GIC loses another $50 Billion - after Temasek ?

-

100 billion / 4million

25k

emmmmmmmmm

-

Holding Lee Kuan Yew accountable – Part 1

Chee Soon Juan

In what has become a landmark speech Minister Mentor pointed out in July 2007 that, thanks to his party, the economy was headed skywards: Tourism, consumer confidence, job creation, inflow of wealth, etc were all at an all time high. Not only was the economy going great guns, social development was apparently also doing swimmingly.

MM LKY

We have drawn in many professionals, especially in financial services, which has expanded to its highest ever levels. Many financial institutions have moved their top people and their regional headquarters to Singapore...

In fact things were so rosy then that Mr Lee couldn't hide his excitement: "If there are no wars or oil crises, this golden period can stretch out over many years."

Barely one, let alone many, later Singapore's economy started to go into a tailspin – and, might it be pointed out, there were no wars or oil crises.

In other words, the MM's prediction was spectacularly wrong – not that there is anything surprising with that, Mr Lee had been wildly off the mark many times before:

In January 1998 Mr Lee predicted: "I don't think you're going to get a significant or dramatic political change in Indonesia." Four months later, Suharto was toppled.

In 1995, the then Senior Minister proclaimed: "Both the Suzhou and Singapore sides recognise that they need to work as a team for the Suzhou Industrial Park to compete successfully..." Three years later, the project collapsed.

In 1997 just prior to the general elections, Mr Lee told HDB residents that upgrading would lead to a "40 to 50 percent increase in the value of your HDB property." Before the year was over, property prices plunged with the advent of the Asian financial crises.

There's nothing wrong, of course, about making bad predictions. Let's be fair, everyone at some point has made calls that have turned out embarrassingly wrong. Mr Lee has made, and will make, his fair share.

The difference with the MM's words is that they drive policy formulation which involves spending of billions of dollars of public monies. Once spoken, these words precipitate PAP groupthink; few dare to tell the Mr Lee that he is wrong, let alone hold him accountable for his errors in judgement which have catastrophic consequences.

Oracle of the East he is not but you wouldn't know that if you spoke to the servants with whom the MM surrounds himself and on whom he lavishes made-in-heaven salaries. These highly intelligent individuals apparently go into a synaptic short-circuit when they are in his presence and suspend all form of independent thinking. (See also Tearing Down the Facade).

Herein lies the danger, which is that of allowing one man to call the shots and of accepting Mr Lee's propaganda that he and the people he has anointed are the only one's who have the answers to our future. This danger must be highlighted, and highlighted again and again until it drenches our national psyche.

In the beginning...

It is clear from his utterances in that fateful 2007 speech how little Mr Lee understood of the economic world. Just months before the crash of the global financial labyrinth, at a time when the system was at its bursting point, the MM told us all:

Indeed, Mr Lee and his ministers had gone into overdrive to push Singapore to be the financial capital of the world, regardless of whether our national infrastructure was equipped to handle such a brutal and risky transformation or not. He did not see, nor did he understand, the decadence that had enveloped Wall Street and that the corruption was already driving the world's financial system to its knees. He was still telling Singaporeans that the boom could go on for years.

Here's what had happened: Banks in the US were hedging on the housing mortgage market through financial instruments they called "credit default swaps".

These fancily named derivatives were really nothing more than side bets -- not unlike the kind that avid football fans place when they watch two teams play each other. The bettors need not buy a direct stake in the teams but stood to gain or lose depending on the outcome of the game.

This was what happened at the banks: Essentially, bets were taken on how the mortgage-loans performed. If mortgagees defaulted on their loans, insurance would be paid out through the credit swaps that investors purchased.

Of course, the financial institutions raked in the money when the US housing market was on a roll between 1996 and 2006, with much of activity fueled, unfortunately, by unscrupulous lending. Housing loans were given to people, called subprime borrowers, who did not meet the criteria for borrowing at the prevailing interest rate. This was a recipe for trouble because as soon as the US economy and the housing market started to wobble, many of these borrowers were unable to keep up with their loan payments.

Then someone screamed “Subprime!" and all of a sudden the housing industry pancaked. Mortgage delinquencies and foreclosures escalated as Americans defaulted on their housing loans and banks were left high and dry.

But as bad as the debacle was, it still wasn't the worst thing that happened to the banks. On the side, investors came a calling and wanted to be paid because they had bought the credit default swaps. The problem was that the banks and investment houses had sold so much of these instruments that they were simply overwhelmed by the amounts they owed (estimates have it in the trillions of dollars). Unbelievable as it may seem, these financial institutions did not set aside any funds to make these payouts. The scheme was really nothing more than legalised gambling run by over-leveraged bookies. Hence the banking meltdown.

Of course, hind-sight suffers not from astigmatism. But there were many signs that all was not right within the financial world. Billionaire investor Mr Warren Buffet had repeatedly warned of the scourge of the derivatives market, calling them “weapons of mass financial destruction”.

Warren Buffet - "There is an electronic herd of people around the world managing an amazing amount of money - I think it's a fool's game"

As early as 2002, Mr Buffet was already warning: “I view derivatives as time bombs, both for the parties that deal in them and the economic system.”

In 2003, he repeated his message that derivatives can push companies onto a "spiral that can lead to a corporate meltdown" and didn't mince words saying that these financial schemes have been devised by "madmen".

Mr Buffet rang the warning bell again in May 2007: "There is an electronic herd of people around the world managing an amazing amount of money...I think it's a fool's game."

As prescient as he was, Mr Buffet was not the first to sound the alarm against the Wall Street whiz kids. Dr Frank Partnoy, an investment banker himself before he became a professor at the University of San Diego, had written a book back in 1997 entitled F.I.A.S.C.O. in which he warned about the shenanigans that were going on in the financial houses.

He authored another book in 2003, Infectious Greed, where he again called attention to the marketing of derivatives and how this was destabilising the financial market.

Another academic, New York University's Dr Nouriel Roubini, had warned at the World Economic Forum in 2007 that a “hard landing” was about to come with the bubbles created by the financial system. (Were any of our ministers there?) He predicted that all the unbridled wheeling and dealing would end in “painful consequences for the U.S. and the global economy.”Note that these red flags were all raised before Mr Lee Kuan Yew made his “golden period” speech (Mr Buffet's "fools' game" warning came just two months before).

