What is inflation?

-

A Simple dichotomy to understand the 2 principle causes of inflation.

Just by my simple observation, though I'm no qualified 'economist'.

Firstly, the definition of inflation [wiki]: "In economics, inflation is a rise in the general level of prices of goods and services in an economy over a period of time."

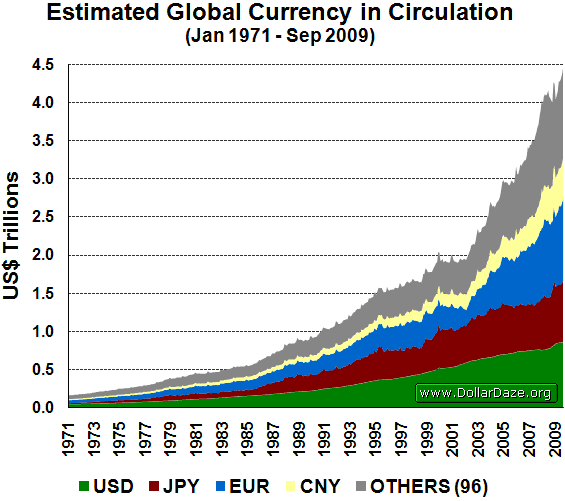

On the same wiki page about inflation, it is stated that "Economists generally agree that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply."

Thus my simple conclusion that we should understand inflation in 2 forms: the first being 'fiscal/ currency expansion' inflation and the 2nd being 'non-fiscal (non-currency expansion based)' inflation.

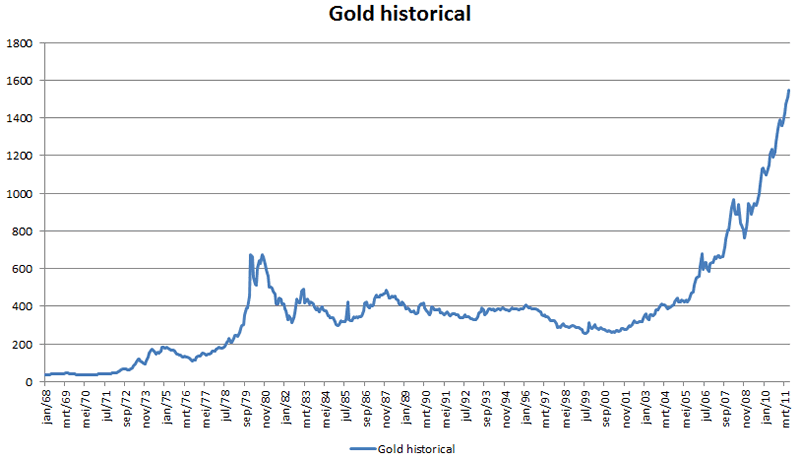

The key reason for this dichotomy is that one must understand that none of the currencies in use in the world today are tagged to gold, a situation progressively arrived at since USA partially left the gold standard in approx 1934 (due to WWII expenditure) and then totally with the collapse of the Bretton Woods system [wiki] (other economic reasons) in Aug15,1971.

Where under the gold standard of currency issuance, central banks were obliged to exchange dollars issued for pure gold bullion at a preset promised rate, there is no longer any such obligation to do so nowadays since the demise of the Bretton Woods system [wiki] and by extension: any form of equivalence to a 'gold standard' currency agreement- parliaments and by extension- governments, are now able to print any amount of monies as they deem fit/ as the electorate seem to dictate according to the results of general elections- rigged or otherwise.

For instance, China is obviously printing yuan to combat the effect of USA's quantitative easing [wiki] so as to artificially make China made goods relatively cheaper as the Chinese government resist an inflation in the price of the Yuan by simply printing more yuan notes (or bond slips) into circulation.

Thus with the exception of gold which might be considered as well a currency (but cannot be printed), most if not all currencies around the world appear to have 'stable' exchange rates against the USD since every dollar printed by the FED generally legitimizes another printed by a central bank in every other country including China- some falls in exchange rates e.g. India, Indonesia and recently Vietnam[Business report 14Feb2012 (Gold fever)] being the consequence of either poor economic policy or else blatant government corruption/ the over relaxation of monetary policy[wiki].

The primary cause of currency expansion is due to unbalanced budgets whereby government tax revenue is insufficient to cover for government expenditure due to wars, corruption, poor economic policy etc. Resulting in government debt[wiki] which then only serves to place more burden on government expenditure as then interest becomes and additional government liability on top of the debt already incurred.

