Bomb ticking for SG banks off-balance gearings of 117 times?

-

Australia:

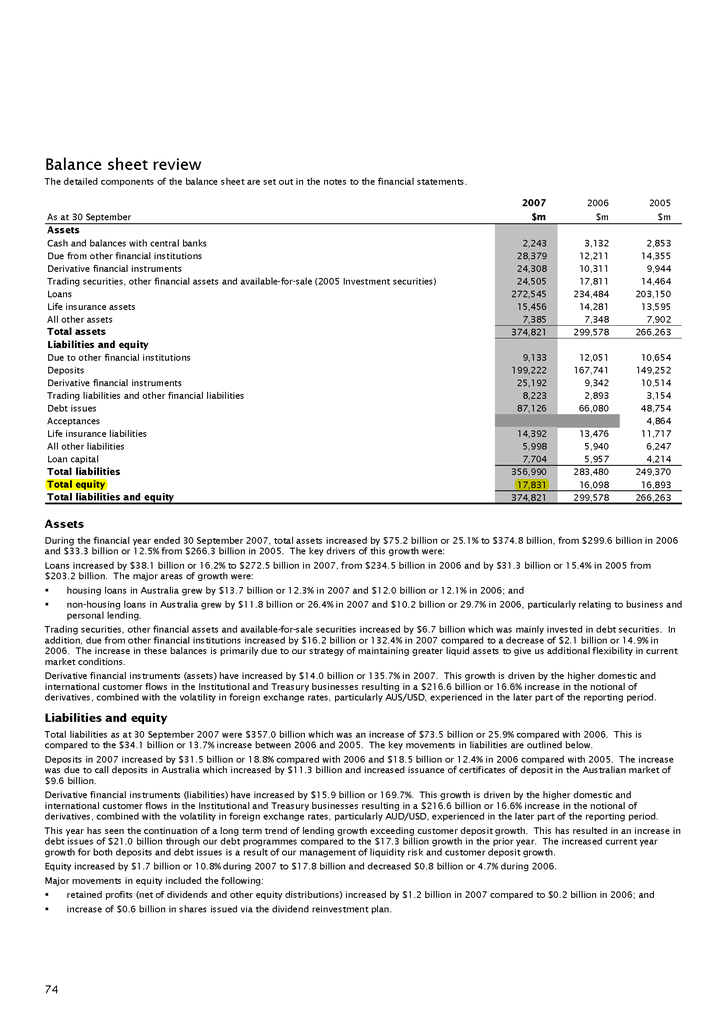

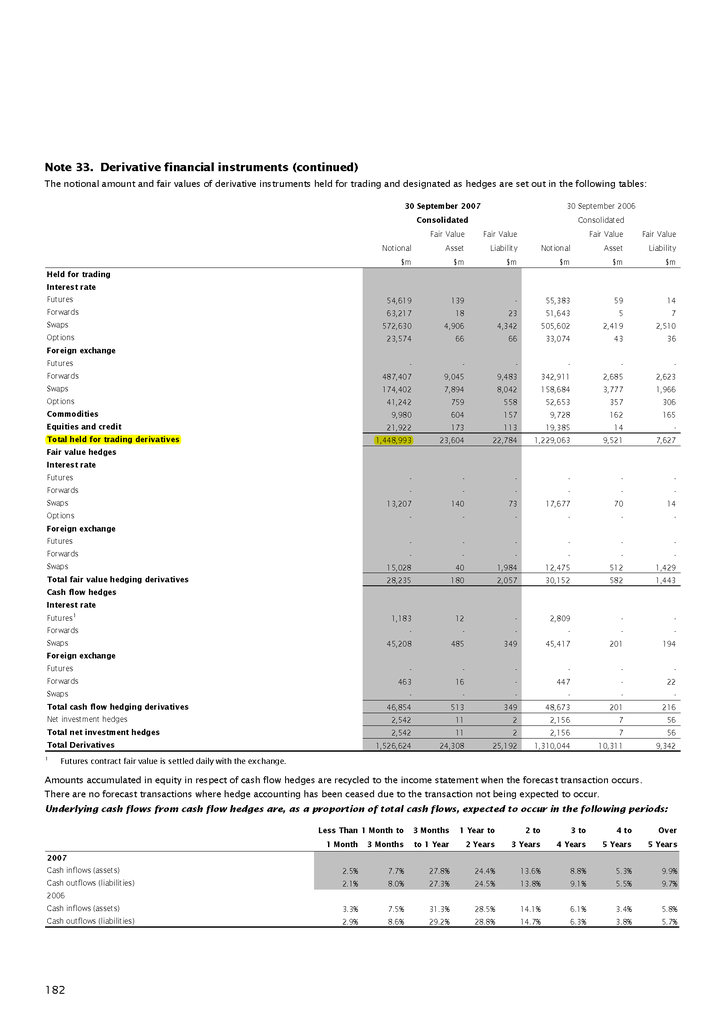