Every night there is this buzz along Orchard Road. It is because a competent and experienced team of ministers took painful and unpopular measures in the last few years since the Asian financial crisis to get our domestic policies to encourage growth. Tourism is up. Consumers have confidence; restaurants, food courts are thriving; unemployment has remained low at 2.9 per cent with a healthy creation of 49,000 jobs for the first quarter this year. This is on top of a record creation of 176,000 jobs in 2006. We are into a period of good economic growth and social development. (emphasis added)

In fact, just before the MM's speech, Bear Stearns, then the fifth largest investment bank in the US, was breathing its last breaths. Two of its hedge funds were up to their eyeballs in the mortgage derivatives market and they were bleeding funds. The bank was losing so much money that shortly thereafter it filed for bankruptcy.

If the Buffets and Partnoys were screaming about the risks, and if Bear Stearns had collapsed in such a stunning fashion, why did Mr Lee and his cabinet ministers not note these danger signals and adopt a more cautionary tone in his speech? Were they all asleep at the wheel?

But not only was there no circumspection, Mr Lee was urging everyone to “maximise our opportunities in this golden period”!

In competence and in experience

Mr Lee had claimed sole credit for himself and his ministers that things had gone on so well. He actually started off his speech with this:

He repeated the line later in the same speech: "An experienced team of ministers is getting our policies set in the right direction." In 2003, never tiring of reminding the people of his goodness, Mr Lee repeated that Singaporeans were fortunate in having a "competent government in charge, anticipating events."

“Competence”, “experience”, and the ability to “anticipate events” are the words Mr Lee chose to describe himself and his ministers, and to justify their salaries. Indeed if they all possessed such traits of distinction why did they not see, and warn Singapore of, the crisis that was brewing and all the warning signs that were hollering for attention?

Now that the MM's rhetoric has been so extravagantly shown up, there is only silence within the establishment. Speech? What speech? seems to be the new strategy going forward. Everyone pretends that it was never made. And yet, that speech is probably the most serious misjudgment of Mr Lee's carreer.

But among the many words that Mr Lee has spoken only one matters, but it is one that we will not hear: Accountability.

Part II, to be posted shortly, highlights even more of Mr Lee's wayward predictions and how they have made the current economic situation even more painful than it has to be. -

Holding Lee Kuan Yew accountable – Part 2

In Part I of this essay, I drew attention to the fact that Mr Lee Kuan Yew was negligent when he, in a speech he delivered in July 2007, called on Singaporeans to “maximise our opportunities in this golden period.” This happened at a time when the world's economy was already teetering on the brink.

Singapore's financial centre was considered over-regulated compared to Hong Kong's. Critics wrote: "in Hong Kong, what is not expressly forbidden is permitted; in Singapore, what is not expressly permitted is forbidden”...Only after the MAS (Monetary Authority of Singapore) had demonstrated the strength of its system to weather the financial crisis of 1987 and 1997-98 did I feel confident enough to move closer to a position where what is not expressly forbidden is permitted.

But some argue that Mr Lee is no longer the prime minister and hasn't been one for nearly two decades. Why should he be the one to take the blame? Take a look at what he wrote in his memoir:

Note the pronoun. It was he, not the cabinet, who allowed the financial system to become less regulated. Note also the period: It was post 1997. He was not the prime minister then, it was Mr Goh Chok Tong. Why was PM Goh not the one to decide which course our financial system should take?

But why is a speech Mr Lee made in 2007 even important in the present crisis?

If you were a Lehman Brothers' investor back then and had heeded the MM's advice, you would have ploughed even more money into buying the minibonds. (Some of the Town Councils obviously did.) If you were looking to buy a house, you would have paid top-dollar for the bubble property price. And if you were looking to start a business then, you would have borrowed heavily to capitalise on the boom.

And if you were Mr Lee or his daughter-in-law, Ho Ching, you would have placed tens of billions of dollars of our reserves in Western banks. Which is exactly what they did.

Banking on banks

The Government of Singapore Investment Corporation (GIC) and Temasek Holdings, led by Mr Lee and Madam Ho respectively, were merrily maximising their opportunities by bailing out European and American banks even as these companies were going bust due to corruption, greed, and bad management.

In the second half of 2007 Swiss bank UBS had written off US$33 billion due to bad debts and exposure to the US subprime crisis. Despite this meltdown, the GIC incredibly injected nearly US$10 billion into the bank in December that year. Four months later, UBS wrote down another US$19 billion.

Matters for the bank worsened in November 2008 when one of its senior officials, Raoul Weil, was indicted in the US for conspiring to help 20,000 wealthy Americans evade taxes amounting to an estimated US$20 billion. He was declared a fugitive by the US Government and has since stepped down from his post at the bank. The latest news is that the Swiss bank has posted a total loss of US$17 billion for 2008.

Despite what had happened at UBS, Mr Lee was still feeling bullish with our money and made another investment of US$6.9 billion in January 2008, this time in Citigroup. Within months, the US banking giant collapsed and had to be rescued with a bailout of more than US$300 billion from the US Government.

But Citi's executives, as financially and morally bankrupt as they were, still found enough chutzpah to take receipt of an exclusive luxury jet worth US$45 million. They only reversed course after warnings emanated from the US Government about their profligacy. These are the kinds of people with whom MM Lee had entrusted our savings.

Not to be outdone, Temasek announced in July 2007 that it had invested $4.5 billion in Barclays Bank. That same year the bank announced a US$2.7 billion write-down.

Merrill Lynch CEO John Thains - spent US$1.2 Million to renovate his office

Temasek also started to invest in Merrill Lynch in December 2007. Madam Ho Ching gradually increased Temasek's stake in Merrill until it reached US$5 billion in 2008. The company, owned by the Ministry of Finance, said that it was buying in to Merrill because of its "great franchise, which has existed through many crises through a long period of time.”

In September 2008, the American company went bust and had to be taken over by Bank of America.

Temasek gave another reason for the investment: It "had great confidence in [Merrill's CEO] John Thain.” Four months after BoA's takeover Mr Thain was forced to step down. The reason? He had not fully disclosed all of Merrill Lynch's losses. Even in the firm's dying months, Mr Thain had spent US$1.2 million of company money to renovate his office – including US$87,000 for a rug, US$25,000 for a table, US$87,000 for guest chairs, US$35,000 for a commode and US$1,400 for a wastebasket.

