays in the wake of the sub-prime crisis..Some feel that Temasek had overpaid for these investments in a weak equities market. They appear to have a case as these investments, including Merrill, have declined by some 47 per cent in value.

-

Originally posted by Panache1976:

Don't be misled by people who have never done any investments. Paper losses are still losses. To say otherwise is self-delusion. To put the losses in perspective:

10,000,000,000 divide by 3,000,000 (Singapore citizens) = $3,333 per citizen

That is the cost of bad judgement.

-

(RTTNews) - The Singapore stock market on Friday halted the three-day losing streak that cost it more than 40 points or 1.5 percent while sending the market to a fresh 22-month closing low. Now the Straits Times Index is tipped to head back to the downside on Monday, possibly handing back support at 2,700 points that it regained last week.

-

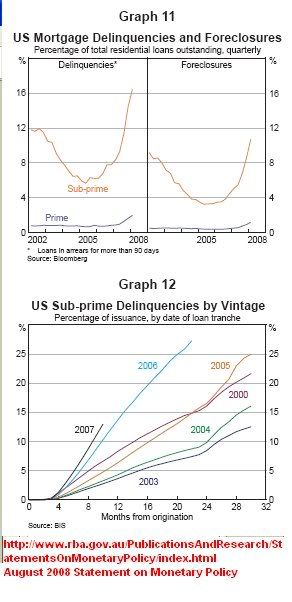

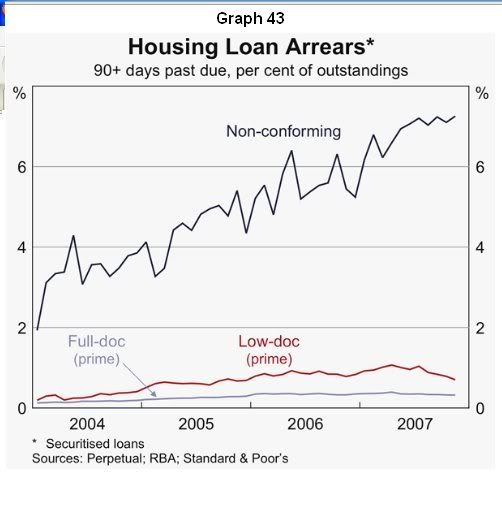

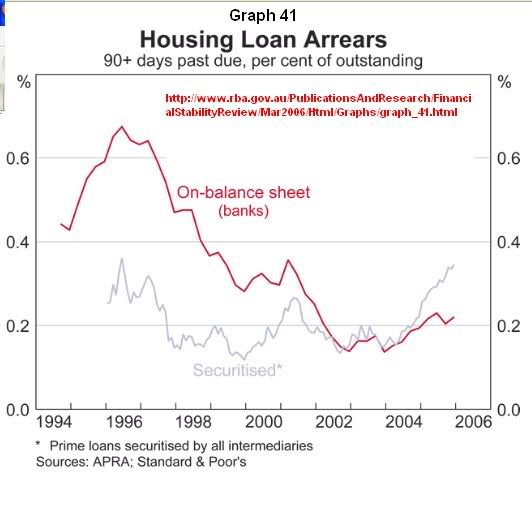

Oz defaulting rate is very low in first world standard.

The biggest debt collector in Oz said the reality may be 4 times higher.1

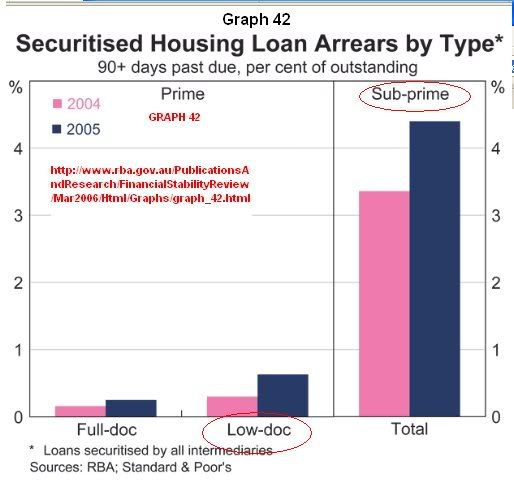

However,oz also get the

A.securitaization and

B .sub prime lending,in oz called non--conforming loan .