Much of the excess monies (earned as interest on their bond holdings) by the rich/ pension funds would then be spent on various goods and services: e.g. property, gold and other forms of equity resulting in the inflation in prices of these items, and later perhaps food/ daily necessities since at current state, since no country in the world, with the exception of Singapore and its 'dictatorial' ultra-capitalistic economic policies and servile workforce seems to be having a positive government budget year after year.

The other cause of inflation (non-currency related) would be everything else unrelated to currency: e.g. where the price of oil increased due to instability in the gulf region.

In conclusion, inflation should be defied as primarily having 2 causes, fiscal (currency supply) and non-fiscal for a better understanding on the causes, outcomes and various solutions towards the remedy of such problematic high inflation situations.

[pict source]

[pict source]

[pict source]

[pict source] -

Good explanation.

But I wanna mention something else.....

Property inflation.

This is something a bit different.

In many countries, property inflation is due to the fact that many people "invest" in property.

People who wanna save and invest, they think they should park their money in property, as an asset and as an investment.

Therefore it pushes up the price of property.

It is not real demand, because they are not real home residents. It's not really for usage.

This has devastating consequences.

Because housing is one of humans basic needs and basic commodities.

If housing is hoarded by the moneyed class, it has many societal implications.

Their money is channeled into something, that sucks something out from circulation and make the system choke.

For instance,

It makes young people have a hard time getting independent. Because when they wanna buy a home, indirectly they are competing with people in their 50s and so on, who have saved all their life and have more savings.

Meanwhile the younger people have only a few years of labour.

So it makes their efforts tougher.

It even lowers the birth rate.

Secondly,

It promotes neo-feudalism.

In the past, one of the basic characteristics of feudalism is that the society is divided into 2 classes, the landlords, and the landless peasants.

Nowadays with housing prices increasing, the moneyed class is the new landlord and the young people and the lower middle class people are the landless peasants.

It is divisive to society and it hampers social mobility.

So in order to increase society's wellbeing, all types of property investment should be discouraged. Stricly, property ownership should only be for usage.

-

Originally posted by Veggie Bao:

Good explanation.

But I wanna mention something else.....

Property inflation.

This is something a bit different.

In many countries, property inflation is due to the fact that many people "invest" in property.

People who wanna save and invest, they think they should park their money in property, as an asset and as an investment.

Therefore it pushes up the price of property.

It is not real demand, because they are not real home residents. It's not really for usage.

This has devastating consequences.

Because housing is one of humans basic needs and basic commodities.

If housing is hoarded by the moneyed class, it has many societal implications.

Their money is channeled into something, that sucks something out from circulation and make the system choke.

For instance,

It makes young people have a hard time getting independent. Because when they wanna buy a home, indirectly they are competing with people in their 50s and so on, who have saved all their life and have more savings.

Meanwhile the younger people have only a few years of labour.

So it makes their efforts tougher.

It even lowers the birth rate.

Secondly,

It promotes neo-feudalism.

In the past, one of the basic characteristics of feudalism is that the society is divided into 2 classes, the landlords, and the landless peasants.

Nowadays with housing prices increasing, the moneyed class is the new landlord and the young people and the lower middle class people are the landless peasants.

It is divisive to society and it hampers social mobility.

So in order to increase society's wellbeing, all types of property investment should be discouraged. Stricly, property ownership should only be for usage.

Hi, thanks for your response, your description of property price inflation is basically logical and correct, just that my proposal disects ANY form of inflation into it's sub-causes for the sake of better understanding of how governments today operate/ the causes of inflation we see today (in various sub-categories not-withstanding).

As mentioned, fiscal/ currency based inflation (due to govt printing $) is like a guaranteed tide that raises all the boats since everything is valued according to currency (even gold is valued according to fiat currency nowadays rather than vice versa), the price level of everything will go up: subject to seasonal change, as the total currency in circulation increases- the USD being the prime mover in this respect since many if not all countries tag the value of their own currencies to the USD, (not least SG'pore for instance).

Property, equities, gold, commodities all increase in nominal price levels as the total currency in circulation increases.

The 2nd cause of inflation is of course non-fiscal(currency) caused: an example of such non-currency based inflation is for instance the increase in vegetable prices due to inclement weather resulting in decreased vegetable yields in the countries supplying.