Madam Ho must have a rather liberal definition of "great confidence". It obviously doesn't include due diligence.As a result of these escapades, it was revealed that Temasek is estimated to have lost 40 percent, or an equivalent of $74 billion, of its portfolio due to exposure to the finance industry. Madam Ho announced last week that she was stepping down -- with no regrets -- as its chief executive.

In the meantime, Finance Minister Tharman Shanmugaratnam stuck his neck out and assured everyone that Temasek and the GIC had "assessed the proposals rigorously" before jumping in to make the investments, a statement he'll probably live to regret making.

I wonder if these rigorous assessments included looking at how both banks invested their funds. The latest revelation is that Citi, UBS, Merrill and Barclays had all invested in the Bernie Madoff scam. Mr Madoff ran the biggest Ponzi scheme in corporate history and duped his investors to part with nearly US$50 billion of their money. In fact UBS is being sued in France by a wealth management company for its involvement in the Madoff madness.

All this was happening at a time when investment guru Jim Rogers was warning that "I'm shorting investment banks on Wall Street...It grieves me to see what Singapore is doing. They are going to lose money."

Investing in the banks was, of course, part of Mr Lee's mega scheme to build Singapore up as a financial centre. Another part of the plan was to attract as many financial professionals to the country as possible: "We have drawn in many professionals, especially in financial services, which has expanded to its highest ever levels. Many financial institutions have moved their top people and their regional headquarters to Singapore to manage the wealth that is flowing from the Gulf oil states, the US, EU and Japan."

Translation: We have become a tax haven. And as the super-rich do their utmost to evade taxes by moving their monies to our shores, taxmen from the US and EU will follow their trail. Is providing a haven for tax cheats and turning a blind eye to tax crimes this Government's idea of sound economic strategy? What happens when the US and EU starts putting the squeeze on us? Are we really maximising our opportunities or merely masquerading our objectives? -

Did you hear that boom?

“These initiatives have sparked off a boom in building around the Marina and Sentosa.” The MM was of course referring to the F1 Grand Prix that was held in Singapore last year and the controversial IR casinos that are being built.

Las Vegas Sands - Sheldon Adelson - going bankrupt suddenly get US$2Billion loan

The only boom we heard was the one in Las Vegas when the Sands Corporation imploded financially in 2008. Sands, headed by Mr Sheldon Adelson, was contracted to develop the Marina project. If Sands had gone bankrupt, Singapore's Marina would have been left in the lurch. The Singapore authorities quickly got in touch with Mr Adelson and, shortly thereafter, the gaming mogul miraculously raised $2 billion -- in a year gripped by financial crisis.

Analysts expect construction of Marina Sands to top US$6 billion (initially budgeted at $3.85 billion). In contrast Sands Macao casino cost $265 million to build and recouped its costs in less than a year. But that was in the boom years in 2004. Experts estimate that Marina Sands will have to earn more than US$1 billion a year just to remain viable. And this has to occur in the midst of a protracted period of an economic bust. Was this what Mr Lee meant by “maximising our opportunities”?

What about the F1 Grand Prix? The Government pumped in about $100 million to host the event in the hope that it would produce a kickback through increased tourism and sales. The result was that retail sales for September 2008 – the month that the race was held – dropped by 0.8 percent. The Singapore Retailers Association's executive director Lau Chuen Wei said: 'This is evidence that F1 did not bring with it the increase in business for the retail sector.”

The uplift

Mr Lee also enthused in 2007 that “The whole Asian region is getting a lift-up. Singapore is at the junction between the two giants, China and India. We are well placed to benefit...”Let's see, China is seeing its growth plummet to heart-stopping lows, companies are closing down by the thousands and, in the process, workers are being laid off in the millions -- 20 at last count. The Beijing government is seriously nervous about widespread social unrest.

India's economic expansion has come to a screeching halt. The country is reeling from double-digit inflation, foreign investment is drying up, the rupee is falling, and the stock market was down by as much as 40% last year.

These two countries desperately need fresh flows of capital and investments, without which businesses cannot continue to stay afloat, let alone service their debts. Collectively, China's companies have about US$2.4 trillion in debt repayments to consider.

And where are the funds going to come from? According to the MM, “There is high liquidity in the money supply of the US, EU and oil-producing countries. This accounts for the large in-flow of foreign money that has benefited the regional stock exchanges.” He could not have been more wrong. The following year the Institute of International Finance reported that the net capital flows from industrialised countries to emerging economies would trickle to a low of US$160 billion – plunging from the US$840 billion in 2007.

En bloc blocked

Over the last few years, a frenzy took over the property market. Seemingly rational people vandalised cars and property because they couldn't get their fellow homeowners to sign the collective agreements to sell their estates to developers who were willing to pay hundreds of millions of dollars for the en bloc purchases. Neighbour took neighbour to court and disputes erupted all over.

This prompted Mr Lee to comment in 2007 that "Demand for high end office and residential accommodation has increased. Many home owners who sold their condos in en bloc sales have received windfall gains. Some of them in turn are buying upper end HDB executive and 5-room flats, pushing up their values."

The bubble was dramatically inflated but everyone was too busy enbloc-ing to notice it. Then came 2008. The fourth quarter of last year saw property prices drop by a margin that was the biggest in a decade. More than 10,000 houses and apartments had to be sold under a deferred mortgage plan where buyers were allowed to postpone their loan payments until the properties were completed.The frenzied rush to sell the condominiums vanished. Owners hoping to attract enbloc buyers had to reduce sale prices by as much as 40 percent in some cases. Developers who had hoped to re-develop their acquisitions are now stuck with their purchases because there is no demand for new homes. A senior manager at the ERA, a realty company, said: "These holding costs are tremendous, because projects like these, some of them are worth a few hundred million to maybe close to a billion dollars. So they would just have to perhaps rent them out to collect as much as they can in terms of rental." Some of the rental are going for as low as 50 percent of the usual rate.

"There was a big surge in demand for offices 10 or 11 months ago," explained CapitaLand Chief Executive Liew Mun Leong, "but it suddenly stops and falls off a cliff."