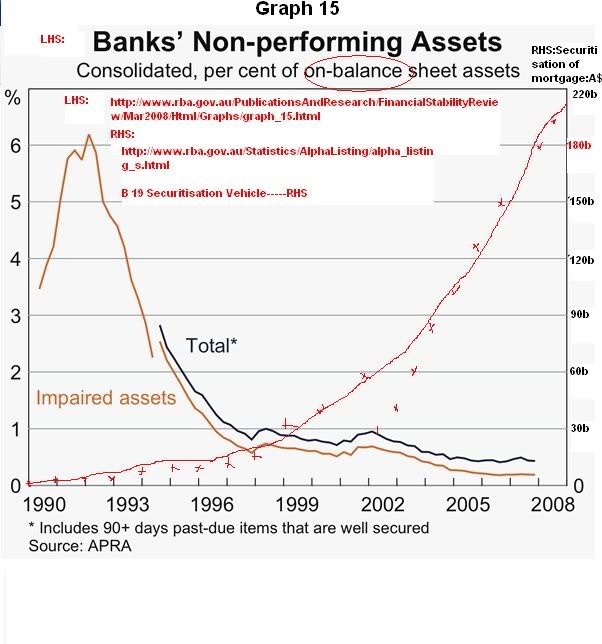

In Oz,all loans once secuitized,are removed out of balance sheet.

So,it is intersting to note the very low rate of defaulting.

This may be the reality.But it is also achieved by

hidden in securitization.

US--the older is the loan,the lower defaulting rate.

u can compare prime and sub prime defaulting rates in US and Oz.

NON-conforming = sub prime in US

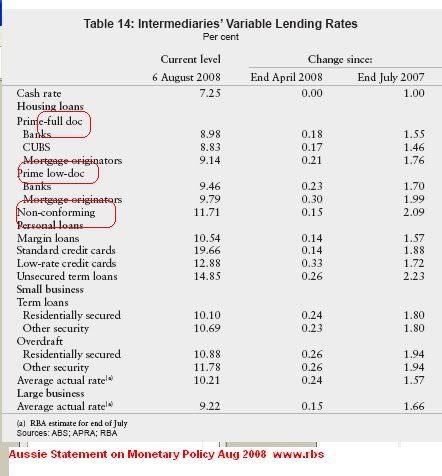

above--This show Oz also get Full document and low document

and sub prime lending,which in Oz is officially called

NON CONFORMING mortgage.Low document mean short

of document to prove income.

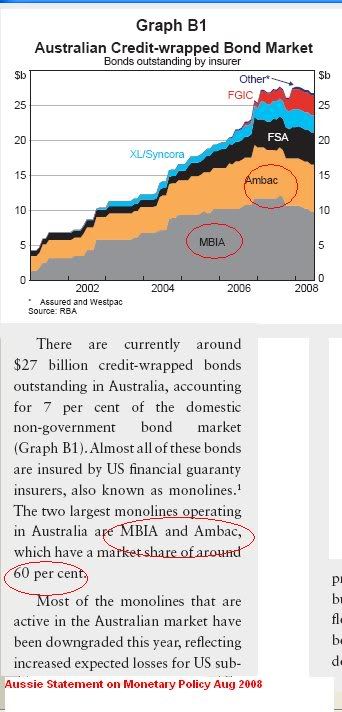

above--Securitisation of mortgage in OZ is A$220 billion in early 2008.

2.This show Oz get Off-balance sheet assets or liability!!

different mortgage rates for mortgages of different risk .

NON conforming = US sub prime

this show there are OFF balance assets and liability.

mbia.com and ambac.com in poor shape in US.

@@@@@@@@@@@@@@@@@@@@@

The A$12.9 trillion off the balance sheet obligations in Oz banks

is the real problems.The Oz BANKS may win a lot or lose a lot.

Have the few big US investment banks pulled down by off the balance

oiligations and the COUNTER PARTS RISKS?

Eg the insurers, who suppose to compensate you when your trading

counterpart cannot fullfil his obligations,also cannot pay,like AIG!!

This is also COUNTER PART RISKD.

....

1. http://www.theaustralian.news.com.au/story/0,20867,21739387-2702,00.html

-

12 small retail banks in US already fell.

Few big investment banks in US fell---,Merrill,Lenman,and Bears B.