The price of veggies in this case is lesser driven by the amount of currency in circulation than it is due to the relative shortage of vegetables as compared to usual supplies, thus the temporary and proportional increase in prices... of course better sourcing methods could alleviate this shortage but then again, import from further afar would certainly incur higher freight charges.

This dichotomy in the causes of inflation distinct as they may seem in theory however may not be so simple to distinguish in practice due to the seasonal change in supply and demand of goods of various categories and make- some substitutable, others less so- however, such supply/ demand variations aside, a chunk of inflation can be attributed to the 'dishonest' printing of monies by governments- the outcome of which is simple inflation in the price levels of goods, some sooner then others, but to all eventually as goods become progressively repriced according to the availability of money that people have to spend, the price of gold in a way reflects its pricing by those who can afford to 'invest' in it- as such, however, due to the low demand for gold in industrial use (10% of annual supply only), much of the inflation in the price of gold can thus be indicative of the inflation of other goods: housing, transport, food etc prices in time to come e.g. the desire of the farmer's wife to own a gold ring, ditto the tractor builder's wife, ditto the petroleum supplier's wife, ditto the vege wholesaler's wife and so on... would pressure the farmer to raise prices where possible to afford her such desire as requested: thus completing a full circle whereby inflation in currency supply by the government causes inflation in the price level of food due to such government intervention (the printing of $$$ that is).

Moral of story, the price of gold will go up, as will everything else, simply for the fact that by the (unwise) precedence of the USA, all governments in the world print $$$ way in excess of what is necessary due to population expansion and genuine advancement of the economy (greater spirituality, green-consciousness/ energy conservancy/ efficiency etc).

In response to your comment about 'feudalism' and how it might disadvantage some menbers of our society (younger, less well off etc) one way would be to increase the cost of property taxes since at present, the 4% of 'annual value'(AV) level (owner occupied discount level) is way too paltry. Many a foreigner intending to invest in SG property would as you have mentioned, purchased a unit and the sit on it (whilst paying the discounted property tax) or else rent it out and pay the undiscounted 10% of AV tax rate just to exploit the SG property market for the purpose of gaining capital appreciation from the property owned. Perhaps a fairer way of apportioning property amongst Singaporeans is for property tax to increase to a uniform 7% across the board (in line with GST levels), with a surcharge of 3% for freehold properties/ properties leasehold in excess of 99years- the 3% surcharge payable to the SAF since it can be argued that freehold property holders have a greater stake to protect the ownership of their properties, the SAF serving that role and not a cheap organisation to operate.

The median er capita property tax paid by Singaporeans would then be repaid to each Singaporean to offset the property tax payable by this Singaporean. PRs would also be entitled to half this property tax rebate only insofar as they remain in Singapore for a cumulative duration in excess of half a year, foreigners who are not PRs will not be entitled at all to this rebate.

This way, the Singapore government can ensure that all property (residential in this case) in Singapore is efficiently utilized. Singaporeans unable to own their own property may use the property tax rebates to offset some of their rental fees whilst rental might actual come down due to a fall in property tax for rented apartments decreasing from 10%AV to 7%AV. The biggest looses would of course be the big bungalow owners would property values are expected to fall with an increase in property tax payable but then again, they must understand that their property stands by the sweat and blood of all Singaporean NS men who serve time to protect our little island state- a fair tax proportionate to the property value and a rebate equal to all Singaporeans should be acceptable to them.

Foreigners will marvel at the robustness of democracy in action in our shining bright little island state.

-

4 asset classes to hedge against inflation

Bank interest rates remain low, so you may have to consider other options to protect your money’s purchasing power

As consumers across Singapore are feeling all too keenly, prices these days seem to be headed stubbornly in one, direction: up.

The latest inflation figures show that prices of consumer goods surged by an unexpected 5.2 per cent in March, mainly from escalating housing rentals and vehicle prices.

The Government last month raised its inflation forecast for the year to between 3.5 per cent and 4.5 per cent.

With bank deposit rates well below that level, money left in a bank will see its value steadily eroding.

That leaves consumers with a thorny problem: how to protect the purchasing power of their money.

“While investors in the United States, Europe and Australia can invest in inflation-linked bonds or treasury inflation-protected securities to preserve their wealth in times of inflation, such tools are not widely available in Singapore and most of the Asian markets,” noted Mr Hugues Delcourt, chef executive officer of ABN Amro Private Banking Asia.