No regrets

Now that the predictions that Mr Lee made in 2007 have gone up in smoke -- and together with it many billions of dollars -- what does the MM do?

First, roll out the Vintage Lee Act: Wag the finger at Singaporeans. "So this generation may believe that Singapore and Singaporeans will automatically go up the escalator every year. This is not so," Mr Lee told his audience at a Lunar New Year dinner last week. He forgot that he was the one who gushed that the golden period could go on for years.

Second, lay the blame on others: "People and systems tend to be carried away by exuberance. Investors get greedy and rush in to buy, believing that prices will only go up. When prices collapse, investors find they have lost huge sums." Of course, these are other people and other investors. Not him and his ministers who just got caught up in the system because "it is in the nature of the free markets of the western world that our economy is plugged into."

In 2007, it was he and his "competent and experienced team of ministers" who adopted "domestic policies to encourage growth." In 2009, it is the banks who "have lost confidence in themselves, in their fellow banks and other financial institutions, and even in their customers."

Third, pretend that there is no poverty in the country. "But nobody will be destitute, depending on soup kitchens or begging in the streets. Everyone has a home..." Mr Lee said to his audience, who were either too polite or too subservient to tell him to take a drive outside the Istana to HDB void decks.

Fourth, play the you-don't-know-how-lucky-you-are gambit. "My generation of Singaporeans will never forget the 1960s and early ‘70s..." he started off and then waxed nostalgic about Konfrontasi and shanty huts. It's another way of telling Singaporeans how good his party is.

In fact Mr Lee talked about everything regarding the present crisis except his role and the role of his ministers in the debacle. No mistakes were admitted, no errors conceded. If he had any tinge of regret about that "golden period" remark, he showed no sign of it.

In an age where accountability has become the touchstone of good government, the PAP continues to march remorselessly forward. -

No war and oil crisis? He hasn't really been paying attention for the past few years has he?

-

You know,those PAP ministers are really naive.They keep on criticising other countries,especially Western countries,using their propaganda saying that how democracy sucks.

On the other hand,they invest on these countries n then expect to earn money from them,often using "Singapore government link companies to invest in them.They think what,those Westerners are idiots?They will allow those PAP ministers to criticise them on one hand,n earn money from them at the same time?LOL!!!

-

To be fair, GIC's performance is pretty decent, percentage wise. I think GIC is more like a balanced fund while Temasek is an equity fund, hence the disparity in performance. No excuse for making investments in soon to be bankrupt banks though!

-

If the extraordinarily intelligent MM Lee and his daughter-in-law can be hookwinked by the ang mor, is it any wonder that we 'lesser mortals' never doubted them?

-

u guys just tell the down side in recent years.

Have u read the up sides(profits) in the past few decades?

Pl open your mind and think!

Dunt just look at one side of the coin!!

Look at the profits in the past few decades and look

at the paper loss in the recent years.

Do u know they sold some assets before the crush.

But they bought lot of assets which are in paper loss.

@@@@@@@@@@@@@@@

Take note lot of assets not in ownership,but loans to UBS etc.

Have SG convert the bonds to shares?

I dunt think so.

So,in this few years,SG SWF still collect interest from the bonds.

SG still have time to consider whether to convert bonds

to shares.

coupon rate of 9 % received by GIC

-

You know when somebody from LKY famiLEE is stepping down from any position it means BAD. Very bad indeed.

I fear that the lost of money may become bigger as time passes by.

They quit to avoid accountability lol. Doh. So they can jump back to their old position once things are going to get better. But when things are going to get real bad. They jump off. Accountability avoidance.

Other words: scape goating.

-

as at Feb 2008,GIC holds less than 1 % of UBS shares.

will u guys pl dunt mix up shares and the right to acquire conversion rights.

''These positions comprise 8,316,717 (0.358%) registered shares of UBS AG, with voting rights, and the right to acquire conversion rights on 213,675,213 (9.186%, both figures excluding dilution from the stock dividend)''

Disclosure of shareholdings as of 27 February 2008 (1)

@@@@@@@@@@@@@

read the details here

http://www.gic.com.sg/newsroom_newsreleases_07.htm

Terms of the Mandatory Convertible Notes

do u think GIC is so stupid to catch a falling knife???kkkk

kkkk

-

Originally posted by lionnoisy:

as at Feb 2008,GIC holds less than 1 % of UBS shares.

will u guys pl dunt mix up shares and the right to acquire conversion rights.

''These positions comprise 8,316,717 (0.358%) registered shares of UBS AG, with voting rights, and the right to acquire conversion rights on 213,675,213 (9.186%, both figures excluding dilution from the stock dividend)''

Disclosure of shareholdings as of 27 February 2008 (1)

@@@@@@@@@@@@@

read the details here

http://www.gic.com.sg/newsroom_newsreleases_07.htm

Terms of the Mandatory Convertible Notes

do u think GIC is so stupid to catch a falling knife???kkkk

kkkk

On 24 September 2008, the leading Singapore Straits Times proudly reported that the ‘GIC achieves 4.5% annual returns’ - less then six months later, we are told that the GIC has lost $50 BILLION from its portfolior of investments.

Has the noisy pussy been fed with trash to proudly regurgitate the trash displayed ?

What has the noisy pussy been fed with that will cause him to believe that the amount the Singapore GIC paid will entitle Singapore to own only 1% of UBS shares ?

Does the noisy pussy know what is the UBS Capitalisation at the end of 2007 ?

Does the noisy pussy even know what was the amount that Singapore GIC paid before it is even entitled to receive 1% of UBS Shares ?

If it was only 1% of UBS Shares - why were the events in Switzerland - prior to the approval by the shareholders - not reported in the Singapore Print or Broadcast Medias but were widely reported in Europe ?

Could GIC be smart enough to avoid the Citizens' knives when the truth of the ‘Terms of the mandatory convertible notes’ cannot be fulfilled by a failed UBS ?

How long does the noisy pussy think will GIC take to recover all that is covered in that piece of paper that is supposed to protect Singapore's "investment" paid for that supposed 1% percent in UBS equities ?

Was the pussy too busy with his noise to miss ‘UBS AG – Letter to Shareholders – 11 Jan 2008.’ ?