Oz also adopts same biz model,but may be in a smaller scale,

in GDP %.

http://www.sgforums.com/forums/10/topics/331012

Oz top investment bank Macquarie;Babcock & B,lost 65 & 97%

This is no suprise we hear the above news.

http://www.asx.com.au/asx/research/CompanyInfoSearchResults.jsp?searchBy=asxCode&allinfo=on&asxCode=BNB#chart

Banks on balance sheet assets

$2.2 T .

http://www.rba.gov.au/PublicationsAndResearch/FinancialStabilityReview/Mar2008/Html/list_of_tables.html#table_2

-

I am appalled by your concern for Australia, seems like you are more interested in Australian issues than Singaporean issues.

You can't better yourself as a person if you look outside for other's mistakes and make excuses for your own failure. To better yourself look at your own mistakes and improve on them. Perhaps this advice will give you a new impetus to look at yourself from a new perspective. Take yourself for example, through the years of posting, you still have not made any improvement in your English. A result of your looking for others mistake to put the blame on, thereby elevating yourself.

You can't better yourself as a person if you look outside for other's mistakes and make excuses for your own failure. To better yourself look at your own mistakes and improve on them. Perhaps this advice will give you a new impetus to look at yourself from a new perspective. Take yourself for example, through the years of posting, you still have not made any improvement in your English. A result of your looking for others mistake to put the blame on, thereby elevating yourself.

Don't worry much, I am sure the Australian Banks will do fine if they have the support of the government. ST Telemedia bought over 100% of Global Crossing in 2003, it has been making USD 300 million losses every year, yet it still managed to survive till today. So don't underestimate the prowess of government financing.

http://www.sgforums.com/forums/10/topics/235957

http://investors.globalcrossing.com/

-

Net foreign debts and many info

$600 billion

http://www.rba.gov.au/Statistics/AlphaListing/alpha_listing_f.html

u can know every things about oz housing,finances,monetary

,reserves here:

http://www.rba.gov.au/PublicationsAndResearch/

PUBLICATIONS & RESEARCH

Statement on Monetary Policy

The Reserve Bank issues a Statement on Monetary Policy four times a year. These Statements assess current economic conditions and the prospects for inflation and output growth. A listing of these statements/reports is available under Reserve Bank Bulletin.

Reserve Bank Bulletin

A monthly publication that contains economic commentary, feature articles, speeches and a set of statistical tables.

Financial Stability Review

The Reserve Bank issues a Financial Stability Review half-yearly. These Reviews assess the current condition of the financial system and potential risks to financial stability, and survey policy developments designed to improve financial stability.

-

All the better that the Australian Bank fails, then alot of Singaporeans can afford to emigrate there and grab up all their housing.

Hooray!!!

We Hail Australia!!!

We Love Australia!!!

-

Temasek Selling Merrill Lynch

Half or total of 87m shares have been sold off at a loss, according to US recorded filings. By Seah Chiang Nee

Jul 24, 2008Temasek Holdings has sold off half its ill-timed investment in Merrill Lynch - or about 87m shares, according to a mutual funds report on institutional trades on US stocks.

The online report, MFFAIRS (Mutual Fund Facts About Individual Stocks), reported it sold off 86,949,594 shares (50%), leaving a current holdings of 86,949,594 shares (50%), according to the filings made public.

The report gave no exact date or price of the sale.

(Update: Making no reference to Mffairs reported sale, aTemasek source says its ML shareholding has remained unchanged at 86.9m since March. See accompanying story).Neither has there been any confirmation from Temasek, which had paid US$48 a share last year. http://www.mffais.com/newsarticles/2008-07-22/2473637-211738.html

Last week Merrill Lynch was traded at $31.

At that price Temasek would have suffered a loss of $17 a share - or a total loss of about US$1.48b for the 87mil shares.

Despite massive write-downs and capital injection, Merrill Lynch's outlook remains uncertain, reports Bloomberg.

The company's equity capital position is weak relative to competitors, said Brad Hintz, a New York-based analyst at Sanford C Bernstein, reports Ambereen Choudhury.

"With $19.9b in CDOs still frozen on the balance sheet and with counterparty risk rising on the hedges underlying these troubled positions, the potential for additional material write-downs remains a concern,” Hintz said.

The New York-based firm's credit rating was cut last week by Moody's Investors Service to A2 from A1.

The third-biggest US securities firm probably will report a loss of $6.57 a share this year, compared with an earlier forecast of $1.07, Hintz said.

The revised estimate assumes the company generates no earnings in the second half.

Merrill may have to take an additional $10 billion of pre-tax write-downs related to its holdings of mortgage securities, Moody's estimates.