“When it comes to inflation protection, diversification is key – not only as protection against inflation risk, but also as a way to protect portfolios against other cyclical risks along the way.”

Here’s a long at four asset classes that help to do just that.

Fixed Income

One asset class to consider is fixed income, such as high-yield corporate bonds.

Bonds offer a fixed annual interest rate called the coupon and repay the principal according to a schedule. A broad range of bonds is on offer out there for investors with varying risk appetites.

For instance, the HDB has a five-year bond which offers a low coupon rate of 1.165 per cent.

At the other end of the spectrum, Hong Kong-listed Central China Real Estate is offering a four-year bond that pays out 10.75 per cent.

Perpetual securities, which are bond-like instruments, are another option.

Unlike in the case of bonds, where the investor gets the interest and principal according to a fixed schedule, issuers of perpetual securities can defer coupon payouts under certain circumstances.

The repayment of the principal is also left to the issuer’s discretion.

Examples include Genting perpetual securities which offer a coupon rate of 5.125 per cent, and Hyflux perpetual securities which are paying 6 per cent.

“The yield (for perpetuals) are high and attractive to counter inflation,” noted CIMB research head Kenneth Ng.

But he cautioned: “The only dampener is that transaction costs to unwind the position could be a little higher, as trading in these perpetuals might not be so liquid.”

GoldThe yellow metal is traditionally seen as one of the best hedges against inflation.

“The price of gold tends to increase under two conditions. First, when inflation is high and rising, and second, when there is imminent economic depression and investors fear the security of their bank deposits,” said Phillip Futures analyst Lynette Tan.

Said IG Markets market strategist Justin Harper: “While the real value of most currencies has generally declined, gold has retained its purchasing power.

“As we have seen in recent years, gold also has the potential to out-perform other assets and provide impressive returns. As an inflationary hedge, it is hard to beat for consistency.”

The price of gold has recently fallen below the US$1,600 level to around US$1,590 per troy ounce, dragged down by fears about Europe’s political crises.

But ANZ senior commodities strategist Nick Trevethan said: “If commodity prices rise, historical data suggests it is by no means certain that gold prices will rise in tandem.”

Ms Tan added: “Unlike silver, gold does not have an industrial purpose. Therefore, when gold loses its safe haven demand stemming from fears or crises, it can face significant price corrections.”

Currencies

Given that Singapore dollar has continued to strengthen, it might remain one of the best to hold.

The Monetary Authority of Singapore said in April that it would let the Singdollar appreciate at a faster pace, in a move to counter ballooning import prices of consumer goods.

But analysts said holding other currencies in your portfolio might also help mitigate against price rises.

"Asian currencies could be a good hedge against inflation in the medium to long term if investors believe in their appreciation trends," said Ms Grace Tam, market strategist at JP Morgan Asset Management.

"However, currencies ' movement could be very volatile in the short term... Asian local currency bonds would be an even better inflation hedge than pure Asian currencies, as investors could potentially benefit from higher yields as well as the appreciation potential of the local currencies."

Mizuho Corporate Bank market economist Vishnu Varatha noted that the currencies of countries that produce commodities might be a good inflation hedge, if commodity prices go up.

In particular, he said the Australian dollar and Malaysian ringgit could be interesting to look at.

"These have exposure to energy segments (coal and petroleum), some hard commodities as well as agricultural commodities.

"Outside of Asia, the Canadian dollar and some South American currencies could be attractive due to the energy and agriculture commodities exposure."

Equities

Despite market volatility, stocks are worth a look as long-run inflation hedges, analysts added.

"Equities may not protect you from short-term spikes in inflation. But over a longer period of time they are likely to outperform the effects of inflation," said IG Markets' Mr Harper.

CIMB's Mr Ng said investors should "pick companies that have pricing power as their costs increase".

One area is real estate investment trusts, or Reits, which generally provide yields of over 5 per cent, Mr Ng said, noting: "For some of the asset sub-sectors like retail and health care, cash flow is less subject to economic conditions."

Another area is emerging market equities. Said Mr Delcourt of ABN Amro Private Banking Asia: "In an inflationary environment, emerging market equities returns may show a higher correlation with commodity returns, since many of these emerging economies are heavy users, or producers, of commodities."

Some currencies, like the ringgit, may gain from exposure to commodities.

Gold is traditionally seen as one of the best hedges against inflation, with the potential to outperform other assets and provide impressive returns.

Invest, The Sunday Times, May 13, 2012 Pg 35-36