-

Apres Ho Ching, Le Deluge?

‘Lee Hsien Loong's wife leaves Temasek just in time for her successor to reap the bad news’

Ho Ching, the wife of prime minister Lee Hsien Loong, is departing from stewardship of Temasek Holdings in good time for her successor to have to be the one in charge when the disastrous performance for 2008 and 2009 comes around.

Such are the circumstances that the Singapore leadership has decided that it is best that a foreigner replace her – not that Temasek's earlier recruitment of Wall Street whiz-kids has done it much good. This time former BHP Billiton boss Chip Goodyear just might shift Temasek's attention away from disastrous forays into finance towards the natural resources which are so abundant in Southeast Asia but so conspicuously lacking from its Temasek's portfolio.

BHP is in good shape compared with the other major mining companies such as Rio Tinto and Xstrata. But do not be deceived by this into thinking that Goodyear is the cautious, far-sighted manager needed by a sovereign wealth fund such as Temasek. BHP owes its relatively strong position largely to luck.

Goodyear, a Wharton-bred former investment banker, made his reputation through an array of acquisitions in a rising metals market. He stepped down as chief executive in September 2007, but remained with the company and close to his successor Marius Kloppers when BHP launched a typical top-of-the-market US$66 billion bid for rival miner Rio Tinto, itself then trying to digest its own acquisition spree, notably aluminum giant Alcan. Only Rio's determination to resist the takeover saved BHP from the potential disaster of such a costly acquisition and Goodyear being classified with the Wall Street crowd whose hubris and arrogance has become the biggest ever bonfire of the vanities.

Ho Ching proved the classic bull market player with Singapore's public funds. At first she could claim success in raising returns by more active management of Temasek's investment portfolio – and in rising markets always report profits generated by disposals as well as by the operating profits of its major assets, the Singapore property, banking, power, telecoms, aviation and shipping companies.

But under her leadership, and spurred by foreign advice, a larger and larger proportion of assets were invested in the financial sector. By March 2008 this had climbed to no less than 40 percent of Temasek's portfolio. Nor was that enough. It continued to believe in Wall Street's self-delusions that first half 2008 just saw a few "localized difficulties" rather than the richly deserved meltdown that occurred, increasing its stakes in Merrill Lynch, Barclays and others, and putting most of its China investments into banking.

Even as late as the end ofAugust, a managing director, Marish Kejriwal, was being quoted as saying "The financial services industry is one we believe in… It is a proxy to the economic growth" – an extraordinary statement and one which showed that Temasek had learned nothing from the Asian crisis of a decade ago, or from Japanese financial troubles, or indeed the mid-1980s banking failure in Hong Kong and Malaysia etc. To make matters even worse, Kejriwal also noted "We recently concentrated on US and UK primarily because we see value."

Temasek's overall performance is hard to assess. Although more transparent than most sovereign wealth funds, it still falls far short of what a public company would have to report. The performance of its major listed subsidiaries is easy enough to track but there is a lot that does not appear, including methods of valuation of some huge, leveraged investments made in private equity funds.

Injections of capital from the Ministry of Finance are also a key to its expansion. For example, last financial year its portfolio value rose by 13 percent to S$185 billion but much of this was apparently accounted for by an official injection. Nor are there any details on dividends, if any, paid to the MoF.

Indeed, not only are the accounts skimpy and largely lacking in the notes normally found but anyone wishing to track the latest Annual Review against past ones will be unable to do so via the Temasek Holdings website, which now has only the latest Review (2007-08) not the previous ones.

What can be deduced, however is that reported profits last year, which zoomed 50 percent to S$20 billion on revenue of just S$83 billion, owed much to disposals, including Tuas Power for S$4.2 billion. The rundown in Singapore assets has been marked. They are now only 33 percent of the total compared with 38 percent a year earlier. This trend is presented as a necessary and valuable diversification, but it also helps maintain profits as the Singapore disposals are mostly of assets acquired years ago and thus can generate big capital gains.

Apart from the trend to non-Singapore assets, there have been two other trends. One is towards non-Asian OECD markets such as US and UK, and the other to unlisted and so-called "liquidity" investments. These mostly opaque investments now account for 52% of total assets helping to further obscure the details.

The latest Review also has a none-too-subtle Ho Ching boast. Assets acquired in the previous six years are credited in one chart with annual growth in value of 32 percent, or double the 16 percent by assets held prior to 2003. It is not hard to imagine that the numbers for 2009 will look rather different – assuming they are published. Nor was the 10-year annual Total Shareholder Return as published particularly impressive – 9 percent since the dark days of the Asian crisis.

But whatever the performance, the skimpy nature of Temasek's published data makes independent analysis very difficult – even assuming that the major brokers, rating agencies and investment banks would ever be willing to incur official wrath by attempting to do so.

As for Goodyear, even with the help of a big capital profit on the December sale of PowerSeraya to Malaysia's YTL for S$3.8 billion, his first Annual Review as Ho Ching's successor will need some remarkable accounting contortions if it is not to look grim indeed.

-

The noisy pussy should learn to ask the right questions instead - ‘Did we spend our money unwittingly on Merrill Lynch Director’s prostitution bills ?’

If LKY has so much talent in his genes to be able to pick talents who are winners, how did he so remarkably achieve $100 Billion loss with our investments - and most of it in a willful efforts to get deeper into the "World of Western Banking and Finance" that was seen to be rotting as early as mid-2007 ?

Temasek bought shares in Merrill Lynch when it was considered too risky by Bank of America. The New York Times reported in October 2008 that a month after Bank of America acquired Merrill Lynch: Bank of America had considered purchasing Merrill some 10 months ago but found its mortgage exposures too unpredictable.

-

With so little transparency in the ways that the Singapore Ministry of Finance, the GIC and Temasek manages Singapore's reserves - is it any wonder that $100 Billion had been lost, and so little is said by way of even an apology ?

Instead, we hear of efforts to blow up the minisicular achievements that were supposed to have been achieved that covered as many failures, but no mention was ever made to the NET Gains.

With Singapore having no natural resources, it is even more important that we learn to manage our hard earned reserves more transparently and with more accountability - that we can learn from the Norwegians.

‘TRANSPARENCY and TRUST: Keys to the Norwegian Pension Fund’.