Huge paper losses

The disposal leaves Temasek Holdings and the Government Investment Corporation (GIC) still holding substantial parts of big troubled Western banks.Its remaining investments in UBS (Switzerland), Citigroup, Barclays and Merrill Lynch - at an original cost of US$21.88b - have declined on by some 47 percent in value.

That is a paper loss of US$10.28b. However, Minister Mentor Lee Kuan Yew had said these investments were made as a long-term strategy of 30 years.

But as the Merrill Lynch sale shows, Temasek is not inflexible about cutting losses, if things threaten to get worse.

The political leadership has defended its investment of these sub-prime banks as “an opportunistic” foray that can happen once in a long while.

It believes these companies will survive the crisis and emerge stronger.

Some experts believe that Temasek has made an error of judgment.

Investment guru Jim Rogers said in July he believed that US bank stocks could fall further and predicted that Singapore's state investors would lose money on Citigroup and Merrill Lynch.

"I'm shorting investment banks on Wall Street," the successful investor said. "It grieves me to see what Singapore is doing. They are going to lose money."

At the Nomura Dialogue recently, Minister Mentor Lee Kuan Yew reported to investment mistakes, but that no one had benefited from it.

Singaporeans who want to see greater transparency in the government’s investments in troubled companies are unhappy with this vague answer to a serious problem.

One writer said, “Should we just move on? I do not think so. The patently huge mistake is not merely the result of recklessness but rather a systemic lack of accountability in making some of our largest investments.

“Let it be clear, the harm is terminally done. The entire reserves system must be re-examined and audited.”

Said slohand, "I saw the interview on TV last night and felt shortchanged.

"He brushed aside the issues with the logic that since the officers who made the decisions were not the beneficiaries in any sense of the word, such lapses are mistakes and are therefore acceptable...

"..The size indicates that it can only come from the very top."

The skies are dark but the storm has not broke yet.

By Seah Chiang Nee -

MAS urges AIA policyholders not to terminate policies hastily

By Pearl Forss/Ryan Huang/Wong Siew Ying, Channel NewsAsia | Posted: 16 September 2008 1542 hrs

Photos 1 of 2

Related Videos

MAS urges AIA policyholders not to terminate policies hastily

Special Report

• The Credit Crisis SINGAPORE : The Monetary Authority of Singapore (MAS) has urged AIA policyholders not to act hastily to terminate their insurance policies, as queues formed outside AIA's offices on Tuesday, with some clients seeking to end their policies.

AIA is a subsidiary of New York-based American International Group (AIG) - one of the world's largest insurers - which has been hit by the financial meltdown. Some Singaporeans are concerned that AIG could be the next financial giant to fall after Lehman Brothers.

With regards to AIG, MAS said: "The value of these assets is not linked to AIA's or AIG's financial condition, but like all investments, their value may be affected by general market conditions."

The MAS assured the public that "AIA currently has sufficient assets in its insurance funds to meet its liabilities to policyholders".

It advised policyholders not to act hastily to terminate their insurance policies as they may suffer losses from the premature termination and lose insurance protection.

MAS explained that there are regulatory requirements, ensuring that all insurance companies maintain statutory insurance funds, including an investment-linked fund. This fund is segregated from its head office and other shareholders' funds.

Within these funds, insurance companies must maintain sufficient assets to meet all its liabilities to policyholders, which include participating policies and investment-linked policies.

MAS monitors the situation closely, and requires insurance companies in Singapore to manage their investment risks carefully.

The MAS will continue to monitor the financial health of AIA. It added that a Policy Owners Protection Fund could also be set up, if necessary.

Meanwhile, many policyholders waited outside AIA's office to find out if AIA will be among those that will be hit by the credit crisis in the US. A queue started since morning and some had to wait for up to four hours.

A few long-term AIA policyholders told Channel NewsAsia that they wanted to surrender their policies, despite incurring losses for premature termination.

One of them, 51-year-old Morgan Krishnan, is not taking any chances. He has decided to terminate three life insurance policies - for himself and his two sons.

He said: "I have been monitoring this for a few years, and I am giving up right now... I will make some returns, I will not make any loss."

Meanwhile, another policyholder said: "I just want to cash out the policy, and I have no intention of putting my money here anymore."

Yet another said: "I contemplated surrendering it a few years ago, so I guess it's about time."

And another noted: "AIG was mentioned in those reports, so we just wanted to make sure that whatever we have is going to be safe."

However, some policy holders are optimistic and confident that the MAS has the situation under control.

AIA has about two million policies which are in force in Singapore. In a statement, AIA said it maintains separate insurance funds for all policies issued by its Singapore arm.