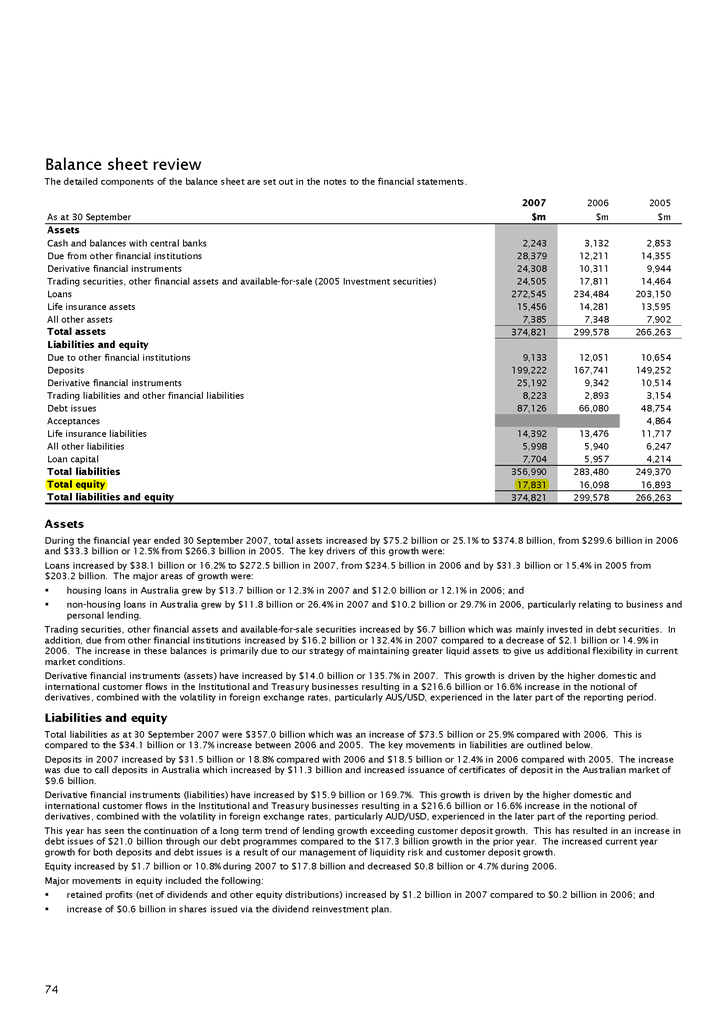

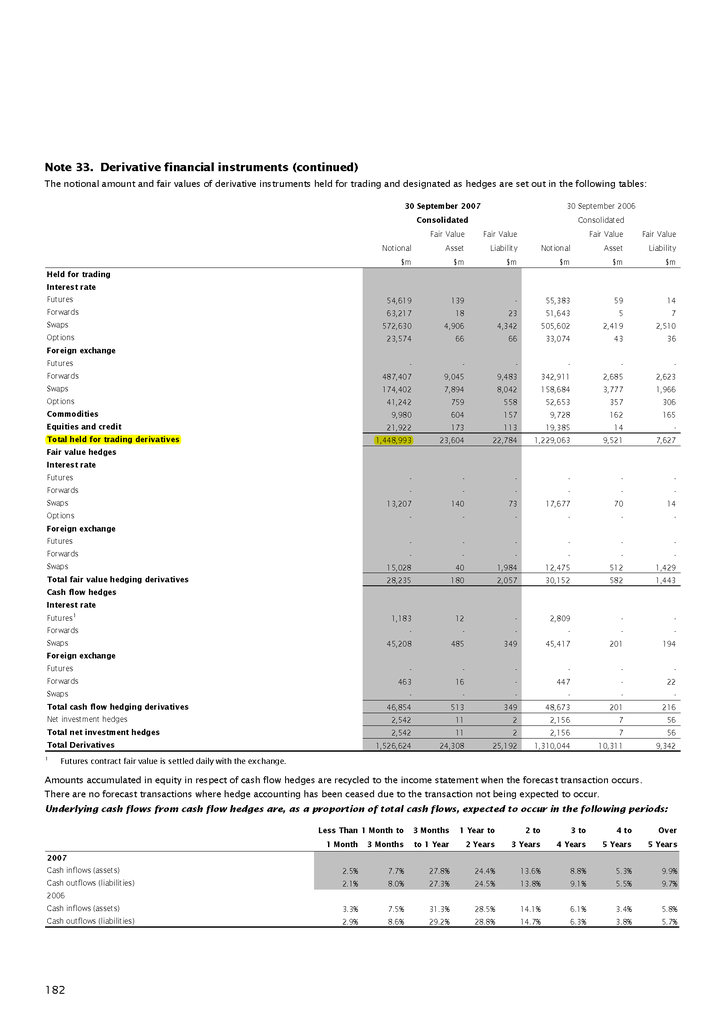

Interestingly I looked up the Westpac Bank (Australia), true enough it had a derivatives position of AU$ 1.449 trillon and an equity of only AU$ 18 billion.

Derivatives Gearing = 1,449 / 18 = 80.5 times

Singapore:

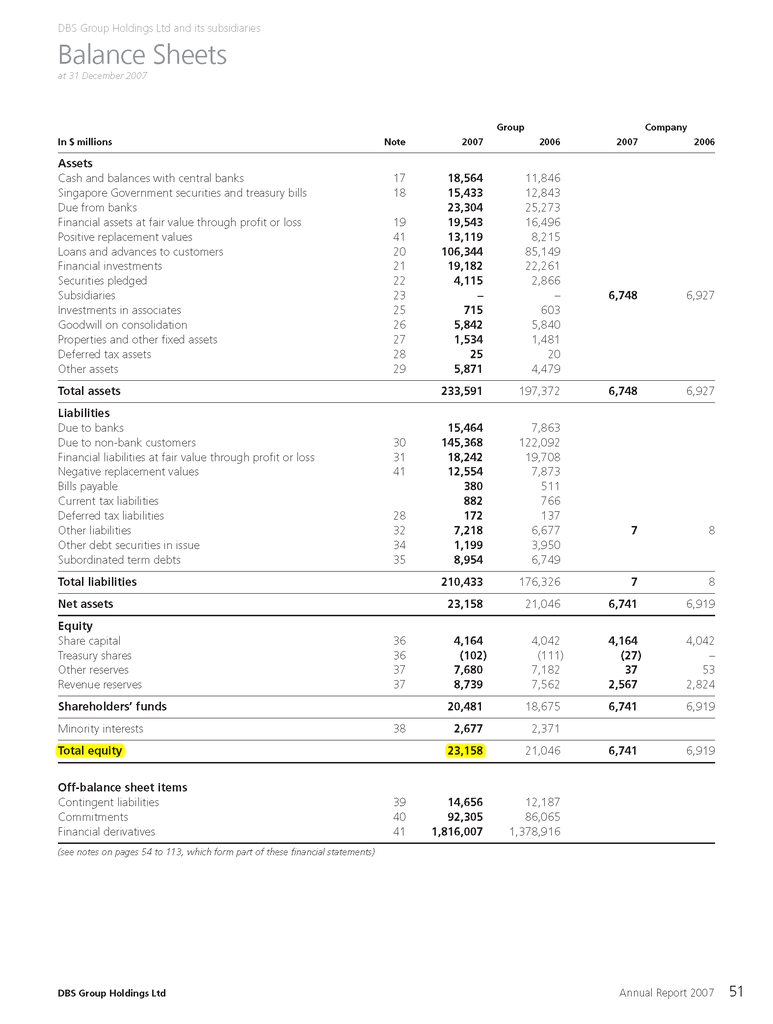

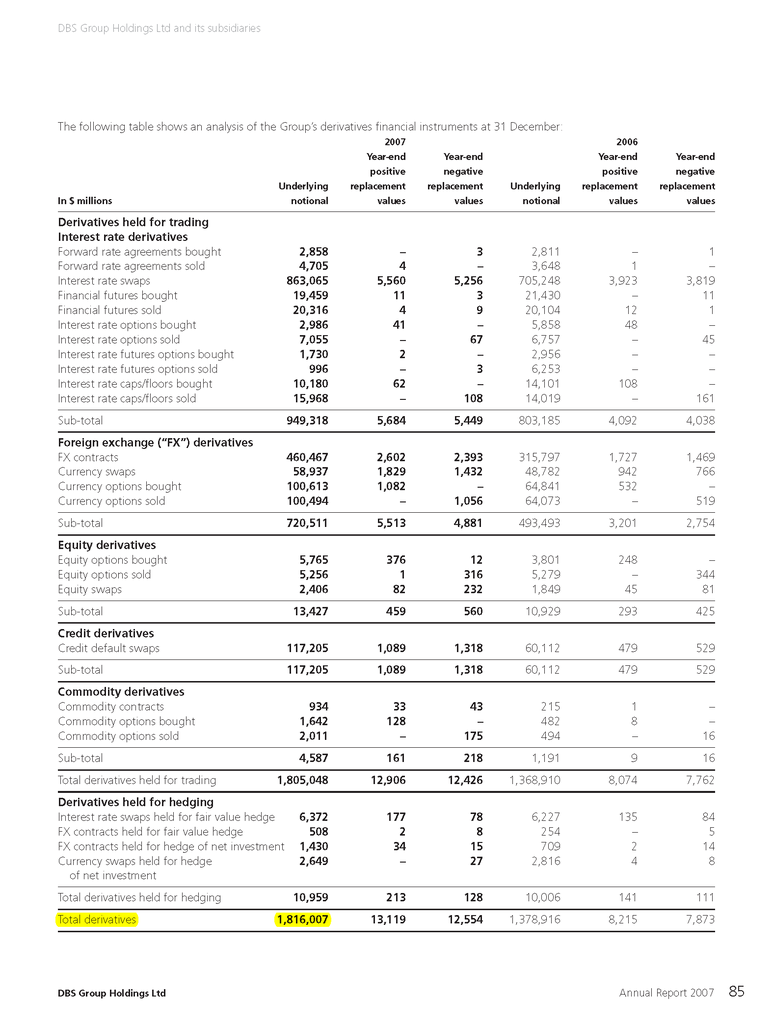

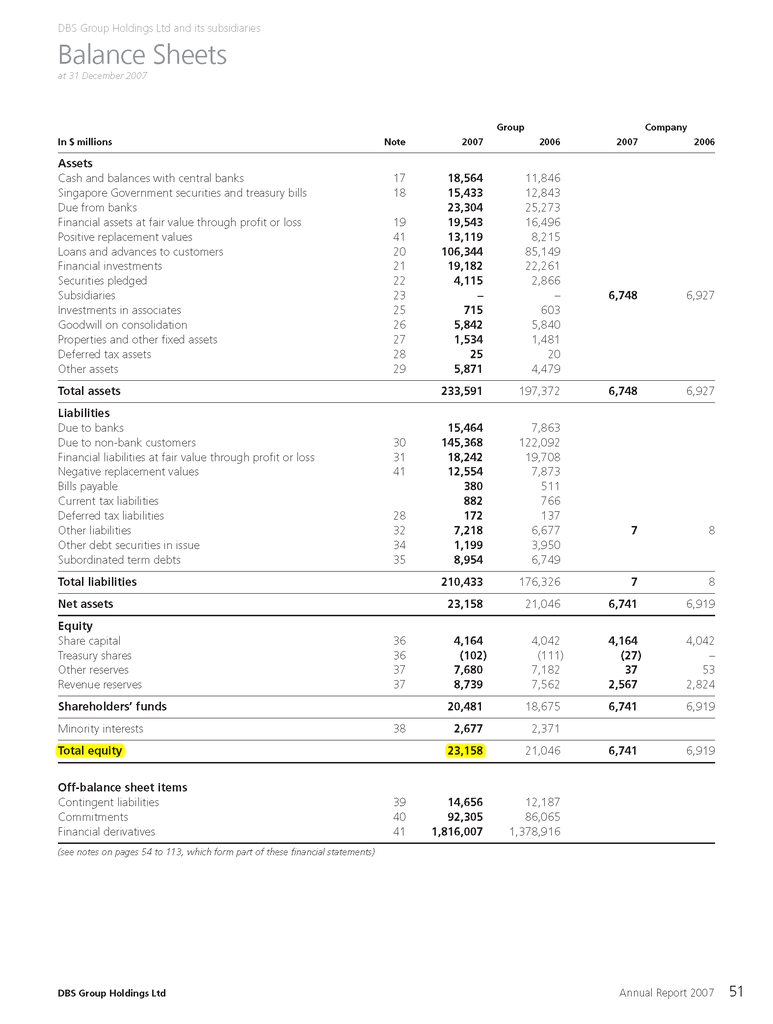

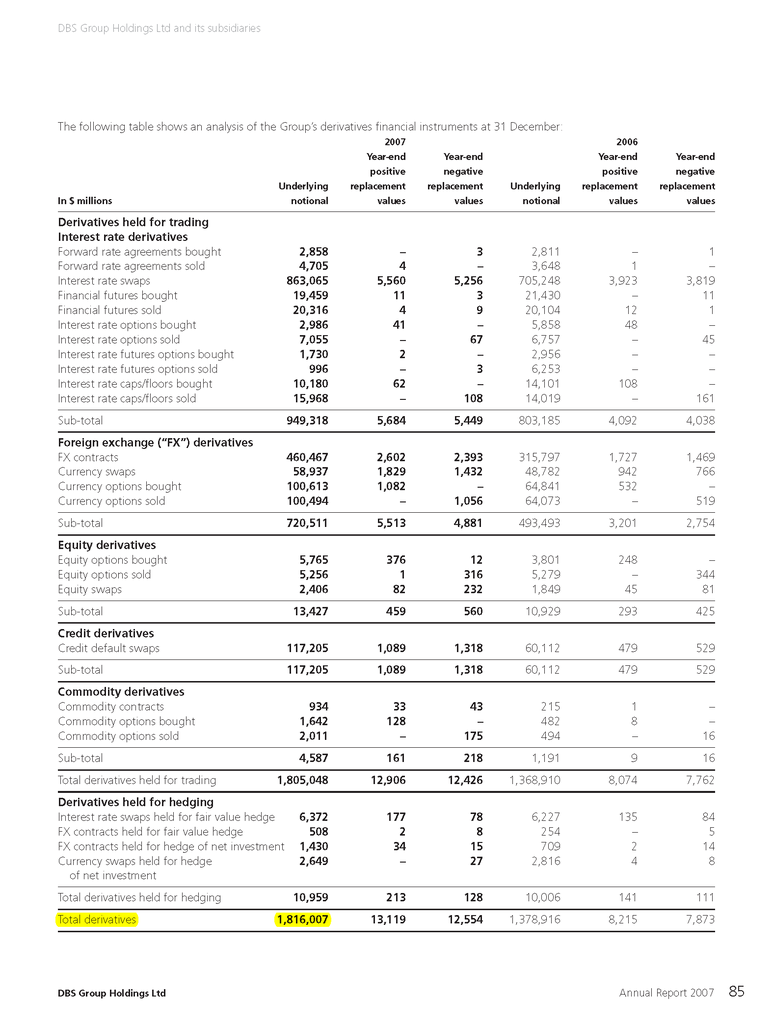

Then I had a look at DBS (Singapore) Balance Sheet, it had a derivatives position of SG$ 1.805 trillion and only an equity of SG$ 23 billion.

Derivatives Gearing = 1,805 / 23 = 78.5 times

So does this also mean that Singapore Banks are highly geared for failure like the Australian Banks?

Westpac Australia

DBS Singapore

Source: Westpac Financial Statements 2007

Source: DBS Financial Statements 2007

-

DBS... Damned Bloody Slow....

-

What Singapore lacks is an independent newspaper (like the Australian) or media to report on negative issues linked to the government.

-

Originally posted by maurizio13:

What Singapore lacks is an independent newspaper (like the Australian) or media to report on negative issues linked to the government.

What you are saying is something like....

Channelnews Asia Losing credibility

or this:

Unfree Press, Official Secrets Act, and being caught off-guard

-

Want to read bad news about Singapore? Read Malaysian newspapers...

click to link

or just log in to sgforums regularly for the truth.... "the truth is out here" hahahahaha

-

... but you have to "find" it in sgforums because many of the assdogs that run the Singapore newspapers have counterparts here trying to sell the same propaganda to you... but at least, unlike the assmedia, you can find the truth here...

-

Upz!!!

-

Originally posted by AndrewPKYap:

... but you have to "find" it in sgforums because many of the assdogs that run the Singapore newspapers have counterparts here trying to sell the same propaganda to you... but at least, unlike the assmedia, you can find the truth here...

Uncle, can you handle the truth or not?? -

if it is true, i am very afraid.

since putting money in banks dont yield any interest. might as well put in my home and ask SS angel to guard my door.

heil hitler!!!

-

there might be something brewing with the banks issuing so many preference shares suddenly...

doesn't sound very good

-

and you are guaranteed up to $20K only

-

Originally posted by maurizio13:

Australia:

Interestingly I looked up the Westpac Bank (Australia), true enough it had a derivatives position of AU$ 1.449 trillon and an equity of only AU$ 18 billion.

Derivatives Gearing = 1,449 / 18 = 80.5 times

Singapore:

Then I had a look at DBS (Singapore) Balance Sheet, it had a derivatives position of SG$ 1.805 trillion and only an equity of SG$ 23 billion.

Derivatives Gearing = 1,805 / 23 = 78.5 times

So does this also mean that Singapore Banks are highly geared for failure like the Australian Banks?

Westpac Australia

DBS Singapore

Source: Westpac Financial Statements 2007

Source: DBS Financial Statements 2007

omg! that's sound bad.

-

LET DBS FALL.

Damm Bloodly Stupid.

Let garment fall.

Let oppsition take OVER.

Let the rich be poor

LET all the ah kong ah MA rob the rich

& enjoy their lives.

Let mi F_ all the minister ass