Transparency and trust are driving forces behind the management of Norway’s revenues from oil and gas production. As sovereign wealth funds (investment funds owned by governments) receive increased scrutiny by regulators, the Norwegian Pension Fund – Global may become a model for other sovereign wealth funds.

1/24/2008 :: Norway, one of the world’s largest petroleum exporters, has invested its oil wealth in a fund with a current market value of more than $350 billion. This makes it Europe’s largest, lagging behind only that of the United Arab Emirates among SWFs.

Morgan Stanley projects that sovereign wealth funds could grow from their current total of $2.5 trillion to $12 trillion within a decade. A concern in the United States and Western Europe is that secretive management under government ownership may raise national security concerns, distort markets by pursuing strategic objectives (not financial) and threathen financial stability.

“There is a serious likelihood of Western governments and funds clashing over what they can buy and where,” chief economist at Standard Chartered Bank in London, Gerard Lyons, recently told the International Herald Tribune.

Will the emergence of sovereign wealth funds really increase the volatility of markets? The opposite may be the case. Because of a long-term investment horizon for SWFs, the funds will not be forced by capital requirements or investor withdrawals to liquidate positions rapidly. “They won’t get ‘cold feet’ in down-times when other investors scramble to sell, but rather stay in it for the long haul and contribute to stabilizing the market,” said Lars Fjell Hansson, Counselor for Economic and Financial Affairs at the Royal Norwegian Embassy in Washington, D.C.

“There is a strong case for sovereign wealth funds to adopt the best practice of open funds like Norway,” Gerard Lyons in Standard Chartered Bank emphasized.

What makes the Norwegian fund different from several other sovereign wealth funds is the amount of information it makes public about its strategy and investments.

Its performance and risk exposure are reported quarterly and its holdings in about 3,500 companies are detailed annually; in most cases, its investment in any company amounts to less than one percent of available shares.

The fund does not seek to control companies through buy-outs. In fact, by its own rules the fund restricts its ownership in any company it invests in to five percent of shares.

The investment objectives are purely financial in nature, safeguarding assets for the long term.

The Norwegian fund is an instrument for ensuring that a reasonable portion of the country’s petroleum wealth benefits future generations. This is regarded as an ethical obligation.

Only the returns from the fund will be spent in the annual national budgets.

The fiscal rule says that four percent of the fund may be spent, which is estimated to be the real return of the fund over time. This strategy of controlled spending will also keep inflation in Norway down.

The second ethical obligation is to respect fundamental human rights. The fund is taking a stand against serious violations of human rights, such as child labor, gross corruption, and severe environmental degradation. The fund divests itself of shares in companies which produces certain weapons, for example, cluster-munitions. Norway has called for a complete ban on such weapons. The ethical guidelines were adopted by the Norwegian Parliament in 2004.

At a hearing in the United States Senate on November 14, 2007, experts testified on the growth of sovereign wealth funds and on maintaining a balance between attracting foreign investments to the United States while managing potential security issues. Edwin Truman, Senior Fellow at the Peterson Institute for International Economics, presented a scoreboard ranking sovereign wealth funds according to benchmarks on structure, governance and transparency & accountability and behavior.

The Norwegian Pension Fund - Global scored 23 out of 25 possible points.

This placed the fund second among the 32 countries on the index, one point below New Zealand's Superannuation Fund.

“The U.S. government should continue to actively encourage foreign governments with large cross-border investments to develop and follow a set of best practices with respect to managing those investments in their interests, in our interests, and in the interests of the stability and openness of the international financial system. Our scoreboard provides a starting point for the development of such a set of best practices for sovereign wealth funds,” Truman said.

Placing third was Timor-Leste Petroleum Fund, followed by Canada’s fund and the Alaska Permanent Fund. “Timor placing this high seems like an anomaly, given that most developing countries placed in the lower part of the index,” Embassy Counselor Hansson said. “But it is probably because as part of its development assistance to Timor, Norway assisted in setting up the structure of the Timor Petroleum Fund. This shows that the guiding principles of the Norwegian model are solid,” he said.

Facts about The Norwegian Pension Fund – Global- The Norwegian Ministry of Finance has the overall responsibility of the Government Pension Fund. The operational management of the Government Pension Fund – Global is delegated to Norges Bank (the Norwegian central bank).

- Key objectives in the management of the Norwegian Pension Fund – Global includes a high degree of transparency in all aspects of its purpose and operation, the fund’s role as a financial investor with non-strategic

holdings, an explicit aim to maximize financial returns, and clear lines of responsibility between political authorities and the operational management. - The fund returned 7.9 percent last year and has averaged 6.5 percent a year over the past decade. After accounting for inflation, costs and management fees, it has averaged an annual return of 4.6 percent since its inception, outpacing the 4.1 percent gain in a government-set benchmark.

- The Norwegian Pension Fund – Global has a current market value of more than $350 billion (January, 2008), equaling about $75,000 for every Norwegian, investsted in markets all over the world. Close to one third of this is invested in the United States. Over time, the share invested in equities will increase to 60 percent, while 40 percent will be invested in fixed income.

If the New Zealand Superannuation Fund is in first position, and the Norwegian Pension Fund in second with a score of 23 out of 25 for sovereign funds achieving best practices, and Timor Leste Petroleum Fund being Third, followed by Canada's Fund and Alaska Permanent Fund making the top five - where does Singapore GIC and Temasek Holding stand ?

Considering that Timor Leste - being a new nation with such a short history - can reach Third in rank in best practices of its sovereign fund, should Singaporeans not raise serious concern to the way that the Singapore's GIC and Temasek Holdings are being managed ?

-

Well, I reckon that this 100 billion is due to investments into the various banks affected by the credit crisis. Well, isn't it near impossible when times are good for a state own enterprise to buy such huge stakes in such financial houses? So, isn't it true then that the potentiality of us recovering these paper losses would be pretty good as soon as the economy picks up?

-

Originally posted by Quincey:

Well, I reckon that this 100 billion is due to investments into the various banks affected by the credit crisis. Well, isn't it near impossible when times are good for a state own enterprise to buy such huge stakes in such financial houses? So, isn't it true then that the potentiality of us recovering these paper losses would be pretty good as soon as the economy picks up?