Despite the short-term liquidity pressures, it assured that the company has sufficient capital to meet its obligations to policyholders. - CNA/ms -

Queues gone at AIA, but fears still remain

The queues have gone at the AIA customer service centre at Finlayson Green.Only a few dozen people were seen inside the customer service area.

This is in part due to better crowd control measures that saw queue numbers being issued a day ahead of appointment.

Policyholders who turned up today were told to return on Monday morning.

But customers still fear the worst, with confidence dropping after AIA announced yesterday the resignation of its General Manager, Mark O' Dell.

AIA says the departure was "in no way related to the recent developments at parent company AIG."

Mr O'Dell resigned on the same day he took out a full-page newspaper advertisement to reassure AIA's customers about the company.

Some customers interviewed by 938LIVE said that Mr O'Dell's resignation cancelled out some of the reassurances given by the Monetary Authority of Singapore.

A policyholder who only wanted to be known as Alan, said he had cancelled his policy on Monday.

Following a statement by MAS that asked policyholders not to panic and take flight, Alan had considered reinstating his policy.

But Mr O'Dell's departure has left him in doubt again.

"There's a bit of doubt, you see. The worry is there, especially when the top guy himself, left the company. So there's bit of worry."

Eileen Chua, another client making inquiries, said the news of Mr O' Dell's leaving, has pushed her towards surrendering her policies.

"Of course I panic. (There's) money concerned. If anything happens, I myself have to bear."

AIA Singapore said only a fraction of policyholders, some 2,500 had cancelled, and announced measures to woo back their clients.

Out of this 20 have reinstated their policies.

AIA has 2.5 million policies in force in Singapore.

-

UNCERTAIN FUTURE?

Future of Singapore

This is a subject of rising concern despite the media's glowing employment figures. By Derek Wee

Oct 12, 2006When I read the Straits Times article (dated 24 Sep) on PM Lee calling the young to be committed and make a difference to Singapore, I have so much thought about the issue.

I am 35 years old, graduated from University and gainfully employed in a multinational company. But I cannot help but feel insecure over the future of Singapore. Lets face it, it's not uncommon to hear, "when you are above 40, you are over the hill".

The government has been stressing on re-training, skills upgrading and re-adapt. The fact is, no matter how well qualified or adaptable one is, once you hit the magical 40, employers will say, "you are simply too old".

We have been focusing our resources and problem solving on low unskilled labour. But in reality, our managerial positions and skilled labour force are actually fast losing its competitiveness.

I travel around the region frequently for the past 10 years. It didn't take me long to realise how far our neighbours have come over the past decade.

They have quality skilled workers, and are less expensive. When I work with them, their analytical skills are equally good, if not better than us.

It's not new anymore. Taxi drivers are fast becoming "too early to retire, too old to work" segment of the society. I like to talk to taxi drivers whenever I am heading for the airport.

There was this driver. Eloquent and well read. He was an export manager for 12 years with an MNC. Retrenched at 40 years old. He had been searching for a job since his retrenchment.

Although he was willing to lower his pay expectations, employers were not willing to lower their prejudice. He was deemed too old. I wouldn't be surprised if we have another No. 1; having the most highly educated taxi drivers in the world.

On PM Lee calling the young to be committed and make a difference. Look around us. How dedicated can we be to Singapore when we can visualise what's in store for us after we turned 40? Then again, how committed are employers to us? But we can't blame them. They have bottom lines & shareholders' gain to answer to.

Onus is really on the government to revamp the society. A society that is not a pressure cooker. A society that does not mirror so perfectly, what survival of the fittest is.

But a society, where it's people can be committed, do their best and not having to fear whether they will still wake up employed tomorrow. Sadly, Singapore does not offer such luxuries and security anymore.

On the issue of babies. The government encourages us to pro-create. The next generation is essential in sustaining our competitive edge. Then again, the current market condition is such that our future has become uncertain. There is no more joy in having babies anymore; they have become more of a liability. It's really a chicken and egg issue.

Many of my peers, bright and well educated have packed up and left. It's what MM Goh called "quitters". It's sad but true, Singapore no longer is a place where one can hope to work hard their lives and retire graciously. It's really the push factor.

A future is something we sweat it out, build and call our own. Unfortunately, people like me, mid 30's going on 40's, staying put by choice or otherwise, we can't help but feel what lies ahead is really a gamble.

To PM Lee and the Ministers, we are on a different platform. Until you truly understand our insecurity, the future of Singapore to me remains a question mark.

(SPH rejected this letter - From: LocalSin)Comments

Richard Sim said,

Good article. keep it upKC said,

True to every word. I am in my 40s, and I experienced the same sentiment in the job market.Anonymous said,

that was a great blog!!

kinda make mi worry abt my future...Anonymous said,

Honestly, you echo my sentiments, It's true. Those that got their fate in their hands are self-employed ones.

Yes, keep it up!Anonymous said,

well written! You know what, I share the same sentiment, except that I do not pen my thoughts down.....

This is especially true to the reality, if not cruelty of this world. Despite the tripartite guidelines on non-discriminatory recruitment, if we look around us, the fact speaks for itself.......

At the end of the day, the ones that suffer the most are those from the middle class as well as those that are heading for their sunset... 40s & above.Anonymous said...

Great, welcome to the real world.... It's creepy but real that Singapore's future is so uncertain and bleak. Definitely something needs to be done for the future of Singapore and our next generation.Anonymous said,

Keep it up..man..You say it all...U hit the G spot of our life in Singapore.. Excellent writeout.. Should bring it up to our Government Feedback Section to tell them how hard our life is in S'pore if you reach 40....sigh..Anonymous said,

Hey!!! You write VERY WELL, but I´m surprised reading it, I didn´t know it was so difficult for you to work here when you are 40. In Europe to be in your 40´s mean to be in the perfect age - for business, for teaching, for EVERYTHING… also 50´s coz your experience!

Well, you can always have the possibility of moving, right? Although I don´t think a company would tell you to leave if you are doing good. AND YOU LOVE YOUR COUNTRY, YES? So… fight for being the best in your company and you´ll have the support of all your bosses. You are a good writer…

(from Spain)anonymous said,

This is a pro-biz government.

No use blaming them when voters

did not sent the right signals.

The people deserve the government.Anonymous said,

Sad that this country has regressed so much!

While we worry about the bleak and uncertain future, we open our arms to welcome so called FT talent/foreigners to seek greener pasture here! Goddamn!

What a revelation!Anonymous said,

Not only are babies a liability, but any thinking parent would be concerned about putting their kids through the same shitty system and let them suffer the same fate in the future.

The pink IC isn't worth much any more. It's sad. It didn't have to be that way. Many people are voting with their feet. The government is only too pleased when it happens - more cheap foreign workers can be imported as replacements. Notice employment stats use the term 'residents' instead of 'citizens', and 'residents' includes the PRs and even certain categories of work visa holders. Simply amazing.Anonymous said...

I am just over 50. I lost my job arround 50. There is no job available for the last few years searching despite my extensive experience/qualification. Some recruiters even told me I should retire and asked why should I bother to find a job. When I was around 30/40, I was always headhunted for well-paid jobs. But, now there is hardly any call from headhunters. Most companies do not respond to your write-in for job. It seems my skill/experience was highly sought in past years whereas it has suddenly become useless in recent years. Why? If you are still in your 30s or 40s, plan for your future NOW! It may be too late when you are at 50s. Migrating to Europe may be an option according to our friend in spain. CheersAnonymous said...

That happens when you have 140th reporting news here!

Truly Global city of residents not citizens?duracell said...

Good blog. And the implication of this trend is not lost on the young. Already we are seeing rising trends where people just want to make their pot of gold as fast as possible, and by any means necessary. The hit and run mentality, no more morals and ethics. This country treats its people like batteries with short lifespan. Use em, squeeze em and chuck em! -

Lehman's staff in Singapore face uncertain future

Francis Chan

The Straits Times

Publication Date: 16-09-2008

Two groups of people in Singapore have been left fretting over the demise of investment bank Lehman Brothers.

First, its staff of about 270 based at Suntec City who, industry sources say, should learn of their future today once it had been communicated from the bank's US headquarters overnight.

The second are investors who bought Lehman products and will now be wondering if they can get their money back.

Lehman, the fourth largest US investment bank, filed for bankruptcy protection on Monday, finally falling to the United States' sub-prime mortgage crisis.

When The Straits Times visited the bank's Singapore office Monday, security was tight and the media were refused access by Lehman.

But a canvass of the cigarette-smoking crowd at Suntec Tower Five painted a picture of gloom and uncertainty.

'We're prepared for the worst,' said one of Lehman's Singapore-based employees. 'You can imagine the gloom around the office.'