When will the economy pick up ?Given the time frame - what would have been the opportunity cost for that loss $100 Billion done elsewhere ?

The Singapore Government has been more generous doling out funds to rescue failed Western financial institutions than rescuing Singapore Companies that failed in the 1987 and 1997 economic downturns.

The lost amount of $100 Billion would have done so much more for the welfare of Singaporeans - which LKY and his PAP has declined even to consider even during the most bleak periods of 1987, 1997 and 2004 in Singapore's economic downturn.

Can the Government hoped to regain any parts of their investments if ever these companies are shut-down or re-sold by their present Owners or Managers ?

-

Not just opportunity costs. When a company is affected by the economy, it will come down as much as the stock market.

Say the stock market comes down by 50%. You expect all those companies affected by the economy to come down by 50%

Take Microsoft or Intel or Disney... their share prices came down by as much as the stock market, and when the economy recovers, their share prices recovers back to original or by as much as the stock market recovers (percentage wise). That is what you should expect.

When the stock market, affected by the economic downturn comes down 50% but your share price comes down by 90%, hello, Quincey, (see 2 post above this), as Bill Clinton would say

It's NOT the Economy, it is the Company, stupid!

Merril Lynch is now worth about US$3.5 and when the economy recovers and the stock market doubles, then Merrill Shares is expected to roughly double to US$7.00, not the price Temasek bought the first time, US$48.00

If the US government takes over BofA and Merrill shares are worth only US$0.07 (7cents) and the US Stock market recovers and go back by 10 times, you should expect Merrill share prices to go up by 10 times. (I am too lazy to work out the exact correlations) but you should think in terms of Merrill shares going up to 70 US cents.

Please don't swallow propaganda blindly. Expect the share prices to recover only by as much as the stock market (percentage), roughly, (unless the COMPANY is exceptional) and not when the economy (stock market) recovers, the share prices will recover back to their original prices.

-

Originally posted by AndrewPKYap:

Not just opportunity costs. When a company is affected by the economy, it will come down as much as the stock market.

Say the stock market comes down by 50%. You expect all those companies affected by the economy to come down by 50%

Take Microsoft or Intel or Disney... their share prices came down by as much as the stock market, and when the economy recovers, their share prices recovers back to original or by as much as the stock market recovers (percentage wise). That is what you should expect.

When the stock market, affected by the economic downturn comes down 50% but your share price comes down by 90%, hello, Quincey, (see 2 post above this), as Bill Clinton would say

It's NOT the Economy, it is the Company, stupid!

Merril Lynch is now worth about US$3.5 and when the economy recovers and the stock market doubles, then Merrill Shares is expected to roughly double to US$7.00, not the price Temasek bought the first time, US$48.00

If the US government takes over BofA and Merrill shares are worth only US$0.07 (7cents) and the US Stock market recovers and go back by 10 times, you should expect Merrill share prices to go up by 10 times. (I am too lazy to work out the exact correlations) but you should think in terms of Merrill shares going up to 70 US cents.

Please don't swallow propaganda blindly. Expect the share prices to recover only by as much as the stock market (percentage), roughly, (unless the COMPANY is exceptional) and not when the economy (stock market) recovers, the share prices will recover back to their original prices.

Not just opportunity costs. When a company is affected by the economy, it will come down as much as the stock market.

Are you discussing some concepts with yourself, or do you have some issues that got you to start a new argument to take off at a tangent from "opportunity costs" ?

What makes the Economy - if it is not the performance in an interplay of other mutually influencing factors ?

Confidence required to support the activities of the Company,

The Company's performance - or the performance of every industry across the economy - that support the Economic Performance of the Country,

The Performance of the Country that in turn inspire confidence that supports the Company.

Sure, Merrill Lynch's shares can be worthless, is that the fault of the economy, or the fault of the Company ?

Even if the Company should recover, can its share return to the good old days - if and when its historical records have now been exposed to be nothing more then carefully concealed or disguised accounting numbers ?

Do you expect Merrill Lynch's shares to go back to the good old days ?

Can Merrill Lynch's shares return to the price that Temasek Holdings paid ?

The amount of money that Temasek Holdings have paid to Merrill Lynch, and now tied up in worthless stocks - could it have made better profits in some other enterprise ?

Even if held in a fixed deposit with some banks, or placed on over-night sovereign loans to some Central Banks - it could have received a better return and with better security to the amount loan.

Sadly - this is OPPORTUNITY lost.

Who has swallowed what propaganda ?

-

i value all the opinions here.

But u guys seem forget that lot of ''investments'' of GIC and Temasek

are just currently in the capacity of creditors!!NOT SHAREHOLDERS!!

I think the western medias want to make these two giants

look like a fool.We will know now ,not years later,that who is a fool.

Dunt hear the word investment then u assume that GIC and Temasek

alreday become a shareholders of any company.In most of the time.

they are just creditors.OK?

u can say anything when they are shareholders or creditors

of any company.Pl be a responsoble person.Know the facts

before u say.

@@@@@@@@@@

This si smart that they become creditors first.They have years to know

the companies better before they decide convert the

Convertible Preferred share into common share etc.

Dunt assume they are already shareholders when u read the

word share!!They are still creditors,just collecting interest!!

The falling share price do not affect the investment value.

They can take back all the capitals,if the company still survive!!

What is a creditor?

Debtor and creditor | LII / Legal Information Institute

look at what did GIC invest in Citi.

15 Jan 2008

GIC invests USD 6.88 billion in Citigroup''Convertible Preferred Securities

Convertible preferred securities enjoy a fixed rate of coupon payment until they are converted to shares. Unlike common stocks or mandatory convertible securities, their downside risk is more limited.''-

http://www.citi.com/citi/press/2008/080115b.htm

How does the falling Citi common shares affect the value of the

above arrangement,stupid?

@@@@@@@@@@@

so,dunt close your eye and mind when u write.

Know all the facts.Other investments of GIC and Temasek

also currently in Convertible Preferred share or alike.

So,the western medias just make themselves look like

a fool when they mix up creditors and shareholders.

@@@@@@@@@@

Singapore is protected by the followings in UBS investment--

Will experts pl share more here.

This is a repeat of my old posting one year ago.

http://www.sgforums.com/forums/10/topics/296563?page=13

UBS deal is a mandatory 2 year convertibalbe note,

CITI is Perpetual Convertertible Preferred Securities.

GIC is a creditors any time before she convert the note to shares.Then GIC has high priority to claim debts in case CITI or UBS go broke.GIC must convert UBS in 2 years,

For CITI deal,too complicated.Will expert pl share here.

I think GIC can hold the CITI security(bond) forever,unless

''After year 5, Citigroup may force conversion if its stock price exceeds 130% of the conversion price Conversion''

Do u think the down side protections ,as claimed by Tony Tan,is enough??

1.USB mandatory 2 year convertibalbe note,

http://www.ubs.com/1/e/media_overview/media_global/latest?newsId=133686

it is the details of the note:

http://www.gic.com.sg/PDF/press_101207%20-%20Terms%20of%20the%20mandatory%20convertible%20notes.pdf

Summary Term Sheet from UBS

Issuer: UBS AG or a subsidiary of UBS AG

Instrument: Mandatory Convertible Notes (the “Notes”)

Issue Size: CHF 13,000,000,000

Issue Price: 100%

Maturity: 2 years

Coupon: 9.00% p.a., payable annually

Convertible into: Registered shares of UBS AG

Payment Date: 5 business days in Zurich after the EGM

Underlying shares: Conditional capital to be created at an extraordinary shareholders meeting of the Issuer (the "EGM"), such EGM to take place no later than February 29, 2008

Reference Price: The average of (i) CHF 57.2 and (ii) the average of the three daily VWAPs

on virt-x for the three days prior to the EGM,

subject to a minimum of CHF 51.48 and a maximum of CHF

62.92.

Minimum Conversion Price: 100 % of the Reference Price

Maximum Conversion Price: 117% of the Reference Price

Mandatory Conversion at

Maturity (Redemption):At Maturity the Notes will be redeemed through conversion into Shares.

The conversion ratio applicable at maturity will be:

---if the share price is below the Minimum Conversion

Price, the par value divided by the Minimum

Conversion Price

--- if the share price is above the Maximum Conversion

Price, the par value divided by the Maximum

Conversion Price

--- if the share price is between the Minimum Conversion Price

and the Maximum Conversion Price, the par value divided by

the share price.

Early Conversion: The Notes contain market-standard provisions allowing for early at the

option of either the Issuer or the holders

Lock-up: 6 months after the Payment Date

Reset Adjustment: If UBS AG issues in excess of CHF 5 billion Shares, other equity securities

or equity-linked securities at a sale price below the Reference Price, or

additional mandatory convertible notes or equivalent instruments with a payment

rate higher than the Coupon on these Notes or a Maximum Conversion Price below the Maximum Conversion Price of these Notes, during the one year period following the announcement of the issuance of theseNotes, the Maximum

Conversion Price may be reduced, but to no less than the Minimum Conversion Price.

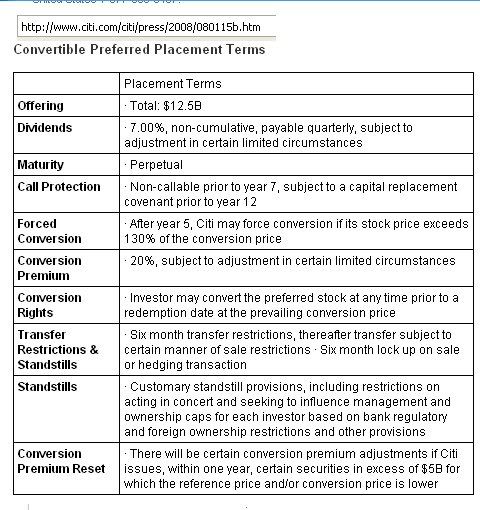

Offering: Private Placement2.CITI deal==Press release fr GIC--repeat of image above

http://www.gic.com.sg/PDF/Terms%20of%20the%20Convertible%20Preferred%20Securities.pdf

Attachment to Press Release

Terms of the Convertible Preferred Securities

Offering --- Total: USD 12.5B

Dividends --- 7.00%, non-cumulative, payable quarterly, subject to adjustment in certain limited circumstances

Maturity --- Perpetual

Call Protection--- Non-callable prior to year 7, subject to a capital replacement covenant prior to year 12

Forced Conversion --- After year 5, Citigroup may force conversion if its stock price exceeds 130% of the conversion price Conversion

Premium--- 20%, subject to adjustment in certain limited circumstancesConversion Rights--- Investor may convert the preferred stock at any time prior to a redemption date at the prevailing conversion price

Transfer Restrictions & Standstills--- 6 month transfer restrictions, thereafter transfer subject to

certain manner of sale restrictions

..........................................----- Six month lock up on sale or hedging transaction

Standstills ---- Customary standstill provisions, including restrictions on acting in concert and seeking to influence management and ownership caps for each investor based on bank regulatory and foreign ownership restrictions and other provisions

Conversion Premium Reset--- There will be certain conversion premium adjustments if Citigroup issues, within one year, certain securities in excess

of USD 5B for which the reference price and/or conversion

price is lowerhttp://www.sgforums.com/forums/10/topics/296563?page=13@@@@@@@@@@@@Dam it---Experts shall write artciles to explain the protections mechanismin these big investments... -

...

-

so wads the difference when u have a convertible preferred share and a common share, dun u still own a share in the company? And so when the share prices fall, people lose confidence in the company, doesn't that equate a fall in value of your holdings in the company?

Yes, I'll be first to concede my stupidness, if that makes you happy and rouses your tattered ego.

-

so wads the difference when u have a convertible preferred share and a common share, dun u still own a share in the company? And so when the share prices fall, people lose confidence in the company, doesn't that equate a fall in value of your holdings in the company?

Yes, I'll be first to concede my stupidness, if that makes you happy and rouses your tattered ego.

-

Originally posted by Atobe:

This will mean that the combine losses of GIC and Temasek will amount to over $100Billion up till 18 February 2009

Who will resign this time ?

Who will be accountable ?

Who will be accountable?Hmm...The senile old man Lou Lee?His silver-spooned Kids LHL?Or Lou Lee boot-licking dog Lou Goh?

I dont know man,u got to pick 1,haha...

-

Or maybe put these 3 misers into a basket n hold them for responsible loss of govt-link companies losses.