'It's a really bad time for us, especially when we don't really know what's going to happen to us here,' explained another who also declined to give his name.

'All we are authorised to say now is that it's still business as usual upstairs,' added a third staff member before stubbing out his cigarette and walking away.

'I just returned from a holiday and have no clue what's going to happen,' said another staff member who was seen leaving Tower Five with a trolley bag.

'But I guess I may now have to start looking for a new job - got any vacancies at The Straits Times?' he quipped.

Judging from the fact that a headhunter from recruitment firm Robert Walters was also spotted in the same lobby, at least some staff may find other work soon.

But when approached, the headhunter reluctantly said that she was just there for 'a meeting'.

Local banks here also could not shed more light at press time - most preferring to adopt a wait and see attitude.

An OCBC spokesman said the bank currently has no updates, but would be 'closely monitoring developments in the US and global financial markets'.

United Overseas Bank also said it is waiting for further clarification from 'the relevant parties' before it can assess the implications of Lehman's fall.

But its spokesperson said the bank's exposure to Lehman remains 'very small and insignificant'.

Although Singapore's largest lender DBS Group Holdings also said its direct exposure to Lehman is 'insignificant', it could not say the same for some of the investment products it used to distribute.

'On the retail front, some investment products DBS sold in the past, such as High Notes 2 and High Notes 5, have Lehman exposure,' said a DBS spokesperson.

Other small retail investors holding Lehman's products such as its Minibond series should also brace themselves for a big hit on their wallets, sources say.

Lehman's Minibond series are structured products widely held by retail investors in Singapore because of its previously high regular payment rate of about 4.8 per cent. But according to industry experts, a Lehman default would result in investors getting back only about 30 US cents for every US$1 invested.

-

Women's Table Tennis: Singapore's silver lines an uncertain future

Updated: 2008-08-16 20:50:46

(BEIJING, August 16) -- Singapore's success against the Republic of Korea in a titanic semifinal struggle that went the maximum five matches, guarantees the tiny city state its first Olympic medal in almost 50 years and will undoubtedly make their lead player, Chinese born Li Jia Wei, the toast of the town.

Li is already a hero in Singapore after her fourth place finish at the Athens 2004 Olympic Games. If that achievement brought her celebrity status, the team's guaranteed silver must surely have the paddlers looking forward to the feting they will receive on their return.

The players cannot be looking too far ahead, as they still have work to do in Beijing. It would likely be the biggest upset of the Beijing 2008 Olympic Games if the Singaporeans were to snatch gold from the Chinese team which is made up of the top three women players in the world rankings.

The Women's Team gold medal contest takes place on Sunday August 17.

"I feel very honored to get an Olympic medal for Singapore after 48 years of waiting", said Li Jia Wei. "We will give 100 per cent effort against China in the final but it doesn't matter whether we win or lose; for us it's already a victory, we have achieved our goal and in the final we will be under no pressure."

The Team silver, or gold, will be Singapore's first Olympic medal since 1960 when Tan Howe-liang won weightlifting silver in Rome.

Li is one of more than a dozen Table Tennis paddlers who are competing for countries in which they were not born. She is a Beijinger who moved to Singapore in the hope of competing internationally after failing to secure a place on the Chinese national team.

At the Beijing 2008 Olympic Games eight of the 16 men's teams have at least one player not born in the country. The rate is even higher among women's teams, where 12 of 16 teams are fielding athletes who are naturalized citizens.

Earlier this year the International Table Tennis Federation passed a new 'nationality' ruling for world title events, which has yet to be adopted by the International Olympic Committee.

The ITTF ruling requires players under the age of 15 to wait three years before being eligible to compete for their new country; players between 15 and 18 years of age must wait five years and players aged 18 years to 21 years must wait seven years. Players over the age of 21 at the time they emigrate will not be allowed to register to play for the adopted countries.

The new rule is being 'grandfathered' in, so it will not affect players like Li who are currently registered to play for their new country. However, as these athletes retire, and if the IOC adopts the nationality rule for the London 2012 Olympics Games, the composition and the fortunes of many countries' teams could change dramatically.

-

How lionnoisy?

Can you answer to all this?

-

Population: A redirection

As Singaporeans feel the over-crowdedness, Lee Kuan Yew reduces the optimum size in future to 5.5m. By Seah Chiang Nee.

Feb 13, 2008SIGNALLING a major redirection, Singapore’s political icon has reduced his own population projection for the future by up to 1.5 million people.

Minister Mentor Lee Kuan Yew has scaled down a projected 6.5 million population – mainly through immigration – by some 20% “to preserve a sense of comfort”.

He now prefers an optimum size of 5 million to 5.5 million, down from the 6 million to 7 million that he wanted two years ago. Currently the population stands at 4.6 million, so expansion has only a little way to go.

In 2005, he told a surprised nation that he foresaw a thriving global Singapore of 6 million to 7 million people by 2030.

That would place Singapore’s size just behind major cities like New York (8.2 million) and London (7.6 million). The time span for achieving this was revised from 30 years to 40-50 years.

Lee’s climb-down is as abrupt as his idea was two years ago; none received prior discussion in Parliament. He is now obviously convinced that there is not enough space in Singapore for such large numbers.

The Minister Mentor said last Tuesday: “I have not quite been sold on the idea that we should have 6.5 million. I think there’s an optimum size for the land that we have, to preserve the open spaces and the sense of comfort.”

Lee told a think tank seminar that he did not want to see Singapore going the way of Hong Kong – “just solid buildings, one blocking the sunlight of the other”.

The revision is more than to keep aesthetic values; it follows the adverse impact of the rapid demographic change in the past few years.

In some areas, there is serious over-crowding, especially on the roads and in public transport, as well as universities and hospitals (a fourth is being planned), which are straining public tolerance.

(Senior Minister Goh Chok Tong recently warned of potential friction between newcomers and locals.)

Singaporeans are fearful of being muscled out by foreigners in their own country. Critics have accused the government of treating them better than citizens on issues such as jobs, national service and education.

Others are worried about the future of this small city-state, which has the fourth densest population in the world.

Concerned at being pushed out of their comfort zone, more Singaporeans now opt to work or settle down abroad.

The brain drain is even hitting close to his family, Lee recently said.

His grandson Li Hongyi, who is studying economics in America on a government scholarship, recently advised his younger brother not to accept a scholarship.

The advice was apparently aimed at telling brother Hao Yi not to tie himself down by a bond to work for six years in Singapore, which is a condition of the financing.

It implies that the son of Prime Minister Lee Hsien Loong may be planning to work abroad after graduation.

The economy is also declining.

Job creation, which has always determined the rate of immigration here, is expected to slow significantly from almost 200,000 in 2007 to 60,000, a Citigroup research says.

The expected drop in employment this year is bound to slow down the number of foreign arrivals, irrespective of what the government wants.

Meanwhile, the authorities are tackling some of the public woes – packed trains and crowded roads during peak hours.

From 7.30am-9am and 5.30pm-7.30pm some stations are so packed that commuters are left standing to wait for the second or third train before they can get on board.

“Going to work every morning is a nightmare. It’s virtually impossible to be able to catch the first train that comes along. There are so many people in it,” said a clerical assistant, who has to start her day half an hour earlier.

Sometimes she would have to join others to make an extra trip upstream in order to make it.

A S$20bil plan has been announced to double the length of MRT tracks from 138km to 278km by 2020 by building two more lines, one of which will run underground.

Buses are also feeling the strain of the increase in population and a major revamp is under way.

The roads are getting clogged as people withstand some hefty costs (the most expensive in the world) to buy and operate a car.

To get motorists to use public transport, cars are taxed electronically every time they pass under some 71 gantries built across the island, the costs depending on location and time.

Recently, as the number of cars increased, more and more gantries were built and they moved from crowded highways to some residential neighbours.

One motorist who lives in non-congested Upper Bukit Timah Road complained that one was erected not far from his house. “This means that every time I drive out of my gate I pay a fee.”

-

from all these articles, i suddenly feel the gloom in our job sector... if i get retrenched at 40 due to whatever reasons (parent company in overseas closed, financial crisis or company closure) i think i'll probably not be employed ever again?

-

Originally posted by novelltie:

from all these articles, i suddenly feel the gloom in our job sector... if i get retrenched at 40 due to whatever reasons (parent company in overseas closed, financial crisis or company closure) i think i'll probably not be employed ever again?

hehehe... you have made a keen observation... maybe that is why lionnoisy, the assdog is so interested in Australia... he is either currently employed by an Australian MNC ( an afraid of being sacked), was kicked out for stupidity or have his application to migrate to Australia rejected for poor English language skills.... hahahahahahahaha....

-

...and he should ask his assmasters, the asspotss to bail out some of the Australian banks if what he says is true... it is hard to tell like in this example...

-

Upz!